Professional Documents

Culture Documents

17

17

Uploaded by

DEV RAJPUTCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17

17

Uploaded by

DEV RAJPUTCopyright:

Available Formats

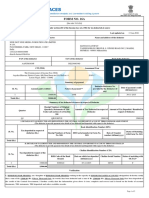

^Form 26AS^

File Creation Date^Permanent Account Number (PAN)^Current Status of PAN^Financial Year^Assessme

nt Year^Name of Assessee^Address Line 1^Address Line 2^Address Line 3^Address Line 4^Address Lin

e 5^Statecode^Pin Code

15-08-2023^AMOPK4497M^ACTIVE AND OPERATIVE^2016-2017^2017-2018^PUNEET KUMAR^VILL

PUNDRI KHURD^SABALPUR BITRA^TEH NAJIBABAD^^BIJNOR^UTTAR PRADESH^246732

^PART A - Details of Tax Deducted at Source^

Sr. No.^Name of Deductor^TAN of Deductor^^^^^Total Amount Paid / Credited(Rs.)^Total Tax Deducted(

Rs.)^Total TDS Deposited(Rs.)

1^DAYAWATI DHARAMVIRA PUBLIC SCHOOL^LKND05297F^^^^^187810.00^17000.00^17000.00^

^Sr. No.^Section^Transaction Date^Status of Booking^Date of Booking^Remarks^Amount Paid / Credited

(Rs.)^Tax Deducted(Rs.)^TDS Deposited(Rs.)

^1^192^14-Mar-2017^F^01-Jun-2017^-^37562.00^4000.00^4000.00^

^2^192^11-Feb-2017^F^01-Jun-2017^-^37562.00^4000.00^4000.00^

^3^192^18-Jan-2017^F^01-Jun-2017^-^37562.00^3000.00^3000.00^

^4^192^22-Dec-2016^F^03-Feb-2017^-^37562.00^3000.00^3000.00^

^5^192^19-Nov-2016^F^03-Feb-2017^-^37562.00^3000.00^3000.00^

2^PUNJAB NATIONAL BANK^MRTP01734F^^^^^80809.00^8081.00^8081.00^

^Sr. No.^Section^Transaction Date^Status of Booking^Date of Booking^Remarks^Amount Paid / Credited

(Rs.)^Tax Deducted(Rs.)^TDS Deposited(Rs.)

^1^194A^30-Mar-2017^F^29-May-2017^-^3020.00^302.00^302.00^

^2^194A^30-Mar-2017^F^29-May-2017^-^22570.00^2257.00^2257.00^

^3^194A^30-Jan-2017^F^29-May-2017^-^760.00^76.00^76.00^

^4^194A^30-Dec-2016^F^06-Feb-2017^-^15760.00^1576.00^1576.00^

^5^194A^30-Dec-2016^F^06-Feb-2017^-^3960.00^396.00^396.00^

^6^194A^30-Dec-2016^F^06-Feb-2017^-^7480.00^748.00^748.00^

^7^194A^30-Sep-2016^F^03-Nov-2016^-^23394.00^2339.00^2339.00^

^8^194A^30-Sep-2016^F^03-Nov-2016^-^3865.00^387.00^387.00^

^PART A1 - Details of Tax Deducted at Source for 15G / 15H^

Sr. No.^Name of Deductor^TAN of Deductor^^^^Total Amount Paid / Credited(Rs.)^Total Tax Deducted(R

s.)^Total TDS Deposited(Rs.)

^^^*********** No Transactions Present **********^

^PART A2 - Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA/ TDS on Rent of

Property u/s 194IB / TDS on payment to resident contractors and professionals u/s 194M (For Seller/Lan

dlord of Property/Payee of resident contractors and professionals)^

Sr. No.^Acknowledgement Number^Name of Deductor^PAN of Deductor^Transaction Date^Total Transac

tion Amount(Rs.)^Total TDS Deposited(Rs.)

^^^*********** No Transactions Present **********^

^PART B - Details of Tax Collected at Source^

Sr. No.^Name of Collector^TAN of Collector^^^^^Total Amount Paid / Debited(Rs.)^Total Tax Collected(R

s.)^Total TCS Deposited(Rs.)

^^^*********** No Transactions Present **********^

^PART C - Details of Tax Paid (other than TDS or TCS)^

Sr. No.^Major Head^Minor Head^Tax(Rs.)^Surcharge(Rs.)^Education Cess(Rs.)^Penalty(Rs.)^Interest(R

s.)^Others(Rs.)^Total Tax(Rs.)^BSR Code^Date of Deposit^Challan Serial Number^Remarks

^^^*********** No Transactions Present **********^

^PART D - Details of Paid Refund^

Sr. No.^Assessment Year^Mode^Refund Issued^Nature of Refund^Amount of Refund(Rs.)^Interest(Rs.)^

Date of Payment^Remarks

^^^*********** No Transactions Present **********^

^PART E - Details of SFT Transaction^

Sr. No.^Type of Transaction^Name of SFT Filer^Transaction Date^Amount(Rs.)^Remarks

^^^*********** No Transactions Present **********^

^PART F - Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA/ TDS on Rent of

Property u/s 194IB /TDS on payment to resident contractors and professionals u/s 194M (For Buyer/Tena

nt of Property /Payer of resident contractors and professionals)^

Sr. No.^Acknowledgement Number^Name of Deductee^PAN of Deductee^Transaction Date^Total Transa

ction Amount(Rs.)^Total TDS Deposited(Rs.)^Total Amount Deposited other than TDS(Rs.)

^^^*********** No Transactions Present **********^

^PART G - TDS Defaults (Processing of Statements)^

Sr. No.^Financial Year^Short Payment^Short Deduction^Interest on TDS Payments Default^Interest on T

DS Deduction Default^Late Filing Fee u/s 234E^Interest u/s 220(2)^Total Default

^^^*********** No Transactions Present **********^

You might also like

- Technical - Specifications - UPI PDFDocument101 pagesTechnical - Specifications - UPI PDFAbhiram TalluriNo ratings yet

- (IPay88) Technical Specification v1.6.2 (For Malaysia Only)Document30 pages(IPay88) Technical Specification v1.6.2 (For Malaysia Only)Atiqul IslamNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Rivera V Sps. ChuaDocument2 pagesRivera V Sps. ChuaKaren Ryl Lozada BritoNo ratings yet

- Bdo Atm Debit Card ReminderDocument4 pagesBdo Atm Debit Card Reminderapi-199238915No ratings yet

- 19 20Document3 pages19 20DEV RAJPUTNo ratings yet

- 18 19Document2 pages18 19DEV RAJPUTNo ratings yet

- 20 21Document2 pages20 21DEV RAJPUTNo ratings yet

- 22 23Document2 pages22 23DEV RAJPUTNo ratings yet

- 26 AsDocument3 pages26 AsBhoomi AnandNo ratings yet

- Aacpt8112a 2021 110889938Document77 pagesAacpt8112a 2021 110889938vnpNo ratings yet

- Abzpk0177g 2021Document11 pagesAbzpk0177g 2021J Chandrakanth RaoNo ratings yet

- Form26AS TXT File FormatDocument6 pagesForm26AS TXT File FormatnidhithackerNo ratings yet

- India Sudar TaxFile 2004-05Document11 pagesIndia Sudar TaxFile 2004-05India Sudar Educational and Charitable TrustNo ratings yet

- PT Adi Jaya Post Closing Trial Balance DECEMBER 31, 2012: Account Name Debit Credit RP RP Account NumberDocument27 pagesPT Adi Jaya Post Closing Trial Balance DECEMBER 31, 2012: Account Name Debit Credit RP RP Account NumbersyifaNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Data Dictionary For Info SystemDocument5 pagesData Dictionary For Info SystemStephanie SierraNo ratings yet

- Fffi? Ahmednacar Muntctpal Corporatton Local Bodv Tax DepartmentDocument2 pagesFffi? Ahmednacar Muntctpal Corporatton Local Bodv Tax DepartmentMahesh BihaniNo ratings yet

- Circular For GWSSB 20211126180254Document3 pagesCircular For GWSSB 20211126180254gautam kumar PODDARNo ratings yet

- Indian Income Tax Challan Payment of Tds and TCS: Form by FinotaxDocument2 pagesIndian Income Tax Challan Payment of Tds and TCS: Form by Finotaxbrayan uyNo ratings yet

- Form 402Document4 pagesForm 402Hariom RajawatNo ratings yet

- R.8Ert. Grear : 3/1 5Al/Jna O CTDocument9 pagesR.8Ert. Grear : 3/1 5Al/Jna O CTS Paul JordanNo ratings yet

- Quarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012Document7 pagesQuarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012amit22505No ratings yet

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghNo ratings yet

- Form 16aa and 12ba (Dev)Document6 pagesForm 16aa and 12ba (Dev)jindalyash1234No ratings yet

- TdsDocument4 pagesTdsSahil SheikhNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Trade License Fee-Self Assessment Form in MCHDocument2 pagesTrade License Fee-Self Assessment Form in MCHSivaramakrishna ReddyNo ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- Kementerian Keuangan Republik Indonesia Direktorat Jenderal PajakDocument32 pagesKementerian Keuangan Republik Indonesia Direktorat Jenderal PajakMuch FachrudeenNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Expense Claim Voucher: PT Trakindo Utama Month: October Year: 2005Document6 pagesExpense Claim Voucher: PT Trakindo Utama Month: October Year: 2005adityapwNo ratings yet

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishNo ratings yet

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesDocument6 pagesAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesStanly OrtizNo ratings yet

- Kishanchand B Adwani A.Y 2016-17Document3 pagesKishanchand B Adwani A.Y 2016-17basecandlesNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Oakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (May 2013) 76pgsDocument76 pagesOakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (May 2013) 76pgsoccupyoaklandNo ratings yet

- MTC - 40Document14 pagesMTC - 40Anonymous eCUVunlzKaNo ratings yet

- HM Charge Transfer CertificateDocument11 pagesHM Charge Transfer CertificateJesu Dhasan50% (4)

- CFfinalDocument4 pagesCFfinalAngela ArleneNo ratings yet

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryNo ratings yet

- Certificate of Collection or Deduction of Income Tax: (Under Rule)Document1 pageCertificate of Collection or Deduction of Income Tax: (Under Rule)debugger911No ratings yet

- Ceklist Serah Terima Pekerjaan: List Pekerjaan Selesai Tanggal Keterangan Paraf Penerima CostsheetDocument5 pagesCeklist Serah Terima Pekerjaan: List Pekerjaan Selesai Tanggal Keterangan Paraf Penerima CostsheetHR & GA LionelNo ratings yet

- Itchellan KeralaDocument2 pagesItchellan KeralaAiju ThomasNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- Ma No GlobeDocument3 pagesMa No GlobeawadnajilpNo ratings yet

- Manual Ifs Finance A-2 Tunai: REKAP HASIL TAGIHAN (Over View Rekap Hasil Tagih)Document29 pagesManual Ifs Finance A-2 Tunai: REKAP HASIL TAGIHAN (Over View Rekap Hasil Tagih)bimastar49No ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- From 16 & 12ba (Dev)Document6 pagesFrom 16 & 12ba (Dev)jindalyash1234No ratings yet

- 8 16 25 Promotional Arrears Calculator For W.B.govt EmployeesDocument10 pages8 16 25 Promotional Arrears Calculator For W.B.govt EmployeesSnehasis Karmahapatra100% (1)

- FTW - 3 (To% Ifrsn 796 Ift.F. 3Ft 8-15 / 2-2018: Raf I5 T Orft IDocument4 pagesFTW - 3 (To% Ifrsn 796 Ift.F. 3Ft 8-15 / 2-2018: Raf I5 T Orft Iprateekbunty81No ratings yet

- Audit Performa OriginalDocument8 pagesAudit Performa OriginalAnamNo ratings yet

- RTI EE Potteru Irrigation DVN BalimelaDocument18 pagesRTI EE Potteru Irrigation DVN BalimelaAnonymous im9mMa5No ratings yet

- 1604 CFDocument8 pages1604 CFNette CutinNo ratings yet

- Authority To Print 2013 - SynerquestDocument3 pagesAuthority To Print 2013 - SynerquestrobinrubinaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Bond1 PDFDocument1 pageBond1 PDFvaibhav aggarwalNo ratings yet

- Oblicon Articles 1252-1261Document5 pagesOblicon Articles 1252-1261kumiko sakamoto100% (1)

- ICP Receipt - ICP 239620Document1 pageICP Receipt - ICP 239620Daniel HewNo ratings yet

- Task 4 - Earn-Out Regime ExampleDocument3 pagesTask 4 - Earn-Out Regime ExampleVikasNo ratings yet

- Initial Invoice emailDT - 20220614.17.12.54.734Document6 pagesInitial Invoice emailDT - 20220614.17.12.54.734Baxter FlynNo ratings yet

- Account Statement DefinedDocument12 pagesAccount Statement DefinedRahul PambharNo ratings yet

- Sales and Tax Declaration Form 2020Document1 pageSales and Tax Declaration Form 2020k act100% (1)

- Ap - Invoices - All: Posted - Fla GDocument3 pagesAp - Invoices - All: Posted - Fla GsaravananNo ratings yet

- Allied Bank Limited: Internship ReportDocument68 pagesAllied Bank Limited: Internship ReportALI SHER HaidriNo ratings yet

- JkuykDocument3 pagesJkuykFaheem KamalNo ratings yet

- Credit Card Product DisclosureDocument4 pagesCredit Card Product DisclosureDave HoNo ratings yet

- NSDL Conso File FVU Error Code ListDocument22 pagesNSDL Conso File FVU Error Code Listlekireddy33% (9)

- Select Your Type of Tickets 1. Dated For 1-4 Days: Can't Wait For Your Trip? Important Information To KnowDocument1 pageSelect Your Type of Tickets 1. Dated For 1-4 Days: Can't Wait For Your Trip? Important Information To KnowRico JLNo ratings yet

- Obligations and Contracts Review Questions 1Document7 pagesObligations and Contracts Review Questions 1Prince ArchieNo ratings yet

- Shubhaarambh SocDocument2 pagesShubhaarambh SocCrAzY PuLkiTNo ratings yet

- NBS Bank Statement Sep 2023Document2 pagesNBS Bank Statement Sep 2023Eric CartmanNo ratings yet

- AMVCS Newsletter - December 2019Document28 pagesAMVCS Newsletter - December 2019kenNo ratings yet

- ITZ Data Mail - Pearson VUE Confirmation of PaymentDocument2 pagesITZ Data Mail - Pearson VUE Confirmation of PaymentGustavo Adolfo Gamboa CruzNo ratings yet

- FSCS04 Sop On Imprest Fund SystemDocument17 pagesFSCS04 Sop On Imprest Fund SystemPauline Caceres AbayaNo ratings yet

- Statement of Accounts: Today's StatementsDocument5 pagesStatement of Accounts: Today's StatementsbronwynnpembertonNo ratings yet

- 3 Adelfa Properties, Inc. V Court of AppealsDocument13 pages3 Adelfa Properties, Inc. V Court of AppealsCrisDBNo ratings yet

- Fintech Industry in BDDocument13 pagesFintech Industry in BDAlvi HasanNo ratings yet

- Handycleaners Invoice 21500Document1 pageHandycleaners Invoice 21500Nabin SahaNo ratings yet

- Act 627 Payment Systems Act 2003Document61 pagesAct 627 Payment Systems Act 2003Adam Haida & CoNo ratings yet

- Departmental Tests May 2021 (Objective Type Pattern-Computer Based Test) For The Employees of TANGEDCO/TANTRANSCO OnlyDocument2 pagesDepartmental Tests May 2021 (Objective Type Pattern-Computer Based Test) For The Employees of TANGEDCO/TANTRANSCO OnlyDhiliban SwaminathanNo ratings yet

- Third Party Funds Transfer: To Other Bank (NEFT)Document2 pagesThird Party Funds Transfer: To Other Bank (NEFT)Yashvanth ShettyNo ratings yet

- Loan Account Statement For T88Erfhf155748: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document4 pagesLoan Account Statement For T88Erfhf155748: Component Due (RS.) Receipt (RS.) Overdue (RS.)subbuvinod vNo ratings yet