Professional Documents

Culture Documents

Internet - Shelter Against Mounting Competition and Soft Momentum During Summer Holiday

Internet - Shelter Against Mounting Competition and Soft Momentum During Summer Holiday

Uploaded by

davidhblimCopyright:

Available Formats

You might also like

- Newzoo Global Games Market Report May 2023 UpdateDocument33 pagesNewzoo Global Games Market Report May 2023 UpdateSao224No ratings yet

- Jeffrey Jones 7.9Document28 pagesJeffrey Jones 7.9Walt Morton100% (4)

- Maps of Singapore Ports (PSA)Document5 pagesMaps of Singapore Ports (PSA)Anawma94% (18)

- Vibe Songs Bill MolenhofDocument26 pagesVibe Songs Bill MolenhofStefanodeRosa100% (5)

- Blizzard Entertainment - SWOT & PEST AnalysisDocument5 pagesBlizzard Entertainment - SWOT & PEST AnalysisShayne Rotte100% (7)

- Ubisoft Swot AnalysisDocument10 pagesUbisoft Swot AnalysisAkash MandalNo ratings yet

- Whitepaper 2021: Classified - ConfidentialDocument35 pagesWhitepaper 2021: Classified - ConfidentialPaulo Vitor Ozela100% (1)

- Company:-: Zeta Inc. (IP Based Game Operator and Publisher in China)Document2 pagesCompany:-: Zeta Inc. (IP Based Game Operator and Publisher in China)Shilpi KumariNo ratings yet

- Internship Report Fill EditedDocument35 pagesInternship Report Fill EditedSushil PrajapatNo ratings yet

- Game Industry ReportDocument38 pagesGame Industry ReportJosephNo ratings yet

- 2024 - Newzoo - PC & Console Gaming ReportDocument46 pages2024 - Newzoo - PC & Console Gaming ReportCostiReduxNo ratings yet

- Ea SportDocument18 pagesEa Sportevasoro52No ratings yet

- SuperData 2020 Year in ReviewDocument23 pagesSuperData 2020 Year in ReviewezequielvilaNo ratings yet

- Tencent Games Strategy 2020Document15 pagesTencent Games Strategy 2020Kevin TroyNo ratings yet

- Wwvgforecaststoc dfc318Document5 pagesWwvgforecaststoc dfc318SILPA SNo ratings yet

- Insights After Rain Comes Sunshine PDFDocument63 pagesInsights After Rain Comes Sunshine PDFNgo TungNo ratings yet

- Ubisoft FY23 EarningsDocument15 pagesUbisoft FY23 EarningsthevikfesNo ratings yet

- What NiggaDocument106 pagesWhat NiggaAmrith PereraNo ratings yet

- PMK Indi 2Document9 pagesPMK Indi 2Siempre Amor deNo ratings yet

- Activision UpdateDocument14 pagesActivision Updatehapho90No ratings yet

- SWOT AnalysisDocument10 pagesSWOT AnalysisBolt MaNo ratings yet

- Ampere Analysis Global Games Market Forecast To Decline in 2022 050722Document4 pagesAmpere Analysis Global Games Market Forecast To Decline in 2022 050722mo moNo ratings yet

- 3008大立光 1130412 JPMDocument16 pages3008大立光 1130412 JPMgradeeagleNo ratings yet

- Full Year 2022 and Themes For 2023Document120 pagesFull Year 2022 and Themes For 2023KhôiMinhTrươngNo ratings yet

- Singapore GamingDocument12 pagesSingapore GamingJunyuanNo ratings yet

- 2021 Newzoo Trends To Watch ReportDocument23 pages2021 Newzoo Trends To Watch ReportLuNo ratings yet

- Netease Games Strategy 2020Document17 pagesNetease Games Strategy 2020Kevin TroyNo ratings yet

- State of The Game Industry 2022Document31 pagesState of The Game Industry 2022mrfixNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market ReportGotchu BroNo ratings yet

- Tencent: China / Hong Kong Company GuideDocument11 pagesTencent: China / Hong Kong Company GuideAnton CastilloNo ratings yet

- SuperData 2019 Year in Review PDFDocument23 pagesSuperData 2019 Year in Review PDFAna Valeria RodriguezNo ratings yet

- Changing Game MarketDocument22 pagesChanging Game MarketQuang Anh LeNo ratings yet

- North West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Document11 pagesNorth West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Nam VoNo ratings yet

- Proyecto Atvi - NtesDocument20 pagesProyecto Atvi - NtesAlejandro100% (1)

- Sgi GDC2024Document37 pagesSgi GDC2024GabrielNo ratings yet

- Monthly Market Insights 2023 11Document17 pagesMonthly Market Insights 2023 11Hưng NguyễnNo ratings yet

- Activision Blizzard - Henry FundDocument37 pagesActivision Blizzard - Henry FundKsl VajralaNo ratings yet

- Raport ChinskiRynekGier 2023 ENDocument33 pagesRaport ChinskiRynekGier 2023 ENremremremremlamlamNo ratings yet

- Internship ReportDocument39 pagesInternship ReportSushil PrajapatNo ratings yet

- Analysis of Pokemons Positive Impact On The EconoDocument5 pagesAnalysis of Pokemons Positive Impact On The Econo09.vicente.sotoNo ratings yet

- 2023 - Newzoo - PC & Console Gaming ReportDocument58 pages2023 - Newzoo - PC & Console Gaming ReportLola AdenizNo ratings yet

- Nikolay Spasov - Blizzard CaseDocument20 pagesNikolay Spasov - Blizzard CaseAnonymous aQxrL6B1No ratings yet

- Case 2 Data Sheet GamingDocument4 pagesCase 2 Data Sheet GamingpriyaNo ratings yet

- Ey TMT Gaming Metaverse Report FinalDocument16 pagesEy TMT Gaming Metaverse Report FinalnikhilNo ratings yet

- Was Sony's Launch of The PS5 in 2020 Successful?: Business Management SL IA Word Count: 1492 Index Number: 60416Document30 pagesWas Sony's Launch of The PS5 in 2020 Successful?: Business Management SL IA Word Count: 1492 Index Number: 60416John JeffersonNo ratings yet

- Toys and Games in Canada - Analysis: Country Report - Jun 2019Document2 pagesToys and Games in Canada - Analysis: Country Report - Jun 2019Martin Elias Prasca GutierrezNo ratings yet

- Sony PlayStation Vita: Mobile Console vs. Cellphone-Based Gaming Market 2012-2017Document4 pagesSony PlayStation Vita: Mobile Console vs. Cellphone-Based Gaming Market 2012-2017Kabir AhmadNo ratings yet

- D20150512042213ubisoft Fy15 Slides Conf Call Finaltcm99202524Document23 pagesD20150512042213ubisoft Fy15 Slides Conf Call Finaltcm99202524PaulMcgraniteNo ratings yet

- Study Id39310 Video-Games@t9.2022Document47 pagesStudy Id39310 Video-Games@t9.2022badboybluefcNo ratings yet

- A Brief On The Global Market of 3D PC GamesDocument11 pagesA Brief On The Global Market of 3D PC Gamesapi-3856333No ratings yet

- R MarkdownDocument18 pagesR Markdownarnav mauryaNo ratings yet

- Blockchain Technology in GamingDocument25 pagesBlockchain Technology in GamingashwindokeNo ratings yet

- MBA Manecon Individual Assignment 9Document2 pagesMBA Manecon Individual Assignment 9Yasir TanveerNo ratings yet

- Market Research ReportDocument13 pagesMarket Research ReportErasmo Nuñez BaezaNo ratings yet

- PwC@How Telco Can Win With GamingDocument24 pagesPwC@How Telco Can Win With GamingbadboybluefcNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market Reportbrunobueno.lmNo ratings yet

- Nazara Technologies (NAZARA IN) : Rating: BUY - CMP: Rs1,794 - TP: Rs2,342Document40 pagesNazara Technologies (NAZARA IN) : Rating: BUY - CMP: Rs1,794 - TP: Rs2,342QUALITY12No ratings yet

- Newzoo 2016 Global Games Market ReportDocument6 pagesNewzoo 2016 Global Games Market ReportcachocachudoNo ratings yet

- WORD TAREA ACADEMICA 1 IncompletoDocument6 pagesWORD TAREA ACADEMICA 1 IncompletoAndres FuentesNo ratings yet

- かなはまあら、Document3 pagesかなはまあら、Hiro MNo ratings yet

- Careers in Focus: Computer and Video Game Design, Third EditionFrom EverandCareers in Focus: Computer and Video Game Design, Third EditionNo ratings yet

- Break Into The Game Industry: How to Get A Job Making Video GamesFrom EverandBreak Into The Game Industry: How to Get A Job Making Video GamesNo ratings yet

- Market Tremors: Quantifying Structural Risks in Modern Financial MarketsFrom EverandMarket Tremors: Quantifying Structural Risks in Modern Financial MarketsNo ratings yet

- There - S Nothing Easy About Giving Up - Natsuki Subaru - S ...Document4 pagesThere - S Nothing Easy About Giving Up - Natsuki Subaru - S ...shubhamNo ratings yet

- Enchanting EvilDocument2 pagesEnchanting EvilJodie NgNo ratings yet

- Giffyglyphs Quick Quest LatestDocument3 pagesGiffyglyphs Quick Quest Latestpretubreu estúdio criativoNo ratings yet

- Osprey - Men-At-Arms - 083 - 1978 - Napoleon's Guard Cavalry (Repr. 1994, OCR)Document50 pagesOsprey - Men-At-Arms - 083 - 1978 - Napoleon's Guard Cavalry (Repr. 1994, OCR)Manuelaxa100% (11)

- Elx200-10p BDL enDocument3 pagesElx200-10p BDL enOsama YaseenNo ratings yet

- Y CF Catalogue 2021 BD DefDocument140 pagesY CF Catalogue 2021 BD Defjesus lopezNo ratings yet

- Naava Nabagesera On The Road With Andrew WommackDocument2 pagesNaava Nabagesera On The Road With Andrew WommackNaava NabageseraNo ratings yet

- Atmel 42702 Image Sensor Interface in SAM V7 E7 S7 Devices - ApplicationNote - AT12861 PDFDocument21 pagesAtmel 42702 Image Sensor Interface in SAM V7 E7 S7 Devices - ApplicationNote - AT12861 PDFMarcel BlinduNo ratings yet

- Rune Keeper GuideDocument101 pagesRune Keeper Guidemctrustry100% (1)

- EyePad Mini InstructionsDocument3 pagesEyePad Mini InstructionsTre Kadabra TesteNo ratings yet

- ACN Micro Project-1Document23 pagesACN Micro Project-1ashutosh dudhaneNo ratings yet

- Athletics 123123Document7 pagesAthletics 123123Ton TonNo ratings yet

- Angelica The RoverDocument1 pageAngelica The RoverStudent Malena García MorenoNo ratings yet

- Argumentative Essay Paying College AthletesDocument7 pagesArgumentative Essay Paying College Athletesapi-430924181100% (1)

- CFC YFC SongbookDocument129 pagesCFC YFC Songbookjhasonify100% (1)

- The Story of The Smart ParrotDocument8 pagesThe Story of The Smart ParrotHerlinawatiNo ratings yet

- Spaceship Part 12 - GTA 5 Guide - IGNDocument1 pageSpaceship Part 12 - GTA 5 Guide - IGNJames GaleNo ratings yet

- Institución Educativa Técnico Cristo ReyDocument21 pagesInstitución Educativa Técnico Cristo ReyHenao JohaNo ratings yet

- Add or Edit Text & Images - Sites HelpDocument5 pagesAdd or Edit Text & Images - Sites HelpDoddy IsmunandarNo ratings yet

- The Enjoyment of Music Thirteenth Edition 13Th Edition Full ChapterDocument41 pagesThe Enjoyment of Music Thirteenth Edition 13Th Edition Full Chapterjonathan.creek822100% (25)

- UplayDocument43 pagesUplayLéo RibeiroNo ratings yet

- OpenShift Virtualization - Technical OverviewDocument74 pagesOpenShift Virtualization - Technical OverviewFrancisco EspositoNo ratings yet

- AWS Machine LearningDocument16 pagesAWS Machine LearningVikas kumar singhNo ratings yet

- Cheer DanceDocument18 pagesCheer Danceashleyeoj12No ratings yet

- RMD 574BT / RMD 574 Manual: EnglishDocument16 pagesRMD 574BT / RMD 574 Manual: EnglishIgnasi Riba GallardoNo ratings yet

- Network Design Assignment Help - Computer Network Assignment HelpDocument4 pagesNetwork Design Assignment Help - Computer Network Assignment HelpComputer Network Assignment HelpNo ratings yet

- CR-Casltlevania Quest (Final)Document20 pagesCR-Casltlevania Quest (Final)Joshua BumpusNo ratings yet

Internet - Shelter Against Mounting Competition and Soft Momentum During Summer Holiday

Internet - Shelter Against Mounting Competition and Soft Momentum During Summer Holiday

Uploaded by

davidhblimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internet - Shelter Against Mounting Competition and Soft Momentum During Summer Holiday

Internet - Shelter Against Mounting Competition and Soft Momentum During Summer Holiday

Uploaded by

davidhblimCopyright:

Available Formats

R e g i o n a l M o r n i n g N o t e s Wednesday, 19 June 2024

SECTOR UPDATE MARKET WEIGHT

Internet – China (Maintained)

Shelter Against Mounting Competition And Soft Momentum During Summer Holiday

We expect a lukewarm 2Q24 and 3Q24, with mobile grossing growth expected to SECTOR PICKS

reaccelerate gradually in 4Q24, primarily due to soft grossing momentum during the Share Target

Company Ticker Rec Price Price

summer holiday ahead amid mounting competition. We opine that the growth of the (HK$) (HK$)

online games sector in 2024 will be fuelled by: a) normalised industry development with Tencent 700 HK BUY 381.4 454

regular issuance of game licences, b) consolidation of top game producers, and c) a Source: UOB Kay Hian

promising pipeline of blockbuster games. Maintain MARKET WEIGHT.

WHAT’S NEW

• Overview of grossing in 2Q24. According to Gamma Data, China's game grossing

dropped 4.2% mom and 0.3% yoy to Rmb22.4b in Apr24. This was mainly due to a decline

in mobile game grossing, but supported by client-based game grossing growth of 2.1%

mom and 1.5% yoy to Rmb5.6b, which was primarily contributed by cross-platform

products. The grossing of Chinese self-developed games in the overseas market dipped

0.7% mom but grew 7% yoy to US$1.4b in Apr 24, stemming from contribution of new

games. According to Sensor Tower, 40 Chinese publishers made it to the top 100 global

mobile game publishers by grossing in May 24, collectively generating US$2.11b

(Rmb15.352b) and accounting for 39.7% of the total revenue of the top 100 global mobile

game publishers. We expect the online games sector to be highly competitive throughout

2024, particularly during the summer holiday.

• Tencent: Grossing reaching an inflection point due to rejuvenation of evergreen

games. We expect Tencent's 2Q24 game revenue to report a reaccelerated growth of

5.5% yoy (vs -1.4% in 1Q24). Tencent reiterated a stable game regulatory environment,

with minor protection measures fully in place. Evergreen games including Supercell key

titles Clash Royale and Clash of Clans saw their grossing double after a successful

revitalisation. Brawl Stars’ grossing has quadrupled, while PUBG mobile has reached an

initial grossing inflection point which should be followed by a more profound growth moving

into FY25 due to a long deferral period.

Mini games saw rapid growth and high margin contribution while mini games with more

than three years' lifecycle also delivered solid growth. DnF mobile was launched on 21

May and topped domestic iPhone grossing rankings in the fourth week after its launch.

DnF has become the most commercially successful game in the domestic iOS market and

has surpassed the combined revenue of Honor of Kings and Peacekeeper Elite for the

past four weeks. This success contributed to a 12% mom growth in Tencent's mobile

game revenue in May. We estimate grossing of Rmb15b or an 11% incremental mobile

revenue contribution in the first 12 months.

• Netease: Adjustments to legacy desktop game Fantasy Westward Journey (FWJ).

We forecast Netease's 2Q24/2024 game revenue to rise 11%/11% yoy mainly on a better

contribution from its legacy title, FWJ, following strategic adjustments that aim to limit

professional gamers and enhance the in-game ecosystem. We believe these adjustments

will help the nearly two-decade-old PC version of FWJ maintain its popularity despite ANALYST(S)

short-term fluctuations in revenue. Recent feedback from ordinary gamers indicates high

Julia Pan

loyalty to FWJ, which serves not only as an online entertainment platform but also as a

+8621 5404 7225 ext 808

community where they regularly connect with friends met through the game. On 17 June, juliapan@uobkayhian.com

Netease’s self-developed top-down action MMORPG Nightmare Breaker ceased

operations after being online for three years. We believe the market has overpriced in the Soong Ming San

soft performance of FWJ. Based on the solid 1Q24 deferred revenue growth of 14% yoy, +603 21471912

we believe 2Q24 game revenue growth could exceed the market’s bearish expectation. mingsan@uobkayhian.com

PEER COMPARISON

Company Tickers Rec Price @ Target Upside/ Market ------------- PE -------------- -------- EV/EBITDA ------- ---------- EV/Sales -------- ROE

17 Jun 24 Price (Downside) Cap 2024F 2025F 2026F 2024F 2025F 2026F 2024F 2025F 2026F 2024F

(lcy (lcy) to TP (%) (lcy m) (x) (x) (x) (x) (x) (x) (x) (x) (x) (%)

Tencent 700 HK BUY 381.4 454 19.0 3,587,788 17.2 15.3 13.6 13.4 12.0 11.0 5.0 4.6 4.2 16.1

Netease 9999 HK BUY 145.2 180 24.0 468,235 13.0 12.2 11.4 9.4 8.4 7.7 2.9 2.7 2.5 25.7

Source: Bloomberg, UOB Kay Hian

Refer to last page for important disclosures. 1

R e g i o n a l M o r n i n g N o t e s Wednesday, 19 June 2024

STOCK IMPACT TENCENT 12-MONTH FORWARD PE BAND

50

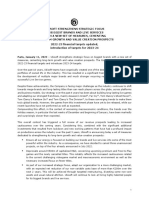

• Overview of NPPA game approval. On 20 May 24, the National Press and Publication 45

(x)

+1std

40

Administration (NPPA) issued the fifth batch of approvals for 2024, with 96 Banhao for 35

30

domestic games in May 24 vs the 95/107/111 approvals in April/March/February 25 Mean=26x

20 -1std

respectively. Among the 96 new game approvals, six were for mobile and client cross- 15

10

platform games, the remaining 90 were for mobile games (including 39 casual puzzle

games). To date, 61 licences have been issued for imported games including the recent 15 1yr forward PE -1 Std Dev Mean +1 Std Dev

new games on 5 June that include three switch games - Pokémon Let's Go, Pikachu!, Source: Bloomberg, UOB Kay Hian

Super Mario 3D World + Bowser's Fury, and Daemon X Machina, as well as the PC game NETEASE 12-MONTH FORWARD PE BAND

Black Desert. Ytd, Tencent and Netease have received three and two licence approvals for

(x)

domestic games respectively. All in all, these indicate a continuous positive regulatory 40

environment which will foster solid monetisation for both companies. 35

30

• Upcoming pipeline appears promising. a) Tencent's upcoming domestic games 25 +1 std

launches include Need For Speed, an open world car racing, which will commence a 20 Mean=15.4x

15

public beta on all platforms starting 11 July. The game is developed by Tencent's TiMi -1 std

10

Studio and officially licensed by EA and boasts a vast "100m sqm open world". Other 5

games in the pipeline include Tarisland as a MMORPG, Delta Force as an FPS and One

Piece: Ambition, an action game. On 11 June, Tencent and Riot Games released the first 1yr forward PE -1 Std Dev

official teaser for the second season of League of Legends: Arcane and is set to launch in Mean +1 Std Dev

Source: Bloomberg, UOB Kay Hian

Nov 24. Valorant Mobile also received an imported game licence on 5 June and is a

medium-term pipeline while Path of Exile 2 is an international games pipeline. b) Netease

is set to re-launch Blizzard's games in China, starting with World of Warcraft (WoW) with a

projected official release in China in July. Prior to the temporary exit in Jan 23, Blizzard's

games contributed a low-teens to Netease's PC game revenue. We are optimistic about

Netease's upcoming titles, Where Winds Meet PC and mobile Naraka Bladepoint. Both are

expected to be launched in July and have strong potential to become hit titles.

EARNINGS REVISION/RISK

• We leave our forecasts largely unchanged.

VALUATION/RECOMMENDATION

• Maintain BUY on Tencent Holdings (700 HK) with a target price of HK$454.00 as we

assigned SOTP valuation multiples on online game/social networking/online ad at

18x/20x/20x respectively. Tencent is confident about its mini-game development and

expects the upcoming new game licence approval to stimulate further innovation. Our

target price implies 20x 2024F PE. Tencent is trading at attractive 15x 2024-25F PE, below

its historical mean of 26x.

• Maintain BUY on Netease Inc (9999 HK) with a target price of HK$180.00

(US$115.00), in view of the disappointing results generated by Legend of the Condor

Heroes upon its release. We remain cautiously optimistic and expect solid top-line growth

recovery from the return of Blizzard games. Our target price implies 15x 2024-25F PE. The

company is currently trading at 12.5x 2024F PE, against its historical mean of 15.4x.

SECTOR CATALYST AND RISK

• Catalysts: a) Increasing user stickiness, b) continued improvement in the number of

paying users, and c) launch of new game genres and expansion packs.

• Risks: a) Regulatory changes (ie further restriction on time/money spent), and b) fewer

players trying to gain market share via unconventional distribution channels.

Refer to last page for important disclosures. 2

R e g i o n a l M o r n i n g N o t e s Wednesday, 19 June 2024

NPPA BANHAO APPROVALS

800 China game license approval volume monthly trend

749

727

700

600

Game approvals 102 new game approvals per month

506 suspended for 8 on average since the new Banhao Game approvals Banhao approval back to

500 months since Apr- review policy in April 2019 until July suspended for 8 months pre-suspension level in

18 2021 since Aug-21 2021 since Dec-22

400

283 279

300 263

191 188

200 164 163 169

147

130 131

124

112 106 101110109 117116 129 129

112 113 121

105 111 95111

87 85 84 8686 87 87 86868988 898787

100 55

71

54 67 60676973 70

40 45 45

22 31

0

Mar-18

Mar-19

Mar-20

Mar-21

Mar-22

Mar-23

Mar-24

Sep-18

Sep-19

Sep-20

Sep-21

Sep-22

Sep-23

Jan-18

May-18

Nov-18

Jan-19

May-19

Nov-19

Jan-20

May-20

Nov-20

Jan-21

May-21

Nov-21

Jan-22

May-22

Nov-22

Jan-23

May-23

Nov-23

Jan-24

May-24

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Jul-23

Source: NPPA, UOB Kay Hian

ONLINE GAME COMPANIES

Price Market -------------- PE --------------- --------- EV/EBITDA -------- ----------- EV/Sales --------- ROE

Company Tickers Currency Year End 17 Jun 24 Cap 2024F 2025F 2026F 2024F 2025F 2026F 2024F 2025F 2026F 2024F

(lcy) (lcy m) (x) (x) (x) (x) (x) (x) (x) (x) (x) (%)

HK-listed Chinese Internet & game companies

Tencent 700 HK HKD 12/2023 381.4 3,587,788 17.2 15.3 13.6 13.4 12.0 11.0 5.0 4.6 4.2 16.1

Netease 9999 HK HKD 12/2023 145.2 468,235 13.0 12.2 11.4 9.4 8.4 7.7 2.9 2.7 2.5 25.7

Kingsoft Corp 3888 HK HKD 12/2023 25.2 33,747 26.5 20.2 16.7 5.6 4.6 3.9 1.7 1.4 1.2 2.8

IGG 799 HK HKD 12/2023 3.0 3,511 6.6 6.5 4.4 4.1 4.7 1.8 0.4 0.4 0.4 2.7

Netdragon 777 HK HKD 12/2023 12.4 6,609 6.1 5.2 4.7 3.0 2.6 2.3 0.7 0.7 0.7 8.6

Bilibili 9626 HK HKD 12/2023 117.6 49,540 n.a. 45.6 23.1 47.1 17.7 15.1 1.5 1.3 1.2 -31.4

XD 2400 HK HKD 12/2023 20.5 9,829 21.9 15.9 13.7 15.7 10.4 8.7 1.7 1.5 1.4 -4.6

Average 13.0 16.8 12.5 14.0 8.6 7.2 2.0 1.8 1.6 13.3

US-listed global Internet & game companies

Microsoft MSFT US USD 06/2023 442.6 3,289,316 35.2 30.5 26.1 23.7 20.5 17.4 12.6 11.0 9.6 38.5

Electronic Arts EA US USD 03/2024 136.0 36,135 18.7 16.9 15.6 14.3 13.2 12.2 4.7 4.4 4.2 17.2

Take-Two TTWO US USD 03/2024 159.0 27,243 63.5 26.0 18.4 49.9 21.1 15.7 5.4 4.0 3.7 -50.9

Average 39.2 24.5 20.0 29.3 18.3 15.1 7.6 6.5 5.8 1.6

Other game companies

Nintendo 7974 JT JPY 03/2024 8,411.0 10,923,282 25.9 24.4 21.2 19.6 18.7 15.8 5.9 5.3 4.7 20.1

Sony 6758 JT JPY 03/2024 12,695.0 15,851,226 16.0 14.8 13.4 8.4 7.9 7.6 1.4 1.4 1.4 13.7

Nexon 3659 JT JPY 12/2023 2,906.0 2,442,581 23.2 20.5 18.4 13.6 11.3 10.5 4.2 3.8 3.6 5.9

Ubisoft UBI FP EUR 03/2024 21.3 2,719 13.9 11.7 10.4 4.1 3.6 3.3 1.7 1.6 1.5 9.4

Ncsoft 036570 KS KRW 12/2023 185,800.0 4,079,057 22.6 15.4 13.3 11.9 7.1 6.2 1.6 1.3 1.2 4.8

Bandai Namco 7832 JT JPY 03/2024 2,989.0 1,972,740 21.0 19.0 17.1 10.9 9.6 8.7 1.6 1.5 1.5 15.0

Average 32.2 17.1 15.6 12.0 9.2 8.7 2.6 2.4 2.3 9.7

Source: Bloomberg, UOB Kay Hian

Refer to last page for important disclosures. 3

R e g i o n a l M o r n i n g N o t e s Wednesday, 19 June 2024

Disclosures/Disclaimers

This report is prepared by UOB Kay Hian Private Limited (“UOBKH”), which is a holder of a capital markets services licence and an

exempt financial adviser in Singapore.

This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an

advice or a recommendation with respect to such securities.

This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the

particular needs of any recipient hereof. Advice should be sought from a financial adviser regarding the suitability of the investment

product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product.

This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this

report to any other person without the prior written consent of UOBKH. This report is not directed to or intended for distribution to or use by

any person or any entity who is a citizen or resident of or located in any locality, state, country or any other jurisdiction as UOBKH may

determine in its absolute discretion, where the distribution, publication, availability or use of this report would be contrary to applicable law

or would subject UOBKH and its connected persons (as defined in the Financial Advisers Act, Chapter 110 of Singapore) to any

registration, licensing or other requirements within such jurisdiction.

The information or views in the report (“Information”) has been obtained or derived from sources believed by UOBKH to be reliable.

However, UOBKH makes no representation as to the accuracy or completeness of such sources or the Information and UOBKH accepts

no liability whatsoever for any loss or damage arising from the use of or reliance on the Information. UOBKH and its connected persons

may have issued other reports expressing views different from the Information and all views expressed in all reports of UOBKH and its

connected persons are subject to change without notice. UOBKH reserves the right to act upon or use the Information at any time,

including before its publication herein.

Except as otherwise indicated below, (1) UOBKH, its connected persons and its officers, employees and representatives may, to the

extent permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit

business from, the subject corporation(s) referred to in this report; (2) UOBKH, its connected persons and its officers, employees and

representatives may also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business

from, other persons in respect of dealings in the securities referred to in this report or other investments related thereto; (3) the officers,

employees and representatives of UOBKH may also serve on the board of directors or in trustee positions with the subject corporation(s)

referred to in this report. (All of the foregoing is hereafter referred to as the “Subject Business”); and (4) UOBKH may otherwise have an

interest (including a proprietary interest) in the subject corporation(s) referred to in this report.

As of the date of this report, no analyst responsible for any of the content in this report has any proprietary position or material interest in

the securities of the corporation(s) which are referred to in the content they respectively author or are otherwise responsible for.

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report was prepared by UOBKH, a company authorized, as noted above, to engage in securities activities in Singapore.

UOBKH is not a registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of

research reports and the independence of research analysts. This research report is provided for distribution by UOBKH (whether directly

or through its US registered broker dealer affiliate named below) to “major U.S. institutional investors” in reliance on the exemption from

registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). All US persons that

receive this document by way of distribution from or which they regard as being from UOBKH by their acceptance thereof represent and

agree that they are a major institutional investor and understand the risks involved in executing transactions in securities.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on

the information provided in this research report should do so only through UOB Kay Hian (U.S.) Inc (“UOBKHUS”), a registered broker-

dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell

securities or related financial instruments through UOBKH.

UOBKHUS accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is

delivered to and intended to be received by a U.S. person other than a major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry

Regulatory Authority (“FINRA”) and may not be an associated person of UOBKHUS and, therefore, may not be subject to applicable

restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research

analyst account.

Refer to last page for important disclosures. 4

R e g i o n a l M o r n i n g N o t e s Wednesday, 19 June 2024

Analyst Certification/Regulation AC

Each research analyst of UOBKH who produced this report hereby certifies that (1) the views expressed in this report accurately reflect

his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by

him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of UOBKH or any other person, any of the Subject Business

involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not receive any

compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any sales,

trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the compensation

received by each such research analyst is based upon various factors, including UOBKH’s total revenues, a portion of which are

generated from UOBKH’s business of dealing in securities.

Reports are distributed in the respective countries by the respective entities and are subject to the additional restrictions listed in the

following table.

General This report is not intended for distribution, publication to or use by any person or entity who is a citizen or resident of or

located in any country or jurisdiction where the distribution, publication or use of this report would be contrary to

applicable law or regulation.

Hong Kong This report is distributed in Hong Kong by UOB Kay Hian (Hong Kong) Limited ("UOBKHHK"), which is regulated by the

Securities and Futures Commission of Hong Kong. Neither the analyst(s) preparing this report nor his associate, has

trading and financial interest and relevant relationship specified under Para. 16.4 of Code of Conduct in the listed

corporation covered in this report. UOBKHHK does not have financial interests and business relationship specified under

Para. 16.5 of Code of Conduct with the listed corporation covered in this report. Where the report is distributed in Hong

Kong and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKHHK (and not the relevant foreign research house) in Hong

Kong in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Hong Kong

who is not a professional investor, or institutional investor, UOBKHHK accepts legal responsibility for the contents of the

analyses or reports only to the extent required by law.

Indonesia This report is distributed in Indonesia by PT UOB Kay Hian Sekuritas, which is regulated by Financial Services Authority

of Indonesia (“OJK”). Where the report is distributed in Indonesia and contains research analyses or reports from a

foreign research house, please note recipients of the analyses or reports are to contact PT UOBKH (and not the relevant

foreign research house) in Indonesia in respect of any matters arising from, or in connection with, the analysis or report.

Malaysia Where the report is distributed in Malaysia and contains research analyses or reports from a foreign research house, the

recipients of the analyses or reports are to contact UOBKHM (and not the relevant foreign research house) in Malaysia,

at +603-21471988, in respect of any matters arising from, or in connection with, the analysis or report as UOBKHM is the

registered person under CMSA to distribute any research analyses in Malaysia.

Singapore This report is distributed in Singapore by UOB Kay Hian Private Limited ("UOBKH"), which is a holder of a capital

markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore.Where the

report is distributed in Singapore and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKH (and not the relevant foreign research house) in Singapore

in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore

who is not an accredited investor, expert investor or institutional investor, UOBKH accepts legal responsibility for the

contents of the analyses or reports only to the extent required by law.

Thailand This report is distributed in Thailand by UOB Kay Hian Securities (Thailand) Public Company Limited, which is regulated

by the Securities and Exchange Commission of Thailand.

United This report is being distributed in the UK by UOB Kay Hian (U.K.) Limited, which is an authorised person in the meaning

Kingdom of the Financial Services and Markets Act and is regulated by The Financial Conduct Authority. Research distributed in

the UK is intended only for institutional clients.

United This report cannot be distributed into the U.S. or to any U.S. person or entity except in compliance with applicable U.S.

States of laws and regulations. It is being distributed in the U.S. by UOB Kay Hian (US) Inc, which accepts responsibility for its

America contents. Any U.S. person or entity receiving this report and wishing to effect transactions in any securities referred to in

(‘U.S.’) the report should contact UOB Kay Hian (US) Inc. directly.

Copyright 2024, UOB Kay Hian Pte Ltd. All rights reserved.

http://research.uobkayhian.com

RCB Regn. No. 197000447W

Refer to last page for important disclosures. 5

You might also like

- Newzoo Global Games Market Report May 2023 UpdateDocument33 pagesNewzoo Global Games Market Report May 2023 UpdateSao224No ratings yet

- Jeffrey Jones 7.9Document28 pagesJeffrey Jones 7.9Walt Morton100% (4)

- Maps of Singapore Ports (PSA)Document5 pagesMaps of Singapore Ports (PSA)Anawma94% (18)

- Vibe Songs Bill MolenhofDocument26 pagesVibe Songs Bill MolenhofStefanodeRosa100% (5)

- Blizzard Entertainment - SWOT & PEST AnalysisDocument5 pagesBlizzard Entertainment - SWOT & PEST AnalysisShayne Rotte100% (7)

- Ubisoft Swot AnalysisDocument10 pagesUbisoft Swot AnalysisAkash MandalNo ratings yet

- Whitepaper 2021: Classified - ConfidentialDocument35 pagesWhitepaper 2021: Classified - ConfidentialPaulo Vitor Ozela100% (1)

- Company:-: Zeta Inc. (IP Based Game Operator and Publisher in China)Document2 pagesCompany:-: Zeta Inc. (IP Based Game Operator and Publisher in China)Shilpi KumariNo ratings yet

- Internship Report Fill EditedDocument35 pagesInternship Report Fill EditedSushil PrajapatNo ratings yet

- Game Industry ReportDocument38 pagesGame Industry ReportJosephNo ratings yet

- 2024 - Newzoo - PC & Console Gaming ReportDocument46 pages2024 - Newzoo - PC & Console Gaming ReportCostiReduxNo ratings yet

- Ea SportDocument18 pagesEa Sportevasoro52No ratings yet

- SuperData 2020 Year in ReviewDocument23 pagesSuperData 2020 Year in ReviewezequielvilaNo ratings yet

- Tencent Games Strategy 2020Document15 pagesTencent Games Strategy 2020Kevin TroyNo ratings yet

- Wwvgforecaststoc dfc318Document5 pagesWwvgforecaststoc dfc318SILPA SNo ratings yet

- Insights After Rain Comes Sunshine PDFDocument63 pagesInsights After Rain Comes Sunshine PDFNgo TungNo ratings yet

- Ubisoft FY23 EarningsDocument15 pagesUbisoft FY23 EarningsthevikfesNo ratings yet

- What NiggaDocument106 pagesWhat NiggaAmrith PereraNo ratings yet

- PMK Indi 2Document9 pagesPMK Indi 2Siempre Amor deNo ratings yet

- Activision UpdateDocument14 pagesActivision Updatehapho90No ratings yet

- SWOT AnalysisDocument10 pagesSWOT AnalysisBolt MaNo ratings yet

- Ampere Analysis Global Games Market Forecast To Decline in 2022 050722Document4 pagesAmpere Analysis Global Games Market Forecast To Decline in 2022 050722mo moNo ratings yet

- 3008大立光 1130412 JPMDocument16 pages3008大立光 1130412 JPMgradeeagleNo ratings yet

- Full Year 2022 and Themes For 2023Document120 pagesFull Year 2022 and Themes For 2023KhôiMinhTrươngNo ratings yet

- Singapore GamingDocument12 pagesSingapore GamingJunyuanNo ratings yet

- 2021 Newzoo Trends To Watch ReportDocument23 pages2021 Newzoo Trends To Watch ReportLuNo ratings yet

- Netease Games Strategy 2020Document17 pagesNetease Games Strategy 2020Kevin TroyNo ratings yet

- State of The Game Industry 2022Document31 pagesState of The Game Industry 2022mrfixNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market ReportGotchu BroNo ratings yet

- Tencent: China / Hong Kong Company GuideDocument11 pagesTencent: China / Hong Kong Company GuideAnton CastilloNo ratings yet

- SuperData 2019 Year in Review PDFDocument23 pagesSuperData 2019 Year in Review PDFAna Valeria RodriguezNo ratings yet

- Changing Game MarketDocument22 pagesChanging Game MarketQuang Anh LeNo ratings yet

- North West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Document11 pagesNorth West Creative and Media Industries PLC 2009: The Videogames & Animation Industry October 2009Nam VoNo ratings yet

- Proyecto Atvi - NtesDocument20 pagesProyecto Atvi - NtesAlejandro100% (1)

- Sgi GDC2024Document37 pagesSgi GDC2024GabrielNo ratings yet

- Monthly Market Insights 2023 11Document17 pagesMonthly Market Insights 2023 11Hưng NguyễnNo ratings yet

- Activision Blizzard - Henry FundDocument37 pagesActivision Blizzard - Henry FundKsl VajralaNo ratings yet

- Raport ChinskiRynekGier 2023 ENDocument33 pagesRaport ChinskiRynekGier 2023 ENremremremremlamlamNo ratings yet

- Internship ReportDocument39 pagesInternship ReportSushil PrajapatNo ratings yet

- Analysis of Pokemons Positive Impact On The EconoDocument5 pagesAnalysis of Pokemons Positive Impact On The Econo09.vicente.sotoNo ratings yet

- 2023 - Newzoo - PC & Console Gaming ReportDocument58 pages2023 - Newzoo - PC & Console Gaming ReportLola AdenizNo ratings yet

- Nikolay Spasov - Blizzard CaseDocument20 pagesNikolay Spasov - Blizzard CaseAnonymous aQxrL6B1No ratings yet

- Case 2 Data Sheet GamingDocument4 pagesCase 2 Data Sheet GamingpriyaNo ratings yet

- Ey TMT Gaming Metaverse Report FinalDocument16 pagesEy TMT Gaming Metaverse Report FinalnikhilNo ratings yet

- Was Sony's Launch of The PS5 in 2020 Successful?: Business Management SL IA Word Count: 1492 Index Number: 60416Document30 pagesWas Sony's Launch of The PS5 in 2020 Successful?: Business Management SL IA Word Count: 1492 Index Number: 60416John JeffersonNo ratings yet

- Toys and Games in Canada - Analysis: Country Report - Jun 2019Document2 pagesToys and Games in Canada - Analysis: Country Report - Jun 2019Martin Elias Prasca GutierrezNo ratings yet

- Sony PlayStation Vita: Mobile Console vs. Cellphone-Based Gaming Market 2012-2017Document4 pagesSony PlayStation Vita: Mobile Console vs. Cellphone-Based Gaming Market 2012-2017Kabir AhmadNo ratings yet

- D20150512042213ubisoft Fy15 Slides Conf Call Finaltcm99202524Document23 pagesD20150512042213ubisoft Fy15 Slides Conf Call Finaltcm99202524PaulMcgraniteNo ratings yet

- Study Id39310 Video-Games@t9.2022Document47 pagesStudy Id39310 Video-Games@t9.2022badboybluefcNo ratings yet

- A Brief On The Global Market of 3D PC GamesDocument11 pagesA Brief On The Global Market of 3D PC Gamesapi-3856333No ratings yet

- R MarkdownDocument18 pagesR Markdownarnav mauryaNo ratings yet

- Blockchain Technology in GamingDocument25 pagesBlockchain Technology in GamingashwindokeNo ratings yet

- MBA Manecon Individual Assignment 9Document2 pagesMBA Manecon Individual Assignment 9Yasir TanveerNo ratings yet

- Market Research ReportDocument13 pagesMarket Research ReportErasmo Nuñez BaezaNo ratings yet

- PwC@How Telco Can Win With GamingDocument24 pagesPwC@How Telco Can Win With GamingbadboybluefcNo ratings yet

- 2023 Newzoo Free Global Games Market ReportDocument52 pages2023 Newzoo Free Global Games Market Reportbrunobueno.lmNo ratings yet

- Nazara Technologies (NAZARA IN) : Rating: BUY - CMP: Rs1,794 - TP: Rs2,342Document40 pagesNazara Technologies (NAZARA IN) : Rating: BUY - CMP: Rs1,794 - TP: Rs2,342QUALITY12No ratings yet

- Newzoo 2016 Global Games Market ReportDocument6 pagesNewzoo 2016 Global Games Market ReportcachocachudoNo ratings yet

- WORD TAREA ACADEMICA 1 IncompletoDocument6 pagesWORD TAREA ACADEMICA 1 IncompletoAndres FuentesNo ratings yet

- かなはまあら、Document3 pagesかなはまあら、Hiro MNo ratings yet

- Careers in Focus: Computer and Video Game Design, Third EditionFrom EverandCareers in Focus: Computer and Video Game Design, Third EditionNo ratings yet

- Break Into The Game Industry: How to Get A Job Making Video GamesFrom EverandBreak Into The Game Industry: How to Get A Job Making Video GamesNo ratings yet

- Market Tremors: Quantifying Structural Risks in Modern Financial MarketsFrom EverandMarket Tremors: Quantifying Structural Risks in Modern Financial MarketsNo ratings yet

- There - S Nothing Easy About Giving Up - Natsuki Subaru - S ...Document4 pagesThere - S Nothing Easy About Giving Up - Natsuki Subaru - S ...shubhamNo ratings yet

- Enchanting EvilDocument2 pagesEnchanting EvilJodie NgNo ratings yet

- Giffyglyphs Quick Quest LatestDocument3 pagesGiffyglyphs Quick Quest Latestpretubreu estúdio criativoNo ratings yet

- Osprey - Men-At-Arms - 083 - 1978 - Napoleon's Guard Cavalry (Repr. 1994, OCR)Document50 pagesOsprey - Men-At-Arms - 083 - 1978 - Napoleon's Guard Cavalry (Repr. 1994, OCR)Manuelaxa100% (11)

- Elx200-10p BDL enDocument3 pagesElx200-10p BDL enOsama YaseenNo ratings yet

- Y CF Catalogue 2021 BD DefDocument140 pagesY CF Catalogue 2021 BD Defjesus lopezNo ratings yet

- Naava Nabagesera On The Road With Andrew WommackDocument2 pagesNaava Nabagesera On The Road With Andrew WommackNaava NabageseraNo ratings yet

- Atmel 42702 Image Sensor Interface in SAM V7 E7 S7 Devices - ApplicationNote - AT12861 PDFDocument21 pagesAtmel 42702 Image Sensor Interface in SAM V7 E7 S7 Devices - ApplicationNote - AT12861 PDFMarcel BlinduNo ratings yet

- Rune Keeper GuideDocument101 pagesRune Keeper Guidemctrustry100% (1)

- EyePad Mini InstructionsDocument3 pagesEyePad Mini InstructionsTre Kadabra TesteNo ratings yet

- ACN Micro Project-1Document23 pagesACN Micro Project-1ashutosh dudhaneNo ratings yet

- Athletics 123123Document7 pagesAthletics 123123Ton TonNo ratings yet

- Angelica The RoverDocument1 pageAngelica The RoverStudent Malena García MorenoNo ratings yet

- Argumentative Essay Paying College AthletesDocument7 pagesArgumentative Essay Paying College Athletesapi-430924181100% (1)

- CFC YFC SongbookDocument129 pagesCFC YFC Songbookjhasonify100% (1)

- The Story of The Smart ParrotDocument8 pagesThe Story of The Smart ParrotHerlinawatiNo ratings yet

- Spaceship Part 12 - GTA 5 Guide - IGNDocument1 pageSpaceship Part 12 - GTA 5 Guide - IGNJames GaleNo ratings yet

- Institución Educativa Técnico Cristo ReyDocument21 pagesInstitución Educativa Técnico Cristo ReyHenao JohaNo ratings yet

- Add or Edit Text & Images - Sites HelpDocument5 pagesAdd or Edit Text & Images - Sites HelpDoddy IsmunandarNo ratings yet

- The Enjoyment of Music Thirteenth Edition 13Th Edition Full ChapterDocument41 pagesThe Enjoyment of Music Thirteenth Edition 13Th Edition Full Chapterjonathan.creek822100% (25)

- UplayDocument43 pagesUplayLéo RibeiroNo ratings yet

- OpenShift Virtualization - Technical OverviewDocument74 pagesOpenShift Virtualization - Technical OverviewFrancisco EspositoNo ratings yet

- AWS Machine LearningDocument16 pagesAWS Machine LearningVikas kumar singhNo ratings yet

- Cheer DanceDocument18 pagesCheer Danceashleyeoj12No ratings yet

- RMD 574BT / RMD 574 Manual: EnglishDocument16 pagesRMD 574BT / RMD 574 Manual: EnglishIgnasi Riba GallardoNo ratings yet

- Network Design Assignment Help - Computer Network Assignment HelpDocument4 pagesNetwork Design Assignment Help - Computer Network Assignment HelpComputer Network Assignment HelpNo ratings yet

- CR-Casltlevania Quest (Final)Document20 pagesCR-Casltlevania Quest (Final)Joshua BumpusNo ratings yet