Professional Documents

Culture Documents

(24-03-22) - ASML Holding N.V. ASML Value Line Report

(24-03-22) - ASML Holding N.V. ASML Value Line Report

Uploaded by

Salman D.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(24-03-22) - ASML Holding N.V. ASML Value Line Report

(24-03-22) - ASML Holding N.V. ASML Value Line Report

Uploaded by

Salman D.Copyright:

Available Formats

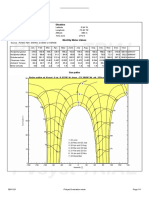

ASML HOLDING N.V.

NDQ-ASML RECENT

PRICE 962.67 P/ERATIO 47.1(Trailing:

Median: 29.0) P/E RATIO 2.63 YLD 0.7%

44.0 RELATIVE DIV’D VALUE

LINE

TIMELINESS 2 Raised 2/9/24 High:

Low:

101.9

62.7

109.9

79.7

114.1

82.1

112.7

77.2

186.4

109.6

221.7

144.5

298.5

147.4

492.7

191.3

895.9

489.7

799.4

363.2

772.0

545.8

1056

696.1

Target Price Range

2027 2028 2029

SAFETY 3 New 9/22/23 LEGENDS

35.0 x ″Cash Flow″ p sh 3500

TECHNICAL 3 Raised 3/15/24 . . . . Relative Price Strength

Options: Yes 2500

BETA 1.10 (1.00 = Market) Shaded area indicates recession

18-Month Target Price Range

1250

Low-High Midpoint (% to Mid)

$722-$1578 $1150 (20%) 800

2027-29 PROJECTIONS 600

Ann’l Total 500

Price Gain Return 400

High 2155 (+125%) 23% 300

Low 1435 (+50%) 11%

% TOT. RETURN 2/24 250

U.S. Institutional Decisions THIS VL ARITH.* 200

2Q2023 3Q2023 4Q2023 STOCK INDEX

Percent 9 1 yr. 55.5 10.4

to Buy 635 656 767 shares 6

to Sell 423 439 432 3 yr. 72.9 16.5

traded 3

Hld’s(000) 75009 75325 73431 5 yr. 449.6 63.1

ASM Lithography was created by Philips 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 © VALUE LINE PUB. LLC 27-29

and Advanced Semiconductor Materials in 1.21 1.09 1.05 1.20 1.14 1.12 1.23 1.13 1.07 1.10 1.10 1.10 Translation Rate(Euro/$) A 1.10

1984. It went public in 1995 with Philips sell- 16.44 16.00 16.69 25.39 29.76 31.61 41.19 52.32 57.42 77.05 79.20 97.35 Sales per sh B 138.90

ing off half its stake. It is traded on Amster- 4.97 4.29 4.49 7.11 8.20 8.13 11.92 17.86 16.83 23.99 23.60 31.60 ‘‘Cash Flow’’ per sh 48.55

C

dam and NASDAQ stock exchanges. KPMG 3.93 3.50 3.63 5.89 6.96 6.91 10.41 16.23 15.12 21.88 21.50 29.00 Earnings per sh 45.00

is the auditor. .84 .76 1.21 1.31 1.69 3.51 2.85 3.96 6.93 6.45 4.45 7.00 Div’ds Decl’d p/sh D■ 16.50

1.01 .95 .78 .95 1.56 2.05 2.83 2.53 3.48 6.03 4.00 4.45 Cap’l Spending per sh 4.15

23.49 21.35 24.12 29.94 31.66 33.68 40.86 28.51 23.89 37.61 38.75 44.15 Book Value per sh 43.95

CAPITAL STRUCTURE as of 12/31/23 432.94 427.99 429.94 427.39 421.10 419.81 416.51 402.60 394.59 393.42 385.00 380.00 Common Shs Outst’g E 360.00

Total Debt $5.09 bill. Due in 5 Yrs $2.07 bill.

LT Debt $5.09 bill. LT Interest $125 mill. 23.6 28.4 27.4 24.8 27.5 31.7 33.5 43.0 37.3 30.3 Bold figures are Avg Ann’l P/E Ratio 40.0

1.24 1.43 1.44 1.25 1.49 1.69 1.72 2.32 2.15 1.69 Value Line Relative P/E Ratio 2.25

(Total interest coverage: NMF) (26% of Cap’l) estimates

.9% .8% 1.2% .9% .9% 1.6% .8% .6% 1.2% 1.0% Avg Ann’l Div’d Yield .9%

Leases, Uncapitalized Annual rentals $2.4 bill. 7118.9 6848.3 7174.5 10852 12533 13271 17156 21065 22656 30315 30500 37000 Sales ($mill) B 50000

30.7% 28.3% 28.3% 31.1% 31.0% 27.4% 32.5% 37.7% 33.5% 35.7% 39.0% 43.0% Operating Margin 43.0%

Pension Assets-12/22: $104.7 mill.

Pension Obligation: $104.2 mill. 429.2 323.4 376.9 500.5 484.1 503.6 602.4 533.1 624.5 814.0 800 880 Depreciation ($mill) 1100

Pfd Stock None 1724.1 1510.9 1554.1 2539.6 2967.9 2910.5 4361.4 6659.0 6017.9 8623.0 8290 11125 Net Profit ($mill) 16385

7.1% 10.4% 13.0% 12.7% 12.0% 6.9% 13.7% 15.2% 15.0% 15.9% 16.0% 16.0% Income Tax Rate 16.0%

Common Stock 393,421,721 common shares. 24.2% 22.1% 21.7% 23.4% 23.7% 21.9% 25.4% 31.6% 26.6% 28.4% 27.2% 31.8% Net Profit Margin 32.8%

4912.9 5010.9 5571.8 6791.1 7718.0 8350.0 11446 6669.1 5436.9 8931.0 6020 9845 Working Cap’l ($mill) 12800

as of 12/31/23 1401.2 1225.9 3243.5 3596.4 3465.9 3489.9 5722.6 4612.3 3760.2 5094.0 4975 3500 Long-Term Debt ($mill) 3000

MARKET CAP: $379 billion (Large Cap) 10170 9137.2 10369 12798 13331 14138 17017 11478 9427.6 14797 14920 16780 Shr. Equity ($mill) 15820

15.0% 14.7% 11.4% 15.7% 17.8% 16.6% 19.3% 41.5% 45.8% 43.5% 41.5% 55.0% Return on Total Cap’l 87.0%

CURRENT POSITION 2021 2022 12/31/23 17.0% 16.5% 15.0% 19.8% 22.3% 20.6% 25.6% 58.0% 63.8% 58.3% 55.5% 66.5% Return on Shr. Equity NMF

($MILL.) 13.8% 12.9% 10.4% 15.0% 17.1% 10.1% 17.9% 44.5% 34.8% 40.8% 37.0% 48.0% Retained to Com Eq NMF

Cash Assets 8565 7891 7711 19% 22% 30% 24% 23% 51% 30% 23% 46% 30% 30% 33% All Divd’s to Net Prof 30%

Receivables 3422 5697 4767

Inventory (FIFO) 5852 7704 9736 BUSINESS: ASML Holding N.V, is traded on the NASDAQ and 2022 (40 EUV). Taiwan sales were 38% of total; South Korea 29%.

Other 2716 3386 4619 Euronext Amsterdam. The company sells an integrated portfolio of Largest customers are TSMC, Intel, and Samsung. Has 39,086 em-

Current Assets 20555 24678 26833 lithography systems mainly for manufacturing complex integrated ployees. As of 2/7/24, insiders own less than 1% of stock; Capital

Accts Payable 2391 2745 2582 circuits. The company supplies systems to integrated circuit semi- Research & Mgmt. 10.3%; BlackRock 8.0%; C.E.O.: Peter Winnick.

Debt Due 575 798 --

Other 10930 15700 15319 conductors (ICs) manufacturers throughout the United States, Asia, Address: De Run 6501, 5504 DR Veldhoven, The Netherlands

Current Liab. 13896 19243 17901 and Western Europe from 60 locations. Sold 561 net systems in Tel.: 31 6 5284 4418. Internet: www.asml.com

ANNUAL RATES Past Past Est’d ’21-’23 The stock price of ASML Holding NV it faces these competitors in mid and lower

of change (per ADR) 10 Yrs. 5 Yrs. to ’27-’29 has soared 36% since our last report, end markets. Management reined in Wall

Sales 15.0% 21.0% 9.5% despite the likelihood of a modest Street expectations three months ago with

‘‘Cash Flow’’ 16.0% 24.5% 6.5%

Earnings 17.0% 26.5% 12.5% profit decline this year. The excitement a flat revenue forecast for this year, but

Dividends 25.0% 33.0% 7.0% surrounding artificial intelligence and the the company’s current firm order book will

Book Value 7.5% 1.0% 8.0% potential for accelerated technological ad- likely translate into double-digit top-line

Cal- QUARTERLY SALES ($ mill.) B Full vancement this decade has propelled the growth in 2025. Combined with rising

endar Mar.31 Jun.30 Sep.30 Dec.31 Year P/E multiple higher, even though demand gross margins (from 50% vicinity to 54%

2021 4939 4550 5932 5643 21065 for lithography tools, much less machines, next year), we look for earnings to be

2022 3781 5810 6182 6880 22655 will face a lull before many new foundries around $29.00 per share.

2023 7218 7385 7340 8372 30315 begin construction in 2025. Elevated costs Bookings ended 2024 at 39 billion

2024 6000 7250 8250 9000 30500 stemming from capacity improvements euros. The shift to new technology nodes

2025 7500 9000 9500 11000 37000 will also dampen margins in coming on the memory side typically fuels

Cal- EARNINGS PER ADR C Full quarters. demand. And innovative HDM technol-

endar Mar.31 Jun.30 Sep.30 Dec.31 Year Our newly introduced 2025 earnings ogies should support memory growth after

2021 3.62 2.85 4.82 4.95 16.13 per share estimate assumes renewed it lagged logic gains in recent quarters.

2022 1.85 3.79 4.59 4.89 15.12 shipment growth. ASML’s lithography Investors should note the unique

2023 5.46 5.42 5.29 5.71 21.88 equipment is used to squeeze an enormous price action of this stock. Even though

2024 3.00 5.50 6.25 6.75 21.50 amount of transistors onto a single chip ASML’s technology is unrivaled, the

2025 6.00 6.50 8.00 8.50 29.00 and enable high volume production. This shares still often trade directionally with

Cal- QUARTERLY DIVIDENDS PAID D■ Full technology is the most critical function in the semiconductor cycle. As a result, inves-

endar Mar.31 Jun.30 Sep.30 Dec.31 Year the semi manufacturing process and is vi- tors looking to price in forward demand

2020 -- 1.46 - - 1.40 2.86 tal for the creation of both memory and levels are exposed to semi industry senti-

2021 -- 1.87 - - 2.09 3.96 logic chips. The company’s EUV (extreme ment on a short term basis. Aside from

2022 -- 4.19 - - 1.34 6.93 ultraviolet) machines cost $200 million to this caveat, investors willing to endure

2023 1.49 1.84 1.59 1.53 6.45 $300 million. And ASML’s EUV offerings volatility should be rewarded with supe-

2024 1.58 have been far superior to those of rivals rior returns over the long haul.

Canon and Nikon for many years, though, Charles C. Moran March 22, 2024

(A) At year end. In $, unless otherwise noted. Earnings may not sum due to rounding. Next ary, May, August, and November. Company’s Financial Strength A

(B) Sales excluding excise taxes. earnings report due early May. (E) In millions. Stock’s Price Stability 55

(C) Earnings based on IFRS from 2013. Based (D) Dividends historically paid in early Febru- Price Growth Persistence 100

on U.S. GAAP. Earnings Predictability 80

© 2024 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part To subscribe call 1-800-VALUELINE

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

You might also like

- Financial Analysis of A BMW-2021 and 2020Document4 pagesFinancial Analysis of A BMW-2021 and 2020Mukoya Odede100% (1)

- Castlepines 2021 V18-1Document8 pagesCastlepines 2021 V18-1Steven RosarioNo ratings yet

- Apple - Report PDFDocument1 pageApple - Report PDFUwie AndrianaNo ratings yet

- FIRM1Document1 pageFIRM1janm45.niazisolutionsNo ratings yet

- Laporan BulananDocument7 pagesLaporan Bulananmuhammad syaifuddin ihsanNo ratings yet

- DownloadDocument1 pageDownloadOscar WanNo ratings yet

- Walmart Inc PDFDocument1 pageWalmart Inc PDFWaqar AhmedNo ratings yet

- Tri VLDocument1 pageTri VLJ Pierre RicherNo ratings yet

- Nextera Library Validation and Cluster Density OptimizationDocument2 pagesNextera Library Validation and Cluster Density OptimizationhellowinstonNo ratings yet

- Bby AaDocument1 pageBby AalondonmorganNo ratings yet

- 1437960464extreme Rainfall JuneDocument7 pages1437960464extreme Rainfall JuneSuyogya DahalNo ratings yet

- Forecasting Stationary ModelsDocument22 pagesForecasting Stationary ModelsVINAY GUPTANo ratings yet

- FID1 B, (LOC/SIG1000953.D) : CountsDocument2 pagesFID1 B, (LOC/SIG1000953.D) : CountsYoosu NguyenNo ratings yet

- Think and HistoryDocument1 pageThink and HistoryfaizNo ratings yet

- GEA - Bock - SemiHerm - Catalogue - GB 4Document1 pageGEA - Bock - SemiHerm - Catalogue - GB 4hadi mehrabiNo ratings yet

- Section 2Document1 pageSection 2Dharmesh YadavNo ratings yet

- CNN Features Off-the-Shelf - An Astounding Baseline For RecognitionDocument8 pagesCNN Features Off-the-Shelf - An Astounding Baseline For RecognitionhiriNo ratings yet

- Daily Brief 02 June 23Document28 pagesDaily Brief 02 June 23waqar009No ratings yet

- Magic Numbers - CordwellDocument19 pagesMagic Numbers - CordwellSónia FernandesNo ratings yet

- Commercial Aspirin IR SpectrumDocument1 pageCommercial Aspirin IR SpectrumJoshua C. CastilloNo ratings yet

- Z ZZZZZZZZDocument1 pageZ ZZZZZZZZabene abebeNo ratings yet

- Bematech KC4112-3Document10 pagesBematech KC4112-3Nicolas EncisoNo ratings yet

- Historico PIB MexicoDocument1 pageHistorico PIB MexicoJUAN SINMIEDONo ratings yet

- SF No 28 Kadhampadi ModelDocument1 pageSF No 28 Kadhampadi ModelmanojNo ratings yet

- SF No 28 Kadhampadi ModelDocument1 pageSF No 28 Kadhampadi ModelmanojNo ratings yet

- 1a. Pagina, PresentationDocument1 page1a. Pagina, PresentationJose A. Bravo B.No ratings yet

- GEA - Bock - SemiHerm - Catalogue - GB 18Document1 pageGEA - Bock - SemiHerm - Catalogue - GB 18hadi mehrabiNo ratings yet

- Spiva Us Year End 2021Document39 pagesSpiva Us Year End 2021Hyenuk ChuNo ratings yet

- Everard - 1st FloorDocument1 pageEverard - 1st Floorartic alibanNo ratings yet

- FW Expansion Bay PCB 0807Document3 pagesFW Expansion Bay PCB 0807wibowit428No ratings yet

- Harley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 pageHarley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDBrent UptonNo ratings yet

- Monitor de SequiaDocument7 pagesMonitor de Sequiass.sefi.infraestructuraNo ratings yet

- Laporan Gizi September 2017Document19 pagesLaporan Gizi September 2017akreditasipuskesmascidahukngNo ratings yet

- BP Stats Review 2019 Full Report 43Document1 pageBP Stats Review 2019 Full Report 43Sakaros BogningNo ratings yet

- Date/Time 6/5/2022 3:49:25 PM No. of Scans Resolution Comment G-D-K-A-K-V-C-A-StandarDocument1 pageDate/Time 6/5/2022 3:49:25 PM No. of Scans Resolution Comment G-D-K-A-K-V-C-A-StandarAndres AriasNo ratings yet

- Group Number 01Document14 pagesGroup Number 01Avishake SahaNo ratings yet

- (Dimension) 84WS70Document1 page(Dimension) 84WS70mmousa12501No ratings yet

- Session 2 - Eng. Hamed Al Saggaf - Saudi Electricity CompanyDocument17 pagesSession 2 - Eng. Hamed Al Saggaf - Saudi Electricity CompanyFaheem PP13No ratings yet

- Treca Faza NX PDFDocument1 pageTreca Faza NX PDFpaki12No ratings yet

- AppleDocument1 pageAppleavinwiriandari61198No ratings yet

- JCDC Logistic Land FenceDocument1 pageJCDC Logistic Land FencevineeshNo ratings yet

- Khadi Chowk To Bridge Part - 2Document1 pageKhadi Chowk To Bridge Part - 2naman jainNo ratings yet

- Debt-To-GDP Ratio Debt-To-GDP RatioDocument2 pagesDebt-To-GDP Ratio Debt-To-GDP RatioFlorea Lucian NicolaeNo ratings yet

- 1-4 Barrel Culvert4Document1 page1-4 Barrel Culvert4Delahan AbatyoughNo ratings yet

- Tartaric Acid (STANDARD)Document2 pagesTartaric Acid (STANDARD)knbiolabsNo ratings yet

- Shruti Vishwakarma Mba I Sem Moe 2021mba015Document81 pagesShruti Vishwakarma Mba I Sem Moe 2021mba015shrutiv vishwakarmaNo ratings yet

- Civil EngineeerDocument1 pageCivil EngineeerKanishka WijesekaraNo ratings yet

- Laporan Gizi November 2017Document13 pagesLaporan Gizi November 2017akreditasipuskesmascidahukngNo ratings yet

- Kurva S PT - Etsa Hari Ke 30Document5 pagesKurva S PT - Etsa Hari Ke 30Ariwibowo SuparnadiNo ratings yet

- No 04 97Document1 pageNo 04 97widibae jokotholeNo ratings yet

- Evaluasi & Optimalisasi Capaian Program Dan Kegiatan Yang Mendukung Capaian SPM Bidang Kesehatan Di Kab. Wonosobo TAHUN 2018Document42 pagesEvaluasi & Optimalisasi Capaian Program Dan Kegiatan Yang Mendukung Capaian SPM Bidang Kesehatan Di Kab. Wonosobo TAHUN 2018Anonymous dxMzYhQR8No ratings yet

- Tenaris SeamlessDimensional Range PDFDocument2 pagesTenaris SeamlessDimensional Range PDFuzzy2No ratings yet

- Let The Show Begin.: Product OverviewDocument6 pagesLet The Show Begin.: Product OverviewHéritier NealNo ratings yet

- CL 2000Document2 pagesCL 2000Frozen MinakoNo ratings yet

- Casa Ejercicio 1Document1 pageCasa Ejercicio 1Ortíz Vázquez María FernandaNo ratings yet

- Duty Master Alternating Current MotorsDocument2 pagesDuty Master Alternating Current Motorsjorge arturoNo ratings yet

- Deep Learning For Scene Classification: A SurveyDocument24 pagesDeep Learning For Scene Classification: A Surveyamta1No ratings yet

- Pvsyst Trial Pvsyst Trial Pvsyst Trial Pvsyst TrialDocument1 pagePvsyst Trial Pvsyst Trial Pvsyst Trial Pvsyst TrialLeonardo MirandaNo ratings yet

- Opzv Series: Tubular Gel BatteryDocument4 pagesOpzv Series: Tubular Gel BatteryAhmed ZeharaNo ratings yet

- Indian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadDocument33 pagesIndian Railways: Trends, Issues, Opportunities and Outlook: G Raghuram Indian Institute of Management, AhmedabadmakbimhrdNo ratings yet

- F II Quality Report 08.02.2023Document4 pagesF II Quality Report 08.02.2023AQUANo ratings yet

- A B Testing - The Complete GuideDocument11 pagesA B Testing - The Complete GuideSalman D.No ratings yet

- Arabic Script and The Rise of Arabic Calligraphy PDFDocument21 pagesArabic Script and The Rise of Arabic Calligraphy PDFSalman D.100% (1)

- FSWEP 2.0 Recruiting A Motivated Civil ServiceDocument6 pagesFSWEP 2.0 Recruiting A Motivated Civil ServiceSalman D.No ratings yet

- Arming The Nation A Paper Prepared by DR Granatstein May 2005Document17 pagesArming The Nation A Paper Prepared by DR Granatstein May 2005Salman D.No ratings yet

- Enigma Securities Ltd. DeckDocument14 pagesEnigma Securities Ltd. DeckBernardo QuintaoNo ratings yet

- Portfolio Analysis and Investment Strategy in The Pakistan Stock ExchangeDocument3 pagesPortfolio Analysis and Investment Strategy in The Pakistan Stock Exchangebsmt22098No ratings yet

- Template - DDQ APM PartnersDocument58 pagesTemplate - DDQ APM PartnersTing-An KuoNo ratings yet

- Institutional Finance To EntrepreneursDocument17 pagesInstitutional Finance To EntrepreneursSelvi balanNo ratings yet

- BioTherm Energy (Pty) Ltd. Was Acquired by Actis LLP - MergermarketDocument8 pagesBioTherm Energy (Pty) Ltd. Was Acquired by Actis LLP - MergermarketrivaltzNo ratings yet

- IC-38 Crash CourseDocument18 pagesIC-38 Crash CourseÅdârsh DûßêyNo ratings yet

- MCQ8. Government Businees ModuleDocument9 pagesMCQ8. Government Businees Modulesimranjyot2021No ratings yet

- Ethical Issues in FinanceDocument20 pagesEthical Issues in FinanceUmar AzizNo ratings yet

- JunaidDocument37 pagesJunaidMuktiNo ratings yet

- Chapter 4 - Activities and Charactristics Under Depository InstitutionsDocument7 pagesChapter 4 - Activities and Charactristics Under Depository Institutionssonchaenyoung2No ratings yet

- Com3701 Assignment OneDocument13 pagesCom3701 Assignment OneShirma MalulekeNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- Risk and Return. Finance and InvestmentDocument77 pagesRisk and Return. Finance and InvestmentPinky RoseNo ratings yet

- Divynshu Yadav - Final Internship ReportDocument61 pagesDivynshu Yadav - Final Internship ReportTamanna AroraNo ratings yet

- D2 JN 1 VRQJ WIDocument40 pagesD2 JN 1 VRQJ WITheoNo ratings yet

- Case Assignment 3 Entrepreneurial Finance in Finland CB PDFDocument3 pagesCase Assignment 3 Entrepreneurial Finance in Finland CB PDFmohamad nassrallahNo ratings yet

- 9418 - Financial Statements TranslationDocument3 pages9418 - Financial Statements Translationjsmozol3434qcNo ratings yet

- SVB Crisis and ImpactDocument1 pageSVB Crisis and Impactharshad jainNo ratings yet

- Module 4 - Approaches of MarketingDocument8 pagesModule 4 - Approaches of MarketingCESTINA, KIM LIANNE, B.No ratings yet

- E-Book Chart Pattern by GaryyDocument12 pagesE-Book Chart Pattern by GaryyRenganathan Venkatavaradhan100% (1)

- Statement of Comprehensive Income: Basic Financial Statements IiDocument5 pagesStatement of Comprehensive Income: Basic Financial Statements IiEurica LimNo ratings yet

- SME Disclosure StatementDocument2 pagesSME Disclosure StatementJose Rico ColigadoNo ratings yet

- Kumkum YadavDocument51 pagesKumkum YadavHarshit KashyapNo ratings yet

- Fria CasesDocument2 pagesFria Casesadditional.memoryv.4.0No ratings yet

- Ananya BoseDocument5 pagesAnanya BoseAnanya BoseNo ratings yet

- ChatLog Affiliate Marketing by MR Saleem Ahrar 2022 - 05 - 07 06 - 32Document5 pagesChatLog Affiliate Marketing by MR Saleem Ahrar 2022 - 05 - 07 06 - 32Tooba ChaudharyNo ratings yet

- IBAN LetterDocument1 pageIBAN Letterhamd2000hamd2No ratings yet

- Barron 39 S Magazine - January 3 2022Document56 pagesBarron 39 S Magazine - January 3 2022whitezizi789No ratings yet