Professional Documents

Culture Documents

Cambridge International AS & A Level: Accounting 9706/22 October/November 2021

Cambridge International AS & A Level: Accounting 9706/22 October/November 2021

Uploaded by

Vernan ZivanaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambridge International AS & A Level: Accounting 9706/22 October/November 2021

Cambridge International AS & A Level: Accounting 9706/22 October/November 2021

Uploaded by

Vernan ZivanaiCopyright:

Available Formats

Cambridge International AS & A Level

ACCOUNTING 9706/22

Paper 2 Structured Questions October/November 2021

MARK SCHEME

Maximum Mark: 90

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge International will not enter into discussions about these mark schemes.

Cambridge International is publishing the mark schemes for the October/November 2021 series for most

Cambridge IGCSE™, Cambridge International A and AS Level components and some Cambridge O Level

components.

This document consists of 15 printed pages.

© UCLES 2021 [Turn over

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Generic Marking Principles

These general marking principles must be applied by all examiners when marking candidate answers. They should be applied alongside the

specific content of the mark scheme or generic level descriptors for a question. Each question paper and mark scheme will also comply with these

marking principles.

GENERIC MARKING PRINCIPLE 1:

Marks must be awarded in line with:

• the specific content of the mark scheme or the generic level descriptors for the question

• the specific skills defined in the mark scheme or in the generic level descriptors for the question

• the standard of response required by a candidate as exemplified by the standardisation scripts.

GENERIC MARKING PRINCIPLE 2:

Marks awarded are always whole marks (not half marks, or other fractions).

GENERIC MARKING PRINCIPLE 3:

Marks must be awarded positively:

• marks are awarded for correct/valid answers, as defined in the mark scheme. However, credit is given for valid answers which go beyond the

scope of the syllabus and mark scheme, referring to your Team Leader as appropriate

• marks are awarded when candidates clearly demonstrate what they know and can do

• marks are not deducted for errors

• marks are not deducted for omissions

• answers should only be judged on the quality of spelling, punctuation and grammar when these features are specifically assessed by the

question as indicated by the mark scheme. The meaning, however, should be unambiguous.

GENERIC MARKING PRINCIPLE 4:

Rules must be applied consistently, e.g. in situations where candidates have not followed instructions or in the application of generic level

descriptors.

© UCLES 2021 Page 2 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

GENERIC MARKING PRINCIPLE 5:

Marks should be awarded using the full range of marks defined in the mark scheme for the question (however; the use of the full mark range may

be limited according to the quality of the candidate responses seen).

GENERIC MARKING PRINCIPLE 6:

Marks awarded are based solely on the requirements as defined in the mark scheme. Marks should not be awarded with grade thresholds or

grade descriptors in mind.

© UCLES 2021 Page 3 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Social Science-Specific Marking Principles

(for point-based marking)

1 Components using point-based marking:

• Point marking is often used to reward knowledge, understanding and application of skills. We give credit where the candidate’s answer

shows relevant knowledge, understanding and application of skills in answering the question. We do not give credit where the answer

shows confusion.

From this it follows that we:

a DO credit answers which are worded differently from the mark scheme if they clearly convey the same meaning (unless the mark

scheme requires a specific term)

b DO credit alternative answers/examples which are not written in the mark scheme if they are correct

c DO credit answers where candidates give more than one correct answer in one prompt/numbered/scaffolded space where extended

writing is required rather than list-type answers. For example, questions that require n reasons (e.g. State two reasons …).

d DO NOT credit answers simply for using a ‘key term’ unless that is all that is required. (Check for evidence it is understood and not used

wrongly.)

e DO NOT credit answers which are obviously self-contradicting or trying to cover all possibilities

f DO NOT give further credit for what is effectively repetition of a correct point already credited unless the language itself is being tested.

This applies equally to ‘mirror statements’ (i.e. polluted/not polluted).

g DO NOT require spellings to be correct, unless this is part of the test. However spellings of syllabus terms must allow for clear and

unambiguous separation from other syllabus terms with which they may be confused (e.g. Corrasion/Corrosion)

2 Presentation of mark scheme:

• Slashes (/) or the word ‘or’ separate alternative ways of making the same point.

• Semi colons (;) bullet points (•) or figures in brackets (1) separate different points.

• Content in the answer column in brackets is for examiner information/context to clarify the marking but is not required to earn the mark

(except Accounting syllabuses where they indicate negative numbers).

© UCLES 2021 Page 4 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

3 Calculation questions:

• The mark scheme will show the steps in the most likely correct method(s), the mark for each step, the correct answer(s) and the mark

for each answer

• If working/explanation is considered essential for full credit, this will be indicated in the question paper and in the mark scheme. In all

other instances, the correct answer to a calculation should be given full credit, even if no supporting working is shown.

• Where the candidate uses a valid method which is not covered by the mark scheme, award equivalent marks for reaching equivalent

stages.

• Where an answer makes use of a candidate’s own incorrect figure from previous working, the ‘own figure rule’ applies: full marks will be

given if a correct and complete method is used. Further guidance will be included in the mark scheme where necessary and any

exceptions to this general principle will be noted.

4 Annotation:

• For point marking, ticks can be used to indicate correct answers and crosses can be used to indicate wrong answers. There is no direct

relationship between ticks and marks. Ticks have no defined meaning for levels of response marking.

• For levels of response marking, the level awarded should be annotated on the script.

• Other annotations will be used by examiners as agreed during standardisation, and the meaning will be understood by all examiners

who marked that paper.

© UCLES 2021 Page 5 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

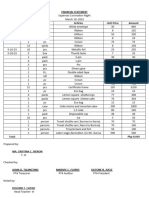

Question Answer Marks

1(a) 3

Debit Credit

$ $

Revaluation reserve 6 000 (1)

Income statement 2 000 (1)

Freehold property 8 000 (1)

1(b) P Limited 15

Income statement for the year ended 31 August 2021

Revenue 210 200 (1)

Cost of sales W1 (88 510) (4)OF

Gross profit 121 690

Administrative expenses (41 860) (1)

Distribution costs W2 (76 730) (7)OF

Profit from operations 3 100

Finance costs (1 890) (1)

Profit for the year 1 210 (1)OF

W1 Cost of sales

22 880 + 88 900 – 23 400 (1) – 260 (1) + 390 (1) = 88 510 (1)OF

W2 Distribution costs

44 320 – 180 (1) + 20 040 (1) + 1 320 (1) + 7 780 (1) + 2 000 (1) + 1 450 (1) = 76 730 (1)OF

© UCLES 2021 Page 6 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

1(c) 3

$

Balance at 1 September 2020 24 200

Dividend paid (3 000) (1)

Profit for the year 1 210 (1)OF

Balance at 31 August 2021 22 410 (1)OF

1(d) Offer discount for early settlement (1) 2

Charge interest on overdue accounts (1)

Regular chasing of debts / improve credit control (1)

Encourage cash sales rather than credit sales/discourage credit sales (1)

Debt factoring (1)

Accept other valid responses

1(e) Option 1 (max 3 marks) 7

Permanent capital (1)

Would existing shareholders be prepared to pay the 25% premium? (1)

The shares would have voting rights which could weaken the directors’ position (1)

But dividend payments would be discretionary (1)

Would rights issue be fully subscribed? (1)

Option 2 (max 3 marks)

Company already has $36 000 debentures due for repayment next year (1)

8% interest rate is more expensive than current debentures (1)

Debenture holders do not have voting rights so no likelihood of loss of control (1)

Interest will have to be paid whether the company makes a profit or loss (1)

Will leave the company very heavily reliant on external borrowing (1)

May require security (1)

Accept other valid responses

Decision (1)

© UCLES 2021 Page 7 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

2(a) Suspense Account

6

$ $

Trial balance difference 8 (1)OF Discount allowed 175 (1)

Motor repairs 27 (1) Sales 220 (1)

Sales ledger control 850 (1) Discount received 490 (1)

885 885

2(b) 3

Error Type of error

1 Transposition (1)

2 Principle (1)

3 Partial omission (1)

2(c) Reduces the possibility of fraud (1) as a result of segregation of duties (1) 4

Identifies total trade payables (1) and so aids the preparation of financial statements (1)

Checks the arithmetical accuracy of the purchases’ ledger (1) the balance on control accounts should equal the total of the

individual balances in the purchases’ ledger (1)

Max 2 benefits x 2 marks

(1 mark for identification, 1 mark for development)

Accept other valid responses

© UCLES 2021 Page 8 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

2(d) Credit purchases (1) 2

Returned cheque (1)

Interest charged by supplier (1)

Brought forward balance (1)

Supplier refund (1)

Max 2 marks

Accept other valid responses

© UCLES 2021 Page 9 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

3(a) Ordinary share capital 11

Date Details $ Date Details $

2021 2020

Jun 30 Balance c/d 220 000 Jul 1 Balance b/d 150 000

1 Aug Bank 30 000 (1)

2021

Mar 1 Share premium 37 000 (1)

Retained earnings 3 000 (1)

220 000 220 000

Jul 1 Balance b/d 220 000 (1)OF

Share premium

Date Details $ Date Details $

2021 2020

Mar 1 Ordinary share capital 37 000 (1)OF Jul 1 Balance b/d 25 000

Aug 1 Bank 12 000 (1)

37 000 37 000

© UCLES 2021 Page 10 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

3(a) Retained Earnings

Date Details $ Date Details $

2020 2020

Dec 1 Bank 7 200 (1) Jul 1 Balance b/d 28 700

2021 2021

Mar 1 Ordinary share capital 3 000 (1)OF Jun 30 Income statement 76 520 (1)

Jun 30 Balance c/d 95 020

105 220 105 220

Jul 1 Balance b/d 95 020 (1)OF

1 mark for all correct dates and labels

3(b) Capital reserves are created from non-trading activities, revenue reserves are created from revenue/trading activities (1). 2

Capital reserves are used to meet capital losses only, not for payment of dividends, revenue reserves may be used to pay

dividends (1).

Revenue reserves are distributable, capital reserves are not distributable (1)

Max 2 marks

Accept other valid responses

3(c) To compensate shareholders (1) in the event of shortage of liquid resources to pay a dividend (1) 2

Increases the issued share capital (1) creating a perception of success (1)

To capitalise revenue reserves (1) to strengthen the statement of financial position (1)

Max 2 marks

Accept other valid responses

© UCLES 2021 Page 11 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

4(a) (i) Floor space (1) 3

(ii) Net book value/cost of machinery (1)

(iii) Budgeted machine hours/power/Kw hours (1)

Accept other valid responses.

4(b) 4

Production departments Service departments

Total Machining Finishing Stores Maintenance

$ $ $ $ $

Total overheads 449 800 188 850 172 850 53 325 34 775

Re-apportion stores 34 128 19 197 (53 325) (1)

Subtotal 222 978 192 047 - 34 775

Re-apportion Maintenance 28 979 5 796 (34 775) (1)

Total overheads cost 251 957 197 843 –

(1)OF (1)OF

4(c) Machining $251 957 / 38 600 hours = $6.53 (1)OF per machine hour (1) 4

Finishing $197 843 / 19 800 hours = $9.99 (1)OF per labour hour (1)

© UCLES 2021 Page 12 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

4(d) 4

Machining Finishing

$ $

Actual 265 800 187 420

Absorbed 36 940 x $6.53 241 218

Absorbed 19 260 x $9.99 192 407

24 582 (1)OF 4 987 (1)OF

Under absorbed (1)OF Over absorbed (1)OF

© UCLES 2021 Page 13 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

4(e) 6

$ Alternative $

presentation

Direct material 36.20 7 240.00

Direct labour – Machining 6.00 (1) 1 200.00 (1)

Direct labour – Finishing 10.00 2 000.00

Overheads – Machining ($6.53 × 20 minutes) 2.18 (1)OF 436.00 (1)OF

Overheads – Finishing ($9.99 × 60 minutes) 9.99 (1)OF 1 998.00 (1)OF

Total cost per unit 64.37 (1)OF

Mark-up (30/70) 27.59 (1)OF

91.96 12 874.00 (1)OF

Number of units 200 5 517.43 (1)OF

Quoted price 18 392.00 (1)OF 18 391.43 (1)OF

© UCLES 2021 Page 14 of 15

9706/22 Cambridge International AS & A Level – Mark Scheme October/November 2021

PUBLISHED

Question Answer Marks

4(f) For factory-wide (max 2 marks) 5

Easier/less complicated to calculate (1)

Saves time (1)

Therefore, saves money (1)

Against factory-wide (max 2 marks)

Does not differentiate capital intensive production from labour intensive production (1)

Produces less accurate selling prices (1)

Produces less accurate overhead absorption rate (1)

Products may spend differing amounts of time in each department/ Does not reflect accurate departmental usage (1)

Advice (1)

Accept other valid responses

4(g) Selling prices may be too high (1) making products uncompetitive/leading to lower demand (1) 4

Lower demand (1) can lead to lower profits (1)

The value of closing inventory may be overstated (1) causing profit to be overstated (1)

Less expenses are recognised in the income statement (1) resulting in more profit being reported (1).

Max 2 effects (1 mark for stating the effect and 1 mark for development).

Accept other valid responses

© UCLES 2021 Page 15 of 15

You might also like

- Topographic Maps: Use The Following Hiking Map From Enchanted Rock To Complete The Following QuestionsDocument3 pagesTopographic Maps: Use The Following Hiking Map From Enchanted Rock To Complete The Following QuestionsVinujah Sukumaran50% (4)

- Government Departments Contact Emails/Phone Numbers EtcDocument149 pagesGovernment Departments Contact Emails/Phone Numbers EtcPaul Smith0% (1)

- vxBjICCrQ7eQYyAgq0O3cg - Debit Credit Rules ActivityDocument1 pagevxBjICCrQ7eQYyAgq0O3cg - Debit Credit Rules ActivityAlok PatilNo ratings yet

- 2 Material HandlingDocument218 pages2 Material HandlingJon Blac100% (1)

- Cambridge International AS & A Level: Accounting 9706/21 October/November 2021Document13 pagesCambridge International AS & A Level: Accounting 9706/21 October/November 2021babarmumtaz1962No ratings yet

- Cambridge O Level: Accounting 7707/22 October/November 2021Document15 pagesCambridge O Level: Accounting 7707/22 October/November 2021FarrukhsgNo ratings yet

- Cambridge IGCSE™: Accounting 0452/22 October/November 2021Document15 pagesCambridge IGCSE™: Accounting 0452/22 October/November 2021Mohammed ZakeeNo ratings yet

- Cambridge O Level: Accounting 7707/22 October/November 2022Document16 pagesCambridge O Level: Accounting 7707/22 October/November 2022Marlene BandaNo ratings yet

- Cambridge O Level: Accounting 7707/24 May/June 2021Document17 pagesCambridge O Level: Accounting 7707/24 May/June 2021Hashir ShaheerNo ratings yet

- Cambridge O Level: Accounting 7707/23 October/November 2021Document17 pagesCambridge O Level: Accounting 7707/23 October/November 2021jeetenjsrNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/32 March 2021Document19 pagesCambridge International AS & A Level: Accounting 9706/32 March 2021Ahmed NaserNo ratings yet

- Cambridge O Level: Accounting 7707/23 October/November 2022Document18 pagesCambridge O Level: Accounting 7707/23 October/November 2022FahadNo ratings yet

- Cambridge IGCSE™: Accounting 0452/23 October/November 2021Document17 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2021Mohammed ZakeeNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/31 October/November 2022Document17 pagesCambridge International AS & A Level: Accounting 9706/31 October/November 2022ryan valtrainNo ratings yet

- Cambridge IGCSE ™: Accounting 0452/22 October/November 2022Document16 pagesCambridge IGCSE ™: Accounting 0452/22 October/November 2022Sean RusikeNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/21 May/June 2021Document15 pagesCambridge International AS & A Level: Accounting 9706/21 May/June 2021fa22msmg0011No ratings yet

- Cambridge International AS & A Level: Accounting 9706/32 October/November 2022Document22 pagesCambridge International AS & A Level: Accounting 9706/32 October/November 2022alanmuchenjeNo ratings yet

- Cambridge IGCSE™: Accounting 0452/23 May/June 2021Document16 pagesCambridge IGCSE™: Accounting 0452/23 May/June 2021Sana IbrahimNo ratings yet

- Cambridge IGCSE™: Economics 0455/22 October/November 2021Document24 pagesCambridge IGCSE™: Economics 0455/22 October/November 2021Mohammed ZakeeNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/21 October/November 2022Document17 pagesCambridge International AS & A Level: Accounting 9706/21 October/November 2022damiangoromonziiNo ratings yet

- Cambridge O Level: Economics 2281/22 October/November 2022Document24 pagesCambridge O Level: Economics 2281/22 October/November 2022FahadNo ratings yet

- Cambridge O Level: Commerce 7100/21 October/November 2021Document18 pagesCambridge O Level: Commerce 7100/21 October/November 2021Abu IbrahimNo ratings yet

- Cambridge IGCSE ™: Accounting 0452/21 October/November 2022Document18 pagesCambridge IGCSE ™: Accounting 0452/21 October/November 2022Muhammad AhmadNo ratings yet

- Cambridge IGCSE™: Accounting 0452/21 May/June 2021Document20 pagesCambridge IGCSE™: Accounting 0452/21 May/June 2021nokutenda zindereNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/13 October/November 2021Document24 pagesCambridge IGCSE™: Business Studies 0450/13 October/November 2021econearthNo ratings yet

- Cambridge International AS & A Level: EconomicsDocument15 pagesCambridge International AS & A Level: EconomicsAndrew BadgerNo ratings yet

- Cambridge O Level: Economics 2281/21 May/June 2021Document26 pagesCambridge O Level: Economics 2281/21 May/June 2021FahadNo ratings yet

- Paper 1 Marking SchemeDocument22 pagesPaper 1 Marking SchemeHussain ShaikhNo ratings yet

- Cambridge O Level: Commerce 7100/22 October/November 2021Document19 pagesCambridge O Level: Commerce 7100/22 October/November 2021Sadia afrinNo ratings yet

- Cambridge International AS & A Level: Economics 9708/23 October/November 2022Document15 pagesCambridge International AS & A Level: Economics 9708/23 October/November 2022Andrew BadgerNo ratings yet

- Cambridge IGCSE™: Accounting 0452/23 October/November 2021Document17 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2021Iron OneNo ratings yet

- Cambridge IGCSE ™: Business Studies 0450/12 October/November 2022Document21 pagesCambridge IGCSE ™: Business Studies 0450/12 October/November 2022Katlego MedupeNo ratings yet

- Cambridge IGCSE™: Accounting 0452/22 February/March 2022Document17 pagesCambridge IGCSE™: Accounting 0452/22 February/March 2022Janvi JainNo ratings yet

- Cambridge O Level: Accounting 7707/22 May/June 2022Document16 pagesCambridge O Level: Accounting 7707/22 May/June 2022Kutwaroo GayetreeNo ratings yet

- Cambridge O Level: Business Studies 7115/12 October/November 2022Document21 pagesCambridge O Level: Business Studies 7115/12 October/November 2022MsuBrainBoxNo ratings yet

- Cambridge International AS & A Level: Economics 9708/22 February/March 2022Document12 pagesCambridge International AS & A Level: Economics 9708/22 February/March 2022Andrew BadgerNo ratings yet

- Cambridge O Level: Commerce 7100/22 October/November 2022Document24 pagesCambridge O Level: Commerce 7100/22 October/November 2022Tapiwa MT (N1c3isH)No ratings yet

- Cambridge International AS & A Level: Economics 9708/21 May/June 2021Document14 pagesCambridge International AS & A Level: Economics 9708/21 May/June 2021Đoàn DũngNo ratings yet

- Cambridge International AS & A Level: Global Perspectives and Research 9239/11 May/June 2021Document21 pagesCambridge International AS & A Level: Global Perspectives and Research 9239/11 May/June 2021Hassan AsadullahNo ratings yet

- Cambridge IGCSE™: Economics 0455/23 October/November 2021Document28 pagesCambridge IGCSE™: Economics 0455/23 October/November 2021Mohammed ZakeeNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/11 October/November 2021Document22 pagesCambridge IGCSE™: Business Studies 0450/11 October/November 2021Callum BirdNo ratings yet

- Feb March 2021 (22) - ADocument12 pagesFeb March 2021 (22) - AMarie Xavier - FelixNo ratings yet

- Cambridge O Level: Business Studies 7115/14 October/November 2022Document22 pagesCambridge O Level: Business Studies 7115/14 October/November 2022Adeela WaqasNo ratings yet

- Cambridge IGCSE™: Accounting 0452/22 March 2021Document19 pagesCambridge IGCSE™: Accounting 0452/22 March 2021Farrukhsg50% (2)

- Cambridge IGCSE™: Business Studies 0450/11 May/June 2021Document21 pagesCambridge IGCSE™: Business Studies 0450/11 May/June 2021Imran Ali100% (1)

- Cambridge O Level: Business Studies 7115/11 May/June 2021Document21 pagesCambridge O Level: Business Studies 7115/11 May/June 2021nayna sharminNo ratings yet

- Cambridge International AS & A Level: Mathematics 9709/13 October/November 2021Document15 pagesCambridge International AS & A Level: Mathematics 9709/13 October/November 2021Robert mukwekweNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/31 October/November 2021Document16 pagesCambridge International AS & A Level: Accounting 9706/31 October/November 2021AB YUNo ratings yet

- Cambridge International AS & A Level: Mathematics 9709/61 October/November 2021Document11 pagesCambridge International AS & A Level: Mathematics 9709/61 October/November 2021Mubashir AsifNo ratings yet

- 9708 w22 Ms 41 PDFDocument16 pages9708 w22 Ms 41 PDFTawanda MakombeNo ratings yet

- November 2021 (v1) MSDocument15 pagesNovember 2021 (v1) MSJesmond TayNo ratings yet

- Cambridge International AS & A Level: Physics 9702/43 October/November 2021Document15 pagesCambridge International AS & A Level: Physics 9702/43 October/November 2021pvaidehi9826No ratings yet

- Cambridge International A Level: Mathematics 9709/31 October/November 2022Document17 pagesCambridge International A Level: Mathematics 9709/31 October/November 2022Wilber TuryasiimaNo ratings yet

- Cambridge IGCSE™: Accounting 0452/23 May/June 2022Document16 pagesCambridge IGCSE™: Accounting 0452/23 May/June 2022Lavanya GoleNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/12 March 2021Document24 pagesCambridge IGCSE™: Business Studies 0450/12 March 2021Wilfred BryanNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/12 March 2021Document24 pagesCambridge IGCSE™: Business Studies 0450/12 March 2021Kausika ThanarajNo ratings yet

- Cambridge International AS & A Level: BusinessDocument21 pagesCambridge International AS & A Level: BusinessEldo PappuNo ratings yet

- Cambridge International AS & A Level: Further Mathematics 9231/41 October/November 2021Document14 pagesCambridge International AS & A Level: Further Mathematics 9231/41 October/November 2021Areeba ImranNo ratings yet

- Cambridge International A Level: Further Mathematics 9231/23 October/November 2020Document15 pagesCambridge International A Level: Further Mathematics 9231/23 October/November 2020Shehzad AslamNo ratings yet

- Cambridge International AS & A Level: Business 9609/22 March 2021Document16 pagesCambridge International AS & A Level: Business 9609/22 March 2021LisaNo ratings yet

- Cambridge International AS & A Level: Mathematics 9709/12 March 2021Document14 pagesCambridge International AS & A Level: Mathematics 9709/12 March 2021JuanaNo ratings yet

- Cambridge International AS & A Level: Mathematics 9709/11 October/November 2021Document19 pagesCambridge International AS & A Level: Mathematics 9709/11 October/November 2021JuniorNo ratings yet

- Cambridge IGCSE ™ (9-1) : Business Studies 0986/21 October/November 2022Document22 pagesCambridge IGCSE ™ (9-1) : Business Studies 0986/21 October/November 2022YahiaNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Self - Assessment Guide: Can I? YES NODocument3 pagesSelf - Assessment Guide: Can I? YES NOJohn Castillo100% (1)

- Business Law Cpa Board Exam Lecture Notes: I. (CO, NO)Document27 pagesBusiness Law Cpa Board Exam Lecture Notes: I. (CO, NO)Shin MelodyNo ratings yet

- HahayysDocument30 pagesHahayys2BGrp3Plaza, Anna MaeNo ratings yet

- The Impact of Different Political Beliefs On The Family Relationship of College-StudentsDocument16 pagesThe Impact of Different Political Beliefs On The Family Relationship of College-Studentshue sandovalNo ratings yet

- Mesina V Meer PDFDocument3 pagesMesina V Meer PDFColee StiflerNo ratings yet

- Complete ModuleDocument99 pagesComplete ModuleMhel DemabogteNo ratings yet

- Answer: The Measure of The Central Angles of An Equilateral TriangleDocument4 pagesAnswer: The Measure of The Central Angles of An Equilateral Trianglesunil_ibmNo ratings yet

- For StatDocument47 pagesFor StatLyn VeaNo ratings yet

- Input Filter Design by EricksonDocument49 pagesInput Filter Design by EricksonshrikrisNo ratings yet

- Law and IT Assignment SEM IXDocument18 pagesLaw and IT Assignment SEM IXrenu tomarNo ratings yet

- PethaDocument4 pagesPethaJeet RajNo ratings yet

- Database Teach IctDocument3 pagesDatabase Teach IctMushawatuNo ratings yet

- Zxdaw 3Document56 pagesZxdaw 3kingNo ratings yet

- Computer Information SystemDocument5 pagesComputer Information SystemAmandaNo ratings yet

- Magnetic Systems Specific Heat$Document13 pagesMagnetic Systems Specific Heat$andres arizaNo ratings yet

- Ebook Contemporary Issues in Accounting 2Nd Edition Rankin Solutions Manual Full Chapter PDFDocument53 pagesEbook Contemporary Issues in Accounting 2Nd Edition Rankin Solutions Manual Full Chapter PDFfideliamaximilian7pjjf100% (11)

- Care of Dying and DeadDocument10 pagesCare of Dying and Deadd1choosenNo ratings yet

- Financial Statement Coronation NightDocument8 pagesFinancial Statement Coronation NightRuel Gapuz ManzanoNo ratings yet

- 1 A-2 Mann - Concept of Infrastructural PowerDocument11 pages1 A-2 Mann - Concept of Infrastructural Powerrichiflowers11gmail.comNo ratings yet

- Mathematics: Quarter 3 - Module 5: Independent & Dependent EventsDocument19 pagesMathematics: Quarter 3 - Module 5: Independent & Dependent EventsAlexis Jon NaingueNo ratings yet

- Boreal Forests Canadian Shield Tundra Arctic Canadian Rockies Coast Mountains Prairies Great Lakes St. Lawrence RiverDocument2 pagesBoreal Forests Canadian Shield Tundra Arctic Canadian Rockies Coast Mountains Prairies Great Lakes St. Lawrence Riversaikiran100No ratings yet

- Quasi JudicialDocument2 pagesQuasi JudicialMich Angeles100% (1)

- Palanca vs. CADocument16 pagesPalanca vs. CASherwin Anoba CabutijaNo ratings yet

- Lap Trình KeyenceDocument676 pagesLap Trình Keyencetuand1No ratings yet

- Week 8 Assignment SiriDocument8 pagesWeek 8 Assignment SiriSiri ReddyNo ratings yet

- Weight Tracking Chartv2 365days WeeklyDocument20 pagesWeight Tracking Chartv2 365days WeeklyozgegizemNo ratings yet