Professional Documents

Culture Documents

Villegas - Tax2 - Prelim Module-Ivisan - Bsa 3 - A and B

Villegas - Tax2 - Prelim Module-Ivisan - Bsa 3 - A and B

Uploaded by

Lisa ManobanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Villegas - Tax2 - Prelim Module-Ivisan - Bsa 3 - A and B

Villegas - Tax2 - Prelim Module-Ivisan - Bsa 3 - A and B

Uploaded by

Lisa ManobanCopyright:

Available Formats

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

COO – FORM 12

SUBJECT TITLE: BUSINESS TAXATION

INSTRUCTOR : MS. JENNIFER M. VILLEGAS, CPA

SUBJECT CODE: TAX 2

Topic 1 – Overview of Value Added Tax

LEARNING OBJECTIVES:

At the end of chapter, the students are expected to:

1. Define business tax

2. Define Value Added Tax.

3. Determine the Nature of Value Added Tax.

4. Determine who is liable to pay the Value Add Tax.

5. Analyze the meaning of in the course of trade or business.

6. Determine how to compute the value added tax payable.

7. Discuss the characteristic of VAT.

8. State the types of transfer and the types of business tax.

NOTES:

1.1. What is Business Taxes?

Business taxes are those imposed upon onerous transfers such as sale, barter,

exchange and importation. It is called as such because without a business pursued

in the Philippines (except importation) by the taxpayer business taxes cannot be

applied. Business taxes are in addition to income and other taxes paid unless

specifically exempted.

1.2. What are the types of transfer?

1. Gratuitous Transfer (transfer without consideration) – not subject to business tax but

subject to transfer taxes (donor’s tax or estate tax).

2. Onerous transfer ( transfer with consideration):

A. In the ordinary course of trade of business including incidental transactions

– subject to business tax (either vat or percentage tax plus excise tax, if

applicable) and income tax, unless exempt.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

1

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

B. Not in the course of trade or business – not subject to business tax but may

be subject to income. ( Isolated/casual transactions made by residents)

Isolated transactions by non- residents on services rendered in the Philippines

are considered in the ordinary course of trade or business, thus, subjected to

Final withholding tax.

1.3. What are the types of business taxes?

There are three major business taxes in the Philippines, namely:

A. Value Added Taxes (VAT)

B. Other Percentage Taxes (OPT)

C. Excise Taxes

1.4. What is VALUE ADDED TAX?

Value Added Tax (VAT) is a tax on consumption levied on the sale, barter,

exchange or lease of goods or properties and services in the Philippines and on

importation of goods into the Philippines.

The seller is the one statutorily liable for the payment of the tax but the amount

of the tax may be shifted or passed on to the buyer, transferee or lessee of the goods,

properties or services. However, in the case of importation, the importer is the one

liable for the VAT.

VAT is a tax on the value added by every seller to the purchase price or cost in

the sale or lease of goods, property or services in the ordinary course of trade or

business as well as on importation of goods into the Philippines, Whether for personal

or business use, It is a tax on consumption levied on the sale, barter, exchange or

lease of goods or properties and services in the Philippines (cross border doctrine) and

on importation of goods into the Philippines levied at each stage of production and

distribution process "Cross border doctrine" means that no VAT shall be imposed to

form part of the cost of goods destined for consumption outside the territorial border

of the Philippine taxing authority.

1.5. Who is liable to pay the VALUE ADDED TAX?

Any person who, in the course of his trade or business, sells, barters, exchanges

or leases goods or properties, or renders services, and any person who imports goods,

shall be liable to VAT under the Tax Code.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

2

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

However, in the case of importation of taxable goods, the importer, whether an

individual or corporation and whether or not made in the course of his trade or

business, shall be liable to VAT under the Tax Code.

1.6. What is mean by in the course of trade or business?

The term in the course of trade or business means the regular conduct or pursuit

of a commercial or economic activity, including transactions incidental thereto, by any

person regardless of whether or not the person engaged therein is a non-stock, non-

profit private organization (irrespective of the disposition of its net income and whether

or not it sells exclusively to members or their guests), or government entity.

Non-resident persons who perform services in the Philippines are deemed to be

making sales in the course of trade or business, even if the performance of services is

not regular.

Illustrations:

Determine which of the following transactions are considered sale in the ordinary

course of trade, consequently subject to business tax

1. Pedro sold his 3-year old sedan to Ana for P400,000.

2. Abe Corporation, distributor of appliances, sold TV units from its inventory to

various malls in Metro Manila.

3. An auditing firm rendered audit and tax services to its clients.

4. Ana sold some of her jewelry for P50,000 to her best friend, Lorna

1.7. What is the nature of VALUE ADDED TAX?

Value Added Tax is an indirect tax and the amount of tax may be shifted or

passed on to the buyer, transferee or lessee of the goods, properties or services.

1.8. How to compute the value added tax payable?

The corresponding liability on value added tax, as presented in the previous

chapter, is generally computed as follows:

Output Tax (Sales or Receipts x 12%) XX

Less: Input Vat (Purchases of Goods or Services x 12%) (XX)

Vat Payable (Excess Input Vat) XX

Output tax means the VAT due on the sale, lease or exchange of taxable goods

or services by any person registered or required to register.

Input tax means the Vat on or paid by a Vat- registered on importation of goods

or local purchase of goods, properties or services, including lease or use of property in

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

3

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

the course of his trade or business. It shall also include the transitional input tax and

the presumptive input tax. It should be supported by receipts.

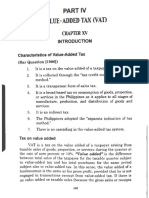

1.9. What are the characteristics of VAT?

It is an indirect tax where tax shifting is always presumed.

It is consumption-based.

It is imposed on the value-added in each stage of production and distribution process.

It is a credit-invoice method value-added tax (tax credit approach).

1.10. What are kinds of VAT?

1. VAT on sale of goods or properties

2. VAT on importation of goods

3. VAT on sale of services and use or lease of properties.

Exercises:

1. Which of the following taxes describes a value-added tax?

a. Income tax c. Indirect tax

b. Sales tax d. Personal tax

2. It is the value-added tax due on the sale of taxable goods, property and services by any

person whether or not he has taken the necessary steps to be registered.

a. Excise tax c. Input tax

b. Indirect tax d. Output tax

3. Under the National Internal Revenue Code, which of the following is not considered as a

business tax?

a. Income tax c. Percentage tax

b. Value-added tax d. Excise tax

4. Statement 1: Any person who imports goods for personal consumption or use is subject

to VAT.

Statement 2: For the imposition of VAT, services rendered in the Philippines by

nonresident foreign persons are considered rendered in the course of trade or business,

regardless of regularity.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

4

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

a. Only statement 1 is correct c. Both statements are correct

b. Only statement 2 is correct d. Both statements are wrong

5. In the course of trade or business, for VAT purposes, means the regular conduct or pursuit

of a commercial or an economic activity by the following persons, except:

a. Person engaged in business

b. Non-stock, non-profit private organization

c. Government entity

d. None of the above

6. Statement 1: The term “output tax” means the value-added tax due from or paid by a

VAT-registered person in the course of his trade or business on importation of goods or

local purchase of goods or services, including lease or use of property, from a VAT-

registered person.

Statement 2: The term “input tax” means the value-added tax due on the sale or

lease of taxable goods or properties or services by any person registered or required

to register.

a. Only statement 1 is correct c. Both statements are correct

b. Only statement 2 is correct d. Both statements are wrong

7. Which of the following is subject to 12% VAT?

a. Non-life insurance companies c. Life insurance

b. Crop insurances d. Answer not given

8. Statement 1: A person subject to excise tax is also subject to value added tax;

Statement 2: A person subject to percentage tax is also subject to value added tax.

a. Both statements are correct;

b. Both statements are wrong;

c. The first statement is correct but the second statement is wrong;

d. The first statement is wrong but the second statement is correct.

9. Which is correct?

a. Without a business pursued in the Philippine (except importation) by the

taxpayer, value added tax cannot be imposed.

b. “In the course of trade or business” means the regular conduct or pursuit of

a commercial or an economic activity, including transactions incidental

thereto, by any person regardless of whether or not the person engaged

therein is a non-stock non – profit private organization or government.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

5

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

c. Services rendered in the Philippines by a non-resident foreign person shall be

considered as being rendered in the course of trade or business even the

performance is not regular.

d. All of the above.

10. Which statement is false? Transactions considered “ in the course of trade or business”,

and therefore subject to business taxes include:

a. Regular conduct or pursuit of a commercial or an economic activity by a stock

private organization.

b. Regular conduct or pursuit of a commercial or an economic activity by a non-

stock, non-profit private organization.

c. Isolated services in the Philippines by non-resident foreign persons.

d. Isolated sale of goods or services for a gross selling price or receipts of

P950,000.

11. Which of the following is/are correct?

I. Persons whose transactions are exempt from the value added tax under

section 109 because their gross sales/ and or receipts do not exceed

P3,000,000 may voluntarily apply for registration under the VAT system.

II. A taxpayer who is subject to percentage on his gross receipts will also be

subject to income tax on his net income.

a. I and II c. II Only

b. I Only d. Neither I nor II

12. Which of the statements is correct?

a. The seller of the goods/services is the one statutorily liable to pay VAT.

b. The burden of the tax is borne by the final consumer although the producers

and suppliers of these goods and services are the ones who have to file their

VAT returns to the Bureau of Internal Revenue. Hence, what is transferred or

shifted to the consumers is not the liability to pay the tax but the tax burden.

c. Both a and b.

d. Neither a nor b.

End of Topic 1.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

6

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

Topic 2 – VAT on Sale of Goods and Properties, Importation and Sale

of Services

LEARNING OBJECTIVES:

At the end of chapter, the students are expected to:

1. Define Value Added Tax on Sale of Goods or Properties.

2. Define transaction deemed sale.

3. Discuss the transaction deemed sale.

4. Discuss the VAT on importation.

5. Explain the VAT on Sale of Service.

6. Determine sale of goods, properties and services subject to VAT.

NOTES:

2.1. What is the Value-added Tax on Sale of Goods or Properties?

Goods or properties include all tangible and intangible objects that are capable

of monetary estimation. To be subject to business tax, the sale must be related to

business or trade. The sale should be consummated in the Philippines regardless of the

terms of payment made between the contracting parties.

Rate and Base of Tax

12% of the Gross Selling Price

Gross selling price means the total amount of money or its equivalent which the

purchaser pays or is obligated to pay to the seller in consideration of the sale, barter or

exchange of the goods or properties, excluding VAT. The excise tax, if any, on such

goods or properties shall form part of the gross selling price.

The term goods and properties means all intangible and tangible objects which are

capable of pecuniary estimation and shall include, among others:

a. Real property held primarily for sale to customers or held for lease in the

ordinary course of trade or business

b. The right or privilege to use patent, copyright, design, or model plan, secret

formula or process goodwill trademark trade brand or other like property or

right.

c. The right or the privilege to use motion picture films, films, tapes, and discs

d. Radio, television, satellite transmission and cable television time.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

7

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

SALE OF REAL PROPERTIES

Sale of real properties shall refer to real properties held primarily for sale to

customers or held for lease in the ordinary course of trade or business of the seller in

the case of sale of real properties on the installment plan, the real estate dealer shall

be subject to VAT on the installment payments, including interest and penalties,

actually and/or constructively received by the seller

2.2. What are the Transactions deemed sale?

Certain transactions which are not actually sales because of the absence of actual

exchange between the buyer and the sell, are considered or included in the term sale

for value added tax purposes. For deemed sale transaction, the taxable base is the

market value of such goods as of the occurrence of the transaction considered as sale.

In transaction deemed sale, the input vat was already used by the seller as a credit

against the output tax. However, since there was no actual sale, no output vat is

actually charged to customers. Consequently, the state will be deprived of its right to

collect the output vat. To avoid a situation where a vat registered taxpayer avail of the

input vat credit without being liable for the corresponding output vat, certain

transactions should be considered sales even in the absence of actual sales.

The following transactions shall be deemed sale:

1. Transfer, use or consumption not in the course of business of goods or properties

originally intended for sale or for use in the course of business;

2. Distribution or transfer to:

a. Shareholders or investors as share in the profits of the VAT-registered persons; or

b. Creditors in payment of debt;

3. Consignment of goods if actual sale is not made within 60 days following the date such

goods were consigned

4. Retirement from or cessation of business, with respect to inventories of taxable goods

existing as of such retirement or cessation.

The VAT shall not apply to goods or properties existing as of the occurrence of the following:

1. Change of control of a corporation by the acquisition of the controlling interest of such

corporation by another stockholder or group of stockholders.

2. Change in the trade or corporate name of the business;

3. Merger or consolidation of corporations. The unused input tax of the dissolved

corporation, as of the date of merger or consolidation, shall be absorbed by the

surviving or new corporation.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

8

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

2.3. What is the effect of Sales Returns, Allowances and Sales Discounts in computing VAT?

The value of goods or properties sold and subsequently returned or for which

allowances were granted by a VAT-registered person may be deducted from the gross

sales or receipts for the quarter in which a refund is made or credit memorandum or

refund is issued. Sales discount granted and indicated in the invoice at the time of sale

and the grant of which does not depend upon the happening of a future event may be

excluded from the gross sales within the same quarter it was given.

2.4. What is the Value-added Tax on Importation of Goods?

Rate and Base of Tax

12% of the Total Value

Total Value means the total value used by the Bureau of Customs in determining tariff

and customs duties, plus customs duties, excise taxes, if any, and other charges.

Where the customs duties are determined on the basis of the quantity or volume of the

goods, the value-added tax shall be based on the landed cost plus excise taxes, if any.

Transfer of Goods by Tax-exempt Persons.

In the case of tax-free importation of goods into the Philippines by persons,

entities or agencies exempt from tax where such goods are subsequently sold,

transferred or exchanged in the Philippines to non-exempt persons or entities, the

purchasers, transferees or recipients shall be considered the importers thereof.

2.6. What is the Value-added Tax on Sale of Services and Use or Lease of Properties?

Rate and Base of Tax

12% of Gross Receipts

The term sale or exchange of services means the performance of all kinds of services in the

Philippines for others for a fee, remuneration or consideration, including those performed or

rendered by :

1. Construction and service contractors

2. Stock, real estate, commercial, customs and immigration brokers;

3. Lessors of property, whether personal or real;

Lease of property shall be subject to VAT regardless of the place where the

contract of lease or licensing agreement was executed if the property leased

or used is located in the Philippines.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

9

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

4. Warehousing services;

5. Lessors or distributors of cinematographic films;

6. Persons engaged in milling, processing, manufacturing or repacking goods for

others;

A miller, who is a person engaged in milling for others (except palay into rice,

corn into corn grits, and sugarcane into raw sugar), is subject to VAT on sale of

services.

7. Proprietors, operators or keepers, of hotels, motels, rest houses, pension

houses, inns, resorts;

8. Proprietors or operators of restaurants, refreshment parlors, cafes and other

eating places, including clubs and caterers;

9. Dealers in securities;

Dealer in securities means a merchant of stock or securities, whether an

individual partnership or corporation, with an established place of business,

regularly engaged in the purchase of securities and their resale to customers,

that is, one who as a merchant buys securities and sells them to customers with

a view to the gains and profits that may be derived therefrom.

10. Lending investors;

Lending investor includes all persons other than banks, non-bank financial

intermediaries, finance companies and other financial intermediaries not

performing quasibanking functions who make a practice of lending money for

themselves or others at interest.

11. Transportation contractors on their transport of goods or cargoes, including

persons who transport goods or cargoes for hire and other domestic common

carriers by land relative to their transport of goods or cargoes;

12. Common carriers by air and sea relative to their transport of passengers, goods

or cargoes from one place in the Philippines to another place in the Philippines;

13. Sales of electricity by generation companies, transmission, and distribution

companies;

14. Services of franchise grantees of electric utilities, telephone and telegraph, radio

and/or television broadcasting and all other franchise grantees, except franchise

grantees of radio and/or television broadcasting whose annual gross receipts of

the preceding year do not exceed P10,000,000.00, and franchise grantees of

gas and water utilities;

15. Non-life insurance companies (except their crop insurances);

16. Similar services regardless of whether or not the performance thereof calls for

the exercise or use of the physical or mental faculties.

The phrase sale or exchange of services also includes:

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

10

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

1) The lease or the use of or the right or privilege to use copyright, patent, design or

model, plan, secret formula or process, goodwill, trademark, trade brand or other

like property or right;

2) The lease or the use of, or the right to use of any industrial, commercial or

scientific equipment;

3) The supply of scientific, technical, industrial or commercial knowledge or

information;

4) The supply of any assistance that is ancillary and subsidiary to and is furnished as

a means of enabling the application or enjoyment of any such property, or right as

is mentioned in subparagraph (2) or any such knowledge or information as is

mentioned in subparagraph (3);

5) The supply of services by a nonresident person or his employee in connection with

the use of property or rights belonging to, or the installation or operation of any

brand, machinery or other apparatus purchased from such nonresident person;

6) The supply of technical advice, assistance or services rendered in connection with

technical management or administration of any scientific, industrial or commercial

undertaking, venture, project or scheme;

7) The lease of motion picture films, films, tapes and discs; and

8) The lease or the use of or the right to use radio, television, satellite transmission

and cable television time.

Gross receipt refers to the total amount of money or its equivalent representing the

contract price, compensation, service fee, rental or royalty, including the amount charged

for materials supplied with the services and deposits applied as payments for services

rendered and advance payments actually or constructively received during the taxable

period for the services performed or to be performed for another person, excluding VAT.

Constructive receipt occurs when the money consideration or its equivalent is placed at

the control of the person who rendered the service without restrictions by the payor. The

following are examples of constructive receipts;

a) Deposit in banks which are made available to the seller of services without

restrictions.

b) Issuance by the debtor of a notice to offset any debt or obligation and acceptance

thereof by the seller as payment for services rendered

c) Transfer of the amounts retained by the payor to the account of the contractor.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

11

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

Exercises:

1. Statement 1: Gross selling price means the total amount of money or its equivalent

which the purchaser pays or is obligated to pay to the seller in consideration of the

sale, barter or exchange of the goods or properties excluding VAT.

Statement 2: The excise tax, if any, on such goods or properties shall form part of

the gross selling price.

a. Only statement 1 is correct

b. Only statement 2 is correct

c. Both statements are correct

d. Both statements are incorrect.

2. The following are transactions deemed sale for VAT purposes. Which is not?

a. Transfer, use or consumption not in the course of business of goods or

properties originally intended for sale or for use in the course of business;

b. Distribution or transfer to stockholders of share in the profits of VAT registered

person;

c. Distribution or transfer to heirs of decedent;

d. Distribution or transfer to creditors in payment of debt;

3. The following transactions are subject to VAT except:

a. Transfer, use or consumption not in the course of business of goods or

properties originally intended for sale or for use in the course of business;

b. Distribution or transfer to stockholders of share in the profits of VAT registered

person;

c. Distribution or transfer to creditors in payment of debt;

d. Consignment sales.

4. Statement 1: “Gross Selling Price”, for VAT purposes, means total amount of money

or its equivalent which the purchaser pays or is obligated to pay to the seller in

consideration of the sale, barter or exchange of the goods or properties, including the

value-added tax.

Statement 2: The excise tax on the goods or properties shall form part of the gross selling

price, for VAT purposes.

a. Only statement 1 is correct c. Both statements are correct

b. Only statement 2 is correct d. Both statements are wrong

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

12

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

5. In the case of tax-free importation of goods into the Philippines by persons, entities or

agencies exempt from tax where such goods are subsequently sold, transferred or

exchanged in the Philippines to non-exempt persons or entities:

a. The purchasers, transferees or recipients shall be considered the importers

thereof and shall be liable for VAT on such importation

b. The purchasers, transferees or recipients shall be considered the importers

thereof but not liable for VAT.

c. The purchasers, transferees or recipients shall be not considered the importers

thereof.

d. None of the above

6. What is the tax base for VAT on importation of goods?

a. Total value used by the Bureau of Customs in determining tariff and customs

duties

b. Total value used by the Bureau of Customs in determining tariff and customs

duties plus customs duties, excise taxes and other charges;

c. Total value used by the BIR in determining the internal revenue taxes

d. Total value used by the BIR in determining the internal revenue taxes plus

customs duties.

End of Topic 2.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

13

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

Topic 3 – Zero – rated / effectively zero- rated

LEARNING OBJECTIVES:

At the end of chapter, the students are expected to:

1. Define zero-rated sale / effectively zero-rated sale.

2. Determine the transactions subject to zero rated sale of goods.

3. Determine the transactions subject to zero rated sale of services.

NOTES:

3.1. What is mean by zero-rated sale / effectively zero-rated sale?

A zero-rated sale of goods or properties (by a VAT-registered person) is a taxable

transaction for VAT purposes, but shall not result in any output tax. However, the input

tax on purchases of goods, properties or services, related to such zero-rated sale, shall

be available as tax credit or refund in accordance with these Regulations.

The term effectively zero-rated sale of goods and properties refers to the local sale of

goods and properties by a VAT-registered person to a person or entity who was

granted indirect tax exemption under special laws or international agreement.

3.2. What are subject to zero rated sale of goods?

The following sales of goods by VAT-registered persons shall be subject to 0% rate:

a. Export Sales. – The term ‘export sales’ means:

1) The sale and actual shipment of goods from the Philippines to a foreign

country, irrespective of any shipping arrangement that may be agreed upon

which may influence or determine the transfer of ownership of the goods so

exported and paid for in acceptable foreign currency or its equivalent in

goods or services, and accounted for in accordance with the rules and

regulations of the Bangko Sentral ng Pilipinas (BSP);

2) Sale and delivery of goods to:

Registered enterprises within a separate customs territory as

provided under special laws; and

Registered enterprises within the tourism enterprise zones as

declared by the Tourism Infrastructure and Enterprise Zone Authority

(TIEZA) subject to the provisions under RA No. 9593 or The Tourism

Act of 2009.

3) Sale of raw materials or packaging materials to a nonresident buyer for

delivery to a resident local export-oriented enterprise to be used in

manufacturing, processing, packing or repacking in the Philippines of the

said buyer’s goods and paid for in acceptable foreign currency and accounted

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

14

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

for in accordance with the rules and regulations of the Bangko Sentral ng

Pilipinas (BSP);

4) Sale of raw materials or packaging materials to export-oriented enterprise

whose export sales exceed 70% of total annual production;

5) Those considered export sales under Executive Order No. 226, otherwise

known as the Omnibus Investment Code of 1987, and other special laws;

and

6) The sale of goods, supplies, equipment and fuel to persons engaged in

international shipping or international air transport operations: Provided,

That the goods, supplies, equipment and fuel shall be used for international

shipping or air transport operations.

Provided, That subparagraphs (2), (3), and (5) hereof shall be subject to the 12%

value added tax and no longer be considered export sales subject to 0% VAT rate

upon satisfaction of the following conditions:

1) The successful establishment and implementation of an enhanced VAT

refund system that grants refunds of creditable input tax within 90 days

from the filing of the VAT refund application with the Bureau: Provided,

That, to determine the effectivity of item no. 1, all applications filed from

January 1, 2018 shall be processed and must be decided within 90 days

from the filing of the VAT, refund application; and

2) All pending VAT refund claims as of December 31, 2017 shall be fully paid

in cash by December 31, 2019.

b. Sales to persons or entities whose exemption under special laws or international

agreements to which the Philippines is a signatory effectively subjects such sales to

zero rate.

3.3. What are subject to zero rated sale of services?

The following services performed in the Philippines by VAT-registered persons shall be

subject to zero percent (0%) rate:

(1) Processing, manufacturing or repacking goods for other persons doing business

outside the Philippines which goods are subsequently exported, where the

services are paid for in acceptable foreign currency and accounted for in

accordance with the rules and regulations of the Bangko Sentral ng Pilipinas

(BSP);

(2) Services other than those mentioned in the preceding paragraph , rendered to

a person engaged in business conducted outside the Philippines or to a

nonresident person not engaged in business who is outside the Philippines when

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

15

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

the services are performed, the consideration for which is paid for in acceptable

foreign currency and accounted for in accordance with the rules and regulations

of the Bangko Sentral ng Pilipinas (BSP);

(3) Services rendered to persons or entities whose exemption under special laws or

international agreements to which the Philippines is a signatory effectively

subjects the supply of such services to 0% rate;

(4) Services rendered to persons engaged in international shipping or international

air transport operations, including leases of property for use thereof Provided,

That these services shall be exclusive for international shipping or air transport

operations;

(5) Services performed by subcontractors and/or contractors in processing,

converting, or manufacturing goods for an enterprise whose export sales exceed

s 70% of total annual production;

(6) Transport of passengers and cargo by domestic air or sea vessels from the

Philippines to a foreign country; and

(7) Sale of power or fuel generated through renewable sources of energy such as,

but not limited to, biomass, solar, wind, hydropower, geothermal, ocean

energy, and other emerging energy sources using technologies such as fuel cells

and hydrogen fuels.

(8) Services rendered to:

Registered enterprises within a separate customs territory as provided

under special law; and

Registered enterprises within tourism enterprise zones as declared by

the TIEZA subject to the provisions under RA No. 9593 or The Tourism

Act of 2009.

Provided, That subparagraphs (1) and (5) hereof shall be subject to the 12% value-

added tax and no longer be subject to 0% VAT rate upon satisfaction of the following

conditions:

(1) The successful establishment and implementation of an enhanced VAT refund

system that grants refunds of creditable input tax within 90 days from the filing

of the VAT refund application with the Bureau: Provided, That, to determine the

effectivity of item no. 1, all applications filed from January 1, 2018 shall be

processed and must be decided within 90 days from the filing of the VAT refund

application; and

(2) All pending VAT refund claims as of December 31, 2017 shall be fully paid in

cash by December 31, 2019.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

16

PROHIBITED

COLLEGE OF SCIENCE AND TECHNOLOGY

Cagamutan Norte, Leganes, Iloilo - 5003

Tel. # (033) 396-2291 ; Fax : (033) 5248081

Email Address : svcst_leganes@yahoo.com

Exercises

1. TRUE/FALSE: Zero rated sales is subject to VAT.

2. TRUE/FALSE: The Output tax in Zero Rated sale is Zero.

3. TRUE/FALSE: A transaction subject to zero rated sale is exempt to VAT.

4. TRUE/FALSE: A non- VAT registered person can be subject to zero percent VAT.

5. TRUE/FALSE: The output tax of a person subject to zero percent tax can be claimed

as refund.

End of Topic 3.

References:

Review Materials – Atty. Ferdinand U. Rosada, CPA

Transfer and Business Taxation – Enrico D. Tabag & Earl Jimson R. Garcia.

THIS IS AN EXCLUSIVE COPY OF ST. VINCENT COLLEGE. ANY ANAUTHORIZED REPRODUCTION IS

17

PROHIBITED

You might also like

- Taxation, Types of Taxation, Main Objectives of TaxationDocument4 pagesTaxation, Types of Taxation, Main Objectives of TaxationKc Cassandra RosalNo ratings yet

- Wakanda's Lemonade Stand Full Business Plan (1) - 1444459739Document3 pagesWakanda's Lemonade Stand Full Business Plan (1) - 1444459739AlNo ratings yet

- Tax 56 Activity 2Document2 pagesTax 56 Activity 2Hannah Alvarado BandolaNo ratings yet

- Mikrotik - How To Set Static DHCP Reservations - Networking For IntegratorsDocument5 pagesMikrotik - How To Set Static DHCP Reservations - Networking For Integratorsmona_mi8202100% (1)

- 1 Introduction To Business TaxDocument3 pages1 Introduction To Business TaxGazelem Zeryne AgootNo ratings yet

- Tax 2 - VATDocument37 pagesTax 2 - VATShirley Marie Cada - CaraanNo ratings yet

- Module 1Document30 pagesModule 1PAMELA EVANGELISTANo ratings yet

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- IM ACCO 20173 Business and Transfer Taxes Module 4 PDFDocument40 pagesIM ACCO 20173 Business and Transfer Taxes Module 4 PDFMakoy BixenmanNo ratings yet

- Bustax Midterm Exam-2021Document26 pagesBustax Midterm Exam-2021Nhel Alvaro100% (3)

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- VAT - GuidenotesDocument14 pagesVAT - GuidenotesNardz AndananNo ratings yet

- Tax 43 - Business TaxationDocument8 pagesTax 43 - Business TaxationFemie AmazonaNo ratings yet

- Module 6. Nature and Concepts of Business TaxesDocument6 pagesModule 6. Nature and Concepts of Business TaxesYolly DiazNo ratings yet

- PM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Document22 pagesPM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Riel Picardal-VillalonNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- Module 1 - VAT ExemptionsDocument15 pagesModule 1 - VAT ExemptionsCrazy DaveNo ratings yet

- Introduction To Business TaxesDocument10 pagesIntroduction To Business TaxesChristine AceronNo ratings yet

- BUSTAXDocument13 pagesBUSTAXKassandra Mari LucesNo ratings yet

- Value Added Tax: 1. DefinitionDocument2 pagesValue Added Tax: 1. DefinitionElla Mae Lopez YusonNo ratings yet

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaNo ratings yet

- Transfer and Business TaxationDocument78 pagesTransfer and Business TaxationLeianneNo ratings yet

- Business Tax ReviewerDocument22 pagesBusiness Tax ReviewereysiNo ratings yet

- Entrep - Summary Report Sophia GandaDocument3 pagesEntrep - Summary Report Sophia GandaRenelle HabacNo ratings yet

- Assignment Cover Sheet: Northrise UniversityDocument6 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- Business TaxesDocument51 pagesBusiness TaxesLuna CakesNo ratings yet

- Chapter 1 ConsumptionDocument41 pagesChapter 1 ConsumptionBeatrix Domingo SampangNo ratings yet

- VatDocument274 pagesVatzaneNo ratings yet

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocument19 pages07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- Tax Notes FinalDocument40 pagesTax Notes FinalKris LaraNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- Introduction To Business TaxationDocument12 pagesIntroduction To Business TaxationMariel CadayonaNo ratings yet

- Taxation 1 Mod 4Document48 pagesTaxation 1 Mod 4Harui Hani-31No ratings yet

- Value Added TaxDocument9 pagesValue Added TaxĴõ ĔĺNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- Lecture Notes XIII Selected Topics On Philippine TaxationDocument9 pagesLecture Notes XIII Selected Topics On Philippine TaxationSar CaermareNo ratings yet

- The Internal Revenue TaxesDocument3 pagesThe Internal Revenue Taxesedadkoay14No ratings yet

- ordinary courseDocument1 pageordinary courseChristine RaizNo ratings yet

- VALUE ADDED TAX - Part 1Document30 pagesVALUE ADDED TAX - Part 1Derek C. EgallaNo ratings yet

- Gruba Tax 2 NotesDocument13 pagesGruba Tax 2 NotesPJezrael Arreza FrondozoNo ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- TAXATION With ActivityDocument14 pagesTAXATION With ActivityAriel Rashid Castardo BalioNo ratings yet

- Calculate TaxDocument17 pagesCalculate Taxterefe kassaNo ratings yet

- Tax 2 ReviewerDocument21 pagesTax 2 ReviewerLouis MalaybalayNo ratings yet

- TaxesDocument4 pagesTaxesFelicity BondocNo ratings yet

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- Business Taxation ModuleDocument20 pagesBusiness Taxation ModuleSandra DandingNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- 2 Value Added TaxDocument216 pages2 Value Added TaxnichNo ratings yet

- Accounting Technician Level 3 Module 3 Part 1Document29 pagesAccounting Technician Level 3 Module 3 Part 1Rona Amor MundaNo ratings yet

- Bureau of Internal RevenueDocument3 pagesBureau of Internal RevenueAngeline LlamasNo ratings yet

- G. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005Document32 pagesG. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005WAYNENo ratings yet

- TAXATIONDocument2 pagesTAXATIONsarahjanemontalban26No ratings yet

- Week 2 Introduction To Business TaxesDocument11 pagesWeek 2 Introduction To Business TaxesJuliaNo ratings yet

- Module 7 LectureDocument8 pagesModule 7 LectureClarence AblazaNo ratings yet

- E-Commerce IndustryDocument2 pagesE-Commerce Industrydarshita bhuwalkaNo ratings yet

- Prop 65 - Reseller Notice Letter. July 31, 2018Document2 pagesProp 65 - Reseller Notice Letter. July 31, 2018Usama LatifNo ratings yet

- WTO, IMF and World BankDocument4 pagesWTO, IMF and World BanktallalbasahelNo ratings yet

- Clicksoftware Mobile Workforce Management For UtilitiesDocument4 pagesClicksoftware Mobile Workforce Management For UtilitiesISHAQ MOHAMMEDNo ratings yet

- Masterglenium Ace: Solutions For The Pre-Cast IndustryDocument7 pagesMasterglenium Ace: Solutions For The Pre-Cast IndustryAlanNo ratings yet

- PDF How To Sell Your Way Through Life DLDocument15 pagesPDF How To Sell Your Way Through Life DLbirgerNo ratings yet

- Inclass P Chapter 3 CF From Fin StatementsDocument6 pagesInclass P Chapter 3 CF From Fin StatementsZhuka TemirbulatovaNo ratings yet

- Marginal Costing InterDocument9 pagesMarginal Costing InterArjun ThawaniNo ratings yet

- ParleDocument12 pagesParleVikrant KarhadkarNo ratings yet

- Business Name: Davao Sugar Central Corporations (DASUCECO)Document3 pagesBusiness Name: Davao Sugar Central Corporations (DASUCECO)FloredelNo ratings yet

- CIR v. V.Y. Domingo JewellersDocument2 pagesCIR v. V.Y. Domingo JewellersBananaNo ratings yet

- Invoice 9935766161Document1 pageInvoice 9935766161Banvari GurjarNo ratings yet

- Occupational Health and Safety Management System (OSHAS 18001)Document8 pagesOccupational Health and Safety Management System (OSHAS 18001)rslapena100% (1)

- Occidental vs. Ecuador PDFDocument336 pagesOccidental vs. Ecuador PDFSofia RestrepoNo ratings yet

- Smart Supply Chain - Report Final - DigitalDocument48 pagesSmart Supply Chain - Report Final - DigitalpulilupiNo ratings yet

- C2 PsychoCeramic SciencesDocument2 pagesC2 PsychoCeramic Sciencesmuhammad haziq abdul ghaniNo ratings yet

- Annapurna ReportDocument31 pagesAnnapurna ReportPritish KumarNo ratings yet

- Cloud Security Lecture 4Document59 pagesCloud Security Lecture 4Hossam EissaNo ratings yet

- 05 - Labour Law Trade UnionDocument3 pages05 - Labour Law Trade UnionBhavya RayalaNo ratings yet

- Business Research: Types, Benefits, and Its ImportanceDocument6 pagesBusiness Research: Types, Benefits, and Its ImportanceRana100% (1)

- Monthly Statistical Bulletin-BangladeshDocument230 pagesMonthly Statistical Bulletin-Bangladeshishani sahaNo ratings yet

- Marketing Across Cultures cw2Document19 pagesMarketing Across Cultures cw2api-518143243No ratings yet

- Forex StrategiesDocument5 pagesForex StrategiesumareemooserNo ratings yet

- Agriculture and Forestry NotesDocument89 pagesAgriculture and Forestry NotesWaqasNo ratings yet

- Unit 2 Instrumental Method of AnalysisDocument50 pagesUnit 2 Instrumental Method of AnalysisMeghaa.DNo ratings yet

- 06.17.2021-2021-List of ClientDocument14 pages06.17.2021-2021-List of ClientAntonio NoblezaNo ratings yet

- MayaSavings SoA 2023OCTDocument17 pagesMayaSavings SoA 2023OCTfitdaddyphNo ratings yet

- Wynyard Walk - Consult Award 2017 - FinalDocument8 pagesWynyard Walk - Consult Award 2017 - FinalUcok DedyNo ratings yet