Professional Documents

Culture Documents

e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat Sheet

e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat Sheet

Uploaded by

Theodore Martinez JrCopyright:

Available Formats

You might also like

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- ZIM 2024 Tax Reference GuideDocument7 pagesZIM 2024 Tax Reference GuideAlex MilarNo ratings yet

- Student Loan Calculator With SAVE PlanDocument34 pagesStudent Loan Calculator With SAVE PlanZach LittleNo ratings yet

- 17vs18taxbracket FinalDocument2 pages17vs18taxbracket Finalapi-426611448No ratings yet

- In Come by Zip Demographics SampleDocument20 pagesIn Come by Zip Demographics SampleJena benNo ratings yet

- Read This First:: Loan & General InfoDocument14 pagesRead This First:: Loan & General InfoJoannaNo ratings yet

- Taxes by The NumbersDocument2 pagesTaxes by The NumbersBrad StevensNo ratings yet

- Annexf 2Document5 pagesAnnexf 2SAIFUL ADIL (Art)No ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- Impairment of LoanDocument4 pagesImpairment of LoanaleywaleyNo ratings yet

- 529credit SS1Document1 page529credit SS1loristurdevantNo ratings yet

- Wise Portfolio IdeasDocument29 pagesWise Portfolio Ideasarpittripathi.bhilwaraNo ratings yet

- 2023 Tax BracketsDocument1 page2023 Tax BracketsElfawizzyNo ratings yet

- Ey Tax Rates Alberta 2023 01 15 v1Document2 pagesEy Tax Rates Alberta 2023 01 15 v1AltafNo ratings yet

- 2021 Tax Data Schedule v.3Document15 pages2021 Tax Data Schedule v.3Brian SneeNo ratings yet

- High-Income Taxpayers 2021Document2 pagesHigh-Income Taxpayers 2021Finn KevinNo ratings yet

- 2021 22 PFS Fee Waiver GuidelinesDocument3 pages2021 22 PFS Fee Waiver GuidelinesOkNo ratings yet

- Tax Foundation FF6241Document5 pagesTax Foundation FF6241muhammad mudassarNo ratings yet

- BudgetChartBook 2022 1Document128 pagesBudgetChartBook 2022 1Team USANo ratings yet

- JAYME, Marx Yuri - 2BSMA-B - PAYROLLDocument42 pagesJAYME, Marx Yuri - 2BSMA-B - PAYROLLMarx Yuri JaymeNo ratings yet

- Self Declaration Form Ay 2022-23-ArthisDocument7 pagesSelf Declaration Form Ay 2022-23-ArthisMurugesan JeevaNo ratings yet

- Costs of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionDocument6 pagesCosts of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionLogan WilsonNo ratings yet

- LIHEAP & USF Application 20212022Document10 pagesLIHEAP & USF Application 20212022kewannrodgersNo ratings yet

- Federal Budget 2021Document4 pagesFederal Budget 2021api-227304535No ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- Age Pension Age Set To Change 2023Document11 pagesAge Pension Age Set To Change 2023FrankNo ratings yet

- DivorceMate Calculation Scenarios 2Document3 pagesDivorceMate Calculation Scenarios 2bfrankln77No ratings yet

- College Station ISD Budget Update 5.21.24Document23 pagesCollege Station ISD Budget Update 5.21.24KBTXNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- Reynolds American Inc 5.85% 2045Document78 pagesReynolds American Inc 5.85% 2045jamesNo ratings yet

- Investment Calculator - SmartAssetDocument1 pageInvestment Calculator - SmartAssetSulemanNo ratings yet

- Individual Retirement Accounts - Roth IRAs 2021Document2 pagesIndividual Retirement Accounts - Roth IRAs 2021Finn KevinNo ratings yet

- Emolument Comp Report - Investment Professional, Associate Director - VP - PrincipalDocument9 pagesEmolument Comp Report - Investment Professional, Associate Director - VP - PrincipalMason DukeNo ratings yet

- Description: Tags: FitzgeraldDocument14 pagesDescription: Tags: Fitzgeraldanon-89362No ratings yet

- Rates Rebates Application Form 2023 2024 Website Version 20230607Document6 pagesRates Rebates Application Form 2023 2024 Website Version 20230607ahmedzahi964No ratings yet

- Cost Breakdown Oct. 09 PDFDocument1 pageCost Breakdown Oct. 09 PDFBreckenridge Grand Real EstateNo ratings yet

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Document6 pages(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNo ratings yet

- Rate Buydown FlyerDocument1 pageRate Buydown FlyerKen CaianiNo ratings yet

- Zoned To Shrink PresentationDocument33 pagesZoned To Shrink PresentationWVXU NewsNo ratings yet

- Mayor Chokwe Antar Lumumba's FY19 Budget PresentationDocument25 pagesMayor Chokwe Antar Lumumba's FY19 Budget Presentationthe kingfishNo ratings yet

- PPT300Document28 pagesPPT300Ram RamNo ratings yet

- Act05!2!1 Esman Giecel E.Document16 pagesAct05!2!1 Esman Giecel E.Kate ManalansanNo ratings yet

- June 7 2021 Grand Forks Mayors 2022 Budget PreviewDocument29 pagesJune 7 2021 Grand Forks Mayors 2022 Budget PreviewJoe BowenNo ratings yet

- Crosswalk CPA Review: Tax Inflation Adjustments 2021Document15 pagesCrosswalk CPA Review: Tax Inflation Adjustments 2021Adhira VenkatNo ratings yet

- Part C - Annexes To SBM FINALDocument44 pagesPart C - Annexes To SBM FINALSwadeep ChhetriNo ratings yet

- Tax Rates Ontario 2019Document2 pagesTax Rates Ontario 2019Pratik BajajNo ratings yet

- 2023 Income Tax TablesDocument5 pages2023 Income Tax TablesKhushboo GuptaNo ratings yet

- Tax Rates and Formula Sheet 2023Document7 pagesTax Rates and Formula Sheet 2023MarvinNo ratings yet

- Obama Tax Plan: New JerseyDocument2 pagesObama Tax Plan: New JerseyThe Heritage FoundationNo ratings yet

- 2023 ReturnDocument2 pages2023 ReturnLuiNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

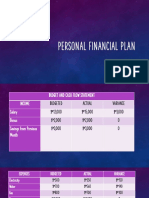

- Personal Financial PlanDocument6 pagesPersonal Financial PlanThomgie TilaNo ratings yet

- 2022 Tax UpdatesDocument12 pages2022 Tax UpdatesJagmohan TeamentigrityNo ratings yet

- Bowers and Company Tax Reform PresentationDocument52 pagesBowers and Company Tax Reform PresentationWatertown Daily TimesNo ratings yet

- GcuDocument2 pagesGcuLaqueena ThompsonNo ratings yet

- Finance and Operating Lease Exercise (Solution)Document10 pagesFinance and Operating Lease Exercise (Solution)Emnet AbNo ratings yet

- CTC ReconciliationDocument4 pagesCTC ReconciliationLaxman GandiNo ratings yet

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDocument3 pagesTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNo ratings yet

- WSJ Tax - Guide - 2023Document75 pagesWSJ Tax - Guide - 2023JoeNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- 2018 Financial Planning Challenge Case Study PDFDocument7 pages2018 Financial Planning Challenge Case Study PDFakashNo ratings yet

- Rollover ChartDocument1 pageRollover Chartsanjeev thadaniNo ratings yet

- 1040 Income Tax PreparationsDocument328 pages1040 Income Tax Preparationsej129100% (2)

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiNo ratings yet

- Disclaimer - : This Spreadsheet Is FreeDocument218 pagesDisclaimer - : This Spreadsheet Is FreePaul BischoffNo ratings yet

- 13 Steps To Investing FoolishlyDocument33 pages13 Steps To Investing FoolishlyadikesaNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- How To Budget Your Money - The 50-20-30 GuidelineDocument7 pagesHow To Budget Your Money - The 50-20-30 GuidelineAndrew Peter100% (1)

- Account Transfer Form: Fax Cover SheetDocument6 pagesAccount Transfer Form: Fax Cover SheetJitendra SharmaNo ratings yet

- Charles Schwab Investments Distribution Form Oct 27..2015Document10 pagesCharles Schwab Investments Distribution Form Oct 27..2015andyNo ratings yet

- FIN 345 - Week 16 - Chap 21 & 22 + Investing Insights-1Document21 pagesFIN 345 - Week 16 - Chap 21 & 22 + Investing Insights-1RhomNo ratings yet

- Nalc Cca Retirement Savings Plan MbaDocument2 pagesNalc Cca Retirement Savings Plan Mbaapi-367316623No ratings yet

- Retirement WorksheetDocument55 pagesRetirement WorksheetRich AbuNo ratings yet

- Essentials of Financial Planning 1: Provided by Liberty University Digital CommonsDocument33 pagesEssentials of Financial Planning 1: Provided by Liberty University Digital CommonsTung TaNo ratings yet

- MC 0623Document10 pagesMC 0623mcchronicleNo ratings yet

- Garvin County Icw Print 2Document1 pageGarvin County Icw Print 2Price LangNo ratings yet

- Chasity D EnglishDocument7 pagesChasity D EnglishbpspillkillNo ratings yet

- DH 0429Document14 pagesDH 0429The Delphos HeraldNo ratings yet

- Retirement Topics - IRA Contribution LimitsDocument3 pagesRetirement Topics - IRA Contribution LimitsSriniNo ratings yet

- Ch20 Taxes, Inflation, and Investment StrategyDocument22 pagesCh20 Taxes, Inflation, and Investment StrategyA_StudentsNo ratings yet

- 21 - 1040 (Forecast)Document153 pages21 - 1040 (Forecast)cjNo ratings yet

- Chapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageDocument6 pagesChapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageVotues PSNo ratings yet

- Questionnaire For 2018 Tax Returns: Worksheets AvailableDocument7 pagesQuestionnaire For 2018 Tax Returns: Worksheets Availableparesh shiralNo ratings yet

- Allocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositDocument4 pagesAllocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositJahe FameNo ratings yet

- Solutions ME Chapter 1Document7 pagesSolutions ME Chapter 1Puji Hikmah100% (3)

- Direct Rollover and Withholding Form For Lump Sum Pension PaymentsDocument5 pagesDirect Rollover and Withholding Form For Lump Sum Pension PaymentsMichaelMorganNo ratings yet

- November 8, 2013Document10 pagesNovember 8, 2013The Delphos HeraldNo ratings yet

- Roth Conversion Strategies To ConsiderDocument5 pagesRoth Conversion Strategies To Considerkj4892No ratings yet

- TSP 536Document8 pagesTSP 536Dakota WoodwardNo ratings yet

e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat Sheet

e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat Sheet

Uploaded by

Theodore Martinez JrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat Sheet

e945qIhDTECxNwlKY1V1 2023 Retirement Planning Cheat Sheet

Uploaded by

Theodore Martinez JrCopyright:

Available Formats

2023 RETIREMENT PLANNING CHEAT SHEET

RETIREMENT PLAN LIMITS 2023 Federal Income Tax Brackets

FUNDING For Single For Married For Heads of

RETIREMENT ACCOUNT TYPE 2023 Rate Individuals Filing

DEADLINE Filers Households

Joint Returns

Traditional IRA AND Roth IRA

10% Up to $11,000 Up to $22,000 Up to $15,700

Maximum Contribution $6,500 04/15/2024

12% $11,001 to $22,001 to $89,450 $15,701 to

Catch Up Contribution (Age 50+) $1,000

$44,725 $59,850

SIMPLE IRA Plans 22% $44,726 to $89,451 to $190,750 $59,851 to

SIMPLE Contribution Limit $15,500 12/31/2023 $95,375 $95,350

Catch Up Contribution (Age 50+) $3,500 24% $95,376 to $190,751 to $364,200 $95,351 to

$182,100

$182,100

401(k), 403(b), 457

32% $182,101 to $364,201 to $462,500 $182,101 to

Elective Deferral Limit $22,500 12/31/2023 $231,250

$231,250

Catch Up Contribution (Age 50+) $7,500

35% $231,251 to $462,501 to $693,750 $231,251 to

SEP IRA $578,125 $578,100

Maximum Contribution $66,000 04/15/2024 37% $578,126 or more $693,751 or more $578,101 or more

Modified Adjusted Gross Income ( MAGI) phase-out ranges for traditional IRA deduction when one taxpayer is covered by a retirement plan at work

Filing Status 2023 Limit

Single or head of household $73,000 - $83,000

Married filing jointly (individual making contribution IS covered by workplace retirement plan) $116,000 - $136,000

Married filing jointly (individual making contribution IS NOT covered by workplace retirement plan, but spouse is) $218,000 - $228,000

MAGI phase-out ranges for Roth IRA annual contributions

Filing Status 2023 Limit

Single or head of household $138,000 - $153,000

Married filing jointly $218,000 - $228,000

REQUIRED MINIMUM DISTRIBUTIONS (RMD) 2023 Capital Gains Tax Rate Thresholds

(a) Required for the year you turn 72 Capital Taxable Income Taxable Income Taxable Income Taxable Income

Gains (Single) (Married Filing (Head of (Married Filing

(b) Based upon prior year 12/31 account balance Tax Rate Separate) Household) Jointly)

(c) First RMD can be deferred until 4/1 of the following year

0% Up to $44,625 Up to $44,625 Up to $59,750 Up to $89,254

(d) Utilize IRS life expenctancy tables

(e) Multiple IRA RMDs can be taken from one IRA 15% $41,625 to $44,625 to $59,750 to $89,250 to

$492,300 $276,900 $523,050 $553,850

(f) Multiple 401(k) accounts require an RMD from each

20% Over $492,300 Over $276,900 Over $523,050 Over $553,850

(g) Roth IRAs NOT subject RMDs

2023 Medicare Premiums

2021 MAGI Single 2021 MAGI Joint Part B Premium Part D

$97,000 or less $194,000 or less $164.90 Your plan premium

More than $97,000 up to $123,000 More than $194,000 up to $246,000 $230.80 $12.20 + your plan premium

More than $123,000 up to $153,000 More than $246,000 up to $306,000 $329.70 $31.50 + your plan premium

More than $153,000 up to $183,000 More than $306,000 up to $366,000 $428.60 $50.70 + your plan premium

More than $183,000 up to $500,000 More than $366,000 up to $750,000 $527.50 $70.00 + your plan premium

$500,000 or more $750,000 or more $560.50 $76.40 + your plan premium

youtube.com/@devincarroll

You might also like

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- ZIM 2024 Tax Reference GuideDocument7 pagesZIM 2024 Tax Reference GuideAlex MilarNo ratings yet

- Student Loan Calculator With SAVE PlanDocument34 pagesStudent Loan Calculator With SAVE PlanZach LittleNo ratings yet

- 17vs18taxbracket FinalDocument2 pages17vs18taxbracket Finalapi-426611448No ratings yet

- In Come by Zip Demographics SampleDocument20 pagesIn Come by Zip Demographics SampleJena benNo ratings yet

- Read This First:: Loan & General InfoDocument14 pagesRead This First:: Loan & General InfoJoannaNo ratings yet

- Taxes by The NumbersDocument2 pagesTaxes by The NumbersBrad StevensNo ratings yet

- Annexf 2Document5 pagesAnnexf 2SAIFUL ADIL (Art)No ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- Impairment of LoanDocument4 pagesImpairment of LoanaleywaleyNo ratings yet

- 529credit SS1Document1 page529credit SS1loristurdevantNo ratings yet

- Wise Portfolio IdeasDocument29 pagesWise Portfolio Ideasarpittripathi.bhilwaraNo ratings yet

- 2023 Tax BracketsDocument1 page2023 Tax BracketsElfawizzyNo ratings yet

- Ey Tax Rates Alberta 2023 01 15 v1Document2 pagesEy Tax Rates Alberta 2023 01 15 v1AltafNo ratings yet

- 2021 Tax Data Schedule v.3Document15 pages2021 Tax Data Schedule v.3Brian SneeNo ratings yet

- High-Income Taxpayers 2021Document2 pagesHigh-Income Taxpayers 2021Finn KevinNo ratings yet

- 2021 22 PFS Fee Waiver GuidelinesDocument3 pages2021 22 PFS Fee Waiver GuidelinesOkNo ratings yet

- Tax Foundation FF6241Document5 pagesTax Foundation FF6241muhammad mudassarNo ratings yet

- BudgetChartBook 2022 1Document128 pagesBudgetChartBook 2022 1Team USANo ratings yet

- JAYME, Marx Yuri - 2BSMA-B - PAYROLLDocument42 pagesJAYME, Marx Yuri - 2BSMA-B - PAYROLLMarx Yuri JaymeNo ratings yet

- Self Declaration Form Ay 2022-23-ArthisDocument7 pagesSelf Declaration Form Ay 2022-23-ArthisMurugesan JeevaNo ratings yet

- Costs of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionDocument6 pagesCosts of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionLogan WilsonNo ratings yet

- LIHEAP & USF Application 20212022Document10 pagesLIHEAP & USF Application 20212022kewannrodgersNo ratings yet

- Federal Budget 2021Document4 pagesFederal Budget 2021api-227304535No ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- Age Pension Age Set To Change 2023Document11 pagesAge Pension Age Set To Change 2023FrankNo ratings yet

- DivorceMate Calculation Scenarios 2Document3 pagesDivorceMate Calculation Scenarios 2bfrankln77No ratings yet

- College Station ISD Budget Update 5.21.24Document23 pagesCollege Station ISD Budget Update 5.21.24KBTXNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- Reynolds American Inc 5.85% 2045Document78 pagesReynolds American Inc 5.85% 2045jamesNo ratings yet

- Investment Calculator - SmartAssetDocument1 pageInvestment Calculator - SmartAssetSulemanNo ratings yet

- Individual Retirement Accounts - Roth IRAs 2021Document2 pagesIndividual Retirement Accounts - Roth IRAs 2021Finn KevinNo ratings yet

- Emolument Comp Report - Investment Professional, Associate Director - VP - PrincipalDocument9 pagesEmolument Comp Report - Investment Professional, Associate Director - VP - PrincipalMason DukeNo ratings yet

- Description: Tags: FitzgeraldDocument14 pagesDescription: Tags: Fitzgeraldanon-89362No ratings yet

- Rates Rebates Application Form 2023 2024 Website Version 20230607Document6 pagesRates Rebates Application Form 2023 2024 Website Version 20230607ahmedzahi964No ratings yet

- Cost Breakdown Oct. 09 PDFDocument1 pageCost Breakdown Oct. 09 PDFBreckenridge Grand Real EstateNo ratings yet

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Document6 pages(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNo ratings yet

- Rate Buydown FlyerDocument1 pageRate Buydown FlyerKen CaianiNo ratings yet

- Zoned To Shrink PresentationDocument33 pagesZoned To Shrink PresentationWVXU NewsNo ratings yet

- Mayor Chokwe Antar Lumumba's FY19 Budget PresentationDocument25 pagesMayor Chokwe Antar Lumumba's FY19 Budget Presentationthe kingfishNo ratings yet

- PPT300Document28 pagesPPT300Ram RamNo ratings yet

- Act05!2!1 Esman Giecel E.Document16 pagesAct05!2!1 Esman Giecel E.Kate ManalansanNo ratings yet

- June 7 2021 Grand Forks Mayors 2022 Budget PreviewDocument29 pagesJune 7 2021 Grand Forks Mayors 2022 Budget PreviewJoe BowenNo ratings yet

- Crosswalk CPA Review: Tax Inflation Adjustments 2021Document15 pagesCrosswalk CPA Review: Tax Inflation Adjustments 2021Adhira VenkatNo ratings yet

- Part C - Annexes To SBM FINALDocument44 pagesPart C - Annexes To SBM FINALSwadeep ChhetriNo ratings yet

- Tax Rates Ontario 2019Document2 pagesTax Rates Ontario 2019Pratik BajajNo ratings yet

- 2023 Income Tax TablesDocument5 pages2023 Income Tax TablesKhushboo GuptaNo ratings yet

- Tax Rates and Formula Sheet 2023Document7 pagesTax Rates and Formula Sheet 2023MarvinNo ratings yet

- Obama Tax Plan: New JerseyDocument2 pagesObama Tax Plan: New JerseyThe Heritage FoundationNo ratings yet

- 2023 ReturnDocument2 pages2023 ReturnLuiNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Personal Financial PlanDocument6 pagesPersonal Financial PlanThomgie TilaNo ratings yet

- 2022 Tax UpdatesDocument12 pages2022 Tax UpdatesJagmohan TeamentigrityNo ratings yet

- Bowers and Company Tax Reform PresentationDocument52 pagesBowers and Company Tax Reform PresentationWatertown Daily TimesNo ratings yet

- GcuDocument2 pagesGcuLaqueena ThompsonNo ratings yet

- Finance and Operating Lease Exercise (Solution)Document10 pagesFinance and Operating Lease Exercise (Solution)Emnet AbNo ratings yet

- CTC ReconciliationDocument4 pagesCTC ReconciliationLaxman GandiNo ratings yet

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDocument3 pagesTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNo ratings yet

- WSJ Tax - Guide - 2023Document75 pagesWSJ Tax - Guide - 2023JoeNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- 2018 Financial Planning Challenge Case Study PDFDocument7 pages2018 Financial Planning Challenge Case Study PDFakashNo ratings yet

- Rollover ChartDocument1 pageRollover Chartsanjeev thadaniNo ratings yet

- 1040 Income Tax PreparationsDocument328 pages1040 Income Tax Preparationsej129100% (2)

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiNo ratings yet

- Disclaimer - : This Spreadsheet Is FreeDocument218 pagesDisclaimer - : This Spreadsheet Is FreePaul BischoffNo ratings yet

- 13 Steps To Investing FoolishlyDocument33 pages13 Steps To Investing FoolishlyadikesaNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- How To Budget Your Money - The 50-20-30 GuidelineDocument7 pagesHow To Budget Your Money - The 50-20-30 GuidelineAndrew Peter100% (1)

- Account Transfer Form: Fax Cover SheetDocument6 pagesAccount Transfer Form: Fax Cover SheetJitendra SharmaNo ratings yet

- Charles Schwab Investments Distribution Form Oct 27..2015Document10 pagesCharles Schwab Investments Distribution Form Oct 27..2015andyNo ratings yet

- FIN 345 - Week 16 - Chap 21 & 22 + Investing Insights-1Document21 pagesFIN 345 - Week 16 - Chap 21 & 22 + Investing Insights-1RhomNo ratings yet

- Nalc Cca Retirement Savings Plan MbaDocument2 pagesNalc Cca Retirement Savings Plan Mbaapi-367316623No ratings yet

- Retirement WorksheetDocument55 pagesRetirement WorksheetRich AbuNo ratings yet

- Essentials of Financial Planning 1: Provided by Liberty University Digital CommonsDocument33 pagesEssentials of Financial Planning 1: Provided by Liberty University Digital CommonsTung TaNo ratings yet

- MC 0623Document10 pagesMC 0623mcchronicleNo ratings yet

- Garvin County Icw Print 2Document1 pageGarvin County Icw Print 2Price LangNo ratings yet

- Chasity D EnglishDocument7 pagesChasity D EnglishbpspillkillNo ratings yet

- DH 0429Document14 pagesDH 0429The Delphos HeraldNo ratings yet

- Retirement Topics - IRA Contribution LimitsDocument3 pagesRetirement Topics - IRA Contribution LimitsSriniNo ratings yet

- Ch20 Taxes, Inflation, and Investment StrategyDocument22 pagesCh20 Taxes, Inflation, and Investment StrategyA_StudentsNo ratings yet

- 21 - 1040 (Forecast)Document153 pages21 - 1040 (Forecast)cjNo ratings yet

- Chapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageDocument6 pagesChapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageVotues PSNo ratings yet

- Questionnaire For 2018 Tax Returns: Worksheets AvailableDocument7 pagesQuestionnaire For 2018 Tax Returns: Worksheets Availableparesh shiralNo ratings yet

- Allocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositDocument4 pagesAllocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositJahe FameNo ratings yet

- Solutions ME Chapter 1Document7 pagesSolutions ME Chapter 1Puji Hikmah100% (3)

- Direct Rollover and Withholding Form For Lump Sum Pension PaymentsDocument5 pagesDirect Rollover and Withholding Form For Lump Sum Pension PaymentsMichaelMorganNo ratings yet

- November 8, 2013Document10 pagesNovember 8, 2013The Delphos HeraldNo ratings yet

- Roth Conversion Strategies To ConsiderDocument5 pagesRoth Conversion Strategies To Considerkj4892No ratings yet

- TSP 536Document8 pagesTSP 536Dakota WoodwardNo ratings yet