Professional Documents

Culture Documents

Acce 312 Kassie Ltd. QP - 1

Acce 312 Kassie Ltd. QP - 1

Uploaded by

PETER MABASSOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acce 312 Kassie Ltd. QP - 1

Acce 312 Kassie Ltd. QP - 1

Uploaded by

PETER MABASSOCopyright:

Available Formats

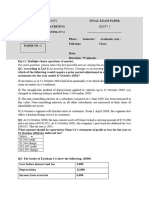

ACCE 312: GENERAL LEDGER ACCOUNTS OF A COMPANY

HOMEWORK 2: KASSIE LTD.

You are provided with information taken from the financial records of Kassie Ltd.

at the end of the financial year, 29 February 2016.

REQUIRED:

2.1 Complete the following accounts in the General ledger of Kassie Ltd.

for the year ended on 29 February 2016:

NOTE: Show all calculations in brackets next to the items in the

general ledger accounts.

Ordinary Share capital (12)

Retained Income (8)

SARS (Income Tax) (12)

Shareholders for dividends (5)

Ordinary share dividends (8)

Appropriation account (10)

INFORMATION:

EXTRACT FROM THE PRE-ADJUSTMENT TRAIL BALANCE ON

29 February 2016

Ordinary share capital ?

Retained income (1 March 2015) 850 000

Shareholders for dividends (1 March 2015) 720 000

SARS (Income tax) (Dr) 535 000

A. Share Capital

The company's authorised share capital consists of 1 000 000 ordinary

shares.

Six hundred thousand (600 000) of these shares were issued at 650 cents

per share by the end of the 2015 financial year.

Seventy-five percent (75%) of the remaining shares were issued on

1 September 2015 at 800 cents a share.

Fifty thousand (50 000) shares were bought back on 31 January 2016 for

250 cents each for more than the average share price.

B. Dividends

Pay the dividends declared the previous financial year via EFT on

25 March 2015.

ACCE 312: Company ledger accounts/ Kassie Ltd./Question paper 1/2

An interim dividend of 50 cents per share was paid on 31 August 2015.

A final dividend of 80 cents per share was recommended on

29 February 2016. Shares repurchased on 31 January 2016 do not qualify

for final dividends.

C. Income tax

Received a direct deposit from SARS on 25 March 2015 for R34 800 in

repayment of the overpayment received the previous financial year.

The company made two equal provisional tax payment to SARS on the

1 September 2015 and the 1 February 2016.

Income tax is calculated at 30% of the Net profit. The Net profit after tax

was R1 190 000.

ACCE 312: Company ledger accounts/ Kassie Ltd./Question paper 2/2

You might also like

- 5325702-Strategic-Management-Assignment-1758476635-1307697674 - 1894915866 .EdiDocument24 pages5325702-Strategic-Management-Assignment-1758476635-1307697674 - 1894915866 .EdiSparsh Sharma100% (1)

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- Income and Changes in Retained Earnings: - Chapter 12Document49 pagesIncome and Changes in Retained Earnings: - Chapter 12Moqadus SeharNo ratings yet

- Three Column Cash BookDocument3 pagesThree Column Cash Bookahmad381100% (1)

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- D8 EpsDocument5 pagesD8 EpsKani Utsini DimaNo ratings yet

- Accounting 22 2016Document10 pagesAccounting 22 2016Thulani NdlovuNo ratings yet

- Accounting 22 Exam 2017Document9 pagesAccounting 22 Exam 2017Thulani NdlovuNo ratings yet

- Eps Tutorial QuestionsDocument15 pagesEps Tutorial QuestionsCostantine Andrew Jr.No ratings yet

- Roll No : NOTE: 1Document8 pagesRoll No : NOTE: 1Anonymous yPWi8p3KkANo ratings yet

- D6 EpsDocument5 pagesD6 EpsKani Utsini DimaNo ratings yet

- Audit of SheDocument3 pagesAudit of ShegbenjielizonNo ratings yet

- IAS 33 (Basic EPS) - Class Practice (Questions)Document2 pagesIAS 33 (Basic EPS) - Class Practice (Questions)Mazhar AzizNo ratings yet

- 2023 Grade 12 Controlled Test 1 QPDocument5 pages2023 Grade 12 Controlled Test 1 QPannabellabloom282007No ratings yet

- Accf3114 2Document13 pagesAccf3114 2Krishna 11No ratings yet

- Example 1Document2 pagesExample 1Thikundeko EdwardNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- Accounting All Papers and Memorandums - zp124322Document91 pagesAccounting All Papers and Memorandums - zp124322Issa AdiemaNo ratings yet

- Delta Corp East Africa Limited (In Liquidation)Document22 pagesDelta Corp East Africa Limited (In Liquidation)LamineNo ratings yet

- Ias 33 Earnings Per Share Review QuestionsDocument6 pagesIas 33 Earnings Per Share Review Questionsabuumgweno1803No ratings yet

- Advanced Accounting QN August 2018 Group AssignmentDocument9 pagesAdvanced Accounting QN August 2018 Group AssignmentGift MoyoNo ratings yet

- Answer All Questions in Part A. Answer Only Three Questions in Part BDocument16 pagesAnswer All Questions in Part A. Answer Only Three Questions in Part BHazim BadrinNo ratings yet

- Analysis and Interpretation of Financial Statements PDFDocument11 pagesAnalysis and Interpretation of Financial Statements PDFKudakwashe MujungwaNo ratings yet

- CA23 Financial Reporting and AnalysisDocument5 pagesCA23 Financial Reporting and AnalysisjoanNo ratings yet

- ASS2 Q2 2018 IIB Final PDFDocument3 pagesASS2 Q2 2018 IIB Final PDFLaurenNo ratings yet

- 19684ipcc Acc Vol2 Chapter2Document0 pages19684ipcc Acc Vol2 Chapter2kevalcharlaNo ratings yet

- QUESTION 1 - Preferance Shares Intragroup Tranaction Investment in AssociateDocument14 pagesQUESTION 1 - Preferance Shares Intragroup Tranaction Investment in Associatedineomokoena327No ratings yet

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- CAFM FULL SYLLABUS TEST-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS TEST-Executive-Revisionshantanuhadge08No ratings yet

- Grade 12 Class Test Company 70 Minutes 120 MarksDocument11 pagesGrade 12 Class Test Company 70 Minutes 120 MarksStars2323100% (1)

- Exercises On Basic EPS (Part II)Document2 pagesExercises On Basic EPS (Part II)Chrystelle Gail LiNo ratings yet

- Financial Accounting and Reporting: IFRS - 2017 June QPDocument8 pagesFinancial Accounting and Reporting: IFRS - 2017 June QPMarchella LukitoNo ratings yet

- RTP Nov 15Document46 pagesRTP Nov 15Aaquib ShahiNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- Paper 17Document5 pagesPaper 17VijayaNo ratings yet

- 6 Sem Cost Control and MNGT Acct., Probs On Tech of Finan Stat AnalysisDocument12 pages6 Sem Cost Control and MNGT Acct., Probs On Tech of Finan Stat Analysismohammedabdulmuqeet07No ratings yet

- FIA132 - Supplementary and Special Assessment NOVEMBER 2022Document8 pagesFIA132 - Supplementary and Special Assessment NOVEMBER 2022kaityNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- F2 Sept 2014 QP Final Version For PrintDocument20 pagesF2 Sept 2014 QP Final Version For PrintFahadNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- PARALEL QUIZ - Introduction of AccountingDocument5 pagesPARALEL QUIZ - Introduction of AccountingCut Farisa MachmudNo ratings yet

- The Financial Statements Chapter 2Document37 pagesThe Financial Statements Chapter 2Rupesh PolNo ratings yet

- LoverrrrrrDocument4 pagesLoverrrrrrsalamat lang akinNo ratings yet

- October Assessment With SolutionDocument19 pagesOctober Assessment With Solution221103909No ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- Statement of Cash Flow Set-3Document5 pagesStatement of Cash Flow Set-3vdj kumarNo ratings yet

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyNo ratings yet

- FR 2019 Paper FinalDocument58 pagesFR 2019 Paper FinalshashalalaxiangNo ratings yet

- Ac2091 Za - 2019Document14 pagesAc2091 Za - 2019Isra WaheedNo ratings yet

- Financialstatements2018 PDFDocument396 pagesFinancialstatements2018 PDFArteezyNo ratings yet

- B.R.De Silva &co. Chartered Accountants: Independent Auditor 'S Report To The Share Holders of MRF Lanka (PVT) LTDDocument24 pagesB.R.De Silva &co. Chartered Accountants: Independent Auditor 'S Report To The Share Holders of MRF Lanka (PVT) LTDshubham ThakerNo ratings yet

- Chapter 15 QB Q5 SolutionDocument5 pagesChapter 15 QB Q5 SolutionRichard SibekoNo ratings yet

- 4 - Self-Study Question - Chapter 7Document11 pages4 - Self-Study Question - Chapter 7Justyne WebbNo ratings yet

- Stcs (Scotland) LTD Annual Report and Unaudited Accounts For The Year Ended 31 January 2020Document11 pagesStcs (Scotland) LTD Annual Report and Unaudited Accounts For The Year Ended 31 January 2020Jacqueline GrayNo ratings yet

- Financial Reporting and AnalysisDocument7 pagesFinancial Reporting and AnalysisSagarPirtheeNo ratings yet

- Corporate Reporting 2012Document4 pagesCorporate Reporting 2012Laskar REAZNo ratings yet

- Comprehensive ProblemsDocument2 pagesComprehensive ProblemsAstridNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Assessment of Purchasing Policy and Procedures in Case of Ethiopian Revenue and Customs Authority Dire Dawa BranchDocument47 pagesAssessment of Purchasing Policy and Procedures in Case of Ethiopian Revenue and Customs Authority Dire Dawa Branchbezawitwubshet100% (1)

- Cambridge International Advanced Subsidiary and Advanced LevelDocument8 pagesCambridge International Advanced Subsidiary and Advanced LevelNguyễn QuânNo ratings yet

- Inventory Trading SampleDocument28 pagesInventory Trading SampleMarcelino CalataNo ratings yet

- Marketing Communication PlanDocument35 pagesMarketing Communication PlanShahan ShakeelNo ratings yet

- Vishang Resume 2024-2025Document3 pagesVishang Resume 2024-2025vrishacharya060No ratings yet

- Correction of Errors PDFDocument7 pagesCorrection of Errors PDFKylaSalvador0% (2)

- Course Outline Summer 2017 - MIS 442 2Document8 pagesCourse Outline Summer 2017 - MIS 442 2Wasif HossainNo ratings yet

- 1715-Article Text-3311-1-10-20201205 PDFDocument13 pages1715-Article Text-3311-1-10-20201205 PDFmohithNo ratings yet

- What Is Software QualityDocument26 pagesWhat Is Software Qualityahsan aliNo ratings yet

- Sebi Faq Substantial Acquisition of Shares and TakeoversDocument31 pagesSebi Faq Substantial Acquisition of Shares and TakeoversRahul SharmaNo ratings yet

- Business Strategy of Bajaj Auto Limited (For Non Seminar Students)Document3 pagesBusiness Strategy of Bajaj Auto Limited (For Non Seminar Students)Ashvin BalarNo ratings yet

- Deloitte Uk Global Mobility Trends 2021 Report LatestDocument16 pagesDeloitte Uk Global Mobility Trends 2021 Report LatestNguyễn Hoàng NhânNo ratings yet

- Enterprise Innovation and Markets (5e)Document378 pagesEnterprise Innovation and Markets (5e)Charlotte JaisonNo ratings yet

- Corporate Governance, CEO Reputation and Value RelevanceDocument28 pagesCorporate Governance, CEO Reputation and Value RelevanceLarventy KhoNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementSiraj Siddiqui100% (1)

- OLEVEL P2 Economics NotesDocument189 pagesOLEVEL P2 Economics NotesAbhinav MuraliNo ratings yet

- Time CoachingDocument12 pagesTime Coachingjasvinder89No ratings yet

- Wack Wack Golf and Country Club Vs NLRCDocument1 pageWack Wack Golf and Country Club Vs NLRCJaps De la CruzNo ratings yet

- Pizza HutDocument4 pagesPizza HutChieEnrileNo ratings yet

- Procurement and Inventory ManagementDocument43 pagesProcurement and Inventory ManagementSAURABH SINGHNo ratings yet

- Notes BBA Sem LLL Marketing 306B Retail ManagementDocument59 pagesNotes BBA Sem LLL Marketing 306B Retail ManagementModenna DaclanNo ratings yet

- Riphah International College Associate Degree ProgramDocument5 pagesRiphah International College Associate Degree ProgramMuhammad HannanNo ratings yet

- Personal Finance Is The Financial Management Which An Individual or A Family Unit Performs To BudgetDocument5 pagesPersonal Finance Is The Financial Management Which An Individual or A Family Unit Performs To Budgetdhwani100% (1)

- Marketing Strategies of Bajaj AutoDocument43 pagesMarketing Strategies of Bajaj AutoSarvesh Shinde0% (1)

- FRM 2018 Mock Exam AnswersDocument22 pagesFRM 2018 Mock Exam AnswersPaul Antonio Rios MurrugarraNo ratings yet

- Ibs JLN Maktab, KL SC 1 31/01/23Document1 pageIbs JLN Maktab, KL SC 1 31/01/23faezahNo ratings yet

- ZARA: Case Study Analysis: September 2015Document14 pagesZARA: Case Study Analysis: September 2015Irfan IdreesNo ratings yet