Professional Documents

Culture Documents

02 Refund

02 Refund

Uploaded by

SABIK SHAIKHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Refund

02 Refund

Uploaded by

SABIK SHAIKHCopyright:

Available Formats

- the value of zero-rated supply of goods made during the relevant period

Chapter 23 Refund without payment of tax under bond or letter of undertaking or

CCP 23.07.12.00 - the value which is 1.5 times the value of like goods domestically supplied by

Wye Ltd. provides the following details of September, 20XX for computation of the same or, similarly placed, supplier, as declared by the supplier,

refund claim under rule 89(4) of the CGST Rules, 2017. Compute the eligible whichever is less,

claim under the said rule assuming that other conditions are fulfilled. - other than the turnover of supplies in respect of which refund is claimed

Particulars Amount (₹) under rules 89(4A) or 89(4B) or both.

Opening balance of ITC 5,00,000 Ø "Adjusted Total turnover" means the sum total of the value of:-

ITC availed during the period, which includes the claim for refund 25,00,000 a) The turnover in a State or a Union territory as per section 2(112) excluding

made of ₹ 5,00,000 eligible under rule 89(4A)/89(4B) of the the turnover of services and

CGST Rules, 2017 b) The turnover of zero-rated supply of services as per clause (D) above & non-

Zero rated supply of goods made during the period without 6,00,00,000 zero-rated supply of services,

payment of tax under bond/LUT, which include the supply of ₹ excluding –

1,00,00,000 for which refund claim is made under rule I) the value of exempt supplies other than zero-rated supplies and

89(4A)/89(4B) of the CGST Rules, 2017 ii) the turnover of supplies for which refund is claimed under rule 89(4A) or

Supply of goods other than zero rated supply 3,00,00,000 (4B) or both, if any, during the relevant period.

[CA Final Exam May 19 New] Ø For the purpose of rule 89(4), the value of goods exported out of India shall be

Answer :- the lower of:-

Legal Provision:- 1) the Free on Board (FOB) value declared in the Shipping Bill or Bill of Export

As per Rule 89(4) of CGST Rules, 2017, in case of zero-rated supply of goods or or

services or both without payment of tax under bond/ letter of undertaking as per 2) the value declared in tax invoice or bill of supply.

section 16(3) of IGST Act, 2017, refund of input tax credit (ITC) shall be granted as Discussion & Conclusion:-

per the following formula:- Ø Accordingly, turnover of zero-rated supply of goods = ` 5,00,00,000 i.e.

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero- [ ` 6,00,00,000 – ` 1,00,00,000]

rated supply of services) x Net ITC ÷ Adjusted Total Turnover Ø Net ITC = ` 20,00,000 i.e. [ ` 25,00,000 – ` 5,00,000].

where, Ø Adjusted Total Turnover = ` 8,00,00,000 i.e. [ ` 6,00,00,000 + ` 3,00,00,000 – `

Ø "Net ITC" means ITC availed on inputs and input services during the relevant 1,00,00,000].

period other than the ITC availed for which refund is claimed under rule 89(4A) Ø Thus, maximum refund amount under rule 89(4) = ` 20,00,000 × ` 5,00,00,000 /

or 89(4B) or both. ` 8,00,00,000 = ` 12,50,000.

Ø "Turnover of zero-rated supply of goods" means

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 6

CA Final GST Questioner

Assumption:- 2) Betty Enterprises is a 100% export-oriented undertaking. It has claimed the

1. It is assumed that value declared in shipping bill and tax invoice is same as not ITC on goods supplied to it by Synotex Pvt. Ltd.

separately given in question. 3) The balance in the electronic credit ledger of Synotex Pvt. Ltd. at the end of

2.Since the value of like goods domestically supplied is absent in the question, it is the tax period for which the refund claim is being filed after GSTR-3B for

assumed that the actual value of goods exported is lower than the like goods the said period has been filed is ₹ 5,80,000.

domestically supplied. 4) The balance in the electronic credit ledger of Synotex Pvt. Ltd. at the time of

CCP.23.07.13.00 filing the refund application is ₹ 3,00,000.

Synotex Pvt. Ltd. manufactures taxable goods, 'Q' and exempt goods 'S'. Compute the amount refundable to Synotex Pvt. Ltd. for the tax period. [CA final

Product 'S' is sold in international markets without payment of tax under RTP Nov 2020]

letter of undertaking. Answer :-

The company is registered under GST in the State of Maharashtra. A. Export of Product 'S':-

The company provides following information in relation to various supplies Legal Provision:-

made by it during a tax period:- Ø As per section 16(1)(a) of IGST Act, 2017, export of goods is a zero-rated supply.

a) Product 'S has been exported to UK for £ 12,000. Ø As per Section 16(2) of IGST Act, 2017, subject to the provisions of section 17(5)

b) Product 'Q' has been supplied to Betty Enterprises within India for ₹ of CGST Act, 2017, input tax credit (ITC) may be availed for making zero-rated

20,00,000. supplies even if such supply may be an exempt supply.

Note:- The above amounts are exclusive of taxes, wherever applicable. Ø As per section 54(3) of CGST Act, 2017, a registered person may claim refund of

The company provides the following information in relation to tax paid on any unutilised ITC at the end of any tax period in the case of zero-rated supply

inward supplies received during the said tax period:- made without payment of tax.

a) GST of ₹ 5,00,000 has been paid on inputs. Ø As per rule 89(4) of CGST Rules, 2017, in case of zero-rated supply of goods or

b) GST of ₹ 2,40,000 has been paid on capital goods. services or both without payment of tax under bond/ letter of undertaking as per

c) GST of ₹ 2,00,000 has paid on input services. section 16(3) of IGST Act, 2017, refund of ITC shall be granted as per the

d) All the above inputs, input services and capital goods are used in the following formula:-

manufacturing process. Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-

Following additional information is also provided:- rated supply of services) x Net ITC ÷ Adjusted Total Turnover

1) Value of product 'S' exported to UK in Indian rupees is value of taxable invoice Discussion:-

₹ 12,00,000, Value in shipping bill is ₹ 12,75,000. However, value of such Ø In given case, Synotex Pvt. Ltd. will be eligible to claim ITC for export of exempt

product when supplied domestically by the company in similar quantities product 'S' under section 16(2) of IGST Act and will thus, be able to claim

is ₹ 10,00,000. refund of unutilised ITC under section 54(3) of CGST Act.

7 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy

CA Final GST Questioner

Ø Accordingly, the amount refundable to Synotex Pvt. Ltd. for the tax period B. Supply of product 'R' to Betty Enterprises, a 100% EOU:-

under rule 89(4) of CGST Rules is as under:- Legal Provision:-

- Net ITC means ITC availed on inputs and input services during the relevant Ø Supplies to EOU is notified as deemed export and for such supplies, the

period. application of refund can be filed by the supplier of deemed export supplies

Thus, Net ITC = `7,00,000 i.e. ( `5,00,000 + `2,00,000). only in cases where the recipient does not avail of ITC on such supplies and

- Turnover of Zero-rated supply of goods (a or b, whichever is less) = furnishes an undertaking to the effect that supplier may claim refund (rule

`12,00,000 89 of CGST Rules)

a) Value of Zero-rated supply of goods under Bond/ LUT = `12,00,000 Discussion & Conclusion:-

(refer note 1) Ø Therefore, since in given case, Betty Enterprises (recipient) is claiming ITC,

Note 1:- The value of goods exported out of India shall be taken as the lower Synotex Pvt. Ltd. (supplier of deemed exports) cannot claim refund of

of:- ITC.

w FOB value declared in shipping bill = `12,75,000 or Therefore, the amount refundable to Synotex Pvt. Ltd. is ₹ 2,62,500.

w Value declared in tax invoice = `12,00,000.

b) 1.5 times the value of like goods domestically supplied in India (by CCP.23.07.14.00

the same supplier) i.e. (`10,00,000 x 1.5) = `15,00,000. The following particulars are furnished by Delight Exporters, Karnataka, which is

- Adjusted total Turnover = `32,00,000 i.e. (`20,00,000 + `12,00,000). duly registered under the GST law. The entity has also filed bond/LUT in order to

- Refund amount under Rule 89(4) = `7,00,000 x `12,00,000/ `32,00,000 export goods without payment of any taxes. You are required to calculate the

= `2,62,500 refund amount in respect of input tax credit on inputs and input services

Ø Further, as per CBIC Circular, the amount refundable to the applicant relating to goods exported in the relevant tax period.

is least of the following amounts:-

S.no Particulars Amount (₹)

a) Maximum refund amount as per the formula in rule 89(4) of CGST

1. Turnover excluding supply of services, but includes exempt 76,00,000

Rules i.e. ₹ 2,62,500.

supplies of ₹ 8,00,000 and inward supplies of ₹ 2,00,000

b) Balance in the electronic credit ledger at the end of the tax period

2. Zero-rated supply of goods under bond/LUT 12,00,000

for which the refund claim is being filed after GSTR-3B for the said

3. Export services under bond/LUT 48,00,000

period has been filed i.e. ₹ 5,80,000.

4. Non-zero-rated supply of services 10,00,000

c) Balance in the electronic credit ledger at the time of filing the

5. Payments received towards zero-rated supply, which includes ₹ 48,00,000

refund application i.e. ₹ 3,00,000.

12,00,000 against which services are yet to be supplied.

Ø Thus, the amount refundable to Synotex Pvt. Ltd. of unutilized ITC is ₹

6. Advance received in the past, against which zero-rated supplies 14,00,000

2,62,500.

have been made in the current tax period

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 8

CA Final GST Questioner

7. Turnover on which suppliers have claimed refund under rule received for which the supply of services has not been completed

89(4A) and rule 89(4B) during the relevant period]

-Goods 6,00,000 [48,00,000 + 14,00,000 - 12,00,000] [Note 4]

-Services 6,00,000 Adjusted total turnover = Turnover in a State excluding turnover of 1,14,00,000

8. ITC on inputs and input services during the tax period including 12,00,000 services + Turnover of zero-rated supply of services determined as

those under rule 89(4A) and rule 89(4B)

above + non-zero-rated supply of services – [Exempt supplies other

9. ITC relating to rule 89(4A) and rule 89(4B) 2,40,000 than zero-rated supplies + Turnover of supplies in respect of which

[CA Final Nov 19 Exam New] refund is claimed under 89(4A) and 89(4B)]

Answer :- [₹76,00,000 - ₹2,00,000 + ₹50,00,000 + ₹10,00,000 - (₹8,00,000

Legal Provision:- As per Rule 89(4) of CGST Rules, 2017, in case of zero-rated + ₹6,00,000 + ₹6,00,000)] [Note 1, 3 & 5]

supply of goods or services or both without payment of tax under bond/ letter of Refund of ITC for zero-rated supply of goods and zero-rated 4,71,579

undertaking as per section 16(3) of IGST Act, 2017, refund of input tax credit supply of services = [₹9,60,000 x (₹56,00,000/ ₹1,14,00,000)] (Rounded off)

(ITC) shall be granted as per the following formula:-

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero- Notes: The above answer is based on following assumptions:-

rated supply of services) x Net ITC ÷ Adjusted Total Turnover 1. Turnover at Sl. No. 1 [₹ 76 lakhs] includes the turnover of zero-rated supply of

Discussion & Conclusion:- goods given at Sl. No. 2 [₹ 12 lakhs].

Accordingly, the amount of refund shall be computed as follows:- 2. Turnover of zero-rated supply of goods given at Sl No. 2 [₹ 12 lakhs] includes

turnover of supplies of goods in respect of which refund has been claimed under

Particulars Amount (₹) rule 89(4A) and 89(4B) [₹ 6 lakhs].

Net ITC on input and input services excluding ITC availed for which 9,60,000 3. Turnover of zero-rated supply of services computed as per rule 89(4)(D) [₹ 50

refund is claimed under rule 89(4A) and 89(4B) i.e. (₹ 12,00,000 -

lakhs] includes the turnover of supplies of services in respect of which the refund

₹ 2,40,000)

is claimed under rule 89(4A) and 89(4B) [₹ 6 Lakhs]

Turnover of zero-rated supply of goods:- 6,00,000 4. It is assumed that Sl. No. 6 of the table in the question belongs to zero rated

Turnover of zero-rated supply of goods excluding turnover of

supply of service and not for zero rated supply of goods.

supplies in respect of which refund is claimed under 89(4A) and

5. The exempt supplies are logically assumed to be other that zero rated supplies.

89(4B) i.e. (12,00,000 - 6,00,000) [Note 2, 6 & 7]

6. The value declared in shipping bill and tax invoice is same as not separate given in

Turnover of zero-rated supply of services:- 50,00,000 the question.

[Aggregate of payments received during the relevant period and 7. Since the value of like goods domestically supplied is absent in the question, it is

services where supply has been completed for which payment had assumed that the actual value of goods exported is lower than the like goods

been received in advance in any prior period reduced by advances domestically supplied.

9 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy

CA Final GST Questioner

Note by ICAI:- However, the above question can also be answered on the basis of Other applicable conditions for claiming the refund are duly complied with.

alternate assumptions e.g., the turnover of zero-rated supply of goods given at Sl. You are required to compute the 'maximum refund amount' eligible under rule

No. 2 [₹ 12 lakhs] excludes turnover of supplies of goods in respect of which

89(5) of CGST Rules, 2017 for inverted duty structure. Also provide working notes

refund has been claimed under rule 89(4A) and 89(4B) [₹ 6 lakh] or the

for your calculation.

turnover at Sl. No. 1 [₹ 76 lakhs] does not include the turnover of zero-rated

Note:- No refund has been claimed under rule 89(3) or rule 89(4) of the CGST

supply of goods given at Sl. No. 2 [₹ 12 lakhs] and turnover of supplies of goods in

respect of which refund has been claimed under rule 89(4A) and 89 (4B) [₹ 6 Rules, 2017 [CA Final Dec 21 Exam]

lakhs]. Answer:- Maximum refund amount under rule 89(5) of CGST Rules, 2017 on account

Author's Note:- While calculating turnover of zero rated supply of goods, 1st of inverted duty structure, is computed as follows:-

deduct supply for which refund claim is made under rule 89(4A) / 89(4B), if any, Maximum Refund Amount =

from the actual value of ZRS made without payment of tax under bond /LUT, and Turnover of inverted Tax payable on such Net ITC

then we compare it with value of 1.5 times the value of like goods domestically rated supply of Goods inverted rated supply ITC availed

supplied by the same, or similarly placed, supplier. & services x Net ITC of goods & Services on Inputs &

Adjusted Total Turnover Inputs services

CCP.23.08.15.00 Where,

Jai and Co, a registered supplier under GST, is engaged in weaving yarn into A. Net ITC means ITC availed only on inputs. Thus, Net ITC = ₹ 24,00,000 X 6% =

fabrics and has provided the following information:- ₹ 1,44,000

Nature of various intra-State Value of supply B. Tax Payable on such inverted supply of goods & services = ₹ 30,00,000 X 2.5%

supplies during April, 20XX (Excluding (each for CGST and SGST) = ₹ 75,000

GST) (₹) C. ITC availed on input and Input services = ₹ 24,00,000 X 6% + ₹ 4,00,000 X

Outward supply of fabrics (Tax rate of CGST and SGST is 2.5% 30,00,000 2.5% = ₹ 1,54,000

each) D. Turnover of inverted rated supply of goods and services = ₹ 30,00,000

Inward supply of rayon yarn (Tax rate of CGST and SGST is 6% 24,00,000 E. Adjusted total turnover = ₹ 30,00,000

each) Thus, the Maximum refund amount =

Inward supply of services for processing the yarn (Tax rate of CGST 4,00,000 (₹ 1,44,000 X ₹ 30,00,000/ ₹ 30,00,000) - (₹ 75,000 X ₹ 1,44,000/ ₹ 1,54,000)

and SGST is 2.5% each) = ₹ 1,44,000 - ₹ 70,130

Inward supply of machineries for weaving the processed yarn into 45,00,000 = ₹ 73,870

fabrics (Tax rate of CGST and SGST is 9% each) Thus, maximum refund amount is ₹ 73,870 each for CGST and SGST.

The concern has not provided any supply other than the outward supply referred Note:- Refund of tax paid on input services and capital goods is not a part of refund of

above. ITC in respect of all types of inward supplies as given above was claimed in accumulated ITC on account of inverted duty structure.

the relevant GSTR 3B as well as reflected in prescribed form.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 10

CA Final GST Questioner

CCP.23.08.16.00 Maximum Refund Amount =

Super Engineering Works, a registered supplier in Haryana, is engaged in supply Turnover of inverted Tax payable on such Net ITC

of taxable goods within the State. Given below are the details of turnover and rated supply of Goods inverted rated supply ITC availed

applicable GST rates of the final products manufactured by Super Engineering & services x Net ITC of goods & Services on Inputs &

Works as also the input tax credit (ITC) availed on inputs used in manufacture Adjusted Total Turnover Inputs services

of each of the final products and GST rates applicable on the same, during a tax Where,

period:- A. "Net ITC" means input tax credit availed (ITC) on inputs during the relevant

Product Turnover* Output ITC Availed (₹) Input GST period other than ITC availed for which refund is claimed under rule 89(4A)

GST Rates Product Product Rates or 89(4B) or both.

A 5,00,000 5% 54,000 20,000 18% B. "Adjusted Total turnover" means the sum total of the value of:-

B 3,50,000 5% 54,000 20,000 18% a) The turnover in a State or a Union territory as per section 2(112)

C 1,00,000 18% 10,000 5,000 18% excluding the turnover of services and

b) The turnover of zero-rated supply of services as per clause (D) of sub

*excluding GST

rule 89(4) & non-zero-rated supply of services,

Determine the maximum amount of refund of the unutilized input tax credit

excluding –

that Super Engineering Works is eligible to claim under section 54(3) of the

i) the value of exempt supplies other than zero-rated supplies and

CGST Act, 2017 provided that Product B is notified as a product, in respect of

ii) the turnover of supplies for which refund is claimed under rules

which no refund of unutilised input tax credit shall be allowed under said

89(4A) or (4B) or both, if any, during the relevant period.

section. [CA Final RTP- Nov 2018) [CA final MTP Apr 19] [ICAI Study Material]

C. “Relevant period” means the period for which the claim has been filed.

Answer:-

Discussion:-

Legal Provision:-

Ø In given case, the rates of tax on inputs used in Products A and B (18% each)

Ø Section 54(3) of CGST Act, 2017 allows refund of unutilized input tax

are higher than rates of tax on output supplies of Products A and B (5%

credit (ITC) at the end of any tax period to a registered person where the

each).

credit has accumulated on account of inverted duty structure i.e. rate of tax

Ø However, Product B is notified as a product for which no refund of unutilised

on inputs being higher than the rate of tax on output supplies (other than

ITC shall be allowed under section 54(3).

nil rated or fully exempt supplies), except supplies of goods &/or services

Ø Therefore, only Product A is eligible for refund under section 54(3).

notified by Government on recommendations of Council.

Calculation & Conclusion:-

Ø Further, as per rule 89(5) of CGST Rules, 2017, in the case of refund on

In given case, the maximum refund amount which Super Engineering Works is eligible

account of inverted duty structure, refund of ITC shall be granted as per

to claim shall be computed as follows:-

the following formula:-

11 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy

CA Final GST Questioner

Ø Tax payable on inverted rated supply of Product A = ₹ 5,00,000 × 5% = ₹ * not notified as a product, in respect of which refund of

25,000 unutilised ITC shall not be allowed under section 54(3) of

Ø Net ITC = ₹ 1,18,000 i.e. (₹ 54,000 + ₹ 54,000 + ₹ 10,000) CGST Act, 2017

[Net ITC availed during the relevant period needs to be considered (iii) Supply of goods to Export Oriented Unit [excluding tax @ 18%] 5,00,000

[ITC has been claimed by the recipient]

irrespective of whether the ITC pertains to inputs eligible for refund of

inverted rated supply of goods or not] (iv) Export of exempt supplies of goods:-

Ø ITC availed on inputs and input services = 1,63,000 i.e. (₹ 54,000 + ₹ Value declared in shipping bill 6,00,000

54,000 + ₹ 10,000 + ₹ 20,000 + ₹ 20,000 + ₹ 5,000) Value declared in tax invoice 7,00,000

Ø Adjusted Total Turnover = ₹ 9,50,000 i.e. (₹ 5,00,000 + ₹ 3,50,000 + ₹ (Value of like goods domestically supplied by similarly placed

supplier is ₹ 5,00,000)

1,00,000)

Ø Turnover of inverted rated supply of Product A = ₹ 5,00,000 The ITC available for the above tax period is as follows:-

Ø Thus, Maximum refund amount for Super Engineering Works = S.no Particulars Amount (₹)

= [5,00,000 × 1,18,000/ 9,50,000] – [25,000 × 1,18,000/ 1,63,000] (I) On inputs (including ₹ 50,000 on export of exempt supplies) 3,50,000

= ₹ 44,007 (rounded off) (ii) On capital goods 1,20,000

(iii) On input services (including ₹ 18,000 on outdoor catering) 2,00,000

Determine the maximum amount of refund admissible to Kailash Global (P) Ltd.

CCP.23.09.17.00

Kailash Global (P) Ltd. supplies various goods in domestic and international for the given tax period. [CA Final RTP May 19] [ICAI Study Material]

markets. It is engaged in both manufacturing and trading of goods. The Answer :-

company is registered under GST in the State of Karnataka. The company Computation of maximum amount of refund admissible to Kailash Global (P) Ltd.

exports goods without payment of tax under letter of undertaking in Particulars Amount (₹)

accordance with the provisions of section 16(3)(a) of the IGST Act, 2017. Exports of product 'A' to UK [Note 1] Nil

The company has made the following supplies during a tax period:- Domestic supplies of taxable product 'B' during the period [Note 2] 92,105

Supply of goods to Export Oriented Unit [Note 3] Nil

S.no Particulars Amount (₹)

Export of exempt supplies [Note 4] 1,14,000

(I) Export of product 'A' to UK for $ 10,000. Assessable value under 7,00,000

customs in Indian rupees. [Export duty is levied on product 'A' Total refund claim admissible 2,06,105

at the time of exports. Further, value of like goods domestically Notes:-

supplied by the similarly placed supplier is ₹ 6,00,000] 1. Export of goods is a zero-rated supply as per section 16(1)(a) of IGST Act, 2017.

Further, Kailash Global (P) Ltd. exports goods without payment of tax under

(ii) Domestic supplies of taxable product 'B'* during the period 10,00,000

letter of undertaking as per section 16(3)(a) of IGST Act, 2017.

[excluding tax @ 5%]

Therefore, as per section 54(3) of CGST Act, 2017, a registered person may

[Inputs used in manufacturing of such goods are taxable @18%]

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 12

CA Final GST Questioner

claim refund of any unutilised ITC in the case of zero-rated supply at the end of Ø Here,

any tax period. However, the refund of unutilized ITC is not allowed if the Tax payable on inverted rated supply of goods = ₹ 10,00,000 × 5% = ₹ 50,000,

goods exported out of India are subjected to export duty. Net ITC = ₹ 3,50,000,

2. As per section 54(3) of CGST Act, 2017, refund of unutilised ITC is allowed in Adjusted Total Turnover = ₹ 28,00,000 i.e. [₹ 7,00,000 + ₹ 10,00,000 +

case of inverted duty structure, i.e. where the credit has accumulated on ₹ 5,00,000 + ₹ 6,00,000],

account of rate of tax on inputs being higher than the rate of tax on output Turnover of inverted rated supply of goods = ₹ 10,00,000 and

supplies (other than nil rated or fully exempt supplies) except supplies of goods ITC availed on inputs and input services = ₹ 3,50,000 + ₹ 1,82,000 =₹ 5,32,000.

or services or both notified by Government. Ø Thus, maximum refund amount under rule 89(5)

Ø Further, as per rule 89(5) of CGST Rules, 2017, in the case of refund on = (₹ 3,50,000 x 10,00,000/ 28,00,000) – (₹ 50,000 X 3,50,000 /5,32,000)

account of inverted duty structure, refund of ITC shall be granted as per the = ₹ 1,25,000 - ₹ 32,895

following formula:- = ₹ 92,105

Maximum Refund Amount =

Turnover of inverted Tax payable on such Net ITC 3. Supplies to EOU is notified as deemed export and for such supplies, the

rated supply of Goods inverted rated supply ITC availed application of refund can be filed by the supplier of deemed export supplies only

& services x Net ITC of goods & Services on Inputs & in cases where the recipient does not avail of ITC on such supplies and furnishes

Adjusted Total Turnover Inputs services an undertaking to the effect that supplier may claim refund (rule 89 of CGST

Rules).

Where,

Therefore, since in given case, the recipient is claiming ITC, Kailash

- "Net ITC" means input tax credit availed (ITC) on inputs during the relevant

Global (P) Ltd. (supplier of deemed exports) cannot claim refund of ITC.

period other than ITC availed for which refund is claimed under rule 89(4A) or

89(4B) or both.

4. As per section 16(2) of IGST Act, 2017, subject to provisions of section 17(5) of

- "Adjusted Total turnover" means the sum total of the value of:-

CGST Act, ITC may be availed for making zero-rated supplies, notwithstanding

a) The turnover in a State or a Union territory as per section 2(112) excluding

that such supply may be an exempt supply. Section 54(3) of CGST Act, 2017

the turnover of services and

allows refund of ITC in the case of zero-rated supply made without payment of

b) The turnover of zero-rated supply of services as per clause (D) of sub rule

tax.

89(4) & non-zero-rated supply of services,

Ø As per Rule 89(4) of CGST Rules, 2017, in case of zero-rated supply of goods or

excluding –

services or both without payment of tax under bond/ letter of undertaking as per

I. the value of exempt supplies other than zero-rated supplies and

section 16(3) of IGST Act, 2017, refund of input tax credit (ITC) shall be granted

ii. the turnover of supplies for which refund is claimed under rules 89(4A)

as per the following formula:-

or (4B) or both, if any, during the relevant period.

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of

13 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy

CA Final GST Questioner

zero-rated supply of services) x Net ITC ÷ Adjusted Total Turnover disallowed under section 17(5) of CGST Act, 2017), and

where, Adjusted total turnover = `2800000 (as computed above in note 2)

a) "Net ITC" means ITC availed on inputs and input services during the Ø Thus, Maximum refund amount under rule 89(4) = `532000 x `600000/

relevant period other than the ITC availed for which refund is claimed `2800000 = ` 1,14,000.

under rule 89(4A) or 89(4B) or both.

b) "Turnover of zero-rated supply of goods" means

- the value of zero-rated supply of goods made during the relevant period CCP.23.12.22.00

without payment of tax under bond or letter of undertaking or Divy Trader obtained permission for provisional assessment and supplied three

- the value which is 1.5 times the value of like goods domestically supplied consignments of furniture on 28th April, 20XX. The tax payment on provisional

by the same or, similarly placed, supplier, as declared by the supplier, basis was made in respect of all the three consignments on 20th May, 20XX.

whichever is less, Consequent to the final assessment order passed by the Assistant

- other than the turnover of supplies in respect of which refund is Commissioner on 21st June, 20XX, a tax of ₹ 1,20,000 and ₹ 1,50,000 became

claimed under rules 89(4A) or 89(4B) or both. refundable on 1st and 3rd consignments, whereas a tax of ₹ 1,20,000 became

c) “Adjusted total turnover” means the same as explained in note (2) due on 2nd consignment. Divy Trader applies for the refund of the tax on 1st and

above. 3rd consignments on 12th July, 20XX and pays the tax due on 2nd consignment

Ø For the purpose of rule 89(4), the value of goods exported out of India shall on the same day. Tax was actually refunded to it of 1st consignment on 8th

be the lower of:- September, 20XX, whereas of 3rd consignment on 18th September, 20XX.

a) the Free on Board (FOB) value declared in the Shipping Bill or Bill of Export Customers of Divy Trader who purchased the consignments have not taken Input

or Tax Credit (ITC).

b) the value declared in tax invoice or bill of supply. Determine the interest payable and receivable, if any, under CGST Act, 2017 by

Ø Here, Divy Trader. [CA Final Exam Nov. 18 New]

Turnover of zero-rated supply of goods is ₹ 6,00,000 which is lower of (a) or Answer:-

(b) below:- Legal Provision:-

a) Value of goods exported out of India shall be `6,00,000 which is the lower Ø As per section 60 of CGST Act, if tax becomes due consequent to order of final

of:- assessment, interest is payable (as per section 50(1) read with rule 88B) @

- FOB value declared in the Shipping Bill = `6,00,000 or 18% p.a., from the first day after the due date of payment of tax for the goods

- Value declared in tax invoice = `7,00,000 or supplied under provisional assessment till the date of actual payment, whether

b) 1.5 times the value of like goods domestically supplied i.e. `5,00,000 * 1.5 = such amount is paid before/ after the issuance of order for final assessment.

`7,50,000. Ø Further, section 56 of CGST Act, 2017 provides that if tax becomes refundable

Net ITC= `532000 i.e. (350000+200000-18000) (ITC on outdoor catering

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 14

CA Final GST Questioner

consequent to the order of final assessment, interest is receivable @ 6% p.a. Answer:-

from the date immediately after the expiry of 60 days from the date of receipt Legal Provision:-

of refund application till the date of refund of such tax. Ø If any applicant has received the refund of integrated tax paid on export of goods

Discussion & Conclusion:- but could not realise the sale proceeds of such exported goods within the

Ø In given case, due date for payment of tax on goods cleared on 28.04.20XX prescribed time limit (or extended time period), he shall deposit the amount so

under provisional assessment is 20.05.20XX. Thus, interest payable in respect refunded along with interest of 18% within 30 days of the expiry of the said

of 2nd consignment period (or extended time period), to the extent of non-realisation of sale

= ₹ 1,20,000 × 18% p.a. × 53 [21.05.20XX – 12.07.20XX]/365 days proceeds.

= ₹ 3,136 (rounded off) Ø However, if the RBI writes off the requirement of such realization on merits,

Ø Further, since refund of tax of 1st consignment has been paid on 08.09.20XX recovery shall not be made.

which is within 60 days from the date of receipt of application of refund Discussion & Conclusion:-

(12.07.20XX), interest is not receivable on tax refunded in respect of 1st Ø In given case, DF Ltd. has to deposit the refund of integrated tax of ₹ 4.5 lakh

consignment. (to the extent of non-realisation of export proceeds of ₹ 25 lakh) along with

Ø However, 60 days from the date of receiving the refund application expire on interest @ 18% within 30 days of the expiry of the prescribed time-limit.

10.09.20XX & thus, interest receivable in respect of 3rd consignment is as Ø In case of failure to do so, the amount will be recovered in accordance with the

follows:- provisions relating to recovery of erroneous refund and also penalty can be

= ₹ 1,50,000 × 6% p.a. × 8 [11.09.20XX-18.09.20XX]/365 days imposed.

= ₹ 197 (rounded off).

CCP.23.13.27.00

DF Ltd. exported goods valued ₹ 50 lakh and received refund of integrated tax

paid amounting to ₹ 9 lakh on 16th August, 20XX. He could realise export

proceeds to the extent of ₹ 25 lakh but did not realise the balance export

proceeds within the prescribed time limit of 9 months and has applied for

extension of time to RBI. There is no dispute about the supply of the goods as

regards quality, time of supply and fulfilment of terms and conditions of sale.

He wants you to inform him of the consequences under GST law in case RBI

does not give him the extension. [CA Final July 21 Exam]

15 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy

CA Final GST Questioner

You might also like

- Deed of Assignment of Partnership Interest: Know All Men by These PresentsDocument3 pagesDeed of Assignment of Partnership Interest: Know All Men by These PresentsEduardo Sajonia75% (4)

- Test Bank For Governmental and Nonprofit Accounting, 10th Edition Robert J. FreemanDocument6 pagesTest Bank For Governmental and Nonprofit Accounting, 10th Edition Robert J. Freemansamuel debebe100% (2)

- RR 9-89Document6 pagesRR 9-89papepipupoNo ratings yet

- Refunds: S. No. Particulars (')Document9 pagesRefunds: S. No. Particulars (')Rohit KasbeNo ratings yet

- GST: Refund of Unutilized Input Tax Credit Accumulated Due To Inverted Duty StructureDocument3 pagesGST: Refund of Unutilized Input Tax Credit Accumulated Due To Inverted Duty StructureSumitNo ratings yet

- 25-7-21 611 nf-8175 GST QueDocument4 pages25-7-21 611 nf-8175 GST QueJignesh NagarNo ratings yet

- Refund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)Document5 pagesRefund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)dinesh kasnNo ratings yet

- Refund of Un Utilised TaxDocument4 pagesRefund of Un Utilised TaxcahardikkachavaNo ratings yet

- Exam Oriented Book Indirect Taxation: CorrigendumDocument19 pagesExam Oriented Book Indirect Taxation: CorrigendumPrasanna KurraNo ratings yet

- Refund of Unutilised ItcDocument6 pagesRefund of Unutilised ItcgrameshchandraNo ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- Refund of Unutilised Input Tax Credit (ITC) : GST FlyersDocument17 pagesRefund of Unutilised Input Tax Credit (ITC) : GST Flyersvijay choudharyNo ratings yet

- Explanation:-For The Purposes of This Sub-Rule, The ExpressionsDocument5 pagesExplanation:-For The Purposes of This Sub-Rule, The ExpressionsRakesh BenganiNo ratings yet

- GSTDocument193 pagesGSTdevikrish897No ratings yet

- 05 Composition SchemeDocument52 pages05 Composition SchemeKANCHIVIVEKGUPTANo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- Taxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveDocument6 pagesTaxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveVamshi Krishna Reddy PathiNo ratings yet

- Ca Final LMR - May 2019 PDFDocument335 pagesCa Final LMR - May 2019 PDFDharmesh BohraNo ratings yet

- RevisionDocument335 pagesRevisionnagababuNo ratings yet

- GST - V2 - May 2023Document326 pagesGST - V2 - May 2023FhfhhNo ratings yet

- Refunds: After Studying This Chapter, You Will Be Able ToDocument59 pagesRefunds: After Studying This Chapter, You Will Be Able Toarohi guptaNo ratings yet

- Refunds: After Studying This Chapter, You Will Be Able ToDocument62 pagesRefunds: After Studying This Chapter, You Will Be Able ToAdventure TimeNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Gstrajkagrawal InputtaxcreditDocument6 pagesGstrajkagrawal InputtaxcreditPrince Of no oneNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Refund in GSTDocument6 pagesRefund in GSTNilesh SoniNo ratings yet

- Input Tax Credit Under GSTDocument52 pagesInput Tax Credit Under GSTkuldeep singhNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyNo ratings yet

- DT MTP 2 AnsDocument19 pagesDT MTP 2 AnsAmra NaazNo ratings yet

- GST Session 43Document20 pagesGST Session 43manjulaNo ratings yet

- Input Tax CreditDocument45 pagesInput Tax CreditGourav PareekNo ratings yet

- GST Divyastra CH 7 Input Tax Credit R 1Document26 pagesGST Divyastra CH 7 Input Tax Credit R 1Sanskar SharmaNo ratings yet

- Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountDocument15 pagesApplication For Refund of Tax, Interest, Penalty, Fees or Any Other Amountdhaval bhalodiaNo ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- Module 3 Dec 20Document132 pagesModule 3 Dec 20Dinesh GadkariNo ratings yet

- 76442bos61715 cp15Document73 pages76442bos61715 cp15Uma SinghalNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Document6 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Bhupen SharmaNo ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- Chapter 4Document26 pagesChapter 4Kritika JainNo ratings yet

- Input Tax CreditDocument12 pagesInput Tax CreditAwesome AngelNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- GST Weekly Update - 45 - 2023-24Document5 pagesGST Weekly Update - 45 - 2023-24guptaharshit2204No ratings yet

- Duty DrawbackDocument4 pagesDuty DrawbackShaji KuttyNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- RefundDocument6 pagesRefundManish K JadhavNo ratings yet

- Refunds: After Studying This Chapter, You Will Be Able ToDocument41 pagesRefunds: After Studying This Chapter, You Will Be Able ToSONICK THUKKANI100% (1)

- 3rd Class Synopsis - Input Tax Credit (16.09.2022)Document26 pages3rd Class Synopsis - Input Tax Credit (16.09.2022)pronab sarkerNo ratings yet

- 9 Value of Supply For StudentsDocument6 pages9 Value of Supply For Studentszaynshk04388No ratings yet

- CGST Act 16-21Document37 pagesCGST Act 16-21Dasari NareshNo ratings yet

- Paper11 3Document34 pagesPaper11 3mhatrenimisha03No ratings yet

- Advanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToDocument18 pagesAdvanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToMurugesh Kasivel EnjoyNo ratings yet

- Section - 80HHC Income-Tax Act 1961 - FA 2022 Deduction in Respect of Profits Retained For Export BusinessDocument6 pagesSection - 80HHC Income-Tax Act 1961 - FA 2022 Deduction in Respect of Profits Retained For Export BusinessPriyank GalaNo ratings yet

- Input Tax CreditDocument10 pagesInput Tax CreditSme 2023No ratings yet

- VAT Theory Question Answer by Subash NepalDocument13 pagesVAT Theory Question Answer by Subash Nepalssah4155No ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- CA Final DT LMR PDFDocument315 pagesCA Final DT LMR PDFCA Mopidevi BharadwajaNo ratings yet

- Final New Indirect Tax Laws Test 3 Detailed May Solution 1617180255Document17 pagesFinal New Indirect Tax Laws Test 3 Detailed May Solution 1617180255CAtestseriesNo ratings yet

- 1fort Bonifacio Development Corp. V.20230216-12-1oof4x8Document38 pages1fort Bonifacio Development Corp. V.20230216-12-1oof4x8MARIA LOURDES NITA FAUSTONo ratings yet

- 1 - 20.09.2018 - Corriogendum 1aDocument1 page1 - 20.09.2018 - Corriogendum 1achtrpNo ratings yet

- Financial Markets: SYBBI-Semester IIIDocument17 pagesFinancial Markets: SYBBI-Semester IIImackrinaNo ratings yet

- Ariane Fe Tabinas-Cabiatao, RSW: Training/Capacity BuildingDocument4 pagesAriane Fe Tabinas-Cabiatao, RSW: Training/Capacity Buildinglynlyn101No ratings yet

- M1S1 Decentralization 2023.09.27Document47 pagesM1S1 Decentralization 2023.09.27Antonette Frilles GibagaNo ratings yet

- Assignment 1Document8 pagesAssignment 1Corliss MurrayNo ratings yet

- Constitution of India and Professional Ethics (CIP) 21CIP37 IADocument8 pagesConstitution of India and Professional Ethics (CIP) 21CIP37 IAÅᴅᴀʀsʜ RᴀᴍNo ratings yet

- 8023 1991 Reff2020Document7 pages8023 1991 Reff2020Ashish DubeyNo ratings yet

- Section 68 (2020)Document10 pagesSection 68 (2020)ungku bahiyahNo ratings yet

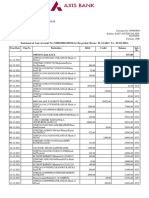

- Statement of Axis Account No:920010006130934 For The Period (From: 01-12-2021 To: 09-05-2022)Document13 pagesStatement of Axis Account No:920010006130934 For The Period (From: 01-12-2021 To: 09-05-2022)subhadeepNo ratings yet

- Tender NoticeDocument1 pageTender Noticebokang sekotsweNo ratings yet

- Handbook of Numerical Heat Transfer, Second EditionDocument963 pagesHandbook of Numerical Heat Transfer, Second EditionSil Franciley QuaresmaNo ratings yet

- DGFT Guidelines and Checklist by KP 062d11c5ae37924 55650887Document50 pagesDGFT Guidelines and Checklist by KP 062d11c5ae37924 55650887Anupam BaliNo ratings yet

- SVat Quick GuideDocument20 pagesSVat Quick GuideIndrajithAbeysinghe100% (1)

- A Study On The Impact of GST On Foreign Trade: Dr. Varsha Agarwal, Kapil Manglani, Nitesh Agarwal & Kaushal SinhalDocument9 pagesA Study On The Impact of GST On Foreign Trade: Dr. Varsha Agarwal, Kapil Manglani, Nitesh Agarwal & Kaushal SinhalROMEET PANIGRAHINo ratings yet

- E-Government To Smart Governance & Smart CityDocument72 pagesE-Government To Smart Governance & Smart CityXing BrandyNo ratings yet

- FMR Group Presentation On Sahara ScamDocument23 pagesFMR Group Presentation On Sahara Scamkumar dhruvaNo ratings yet

- Teacher S Copy in Grade 3Document7 pagesTeacher S Copy in Grade 3Yunilyn GallardoNo ratings yet

- Chinese Civil CodeDocument4 pagesChinese Civil CodeBo ZhouNo ratings yet

- Law3201 (F) Aug2014Document3 pagesLaw3201 (F) Aug2014telieNo ratings yet

- A-112 Group-1 YMATHBUSFIN Written-ReportDocument10 pagesA-112 Group-1 YMATHBUSFIN Written-ReportShane RazonNo ratings yet

- Civil SocietyDocument10 pagesCivil Societyjoyce godelosaoNo ratings yet

- Pro PR 001 Eni Spa r04Document59 pagesPro PR 001 Eni Spa r04ernouldNo ratings yet

- Updated Catalogue - Blore LA 27.09.19Document12 pagesUpdated Catalogue - Blore LA 27.09.19Rajeshwari MgNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementArpit SharmaNo ratings yet

- FORM 6 Revised 2022 SchoolDocument5 pagesFORM 6 Revised 2022 SchoolABEL AQUINONo ratings yet

- Air Niugini Membership Tearms and ConditionsDocument10 pagesAir Niugini Membership Tearms and ConditionshandaichrisgumaNo ratings yet

- Labor Law Review Digests - Lourleth LluzDocument8 pagesLabor Law Review Digests - Lourleth LluzLourleth Caraballa LluzNo ratings yet

- Deed of Absolute Sale of A Parcel of Land-DarDocument3 pagesDeed of Absolute Sale of A Parcel of Land-DarNina Anne ParacadNo ratings yet