Professional Documents

Culture Documents

Acce 312 Reader Su 2 Memo Revised - 2

Acce 312 Reader Su 2 Memo Revised - 2

Uploaded by

PETER MABASSOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acce 312 Reader Su 2 Memo Revised - 2

Acce 312 Reader Su 2 Memo Revised - 2

Uploaded by

PETER MABASSOCopyright:

Available Formats

STUDY UNIT 2

FINANCIAL ACCOUNTING OF COMPANIES: BASIC CONCEPTS AND LEDGER ACCOUNTS

MEMORANDUMS

ACTIVITY 1

sheet: Activity 1

MEMORANDUM

1 Shareholders G

2 Directors D

3 Independent auditor A

4 Directors’ fees K

5 Audit fees B

6 Shares J

7 Dividends C

8 Companies Act No 71 of 2008 L

9 Limited liability E

10 Separation of ownership from control of a F

company

11 Memorandum of Incorporation H

12 Companies and Intellectual Property Commission I

EXAMPLE 2.1

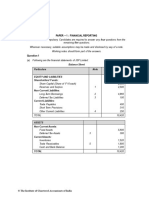

MEMORANDUM:

Double entries will be as follows:

No Account debited Account credited A OE L

1. No entry in accounting records

2. Bank Ordinary share capital +102 000 +102 000 0

3. SARS (Income tax) Bank -36 000 0 -36 000

4. Ordinary share dividends Bank -15 000 -15 000 0

5. SARS (Income tax) Bank -34 000 0 -34 000

6. Ordinary share dividends Shareholders for dividends 0 -20 400 +20 400

7. Director fees Bank -60 000 -60 000 0

8. Audit fees Bank -30 000 -30 000 0

ACCE 312: Practical Reader/SU 2/Memorandum

1

HOMEWORK 2.1

BUNDU PAINTS LIMITED

MEMORANDUM: HOMEWORK 2.1

NO. Account debited Account credited A OE L

1 NO ENTRY

2 SARS (Income tax) Bank -16 500 0 -16 500

3 NO ENTRY

4 Ordinary share Shareholders for 0 - 15 000 + 15 000

dividends dividends

5 Shareholders for Bank -15 000 0 -15 000

dividends

6 Bank Ordinary share +80 000 + 80 000 0

capital

7 SARS (Income tax) Bank - 16 500 - 16 500

8 Profit & Loss Appropriation acc 0 + 120 000 0

-120 000

Income tax SARS (Income tax) 0 -42 000 + 42 000

Ordinary share Shareholders for 0 -48 000 + 48 000

dividends dividends

ACCE 312: Practical Reader/SU 2/Memorandum

2

ASSIGNMENT 2

PHOENIX LIMITED

MEMORANDUM: ASSIGNMENT 2

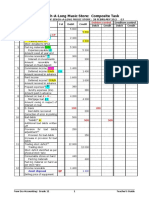

ASSETS EQUITY LIABILITIES

No Influence Reason Influence Reason Influence Reason

1. - 6 500 Payment to

SARS

+6 500 Bank overdraft

increase

-8000 Payment to

shareholders

+8 000 Bank overdraft

increase

2. -52 400 Payment to

SARS

+52 400 Bank overdraft

increase

3 -25 000 Ordinary share + 25 000 Bank overdraft

div is expense increase

4 -750 Equipment -750 Directors

decrease remuneration is

expense

5 -18 750 Ordinary share +18750 Shareholders

div is expense for div is

liability

6 NO ENTRY

7 + 60 000 Ordinary share -60 000 Bank overdraft

capital increase decrease

8 -110 000 Income tax is + 110 000 Owe SARS

expense that more

increase

ACCE 312: Practical Reader/SU 2/Memorandum

3

NO. Account debited Account credited A OE L

1. SARS (Income tax) Bank (Overdraft) 0 0 -6 500

+6 500

Shareholders for Bank 0 0 -8 000

dividends +8 000

2. SARS (Income tax) Bank 0 0 -52 400

+52 400

3. Ordinary share Bank 0 -25 000 +25 000

dividends

4. Director fees Equipment -750 -750 0

5. Ordinary share Shareholders for 0 -18 750 +18 750

dividends dividends

6. NO ENTRY

7. Bank Ordinary share 0 +60 000 -60 000

capital

8. Income tax SARS (Income tax) 0 -110 000 +110 000

ACCE 312: Practical Reader/SU 2/Memorandum

4

You might also like

- Liabilities With Answer For StudentsDocument29 pagesLiabilities With Answer For StudentsDivine CuasayNo ratings yet

- Afm Paper DalmiaDocument5 pagesAfm Paper DalmiaasheetakapadiaNo ratings yet

- Solution Fin Accting FundamentalsDocument7 pagesSolution Fin Accting Fundamentalsabhaymvyas1144No ratings yet

- FIA141 Term Test 1 Solution 2019 3Document9 pagesFIA141 Term Test 1 Solution 2019 3Nosipho MsimangoNo ratings yet

- Basic Consol - Tutorial Q 82022Document10 pagesBasic Consol - Tutorial Q 82022ZhaoYing TanNo ratings yet

- RIL Excel Sheet FRADocument56 pagesRIL Excel Sheet FRAAditi AgrawalNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Paper Financial ManagementDocument8 pagesPaper Financial ManagementAbul Ala Daniyal QaziNo ratings yet

- Recognition of Current Assets and EquityDocument8 pagesRecognition of Current Assets and EquityMd. N UraminNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- Ex: 22 PG: 14.80: 1. Holding Minority RatioDocument20 pagesEx: 22 PG: 14.80: 1. Holding Minority RatioSuriya DeviNo ratings yet

- Preparation & Analysis of Cash Flow StatementsDocument27 pagesPreparation & Analysis of Cash Flow StatementsAniket PanchalNo ratings yet

- Accounting Chapter 2Document19 pagesAccounting Chapter 2MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Accounting For Banking: Model QuestionDocument22 pagesAccounting For Banking: Model QuestionJIWAN DHAMALANo ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Answer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Document9 pagesAnswer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Abul Ala Daniyal QaziNo ratings yet

- PDF 04Document7 pagesPDF 04Hiruni LakshaniNo ratings yet

- Grade 10 Learner Marking GuidelineDocument19 pagesGrade 10 Learner Marking GuidelineyandisaNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Fund Flow Statement: by Dr. Aleem AnsariDocument18 pagesFund Flow Statement: by Dr. Aleem AnsariPRIYAL GUPTANo ratings yet

- 3f Basic Principles ALC Past Papers 2016 2020Document3 pages3f Basic Principles ALC Past Papers 2016 2020Rashid UsmanNo ratings yet

- Ia LTD EngDocument1 pageIa LTD Engisabella.desa04No ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- CA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Document32 pagesCA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Upasana NimjeNo ratings yet

- Cash Flow ProblemsDocument2 pagesCash Flow ProblemsMeiMisakiNo ratings yet

- Week 5 Topic Tutorial Solutions CB2100 - 1920ADocument6 pagesWeek 5 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- 04 Extra Question Pack For Chapter 4 After Initial AcquisitionDocument3 pages04 Extra Question Pack For Chapter 4 After Initial AcquisitionhlisoNo ratings yet

- Bs 320 Test One TutorialDocument12 pagesBs 320 Test One TutorialPrince Daniels TutorNo ratings yet

- Jovero, Judith G. HRDM Iv-1 Mrs. Evelyn Celestial: The Components of Financial Statement Control EnvironmentDocument6 pagesJovero, Judith G. HRDM Iv-1 Mrs. Evelyn Celestial: The Components of Financial Statement Control EnvironmentKRISTINE CLAIRE VISTONo ratings yet

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Document10 pagesTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaNo ratings yet

- Specialised Accounting - Holding Company With One Subsidiary CompanyDocument19 pagesSpecialised Accounting - Holding Company With One Subsidiary CompanyManan SaxenaNo ratings yet

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- Fac1601 Exam Pack 2018 - Financial Accounting ReportingDocument97 pagesFac1601 Exam Pack 2018 - Financial Accounting ReportingandreqwNo ratings yet

- Accounting Grade 12 Test 1Document4 pagesAccounting Grade 12 Test 1Ryno de BeerNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Principles of AccountingDocument7 pagesPrinciples of AccountingMuốn Đi Ngủ CơNo ratings yet

- TASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraDocument4 pagesTASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraSincy MathewNo ratings yet

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaDocument8 pagesProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaNo ratings yet

- Assignment No. 1 (Financial Transactions) Answer KeyDocument9 pagesAssignment No. 1 (Financial Transactions) Answer KeyHeasylyn tadeoNo ratings yet

- Class Discussion On Ratios 28022023Document2 pagesClass Discussion On Ratios 28022023lil telNo ratings yet

- Case Study 1Document5 pagesCase Study 18142301001No ratings yet

- Intermediate 1 Ch5 Ø Ù Ø Ø Ø Ø Ù Ø Ø Ø ØDocument12 pagesIntermediate 1 Ch5 Ø Ù Ø Ø Ø Ø Ù Ø Ø Ø Ømobilhamdan318No ratings yet

- Consolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000Document1 pageConsolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000.No ratings yet

- Tut 8 Submission QuestionsDocument6 pagesTut 8 Submission Questionsxabaandiswa8No ratings yet

- Accounting GR 10 MEMODocument11 pagesAccounting GR 10 MEMOJoy LenyatsaNo ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Sanjoy Das 23-021: Ans of Question 01 Ans of ADocument2 pagesSanjoy Das 23-021: Ans of Question 01 Ans of ASanjoy dasNo ratings yet

- Financial Accounting and Reporting-I: Page 1 of 7Document7 pagesFinancial Accounting and Reporting-I: Page 1 of 7Obaid RasheedNo ratings yet

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- WAMUNIMA. Financial Accounting 2 Assignment.Document8 pagesWAMUNIMA. Financial Accounting 2 Assignment.simpitorussellNo ratings yet

- National University of Science and TechnologyDocument5 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Q10.2 - Raider LTD - SOLDocument5 pagesQ10.2 - Raider LTD - SOLnessamuchenaNo ratings yet

- Professional - May 2021Document173 pagesProfessional - May 2021Jason Baba KwagheNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- 11 Acc 5.26 CH 6 .7 6.9 Memos 2021Document26 pages11 Acc 5.26 CH 6 .7 6.9 Memos 2021ora mashaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ACCE312 vcPaper1Jun2023 240617 131058Document19 pagesACCE312 vcPaper1Jun2023 240617 131058PETER MABASSONo ratings yet

- Acce 312 Kassie Ltd. QP - 1Document2 pagesAcce 312 Kassie Ltd. QP - 1PETER MABASSONo ratings yet

- Homework 3.2 Kima Traders MemorandumDocument2 pagesHomework 3.2 Kima Traders MemorandumPETER MABASSONo ratings yet

- ACCE 312 Practical Reader SU4 - Question Papers, Answer Sheets - EngDocument19 pagesACCE 312 Practical Reader SU4 - Question Papers, Answer Sheets - EngPETER MABASSONo ratings yet

- Chapter 3 Strat CostDocument19 pagesChapter 3 Strat CostAngela AquinoNo ratings yet

- UNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeDocument24 pagesUNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeEren KırıcıNo ratings yet

- Themes in Information System DevelopmentDocument14 pagesThemes in Information System DevelopmentMuhammad BilalNo ratings yet

- Ballot Guidelines For General Secretary Election: (Insert Date)Document12 pagesBallot Guidelines For General Secretary Election: (Insert Date)Paul WaughNo ratings yet

- Adr Finals ReviewerDocument8 pagesAdr Finals ReviewerMiguel Anas Jr.No ratings yet

- Sigmund Freud: Psychosexual DevelopmentDocument6 pagesSigmund Freud: Psychosexual DevelopmentKarlo Gil ConcepcionNo ratings yet

- Field Study 1: Observations of Teaching-Learning in Actual School EnvironmentDocument18 pagesField Study 1: Observations of Teaching-Learning in Actual School EnvironmentAndrea MendozaNo ratings yet

- Date Time Game Id Match 1 X 2 1X 12 X2 Over 2.5 Under 2.5 Yes NoDocument2 pagesDate Time Game Id Match 1 X 2 1X 12 X2 Over 2.5 Under 2.5 Yes NoMichael MwirikiaNo ratings yet

- Assignment 1Document27 pagesAssignment 1Quỳnh MaiNo ratings yet

- International Training and Development IHRM 9Document17 pagesInternational Training and Development IHRM 9JaanuNo ratings yet

- Mayor of Casterbridge LIT PlanDocument42 pagesMayor of Casterbridge LIT Plankennycarlos25No ratings yet

- President CEO COO EVP Construction in Boca Raton FL Resume Martin DriscollDocument2 pagesPresident CEO COO EVP Construction in Boca Raton FL Resume Martin DriscollMartinDriscollNo ratings yet

- Doctor of Philosophy in CommerceDocument18 pagesDoctor of Philosophy in CommerceNishant KushwahaNo ratings yet

- Consultancy Services TCSDocument7 pagesConsultancy Services TCSPahulpreetSinghNo ratings yet

- National Bookstore's Founder Maria Socorro "Nanay Coring" Cancio RamosDocument12 pagesNational Bookstore's Founder Maria Socorro "Nanay Coring" Cancio RamosRyan Joshua FloresNo ratings yet

- Piezoelectric Vibrating Gyroscopes (GYROSTAR)Document4 pagesPiezoelectric Vibrating Gyroscopes (GYROSTAR)Imtiaz AhmedNo ratings yet

- Cost-Benefit AnalysisDocument7 pagesCost-Benefit Analysishoogggleee100% (1)

- Nev 2Document3 pagesNev 2achmadzulfaNo ratings yet

- SKM Cambrian ForestDocument4 pagesSKM Cambrian ForestjmdpropertiesNo ratings yet

- Bertolt Brecht - WikipediaDocument144 pagesBertolt Brecht - WikipediaJulietteNo ratings yet

- Sustainability Report: Samsung Electronics Nordic ABDocument9 pagesSustainability Report: Samsung Electronics Nordic ABRenanda LaradutaTMNo ratings yet

- Eckert (2006) Community of PracticeDocument3 pagesEckert (2006) Community of PracticeAnderson Luiz da Silva FariasNo ratings yet

- Professor Muhammad MunawwarDocument15 pagesProfessor Muhammad MunawwarMunirahmadmughal MughalNo ratings yet

- Industrial and Visual Communication Design Internship Opportunity at The Design Studio, Center For Technology Innovation, LVPEIDocument2 pagesIndustrial and Visual Communication Design Internship Opportunity at The Design Studio, Center For Technology Innovation, LVPEIKarthik SridharNo ratings yet

- Profit & Loss - Practice Sheet: The Winners Institute IndoreDocument34 pagesProfit & Loss - Practice Sheet: The Winners Institute Indoreshubhamsarin855No ratings yet

- KBB Nov 22Document1 pageKBB Nov 22Bernard GMKNo ratings yet

- Percieved Social Media Influence On The Choice of National Candidates in 2022 Philippine Elections Senior High School StudentsDocument25 pagesPercieved Social Media Influence On The Choice of National Candidates in 2022 Philippine Elections Senior High School StudentsDan Gela Mæ MaYoNo ratings yet

- Statement of PurposeDocument2 pagesStatement of PurposeKasturi MandalNo ratings yet

- MBA 706 Mod 2Document35 pagesMBA 706 Mod 2Kellie ParendaNo ratings yet

- Latest LSC TT Asgn Submission J-2021Document2 pagesLatest LSC TT Asgn Submission J-2021rohitbanerjeeNo ratings yet