Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsEntries 1

Entries 1

Uploaded by

DreahCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Casos de Ajuste.Document9 pagesCasos de Ajuste.Alguien algunoNo ratings yet

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersDocument10 pagesAUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersVincent Larrie MoldezNo ratings yet

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Exercises II - Adjusting TransactionsDocument2 pagesExercises II - Adjusting TransactionsJowjie TV80% (5)

- Aud Prob - 2nd PreboardDocument13 pagesAud Prob - 2nd PreboardKim Cristian MaañoNo ratings yet

- Solution To Worksheet - Modified-2Document25 pagesSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Notes Adjusting EntriesDocument14 pagesNotes Adjusting EntriesGelesabeth Garcia100% (1)

- Completion of Accounting CycleDocument12 pagesCompletion of Accounting Cycleeater PeopleNo ratings yet

- Whatever - Ciclo ContableDocument6 pagesWhatever - Ciclo ContablemillionextupNo ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Answer Key - Quizzer On AJEDocument2 pagesAnswer Key - Quizzer On AJEClarissa De GuzmanNo ratings yet

- Pract 1 - Exam1Document8 pagesPract 1 - Exam1MimiNo ratings yet

- Financial Accounting Week 4Document7 pagesFinancial Accounting Week 4chapmanalexis73No ratings yet

- Chapter 3 Exercises SolutionDocument5 pagesChapter 3 Exercises SolutionNguyen Huong Huyen (K15 HL)No ratings yet

- 2nd Quiz Aud ProbDocument4 pages2nd Quiz Aud ProbJohn Patrick Lazaro AndresNo ratings yet

- Mock 1 Mid-Term Exam AcountabilityDocument6 pagesMock 1 Mid-Term Exam AcountabilityJhon WickNo ratings yet

- NFJPIA Mockboard 2011 P1 PDFDocument9 pagesNFJPIA Mockboard 2011 P1 PDFLei LucasNo ratings yet

- 5&6Document2 pages5&6syraNo ratings yet

- Cash and AccrualDocument1 pageCash and AccrualGloria BeltranNo ratings yet

- Problem: Echon - Dizon - TuazonDocument12 pagesProblem: Echon - Dizon - TuazonChela Nicole EchonNo ratings yet

- C) D e P R e C I A T I o N o F F I X e D A S S e T SDocument17 pagesC) D e P R e C I A T I o N o F F I X e D A S S e T SMohamed ZizoNo ratings yet

- Mock 1 Mid-Term Exam (Answers and Explanations)Document8 pagesMock 1 Mid-Term Exam (Answers and Explanations)100519554No ratings yet

- FAR ModuleDocument6 pagesFAR ModuleFannilyn Florentino GonzalesNo ratings yet

- 1st AssignmentDocument12 pages1st AssignmentAnonymous f7wV1lQKRNo ratings yet

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Answers To Handout 1 Financial AccountingDocument40 pagesAnswers To Handout 1 Financial AccountingMohand ElbakryNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- NFJPIA - Mockboard 2011 - APDocument12 pagesNFJPIA - Mockboard 2011 - APHazel Iris CaguinginNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- (ACCT2010) (2017) (F) Midterm In5mue0 38655Document4 pages(ACCT2010) (2017) (F) Midterm In5mue0 38655Pak HoNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocument10 pagesResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- On November 1 2017 The Account Balances of Pine EquipmentDocument2 pagesOn November 1 2017 The Account Balances of Pine EquipmentDoreenNo ratings yet

- Exercise 4Document17 pagesExercise 4LoyalNamanAko LLNo ratings yet

- Assess II Act CreatingDocument15 pagesAssess II Act CreatingBrian GoNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaNo ratings yet

- Accounting VacationDocument28 pagesAccounting VacationPro NdebeleNo ratings yet

- Accounting Adjusting EntriesDocument6 pagesAccounting Adjusting EntriescamilleNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFaizaNo ratings yet

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- Act110 Activity 9Document7 pagesAct110 Activity 9Kilwa DyNo ratings yet

- Nfjpia Mockboard 2011 p1 With Answers PDF FreeDocument12 pagesNfjpia Mockboard 2011 p1 With Answers PDF FreeBea GarciaNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Seminar3 Accrual Accounting and IncomeDocument4 pagesSeminar3 Accrual Accounting and IncomeThomas ShelbyNo ratings yet

- CH 04Document9 pagesCH 04Antonios FahedNo ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- QuestionsDocument80 pagesQuestionsjoshuaNo ratings yet

- Electivem2 Midterm Requirement LaraDocument4 pagesElectivem2 Midterm Requirement LaraWinnie LaraNo ratings yet

- Acctg 100C 08Document2 pagesAcctg 100C 08Maddie ManganoNo ratings yet

- Tibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRDocument33 pagesTibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRjoshuaNo ratings yet

Entries 1

Entries 1

Uploaded by

Dreah0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

entries 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageEntries 1

Entries 1

Uploaded by

DreahCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

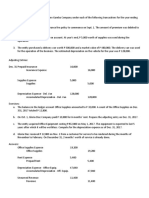

On December 31, 2015, prepare the necessary adjusting entries for

Red Carpet Company:

a) Depreciation of office equipment, P 11,800

Depreciation expense-office equipment 11,800

Accumulated Depreciation 11,800

To record depreciation expense on office equip.

b) The Unearned Rent account at December 31 is P 10,500 representing the

receipt of an advance on December 1, of five months' rent from tenants.

Rent Income 2,100

Unearned Rent Income 2,100

10,500*1/5= 2,100

c) To record rent that already earned Fees

accrued but unbilled at December 31, amounted to P 20,000.

Fees receivable 20,000

Fees earned 20,000

To record accrued fees earned.

d) Salaries accrued but not paid at December 31, amounted to P 5,000

Salaries expense 5,000

Salaries payable 5,000

To record accrued salaries payable

e) The Supplies Expense account balance on December 31, amounted to P 4,000. The

supplies on hand on December 31, amounted to P 1,000

Supplies 1,000

Supplies Expense 1,000

To record supplies not consumed

You might also like

- Casos de Ajuste.Document9 pagesCasos de Ajuste.Alguien algunoNo ratings yet

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersDocument10 pagesAUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersVincent Larrie MoldezNo ratings yet

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Exercises II - Adjusting TransactionsDocument2 pagesExercises II - Adjusting TransactionsJowjie TV80% (5)

- Aud Prob - 2nd PreboardDocument13 pagesAud Prob - 2nd PreboardKim Cristian MaañoNo ratings yet

- Solution To Worksheet - Modified-2Document25 pagesSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Notes Adjusting EntriesDocument14 pagesNotes Adjusting EntriesGelesabeth Garcia100% (1)

- Completion of Accounting CycleDocument12 pagesCompletion of Accounting Cycleeater PeopleNo ratings yet

- Whatever - Ciclo ContableDocument6 pagesWhatever - Ciclo ContablemillionextupNo ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Answer Key - Quizzer On AJEDocument2 pagesAnswer Key - Quizzer On AJEClarissa De GuzmanNo ratings yet

- Pract 1 - Exam1Document8 pagesPract 1 - Exam1MimiNo ratings yet

- Financial Accounting Week 4Document7 pagesFinancial Accounting Week 4chapmanalexis73No ratings yet

- Chapter 3 Exercises SolutionDocument5 pagesChapter 3 Exercises SolutionNguyen Huong Huyen (K15 HL)No ratings yet

- 2nd Quiz Aud ProbDocument4 pages2nd Quiz Aud ProbJohn Patrick Lazaro AndresNo ratings yet

- Mock 1 Mid-Term Exam AcountabilityDocument6 pagesMock 1 Mid-Term Exam AcountabilityJhon WickNo ratings yet

- NFJPIA Mockboard 2011 P1 PDFDocument9 pagesNFJPIA Mockboard 2011 P1 PDFLei LucasNo ratings yet

- 5&6Document2 pages5&6syraNo ratings yet

- Cash and AccrualDocument1 pageCash and AccrualGloria BeltranNo ratings yet

- Problem: Echon - Dizon - TuazonDocument12 pagesProblem: Echon - Dizon - TuazonChela Nicole EchonNo ratings yet

- C) D e P R e C I A T I o N o F F I X e D A S S e T SDocument17 pagesC) D e P R e C I A T I o N o F F I X e D A S S e T SMohamed ZizoNo ratings yet

- Mock 1 Mid-Term Exam (Answers and Explanations)Document8 pagesMock 1 Mid-Term Exam (Answers and Explanations)100519554No ratings yet

- FAR ModuleDocument6 pagesFAR ModuleFannilyn Florentino GonzalesNo ratings yet

- 1st AssignmentDocument12 pages1st AssignmentAnonymous f7wV1lQKRNo ratings yet

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Answers To Handout 1 Financial AccountingDocument40 pagesAnswers To Handout 1 Financial AccountingMohand ElbakryNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- NFJPIA - Mockboard 2011 - APDocument12 pagesNFJPIA - Mockboard 2011 - APHazel Iris CaguinginNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- (ACCT2010) (2017) (F) Midterm In5mue0 38655Document4 pages(ACCT2010) (2017) (F) Midterm In5mue0 38655Pak HoNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocument10 pagesResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- On November 1 2017 The Account Balances of Pine EquipmentDocument2 pagesOn November 1 2017 The Account Balances of Pine EquipmentDoreenNo ratings yet

- Exercise 4Document17 pagesExercise 4LoyalNamanAko LLNo ratings yet

- Assess II Act CreatingDocument15 pagesAssess II Act CreatingBrian GoNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaNo ratings yet

- Accounting VacationDocument28 pagesAccounting VacationPro NdebeleNo ratings yet

- Accounting Adjusting EntriesDocument6 pagesAccounting Adjusting EntriescamilleNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFaizaNo ratings yet

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- Act110 Activity 9Document7 pagesAct110 Activity 9Kilwa DyNo ratings yet

- Nfjpia Mockboard 2011 p1 With Answers PDF FreeDocument12 pagesNfjpia Mockboard 2011 p1 With Answers PDF FreeBea GarciaNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Seminar3 Accrual Accounting and IncomeDocument4 pagesSeminar3 Accrual Accounting and IncomeThomas ShelbyNo ratings yet

- CH 04Document9 pagesCH 04Antonios FahedNo ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- QuestionsDocument80 pagesQuestionsjoshuaNo ratings yet

- Electivem2 Midterm Requirement LaraDocument4 pagesElectivem2 Midterm Requirement LaraWinnie LaraNo ratings yet

- Acctg 100C 08Document2 pagesAcctg 100C 08Maddie ManganoNo ratings yet

- Tibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRDocument33 pagesTibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRjoshuaNo ratings yet