Professional Documents

Culture Documents

Case 3 1

Case 3 1

Uploaded by

Kanishka KartikeyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 3 1

Case 3 1

Uploaded by

Kanishka KartikeyaCopyright:

Available Formats

Case 3.

1:

1) Income Statement for June Month as below:

a) Sales Revenue: It will include both cash and credit sales. As per the receipt of

June month cash sales was $44,420 and accounts receivable (credit sale) was

$26,505(June 30 a/c receivable) + $21,798 (cash received from a/c

receivable) – $21,798 (June 1 a/c receivable) = $70,925

b) Cost of Goods sold: is (inventory Opening – inventory closing + inventory

purchased). Here it comes as $29,835 (opening) – $265,520 (closing) +

$14,715(inventory purchased by cash) + ($21,315 – $8,517 + $8,517)

(inventory purchased on account) = $39,345

c) Gross Margin: is the difference of sales revenues and cost of the good sold.

d) Supplies Expenses: is (supplies opening – supplies closing + supplies

purchased). Here it is $5,559 (opening) – $6,630 (closing) + $1,671(supplies

purchased by cash) = $600. There were no supplies purchased on account.

Maynard Company

Income Statement

For Month of June

Particulars Total($)

Sales Revenue 70925

Cost of Goods Sold 39345

Gross Margin 31580

Supplies Expenses 600

Wage Expenses 5888

Utilities Expenses 900

Depreciation Expenses(building and equipment) 2574

Insurance Expenses 324

Miscellaneous Expenses 135

Income before income taxes(IBIT) 21159

Income tax expenses 1524

Net Income 19635

e) Wage Expenses: will be the difference between accrued wages payable at

EOM and SOM + wages paid during this month. It comes as $2,202(accrued at

EOM) - $1,974 (accrued at SOM) + $5,660 (wages paid during the month) =

$5,888. There were no prepaid wage expenses otherwise we would have to

subtract that amount.

f) Utilities Expense: As per the case receipts $900 was expense for utilities.

There is no opening and closing balance as well as credit purchase of utilities.

g) Depreciation Expenses: It includes both building and equipment depreciation

expenses. It was calculated on the basis of accumulated depreciation

difference at EOM and SOM.

h) Insurance Expenses: Difference of prepaid insurance at SOM and EOM will

result in the insurance expenses for month June.

i) Miscellaneous Expenses: are shown in the cash receipt for month of June so

will come into the income statement as is.

j) Income before income taxes (IBIT): is calculated by taking the difference of

all the operating expenses from gross margin.

k) Net Profit: is the difference between the IBIT and income taxes paid.

2) Explanation of the difference between cash balance and net income: Net income for a

particular period is the difference between the sales revenue and (cost of the good sold

+ operating expenses + income taxes). It does not matter if business got the cash for

revenues or did not pay for the purchases/operating expenses/income taxes during the

period when these were realized. These unpaid expenses/accrued wages/ accounts

payable and accounts receivable will be shown in the balance sheet as per the nature

but income sheet.

For example in June month Maynard Company got the $20,865 cash from bank loan but

it will not be shown in the income sheet but balance sheet as liability. Same goes for the

other transactions also resulting in the difference between net income and increased

cash during June period.

3) Incorrect amount of cost of goods sold:

a) $14,175 – this was the just cash purchase of merchandise but the cost of

sales is (inventory Opening – inventory closing + inventory purchased both

cash and on account). So we will not just take $14,175 as cost of sale.

b) $36,030 – this was just the inventory purchase both on cash and credit but

did not include the difference of inventory opening and closing so we can not

take it as cost of sales either.

You might also like

- A Level Incomplete Records Practice QuestionsDocument9 pagesA Level Incomplete Records Practice QuestionsMUSTHARI KHAN100% (1)

- Case 3.1Document2 pagesCase 3.1Sandeep Agrawal100% (6)

- Maharaja Sayajirao University of Baroda B.com SyllabusDocument105 pagesMaharaja Sayajirao University of Baroda B.com SyllabusKartik ChaturvediNo ratings yet

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersenkay12100% (3)

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- 6th Ed Module 1 Selected Homework AnswersDocument7 pages6th Ed Module 1 Selected Homework AnswersjoshNo ratings yet

- Palmer Limited Case StudyDocument9 pagesPalmer Limited Case StudyPrashil Raj MehtaNo ratings yet

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Case 31: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 31: Maynard Company (B) : DR Ashish Varma / IMTAranhav SinghNo ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- BUS FPX4060 - Assessment2 1Document14 pagesBUS FPX4060 - Assessment2 1AA TsolScholarNo ratings yet

- Lesson 25 Exporting Reports & CashflowsDocument8 pagesLesson 25 Exporting Reports & CashflowsBarry HolmesNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Key Chapter 1Document4 pagesKey Chapter 1duyanh.vinunihanoiNo ratings yet

- Unithibs LTDDocument4 pagesUnithibs LTDRobert Daniel AquinoNo ratings yet

- FIN202 - SU23 - Individual AssignmentDocument8 pagesFIN202 - SU23 - Individual AssignmentÁnh Dương NguyễnNo ratings yet

- Financial StatementsDocument24 pagesFinancial Statementstranlamtuyen1911No ratings yet

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- ACT 205 Assignment - Spring 2019-20Document5 pagesACT 205 Assignment - Spring 2019-20Muhammad AhamdNo ratings yet

- Case - Maynard Company (A)Document2 pagesCase - Maynard Company (A)Sujay SaxenaNo ratings yet

- Browning-Manufacturing BudgetingDocument19 pagesBrowning-Manufacturing BudgetingMavis ThoughtsNo ratings yet

- HomeDepot F22 SolutionDocument4 pagesHomeDepot F22 SolutionFalguni ShomeNo ratings yet

- hw4 (Answers) R2Document6 pageshw4 (Answers) R2Arslan HafeezNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- The Final Accounts of Sole Trader (Financial Statements) : Topic 5Document32 pagesThe Final Accounts of Sole Trader (Financial Statements) : Topic 5vickramravi16No ratings yet

- A09 Chapter 4 Class Notes 1232Document6 pagesA09 Chapter 4 Class Notes 1232raylannister14No ratings yet

- Cdresultat GDocument5 pagesCdresultat GvonyirvineNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Financial Accounting and Reporting-I: Page 1 of 7Document7 pagesFinancial Accounting and Reporting-I: Page 1 of 7Hareem AbbasiNo ratings yet

- Intermediate: AccountingDocument76 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- Advanced Corp AccountingDocument10 pagesAdvanced Corp AccountingTejas GNo ratings yet

- 助教課講義 Ch.3 (A4雙面)Document10 pages助教課講義 Ch.3 (A4雙面)5213adamNo ratings yet

- Final Accounts Notes and Numericals 2023 To Be Solved in ClassDocument8 pagesFinal Accounts Notes and Numericals 2023 To Be Solved in ClassDishuNo ratings yet

- Afif Juwandira-1162003016-Jawaban UTS Semester GenapDocument10 pagesAfif Juwandira-1162003016-Jawaban UTS Semester GenapYusuf AssegafNo ratings yet

- SD 05684602Document13 pagesSD 05684602Miguel gagoNo ratings yet

- Chapter 3 - Understanding The Income StatementDocument68 pagesChapter 3 - Understanding The Income StatementNguyễn Yến NhiNo ratings yet

- NCB Y12 13 A Level Accounting Resources PPT SIL 2023Document25 pagesNCB Y12 13 A Level Accounting Resources PPT SIL 2023Joshua RuizNo ratings yet

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Financial Statement Analysis Midterm Assignment AssignmentDocument5 pagesFinancial Statement Analysis Midterm Assignment AssignmentHaidar NuraNo ratings yet

- Chap 2Document5 pagesChap 2Cẩm ChiNo ratings yet

- Financial Reporting and Analysis 7th Edition by Gibson ISBN Solution ManualDocument46 pagesFinancial Reporting and Analysis 7th Edition by Gibson ISBN Solution Manualphyllis100% (40)

- مادة الدراساتSlides No.2Document39 pagesمادة الدراساتSlides No.2gehad ahmedNo ratings yet

- Week 3 Illustrative Lecture SolutionsDocument7 pagesWeek 3 Illustrative Lecture SolutionsKristel AndreaNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Zuying. XueDocument9 pagesZuying. XueAbiot Asfiye GetanehNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Exercise No 1 (CGS CGM) - P SDocument11 pagesExercise No 1 (CGS CGM) - P SArun kumarNo ratings yet

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document13 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Ramakrishna MaityNo ratings yet

- Assignment FM I (2020)Document11 pagesAssignment FM I (2020)ShaggYNo ratings yet

- Case-2-Business Analysis and ReportingDocument3 pagesCase-2-Business Analysis and Reportinglehoangminhchau21No ratings yet

- 6 Incomplete RecordsDocument16 pages6 Incomplete Recordssana.ibrahimNo ratings yet

- Chapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongDocument12 pagesChapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongMai Phương NguyễnNo ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayNo ratings yet

- Master Budget Case: Toyworks Ltd. (A)Document4 pagesMaster Budget Case: Toyworks Ltd. (A)RIKUDO SENNIN100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- heizer_om14_im_05Document16 pagesheizer_om14_im_05Kanishka KartikeyaNo ratings yet

- Alrich Farms CaseDocument1 pageAlrich Farms CaseKanishka KartikeyaNo ratings yet

- Western Telecommunication CashflowDocument3 pagesWestern Telecommunication CashflowKanishka KartikeyaNo ratings yet

- Amerbran Company CashflowDocument1 pageAmerbran Company CashflowKanishka KartikeyaNo ratings yet

- Muhammad Azhar Bin Mat SaadDocument1 pageMuhammad Azhar Bin Mat Saadmuhammad azharNo ratings yet

- APES 2020 Exam Reference SheetDocument3 pagesAPES 2020 Exam Reference SheetIrene LiaoNo ratings yet

- Mutation CancellationDocument4 pagesMutation Cancellationkamran wahabNo ratings yet

- Training A320 DoorsDocument216 pagesTraining A320 DoorsMUHANDES UKRAINE100% (2)

- Forest Laws and Their Impact On Adivasi Economy in Colonial India1Document12 pagesForest Laws and Their Impact On Adivasi Economy in Colonial India1NidhiNo ratings yet

- Syllabi Econ 1CDocument2 pagesSyllabi Econ 1Challel jhon butacNo ratings yet

- Physics Investigatory ProjectDocument18 pagesPhysics Investigatory ProjectMoghanNo ratings yet

- Lecture 11 GearDocument96 pagesLecture 11 GearMohd Naim Bin KaramaNo ratings yet

- Neet Code C Question Paper PDFDocument41 pagesNeet Code C Question Paper PDFMagnifestoNo ratings yet

- People vs. ObiasDocument2 pagesPeople vs. ObiasRobNo ratings yet

- PD 477Document21 pagesPD 477Rak Nopel Taro100% (1)

- Antiragging Committee - Jan-20Document1 pageAntiragging Committee - Jan-20TRH RECRUITMENTNo ratings yet

- Warhammer Skaven Paint GuideDocument2 pagesWarhammer Skaven Paint Guiderandom-userNo ratings yet

- Basic Accounting Principles ModuleDocument23 pagesBasic Accounting Principles ModulezendeexNo ratings yet

- Verge PH Swot AnalysisDocument3 pagesVerge PH Swot AnalysisPamela ApacibleNo ratings yet

- Group Hot TopicDocument40 pagesGroup Hot Topicapi-425561076No ratings yet

- Katarungang Pambarangay: By: Angelo S. Mahinay Enhanced By: Mlgoo Fidel M. NarismaDocument138 pagesKatarungang Pambarangay: By: Angelo S. Mahinay Enhanced By: Mlgoo Fidel M. NarismaMelvs NavarraNo ratings yet

- Internal Motivation Infographics by SlidesgoDocument34 pagesInternal Motivation Infographics by Slidesgoyosua tafulyNo ratings yet

- 友谊论文的论点Document6 pages友谊论文的论点gwhjcowlfNo ratings yet

- G9 Nghĩa ĐiềnDocument10 pagesG9 Nghĩa ĐiềnNguyệt Võ Thị MinhNo ratings yet

- CIRFormDocument3 pagesCIRFormVina Mae AtaldeNo ratings yet

- Operating, Maintenance & Parts Manual: Rated LoadsDocument48 pagesOperating, Maintenance & Parts Manual: Rated LoadsAmanNo ratings yet

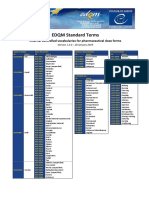

- Standard Terms Internal Vocabularies For Pharmaceutical Dose FormsDocument7 pagesStandard Terms Internal Vocabularies For Pharmaceutical Dose FormsJose De La Cruz De La ONo ratings yet

- Literary Appreciation SkillsDocument18 pagesLiterary Appreciation SkillsZaineid CaelumNo ratings yet

- 04 What Is Easement Distinguish Easement From Usufruct 2 Can There Be A An - Course HeroDocument9 pages04 What Is Easement Distinguish Easement From Usufruct 2 Can There Be A An - Course HerojrstockholmNo ratings yet

- Qualitative ResearchDocument27 pagesQualitative ResearchElizabeth PalasanNo ratings yet

- IRDocument4 pagesIRBenny JohnNo ratings yet

- 1.socio Economic Determinants of HealthDocument64 pages1.socio Economic Determinants of HealthdenekeNo ratings yet

- 32 Osmeña III V SSSDocument10 pages32 Osmeña III V SSSAisa CastilloNo ratings yet