Professional Documents

Culture Documents

PFRS 1, 2, 3, 5

PFRS 1, 2, 3, 5

Uploaded by

taperogegetCopyright:

Available Formats

You might also like

- QUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsDocument2 pagesQUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsGonzalo Jr. Ruales86% (7)

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- Alcohol Compliance Course DoordashDocument15 pagesAlcohol Compliance Course DoordashRalph Lorenz AquinoNo ratings yet

- TCAR OPS Introduction To Industry - 9-10 June 2022Document196 pagesTCAR OPS Introduction To Industry - 9-10 June 2022Nisarat Joeytong100% (3)

- Ifrs 1 PDFDocument2 pagesIfrs 1 PDFBheki Tshimedzi0% (1)

- Ashok Leyland SEA FORMATDocument68 pagesAshok Leyland SEA FORMATVi KraNo ratings yet

- Global Trade Services OverviewDocument18 pagesGlobal Trade Services OverviewShyam Chinthalapudi100% (1)

- CFASDocument5 pagesCFASLurissa CabigNo ratings yet

- First-Time Adoption of Philippine Financial Reporting StandardsDocument11 pagesFirst-Time Adoption of Philippine Financial Reporting StandardszxcvbnmNo ratings yet

- "Full" Pfrss Refer To The Standards That We Had DiscussedDocument7 pages"Full" Pfrss Refer To The Standards That We Had DiscussedJustine VeralloNo ratings yet

- Pfrs 1 First Time Adoptation of Philippine Financial Reporting StandardsDocument4 pagesPfrs 1 First Time Adoptation of Philippine Financial Reporting StandardsSHARON SAMSONNo ratings yet

- Chapter 1 PFRS 1 AnswerDocument1 pageChapter 1 PFRS 1 Answer03LJNo ratings yet

- Pfrs 1 First-Time Adoptation of Philippine Financial Reporting StandardsDocument3 pagesPfrs 1 First-Time Adoptation of Philippine Financial Reporting StandardsR.A.No ratings yet

- Pfrs 1 9 Accounting 1Document23 pagesPfrs 1 9 Accounting 16wv84xgwnbNo ratings yet

- First-Time Adoption of Philippine Financial Reporting StandardsDocument11 pagesFirst-Time Adoption of Philippine Financial Reporting StandardszxcvbnmNo ratings yet

- Unit IV Accounting Standards Part IVDocument34 pagesUnit IV Accounting Standards Part IVChin FiguraNo ratings yet

- Actg 431 Week 5Document2 pagesActg 431 Week 5Kimberly ZafraNo ratings yet

- PFRS 1 - FIRST-TIME ADOPTION OF PFRSsDocument10 pagesPFRS 1 - FIRST-TIME ADOPTION OF PFRSsHannah TaduranNo ratings yet

- PFRS 12 MergedDocument45 pagesPFRS 12 MergedRojie Ann AmorNo ratings yet

- Introduction To IFRS 1 - First-Time Adoption of InternationaDocument12 pagesIntroduction To IFRS 1 - First-Time Adoption of InternationaPriyaka khannaNo ratings yet

- IFRS1Document2 pagesIFRS1Jkjiwani AccaNo ratings yet

- IFRS 1 First TimeDocument2 pagesIFRS 1 First TimeCatalin BlesnocNo ratings yet

- Chapter 23Document40 pagesChapter 23rameelamirNo ratings yet

- Assignment ON Ifrs1-First Time Adoption of IfrsDocument46 pagesAssignment ON Ifrs1-First Time Adoption of IfrsMohit BansalNo ratings yet

- IFRS IAS SummaryDocument94 pagesIFRS IAS SummaryLin AungNo ratings yet

- PAS 1 Presentation of FS: Intermediate Accounting Lecture 1Document3 pagesPAS 1 Presentation of FS: Intermediate Accounting Lecture 1Io AyaNo ratings yet

- 1 - Pdfsam - IAS & IFRS Bare StandardDocument1 page1 - Pdfsam - IAS & IFRS Bare StandarddskrishnaNo ratings yet

- PFRS 1 9Document22 pagesPFRS 1 9Apol AsusNo ratings yet

- Note 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSDocument6 pagesNote 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSdemolaojaomoNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- IFRS 1 - For PresDocument27 pagesIFRS 1 - For Presnati67% (3)

- MBC Audited FS 2017 PARENTDocument57 pagesMBC Audited FS 2017 PARENTMikx LeeNo ratings yet

- IFRS at A Glance - BDODocument29 pagesIFRS at A Glance - BDONaim Aqram67% (3)

- P2 MindmapsDocument49 pagesP2 MindmapsPui Fun LeoNo ratings yet

- ABA - Annual Report 2018Document146 pagesABA - Annual Report 2018Ivan ChiuNo ratings yet

- Acctg 112 Reviewer Pas 1 8Document26 pagesAcctg 112 Reviewer Pas 1 8surbanshanrilNo ratings yet

- Accounting Policy Options in IFRSDocument11 pagesAccounting Policy Options in IFRSSaiful Iksan PratamaNo ratings yet

- IFRS 1 - First Time AdopterDocument9 pagesIFRS 1 - First Time AdopterAkinwumi AyodejiNo ratings yet

- IFRS TransitionDocument4 pagesIFRS Transitiondarshanshah86No ratings yet

- Cfas Presentation of FSDocument27 pagesCfas Presentation of FSRogelio F Geronimo Jr.No ratings yet

- Pfrs 1Document8 pagesPfrs 1Jenne LeeNo ratings yet

- Perfast Corporation - NotesDocument9 pagesPerfast Corporation - NotesMCDABCNo ratings yet

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNo ratings yet

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- Acctg 112 Reviewer Chap 34Document15 pagesAcctg 112 Reviewer Chap 34surbanshanrilNo ratings yet

- CFAS - Philippine Accounting StandardsDocument39 pagesCFAS - Philippine Accounting StandardsZerille Lynnelle Villamor Simbajon100% (1)

- UpFRS - Midterm Reviewer (1-3)Document9 pagesUpFRS - Midterm Reviewer (1-3)Penryu LeeNo ratings yet

- Ifrs 1: Advance Accounting IiDocument12 pagesIfrs 1: Advance Accounting IiAditya ArfanNo ratings yet

- Chapter 5 PAS 8 Accounting Policies, Changes in Accouting Estimates and ErrorsDocument12 pagesChapter 5 PAS 8 Accounting Policies, Changes in Accouting Estimates and ErrorsSimon RavanaNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Jollibee Foods Corporation and Subsidiaries Notes To Unaudited Consolidated Financial StatementsDocument53 pagesJollibee Foods Corporation and Subsidiaries Notes To Unaudited Consolidated Financial StatementsRex dela CruzNo ratings yet

- Ifrs 1Document6 pagesIfrs 1Marc Eric RedondoNo ratings yet

- FA Assignment 2 MarkupDocument2 pagesFA Assignment 2 MarkupKomal RehmanNo ratings yet

- Acc 102 - Module 3aDocument12 pagesAcc 102 - Module 3aPatricia CarreonNo ratings yet

- First-Time Adoption of International Financial Reporting StandardsDocument21 pagesFirst-Time Adoption of International Financial Reporting StandardsEshetie Mekonene AmareNo ratings yet

- UntitledDocument150 pagesUntitledRica Ella RestauroNo ratings yet

- PPSAS 01-Presentation of FS Oct-18 2013Document3 pagesPPSAS 01-Presentation of FS Oct-18 2013CarmelaEspinoNo ratings yet

- IA3 1st HandoutDocument3 pagesIA3 1st HandoutUyara LeisbergNo ratings yet

- PFRS 14: Regulatory Deferral AccountsDocument23 pagesPFRS 14: Regulatory Deferral AccountsMeiNo ratings yet

- Pas 1 Presentation of Financial StatementsDocument8 pagesPas 1 Presentation of Financial StatementsR.A.100% (1)

- Presentation of Financial StatementsDocument17 pagesPresentation of Financial StatementsFRANCIS IAN ALBARACIN IINo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Norden FCM Docs and TraceabilityDocument87 pagesNorden FCM Docs and TraceabilityDANIELANo ratings yet

- Corporate Governance StatementDocument15 pagesCorporate Governance StatementRahul PagariaNo ratings yet

- TSC Tbl1plus Rams Certif Plan Tbl1plus V1.2.1Document11 pagesTSC Tbl1plus Rams Certif Plan Tbl1plus V1.2.1Marocain DbxNo ratings yet

- Jim Marous - Banking TransformedDocument29 pagesJim Marous - Banking TransformedAbhishek CANewNo ratings yet

- SteeleeyeDocument2 pagesSteeleeyeKaushal AnandNo ratings yet

- ISO 20121 Lead Auditor - Two Page BrochureDocument2 pagesISO 20121 Lead Auditor - Two Page BrochurePECBCERTIFICATIONNo ratings yet

- Hermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Document263 pagesHermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Karoly SoosNo ratings yet

- SC Licensing Examinations Form: Company HouseDocument18 pagesSC Licensing Examinations Form: Company HouseBill LyeNo ratings yet

- ISEAL Standard-Setting Code of Good Practice (ASC)Document24 pagesISEAL Standard-Setting Code of Good Practice (ASC)Aldamir AcostaNo ratings yet

- Financial Liability Mechanism Section 15Document1 pageFinancial Liability Mechanism Section 15kc lovessNo ratings yet

- Distributor Empanelment Form - M F - NewDocument5 pagesDistributor Empanelment Form - M F - NewSudish Singh100% (1)

- SOW - General - EarthworksDocument19 pagesSOW - General - EarthworksJonald Dagsa100% (1)

- BS 7799 / ISO 17799: PresentationDocument25 pagesBS 7799 / ISO 17799: PresentationScribd 90210No ratings yet

- Strategic Plan Term PaperDocument36 pagesStrategic Plan Term PaperFelichesm FestoNo ratings yet

- Legal Compliance and HRM: Factories, Contract Labor, Apprentice, Shop and EstablishmentsDocument13 pagesLegal Compliance and HRM: Factories, Contract Labor, Apprentice, Shop and Establishmentskavan sardaNo ratings yet

- FakirKnitwearsLtd - Profile 2015Document21 pagesFakirKnitwearsLtd - Profile 2015SakibMDShafiuddin100% (1)

- Hino - Annual Report 2015Document118 pagesHino - Annual Report 2015Wasif Pervaiz Dar100% (1)

- DBM Local Budget Circular No 135 S. 2021Document37 pagesDBM Local Budget Circular No 135 S. 2021PolevuNo ratings yet

- Guided Self Regulation (March 2020) PDFDocument4 pagesGuided Self Regulation (March 2020) PDFHasnulNo ratings yet

- 2a Review On Applications of Gamp 5 in Pharmaceutical IndustriesDocument13 pages2a Review On Applications of Gamp 5 in Pharmaceutical IndustriesLuis CárdenasNo ratings yet

- ACTED Compliance Officer, Compliance Assistant, AMEU Officer and AMEU Assistant Jobs in KenyaDocument4 pagesACTED Compliance Officer, Compliance Assistant, AMEU Officer and AMEU Assistant Jobs in KenyaAlice WairimuNo ratings yet

- SadDocument2 pagesSadSuryanarayan MahatoNo ratings yet

- Information Security Awareness in Financial OrganizationsDocument49 pagesInformation Security Awareness in Financial OrganizationsStefano Bendandi100% (1)

- Falling Apart at The Seams: A Critical Analysis of New York City's Failure To Enforce Its Building Code & A Roadmap To ReformDocument32 pagesFalling Apart at The Seams: A Critical Analysis of New York City's Failure To Enforce Its Building Code & A Roadmap To ReformCMLevineNo ratings yet

- The Top 10 Financial Red Flags: Securing Your Record To Report ProcessDocument19 pagesThe Top 10 Financial Red Flags: Securing Your Record To Report ProcessManna MahadiNo ratings yet

- The FMD Handbook: A Guide To Full Material DisclosuresDocument20 pagesThe FMD Handbook: A Guide To Full Material DisclosuresAnnz CastleNo ratings yet

PFRS 1, 2, 3, 5

PFRS 1, 2, 3, 5

Uploaded by

taperogegetCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PFRS 1, 2, 3, 5

PFRS 1, 2, 3, 5

Uploaded by

taperogegetCopyright:

Available Formats

Hi, greetings everyone ಥ‿ಥ

We are group 1 and we will have an upcoming lesson this Saturday take some important notes sa lecture

natin ໒(⊙ᴗ⊙)७✎▤. Thank you.

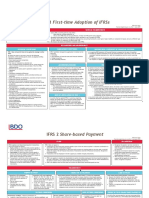

PFRS 1 FIRST-TIME ADOPTION OF PHILIPPINE FINANCIAL REPORTING STANDARDS.

Prior to the full adoption of the IFRSs in 2005, the reporting standards used in

the Philippines were primarily based on US GAAP (then called ‘SFASs’ –

Statement of Financial Accounting Standards).

In 2005, these SFASs were superseded by PFRSs (based on IFRSs).

Reporting entities in the Philippines were mandated to transition from their

previous GAAP to PFRSs.

On their transition to PFRSs in 2005, reporting entities were required to apply

PFRS 1.

Objective

To ensure that an entity’s First PFRS financial statements, including interim

financial reports covered thereon, contain high quality information that is transparent

to users, comparable, makes way for accounting in accordance with PFRSs, and

can be prepares with cost efficiency.

First PFRS financial statements

“The first annual financial statements in which an entity adopts PFRSs, by an explicit

and unreserved statement of compliance with PFRSs.”

Considered the entity’s “First PFRS financial statements” if the previous

financial statements:

a. were prepared in accordance with other reporting standards not consistent

with PFRSs; or

b. did not contain an explicit and unreserved statement of compliance with

PFRSs; or

c. contained an explicit and unreserved statement of compliance with some, but

not all, PFRSs; or

d. were prepared using some, but not all, applicable PFRSs; or

e. prepared in accordance with PFRSs but were used for internal reporting

purposes only; or

f. did not contain a complete set of financial statements as required under PAS 1

Presentation of Financial Statements.

g. The entity did not present financial statements in previous periods.

PFRS 1 is applied only once, that is, when the entity first adopts PFRSs.

PFRS 1 does not apply when previous financial statements contained an explicit

and unreserved statement of compliance with PFRSs, even if the auditors’ report

has been qualified.

PFRS 1 does not apply when an entity that has been applying PFRSs

subsequently changes its accounting policy in accordance with PAS 8 or specific

transitional provisions of other standards

Recognition and measurement

Requires an entity to prepare and present an opening PFRS statement of

financial position at the date of transition to PFRSs.

The date to transition to PFRSs’ is the beginning of the earliest period for which

an entity presents full comparative information under PFRSs in its first PFRS

financial statements. (application of PFRSs starts in this date)

Accounting policies

Based on the latest versions of PFRSs as at the current reporting date.

The selected policies are then applied to all financial statements presented

together with the first PFRS financial statements

PFRS 1 prohibits the application of non-uniform accounting policies or earlier

versions of PFRSs to the comparative periods as these undermine

comparability.

Early application of PFRSs that have not yet become effective as of the current

reporting period is permitted, but not required

Retrospective application

In general, PFRS 1 requires retrospective application of the accounting

policies selected by the first-time adopter.

This application requires restating assets and liabilities in the opening statement

of financial position.

The resulting adjustments are recognized directly in retained earnings.

PFRS 1 requires an entity to do the following in its opening PFRS statement

of financial position:

a. Recognize all assets and liabilities whose recognition is required by PFRSs;

b. Not recognize items as assets or liabilities if PFRSs do not permit.

c. Reclassify items recognized under previous GAAP that have different

classifications under PFRSs; and

d. Apply PFRSs in measuring all recognized assets and liabilities.

You might also like

- QUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsDocument2 pagesQUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsGonzalo Jr. Ruales86% (7)

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- Alcohol Compliance Course DoordashDocument15 pagesAlcohol Compliance Course DoordashRalph Lorenz AquinoNo ratings yet

- TCAR OPS Introduction To Industry - 9-10 June 2022Document196 pagesTCAR OPS Introduction To Industry - 9-10 June 2022Nisarat Joeytong100% (3)

- Ifrs 1 PDFDocument2 pagesIfrs 1 PDFBheki Tshimedzi0% (1)

- Ashok Leyland SEA FORMATDocument68 pagesAshok Leyland SEA FORMATVi KraNo ratings yet

- Global Trade Services OverviewDocument18 pagesGlobal Trade Services OverviewShyam Chinthalapudi100% (1)

- CFASDocument5 pagesCFASLurissa CabigNo ratings yet

- First-Time Adoption of Philippine Financial Reporting StandardsDocument11 pagesFirst-Time Adoption of Philippine Financial Reporting StandardszxcvbnmNo ratings yet

- "Full" Pfrss Refer To The Standards That We Had DiscussedDocument7 pages"Full" Pfrss Refer To The Standards That We Had DiscussedJustine VeralloNo ratings yet

- Pfrs 1 First Time Adoptation of Philippine Financial Reporting StandardsDocument4 pagesPfrs 1 First Time Adoptation of Philippine Financial Reporting StandardsSHARON SAMSONNo ratings yet

- Chapter 1 PFRS 1 AnswerDocument1 pageChapter 1 PFRS 1 Answer03LJNo ratings yet

- Pfrs 1 First-Time Adoptation of Philippine Financial Reporting StandardsDocument3 pagesPfrs 1 First-Time Adoptation of Philippine Financial Reporting StandardsR.A.No ratings yet

- Pfrs 1 9 Accounting 1Document23 pagesPfrs 1 9 Accounting 16wv84xgwnbNo ratings yet

- First-Time Adoption of Philippine Financial Reporting StandardsDocument11 pagesFirst-Time Adoption of Philippine Financial Reporting StandardszxcvbnmNo ratings yet

- Unit IV Accounting Standards Part IVDocument34 pagesUnit IV Accounting Standards Part IVChin FiguraNo ratings yet

- Actg 431 Week 5Document2 pagesActg 431 Week 5Kimberly ZafraNo ratings yet

- PFRS 1 - FIRST-TIME ADOPTION OF PFRSsDocument10 pagesPFRS 1 - FIRST-TIME ADOPTION OF PFRSsHannah TaduranNo ratings yet

- PFRS 12 MergedDocument45 pagesPFRS 12 MergedRojie Ann AmorNo ratings yet

- Introduction To IFRS 1 - First-Time Adoption of InternationaDocument12 pagesIntroduction To IFRS 1 - First-Time Adoption of InternationaPriyaka khannaNo ratings yet

- IFRS1Document2 pagesIFRS1Jkjiwani AccaNo ratings yet

- IFRS 1 First TimeDocument2 pagesIFRS 1 First TimeCatalin BlesnocNo ratings yet

- Chapter 23Document40 pagesChapter 23rameelamirNo ratings yet

- Assignment ON Ifrs1-First Time Adoption of IfrsDocument46 pagesAssignment ON Ifrs1-First Time Adoption of IfrsMohit BansalNo ratings yet

- IFRS IAS SummaryDocument94 pagesIFRS IAS SummaryLin AungNo ratings yet

- PAS 1 Presentation of FS: Intermediate Accounting Lecture 1Document3 pagesPAS 1 Presentation of FS: Intermediate Accounting Lecture 1Io AyaNo ratings yet

- 1 - Pdfsam - IAS & IFRS Bare StandardDocument1 page1 - Pdfsam - IAS & IFRS Bare StandarddskrishnaNo ratings yet

- PFRS 1 9Document22 pagesPFRS 1 9Apol AsusNo ratings yet

- Note 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSDocument6 pagesNote 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSdemolaojaomoNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- IFRS 1 - For PresDocument27 pagesIFRS 1 - For Presnati67% (3)

- MBC Audited FS 2017 PARENTDocument57 pagesMBC Audited FS 2017 PARENTMikx LeeNo ratings yet

- IFRS at A Glance - BDODocument29 pagesIFRS at A Glance - BDONaim Aqram67% (3)

- P2 MindmapsDocument49 pagesP2 MindmapsPui Fun LeoNo ratings yet

- ABA - Annual Report 2018Document146 pagesABA - Annual Report 2018Ivan ChiuNo ratings yet

- Acctg 112 Reviewer Pas 1 8Document26 pagesAcctg 112 Reviewer Pas 1 8surbanshanrilNo ratings yet

- Accounting Policy Options in IFRSDocument11 pagesAccounting Policy Options in IFRSSaiful Iksan PratamaNo ratings yet

- IFRS 1 - First Time AdopterDocument9 pagesIFRS 1 - First Time AdopterAkinwumi AyodejiNo ratings yet

- IFRS TransitionDocument4 pagesIFRS Transitiondarshanshah86No ratings yet

- Cfas Presentation of FSDocument27 pagesCfas Presentation of FSRogelio F Geronimo Jr.No ratings yet

- Pfrs 1Document8 pagesPfrs 1Jenne LeeNo ratings yet

- Perfast Corporation - NotesDocument9 pagesPerfast Corporation - NotesMCDABCNo ratings yet

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNo ratings yet

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- Acctg 112 Reviewer Chap 34Document15 pagesAcctg 112 Reviewer Chap 34surbanshanrilNo ratings yet

- CFAS - Philippine Accounting StandardsDocument39 pagesCFAS - Philippine Accounting StandardsZerille Lynnelle Villamor Simbajon100% (1)

- UpFRS - Midterm Reviewer (1-3)Document9 pagesUpFRS - Midterm Reviewer (1-3)Penryu LeeNo ratings yet

- Ifrs 1: Advance Accounting IiDocument12 pagesIfrs 1: Advance Accounting IiAditya ArfanNo ratings yet

- Chapter 5 PAS 8 Accounting Policies, Changes in Accouting Estimates and ErrorsDocument12 pagesChapter 5 PAS 8 Accounting Policies, Changes in Accouting Estimates and ErrorsSimon RavanaNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Jollibee Foods Corporation and Subsidiaries Notes To Unaudited Consolidated Financial StatementsDocument53 pagesJollibee Foods Corporation and Subsidiaries Notes To Unaudited Consolidated Financial StatementsRex dela CruzNo ratings yet

- Ifrs 1Document6 pagesIfrs 1Marc Eric RedondoNo ratings yet

- FA Assignment 2 MarkupDocument2 pagesFA Assignment 2 MarkupKomal RehmanNo ratings yet

- Acc 102 - Module 3aDocument12 pagesAcc 102 - Module 3aPatricia CarreonNo ratings yet

- First-Time Adoption of International Financial Reporting StandardsDocument21 pagesFirst-Time Adoption of International Financial Reporting StandardsEshetie Mekonene AmareNo ratings yet

- UntitledDocument150 pagesUntitledRica Ella RestauroNo ratings yet

- PPSAS 01-Presentation of FS Oct-18 2013Document3 pagesPPSAS 01-Presentation of FS Oct-18 2013CarmelaEspinoNo ratings yet

- IA3 1st HandoutDocument3 pagesIA3 1st HandoutUyara LeisbergNo ratings yet

- PFRS 14: Regulatory Deferral AccountsDocument23 pagesPFRS 14: Regulatory Deferral AccountsMeiNo ratings yet

- Pas 1 Presentation of Financial StatementsDocument8 pagesPas 1 Presentation of Financial StatementsR.A.100% (1)

- Presentation of Financial StatementsDocument17 pagesPresentation of Financial StatementsFRANCIS IAN ALBARACIN IINo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Norden FCM Docs and TraceabilityDocument87 pagesNorden FCM Docs and TraceabilityDANIELANo ratings yet

- Corporate Governance StatementDocument15 pagesCorporate Governance StatementRahul PagariaNo ratings yet

- TSC Tbl1plus Rams Certif Plan Tbl1plus V1.2.1Document11 pagesTSC Tbl1plus Rams Certif Plan Tbl1plus V1.2.1Marocain DbxNo ratings yet

- Jim Marous - Banking TransformedDocument29 pagesJim Marous - Banking TransformedAbhishek CANewNo ratings yet

- SteeleeyeDocument2 pagesSteeleeyeKaushal AnandNo ratings yet

- ISO 20121 Lead Auditor - Two Page BrochureDocument2 pagesISO 20121 Lead Auditor - Two Page BrochurePECBCERTIFICATIONNo ratings yet

- Hermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Document263 pagesHermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Karoly SoosNo ratings yet

- SC Licensing Examinations Form: Company HouseDocument18 pagesSC Licensing Examinations Form: Company HouseBill LyeNo ratings yet

- ISEAL Standard-Setting Code of Good Practice (ASC)Document24 pagesISEAL Standard-Setting Code of Good Practice (ASC)Aldamir AcostaNo ratings yet

- Financial Liability Mechanism Section 15Document1 pageFinancial Liability Mechanism Section 15kc lovessNo ratings yet

- Distributor Empanelment Form - M F - NewDocument5 pagesDistributor Empanelment Form - M F - NewSudish Singh100% (1)

- SOW - General - EarthworksDocument19 pagesSOW - General - EarthworksJonald Dagsa100% (1)

- BS 7799 / ISO 17799: PresentationDocument25 pagesBS 7799 / ISO 17799: PresentationScribd 90210No ratings yet

- Strategic Plan Term PaperDocument36 pagesStrategic Plan Term PaperFelichesm FestoNo ratings yet

- Legal Compliance and HRM: Factories, Contract Labor, Apprentice, Shop and EstablishmentsDocument13 pagesLegal Compliance and HRM: Factories, Contract Labor, Apprentice, Shop and Establishmentskavan sardaNo ratings yet

- FakirKnitwearsLtd - Profile 2015Document21 pagesFakirKnitwearsLtd - Profile 2015SakibMDShafiuddin100% (1)

- Hino - Annual Report 2015Document118 pagesHino - Annual Report 2015Wasif Pervaiz Dar100% (1)

- DBM Local Budget Circular No 135 S. 2021Document37 pagesDBM Local Budget Circular No 135 S. 2021PolevuNo ratings yet

- Guided Self Regulation (March 2020) PDFDocument4 pagesGuided Self Regulation (March 2020) PDFHasnulNo ratings yet

- 2a Review On Applications of Gamp 5 in Pharmaceutical IndustriesDocument13 pages2a Review On Applications of Gamp 5 in Pharmaceutical IndustriesLuis CárdenasNo ratings yet

- ACTED Compliance Officer, Compliance Assistant, AMEU Officer and AMEU Assistant Jobs in KenyaDocument4 pagesACTED Compliance Officer, Compliance Assistant, AMEU Officer and AMEU Assistant Jobs in KenyaAlice WairimuNo ratings yet

- SadDocument2 pagesSadSuryanarayan MahatoNo ratings yet

- Information Security Awareness in Financial OrganizationsDocument49 pagesInformation Security Awareness in Financial OrganizationsStefano Bendandi100% (1)

- Falling Apart at The Seams: A Critical Analysis of New York City's Failure To Enforce Its Building Code & A Roadmap To ReformDocument32 pagesFalling Apart at The Seams: A Critical Analysis of New York City's Failure To Enforce Its Building Code & A Roadmap To ReformCMLevineNo ratings yet

- The Top 10 Financial Red Flags: Securing Your Record To Report ProcessDocument19 pagesThe Top 10 Financial Red Flags: Securing Your Record To Report ProcessManna MahadiNo ratings yet

- The FMD Handbook: A Guide To Full Material DisclosuresDocument20 pagesThe FMD Handbook: A Guide To Full Material DisclosuresAnnz CastleNo ratings yet