Professional Documents

Culture Documents

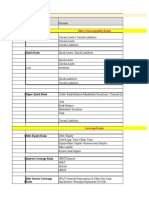

Profit or Loss

Profit or Loss

Uploaded by

imandimahawatte2008Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit or Loss

Profit or Loss

Uploaded by

imandimahawatte2008Copyright:

Available Formats

Profit or Loss

How does a business measure profit or loss?

An accountant prepares an income statement for a business to show if the

business is making a profit or a loss

The profit or loss is the difference between the total income and the total

expenses

o A profit is made if the income is higher than the expenses

o A loss is made if the income is lower than the expenses

Why is it important to measure profit or loss?

The information provided by financial statements shows the owner what has

happened to the business during a certain period of time

o This is usually a year

It can be used to monitor the progress of the business

o If a profit is made, the owner is making money on their investment

o If a loss is made, the owner might have to make changes to the business

Assets, Liabilities & Capital

How does a business measure its financial position?

An accountant prepares a statement of financial position to show:

o Assets

o Liabilities

o Capital

What are assets?

Assets are things owned by the business

o Premises, inventory, motor vehicles, money in the bank, etc

Assets also include amounts that are owed to the business by other people or

businesses

o Money owed to the business by credit customers

These are called trade receivables

Current assets are short-term assets that the business intends

to liquidate within a year

o Trade receivables, inventory, money in the bank, etc

Non-current assets are long-term assets that the business intends to own for

more than a year and they are not easily liquated

o Premises, motor vehicles, etc

What are liabilities?

Liabilities are the amounts that the business owes to other people or

businesses

o Bank loans, bank overdraft, etc

o Money owed to credit suppliers by the business

These are called trade payables

Current liabilities are short-term liabilities which the business intends to

pay within a year

o Trade payables, bank overdraft, etc

Non-current liabilities are long-term liabilities which the business intends

to take longer than a year to repay

o Bank loans, etc

What is capital or owner’s equity?

Capital is any resource provided by the owner to start up the

business or keep it going

o This is sometimes referred to as owner’s equity

Capital is often in the form of money

o However, it may also consist of other assets

Such as buildings, furniture, equipment, motor vehicles, goods, etc

The owner invests capital into their business

o Technically the business owes these assets to the owner

If a business makes a profit then its capital increases

If a business makes a loss then its capital decreases

What are drawings?

Drawings refer to when an owner takes assets from the business for personal

use

o This could be money, goods, motor vehicles, etc

If the owner takes drawings from the business then the capital decreases

You might also like

- NC-III Bookkeeping ReviewerDocument33 pagesNC-III Bookkeeping ReviewerNovelyn Gamboa94% (62)

- The Mechanics of Removing DebtDocument17 pagesThe Mechanics of Removing DebtNewEra30100% (5)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Accounting Crash Course NotesDocument7 pagesAccounting Crash Course NotesShashank MallepulaNo ratings yet

- Financial Planning and ForecastingDocument3 pagesFinancial Planning and ForecastingPrima FacieNo ratings yet

- Book 3Document2 pagesBook 3hothayfahNo ratings yet

- Basic Understanding of Accounting and TerminilogyDocument40 pagesBasic Understanding of Accounting and TerminilogyGautam MNo ratings yet

- Accounting ConceptsDocument95 pagesAccounting Conceptsgaurav gargNo ratings yet

- Basics of AccountingDocument32 pagesBasics of AccountingAnshuma ChughNo ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Business Finance Lecture1Document18 pagesBusiness Finance Lecture1Vilma Dalag LamoNo ratings yet

- Finance For Non Finance Professionals Statements and RatiosDocument32 pagesFinance For Non Finance Professionals Statements and Ratioskrithika1288No ratings yet

- Overview of AccountingDocument5 pagesOverview of AccountingFraulien Legacy MaidapNo ratings yet

- Major Account TitleDocument63 pagesMajor Account TitleElla RamosNo ratings yet

- III Business Plan - Elements - Elements 3th PartDocument30 pagesIII Business Plan - Elements - Elements 3th PartefrenNo ratings yet

- Final AccountsDocument20 pagesFinal Accountsabhimanbehera0% (1)

- Accounting NotesDocument42 pagesAccounting NotesMattheus Lim0% (1)

- Unit 1 - Introduction To AccountingDocument15 pagesUnit 1 - Introduction To AccountingTanvi JainNo ratings yet

- 2assets, Liabilities and CapitalDocument5 pages2assets, Liabilities and Capitaldilhani sheharaNo ratings yet

- Accounting Basics - Assets, Liabilities, Equity, Revenue, and ExpensesDocument4 pagesAccounting Basics - Assets, Liabilities, Equity, Revenue, and ExpensesShah JehanNo ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To Accountingsampath wanasingheNo ratings yet

- Bookkeeping Concepts NotesDocument10 pagesBookkeeping Concepts Notesnkosii.mthekuuuNo ratings yet

- Assets, Liabilities, and The Balance SheetDocument19 pagesAssets, Liabilities, and The Balance Sheetdebojyoti100% (1)

- Tally ERP9Document68 pagesTally ERP9Jinesh100% (2)

- Corporate Finance Assignment - 1Document14 pagesCorporate Finance Assignment - 1nsmkarthickNo ratings yet

- NCERT Solutions For Class 11th: CH 1 Introduction To Accounting AccountancyDocument36 pagesNCERT Solutions For Class 11th: CH 1 Introduction To Accounting Accountancydinesh100% (1)

- BREAKING DOWN 'Noncurrent Liabilities': Balance Sheet Lease Cash Flow Current Liabilities Accounts PayableDocument8 pagesBREAKING DOWN 'Noncurrent Liabilities': Balance Sheet Lease Cash Flow Current Liabilities Accounts PayableThalia Rhine AberteNo ratings yet

- Introduction To AccountingDocument39 pagesIntroduction To AccountingRazib KhanNo ratings yet

- Balance SheetDocument23 pagesBalance Sheetdeepakpareek143No ratings yet

- Lecture 2 21317Document35 pagesLecture 2 21317king heartNo ratings yet

- Business Administration 1220 - Introduction To Business Final Exam Study GuideDocument134 pagesBusiness Administration 1220 - Introduction To Business Final Exam Study GuideEthan ConroyNo ratings yet

- CH 22-Notes 1025627583Document4 pagesCH 22-Notes 1025627583ayten.ayman.elerakyNo ratings yet

- Accounting IntroductionDocument10 pagesAccounting Introductionomer mazharNo ratings yet

- Principles of AccountsDocument7 pagesPrinciples of AccountsJadeja ChatrieNo ratings yet

- Accounting 111 - Prelim Topic 3Document22 pagesAccounting 111 - Prelim Topic 3tempoNo ratings yet

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDocument24 pagesTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- Accounting BasicsDocument26 pagesAccounting BasicsAziz MalikNo ratings yet

- DPB2012 - T6Document26 pagesDPB2012 - T6suhanaNo ratings yet

- 2.1 The Recording Phase: Sheet and Income Statement AccountsDocument12 pages2.1 The Recording Phase: Sheet and Income Statement Accountsayitenew temesgenNo ratings yet

- 2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3Document70 pages2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3yared destaNo ratings yet

- 1 - Classification of AccountsDocument6 pages1 - Classification of AccountsKanganFatimaNo ratings yet

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Accounting: 2.financial StatementsDocument4 pagesAccounting: 2.financial StatementsYinan CuiNo ratings yet

- Account DefinationsDocument7 pagesAccount DefinationsManasa GuduruNo ratings yet

- Financial Planning IDocument6 pagesFinancial Planning Isambhussakshi3No ratings yet

- bd4769edd615cbff9a10b93d43ba3972Document17 pagesbd4769edd615cbff9a10b93d43ba3972Tanish HandaNo ratings yet

- Cash ManagementDocument8 pagesCash ManagementsujkubvsNo ratings yet

- How To Read Balance SheetDocument28 pagesHow To Read Balance SheetAnupam JyotiNo ratings yet

- 01 Accounting Study NotesDocument8 pages01 Accounting Study NotesJonas ScheckNo ratings yet

- FABM - Reviewer Q1Document2 pagesFABM - Reviewer Q1Ahlfea JugalbotNo ratings yet

- Basics of Financial Accounting - 1Document40 pagesBasics of Financial Accounting - 1Dr.Ashok Kumar PanigrahiNo ratings yet

- Bài C A NhiDocument5 pagesBài C A NhiTien Dung HoangNo ratings yet

- Taxation and Internal AuditDocument233 pagesTaxation and Internal AuditHazlie HassanNo ratings yet

- Ed 3rd ModuleDocument11 pagesEd 3rd ModuleShahnawaz AhmadNo ratings yet

- Course 1: What Is Accounting?Document5 pagesCourse 1: What Is Accounting?Ileana SendreaNo ratings yet

- 1.understanding Financial StatementDocument25 pages1.understanding Financial StatementJayant CrNo ratings yet

- Key Points For Week 3 TopicDocument4 pagesKey Points For Week 3 TopicKyaw Thwe TunNo ratings yet

- FA 2024 NotesDocument32 pagesFA 2024 NotesJoshua JamesNo ratings yet

- Principle of AccountingDocument25 pagesPrinciple of AccountingBaktash Ahmadi100% (1)

- Purpose of Business DocumentsDocument2 pagesPurpose of Business Documentsimandimahawatte2008No ratings yet

- Friend To AnimalDocument8 pagesFriend To Animalimandimahawatte2008No ratings yet

- Project ProposalDocument2 pagesProject Proposalimandimahawatte2008No ratings yet

- Log BookDocument30 pagesLog Bookimandimahawatte2008No ratings yet

- Revision NotesDocument128 pagesRevision Notesimandimahawatte2008No ratings yet

- Uganda Management Institute Master of Business Administration (MBA)Document5 pagesUganda Management Institute Master of Business Administration (MBA)Mwesigwa DaniNo ratings yet

- MA Sem-4 2018-2019Document23 pagesMA Sem-4 2018-2019Akki GalaNo ratings yet

- Economic CrisisDocument5 pagesEconomic Crisisabdulmateen01No ratings yet

- Creative AccountingDocument7 pagesCreative Accountingeugeniastefania raduNo ratings yet

- Accountancy Notes Ch.1 Introduction To AccountingDocument6 pagesAccountancy Notes Ch.1 Introduction To AccountingSancia D'silva100% (1)

- Civil Law Exam (Topic Interest) Question and AnswerDocument3 pagesCivil Law Exam (Topic Interest) Question and AnswerKrizzy GayleNo ratings yet

- Accounting Interview Questions With Answers (Top 100 Updated Questions)Document39 pagesAccounting Interview Questions With Answers (Top 100 Updated Questions)mohamedNo ratings yet

- Final AccountsDocument36 pagesFinal AccountsPRAKHAR GUPTANo ratings yet

- Accounting-CASH FLOW and CGDocument58 pagesAccounting-CASH FLOW and CGBoogy Grim100% (1)

- (Acctg 112) Pas 1, 2, 7Document7 pages(Acctg 112) Pas 1, 2, 7Mae PandoraNo ratings yet

- ACCT101 - Prelim - THEORY (25 PTS)Document3 pagesACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- North West Company: Analyzing Financial Performance: SolvencyDocument5 pagesNorth West Company: Analyzing Financial Performance: SolvencyAbdullah QureshiNo ratings yet

- Unit 1 Introduction Acc 558 2020 LecturesDocument84 pagesUnit 1 Introduction Acc 558 2020 LecturesElvis YarigNo ratings yet

- Accountancy IIDocument304 pagesAccountancy IIuirehfvbidfNo ratings yet

- AGIF Car Loan Application Form PDFDocument12 pagesAGIF Car Loan Application Form PDFMansi0% (1)

- Example Question Financial ManagementDocument3 pagesExample Question Financial ManagementNadhirah NadriNo ratings yet

- Business Exit Strategy - 1Document2 pagesBusiness Exit Strategy - 1SUBRATA MODAKNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- This Loan Agreement Is Executed On : (PAN ), S/o, R/oDocument1 pageThis Loan Agreement Is Executed On : (PAN ), S/o, R/ohope mfungweNo ratings yet

- Research Paper On Financial Performance AnalysisDocument7 pagesResearch Paper On Financial Performance AnalysisxfeivdsifNo ratings yet

- Accounting For Partnership FARDocument31 pagesAccounting For Partnership FARlousevero10No ratings yet

- Final Summative Assessment - Ae112 (1St Sem 2020-2021) - Quiz 2 Suggested Key AnswerDocument3 pagesFinal Summative Assessment - Ae112 (1St Sem 2020-2021) - Quiz 2 Suggested Key AnswerDjunah ArellanoNo ratings yet

- Aurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleDocument13 pagesAurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleAryan RajNo ratings yet

- Unit 5 - Conveyancing Assign. 3Document7 pagesUnit 5 - Conveyancing Assign. 3KemarWilliamsNo ratings yet

- FAR101A-Financial Accounting and Reporting ADocument153 pagesFAR101A-Financial Accounting and Reporting AMark Juliah NaveraNo ratings yet

- A Study of Treasury Management in A Non-Banking Entity-Namely Balmer Lawrie & Co. LTDDocument36 pagesA Study of Treasury Management in A Non-Banking Entity-Namely Balmer Lawrie & Co. LTDnasleshaNo ratings yet

- The Conceptual Framework of Accounting and Its Relevance To Financial ReportingDocument24 pagesThe Conceptual Framework of Accounting and Its Relevance To Financial Reportingmartain maxNo ratings yet

- FY24 Q1 Consolidated Financial StatementsDocument3 pagesFY24 Q1 Consolidated Financial StatementsDhanaRajNo ratings yet