Professional Documents

Culture Documents

Screenshot 2023-02-07 at 8.19.04 PM

Screenshot 2023-02-07 at 8.19.04 PM

Uploaded by

Kyle FelkinsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot 2023-02-07 at 8.19.04 PM

Screenshot 2023-02-07 at 8.19.04 PM

Uploaded by

Kyle FelkinsCopyright:

Available Formats

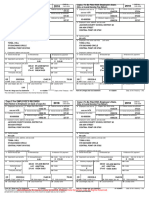

Copy B--To Be Filed With Employee's FEDERAL Tax Return OMB No.

OMB No. 1545-0008 Copy 2--To Be Filed With Employee's State, City, OMB No. 1545-0008

This information is being furnished to the Internal Revenue Service. or Local Income Tax Return

a. Employee's social security number 1. Wages, tips, other compensation 2. Federal income tax withheld a. Employee's social security number 1. Wages, tips, other compensation 2. Federal income tax withheld

XXX-XX-1754 4167.28 70.02 XXX-XX-1754 4167.28 70.02

b. Employer ID number (EIN) 3. Social security wages 4. Social security tax withheld b. Employer ID number (EIN) 3. Social security wages 4. Social security tax withheld

38-4140750 3240.42 258.37 38-4140750 3240.42 258.37

d. Control number 5. Medicare wages and tips 6. Medicare tax withheld d. Control number 5. Medicare wages and tips 6. Medicare tax withheld

4527-6 4167.28 60.43 4527-6 4167.28 60.43

c. Employer's name, address, and ZIP code c. Employer's name, address, and ZIP code

Platinum Management Platinum Management

2444 W Loop 340 2444 W Loop 340

Waco, TX 76711 Waco, TX 76711

e. Employee's name, address, and ZIP code e. Employee's name, address, and ZIP code

Kyle T Felkins Kyle T Felkins

1501 S 9th St #416 1501 S 9th St #416

Waco, TX 76706 Waco, TX 76706

7. Social security tips 8. Allocated tips 9. 7. Social security tips 8. Allocated tips 9.

926.86 926.86

10. Dependent care benefits 11. Nonqualified plans 12a. Code See inst. for Box 12 10. Dependent care benefits 11. Nonqualified plans 12a. Code See inst. for Box 12

13. Statutory employee 14. Other 12b. Code 13. Statutory employee 14. Other 12b. Code

Retirement plan 12c. Code Retirement plan 12c. Code

Third-party sick pay 12d. Code Third-party sick pay 12d. Code

15. State Employer's state ID number 16. State wages, tips, etc. 17.State income tax 15. State Employer's state ID number 16. State wages, tips, etc. 17.State income tax

18. Local wages, tips, etc. 19. Local income tax 20. Locality name 18. Local wages, tips, etc. 19. Local income tax 20. Locality name

Form W-2 Wage and Tax Statement 2022 Department of the Treasury ~ Internal Revenue Service Form W-2 Wage and Tax Statement 2022 Department of the Treasury ~ Internal Revenue Service

Copy C--For EMPLOYEE'S RECORDS(See Notice to Employee.)

This information is being furnished to the Internal Revenue Service. If you are required to file a tax OMB No. 1545-0008 Copy 2--To Be Filed With Employee's State, City, OMB No. 1545-0008

return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you or Local Income Tax Return

fail to report it.

a. Employee's social security number 1. Wages, tips, other compensation 2. Federal income tax withheld a. Employee's social security number 1. Wages, tips, other compensation 2. Federal income tax withheld

XXX-XX-1754 4167.28 70.02 XXX-XX-1754 4167.28 70.02

b. Employer ID number (EIN) 3. Social security wages 4. Social security tax withheld b. Employer ID number (EIN) 3. Social security wages 4. Social security tax withheld

38-4140750 3240.42 258.37 38-4140750 3240.42 258.37

d. Control number 5. Medicare wages and tips 6. Medicare tax withheld d. Control number 5. Medicare wages and tips 6. Medicare tax withheld

4527-6 4167.28 60.43 4527-6 4167.28 60.43

c. Employer's name, address, and ZIP code c. Employer's name, address, and ZIP code

Platinum Management Platinum Management

2444 W Loop 340 2444 W Loop 340

Waco, TX 76711 Waco, TX 76711

e. Employee's name, address, and ZIP code e. Employee's name, address, and ZIP code

Kyle T Felkins Kyle T Felkins

1501 S 9th St #416 1501 S 9th St #416

Waco, TX 76706 Waco, TX 76706

7. Social security tips 8. Allocated tips 9. 7. Social security tips 8. Allocated tips 9.

926.86 926.86

10. Dependent care benefits 11. Nonqualified plans 12a. Code See inst. for Box 12 10. Dependent care benefits 11. Nonqualified plans 12a. Code See inst. for Box 12

13. Statutory employee 14. Other 12b. Code 13. Statutory employee 14. Other 12b. Code

Retirement plan 12c. Code Retirement plan 12c. Code

Third-party sick pay 12d. Code Third-party sick pay 12d. Code

15. State Employer's state ID number 16. State wages, tips, 17.State income tax 15. State Employer's state ID number 16. State wages, tips, 17.State income tax

etc. etc.

18. Local wages, tips, etc. 19. Local income tax 20. Locality name 18. Local wages, tips, etc. 19. Local income tax 20. Locality name

Form W-2 Wage and Tax Statement Department of the Treasury ~ Internal Revenue Service Form W-2 Wage and Tax Statement Department of the Treasury ~ Internal Revenue Service

2022 2022

You might also like

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- A Comprehensive Examination of The Compensation and Benefit Practices of Whole Foods MarketDocument6 pagesA Comprehensive Examination of The Compensation and Benefit Practices of Whole Foods MarketJason RobinsonNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Chemie-Tech Projects Limited Attendance PolicyDocument5 pagesChemie-Tech Projects Limited Attendance PolicyRahul100% (2)

- What Are The Advantages and Disadvantages of GlobalizationDocument8 pagesWhat Are The Advantages and Disadvantages of GlobalizationVictor Perea100% (1)

- What Is The American Approach To HRMDocument18 pagesWhat Is The American Approach To HRMkiranaishaNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Returnjenner.domasNo ratings yet

- Carlosw 2Document2 pagesCarlosw 2winnievaledocsNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- 2 41923892Document1 page2 41923892spurlock90No ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- Tax FormsDocument2 pagesTax FormsJose Manuel Aranzazu ManzaneroNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- R SwieratDocument2 pagesR SwieratDe Gen G.No ratings yet

- Bill W2Document2 pagesBill W2ISSA AWADHNo ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- W2 - 2022 Ryan OnealDocument1 pageW2 - 2022 Ryan Onealjhonsmith900012No ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- Employee W-2 Report 20240115172542Document1 pageEmployee W-2 Report 20240115172542ANAYELI GUTIERREZNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- E Name w2 2021 WithInstructionsDocument3 pagesE Name w2 2021 WithInstructionsKandice ChandlerNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- w2 hh83UtqU4WlQsBEvVnOTDocument1 pagew2 hh83UtqU4WlQsBEvVnOTDutchavelli5thNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Myadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesDocument2 pagesMyadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesnxtbh6xy6yNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008dashaviaNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- Gamaliel Bribiesca 523 S Huron DR Santa Ana, CA 92704: Wage and Tax Employee Reference Copy StatementDocument2 pagesGamaliel Bribiesca 523 S Huron DR Santa Ana, CA 92704: Wage and Tax Employee Reference Copy Statementgamaliel.lomeNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Batch #02283: Starco Group 250 26TH ST Sant A Monica Ca 90402Document1 pageBatch #02283: Starco Group 250 26TH ST Sant A Monica Ca 90402allthewayupp21No ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Reissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Document1 pageReissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Sadiki LuhandeNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Welcome To Presentation: Legal Framework On Compensation StructureDocument30 pagesWelcome To Presentation: Legal Framework On Compensation StructureVijay KishanNo ratings yet

- Maharaja Dihydretion P.V.TDocument64 pagesMaharaja Dihydretion P.V.TNilesh BambhaniyaNo ratings yet

- Philippine Health Care LawsDocument6 pagesPhilippine Health Care LawsLrak EedNo ratings yet

- Module 1Document34 pagesModule 1Jennifer JosephNo ratings yet

- Accident Cost CalculationDocument12 pagesAccident Cost Calculationdhavalesh1No ratings yet

- Journal Employees Union, G.R. No. 192601, June 26, 2013)Document2 pagesJournal Employees Union, G.R. No. 192601, June 26, 2013)MirellaNo ratings yet

- GRATUITY FORM F-Sample FilledDocument3 pagesGRATUITY FORM F-Sample FilledSanjay SudhakarNo ratings yet

- SM7 Ch11 PeopleDocument39 pagesSM7 Ch11 PeopleMayank Sharma100% (1)

- Prime CostDocument1 pagePrime CostAva DasNo ratings yet

- 004 Magana v. Medicard Phil., IncDocument1 page004 Magana v. Medicard Phil., IncRoma MonzonNo ratings yet

- Min Wage UttrakhandDocument8 pagesMin Wage UttrakhandAnimesh SahaNo ratings yet

- Three Faces of HRMDocument52 pagesThree Faces of HRMaddiyat100% (2)

- Tapal HRM ProjectDocument31 pagesTapal HRM ProjectKashif AliNo ratings yet

- A Form of Modern Slavery: by Krishna Aarti ReddyDocument15 pagesA Form of Modern Slavery: by Krishna Aarti Reddyankita wilsonNo ratings yet

- The Maharashtra Labour Welfare Fund Act, 1953: D.R. Haibat Corporate Consultant and Consulting Lawyer NGO MemberDocument10 pagesThe Maharashtra Labour Welfare Fund Act, 1953: D.R. Haibat Corporate Consultant and Consulting Lawyer NGO MemberDeepakNo ratings yet

- 1296466693892-Compendium 2007Document301 pages1296466693892-Compendium 2007Krishna Chaitanya JonnalagaddaNo ratings yet

- Emco Case StudyDocument15 pagesEmco Case StudyUsman Hamid100% (1)

- Ir328 2021Document1 pageIr328 2021api-527215716No ratings yet

- In Case of Hawassa University Awada Business and Economics College, Administrative StaffDocument34 pagesIn Case of Hawassa University Awada Business and Economics College, Administrative StaffAnonymous mwlglG100% (1)

- Chapter ViDocument21 pagesChapter ViHarshada SinghNo ratings yet

- Review of Radical Political Economics Special Issue Economic Democracy, March 2012Document127 pagesReview of Radical Political Economics Special Issue Economic Democracy, March 2012tprugNo ratings yet

- CWG English - Part-2Document328 pagesCWG English - Part-2Ravi TejaNo ratings yet

- Sem Vi LabourDocument17 pagesSem Vi Labourdoddamarg12No ratings yet

- Jalan Trading Co. (Private LTD.) Vs Mill Mazdoor Union (With ... On 5 August, 1966Document36 pagesJalan Trading Co. (Private LTD.) Vs Mill Mazdoor Union (With ... On 5 August, 1966Amit KumarNo ratings yet

- Angol Tétel Az Egyes Szakmák Társadalmi Presztízse - PályamódosításDocument1 pageAngol Tétel Az Egyes Szakmák Társadalmi Presztízse - PályamódosításEszter FarkasNo ratings yet

- Employee Attrition Analysis of Hotel IndustryDocument14 pagesEmployee Attrition Analysis of Hotel Industrycutevenkatesh5648No ratings yet