Professional Documents

Culture Documents

Principles of International Taxation-300

Principles of International Taxation-300

Uploaded by

luxdriver24Copyright:

Available Formats

You might also like

- TEMPLATE - Deed of Assignment of Stock Subscription With Assumption of ObligationDocument4 pagesTEMPLATE - Deed of Assignment of Stock Subscription With Assumption of ObligationClang SantosNo ratings yet

- Financial Accounting 2020 June - July Exam Question PaperDocument16 pagesFinancial Accounting 2020 June - July Exam Question PaperLaston Milanzi50% (2)

- Arms Length PrincipleDocument18 pagesArms Length PrincipleMARY IRUNGUNo ratings yet

- Kick Off Meeting Al Rajhi PDFDocument5 pagesKick Off Meeting Al Rajhi PDFAnonymous xtmbIHyNo ratings yet

- Bata Case Study SolutionDocument5 pagesBata Case Study SolutionMuhammad UmerNo ratings yet

- SSGC Internship ReportDocument68 pagesSSGC Internship ReportMohammad AliNo ratings yet

- Principles of International Taxation-301Document1 pagePrinciples of International Taxation-301luxdriver24No ratings yet

- Oecd/United States Tax Alert: Oecd Releases New Discussion Draft On Attribution of Profits To PesDocument4 pagesOecd/United States Tax Alert: Oecd Releases New Discussion Draft On Attribution of Profits To PesAnonymous w9EXUnNo ratings yet

- Sydney Law School: Legal Studies Research Paper No. 11/01Document17 pagesSydney Law School: Legal Studies Research Paper No. 11/01Kamel ElshandidyNo ratings yet

- PE Watch - 2023 in ReviewDocument18 pagesPE Watch - 2023 in ReviewRahma BellanyNo ratings yet

- Profit Attribution To PEDocument7 pagesProfit Attribution To PEPiyush AggarwalNo ratings yet

- Principles of International Taxation-303Document1 pagePrinciples of International Taxation-303luxdriver24No ratings yet

- Uae Corporate Tax Transfer Pricing GuideDocument7 pagesUae Corporate Tax Transfer Pricing GuideMuhammad UmarNo ratings yet

- Tax Challenges: Update Tax Laws Vs Use Existing TaxDocument6 pagesTax Challenges: Update Tax Laws Vs Use Existing TaxStefi Monika SueroNo ratings yet

- How OECD Developments Are Shaping Transfer Pricing: by Graham PooleDocument10 pagesHow OECD Developments Are Shaping Transfer Pricing: by Graham PooleJhon F SinagaNo ratings yet

- Corporate Tax Harmonization in The EU: Fiftieth Panel Meeting Hosted by The Universiteit Van TilburgDocument67 pagesCorporate Tax Harmonization in The EU: Fiftieth Panel Meeting Hosted by The Universiteit Van TilburgJonisa HoxhaNo ratings yet

- The 15 Action Points BEPSDocument8 pagesThe 15 Action Points BEPSErique Miguel MachariaNo ratings yet

- IC Loans in ItalyDocument9 pagesIC Loans in Italymalejandrabv87No ratings yet

- Principles of International Taxation-299Document1 pagePrinciples of International Taxation-299luxdriver24No ratings yet

- OECD Vs UN PDFDocument8 pagesOECD Vs UN PDFSujit KoiralaNo ratings yet

- Thesis On FarmoutDocument322 pagesThesis On FarmoutPhạm ThaoNo ratings yet

- Under Pillar One: Overall Comments On The Proposal For A "Unified Approach"Document15 pagesUnder Pillar One: Overall Comments On The Proposal For A "Unified Approach"harryNo ratings yet

- Decentralized Bargaining and Measures For Productivity and Corporate Welfare Growth in ItalyDocument25 pagesDecentralized Bargaining and Measures For Productivity and Corporate Welfare Growth in ItalyRublev09No ratings yet

- UK Stewardship CodeDocument4 pagesUK Stewardship CodeCharity ChikwandaNo ratings yet

- MGMT 3046 9781484315224-ch004Document22 pagesMGMT 3046 9781484315224-ch004JENNIFER LEGGNo ratings yet

- Comprehensive Income in Italy: Reporting Format Used, Nature of OCI Items and Its Effects On Company PerformanceDocument14 pagesComprehensive Income in Italy: Reporting Format Used, Nature of OCI Items and Its Effects On Company PerformanceYgdNo ratings yet

- English Eiti StandardDocument60 pagesEnglish Eiti StandardwhoismeNo ratings yet

- Transfer Pricing Aspects of Intra-Group Services What Are The Open Issues and What Can Be ImprovedDocument9 pagesTransfer Pricing Aspects of Intra-Group Services What Are The Open Issues and What Can Be Improvedokta7373No ratings yet

- The Relationship Between Accounting and Taxation: Paper Number 02/09Document23 pagesThe Relationship Between Accounting and Taxation: Paper Number 02/09andreidp6399No ratings yet

- Pub How Oecd Impact Ip TP ItrDocument6 pagesPub How Oecd Impact Ip TP ItrramitkatyalNo ratings yet

- EBITDA, Luc MartyDocument4 pagesEBITDA, Luc MartyFouzi TahiNo ratings yet

- Benefits of Tax Effective Supply Chain Restructuring: Management ControlDocument7 pagesBenefits of Tax Effective Supply Chain Restructuring: Management ControlMatti Ur RehmanNo ratings yet

- CMA IFRS Statements February09Document6 pagesCMA IFRS Statements February09osogboandrew_9480574No ratings yet

- IFRIC 23 - Uncertainty Over Income Tax Treatments: IFRS DevelopmentsDocument3 pagesIFRIC 23 - Uncertainty Over Income Tax Treatments: IFRS DevelopmentsFares BéjaouiNo ratings yet

- Business Combinations in Cooperatives A Critical View of AccountingDocument18 pagesBusiness Combinations in Cooperatives A Critical View of Accountingatinafu assefaNo ratings yet

- Problems in Revenue RecognitionDocument4 pagesProblems in Revenue RecognitionNaga Praveen TNo ratings yet

- 001 Grant Thornton Corporate Governance Review 2011Document60 pages001 Grant Thornton Corporate Governance Review 2011Ali LoughreyNo ratings yet

- A Step Towards New Market Jurisdiction Taxation RightsDocument6 pagesA Step Towards New Market Jurisdiction Taxation RightsRia KuvadiaNo ratings yet

- Reforming Capital Maintenance Law: The Companies (Amendment) Act 2005Document43 pagesReforming Capital Maintenance Law: The Companies (Amendment) Act 2005yohannis asfachewNo ratings yet

- CHAPTER 18 - CAPITAL BUDGETING - IngDocument48 pagesCHAPTER 18 - CAPITAL BUDGETING - IngNuha RSNo ratings yet

- Pillar Two Model Rules in A NutshellDocument5 pagesPillar Two Model Rules in A NutshellCeyahe HernándezNo ratings yet

- Deloitte Audit ReportDocument12 pagesDeloitte Audit Reportআনীক অবকাশNo ratings yet

- Icc Policy Statement On Co Operative Compliance PDFDocument10 pagesIcc Policy Statement On Co Operative Compliance PDFInu RukawaNo ratings yet

- The First Time Adoption of Comprehensive Income Statement in Italy: Critical Aspects On A Financial Performance IndicatorDocument24 pagesThe First Time Adoption of Comprehensive Income Statement in Italy: Critical Aspects On A Financial Performance IndicatorYgdNo ratings yet

- The Effect of Tax Avoidance, Profit Management, Managerial Ownership On Tax DisclosureDocument9 pagesThe Effect of Tax Avoidance, Profit Management, Managerial Ownership On Tax DisclosureInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Book-Tax Income Differences and Major Determining FactorsDocument11 pagesBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsNo ratings yet

- Audit Firm Governance Code: Practice Note 14Document22 pagesAudit Firm Governance Code: Practice Note 14Abdelmadjid djibrineNo ratings yet

- (2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian JurisprudenceDocument4 pages(2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian Jurisprudencesuraj gulipalliNo ratings yet

- Ne Gash 2012Document20 pagesNe Gash 2012Fenny MarietzaNo ratings yet

- Current Challenges in Insurance and Best Practice SolutionsDocument39 pagesCurrent Challenges in Insurance and Best Practice SolutionsasimaneelNo ratings yet

- Assignment On Corporate Taxation in BangladeshDocument28 pagesAssignment On Corporate Taxation in BangladeshNazmulHasanNo ratings yet

- Tax Risk MGTDocument26 pagesTax Risk MGTFrancis DansoNo ratings yet

- BEPS Project Final Reports: Issues For The Investment Funds SectorDocument8 pagesBEPS Project Final Reports: Issues For The Investment Funds SectorEduardo Fernandes ArandasNo ratings yet

- 1980 Report Correp Adjust DAF-CFA-WP6 (80) 10EDocument9 pages1980 Report Correp Adjust DAF-CFA-WP6 (80) 10EHoracio VianaNo ratings yet

- AA Tech Update 12 11 Public VersionDocument2 pagesAA Tech Update 12 11 Public Versionsanjay_kafleNo ratings yet

- ICRICT Alternatives Eng Sept 2017Document30 pagesICRICT Alternatives Eng Sept 2017Fritz BruggerNo ratings yet

- Lund University: PE Threshold For Business Profits in E-Commerce ContextDocument42 pagesLund University: PE Threshold For Business Profits in E-Commerce ContextPaulus TjhieNo ratings yet

- Sarbanes-Oxley Act: Will It Close The GAAP Between Economic and Accounting ProfitDocument28 pagesSarbanes-Oxley Act: Will It Close The GAAP Between Economic and Accounting ProfitRakesh KumarNo ratings yet

- Tax Implications On Mergers and Acquisitions ProcessDocument13 pagesTax Implications On Mergers and Acquisitions Processgayathris111No ratings yet

- Tax Implications On Mergers and Acquisitions ProcessDocument13 pagesTax Implications On Mergers and Acquisitions Processsiddharth pandeyNo ratings yet

- 2 PDFDocument13 pages2 PDFKaRan K KHetaniNo ratings yet

- IAS Plus: Amendments To IFRS 2 - Vesting Conditions and CancellationsDocument3 pagesIAS Plus: Amendments To IFRS 2 - Vesting Conditions and CancellationsFarhat ParveenNo ratings yet

- Cameran Et Al - 2014Document28 pagesCameran Et Al - 2014Jenn AtidaNo ratings yet

- 2023 March - PWC - Pay Versus Performance Disclosure and The Boards RoleDocument4 pages2023 March - PWC - Pay Versus Performance Disclosure and The Boards RoleValter FariaNo ratings yet

- Blacher - Pricing With A Volatility SmileDocument2 pagesBlacher - Pricing With A Volatility Smilefrolloos100% (1)

- Jennifer Williamson Recently Quit Her Job As An Investment Banker PDFDocument1 pageJennifer Williamson Recently Quit Her Job As An Investment Banker PDFhassan taimourNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Roy III v. HerbosaDocument88 pagesRoy III v. HerbosaChieDelRosarioNo ratings yet

- 2016-Davao Prison and Penal FarmDocument9 pages2016-Davao Prison and Penal FarmRodolfoNo ratings yet

- Property Conflict of LawsDocument3 pagesProperty Conflict of LawsWillam MontalbanNo ratings yet

- AIK CH 7 Part 1Document17 pagesAIK CH 7 Part 1rizky unsNo ratings yet

- Chapter 11 ExercisesDocument11 pagesChapter 11 ExercisesLakeNo ratings yet

- Finance Chapter 20Document21 pagesFinance Chapter 20courtdubs100% (3)

- Hyundai Motor India (Hmil) Interview Call LetterDocument3 pagesHyundai Motor India (Hmil) Interview Call LetterJaydeep PawarNo ratings yet

- HOUSING BARCH Question Paper AnsweringDocument27 pagesHOUSING BARCH Question Paper AnsweringSandra BettyNo ratings yet

- Northern Arc BookletDocument16 pagesNorthern Arc BookletPRAPTI TIWARINo ratings yet

- Introduction To Investment ClubsDocument50 pagesIntroduction To Investment ClubsBeyond Medicine100% (1)

- Hacienda San Vicente by Baldomero de La RamaDocument2 pagesHacienda San Vicente by Baldomero de La RamaMartin Mabunay Dela RamaNo ratings yet

- 03 Standards of Professional ... Egrity of Capital MarketsDocument14 pages03 Standards of Professional ... Egrity of Capital MarketsIves LeeNo ratings yet

- Consumer Perceptions PDFDocument14 pagesConsumer Perceptions PDFponniNo ratings yet

- Modulo Iscrizione TERZA EDIZIONE CORTONA - It.enDocument3 pagesModulo Iscrizione TERZA EDIZIONE CORTONA - It.enRexel ReedusNo ratings yet

- SipDocument79 pagesSipGangani PinalNo ratings yet

- SFP 1 and 2 AccountingDocument13 pagesSFP 1 and 2 AccountingAlissa MayNo ratings yet

- SRMC InviiceDocument1 pageSRMC InviiceSrmc InfratechNo ratings yet

- Bir Ruling Un 041 95Document2 pagesBir Ruling Un 041 95mikmgonzalesNo ratings yet

- Scarb Eesbm6e TB 11Document40 pagesScarb Eesbm6e TB 11Nour AbdallahNo ratings yet

- Appendix 26 - RCD FormDocument1 pageAppendix 26 - RCD FormRogie Apolo0% (1)

- Letter of Request For An Equity Investment D471Document2 pagesLetter of Request For An Equity Investment D471Naison StanleyNo ratings yet

- Benefits of Harmonisation and ConvergenceDocument3 pagesBenefits of Harmonisation and ConvergencemclerenNo ratings yet

Principles of International Taxation-300

Principles of International Taxation-300

Uploaded by

luxdriver24Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of International Taxation-300

Principles of International Taxation-300

Uploaded by

luxdriver24Copyright:

Available Formats

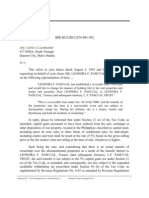

Exposure to tax where the PE is located 9.

40

assets used and risks assumed by the enterprise through the perma-

nent establishment and through the other parts of the enterprise.’

This wording reflects a lengthy process of consultation and development and

replaced the much simpler wording which existed until 2008:

‘the profits which it might be expected to make if it were a distinct

and separate enterprise engaged in the same or similar activities under

the same or similar conditions and dealing wholly independently with

the enterprise of which it is a PE.’

The reason for the change was that the OECD perceived that there was consid-

erable uncertainty as to how it should be implemented. Some states believe that

it is correct to look at the profits of the company as a whole and decide how

much of them are to be attributed to the PE. Others believe that the PE should

be viewed as a functionally separate enterprise and its profits determined with-

out reference to the profits of the company as a whole. This uncertainty is

evidenced by a whole series of consultations, draft reports, updates and reports

issued by the OECD over the last couple of decades (see for example, the 1993

report Attribution of Income to PEs).1

In 2008 the OECD published its final report setting out a complete overhaul

of the approach to the interpretation of Article 7 of the Model,2 which sets out

how profits of an enterprise are to be attributed to a PE (and thus taxable by the

host state). The OECD had published landmark guidance on transfer pricing

in 1995, and following that, the outcome of the OECD’s work on the effect

of e-commerce on the taxing rights of various states in which an enterprise

operated. Many had expected that the work on attribution of profits to PEs

would follow on directly after the publication of the transfer pricing guide-

lines, but the need to deal with the tax effects of e-commerce was found to

be more pressing. In the event, the main outcome of the work on e-commerce

was merely to confirm that what was really needed were better principles for

dealing with the attribution of profits to any sort of PE, e-commerce related or

otherwise. A Discussion Draft released by the OECD in 20013 went to some

lengths to set out a ‘working hypothesis’ for the attribution of profits to a PE

using the hypothesis that the PE is a ‘distinct and separate enterprise’ rather

than any approach which merely attempts to apportion the total profits of the

firm. Thus the approach to the attribution of profits to a PE places heavy reli-

ance on the content of the OECD’s transfer pricing principles (see Chapter 13).

These principles are aimed at transactions between companies in the same cor-

porate group. The OECD recognizes that dealings between different parts of

the same company (eg head office and branch) are not the same as transactions

between companies in the same corporate group but has stated that the transfer

pricing principles apply by analogy. The July 2008 Report was the culmina-

tion of a series of discussion documents and draft reports produced from 2001

onwards. The OECD has declared that the question of attributing profits to PEs

is to be determined without being constrained either by the original intent or

any historical interpretation of Article 7.4

The new approach was introduced by the OECD in two stages: in 2008, new

material was introduced into the Commentary, which did not conflict with

265

You might also like

- TEMPLATE - Deed of Assignment of Stock Subscription With Assumption of ObligationDocument4 pagesTEMPLATE - Deed of Assignment of Stock Subscription With Assumption of ObligationClang SantosNo ratings yet

- Financial Accounting 2020 June - July Exam Question PaperDocument16 pagesFinancial Accounting 2020 June - July Exam Question PaperLaston Milanzi50% (2)

- Arms Length PrincipleDocument18 pagesArms Length PrincipleMARY IRUNGUNo ratings yet

- Kick Off Meeting Al Rajhi PDFDocument5 pagesKick Off Meeting Al Rajhi PDFAnonymous xtmbIHyNo ratings yet

- Bata Case Study SolutionDocument5 pagesBata Case Study SolutionMuhammad UmerNo ratings yet

- SSGC Internship ReportDocument68 pagesSSGC Internship ReportMohammad AliNo ratings yet

- Principles of International Taxation-301Document1 pagePrinciples of International Taxation-301luxdriver24No ratings yet

- Oecd/United States Tax Alert: Oecd Releases New Discussion Draft On Attribution of Profits To PesDocument4 pagesOecd/United States Tax Alert: Oecd Releases New Discussion Draft On Attribution of Profits To PesAnonymous w9EXUnNo ratings yet

- Sydney Law School: Legal Studies Research Paper No. 11/01Document17 pagesSydney Law School: Legal Studies Research Paper No. 11/01Kamel ElshandidyNo ratings yet

- PE Watch - 2023 in ReviewDocument18 pagesPE Watch - 2023 in ReviewRahma BellanyNo ratings yet

- Profit Attribution To PEDocument7 pagesProfit Attribution To PEPiyush AggarwalNo ratings yet

- Principles of International Taxation-303Document1 pagePrinciples of International Taxation-303luxdriver24No ratings yet

- Uae Corporate Tax Transfer Pricing GuideDocument7 pagesUae Corporate Tax Transfer Pricing GuideMuhammad UmarNo ratings yet

- Tax Challenges: Update Tax Laws Vs Use Existing TaxDocument6 pagesTax Challenges: Update Tax Laws Vs Use Existing TaxStefi Monika SueroNo ratings yet

- How OECD Developments Are Shaping Transfer Pricing: by Graham PooleDocument10 pagesHow OECD Developments Are Shaping Transfer Pricing: by Graham PooleJhon F SinagaNo ratings yet

- Corporate Tax Harmonization in The EU: Fiftieth Panel Meeting Hosted by The Universiteit Van TilburgDocument67 pagesCorporate Tax Harmonization in The EU: Fiftieth Panel Meeting Hosted by The Universiteit Van TilburgJonisa HoxhaNo ratings yet

- The 15 Action Points BEPSDocument8 pagesThe 15 Action Points BEPSErique Miguel MachariaNo ratings yet

- IC Loans in ItalyDocument9 pagesIC Loans in Italymalejandrabv87No ratings yet

- Principles of International Taxation-299Document1 pagePrinciples of International Taxation-299luxdriver24No ratings yet

- OECD Vs UN PDFDocument8 pagesOECD Vs UN PDFSujit KoiralaNo ratings yet

- Thesis On FarmoutDocument322 pagesThesis On FarmoutPhạm ThaoNo ratings yet

- Under Pillar One: Overall Comments On The Proposal For A "Unified Approach"Document15 pagesUnder Pillar One: Overall Comments On The Proposal For A "Unified Approach"harryNo ratings yet

- Decentralized Bargaining and Measures For Productivity and Corporate Welfare Growth in ItalyDocument25 pagesDecentralized Bargaining and Measures For Productivity and Corporate Welfare Growth in ItalyRublev09No ratings yet

- UK Stewardship CodeDocument4 pagesUK Stewardship CodeCharity ChikwandaNo ratings yet

- MGMT 3046 9781484315224-ch004Document22 pagesMGMT 3046 9781484315224-ch004JENNIFER LEGGNo ratings yet

- Comprehensive Income in Italy: Reporting Format Used, Nature of OCI Items and Its Effects On Company PerformanceDocument14 pagesComprehensive Income in Italy: Reporting Format Used, Nature of OCI Items and Its Effects On Company PerformanceYgdNo ratings yet

- English Eiti StandardDocument60 pagesEnglish Eiti StandardwhoismeNo ratings yet

- Transfer Pricing Aspects of Intra-Group Services What Are The Open Issues and What Can Be ImprovedDocument9 pagesTransfer Pricing Aspects of Intra-Group Services What Are The Open Issues and What Can Be Improvedokta7373No ratings yet

- The Relationship Between Accounting and Taxation: Paper Number 02/09Document23 pagesThe Relationship Between Accounting and Taxation: Paper Number 02/09andreidp6399No ratings yet

- Pub How Oecd Impact Ip TP ItrDocument6 pagesPub How Oecd Impact Ip TP ItrramitkatyalNo ratings yet

- EBITDA, Luc MartyDocument4 pagesEBITDA, Luc MartyFouzi TahiNo ratings yet

- Benefits of Tax Effective Supply Chain Restructuring: Management ControlDocument7 pagesBenefits of Tax Effective Supply Chain Restructuring: Management ControlMatti Ur RehmanNo ratings yet

- CMA IFRS Statements February09Document6 pagesCMA IFRS Statements February09osogboandrew_9480574No ratings yet

- IFRIC 23 - Uncertainty Over Income Tax Treatments: IFRS DevelopmentsDocument3 pagesIFRIC 23 - Uncertainty Over Income Tax Treatments: IFRS DevelopmentsFares BéjaouiNo ratings yet

- Business Combinations in Cooperatives A Critical View of AccountingDocument18 pagesBusiness Combinations in Cooperatives A Critical View of Accountingatinafu assefaNo ratings yet

- Problems in Revenue RecognitionDocument4 pagesProblems in Revenue RecognitionNaga Praveen TNo ratings yet

- 001 Grant Thornton Corporate Governance Review 2011Document60 pages001 Grant Thornton Corporate Governance Review 2011Ali LoughreyNo ratings yet

- A Step Towards New Market Jurisdiction Taxation RightsDocument6 pagesA Step Towards New Market Jurisdiction Taxation RightsRia KuvadiaNo ratings yet

- Reforming Capital Maintenance Law: The Companies (Amendment) Act 2005Document43 pagesReforming Capital Maintenance Law: The Companies (Amendment) Act 2005yohannis asfachewNo ratings yet

- CHAPTER 18 - CAPITAL BUDGETING - IngDocument48 pagesCHAPTER 18 - CAPITAL BUDGETING - IngNuha RSNo ratings yet

- Pillar Two Model Rules in A NutshellDocument5 pagesPillar Two Model Rules in A NutshellCeyahe HernándezNo ratings yet

- Deloitte Audit ReportDocument12 pagesDeloitte Audit Reportআনীক অবকাশNo ratings yet

- Icc Policy Statement On Co Operative Compliance PDFDocument10 pagesIcc Policy Statement On Co Operative Compliance PDFInu RukawaNo ratings yet

- The First Time Adoption of Comprehensive Income Statement in Italy: Critical Aspects On A Financial Performance IndicatorDocument24 pagesThe First Time Adoption of Comprehensive Income Statement in Italy: Critical Aspects On A Financial Performance IndicatorYgdNo ratings yet

- The Effect of Tax Avoidance, Profit Management, Managerial Ownership On Tax DisclosureDocument9 pagesThe Effect of Tax Avoidance, Profit Management, Managerial Ownership On Tax DisclosureInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Book-Tax Income Differences and Major Determining FactorsDocument11 pagesBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsNo ratings yet

- Audit Firm Governance Code: Practice Note 14Document22 pagesAudit Firm Governance Code: Practice Note 14Abdelmadjid djibrineNo ratings yet

- (2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian JurisprudenceDocument4 pages(2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian Jurisprudencesuraj gulipalliNo ratings yet

- Ne Gash 2012Document20 pagesNe Gash 2012Fenny MarietzaNo ratings yet

- Current Challenges in Insurance and Best Practice SolutionsDocument39 pagesCurrent Challenges in Insurance and Best Practice SolutionsasimaneelNo ratings yet

- Assignment On Corporate Taxation in BangladeshDocument28 pagesAssignment On Corporate Taxation in BangladeshNazmulHasanNo ratings yet

- Tax Risk MGTDocument26 pagesTax Risk MGTFrancis DansoNo ratings yet

- BEPS Project Final Reports: Issues For The Investment Funds SectorDocument8 pagesBEPS Project Final Reports: Issues For The Investment Funds SectorEduardo Fernandes ArandasNo ratings yet

- 1980 Report Correp Adjust DAF-CFA-WP6 (80) 10EDocument9 pages1980 Report Correp Adjust DAF-CFA-WP6 (80) 10EHoracio VianaNo ratings yet

- AA Tech Update 12 11 Public VersionDocument2 pagesAA Tech Update 12 11 Public Versionsanjay_kafleNo ratings yet

- ICRICT Alternatives Eng Sept 2017Document30 pagesICRICT Alternatives Eng Sept 2017Fritz BruggerNo ratings yet

- Lund University: PE Threshold For Business Profits in E-Commerce ContextDocument42 pagesLund University: PE Threshold For Business Profits in E-Commerce ContextPaulus TjhieNo ratings yet

- Sarbanes-Oxley Act: Will It Close The GAAP Between Economic and Accounting ProfitDocument28 pagesSarbanes-Oxley Act: Will It Close The GAAP Between Economic and Accounting ProfitRakesh KumarNo ratings yet

- Tax Implications On Mergers and Acquisitions ProcessDocument13 pagesTax Implications On Mergers and Acquisitions Processgayathris111No ratings yet

- Tax Implications On Mergers and Acquisitions ProcessDocument13 pagesTax Implications On Mergers and Acquisitions Processsiddharth pandeyNo ratings yet

- 2 PDFDocument13 pages2 PDFKaRan K KHetaniNo ratings yet

- IAS Plus: Amendments To IFRS 2 - Vesting Conditions and CancellationsDocument3 pagesIAS Plus: Amendments To IFRS 2 - Vesting Conditions and CancellationsFarhat ParveenNo ratings yet

- Cameran Et Al - 2014Document28 pagesCameran Et Al - 2014Jenn AtidaNo ratings yet

- 2023 March - PWC - Pay Versus Performance Disclosure and The Boards RoleDocument4 pages2023 March - PWC - Pay Versus Performance Disclosure and The Boards RoleValter FariaNo ratings yet

- Blacher - Pricing With A Volatility SmileDocument2 pagesBlacher - Pricing With A Volatility Smilefrolloos100% (1)

- Jennifer Williamson Recently Quit Her Job As An Investment Banker PDFDocument1 pageJennifer Williamson Recently Quit Her Job As An Investment Banker PDFhassan taimourNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Roy III v. HerbosaDocument88 pagesRoy III v. HerbosaChieDelRosarioNo ratings yet

- 2016-Davao Prison and Penal FarmDocument9 pages2016-Davao Prison and Penal FarmRodolfoNo ratings yet

- Property Conflict of LawsDocument3 pagesProperty Conflict of LawsWillam MontalbanNo ratings yet

- AIK CH 7 Part 1Document17 pagesAIK CH 7 Part 1rizky unsNo ratings yet

- Chapter 11 ExercisesDocument11 pagesChapter 11 ExercisesLakeNo ratings yet

- Finance Chapter 20Document21 pagesFinance Chapter 20courtdubs100% (3)

- Hyundai Motor India (Hmil) Interview Call LetterDocument3 pagesHyundai Motor India (Hmil) Interview Call LetterJaydeep PawarNo ratings yet

- HOUSING BARCH Question Paper AnsweringDocument27 pagesHOUSING BARCH Question Paper AnsweringSandra BettyNo ratings yet

- Northern Arc BookletDocument16 pagesNorthern Arc BookletPRAPTI TIWARINo ratings yet

- Introduction To Investment ClubsDocument50 pagesIntroduction To Investment ClubsBeyond Medicine100% (1)

- Hacienda San Vicente by Baldomero de La RamaDocument2 pagesHacienda San Vicente by Baldomero de La RamaMartin Mabunay Dela RamaNo ratings yet

- 03 Standards of Professional ... Egrity of Capital MarketsDocument14 pages03 Standards of Professional ... Egrity of Capital MarketsIves LeeNo ratings yet

- Consumer Perceptions PDFDocument14 pagesConsumer Perceptions PDFponniNo ratings yet

- Modulo Iscrizione TERZA EDIZIONE CORTONA - It.enDocument3 pagesModulo Iscrizione TERZA EDIZIONE CORTONA - It.enRexel ReedusNo ratings yet

- SipDocument79 pagesSipGangani PinalNo ratings yet

- SFP 1 and 2 AccountingDocument13 pagesSFP 1 and 2 AccountingAlissa MayNo ratings yet

- SRMC InviiceDocument1 pageSRMC InviiceSrmc InfratechNo ratings yet

- Bir Ruling Un 041 95Document2 pagesBir Ruling Un 041 95mikmgonzalesNo ratings yet

- Scarb Eesbm6e TB 11Document40 pagesScarb Eesbm6e TB 11Nour AbdallahNo ratings yet

- Appendix 26 - RCD FormDocument1 pageAppendix 26 - RCD FormRogie Apolo0% (1)

- Letter of Request For An Equity Investment D471Document2 pagesLetter of Request For An Equity Investment D471Naison StanleyNo ratings yet

- Benefits of Harmonisation and ConvergenceDocument3 pagesBenefits of Harmonisation and ConvergencemclerenNo ratings yet