Professional Documents

Culture Documents

Difference Between Finance Lease and Operating Le

Difference Between Finance Lease and Operating Le

Uploaded by

Rajkumar SahCopyright:

Available Formats

You might also like

- Letter of EnrolmentDocument1 pageLetter of EnrolmentFloyd ElgarNo ratings yet

- Franchise AgreementDocument21 pagesFranchise Agreementinnovatingwork94% (17)

- ECON6033 Corporate Finance Assignment 1 SolutionDocument2 pagesECON6033 Corporate Finance Assignment 1 SolutionHaiyan LIU100% (1)

- Lease FinanceDocument62 pagesLease Financepriyankakataria143100% (1)

- Leasing and Hire PurchaseDocument48 pagesLeasing and Hire PurchasePreeti Sharma100% (1)

- Picatrix Arabic VersionDocument443 pagesPicatrix Arabic VersionStrata mapNo ratings yet

- ECEPP Works Single 1.5.4 Tender Security ENGDocument3 pagesECEPP Works Single 1.5.4 Tender Security ENGDilya KhaliulinaNo ratings yet

- Financial Lease Vs Operating LeaseDocument7 pagesFinancial Lease Vs Operating LeasePhuongwater Le Thanh PhuongNo ratings yet

- Material Unit 3Document14 pagesMaterial Unit 3Pranjay PoddarNo ratings yet

- 1 Year MBADocument28 pages1 Year MBABijoy BijoyNo ratings yet

- Leasing: E10 Corporate FinanceDocument29 pagesLeasing: E10 Corporate FinanceprabodhNo ratings yet

- By Otmar, B.A: Leasing PreparedDocument53 pagesBy Otmar, B.A: Leasing PreparedAnna Mwita100% (1)

- Hybrid SecurityDocument3 pagesHybrid SecurityTahmidul HaqueNo ratings yet

- Chapters 1819Document66 pagesChapters 1819Andualem UfoNo ratings yet

- Leasing and Hire-PurchaseDocument30 pagesLeasing and Hire-PurchaseDileep SinghNo ratings yet

- Meezan Bank ReportDocument19 pagesMeezan Bank ReportkashifislamicNo ratings yet

- Lease, Buy & Status QuoDocument4 pagesLease, Buy & Status QuoJulaihie SabriNo ratings yet

- Notes of MFBSDocument23 pagesNotes of MFBSScroll with deepriyaNo ratings yet

- Leasing: Presented By: Ravish Magajwala (Gm065)Document17 pagesLeasing: Presented By: Ravish Magajwala (Gm065)RavishNo ratings yet

- Chapter 7 - LeasingDocument4 pagesChapter 7 - LeasingNicole Feliz InfanteNo ratings yet

- LeasingDocument52 pagesLeasingShishir N VNo ratings yet

- Accounting LeaseDocument18 pagesAccounting LeaseNune SabanalNo ratings yet

- LeasingDocument6 pagesLeasingShubham DhimaanNo ratings yet

- Leasing Is A Process by Which A Firm Can Obtain The Use of A Certain Fixed Assets For Which It MustDocument6 pagesLeasing Is A Process by Which A Firm Can Obtain The Use of A Certain Fixed Assets For Which It MustmanyasinghNo ratings yet

- Difference Between Hire Purchase vs. Installment PurchaseDocument5 pagesDifference Between Hire Purchase vs. Installment PurchaseMayank SharmaNo ratings yet

- Chapter Four Lease AccountingDocument11 pagesChapter Four Lease AccountingBikila MalasaNo ratings yet

- Unit III-Leasing and Hire PurchaseDocument50 pagesUnit III-Leasing and Hire PurchaseAkashik GgNo ratings yet

- Leasing: Compiled To Fulfill The Duties of Advanced Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiDocument7 pagesLeasing: Compiled To Fulfill The Duties of Advanced Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiGaluh DewandaruNo ratings yet

- Chapter 4 - LeaseDocument7 pagesChapter 4 - LeaseGebeyaw BayeNo ratings yet

- Leasing and Hire PurchaseDocument27 pagesLeasing and Hire PurchaseIshaan KhatriNo ratings yet

- What Is Lease Financing?: Parties To A LeaseDocument14 pagesWhat Is Lease Financing?: Parties To A LeasesumitruNo ratings yet

- 202004021945300501vasudha Kumar Finance Management 1Document7 pages202004021945300501vasudha Kumar Finance Management 1StarboyNo ratings yet

- Chapter 4 Accounting For LeaseDocument11 pagesChapter 4 Accounting For LeaseDawit AmahaNo ratings yet

- What Is A LeaseDocument9 pagesWhat Is A LeaseAshutosh PandeyNo ratings yet

- Lease FinancingDocument13 pagesLease FinancingJay KishanNo ratings yet

- Keompok 5 - Accounting For LeasesDocument49 pagesKeompok 5 - Accounting For LeasesSirly NovianiNo ratings yet

- Basics of LeasingDocument10 pagesBasics of LeasingNeeraj PariharNo ratings yet

- Financial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverDocument41 pagesFinancial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverSouliman MuhammadNo ratings yet

- Accounting For LeasesDocument5 pagesAccounting For LeasesJi YuNo ratings yet

- Types of LeaseDocument3 pagesTypes of LeaseAmit KainthNo ratings yet

- Lease FinancingDocument16 pagesLease Financingparekhrahul9988% (8)

- Presented By: Dilpreet Kaur Navneet KaurDocument9 pagesPresented By: Dilpreet Kaur Navneet Kaurnavneet_kaur2345No ratings yet

- LeasingDocument19 pagesLeasingmaitrisharma131295No ratings yet

- Hire Purchase and LeasingDocument30 pagesHire Purchase and LeasingShreyas Khanore100% (1)

- Essential For Islamic Finance: Ijara (Leasing) "Document31 pagesEssential For Islamic Finance: Ijara (Leasing) "shariq_No ratings yet

- New LeasingDocument56 pagesNew LeasingChirag Goyal100% (1)

- UGBA 120AB Chapter 15 Leases Spring 2020 Without SolutionsDocument123 pagesUGBA 120AB Chapter 15 Leases Spring 2020 Without Solutionsyadi lauNo ratings yet

- Lease and Hire PurchaseDocument27 pagesLease and Hire Purchasekrishan60No ratings yet

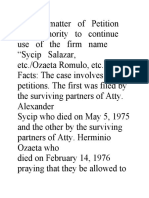

- Final Special Topics Lesson 1 2Document36 pagesFinal Special Topics Lesson 1 2nomer christian verderaNo ratings yet

- LeasingDocument2 pagesLeasingtanjimalomturjo1No ratings yet

- Unit - 3 Financial Services in India: LeasingDocument15 pagesUnit - 3 Financial Services in India: Leasingcmmounika1998gmail.comNo ratings yet

- 7.lease Vs FinanceDocument6 pages7.lease Vs FinanceShiva AroraNo ratings yet

- Financial Services: Topic:-LeasingDocument11 pagesFinancial Services: Topic:-LeasingUtkarsh RajputNo ratings yet

- Leasing of A WarehouseDocument8 pagesLeasing of A Warehouserollingsam7213No ratings yet

- Types of LeasesDocument4 pagesTypes of LeasesPui YanNo ratings yet

- Basic Rules Governing Leasing Under Islamic LawDocument4 pagesBasic Rules Governing Leasing Under Islamic LawmobinnaimNo ratings yet

- Lease Financing: Presentation By: Mohammed Akbar KhanDocument30 pagesLease Financing: Presentation By: Mohammed Akbar KhanMohammed Akbar KhanNo ratings yet

- Concept 0f Lease FinancingDocument6 pagesConcept 0f Lease FinancingParag TravadiNo ratings yet

- Leasing and Hire Purchase (Autosaved)Document72 pagesLeasing and Hire Purchase (Autosaved)medha_mehtaNo ratings yet

- Module 3 - Leasing Decisions: Pebsbafm 004 - Strategic Financial ManagementDocument12 pagesModule 3 - Leasing Decisions: Pebsbafm 004 - Strategic Financial ManagementLester BuenoNo ratings yet

- Leasing NotesDocument3 pagesLeasing Notesfazalwahab89100% (1)

- Landlord And Tenant Relationship: Fast & Easy Solutions To Tenancy Problems; In Simple English, For EveryoneFrom EverandLandlord And Tenant Relationship: Fast & Easy Solutions To Tenancy Problems; In Simple English, For EveryoneRating: 5 out of 5 stars5/5 (1)

- Commercial Law Exercise QuestionsDocument38 pagesCommercial Law Exercise QuestionsRachel100% (1)

- Sales Part 6: Coverage of DiscussionDocument21 pagesSales Part 6: Coverage of DiscussionAmie Jane MirandaNo ratings yet

- GR No. 178584 - October 8, 2012 Facts: Digest By: Shimi Fortuna Associated Marine Officers Vs DecenaDocument1 pageGR No. 178584 - October 8, 2012 Facts: Digest By: Shimi Fortuna Associated Marine Officers Vs DecenaShimi Fortuna0% (1)

- Financial InstrumentsDocument10 pagesFinancial InstrumentsSiddeshNo ratings yet

- Amenities AgreementDocument10 pagesAmenities AgreementVishal Dilip PanditNo ratings yet

- Essay TestDocument3 pagesEssay Testngabmhs160673No ratings yet

- IRaksha TROP Version2 Brochure WebDocument5 pagesIRaksha TROP Version2 Brochure WebNazeerNo ratings yet

- Vehicle Payment AgreementDocument3 pagesVehicle Payment AgreementRome VonhartNo ratings yet

- Trading Member and Authorised Person AgreementDocument8 pagesTrading Member and Authorised Person AgreementAshish AgarwalNo ratings yet

- Petition For Extra-Judicial ForeclosureDocument4 pagesPetition For Extra-Judicial ForeclosureEliseo C. Alibania, Jr.No ratings yet

- H04 Post TestDocument4 pagesH04 Post TestCharles D. FloresNo ratings yet

- DoorDocument4 pagesDoorapi-3807149No ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyGodwin LoboNo ratings yet

- Trad - Mock Exam 1-6 - Using Short BondDocument20 pagesTrad - Mock Exam 1-6 - Using Short BondTGiF TravelNo ratings yet

- AYM Shafa - Indicative Offer May 2019 (9649)Document4 pagesAYM Shafa - Indicative Offer May 2019 (9649)Chioma EzeNo ratings yet

- New India All Risks Insurance Claim FormDocument2 pagesNew India All Risks Insurance Claim FormALOK BHARTINo ratings yet

- Encumbrance CertificateDocument4 pagesEncumbrance CertificatesanjNo ratings yet

- Two Faces Demystifying The Mortgage Electronic Registration System's Land Title TheoryDocument32 pagesTwo Faces Demystifying The Mortgage Electronic Registration System's Land Title TheoryForeclosure Fraud100% (2)

- Topic 5c - Audit of Shareholders' Equity and Long Term LiabilityDocument14 pagesTopic 5c - Audit of Shareholders' Equity and Long Term LiabilityLANGITBIRUNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseRonilo BorjaNo ratings yet

- Law On ParCor Sec. 35 58Document34 pagesLaw On ParCor Sec. 35 58Carlos VillanuevaNo ratings yet

- Pettet B Company Law 2005 PDFDocument485 pagesPettet B Company Law 2005 PDFsverdlikNo ratings yet

- Cases Article 1815 - 1835Document35 pagesCases Article 1815 - 1835luckyNo ratings yet

- Atty. Uy (DAY 2) - Commercial LawDocument14 pagesAtty. Uy (DAY 2) - Commercial LawLoveUyNo ratings yet

- Chapter 1 Malaysian Derivatives MarketDocument16 pagesChapter 1 Malaysian Derivatives MarketAsyraf SalihinNo ratings yet

Difference Between Finance Lease and Operating Le

Difference Between Finance Lease and Operating Le

Uploaded by

Rajkumar SahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Difference Between Finance Lease and Operating Le

Difference Between Finance Lease and Operating Le

Uploaded by

Rajkumar SahCopyright:

Available Formats

› Banking, Finance & Insurance › Banking, Finance & Insurance Articles

› Difference Between Finance Lease And Operating Lease

Difference Between Finance Lease and

Operating Lease

6 mins read 15.5K Comment Share

Download As PDF

Anshuman Singh

Senior Executive - Content

Updated on Jun 11, 2024 13:28 IST

The main difference between finance lease and

operating lease is that a finance lease is a long-term

concept in which the ownership of the asset is

transferred to the lessee (owner of an asset that is

leased or rented). On the other hand, an operating lease

is a short-term concept in which the ownership of the

asset is not transferred and remains with the lessor (legal

owner of the asset).

Understanding the distinction between financial lease

and operating lease is crucial for businesses seeking to

acquire assets through leasing. These two leasing

options offer distinct benefits and implications,

influencing financial strategies and operational decisions.

A finance lease entails lessees assuming near-ownership

responsibilities, while an operating lease provides more

flexibility and less long-term commitment. Exploring

these differences empowers businesses to select the

most suitable leasing arrangement based on their

specific needs, financial goals, and risk tolerance.

You can also explore: Finance online courses &

certifications

Table of content

Difference between finance lease and operating

lease

What is a finance lease?

What is an operating lease?

Key differences between finance lease and

operating lease

Admissions Open

Parul University : Master of Business

Administration (Online) | A+ NAAC-

accredited university | 100% placement

support | Industry experts | Learn through

case studies Apply Now

Admissions Open

Parul University : Bachelor of Computer

Application - Online | A+ NAAC-accredited

university | 100% placement support |

Industry experts | Peer learning &

interactions Apply Now

Difference between Finance Lease and Operating

Lease

The terms “finance lease” and “operating lease” are so

frequently confused that the key difference between the

two is easily missed. So, to understand the difference

between finance lease and operating lease better, let’s

explore it in a tabular format.

Stay updated with the latest blogs on

online courses and skills

Enter Mobile Number

Register Now

Benchmark Finance Lease Operating Lease

A commercial

A commercial

contract in which the

contract in which the

lessor allows the

lessor allows the

lessee to use an

What is it? lessee to use an

asset in favour of

asset in favour of

regular payments for

regular payments for

a usually short

a usually long period.

period.

It is a long-term It is a short-term

Duration

contract contract

Ownership is

transferred to the Ownership remains

Owner lessee (owner of an with the lessor (legal

asset that is rented or owner of the asset).

leased).

This lease is

Capital lease Rental lease

also called

The risk of

obsolescence

Lessee Lessor

lies on the

part of the

Who takes

care of or

Lessee Lessor

maintains the

asset?

Can only be done on

Cancellation Can be done at any

the occurrence of a

of the lease time.

specific event.

In this lease,

is the bargain Yes. In this lease, the

No. In this lease, no

purchase or purchasing option is

such option is given.

purchasing given.

option given?

Craft Your Career Path: Find Courses After 12th That

Lead to Jobs and Free Online Courses!

What is a Finance Lease?

Finance lease definition: A finance lease is a long-term

concept in which the ownership of the asset is

transferred to the lessee (owner of an asset that is

leased or rented).

A finance lease is a commercial lease in which the

lessee receives almost all of the risks and rewards of

fixed asset ownership. In a finance lease, the lessee can

purchase the asset for a price less than the asset’s fair

market value.

To understand finance lease better, let’s go through an

example. Suppose there are two people, A and B.

Person A purchased a new car, and after some days, B

asks him to rent the car for five years (finance lease).

The terms of the finance lease will be something like this:

The term will be decided as the useful life span of the

asset, say five years,

Then the rental amount will be decided, and all the

risk/profit will belong to person B. (In this case, the

damages, insurance, etc.)

Person B pays the rental amount; at the end of the

lease period, he can pay a balloon payment and keep

the vehicle.

You can also explore: Difference Between Void and

Voidable Contract

What is an Operating Lease?

Operating lease definition: An operating lease is a

short-term concept in which the ownership of the asset is

not transferred and remains with the lessor (legal owner

of the asset).

In simple terms, in an operating lease contract, the right

to use assets is given, but the right of ownership of an

asset is not given. This lease is highly beneficial for

individuals or businesses, mainly when a company does

not require machines or assets for an extended period or

when they want to replace their assets. In an operating

lease, the lessee does not have the choice to purchase

the asset for a price less than the asset’s fair market

value.

To understand finance lease better, let’s go through an

example. Suppose there are two people, A and B.

Person A purchased a new car, and after some days, B

asks him to rent the car for one month (operating lease).

The terms of the operating lease will be something like

this:

Person B can use the vehicle for the duration of the

agreement, paying monthly rental fees. (Note: These

payments are not the same as the vehicle’s total

value, as with a finance lease.)

The risks remain with person A, and the vehicle will be

returned to them at the end of the term.

You can also explore: Difference Between Forward

and Future Contract

Key Differences Between a Finance Lease and

Operating Lease

Here are the key differences between finance lease and

operating lease:

A finance lease is a long-term contract, whereas an

operating lease is a short-term contract.

In the finance lease, the ownership of the asset is

transferred to the lessee. But, it not the case in the

operating lease. Open

in app

In the finance lease, the lessee takes care of or

maintains the asset, whereas, in the operating lease,

the lessor takes care of or maintains the asset.

In the finance lease, the lessee can buy the asset for a

price less than the asset’s fair market value. On the

other hand, in the operating lease, the lessee does not

get a choice to buy the asset for a price less than the

asset’s fair market value.

Conclusion

The main difference between finance lease and

operating lease is that a finance lease is a long-term

concept in which the ownership of the asset is

transferred to the lessee (owner of an asset that is

leased or rented). On the other hand, an operating lease

is a short-term concept in which the ownership of the

asset is not transferred and remains with the lessor (legal

owner of the asset).

I hope that now that you know the difference between

finance lease and operating lease, you will not get

confused between these terms.

Recommended Reads

Difference Between Fraud and…

Misrepresentation

The main difference between fraud and misrepresentation is that

fraud happens when a person or a party intentionally and willfully

represents false information to deceive another party. In contrast,

misrepresentation...read more

Difference Between Balance of Trade and…

Balance of Payment

The main difference between balance of trade and balance of

payment is that a balance of trade statement is a type of statement

that records a nation’s exports and imports...read more

Difference Between Forward and Future…

Contract

A forward contract is a type of agreement among two parties to

purchase or sell an asset (of any kind) at a specified price at a pre-

determined future time. A...read more

Difference Between Production and…

Manufacturing

The main difference between production and manufacturing is that

production is a process that may or may not use machines to create a

finished good. On the other hand, manufacturing...read more

FAQs

What is the difference between financial lease and

operating lease?

Regarding the difference between financial lease

and operating lease, in which one of these two does

the lessee get a choice to buy the asset for a price

less than the asset's fair market value?

Regarding the difference between financial lease

and operating lease, in which one of these two does

the lessee take care of or maintain the asset?

Download this article as PDF to

Download As PDF

read offline

Share this :

Your opinion matters to us!

Rate your experience using this page so far.

About the Author

Anshuman Singh

Senior Executive - Content

Anshuman Singh is an accomplished content writer with over

three years of experience specializing in cybersecurity, cloud

computing, networking, and software testing. Known for his

clear, concise, and informative wr... Read Full Bio

Trending Finance Courses

Popular Starting Soon

Management Accounting

edX 5.0

Projections and Structuring

edX

Business and Financial Modeling

Specialization

Coursera 4.7

Top Picks & New Arrivals

Popular Blogs Latest Blogs

Top 52 Financial Analyst Interview

Questions and A...

3.3L views

Learning The Important Functions of

Financial Mana...

1L views

Difference between MOA and AOA

87.5K views

NISM Exam 2024: Eligibility, Syllabus,

and Exam Pa...

69.6K views

TOP OF PAGE

Get in touch

Contact Us

Connect with us

Explore Websites +

Legal +

Naukri.com shiksha Jeevansathi 99acers

All rights reserved @ 2024 Info Edge (India) Ltd.

Share Download As PDF

You might also like

- Letter of EnrolmentDocument1 pageLetter of EnrolmentFloyd ElgarNo ratings yet

- Franchise AgreementDocument21 pagesFranchise Agreementinnovatingwork94% (17)

- ECON6033 Corporate Finance Assignment 1 SolutionDocument2 pagesECON6033 Corporate Finance Assignment 1 SolutionHaiyan LIU100% (1)

- Lease FinanceDocument62 pagesLease Financepriyankakataria143100% (1)

- Leasing and Hire PurchaseDocument48 pagesLeasing and Hire PurchasePreeti Sharma100% (1)

- Picatrix Arabic VersionDocument443 pagesPicatrix Arabic VersionStrata mapNo ratings yet

- ECEPP Works Single 1.5.4 Tender Security ENGDocument3 pagesECEPP Works Single 1.5.4 Tender Security ENGDilya KhaliulinaNo ratings yet

- Financial Lease Vs Operating LeaseDocument7 pagesFinancial Lease Vs Operating LeasePhuongwater Le Thanh PhuongNo ratings yet

- Material Unit 3Document14 pagesMaterial Unit 3Pranjay PoddarNo ratings yet

- 1 Year MBADocument28 pages1 Year MBABijoy BijoyNo ratings yet

- Leasing: E10 Corporate FinanceDocument29 pagesLeasing: E10 Corporate FinanceprabodhNo ratings yet

- By Otmar, B.A: Leasing PreparedDocument53 pagesBy Otmar, B.A: Leasing PreparedAnna Mwita100% (1)

- Hybrid SecurityDocument3 pagesHybrid SecurityTahmidul HaqueNo ratings yet

- Chapters 1819Document66 pagesChapters 1819Andualem UfoNo ratings yet

- Leasing and Hire-PurchaseDocument30 pagesLeasing and Hire-PurchaseDileep SinghNo ratings yet

- Meezan Bank ReportDocument19 pagesMeezan Bank ReportkashifislamicNo ratings yet

- Lease, Buy & Status QuoDocument4 pagesLease, Buy & Status QuoJulaihie SabriNo ratings yet

- Notes of MFBSDocument23 pagesNotes of MFBSScroll with deepriyaNo ratings yet

- Leasing: Presented By: Ravish Magajwala (Gm065)Document17 pagesLeasing: Presented By: Ravish Magajwala (Gm065)RavishNo ratings yet

- Chapter 7 - LeasingDocument4 pagesChapter 7 - LeasingNicole Feliz InfanteNo ratings yet

- LeasingDocument52 pagesLeasingShishir N VNo ratings yet

- Accounting LeaseDocument18 pagesAccounting LeaseNune SabanalNo ratings yet

- LeasingDocument6 pagesLeasingShubham DhimaanNo ratings yet

- Leasing Is A Process by Which A Firm Can Obtain The Use of A Certain Fixed Assets For Which It MustDocument6 pagesLeasing Is A Process by Which A Firm Can Obtain The Use of A Certain Fixed Assets For Which It MustmanyasinghNo ratings yet

- Difference Between Hire Purchase vs. Installment PurchaseDocument5 pagesDifference Between Hire Purchase vs. Installment PurchaseMayank SharmaNo ratings yet

- Chapter Four Lease AccountingDocument11 pagesChapter Four Lease AccountingBikila MalasaNo ratings yet

- Unit III-Leasing and Hire PurchaseDocument50 pagesUnit III-Leasing and Hire PurchaseAkashik GgNo ratings yet

- Leasing: Compiled To Fulfill The Duties of Advanced Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiDocument7 pagesLeasing: Compiled To Fulfill The Duties of Advanced Financial Management Courses Lecturer: Prof. Dr. Isti Fadah, M.SiGaluh DewandaruNo ratings yet

- Chapter 4 - LeaseDocument7 pagesChapter 4 - LeaseGebeyaw BayeNo ratings yet

- Leasing and Hire PurchaseDocument27 pagesLeasing and Hire PurchaseIshaan KhatriNo ratings yet

- What Is Lease Financing?: Parties To A LeaseDocument14 pagesWhat Is Lease Financing?: Parties To A LeasesumitruNo ratings yet

- 202004021945300501vasudha Kumar Finance Management 1Document7 pages202004021945300501vasudha Kumar Finance Management 1StarboyNo ratings yet

- Chapter 4 Accounting For LeaseDocument11 pagesChapter 4 Accounting For LeaseDawit AmahaNo ratings yet

- What Is A LeaseDocument9 pagesWhat Is A LeaseAshutosh PandeyNo ratings yet

- Lease FinancingDocument13 pagesLease FinancingJay KishanNo ratings yet

- Keompok 5 - Accounting For LeasesDocument49 pagesKeompok 5 - Accounting For LeasesSirly NovianiNo ratings yet

- Basics of LeasingDocument10 pagesBasics of LeasingNeeraj PariharNo ratings yet

- Financial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverDocument41 pagesFinancial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverSouliman MuhammadNo ratings yet

- Accounting For LeasesDocument5 pagesAccounting For LeasesJi YuNo ratings yet

- Types of LeaseDocument3 pagesTypes of LeaseAmit KainthNo ratings yet

- Lease FinancingDocument16 pagesLease Financingparekhrahul9988% (8)

- Presented By: Dilpreet Kaur Navneet KaurDocument9 pagesPresented By: Dilpreet Kaur Navneet Kaurnavneet_kaur2345No ratings yet

- LeasingDocument19 pagesLeasingmaitrisharma131295No ratings yet

- Hire Purchase and LeasingDocument30 pagesHire Purchase and LeasingShreyas Khanore100% (1)

- Essential For Islamic Finance: Ijara (Leasing) "Document31 pagesEssential For Islamic Finance: Ijara (Leasing) "shariq_No ratings yet

- New LeasingDocument56 pagesNew LeasingChirag Goyal100% (1)

- UGBA 120AB Chapter 15 Leases Spring 2020 Without SolutionsDocument123 pagesUGBA 120AB Chapter 15 Leases Spring 2020 Without Solutionsyadi lauNo ratings yet

- Lease and Hire PurchaseDocument27 pagesLease and Hire Purchasekrishan60No ratings yet

- Final Special Topics Lesson 1 2Document36 pagesFinal Special Topics Lesson 1 2nomer christian verderaNo ratings yet

- LeasingDocument2 pagesLeasingtanjimalomturjo1No ratings yet

- Unit - 3 Financial Services in India: LeasingDocument15 pagesUnit - 3 Financial Services in India: Leasingcmmounika1998gmail.comNo ratings yet

- 7.lease Vs FinanceDocument6 pages7.lease Vs FinanceShiva AroraNo ratings yet

- Financial Services: Topic:-LeasingDocument11 pagesFinancial Services: Topic:-LeasingUtkarsh RajputNo ratings yet

- Leasing of A WarehouseDocument8 pagesLeasing of A Warehouserollingsam7213No ratings yet

- Types of LeasesDocument4 pagesTypes of LeasesPui YanNo ratings yet

- Basic Rules Governing Leasing Under Islamic LawDocument4 pagesBasic Rules Governing Leasing Under Islamic LawmobinnaimNo ratings yet

- Lease Financing: Presentation By: Mohammed Akbar KhanDocument30 pagesLease Financing: Presentation By: Mohammed Akbar KhanMohammed Akbar KhanNo ratings yet

- Concept 0f Lease FinancingDocument6 pagesConcept 0f Lease FinancingParag TravadiNo ratings yet

- Leasing and Hire Purchase (Autosaved)Document72 pagesLeasing and Hire Purchase (Autosaved)medha_mehtaNo ratings yet

- Module 3 - Leasing Decisions: Pebsbafm 004 - Strategic Financial ManagementDocument12 pagesModule 3 - Leasing Decisions: Pebsbafm 004 - Strategic Financial ManagementLester BuenoNo ratings yet

- Leasing NotesDocument3 pagesLeasing Notesfazalwahab89100% (1)

- Landlord And Tenant Relationship: Fast & Easy Solutions To Tenancy Problems; In Simple English, For EveryoneFrom EverandLandlord And Tenant Relationship: Fast & Easy Solutions To Tenancy Problems; In Simple English, For EveryoneRating: 5 out of 5 stars5/5 (1)

- Commercial Law Exercise QuestionsDocument38 pagesCommercial Law Exercise QuestionsRachel100% (1)

- Sales Part 6: Coverage of DiscussionDocument21 pagesSales Part 6: Coverage of DiscussionAmie Jane MirandaNo ratings yet

- GR No. 178584 - October 8, 2012 Facts: Digest By: Shimi Fortuna Associated Marine Officers Vs DecenaDocument1 pageGR No. 178584 - October 8, 2012 Facts: Digest By: Shimi Fortuna Associated Marine Officers Vs DecenaShimi Fortuna0% (1)

- Financial InstrumentsDocument10 pagesFinancial InstrumentsSiddeshNo ratings yet

- Amenities AgreementDocument10 pagesAmenities AgreementVishal Dilip PanditNo ratings yet

- Essay TestDocument3 pagesEssay Testngabmhs160673No ratings yet

- IRaksha TROP Version2 Brochure WebDocument5 pagesIRaksha TROP Version2 Brochure WebNazeerNo ratings yet

- Vehicle Payment AgreementDocument3 pagesVehicle Payment AgreementRome VonhartNo ratings yet

- Trading Member and Authorised Person AgreementDocument8 pagesTrading Member and Authorised Person AgreementAshish AgarwalNo ratings yet

- Petition For Extra-Judicial ForeclosureDocument4 pagesPetition For Extra-Judicial ForeclosureEliseo C. Alibania, Jr.No ratings yet

- H04 Post TestDocument4 pagesH04 Post TestCharles D. FloresNo ratings yet

- DoorDocument4 pagesDoorapi-3807149No ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyGodwin LoboNo ratings yet

- Trad - Mock Exam 1-6 - Using Short BondDocument20 pagesTrad - Mock Exam 1-6 - Using Short BondTGiF TravelNo ratings yet

- AYM Shafa - Indicative Offer May 2019 (9649)Document4 pagesAYM Shafa - Indicative Offer May 2019 (9649)Chioma EzeNo ratings yet

- New India All Risks Insurance Claim FormDocument2 pagesNew India All Risks Insurance Claim FormALOK BHARTINo ratings yet

- Encumbrance CertificateDocument4 pagesEncumbrance CertificatesanjNo ratings yet

- Two Faces Demystifying The Mortgage Electronic Registration System's Land Title TheoryDocument32 pagesTwo Faces Demystifying The Mortgage Electronic Registration System's Land Title TheoryForeclosure Fraud100% (2)

- Topic 5c - Audit of Shareholders' Equity and Long Term LiabilityDocument14 pagesTopic 5c - Audit of Shareholders' Equity and Long Term LiabilityLANGITBIRUNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseRonilo BorjaNo ratings yet

- Law On ParCor Sec. 35 58Document34 pagesLaw On ParCor Sec. 35 58Carlos VillanuevaNo ratings yet

- Pettet B Company Law 2005 PDFDocument485 pagesPettet B Company Law 2005 PDFsverdlikNo ratings yet

- Cases Article 1815 - 1835Document35 pagesCases Article 1815 - 1835luckyNo ratings yet

- Atty. Uy (DAY 2) - Commercial LawDocument14 pagesAtty. Uy (DAY 2) - Commercial LawLoveUyNo ratings yet

- Chapter 1 Malaysian Derivatives MarketDocument16 pagesChapter 1 Malaysian Derivatives MarketAsyraf SalihinNo ratings yet