Professional Documents

Culture Documents

Accounting Information System For Decision Making

Accounting Information System For Decision Making

Uploaded by

ASHLEY TANAKA MOYOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Information System For Decision Making

Accounting Information System For Decision Making

Uploaded by

ASHLEY TANAKA MOYOCopyright:

Available Formats

Quest Journals

Journal of Research in Business and Management

Volume 11 ~ Issue 9 (2023) pp: 24-26

ISSN(Online):2347-3002

www.questjournals.org

Research Paper

Accounting Information System for Decision making.

1.

Dr. Rajat Kumar Kamboj, Teaching Assistant, Bundelkhand University, Jhansi.

2

Dr. Shivika Bhatnagar, Teaching Assistant, Bundelkhand University, Jhansi.

Abstract: The AIS incorporates both manual and automated processes to ensure the accurate and efficient

handling of financial data. It encompasses a range of components, including people, procedures, data, software,

information technology infrastructure, and internal controls, all working in tandem to support the

organization's financial operations.

Key stakeholders, such as accountants, managers, auditors, and chief financial officers, rely on the AIS to

access timely and reliable financial information. This information serves as the basis for strategic planning,

performance evaluation, resource allocation, and compliance with regulatory requirements.

Keywords: AIS, Financial Information, Internal control and strategic planning.

Received 02 Sep., 2023; Revised 12 Sep., 2023; Accepted 14 Sep., 2023 © The author(s) 2023.

Published with open access at www.questjournals.org

I. Introduction:

AIS plays a critical role in modern businesses, as it helps ensure the integrity and reliability of financial

data, enabling various stakeholders to make informed decisions. Trained accountants are instrumental in

operating and maintaining these systems, ensuring that financial information is handled with precision,

confidentiality, and security. They act as custodians of financial data, making it accessible to authorized

personnel while safeguarding it from unauthorized access or tampering. This is crucial for regulatory

compliance, financial reporting, auditing, and overall business transparency.

An effective AIS is crucial for the smooth operation of a business and for producing reliable financial

information that can be used for various purposes, including decision-making, financial reporting, auditing, and

compliance with regulatory requirements.

II. Literature Review

(Khan, 2016) This study highlights the importance of accounting information systems in recording,

summarizing, and validating data about business financial transactions for decision-making within

organizations, including managerial accounting and tax compliance.

(Smith & Johnson, 2017) This review provides an in-depth examination of the historical development and

evolution of accounting information systems. It covers the transition from manual bookkeeping to computerized

systems, highlighting key technological advancements and their impact on accounting practices. The review also

discusses emerging trends and future directions in accounting information systems

(Davis & Brown, 2019)Focusing on internal control and security aspects, this review explores the measures and

protocols implemented in accounting information systems to safeguard financial data. It covers topics such as

access controls, encryption, and authentication methods. Additionally, the review discusses compliance with

regulatory frameworks and industry best practices in ensuring the integrity and confidentiality of accounting

information.

(Anderson & Clark, 2020) This review examines the impact of emerging technologies, such as blockchain,

artificial intelligence, and cloud computing, on accounting information systems. It explores the potential

benefits, challenges, and implementation considerations associated with adopting these technologies in

accounting practices. The review also discusses the evolving role of accountants in leveraging these innovations

for improved financial reporting and analysis

(Davis & Roberts, 2018)Focusing on decision support and performance measurement, this review explores how

accounting information systems facilitate managerial decision-making and performance evaluation. It covers

topics such as budgeting, variance analysis, and balanced scorecard implementation. The review also highlights

the integration of AIS with Business Intelligence (BI) tools for enhanced reporting and analysis

*Corresponding Author: Dr. Rajat Kumar Kamboj 24 | Page

Accounting Information System for Decision making.

(Baker & White, 2021) This review examines the impact of emerging technologies, such as blockchain,

artificial intelligence, and cloud computing, on accounting information systems. It explores the potential

benefits, challenges, and implementation considerations associated with adopting these technologies in

accounting practices. The review also discusses the evolving role of accountants in leveraging these innovations

for improved financial reporting and analysis.

Objectives of the study:

(1) To study the Components of AIS.

(2) To study the role of accounting information system in decision making.

Research Methodology

1. Research Design Descriptive and Conceptual Design

2. Sampling Technique Convenience sampling Technique

3. Data Collection Method Secondary has been considered in my study

Components of AIS: the components of Accounting Information System Can be understand by the following

Diagram

People

Internal Procedure

components

Controls of A.I.S and

Instruction

Software Data

-1. People: The people involved with an AIS are the system users. AIS help the different departments within a

company work together. Professionals who may need to use an organization's AIS include: Accountants,

Consultants, Business analysts, Managers, Chief financial officers and Auditors.

2. Procedure and Instruction: Procedures and instructions refer to the established protocols and guidelines that

dictate how the AIS handles various tasks, such as collecting, storing, retrieving, processing, and reporting data.

These procedures can be both manual (performed by humans) and automated (executed by the system).

3. Data Handling: The AIS employs a combination of manual and automated methods to manage data. Manual

methods involve human intervention in tasks like data entry and verification. Automated methods leverage

technology to handle tasks such as data processing, calculation, and reporting.

The data that the AIS processes can originate from both internal and external sources. Internal sources may

include information generated by employees, such as payroll data or internal financial transactions. External

sources can encompass data received from customers, suppliers, or other external entities, such as online orders.

4. Software: The software component of an AIS refers to the computer programs and applications that are used

to handle various functions related to financial data. This includes tasks such as data entry, storage, retrieval,

processing, and analysis.

5. Internal Controls: Internal controls in an AIS refer to the security measures put in place to safeguard

sensitive data. These controls are critical for protecting against unauthorized access, ensuring data integrity, and

maintaining confidentiality.

Accounting Information System as a Decision Making: An Accounting Information System (AIS) plays a

pivotal role in decision-making within an organization. Here are some key ways in which AIS influences and

supports the decision-making process:

Accurate Financial Data: An AIS ensures that financial data is accurately collected, recorded, and

stored. This reliable data forms the basis for sound decision-making.

*Corresponding Author: Dr. Rajat Kumar Kamboj 25 | Page

Accounting Information System for Decision making.

Timely Information: AIS provides real-time or near-real-time access to financial information. This

timeliness is crucial for making informed and timely decisions

Financial Analysis: AIS generates various financial reports and statements, which are essential for

analyzing the company's financial performance. This analysis aids in identifying trends, strengths, weaknesses,

and areas for improvement.

Budgeting and Forecasting: AIS supports the creation of budgets and forecasts based on historical

financial data. This enables managers to set realistic financial goals and track progress towards achieving them.

Resource Allocation: Managers use information from the AIS to allocate resources effectively. This

includes decisions related to capital investments, budget allocations for different departments, and determining

staffing levels.

Performance Evaluation: AIS provides data for evaluating the performance of various departments,

products, projects, and individuals. This helps in identifying areas of excellence and areas that require

improvement.

III. Conclusion:

In conclusion, an Accounting Information System (AIS) stands as a cornerstone of financial

management within an organization. Its multifaceted role encompasses the collection, storage, processing, and

reporting of financial data, providing a robust foundation for informed decision-making.

The AIS ensures the accuracy, timeliness, and integrity of financial information, which is vital for

stakeholders ranging from accountants and consultants to managers and auditors. Its procedures and

instructions, whether manual or automated, dictate how data is handled, while the software component, often

computer-based, facilitates efficient data management

Suggestion:

Provide ongoing training to users to ensure they are proficient in using the AIS and understand its

capabilities. This includes both technical training and education on best practices for data entry and reporting.

Implement robust security measures to safeguard sensitive financial data. This includes encryption,

access controls, regular security audits, and employee training on cyber security best practices.

Establish and maintain a reliable data backup and recovery plan to ensure that critical financial

information is not lost in case of system failures, data corruption, or cyber attacks.

REFERENCES

[1]. Anderson, M. R., & Clark, L. J. (2020). Integration of ERP Systems in Accounting Information: A Critical Review.

[2]. Baker, D. W., & White, J. S. (2021). Emerging Technologies and Innovations in Accounting Information Systems: A Review.

[3]. Davis, E. M., & Roberts, M. A. (2018). The Role of AIS in Decision Support and Performance Measurement: A Comprehensive Survey.

[4]. Davis, M. L., & Brown, R. M. (2019). Internal Control and Security in Accounting Information Systems: A Literature Synthesis.

[5]. Khan, H. F. (2016). Accounting Information System: The Need of. International Journal of Management and Commerce Innovations , 4-10.

[6]. Smith, J. A., & Johnson, S. K. (2017). The Evolution of Accounting Information Systems: A Comprehensive Review.

*Corresponding Author: Dr. Rajat Kumar Kamboj 26 | Page

You might also like

- Full Step by Step Tutorial On How To HACK GMail AccountsDocument3 pagesFull Step by Step Tutorial On How To HACK GMail AccountsAditya Thakker91% (11)

- Management Information systems - MIS: Business strategy books, #4From EverandManagement Information systems - MIS: Business strategy books, #4No ratings yet

- Introduction To Accounting Information SystemsDocument11 pagesIntroduction To Accounting Information SystemsrachellesgNo ratings yet

- EC-Council Certified Incident Handler (ECIH) Course SummaryDocument7 pagesEC-Council Certified Incident Handler (ECIH) Course SummaryVinay KumarNo ratings yet

- Network Management and Administration-NotesDocument11 pagesNetwork Management and Administration-NotesSalman Ilyas Awan71% (7)

- How To Hack Wifi Wpa and Wpa2 Without Using Wordlist in Kali Linux or Hacking Wifi Through Reaver - Hacking-News & TutorialsDocument15 pagesHow To Hack Wifi Wpa and Wpa2 Without Using Wordlist in Kali Linux or Hacking Wifi Through Reaver - Hacking-News & TutorialsTom CattNo ratings yet

- Impact of Accounting Information Systems (AIS) On Organizational Performance A Case Study of TATA Consultancy Services (TCS) - IndiaDocument8 pagesImpact of Accounting Information Systems (AIS) On Organizational Performance A Case Study of TATA Consultancy Services (TCS) - IndiaHerna TobingNo ratings yet

- AIS Chapter 1 Questions AnswersDocument9 pagesAIS Chapter 1 Questions AnswersMR ANo ratings yet

- IM Unit 4Document28 pagesIM Unit 4Sara ZafarNo ratings yet

- Sheet - 1: Arrange-MentDocument7 pagesSheet - 1: Arrange-MentShaheen MahmudNo ratings yet

- NEOGYDocument19 pagesNEOGYsoniaNo ratings yet

- Evaluation of Efficiency of Accounting Information Systems: A Study On Mobile Telecommunication Companies in BangladeshDocument16 pagesEvaluation of Efficiency of Accounting Information Systems: A Study On Mobile Telecommunication Companies in BangladeshISRAEL MUGWENHINo ratings yet

- Accounting Information SystemDocument22 pagesAccounting Information SystemMickey KNo ratings yet

- Ais lý thuyếtDocument13 pagesAis lý thuyếtAnh Trần ViệtNo ratings yet

- (Accounting Information System) : Module Duration: FEB 3 - March.12,2022Document9 pages(Accounting Information System) : Module Duration: FEB 3 - March.12,2022Gaba, Yna MarieNo ratings yet

- Designing A Web Based Quality of Accounting Information SystemDocument6 pagesDesigning A Web Based Quality of Accounting Information SystemOki DewaNo ratings yet

- Data Analytics in Accounting Informtion SystemsDocument28 pagesData Analytics in Accounting Informtion Systemsashrafurrahman119No ratings yet

- AIS ch1Document4 pagesAIS ch1BappyNo ratings yet

- AFIS AssignmentDocument3 pagesAFIS Assignmentbsaf2147266No ratings yet

- The Information System: An Accountant's PerspectiveDocument33 pagesThe Information System: An Accountant's PerspectiveLUIS ALFONSO DELA CRUZNo ratings yet

- Group 1 - Bsa 2a - Definition&history of AisDocument7 pagesGroup 1 - Bsa 2a - Definition&history of AisCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Accounting Information System ManuscriptDocument11 pagesAccounting Information System ManuscriptShivani GuptaNo ratings yet

- Chapter 1: The Study of Accounting Information SystemsDocument36 pagesChapter 1: The Study of Accounting Information SystemsAliah CyrilNo ratings yet

- Accounting Information SystemDocument5 pagesAccounting Information Systemaccajay230% (1)

- AIS For DM in Nigerian BanksDocument10 pagesAIS For DM in Nigerian BanksASHLEY TANAKA MOYONo ratings yet

- Cost TyaDocument7 pagesCost TyaTya NwsNo ratings yet

- Sistem Information AccountingDocument9 pagesSistem Information AccountingNicole Daniella JinggaNo ratings yet

- Ais Ali & Hussein. Last Edit DoneDocument12 pagesAis Ali & Hussein. Last Edit DoneASHLEY TANAKA MOYONo ratings yet

- Cost Accounting CoverDocument10 pagesCost Accounting CoverRavi MogliNo ratings yet

- AIN1501 - Study Unit - 2Document4 pagesAIN1501 - Study Unit - 2Hazel NyamukapaNo ratings yet

- Chapter22222 OuttDocument14 pagesChapter22222 OuttAmrran AbdiNo ratings yet

- REFLECTION NO.2 - Business RiskDocument6 pagesREFLECTION NO.2 - Business RiskJenny DomilomNo ratings yet

- Usefulness of Accounting Information System in Emerging Economy: Empirical Evidence of IranDocument10 pagesUsefulness of Accounting Information System in Emerging Economy: Empirical Evidence of IranYusuf HusseinNo ratings yet

- 5 Dr. Abhay UpadhyayaDocument8 pages5 Dr. Abhay UpadhyayaRavi ModiNo ratings yet

- AIS Lec1Document32 pagesAIS Lec1Monique del RosarioNo ratings yet

- Module 1 - Introduction To Acctg Info SystemDocument44 pagesModule 1 - Introduction To Acctg Info SystemPatricia BelecinaNo ratings yet

- Accounting Information System-OverviewDocument15 pagesAccounting Information System-Overviewsema100% (1)

- Impact of Accounting Information System As A Management Tool in OrganisationsDocument8 pagesImpact of Accounting Information System As A Management Tool in OrganisationsJimmer CapeNo ratings yet

- Accounting Information Systems: Study Smarter. Welcome, Guest!Document11 pagesAccounting Information Systems: Study Smarter. Welcome, Guest!complicatedsolNo ratings yet

- Muhammad Arzim Naim: EPPA3613 Pembangunan Dan Aplikasi Strategik Sistem Maklumat Perakaunan Semester 2 SESSION 2009/2010Document22 pagesMuhammad Arzim Naim: EPPA3613 Pembangunan Dan Aplikasi Strategik Sistem Maklumat Perakaunan Semester 2 SESSION 2009/2010kahmun616No ratings yet

- Presented To DR By: Modern Sciences and Arts University Faculty of ManagementDocument4 pagesPresented To DR By: Modern Sciences and Arts University Faculty of ManagementMega Pop LockerNo ratings yet

- MIS MIsem Unit 2Document10 pagesMIS MIsem Unit 2Tanish DewaseNo ratings yet

- Actg 3 PDFDocument5 pagesActg 3 PDFHo Ming LamNo ratings yet

- Financial AccountingDocument19 pagesFinancial AccountingsaniaNo ratings yet

- Accounting Information SystemDocument4 pagesAccounting Information SystemtheateeqNo ratings yet

- IT - Unit 1Document52 pagesIT - Unit 1Kadam VedantNo ratings yet

- MIS 5TH UINT NotesDocument6 pagesMIS 5TH UINT NotesMala niveNo ratings yet

- Accounting Information SystemDocument11 pagesAccounting Information SystemJoshua Oranga0% (1)

- I Tool in OrganisationsDocument7 pagesI Tool in OrganisationsDark ShadowNo ratings yet

- Module 1 Introduction To AISDocument7 pagesModule 1 Introduction To AISArn KylaNo ratings yet

- Study of Effect of Accounting Information Systems and Softwares On Qualitative Features of Accounting InformationDocument12 pagesStudy of Effect of Accounting Information Systems and Softwares On Qualitative Features of Accounting InformationAjup SafarudinNo ratings yet

- AIS Course OutlineDocument6 pagesAIS Course OutlineRajivManochaNo ratings yet

- Jurnal 1 Analysis and Design Accounting Information System in Purchasing and Supplying PDFDocument3 pagesJurnal 1 Analysis and Design Accounting Information System in Purchasing and Supplying PDFSetia Nurul100% (1)

- Accounting Information SystemDocument22 pagesAccounting Information SystemkvkumarnaveenNo ratings yet

- QNDocument6 pagesQNdoctor andey1No ratings yet

- AIS C1 EdDocument12 pagesAIS C1 Edhanan yishakNo ratings yet

- Chapter 1 ReviewerDocument16 pagesChapter 1 Revieweranon_879788236No ratings yet

- Fundamentals of Management Information SystemDocument36 pagesFundamentals of Management Information SystemJaybee100% (2)

- Financial Management Information System: SSRN Electronic Journal May 2012Document13 pagesFinancial Management Information System: SSRN Electronic Journal May 2012Chandu BhanuNo ratings yet

- Business Intelligence: A View On Requirements, Process and ToolsDocument4 pagesBusiness Intelligence: A View On Requirements, Process and ToolsInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- ACC5220 Tutorial L6 AnswerDocument4 pagesACC5220 Tutorial L6 Answerjasonneo999No ratings yet

- Accounting Information SystemDocument1 pageAccounting Information SystemJOY YangcoNo ratings yet

- AiS Module 1Document5 pagesAiS Module 1jhell dela cruzNo ratings yet

- Follow Who Know RoadDocument8 pagesFollow Who Know RoadIbrahimm Denis FofanahNo ratings yet

- If You Have To Both Encrypt and Compress Data During TransmissionDocument12 pagesIf You Have To Both Encrypt and Compress Data During TransmissionPallavi BhartiNo ratings yet

- Subject: Cyber Law: Phishing and Its Changing DimensionsDocument18 pagesSubject: Cyber Law: Phishing and Its Changing Dimensionsparth sharmaNo ratings yet

- Cyber Capabilities and National Power - Executive SummaryDocument2 pagesCyber Capabilities and National Power - Executive SummaryTalha TalhaNo ratings yet

- JARUS Safety Impacts of Cyber Vulnerabilities Applied To SORA v8 - LandscapeDocument14 pagesJARUS Safety Impacts of Cyber Vulnerabilities Applied To SORA v8 - LandscapeChris1715No ratings yet

- Limitations of Proof of Stake Algorithm in Blockchain: A ReviewDocument15 pagesLimitations of Proof of Stake Algorithm in Blockchain: A ReviewCynthia DirisNo ratings yet

- IAPP Privacy Program Management 2E 2019-SAMPLEDocument37 pagesIAPP Privacy Program Management 2E 2019-SAMPLEsumitNo ratings yet

- Cardless Transaction in ATMDocument6 pagesCardless Transaction in ATMIJRASETPublicationsNo ratings yet

- Presented by Nirav Patel 07CE64Document22 pagesPresented by Nirav Patel 07CE64Shweta PatelNo ratings yet

- ICDL IT SecurityDocument62 pagesICDL IT Securityc.shajid100% (1)

- Best Practices For Managing Safety With Basic ControllersDocument39 pagesBest Practices For Managing Safety With Basic ControllersWellington Silva TomNo ratings yet

- Self Defending NetworksDocument17 pagesSelf Defending Networkssarthak_ganguly100% (1)

- Authentication inDocument3 pagesAuthentication inPrath MethilNo ratings yet

- DownloadDocument12 pagesDownloadmanav.mahajan2994No ratings yet

- Cyber Crime in MalaysiaDocument6 pagesCyber Crime in Malaysiacta_itaNo ratings yet

- Planning and Designing A Windows Server EnvironmentDocument34 pagesPlanning and Designing A Windows Server EnvironmentSonPhamNo ratings yet

- ISO27k SOA SampleDocument10 pagesISO27k SOA Samplevishnukesarwani100% (4)

- Esa DLPDocument13 pagesEsa DLPGerardoNo ratings yet

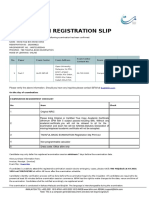

- Examination Registration Slip: No. Paper Exam Center Exam Address Exam Center Contact No. Room DateDocument2 pagesExamination Registration Slip: No. Paper Exam Center Exam Address Exam Center Contact No. Room DateEjen Faiz HafizNo ratings yet

- Chapter 7Document34 pagesChapter 7alaamabood6No ratings yet

- Use Case RelationshipsDocument2 pagesUse Case RelationshipsUmamageswari KumaresanNo ratings yet

- Confucius Institutes at U.S. Institutions of Higher Education: Waiver Criteria For The Department of Defense (2023)Document104 pagesConfucius Institutes at U.S. Institutions of Higher Education: Waiver Criteria For The Department of Defense (2023)Harry the GreekNo ratings yet

- Back Up Your Files To The CloudDocument1 pageBack Up Your Files To The CloudnayaNo ratings yet

- Online Banking ThesisDocument109 pagesOnline Banking ThesisAbdul Mannan100% (4)

- Israel Routers Pal GaintDocument346 pagesIsrael Routers Pal GaintAnonymous nKg71y6OyL100% (1)

- ThesisDocument65 pagesThesis쯔엉당꽝/학생/정보통신공학No ratings yet

- United Arab Emirates: Cybersecurity PolicyDocument3 pagesUnited Arab Emirates: Cybersecurity Policymmh771No ratings yet