Professional Documents

Culture Documents

New TDS Changes For FY 2023-24

New TDS Changes For FY 2023-24

Uploaded by

BalajiCopyright:

Available Formats

You might also like

- Case Problem 1 Planning An Advertising CampaignDocument4 pagesCase Problem 1 Planning An Advertising CampaignAdmin0% (1)

- Choose Your Tax RegimeDocument3 pagesChoose Your Tax Regimejanesh singhNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- Income Tax Calculator FY 2023 24 Senior Citizen 60 79 YearsDocument2 pagesIncome Tax Calculator FY 2023 24 Senior Citizen 60 79 YearsSingaiah PathuriNo ratings yet

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocument15 pagesHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNo ratings yet

- QuestionsDocument15 pagesQuestionsSamuelNyaungaNo ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- Consumer Deposit Rates: Rates in Effect As ofDocument1 pageConsumer Deposit Rates: Rates in Effect As ofvijayarajindNo ratings yet

- Income Tax Calculator FY 2023 24 Age Below 60 YearsDocument4 pagesIncome Tax Calculator FY 2023 24 Age Below 60 YearsRrrNo ratings yet

- Income TAX: Particular Case 1 Case 2Document15 pagesIncome TAX: Particular Case 1 Case 2Shekh SalmanNo ratings yet

- Practice Questions For Time Value of Money and Capital BudgetingDocument2 pagesPractice Questions For Time Value of Money and Capital BudgetingMr. KhanNo ratings yet

- FAQ On New Tax Regime - V3Document6 pagesFAQ On New Tax Regime - V3ash tiwariNo ratings yet

- Questions PDFDocument12 pagesQuestions PDFSamuelNyaungaNo ratings yet

- Efiling 2024Document6 pagesEfiling 2024nehasingh7364No ratings yet

- Income Tax Amendments 2018-2019Document6 pagesIncome Tax Amendments 2018-2019Thileep SathyaNo ratings yet

- Income Tax Slab Fy 2020-21Document1 pageIncome Tax Slab Fy 2020-21Nabhya's FamilyNo ratings yet

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- 58 Basic Concepts Tax Rates 1696517395-3Document14 pages58 Basic Concepts Tax Rates 1696517395-3hbjh jknNo ratings yet

- Sujay XLSJJDocument2 pagesSujay XLSJJmohankuma121No ratings yet

- New Income Slab Rates CalculationsDocument6 pagesNew Income Slab Rates Calculationsphani raja kumarNo ratings yet

- Tax SlabDocument3 pagesTax Slabmuneerpp78No ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- 24q Salary DetailsDocument3 pages24q Salary Detailssourav.dey.bcom24No ratings yet

- Deposit RatesDocument2 pagesDeposit Ratesanammansoor03No ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- UntitledDocument5 pagesUntitledRwings JeansNo ratings yet

- FCY LCY Rack Rates July 2023Document2 pagesFCY LCY Rack Rates July 2023Madad GaarNo ratings yet

- Income Tax Calculator FY 2023 24 Senior Citizen 60 79 YearsDocument2 pagesIncome Tax Calculator FY 2023 24 Senior Citizen 60 79 Yearssaxena84ankurNo ratings yet

- Indian Cost Accountants Service - Notes: By: Tarun MahajanDocument38 pagesIndian Cost Accountants Service - Notes: By: Tarun MahajanAKSHAYA RAVINo ratings yet

- Agency Mentor Monthly, Annual Scheme FY 19-20Document8 pagesAgency Mentor Monthly, Annual Scheme FY 19-20Prasad KVNo ratings yet

- S. No. Target - Per Month Commission (%) On MRP Amount Commission (%) On Discount AmountDocument1 pageS. No. Target - Per Month Commission (%) On MRP Amount Commission (%) On Discount AmountwawecorNo ratings yet

- Old Tax Regime Vs New Tax Regime Comparision - FinalDocument1 pageOld Tax Regime Vs New Tax Regime Comparision - FinalRajNo ratings yet

- 1.1tax Rates Fy 2022-23 & 2023-24Document14 pages1.1tax Rates Fy 2022-23 & 2023-24mxwnknm4ckNo ratings yet

- Tax RatesDocument9 pagesTax RatesSai SwarupNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Data Analytics Group 7Document7 pagesData Analytics Group 7SrujanNo ratings yet

- New Vs Old Tax Regime - How Income Up To Rs 10 Lakh Can Be Tax Free, Know The Method - Business LeagueDocument3 pagesNew Vs Old Tax Regime - How Income Up To Rs 10 Lakh Can Be Tax Free, Know The Method - Business Leaguedipeshbarua55No ratings yet

- Comparison of Old Vs New Tax Regime (MS)Document11 pagesComparison of Old Vs New Tax Regime (MS)sriharikosaNo ratings yet

- Old Vs New Tax Regime - Which Is Better New or Old Tax Regime For Salaried EmployeesDocument20 pagesOld Vs New Tax Regime - Which Is Better New or Old Tax Regime For Salaried EmployeesKhalid NaseemNo ratings yet

- Sip H2Document12 pagesSip H2AbinayaaNo ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Guidance From SGC - New - Old Tax RegimeDocument2 pagesGuidance From SGC - New - Old Tax RegimeManoj BishtNo ratings yet

- Eyes Wide Open: The Implications and Opportunities of The Current Tax Reform DebateDocument12 pagesEyes Wide Open: The Implications and Opportunities of The Current Tax Reform DebaterepsandylevinNo ratings yet

- Module 1 Tax DR BRR 2018Document7 pagesModule 1 Tax DR BRR 2018Prajwal kumarNo ratings yet

- 23 Effective Rate of Interest CalculationsDocument3 pages23 Effective Rate of Interest CalculationssreekanthsubbaraoNo ratings yet

- DCU Rate Sheet PrintableDocument7 pagesDCU Rate Sheet PrintableVadim ShabelnikovNo ratings yet

- Tax RatesDocument4 pagesTax RatesOnkar BandichhodeNo ratings yet

- Ques. Defered TaxDocument40 pagesQues. Defered TaxKALYANI JAYAKRISHNAN 2022155No ratings yet

- Old Vs New Tax Regime Comparative AnalysisDocument11 pagesOld Vs New Tax Regime Comparative AnalysisAkchu KadNo ratings yet

- Module 1 Direct Tax DR BRR 2022 StudentsDocument9 pagesModule 1 Direct Tax DR BRR 2022 StudentsDr. Batani Raghavendra RaoNo ratings yet

- EBIT EPS AnalysisDocument29 pagesEBIT EPS Analysisshalini swarajNo ratings yet

- Amendments DT 2016Document70 pagesAmendments DT 2016dbp9050No ratings yet

- Budget 2008Document7 pagesBudget 2008api-3727562No ratings yet

New TDS Changes For FY 2023-24

New TDS Changes For FY 2023-24

Uploaded by

BalajiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New TDS Changes For FY 2023-24

New TDS Changes For FY 2023-24

Uploaded by

BalajiCopyright:

Available Formats

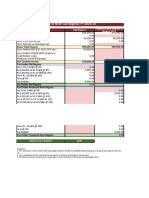

2023-2024 New TDS Regime

For financial Year 2023-24 Employee will have choices of tax regime.

There are two regimes:

1. New (Default)

2. Old

New Regime:

➢ New tax regime slab rates are not differentiated based on age group.

➢ The rebate limit has been increased from 5 lakh to 7 lakh.

➢ Rebate of 25000 is Applicable. This tax rebate is applicable for all individuals whose taxable

income does not exceed Rs 7 lakh.

➢ Individuals having an income of 15.5 lakhs or more they are eligible for a Standard Deduction of

52500.

➢ No Professional Tax deduction applicable.

➢ In New regime only one concession -Deduction under section 10, Chapter VI (80CCD 2) is

Applicable. Other Concessions cannot be used to declare.

From To Rate

0 300000 0%

300001 600000 5%

600001 900000 10%

900001 1200000 15%

1200001 1500000 20%

1500001 Above 30%

Old Regime:

Previous year TDS slabs will remain same for current financial year

From To Rate

0 250000 0%

250001 500000 5%

500001 1000000 20%

Above 1000001 30%

Please Note:

➢ Employee can ask admin (Employer) to change his Income tax Regime(old/New). Admin can

change employee's Income tax regime.

➢ Regime selected in the first month of year will be considered for rest of the year, hence do not

change regime every month.

➢ As per selected regime employee’s Income tax will be calculated.

➢ Admin cannot change regime once salary is saved. So, ensure that before salary is saved regime

is updated in employee master.

➢ Default regime is New (I.e., current).

People Prime Worldwide Private Limited|4th Floor | HIG 170, 6th Phase| KPHB| Hyderabad – 500085

You might also like

- Case Problem 1 Planning An Advertising CampaignDocument4 pagesCase Problem 1 Planning An Advertising CampaignAdmin0% (1)

- Choose Your Tax RegimeDocument3 pagesChoose Your Tax Regimejanesh singhNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- Income Tax Calculator FY 2023 24 Senior Citizen 60 79 YearsDocument2 pagesIncome Tax Calculator FY 2023 24 Senior Citizen 60 79 YearsSingaiah PathuriNo ratings yet

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocument15 pagesHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNo ratings yet

- QuestionsDocument15 pagesQuestionsSamuelNyaungaNo ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- Consumer Deposit Rates: Rates in Effect As ofDocument1 pageConsumer Deposit Rates: Rates in Effect As ofvijayarajindNo ratings yet

- Income Tax Calculator FY 2023 24 Age Below 60 YearsDocument4 pagesIncome Tax Calculator FY 2023 24 Age Below 60 YearsRrrNo ratings yet

- Income TAX: Particular Case 1 Case 2Document15 pagesIncome TAX: Particular Case 1 Case 2Shekh SalmanNo ratings yet

- Practice Questions For Time Value of Money and Capital BudgetingDocument2 pagesPractice Questions For Time Value of Money and Capital BudgetingMr. KhanNo ratings yet

- FAQ On New Tax Regime - V3Document6 pagesFAQ On New Tax Regime - V3ash tiwariNo ratings yet

- Questions PDFDocument12 pagesQuestions PDFSamuelNyaungaNo ratings yet

- Efiling 2024Document6 pagesEfiling 2024nehasingh7364No ratings yet

- Income Tax Amendments 2018-2019Document6 pagesIncome Tax Amendments 2018-2019Thileep SathyaNo ratings yet

- Income Tax Slab Fy 2020-21Document1 pageIncome Tax Slab Fy 2020-21Nabhya's FamilyNo ratings yet

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- 58 Basic Concepts Tax Rates 1696517395-3Document14 pages58 Basic Concepts Tax Rates 1696517395-3hbjh jknNo ratings yet

- Sujay XLSJJDocument2 pagesSujay XLSJJmohankuma121No ratings yet

- New Income Slab Rates CalculationsDocument6 pagesNew Income Slab Rates Calculationsphani raja kumarNo ratings yet

- Tax SlabDocument3 pagesTax Slabmuneerpp78No ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- 24q Salary DetailsDocument3 pages24q Salary Detailssourav.dey.bcom24No ratings yet

- Deposit RatesDocument2 pagesDeposit Ratesanammansoor03No ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- UntitledDocument5 pagesUntitledRwings JeansNo ratings yet

- FCY LCY Rack Rates July 2023Document2 pagesFCY LCY Rack Rates July 2023Madad GaarNo ratings yet

- Income Tax Calculator FY 2023 24 Senior Citizen 60 79 YearsDocument2 pagesIncome Tax Calculator FY 2023 24 Senior Citizen 60 79 Yearssaxena84ankurNo ratings yet

- Indian Cost Accountants Service - Notes: By: Tarun MahajanDocument38 pagesIndian Cost Accountants Service - Notes: By: Tarun MahajanAKSHAYA RAVINo ratings yet

- Agency Mentor Monthly, Annual Scheme FY 19-20Document8 pagesAgency Mentor Monthly, Annual Scheme FY 19-20Prasad KVNo ratings yet

- S. No. Target - Per Month Commission (%) On MRP Amount Commission (%) On Discount AmountDocument1 pageS. No. Target - Per Month Commission (%) On MRP Amount Commission (%) On Discount AmountwawecorNo ratings yet

- Old Tax Regime Vs New Tax Regime Comparision - FinalDocument1 pageOld Tax Regime Vs New Tax Regime Comparision - FinalRajNo ratings yet

- 1.1tax Rates Fy 2022-23 & 2023-24Document14 pages1.1tax Rates Fy 2022-23 & 2023-24mxwnknm4ckNo ratings yet

- Tax RatesDocument9 pagesTax RatesSai SwarupNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Data Analytics Group 7Document7 pagesData Analytics Group 7SrujanNo ratings yet

- New Vs Old Tax Regime - How Income Up To Rs 10 Lakh Can Be Tax Free, Know The Method - Business LeagueDocument3 pagesNew Vs Old Tax Regime - How Income Up To Rs 10 Lakh Can Be Tax Free, Know The Method - Business Leaguedipeshbarua55No ratings yet

- Comparison of Old Vs New Tax Regime (MS)Document11 pagesComparison of Old Vs New Tax Regime (MS)sriharikosaNo ratings yet

- Old Vs New Tax Regime - Which Is Better New or Old Tax Regime For Salaried EmployeesDocument20 pagesOld Vs New Tax Regime - Which Is Better New or Old Tax Regime For Salaried EmployeesKhalid NaseemNo ratings yet

- Sip H2Document12 pagesSip H2AbinayaaNo ratings yet

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- Guidance From SGC - New - Old Tax RegimeDocument2 pagesGuidance From SGC - New - Old Tax RegimeManoj BishtNo ratings yet

- Eyes Wide Open: The Implications and Opportunities of The Current Tax Reform DebateDocument12 pagesEyes Wide Open: The Implications and Opportunities of The Current Tax Reform DebaterepsandylevinNo ratings yet

- Module 1 Tax DR BRR 2018Document7 pagesModule 1 Tax DR BRR 2018Prajwal kumarNo ratings yet

- 23 Effective Rate of Interest CalculationsDocument3 pages23 Effective Rate of Interest CalculationssreekanthsubbaraoNo ratings yet

- DCU Rate Sheet PrintableDocument7 pagesDCU Rate Sheet PrintableVadim ShabelnikovNo ratings yet

- Tax RatesDocument4 pagesTax RatesOnkar BandichhodeNo ratings yet

- Ques. Defered TaxDocument40 pagesQues. Defered TaxKALYANI JAYAKRISHNAN 2022155No ratings yet

- Old Vs New Tax Regime Comparative AnalysisDocument11 pagesOld Vs New Tax Regime Comparative AnalysisAkchu KadNo ratings yet

- Module 1 Direct Tax DR BRR 2022 StudentsDocument9 pagesModule 1 Direct Tax DR BRR 2022 StudentsDr. Batani Raghavendra RaoNo ratings yet

- EBIT EPS AnalysisDocument29 pagesEBIT EPS Analysisshalini swarajNo ratings yet

- Amendments DT 2016Document70 pagesAmendments DT 2016dbp9050No ratings yet

- Budget 2008Document7 pagesBudget 2008api-3727562No ratings yet