Professional Documents

Culture Documents

Receivables Solution 5

Receivables Solution 5

Uploaded by

Wymar Joshua EdiongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Receivables Solution 5

Receivables Solution 5

Uploaded by

Wymar Joshua EdiongCopyright:

Available Formats

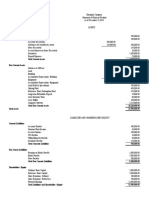

11.

An entity provided the following information for the current year:

Accounts receivable – January 1 2,000,000.00

Credit sales 10,000,000.00

Collection from customers, excluding recovery of accounts written off 7,500,000.00

Accounts written off as worthless 100,000.00

Sales returns 400,000.00

Recovery of accounts written off 50,000.00

Estimated future sales returns on December 31 300,000.00

Estimated uncollectible accounts on December 31 per aging 600,000.00

What is the “amortized cost” of accounts receivable on December 31?

a. 4,000,000 b. 3,700,000 c. 3,450,000 d. 3,100,000

AR

2,000,000.00 7,500,000.00 4,000,000.00

10,000,000.00 100,000.00 - 300,000.00

50,000.00 400,000.00 - 600,000.00

50,000.00 3,100,000.00

12,050,000.00 8,050,000.00

4,000,000.00

12. An entity provided the following data for the current year:

Allowance for doubtful accounts January 1 180,000.00

Sales 9,500,000.00

Sales returns and allowances 800,000.00

Sales discount 200,000.00

Accounts written off as uncollectible 200,000.00

The entity provided for doubtful accounts expense at the rate of 5% of net sales . What amount should be reported as doubtful accounts expense for the current year?

a. 435,000 b. 425,000 c. 475,000 d. 415,000

Allowance for doubtful accounts Gross sales 9,500,000.00

180,000.00 Sales returns and al - 800,000.00

200,000.00 425,000.00 Sales discount - 200,000.00

200,000.00 605,000.00 Net sales 8,500,000.00

0.05

425,000.00

13. An entity provided the following accounts abstracted from the unadjusted trial balance at year-end:

Debit Credit

Accounts receivable 5,000,000.00

Allowance for doubtful accounts 100,000.00

Net credit sales 20,000,000.00

The entity estimated that 10% of the gross accounts receivable will become uncollectible.

What amount should be recognized as doubtful accounts expense for the current year?

a. 500,000 b. 400,000 c. 200,000 d. 600,000

Allowance for doubtful accounts

100,000.00

600,000.00

- 500,000.00

14. An entity used the net price method of accounting for cash discounts. In one of its transactions on December 26, 2021, the entity sold merchandise with a list price of P5,000,000 to a client who was

given a trade discount of 20%, 10% and 5%. Credit terms were 4/10, n/30. The goods were shipped FOB destination, freight collect. Total freight charge paid by the client was P100,000. On December

27, 2021, the client returned damaged goods originally billed at P500,000. What is the net realizable value of the accounts receivable on December 31, 2021?

a. 3,420,000 b. 2,920,000 c. 2,703,200 d. 2,803,200

5,000,000*.80*.90*.95 Invoice price 3,420,000.00 AR

0.96

Net of CD 3,283,200.00

Sales returns - 480,000.00

Freight charge - 100,000.00

2,703,200.00

From inception of operations, an entity provided for doubtful accounts under the allowance method and provisions were made monthly at 2% of credit sales. No year-end adjustments to the allowance

account were made. The balance in the allowance for doubtful accounts was P1,000,000 on January 1, 2021. During 2021, credit sales totaled P20,000,000, interim provisions for doubtful accounts were made

at 2% of credit sales, P200,000 of bad debts were written off, and recoveries of accounts previously

written off amounted to P50,000. An aging was made on December 31, 2021.

Classification Balance Uncollectible

November - December 6,000,000.00 0.10 600,000.00

July - October 2,000,000.00 0.20 400,000.00

January - June 1,500,000.00 0.30 450,000.00

Prior to January 1, 2021 500,000.00 0.50 (500,000-100,000) 200,000.00

Based on the review of collectibility of the account balances in the “prior to January 1, 2021” aging category, additional accounts totaling P100,000 are to be written off on December 31, 2021. Effective

December 31, 2021, the entity adopted aging method for estimating the allowance for doubtful accounts.

15. What amount should be reported as doubtful accounts expense for current year?

a. 1,200,000 b. 1,650,000 c. 900,000.00 d. 950,000.00

Allowance for doubtful accounts

1,000,000.00

200,000.00 50,000.00

100,000.00

900,000.00

- 1,650,000.00

16. What is the net realizable value of accounts receivable on December 31, 2021?

a. 9,900,000 b. 8,250,000 c. 8,350,000 d. 8,200,000

November - December 6,000,000.00

July - October 2,000,000.00

January - June 1,500,000.00

Prior to January 1, 2021 400,000.00

9,900,000.00

- 1,650,000.00

8,250,000.00

An entity provided the following transactions affecting accounts receivable during the current year:

Sales – cash and credit 5,900,000.00

Cash received from credit customers, all of whom took advantage of the discount feature of the credit terms 4/10, n/30 3,024,000.00

Cash received from cash customers 2,100,000.00

Accounts receivable written off as worthless 50,000.00

Credit memorandum issued to credit customers for sales return and allowances 250,000.00

Cash refunds given to cash customers for sales returns and allowances 20,000.00

Recoveries on accounts receivable written off as uncollectible in prior periods not included in cash received from customers stated above 80,000.00

At the beginning of current year, the balances are accounts receivable P950,000 and the allowance for bad debts P100,000. At year-end, an aging of accounts receivable indicated that P170,000 would be uncollectible.

17. What is the balance of accounts receivable on December 31?

a. 1,300,000 b. 1,426,000 c. 1,280,000 d. 1,220,000

Sales – cash and credit 5,900,000.00

Cash received from cash customers - 2,100,000.00

AR Credit sales 3,800,000.00

950,000.00 3,150,000.00

3,800,000.00 50,000.00

80,000.00 250,000.00

80,000.00 (3,024,000/.96)

3,150,000.00

4,830,000.00 3,530,000.00

1,300,000.00

18. What amount was recognized as bad debt expense for the current year?

a. 70,000 b. 40,000 c. 90,000 d. 50,000

Allowance for doubtful accounts

100,000.00

50,000.00 80,000.00

40,000.00

- 170,000.00

19. At January 1, 20x1, Judy Co. had a credit balance of ₱260,000 in its allowance for uncollectible accounts. Based on past experience, 2% of Judy 's credit sales have been uncollectible. During 20x1, Judy

wrote off ₱325,000 of uncollectible accounts. Credit sales for 20x1 were ₱9,000,000. In its December 31, 20x1, balance sheet, what amount should Judy report as allowance for uncollectible accounts?

a. 115,000 b. 180,000 c. 245,000 d. 440,000

Allowance for doubtful accounts Bad debt expense

260,000.00 9M*2%

325,000.00 180,000.00

- 115,000.00

20. On the December 31, 20x6, balance sheet of Esther Co., the current receivables consisted of the following:

Trade accounts receivable 93,000.00

Allowance for uncollectible accounts - 2,000.00

Claim against shipper for goods lost in transit (November 20x6) 3,000.00

Selling price of unsold goods sent by Esther on consignment at 130% of cost (not included in Esther's ending inventory) 26,000.00

Security deposit on lease of warehouse used for storing some inventories 30,000.00

Total 150,000.00

At December 31, 20x6, the correct total of Esther's current net receivables was

a. 94,000 b. 120,000 c. 124,000 d. 150,000

Trade accounts receivable 93,000.00

Allowance for uncollectible accounts - 2,000.00

Claim against shipper for goods lost in transit (November 20x6) 3,000.00

94,000.00

21. The following information is from the records of Prosser, Inc. for the year ended December 31, 2002.

Allowance for Doubtful Accounts, January 1, 2002 .. 6,000.00

Sales, 2002 ....................................... 2,920,000.00

Sales Returns and Allowances, 2002 ................ 32,000.00

If the basis for estimating bad debts is 1 percent of net sales, the correct amount of doubtful accounts expense for 2002 is

a. ₱22,800. b. ₱23,200. c. ₱28,880 d. ₱34,880.

Gross sales 2,920,000.00

Sales returns - 32,000.00

Net sales 2,888,000.00

0.01

28,880.00

22. An analysis and aging of the accounts receivable of Shriner Company at December 31 revealed the following data:

Accounts Receivable .................................. 450,000.00

Allowance for Doubtful Accounts (before adjustment) .. 25,000.00 (cr)

Required ending balance of allowance ............... 32,000.00 (cr)

The net realizable value of the accounts receivable at December 31 should be

a. ₱450,000. b. ₱443,000. c. ₱425,000. d. ₱418,000.

Accounts Receivable .................................. 450,000.00

Required ending balance of allowance ............... - 32,000.00

418,000.00

23. Maple Company provides for doubtful accounts expense at the rate of 3 percent of credit sales. The following data are available for last year:

Allowance for Doubtful Accounts, January 1 ........ 54,000.00 (cr)

Accounts written off as uncollectible during the year ............. 60,000.00

Collection of accounts written off in prior years .(customer credit was re-established) ..... 15,000.00

Credit sales, year-ended December 31 .............. 3,000,000.00

The allowance for doubtful accounts balance at December 31, after adjusting entries, should be

a. ₱45,000. b. ₱84,000. c. ₱90,000. d. ₱99,000.

Allowance for doubtful accounts

54,000.00

60,000.00 15,000.00

90,000.00

99,000.00

24. Based on the aging of its accounts receivable at December 31, Pribob Company determined that the net realizable value of the receivables at that date is ₱760,000. Additional information is as follows:

Accounts Receivable at December 31 ................ 880,000.00

Allowance for Doubtful Accounts at January 1 ...... 128,000.00 (cr)

Accounts written off as uncollectible during the 88,000.00

Pribob's doubtful accounts expense for the year ended December 31 is

a. ₱80,000. b. ₱96,000. c. ₱120,000. d. ₱160,000.

Allowance for doubtful accounts

128,000.00 Gross receivables 880,000.00

88,000.00 Allowance for doubtful accounts - 120,000.00

80,000.00 Net realizable 760,000.00

120,000.00

25. Based on its past collection experience, Ace Company provides for bad debts at the rate of 2 percent of net credit sales. On January 1, 2002, the allowance for doubtful accounts credit

balance was ₱10,000. During 2002, Ace wrote off ₱18,000 of uncollectible receivables and recovered ₱5,000 on accounts written off in prior years. If net credit sales for 1999 totaled

₱1,000,000, the doubtful accounts expense for 2002 should be

a. ₱17,000. b. ₱20,000. c. ₱23,000. d. ₱35,000.

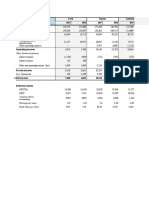

26. Richards Company uses the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year.

No. of Days Probability

Outstanding Amount of Collection

0-30 days 500,000.00 0.98

31-60 days 200,000.00 0.90

Over 60 days 100,000.00 0.80

The following additional information is available for the current year:

Net credit sales for the year .................. 4,000,000.00

Allowance for Doubtful Accounts:

Balance, January 1 ............................. 45,000.00 (cr)

Balance before adjustment, December 31 ......... 2,000.00 (dr)

If Richards determines bad debt expense using 1.5 percent of net credit sales, the net realizable value of accounts receivable on the December 31 balance sheet will be

a. ₱738,000. b. ₱740,000. c. ₱742,000. d. ₱750,000

Using aging of AR: 4000000*.015

0-30 days 10,000.00 bad debt expense 60,000.00

31-60 days 20,000.00

Over 60 days 20,000.00

All. For doubtful accounts, end 50,000.00 Gross receivables 800,000.00

All. For doubtful accounts, beg. 45,000.00

Allowance for doubtful accounts Provision 60,000.00

45,000.00 Write-off - 47,000.00 - 58,000.00

47,000.00 742,000.00

2,000.00

27. Gekko, Inc. reported the following balances (after adjustment) at the end of 2002 and 2001.

12/31/2002 12/31/2001

Total accounts receivable ................. 105,000.00 96,000.00

Net accounts receivable ................... 102,000.00 94,500.00

Allowance for doubtful accounts 3,000.00 1,500.00

During 2002, Gekko wrote off customer accounts totaling ₱3,200 and collected ₱800 on accounts written off in previous years. Gekko's doubtful accounts expense for the year ending December 31, 2002 is

a. ₱1,500. b. ₱2,400. c. ₱3,000. d. ₱3,900.

Allowance for doubtful accounts

1,500.00

3,200.00 800.00

3,900.00

3,000.00

28. Gray Company had an accounts receivable balance of ₱50,000 on December 31, 2001, and ₱75,000 on December 31, 2002. The company wrote off ₱20,000 of accounts receivable during 2002, and collected ₱3,000 on

an account written off in 2000. Sales for the year 2002 totaled ₱620,000. All sales were on account. The amount collected from customers on accounts receivable during 2002, including recoveries, was

a. ₱575,000. b. ₱578,000. c. ₱600,000. d. ₱595,000.

AR

50,000.00

Re-establishment of AR for the recovery 3,000.00 20,000.00 Write-off

Sales 620,000.00 - 578,000.00

75,000.00

On December 1, 2021, an entity assigned on a nonnotification basis accounts receivable of P5,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity

signed a note for the bank loan.

On December 31, 2021, the entity collected assigned accounts o P2,000,000 less discount of P200,000. The entity remitted the collections to the bank in partial payment for the loan.

The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance.

The entity accepted sales returns of P100,000 on the assigned accounts and wrote off assigned accounts of P300,000.

29. What is the balance of accounts receivable assigned on December 31, 2021?

a. 3,000,000 b. 2,600,000 c. 2,400,000 d. 2,900,000

Sales returns 100,000.00

AR -assigned, beg. 5,000,000.00 AR - Assigned 5M AR - Assigned 100,000.00

Collection - 2,000,000.00 AR 5M

Sales returns - 100,000.00 Cash 1,800,000.00 All. For doubtful accounts 300,000.00

account written off - 300,000.00 Sales discount 200,000.00 AR - Assigned 300,000.00

2,600,000.00 AR- Assigned 2,000,000.00

30. What is the equity of the assignor in assigned accounts on December 31, 2021?

a. 2,600,000 b. 2,240,000 c. 360,000.00 d. -

Remaining AR Assigned 2,600,000.00 5,000,000.00 Cash 3,800,000.00

Remaining payable - 2,240,000.00 0.80 Service fee 200,000.00

360,000.00 Total NP 4,000,000.00 Note payable 4,000,000.00

Partial payment - 1,760,000.00

Remaining payable 2,240,000.00 Interest expense 4M * .01

Amount collected 1,800,000.00

Payment of interest - 40,000.00

Amount remaining to the principal 1,760,000.00

An entity factored P5,000,000 of accounts receivable. Control was surrendered by the entity. The transaction met the criteria to be accounted for as sale but subject to recourse for nonpayment. The fair

value of the recourse obligation is P250,000.

The finance company assessed a fee of 6% and retained a holdback equal to 10% of the accounts receivable. In addition, the finance company charged 12% interest computed on a weighted average time to

maturity of the accounts receivable for 60 days.

31. What amount was initially received from the factoring of accounts receivable?

a. 4,500,000 b. 4,200,000 c. 4,100,000 d. 4,101,370

Finance Charge Factor's holdback Weighted average time to maturity

5,000,000.00 5000000

0.06 10% (5M *.12*(60/365)

300,000.00 500000 98,630.00

Accounts receivable (gross) 5,000,000.00

Less: Finance Charge - 300,000.00

Factor's holdback - 500,000.00

Weighted average time to maturity - 98,630.00

Net proceeds 4,101,370.00

32. What total amount should be recognized initially as loss on factoring?

a. 398,630 b. 898,630 c. 800,000 d. 648,630

Cash 4,101,370.00

Receivable from factor 500,000.00

Loss on factoring 648,630.00

Provision on recourse obligation 250,000.00

Accounts receivable 5,000,000.00

33. What amount should be reported as loss on factoring assuming the accounts are fully collected by the factor?

a. 398,630 b. 300,000 c. 550,000 d. 400,000

34. An entity sells goods either on cash basis or on 6-month installment basis. On January 1, 20x1, goods with cash price of ₱50,000 were sold at an

installment price of ₱75,000. Which of the following statements is correct?

a. Net receivable of ₱75,000 is recognized on the date of sale.

b. Net receivable of ₱50,000 is recognized upon full payment of the total price.

c. The ₱20,000 difference between the cash price and installment price is recognized as interest income on the date of sale.

d. Net receivable of ₱50,000 is recognized on the date of sale.

35. An entity sells goods for ₱150,000 to a customer who was granted a special credit period of 1 year. The entity normally sells the goods for ₱120,000 with a credit period of one month or

with a ₱10,000 discount for outright payment in cash. How much is the initial measurement of the receivable?

a. 150,000 b. 120,000 c. 130,000 d. 110,000

On January 1, 20x1, ABC Co. sold a transportation equipment with a historical cost of ₱1,000,000 and accumulated depreciation of ₱300,000 in exchange for cash of ₱100,000 and a noninterest-bearing note

receivable of ₱800,000 due on January 1, 20x4. The prevailing rate of interest for this type of note is 12%.

36. How much is the interest income in 20x1?

a. 68,331 b. 76,532 c. 85,714 d. 96,000

PV of P1

PV Factor 0.71178 *800,000 569,424.20 Present Value (1/1/20x1)

12%

68,330.90

37. How much is the carrying amount of the receivable on December 31, 20x2?

a. 800,000 b. 569,424 c. 637,755 d. 714,286

(569424*1.12*1.12)

On January 1, 20x1, ABC Co. sold transportation equipment with a historical cost of ₱20,000,000 and accumulated depreciation of ₱7,000,000 in exchange for cash of ₱500,000 and a noninterest-bearing

note receivable of ₱8,000,000 due in 4 equal annual installments starting on December 31, 20x1 and every December 31 thereafter. The prevailing rate of interest for this type of note is 12%.

38. How much is the interest income in 20x1?

a. 728,946 b. 678,334 c. 728,964 d. 704,236

PV of ordinary annuity

PV Factor 3.0373

Annual installment 2,000,000.00

Present value 6,074,600.00

Interest rate 0.12

728,952.00

39. How much is the current portion of the

receivable on December 31, 20x1?

a. 1,271,036 b. 1,423,560 c. 3,380,102 d. 1,594,388

Annual payment Annual Amortizat Preset value

1/1/20x1 6,074,600.00

12/31/20x1 2,000,000.00 728,952.00 4,803,552.00 ########## Current portion

12/31/20x2 2,000,000.00 576,426.24 3,379,978.24 Noncurrent portion

40. How much is the carrying amount of the

receivable on December 31, 20x2?

a. 4,803,663 b. 3,380,102 c. 6,074,699 d. 6,000,000

On January 1, 20x1, ABC Co. sold transportation equipment with a historical cost of ₱12,000,000 and accumulated depreciation of ₱7,000,000 in exchange for cash of ₱100,000 and a noninterest-bearing

note receivable of ₱4,000,000 due in 4 equal annual installments starting on January 1, 20x1 and every January 1 thereafter. The prevailing rate of interest for this type of note is 12%.

41. How much is the interest income in 20x1?

a. 408,230 b. 278,334 c. 328,964 d. 288,220

PV of annuity due

PV Factor 3.40183

Annual installment 1,000,000.00

Present value 3,401,830.00

Less: advance payment 1,000,000.00

Receivable balance (1/1/20x1) 2,401,830.00

Interest rate 0.12

288,219.60

42. How much is the carrying amount of the

receivable on December 31, 20x1?

a. 1,690,510 b. 892,857 c. 2,690,051 d. 1,594,388

Annual payment Annual Amortizat Preset value

1/1/20x1 3,401,830.00

1/1/20x1 1,000,000.00 2,401,830.00

12/31/20x1 288,219.60 2,690,049.60

1/1/20x2 1,000,000.00 1,690,049.60

12/31/20x2 202,805.95 1,892,855.55

1/1/20x3 1,000,000.00 892,855.55

43. How much is the carrying amount of the

receivable on January 1, 20x3?

a. 892,857 b. 3,380,102 c. 6,074,699 d. 6,000,000

44. On January 1, 20x1, ABC Co. sold machinery with historical cost of ₱3,000,000 and accumulated depreciation of ₱900,000 in exchange for a 3-year, ₱2,100,000 noninterest-bearing note receivable due in

equal semi-annual payments every July 1 and December 31 starting on July 1, 20x1. The prevailing rate of interest for this type of note is 10%.

How much is the interest income in 20x1?

a. 88,825 b. 177,649 c. 128,964 d. 164,591

PV of ordinary annuity (1,776,491.50*1.05 - 350000)

PV Factor 5.07569 Present value (7/1/20x1) 1,515,316.08

Semi-annual installment 350,000.00 Interest rate 0.05

Present value 1,776,491.50 Interest income 12/31/20x1 75,765.80

Interest rate 0.05

Interest income 7/1/20x1 88,824.58

45. On January 1, 20x1, ABC Co. sold machinery costing ₱3,000,000 with accumulated depreciation of ₱1,100,000 in exchange for a 3-year, ₱900,000 noninterest-bearing note receivable

due as follows:

Date Amount of installment

December 31, 20x1 400,000.00

December 31, 20x2 300,000.00

December 31, 20x3 200,000.00

Total 900,000.00

The prevailing rate of interest for this type of note is 10%. How much is the carrying amount of the receivable on December 31, 20x1?

a. 467,354 b. 438,016 c. 376,345 d. 428,346

PV of P1 PV Factor PV

400,000.00 0.90910 363,640.00

300,000.00 0.82645 247,935.00

200,000.00 0.75131 150,262.00

761,837.00

Annual payment Annual Amortizat Preset value

1/1/20x1 761,837.00

12/31/20x1 400,000.00 76,183.70 438,020.70

An entity accepted from a customer in settlement of an account a P5,000,000. 180-day 9% note dated August 1, 2021. On September 30, 2021, the entity discounted the note at 12% with recourse at the

bank. The note was paid in full by the maker on maturity. The discounting is accounted for as a conditional sale with recognition of a contingent liability.

46. What amount was received from the note

receivable discounting?

a. 5,225,000 b. 5,075,000 c. 5,016,000 d. 5,000,000

Principal 5,000,000.00

Interest (5M * 9% * 180/360) 225,000.00

Maturity value 5,225,000.00

Discount (5,225,000*.12*(120/360) - 209,000.00

Net proceeds 5,016,000.00

47. What is the loss on note receivable discounting?

a. 59,000 b. 16,000 c. 75,000 d. 60,000

Principal 5,000,000.00

Accrued interest income (5M*.09*60/360) 75,000.00

Total receivables 5,075,000.00

Less: net proceeds 5,016,000.00

- 59,000.00

48. On April 1, 2021, an entity discounted with recourse a 9-month, 10% note dated January 1, 2021 with face of P6,000,000. The bank discount rate is 12%. The discounting transaction is

accounted for as a conditional sale with recognition of contingent liability.

On October 1, 2021, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P50,000.

On December 31, 2021, the entity collected the dishonored note in full plus 12% annual interest on the total amount due.

What amount was received from the note receivable discounting?

a. 6,063,000 b. 6,450,000 c. 6,150,000 d. 5,963,000 e. 6,662,500

Principal 6,000,000.00

Interest (6M * 10% * 9/12) 450,000.00

Mnaturity value 6,450,000.00

Discount (6,450,000*.12*(6/12) - 387,000.00

Net proceeds 6,063,000.00

On January 1, 2021, an entity sold a building with carrying amount of P6,000,000 in exchange for a noninterest bearing note requiring ten annual payments of P1,000,000. The first payment

was made on December 31, 2021. The market interest rate for similar notes at date of issuance was 8%. The present value of an ordinary annuity of 1 at 8% is 6.71 for ten periods. The

present value of an annuity due of 1 at 8% is 7.25 for ten periods.

49. What is the interest income for 2021?

a. 500,000 b. 580,000 c. 536,800 d. 376,800

PV of ordinary annuity 6.71

Annual installment 1,000,000.00

Present value 6,710,000.00

Interest income 8%

536,800.00

50. What is the carrying amount of note receivable on December 31, 2021?

a. 6,246,800 b. 7,246,800 c. 6,830,000 d. 6,750,000

PV (1/1/20X1) 6,710,000.00

Interest income 536,800.00

Annual amortization - 1,000,000.00

6,246,800.00

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Chapter 7 ProblemsDocument25 pagesChapter 7 ProblemsRhoda Claire M. Gansobin100% (1)

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Account ReceivableDocument13 pagesAccount ReceivableAndrea FontiverosNo ratings yet

- Cash and Accrual BasisDocument3 pagesCash and Accrual Basisattiva jade100% (1)

- SOPL, SOFP Dynamic Peony EnterpriseDocument3 pagesSOPL, SOFP Dynamic Peony EnterpriseIsmahNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- Book 1Document4 pagesBook 1almira garciaNo ratings yet

- Mahusay Bsa 315 Module 4 CaseletsDocument9 pagesMahusay Bsa 315 Module 4 CaseletsJeth MahusayNo ratings yet

- CB Niat 2019 Exam SolutionsDocument14 pagesCB Niat 2019 Exam Solutionsdean garciaNo ratings yet

- Problem 1Document13 pagesProblem 1Caila Nicole ReyesNo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- Accounting 1 - Part 2Document18 pagesAccounting 1 - Part 2Jessica ManuelNo ratings yet

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDocument17 pagesA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- Intermediate Accounting Chapter 4 Exercises - ValixDocument34 pagesIntermediate Accounting Chapter 4 Exercises - ValixAbbie ProfugoNo ratings yet

- This Study Resource Was: Chapter 18: Accounts ReceivableDocument7 pagesThis Study Resource Was: Chapter 18: Accounts ReceivableXENA LOPEZNo ratings yet

- ShubhamTrial PDFDocument1 pageShubhamTrial PDFI am DannyHNo ratings yet

- Yllana Bayview College Inc Fundamentals of Accountancy, Business and Management IIDocument1 pageYllana Bayview College Inc Fundamentals of Accountancy, Business and Management IIRalph Christer MaderazoNo ratings yet

- PT 4&5 PDFDocument3 pagesPT 4&5 PDFADRIAN ALDRIEZ NICDAONo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Problem-Solving-1-4 Audit ProblemsDocument15 pagesProblem-Solving-1-4 Audit ProblemsRomina LopezNo ratings yet

- Activity 4-IntAcc1Document2 pagesActivity 4-IntAcc10322-1975No ratings yet

- Chapter 18: Accounts Receivable: Problem 18-1 (AICPA Adapted)Document7 pagesChapter 18: Accounts Receivable: Problem 18-1 (AICPA Adapted)Rhea Jane SuarezNo ratings yet

- AEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful AccountDocument4 pagesAEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful Accountjames bryan angklaNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Worksheet 31 Desember 2017Document3 pagesWorksheet 31 Desember 2017lastiarNo ratings yet

- RECEIVABLESDocument23 pagesRECEIVABLESSaghielyn BicomongNo ratings yet

- Accounts ReceivableDocument7 pagesAccounts ReceivablePeter PiperNo ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- AE 111 Midterm Summative Assessment 3 SolutionsDocument12 pagesAE 111 Midterm Summative Assessment 3 SolutionsDjunah ArellanoNo ratings yet

- Assignemnt Analysis of FS 03.22.2021Document5 pagesAssignemnt Analysis of FS 03.22.2021lynnrodrigo16No ratings yet

- ABC Company Worksheet For The Year Ended December 31, 2019Document1 pageABC Company Worksheet For The Year Ended December 31, 2019Rosemarie VillanuevaNo ratings yet

- HW 16433Document2 pagesHW 16433Abdullah Khan100% (1)

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- R&L Company: Assignment 1 Premium Liability, Warranty LiabilityDocument6 pagesR&L Company: Assignment 1 Premium Liability, Warranty Liabilityangelian bagadiongNo ratings yet

- Problem 8-3Document1 pageProblem 8-3Gilbert MoralesNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- Pa Revision For FinalsDocument9 pagesPa Revision For FinalsKhải Hưng NguyễnNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Bizcom Problem 3-2Document1 pageBizcom Problem 3-2kate trishaNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- MALINAO-Fundamentals-01 26 2022Document8 pagesMALINAO-Fundamentals-01 26 2022ollem mark mamatoNo ratings yet

- General Balance Workshop..-4Document2 pagesGeneral Balance Workshop..-4ScribdTranslationsNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- 6809 Accounts ReceivableDocument2 pages6809 Accounts ReceivableEsse Valdez0% (1)

- Partnership LiquidationDocument10 pagesPartnership LiquidationAbc xyzNo ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- Bizcom Problem 3-3Document1 pageBizcom Problem 3-3kate trishaNo ratings yet

- CA No. 2 - Business FinanceDocument43 pagesCA No. 2 - Business FinanceArthurLeonard MalijanNo ratings yet

- Qualifying Exam - FAR - 1st YearDocument11 pagesQualifying Exam - FAR - 1st YearKristina Angelina ReyesNo ratings yet

- Ia1 Midterm Activity-1Document2 pagesIa1 Midterm Activity-1Lorraine Millama PurayNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Week 1 Statement of Financial Position Balance SheetDocument24 pagesWeek 1 Statement of Financial Position Balance SheetCamille ReyesNo ratings yet

- Quiz 2 - Dissolution and LiquidationDocument2 pagesQuiz 2 - Dissolution and LiquidationMarcel BermudezNo ratings yet

- Insolvency and Bankruptcy: Social, Legal, Economic and Financial PerspectivesDocument23 pagesInsolvency and Bankruptcy: Social, Legal, Economic and Financial PerspectivesAlisha0% (1)

- 6809 Accounts ReceivableDocument2 pages6809 Accounts ReceivableEsse Valdez0% (1)

- Multiple Choice Questions 1 Which of The Following Statements Is True A UnderDocument2 pagesMultiple Choice Questions 1 Which of The Following Statements Is True A UnderHassan JanNo ratings yet

- Cfin 4 4th Edition Besley Test BankDocument31 pagesCfin 4 4th Edition Besley Test Bankacrania.dekle.z2kajy100% (20)

- Fin 533Document14 pagesFin 533Can ManNo ratings yet

- 1 Spouses Raymundo V BandongDocument2 pages1 Spouses Raymundo V BandongseentherellaaaNo ratings yet

- 19.1 Banks FMP 2Document17 pages19.1 Banks FMP 2Javneet KaurNo ratings yet

- Ford Case Study (LT 11) - Jerry's Edit v2Document31 pagesFord Case Study (LT 11) - Jerry's Edit v2JerryJoshuaDiazNo ratings yet

- All Fixed Income Formulas For Level 1 by Kunal Doshi CFA 1684453409Document15 pagesAll Fixed Income Formulas For Level 1 by Kunal Doshi CFA 1684453409Micole ChanNo ratings yet

- Merrill (Company) - WikipediaDocument21 pagesMerrill (Company) - WikipediaMarisa Castillo TaborNo ratings yet

- Article 1252 Case SummaryDocument6 pagesArticle 1252 Case SummaryApril Rose CorralNo ratings yet

- Intermediate Finance: Session 7Document54 pagesIntermediate Finance: Session 7rizaunNo ratings yet

- Equifax - Dispute LetterDocument5 pagesEquifax - Dispute LetterLakeesha Dixon-StarnesNo ratings yet

- Factoring AgreementDocument17 pagesFactoring Agreementfra.spNo ratings yet

- Problem15 The Cost of Inventory of Coffee Beans 1,850,000 LCRNV 50,000Document9 pagesProblem15 The Cost of Inventory of Coffee Beans 1,850,000 LCRNV 50,000Kyle Vincent SaballaNo ratings yet

- REVISION PaDocument54 pagesREVISION PaNgoc Nguyen ThanhNo ratings yet

- The Cash Price or Delivered Price of The Property or Service To Be Acquired (2) The Amounts, If Any, To Be Credited As Down Payment And/or Trade-InDocument2 pagesThe Cash Price or Delivered Price of The Property or Service To Be Acquired (2) The Amounts, If Any, To Be Credited As Down Payment And/or Trade-InJaneth NavalesNo ratings yet

- English For Accounting VocabularyDocument7 pagesEnglish For Accounting VocabularyMarcia OhtaNo ratings yet

- CCRO Report v2t1 Commentaries Books 1-4Document573 pagesCCRO Report v2t1 Commentaries Books 1-4Catalin TudoriuNo ratings yet

- Commercial Banking Interview Prep GuideDocument14 pagesCommercial Banking Interview Prep GuideJithin RajanNo ratings yet

- PT JayatamaDocument24 pagesPT Jayatamaputri apriliaNo ratings yet

- 1400+financial Prompts For ChatGPTDocument67 pages1400+financial Prompts For ChatGPTMd Ahsan AliNo ratings yet

- Failure To Perform An Obligation On Time Which Failure Constitutes A Breach of The ObligationsDocument5 pagesFailure To Perform An Obligation On Time Which Failure Constitutes A Breach of The ObligationsZero OneNo ratings yet

- The Accounting Cycle: Accruals and Deferrals: Mcgraw-Hill/IrwinDocument45 pagesThe Accounting Cycle: Accruals and Deferrals: Mcgraw-Hill/Irwinazee inmix100% (1)

- The Merchant of VeniceDocument11 pagesThe Merchant of VeniceSergio CastellanosNo ratings yet

- 7 - Corp LiquidationDocument4 pages7 - Corp LiquidationALLYSON BURAGANo ratings yet

- Credit and CollectionDocument26 pagesCredit and CollectionMark joseph MartinezNo ratings yet

- Revision Sheet - 2023 - 2024Document27 pagesRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)