Professional Documents

Culture Documents

NYU Session 9 Test - Assignment 9

NYU Session 9 Test - Assignment 9

Uploaded by

lilyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NYU Session 9 Test - Assignment 9

NYU Session 9 Test - Assignment 9

Uploaded by

lilyCopyright:

Available Formats

Session

9: Post Class tests

1. A key input into your terminal value is the expected growth rate in perpetuity.

Assuming that you are valuing a company in a currency with a risk free rate of

3%. Which of the following growth rates is not feasible?

a. -‐3% in perpetuity

b. 0% in perpetuity

c. 2% in perpetuity

d. 4% in perpetuity

e. None of the above

2. Avalon Inc. is a high growth publicly traded firm that is expected to become a

stable growth firm after 5 years. You have estimated an expected after-‐tax

operating income of $60 million in year 6 and believe that the firm will generate

a return on capital of 12% in perpetuity. If the cost of capital is 10% and the

expected growth rate in perpetuity after year 5 is 3%, what will the terminal

value be at the end of year 5?

a. $857.14 million

b. $666.67 million

c. $642.86 million

d. $450 million

e. None of the above

3. Wayfarers Inc. is a risky technology company that is expected to have a cost of

capital of 12% for the next 10 years. At the end of year 10, it is anticipated that

the firm will become a mature company, earning a return on invested capital

equal to its stable period cost of capital of 10% in perpetuity. If the expected

after-‐tax operating income in year 11 is $80 million and the expected growth

rate in perpetuity is 3%, estimate the present value of the terminal value at the

end of year 10.

a. $257.58 million

b. $308.43 million

c. $367.97 million

d. $440.62 million

e. None of the above

4. It is true that in a discounted cash flow valuation, the terminal value accounts for

a large proportion (60% or more) of the value. It follows that the assumptions

you make about terminal value are the most critical determinants of value.

a. True

b. False

5. You are using a dividend discount model to value a bank, which is expected to

generate a 15% return on equity in perpetuity. The company paid dividends of

$40 million on net income of $100 million in the most recent year and is

expected to maintain high growth for the next 3 years, before settling into stable

growth, growing 3% a year in perpetuity. If the cost of equity is 9%, estimate the

terminal value at the end of year 3.

a. $889.25 million

b. $1778.51 million

c. $2223.13 million

d. $741.04 million

e. None of the above

Session 9: Post class test solutions

1. d.

4%

in

perpetuity.

Using

a

growth

rate

that

exceeds

the

risk

free

rate

is

dangerous,

since

the

risk

free

rate

operates

as

a

proxy

for

nominal

growth

in

the

economy.

2. c.

$642.86

million.

To

compute

the

terminal

value

after

year,

you

first

have

to

estimate

a

reinvestment

rate:

• Reinvestment

rate

=

3%/12%

=

25%

• FCFF

in

year

6

=

60

(1-‐.25)/

(.10-‐.03)

=

$642.86

million

3. a.

$257.58

million.

The

first

step

is

to

estimate

the

terminal

value

at

the

end

of

year

10

• Reinvestment

Rate

=

g/

ROC

=

3%/10%

-‐

30%

• Terminal

value

=

80

(1-‐.30)/(.10-‐.03)

=

$800

million

• PV

of

terminal

value

=

$800/1.1210

=

$257.58

million

4. b.

False.

The

terminal

value

is

determined

in

large

part

by

your

assumptions

about

growth

during

the

high

growth

period.

The

cash

flow

you

have

in

your

terminal

value

equation

will

be

much

higher,

if

you

use

higher

growth

during

the

growth

period

and

thus

the

terminal

value

will

be

significantly

impacted

by

what

you

assume

will

happen

during

high

growth.

5. b.

$1778.51

million.

To

get

the

terminal

value,

you

have

to

first

estimate

the

earnings

in

year

4,

followed

by

the

payout

ratio

in

year

4:

• Expected

growth

rate

for

next

3

years

=

.6*.15

=

.09

or

9%

• Net

Income

in

year

4

=

100

(1.093)(1.03)

=

$133.39

million

• Payout

ratio

in

year

4

=

g/

ROE

=

3%/15%

=

20%

• Terminal

value

in

year

3

=

133.39

(1-‐.20)/(.09-‐.03)

=

$1778.51

m

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Fabozzi-Foundations of Financial Markets and Institutions 4eDocument18 pagesFabozzi-Foundations of Financial Markets and Institutions 4eMariam Mirzoyan100% (4)

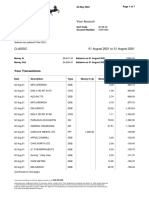

- 2021 August StatementDocument7 pages2021 August StatementJawad AhmedNo ratings yet

- CH 10Document18 pagesCH 10prashantgargindia_93No ratings yet

- BUS 497a - Homework 1 - Solution GuideDocument5 pagesBUS 497a - Homework 1 - Solution GuidesaltyaxelNo ratings yet

- Comparative Study of Credit Cards in Indian MarketDocument97 pagesComparative Study of Credit Cards in Indian MarketSami ZamaNo ratings yet

- Fin 455 SP 2017 CumulativeDocument10 pagesFin 455 SP 2017 CumulativedasfNo ratings yet

- Chapter 18 - International Capital BudgetingDocument91 pagesChapter 18 - International Capital BudgetingAhmed El KhateebNo ratings yet

- Tuto5 - Corporate Valuation & GovernanceDocument4 pagesTuto5 - Corporate Valuation & Governancebouchahdamajd7No ratings yet

- StudentDocument33 pagesStudentKevin Che100% (2)

- AccountingDocument6 pagesAccountingHaneefa Soomro0% (1)

- Fin 455 Fall 2017 FinalDocument10 pagesFin 455 Fall 2017 FinaldasfNo ratings yet

- Test 1 NewDocument4 pagesTest 1 Newyen saubiNo ratings yet

- 2009T2 Fins1613 FinalExamDocument24 pages2009T2 Fins1613 FinalExamchoiyokbao100% (1)

- 33 Comm 308 Final Exam (Summer 1 2018)Document16 pages33 Comm 308 Final Exam (Summer 1 2018)Carl-Henry FrancoisNo ratings yet

- 33 Comm 308 Final Exam (Summer 1 2018) SolutionsDocument13 pages33 Comm 308 Final Exam (Summer 1 2018) SolutionsCarl-Henry FrancoisNo ratings yet

- Chap 001Document5 pagesChap 001charlie simoNo ratings yet

- Final Exam/2: Multiple ChoiceDocument4 pagesFinal Exam/2: Multiple ChoiceJing SongNo ratings yet

- Practice Final ExamDocument8 pagesPractice Final ExamrahulgattooNo ratings yet

- The Following Questions Are Worth 3 Points Each. Provide The Single Best ResponseDocument9 pagesThe Following Questions Are Worth 3 Points Each. Provide The Single Best ResponsePaul Anthony AspuriaNo ratings yet

- ANSWER KEY Discounted Cash Flow MethodDocument10 pagesANSWER KEY Discounted Cash Flow MethodDanna VargasNo ratings yet

- Problem Sets: Example, Requires Compounded Semiannualiy. Equivalent CompoundedDocument5 pagesProblem Sets: Example, Requires Compounded Semiannualiy. Equivalent CompoundedvineethNo ratings yet

- Practice Qns - Cap StructureDocument8 pagesPractice Qns - Cap StructureSadi0% (1)

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384No ratings yet

- Mcqs Help FahadDocument7 pagesMcqs Help FahadAREEBA ABDUL MAJEEDNo ratings yet

- Coroporate Finance ExamDocument4 pagesCoroporate Finance ExammustafaNo ratings yet

- Midtest 2Document6 pagesMidtest 2Thảo NhưNo ratings yet

- FIN3403 Exam 4 PracticeDocument8 pagesFIN3403 Exam 4 Practicek10924No ratings yet

- Assignment 1Document7 pagesAssignment 1Camilo Andres MesaNo ratings yet

- CFA QuestionsDocument42 pagesCFA Questionspuntanalyst100% (2)

- Sample of The Fin320 Department Final Exam With SolutionDocument10 pagesSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- Trustee. B. States The Bond's Current Rating. C. States The Yield To Maturity of The Bond DDocument5 pagesTrustee. B. States The Bond's Current Rating. C. States The Yield To Maturity of The Bond DAshish BhallaNo ratings yet

- Chapter 4 - Time Value of MoneyDocument5 pagesChapter 4 - Time Value of MoneyLayla MainNo ratings yet

- 2 SDocument12 pages2 SRohith ThatchanNo ratings yet

- Selected BKM Exercises 1 - v2Document19 pagesSelected BKM Exercises 1 - v2Mattia CampigottoNo ratings yet

- FIN2001 Exam - 2021feb - FormoodleDocument7 pagesFIN2001 Exam - 2021feb - Formoodletanren010727No ratings yet

- 97fi MasterDocument12 pages97fi MasterHamid UllahNo ratings yet

- Estimating The Cost of CapitalDocument32 pagesEstimating The Cost of CapitalRRafeh119No ratings yet

- Dividend Payout Ratio 1 Retention Ratio: Abdullah Alnasser 436170093Document4 pagesDividend Payout Ratio 1 Retention Ratio: Abdullah Alnasser 436170093abdullahNo ratings yet

- Af208 2015 MSTDocument15 pagesAf208 2015 MSTPaul Sau HutaNo ratings yet

- Blank ExamsDocument9 pagesBlank ExamsAndros MafraugarteNo ratings yet

- F9) QuestionsDocument15 pagesF9) Questionspavishne0% (1)

- Islamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMDocument7 pagesIslamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMTaha Wael QandeelNo ratings yet

- Fin C 000002Document14 pagesFin C 000002Nageshwar SinghNo ratings yet

- Acca FM PT 2 (091020)Document7 pagesAcca FM PT 2 (091020)Sukhdeep KaurNo ratings yet

- Homework Notes Unit 3 MBA 615Document9 pagesHomework Notes Unit 3 MBA 615Kevin NyasogoNo ratings yet

- Session 6Document3 pagesSession 6loujaynNo ratings yet

- Principles of Finance - (Fin 3301) Student Name: - Quiz - Capital Budgeting - Cost of CapitalDocument5 pagesPrinciples of Finance - (Fin 3301) Student Name: - Quiz - Capital Budgeting - Cost of CapitalHamza AmmadNo ratings yet

- FM Worksheet IDocument3 pagesFM Worksheet IMISRA MUHUDINNo ratings yet

- FIN370 Final ExamDocument9 pagesFIN370 Final ExamWellThisIsDifferentNo ratings yet

- Corporate Finance Mock Exam AnswerDocument7 pagesCorporate Finance Mock Exam AnswerTrang HuongNo ratings yet

- Tute 1Document4 pagesTute 1Rony RahmanNo ratings yet

- Fin C 000222222Document12 pagesFin C 000222222Nageshwar SinghNo ratings yet

- Calculation PracticeDocument5 pagesCalculation Practicenguyenductai2006No ratings yet

- Cost of Capital QuizDocument3 pagesCost of Capital QuizSardar FaaizNo ratings yet

- Double Ticking and Cancellation Is Not Allowed. Think Through The Question Very Well Before YouDocument9 pagesDouble Ticking and Cancellation Is Not Allowed. Think Through The Question Very Well Before YouMRS.JENNIFER AKUA NYARKO ANDOHNo ratings yet

- Quiz MoolyankanDocument26 pagesQuiz Moolyankanapi-3754028No ratings yet

- Winter 2010 Midterm With SolutionsDocument11 pagesWinter 2010 Midterm With Solutionsupload55No ratings yet

- Corporate+Finance Tutorial 05 ExercisesDocument2 pagesCorporate+Finance Tutorial 05 Exercisesstrategy.informNo ratings yet

- Practice Final Exam Questions399Document17 pagesPractice Final Exam Questions399MrDorakonNo ratings yet

- FIN331-004 2010 Fall Exam2 AnswersDocument7 pagesFIN331-004 2010 Fall Exam2 AnswersAnmol NadkarniNo ratings yet

- Valuation: Future Growth and Cash FlowsDocument12 pagesValuation: Future Growth and Cash FlowsAnshik BansalNo ratings yet

- The Best of Charlie Munger 1994 2011Document349 pagesThe Best of Charlie Munger 1994 2011VALUEWALK LLC100% (6)

- Dell CampusambasadorDocument4 pagesDell CampusambasadorAnshik BansalNo ratings yet

- Dividend Assessment: The Cash - Trust NexusDocument13 pagesDividend Assessment: The Cash - Trust NexusAnshik BansalNo ratings yet

- SQL Sqlite Commands Cheat Sheet PDFDocument5 pagesSQL Sqlite Commands Cheat Sheet PDFAnshik BansalNo ratings yet

- Valuation: Cash Flows & Discount RatesDocument12 pagesValuation: Cash Flows & Discount RatesAnshik BansalNo ratings yet

- Optimal Financing Mix Iv: Wrapping Up The Cost of Capital ApproachDocument16 pagesOptimal Financing Mix Iv: Wrapping Up The Cost of Capital ApproachAnshik BansalNo ratings yet

- Session 27 TestDocument2 pagesSession 27 TestAnshik BansalNo ratings yet

- Session 26 TestDocument3 pagesSession 26 TestAnshik BansalNo ratings yet

- Dividends: Peer Group Analysis: Me Too, Me Too.Document10 pagesDividends: Peer Group Analysis: Me Too, Me Too.Anshik BansalNo ratings yet

- Dividends: The Trade OffDocument19 pagesDividends: The Trade OffAnshik BansalNo ratings yet

- Session 30 TestDocument2 pagesSession 30 TestAnshik BansalNo ratings yet

- The Right Financing: The Perfect Financing For You. Yes, It Exists!Document17 pagesThe Right Financing: The Perfect Financing For You. Yes, It Exists!Anshik BansalNo ratings yet

- Optimal Financing Mix Iii: Following Up The Cost of Capital ApproachDocument17 pagesOptimal Financing Mix Iii: Following Up The Cost of Capital ApproachAnshik BansalNo ratings yet

- Session 20 TestDocument2 pagesSession 20 TestAnshik BansalNo ratings yet

- Session 17 TestDocument3 pagesSession 17 TestAnshik BansalNo ratings yet

- Session 19 TestDocument3 pagesSession 19 TestAnshik BansalNo ratings yet

- Investment Returns Iii: Loose Ends: No Garnishing Allowed in Investment AnalysisDocument16 pagesInvestment Returns Iii: Loose Ends: No Garnishing Allowed in Investment AnalysisAnshik BansalNo ratings yet

- Getting To The Optimal Financing MixDocument7 pagesGetting To The Optimal Financing MixAnshik BansalNo ratings yet

- Session 21 TestDocument3 pagesSession 21 TestAnshik BansalNo ratings yet

- Optimal Financing Mix V: Alternate ApproachesDocument16 pagesOptimal Financing Mix V: Alternate ApproachesAnshik BansalNo ratings yet

- Open Economy MacroeconomicsDocument31 pagesOpen Economy MacroeconomicsMuhammadNo ratings yet

- CH 8 Liquidity and Treasury Risk Measurement and Management LAJIDIDVB2Document295 pagesCH 8 Liquidity and Treasury Risk Measurement and Management LAJIDIDVB2irvinNo ratings yet

- CH08SOLSDocument23 pagesCH08SOLSMiki TiendaNo ratings yet

- Karnataka II PUC Accountancy Sample Question Paper 18Document6 pagesKarnataka II PUC Accountancy Sample Question Paper 18Kishu KishoreNo ratings yet

- Commercial Banks: Websites: WWW - Apra.gov - Au WWW - Asic.gov - Au WWW - Accc.gov - Au WWW - Rbnz.govt - NZDocument45 pagesCommercial Banks: Websites: WWW - Apra.gov - Au WWW - Asic.gov - Au WWW - Accc.gov - Au WWW - Rbnz.govt - NZThu NguyenNo ratings yet

- Group 7 - Neelabh Barua - PGFB2027Document49 pagesGroup 7 - Neelabh Barua - PGFB2027NeelabhNo ratings yet

- Third Point Q4 LetterDocument6 pagesThird Point Q4 LetterDistressedDebtInvest67% (3)

- CB-05 Functions and Operations of BSPDocument5 pagesCB-05 Functions and Operations of BSPJHERRY MIG SEVILLA100% (1)

- Ambit - Economy - Update - FY24 Budget A Year of Normalization - 10dec2023Document18 pagesAmbit - Economy - Update - FY24 Budget A Year of Normalization - 10dec2023adithyaNo ratings yet

- Electronic Payment Systems: MBA EX 9607 - Managing E-BusinessDocument32 pagesElectronic Payment Systems: MBA EX 9607 - Managing E-BusinessAshutosh SinghalNo ratings yet

- How To Save Money: To Use This For More Than One Time?"Document2 pagesHow To Save Money: To Use This For More Than One Time?"Han O100% (1)

- NCRAM-CEO CIO Monthly Update December 4 2023Document3 pagesNCRAM-CEO CIO Monthly Update December 4 2023bagus.dpbri6741No ratings yet

- 1.3 FRM Test 03 AnsDocument22 pages1.3 FRM Test 03 AnsPrachet KulkarniNo ratings yet

- Chapter-2 Review of LiteratureDocument5 pagesChapter-2 Review of LiteratureRajesh BathulaNo ratings yet

- Reference BikashDocument15 pagesReference Bikashroman0% (1)

- Major Assignment 3 Excel Template 20200907 Nirvan RadDocument14 pagesMajor Assignment 3 Excel Template 20200907 Nirvan RadnirvanNo ratings yet

- Financial AnalysisDocument18 pagesFinancial AnalysisanjuNo ratings yet

- FAC4863 NFA4863 Exam Paper 1 RequiredDocument3 pagesFAC4863 NFA4863 Exam Paper 1 RequiredNosipho NyathiNo ratings yet

- Quiz Week 2Document6 pagesQuiz Week 2Riri FahraniNo ratings yet

- Fee Based Financial Services1Document35 pagesFee Based Financial Services1karishmapatel93No ratings yet

- Internal Control Reviewer3Document12 pagesInternal Control Reviewer3Lon DiazNo ratings yet

- Reinforcement Learning For Quantitative Trading - 2021Document26 pagesReinforcement Learning For Quantitative Trading - 2021biddon14No ratings yet

- Banjara ReportDocument96 pagesBanjara Reportvipin5678No ratings yet

- Assignment 1Document13 pagesAssignment 1Elin EkströmNo ratings yet

- Lecture 4 PostDocument29 pagesLecture 4 PostSamantha YuNo ratings yet

- AlliedDocument43 pagesAlliedMahrukh RasheedNo ratings yet

- Notice Annual Membership Fees For The Financial Year 2022-23Document4 pagesNotice Annual Membership Fees For The Financial Year 2022-23APNo ratings yet