Professional Documents

Culture Documents

Bblpk2132a 2017-18

Bblpk2132a 2017-18

Uploaded by

getajaykaushalCopyright:

Available Formats

You might also like

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Crane e A4Document0 pagesCrane e A4DikacukNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- CTS FormB16 202021Document6 pagesCTS FormB16 202021Milind MoreNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form 16ADocument4 pagesForm 16AniranjansankaNo ratings yet

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- Ddopm6840n 2021-22Document2 pagesDdopm6840n 2021-22Gaurav MishraNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Servlet ControllerDocument7 pagesServlet ControllerSurender SharmaNo ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Buqpk7858h 2021-22Document2 pagesBuqpk7858h 2021-22Rahul AryanNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- GBVPM5241K 2020 21Document6 pagesGBVPM5241K 2020 21Nishant RoyNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Form 16 FY 2018-19 PDFDocument9 pagesForm 16 FY 2018-19 PDFSujata ChoudharyNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- DFCPS4106B Ay201920 16 Unsigned PDFDocument6 pagesDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- PDFReports PDFDocument6 pagesPDFReports PDFAnonymous NzCr2mvNo ratings yet

- Auvpb1446l 2018-19Document2 pagesAuvpb1446l 2018-19Sunil SharmaNo ratings yet

- Form16 18 19Document9 pagesForm16 18 19rushigadhave12No ratings yet

- పెరుగుదల - వికాస నియమాలుDocument6 pagesపెరుగుదల - వికాస నియమాలుIliyas GNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Attpp2455j 2021-22Document2 pagesAttpp2455j 2021-22Aditya PLNo ratings yet

- Akapr2160g 2019-20Document2 pagesAkapr2160g 2019-20Satyanarayana Sharma ValluriNo ratings yet

- G CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFDocument2 pagesG CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFjay krishnaNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- BJCPK1678J 2018-19Document2 pagesBJCPK1678J 2018-19AnbarasanNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- Akshay - Dev@vedanta - Co.in F16Document10 pagesAkshay - Dev@vedanta - Co.in F16Akshay DevNo ratings yet

- Form16 ANNPM2039F 40000516 PDFDocument8 pagesForm16 ANNPM2039F 40000516 PDFDr. Pankaj MishraNo ratings yet

- Form16 Part ADocument2 pagesForm16 Part ATrinadh CheemaladinneNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- BSBPG6820L 2020-21Document2 pagesBSBPG6820L 2020-21Arun PVNo ratings yet

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form16 488Document4 pagesForm16 488karpaga prasannaNo ratings yet

- Form No. 16: Part ADocument9 pagesForm No. 16: Part ArakehsNo ratings yet

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiNo ratings yet

- Form16 SignedDocument7 pagesForm16 SignedrajNo ratings yet

- HTMLReportsDocument7 pagesHTMLReportsPushpraj ThakurNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part APlay GoogleNo ratings yet

- Form 16Document6 pagesForm 16Ashwani KumarNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- R.C.C Project Upto Plinth Level: Abstract SheetDocument10 pagesR.C.C Project Upto Plinth Level: Abstract SheetVivÊk Síngh PâlNo ratings yet

- Bio ResonanceDocument32 pagesBio ResonanceJuan Pablo RosasNo ratings yet

- Tugas2 M. Ismeth B. INGDocument2 pagesTugas2 M. Ismeth B. INGtugaskls12xpaNo ratings yet

- 19/05/2021 Visit Date 39Y/Male Age & Gender Med110222452 Customerid MR.L Venkatachalam CustomernameDocument5 pages19/05/2021 Visit Date 39Y/Male Age & Gender Med110222452 Customerid MR.L Venkatachalam Customernamesyed imranNo ratings yet

- PWC Stock Based Compensation Second EditionDocument392 pagesPWC Stock Based Compensation Second EditionmzurzdcoNo ratings yet

- Nutrition Support in Critically Ill PatientDocument19 pagesNutrition Support in Critically Ill PatienttantoNo ratings yet

- Authentication of Instruments and Documents Without The Philippine IslandsDocument19 pagesAuthentication of Instruments and Documents Without The Philippine Islandswakadu095068No ratings yet

- The Old Man and Two GoatsDocument13 pagesThe Old Man and Two GoatshassNo ratings yet

- PushkalavatiDocument5 pagesPushkalavatiSana KhanNo ratings yet

- Political Dynasty: A Political InequalityDocument11 pagesPolitical Dynasty: A Political InequalityAngelNo ratings yet

- Computer Organization & Computer Organization & Computer Organization & Computer Organization & Assembly Languages Assembly LanguagesDocument119 pagesComputer Organization & Computer Organization & Computer Organization & Computer Organization & Assembly Languages Assembly LanguagesEdel Karlo Sibidal ZarasateNo ratings yet

- Adf Common TermsDocument2 pagesAdf Common TermsPearl NardoNo ratings yet

- 7.sericulture at RSRSDocument22 pages7.sericulture at RSRSSamuel DavisNo ratings yet

- Manual de Motor Fuera de Borda Mercury XP 115 ProDocument150 pagesManual de Motor Fuera de Borda Mercury XP 115 ProGestión De MantenimientoNo ratings yet

- Alternator 2 PDFDocument2 pagesAlternator 2 PDFvictoverNo ratings yet

- Carlsberg Sustainability Report 2018Document62 pagesCarlsberg Sustainability Report 2018Mike MichaelidesNo ratings yet

- Sync3 U6 STDocument6 pagesSync3 U6 STAna CondeNo ratings yet

- Short Story Analysis - The Doctor's Word by R.K. NarayanDocument1 pageShort Story Analysis - The Doctor's Word by R.K. Narayanjay pal0% (1)

- Doctrina Basica Usaf PDFDocument118 pagesDoctrina Basica Usaf PDFMirko Rodríguez ClaureNo ratings yet

- Describing People The Composition Should Be Divided in Three PartsDocument3 pagesDescribing People The Composition Should Be Divided in Three Partsrrrosaco100% (1)

- Textual MetafunctionDocument8 pagesTextual MetafunctionAniOrtiz100% (1)

- Polycarbonate Tube Chemical Resistance GuideDocument1 pagePolycarbonate Tube Chemical Resistance GuideInmaNo ratings yet

- Grove Music Online: Bar FormDocument3 pagesGrove Music Online: Bar Formedition58No ratings yet

- AP World History Summer AssignmentDocument9 pagesAP World History Summer AssignmentAnonymous tvG8tBNo ratings yet

- Quantum Hall EffectsDocument131 pagesQuantum Hall EffectsArmando IdarragaNo ratings yet

- Out of Hospital Cardiac Arrest in Kuala Lumpur: Incidence Adherence To Protocol and Issues: A Mixed Method StudyDocument10 pagesOut of Hospital Cardiac Arrest in Kuala Lumpur: Incidence Adherence To Protocol and Issues: A Mixed Method Studythabuty 21No ratings yet

- Big-Data-Ai-Ml-And-Data-Protection ICO - UKDocument114 pagesBig-Data-Ai-Ml-And-Data-Protection ICO - UKluanprotazioNo ratings yet

- Rafael Valencia Goyzueta Yessica Huanto Machicado Algebra Linial E Mat 103Document8 pagesRafael Valencia Goyzueta Yessica Huanto Machicado Algebra Linial E Mat 103Abraham Saire ChoqueNo ratings yet

- Ebs-250 Handjet-Hand Held Portable Inkjet Stencil Marking Leading MarksDocument4 pagesEbs-250 Handjet-Hand Held Portable Inkjet Stencil Marking Leading Marksapi-581452247No ratings yet

Bblpk2132a 2017-18

Bblpk2132a 2017-18

Uploaded by

getajaykaushalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bblpk2132a 2017-18

Bblpk2132a 2017-18

Uploaded by

getajaykaushalCopyright:

Available Formats

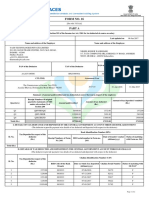

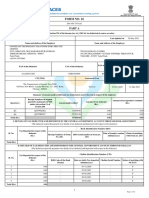

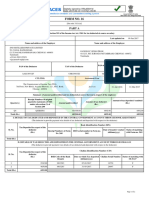

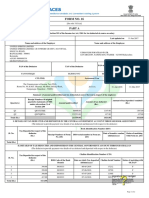

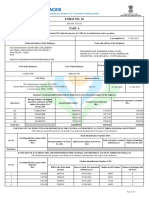

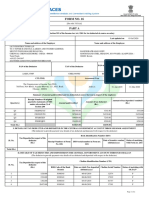

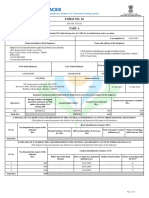

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. FHLZIAK Last updated on 25-May-2017

Name and address of the Employer Name and address of the Employee

HENKEL ANAND INDIA PRIVATE LIMITED

74, INDUSTRIAL DEVELOPMENT CO, MEHROLI ROAD,

AJAY KUMAR

GURGAON - 122001

AJAY KUMAR DHARM SINGH, KARANDOLA, RAIL, NADAUN,

Haryana

HAMIRPUR - 177045 Himachal Pradesh

omkar.anand@henkel.com

Employee Reference No.

PAN of the Employee

PAN of the Deductor TAN of the Deductor provided by the Employer

(If available)

AAACH5216Q RTKH01176A BBLPK2132A

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

2017-18 01-Apr-2016 31-Mar-2017

C.R. Building, Sector 17 . E, Himalaya Marg Chandigarh - 160017

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Receipt Numbers of original

Amount of tax deposited / remitted

quarterly statements of TDS Amount of tax deducted

Quarter(s) Amount paid/credited (Rs.)

under sub-section (3) of (Rs.)

Section 200

Q1 QRWNKRQG 322580.00 8359.00 8359.00

Total (Rs.) 322580.00 8359.00 8359.00

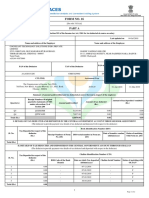

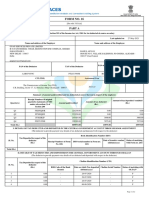

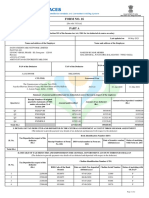

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Tax Deposited in respect of the

Sl. No. deductee Date of transfer voucher Status of matching

Receipt Numbers of Form DDO serial number in Form no.

(Rs.) (dd/mm/yyyy) with Form no. 24G

No. 24G 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

1 8359.00 6910333 06-05-2016 17439 F

2 0.00 - 07-06-2016 - F

3 0.00 - 07-07-2016 - F

Total (Rs.) 8359.00

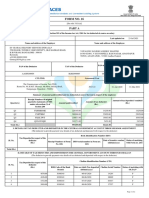

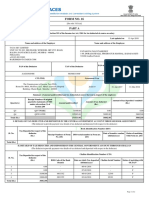

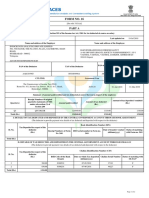

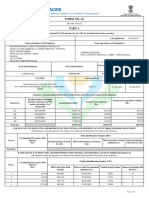

Digitally signed by OMKAR ANAND

Date: 09.06.2017 13:59:25 +05:30

Page 1 of 2

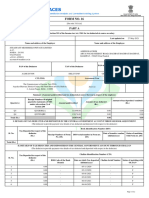

Certificate Number: FHLZIAK TAN of Employer: RTKH01176A PAN of Employee: BBLPK2132A Assessment Year: 2017-18

Verification

I, OMKAR ANAND, son / daughter of working in the capacity of MANAGER (designation) do hereby certify that a sum of Rs. 8359.00 [Rs. Eight Thousand Three

Hundred and Fifty Nine Only (in words)] has been deducted and a sum of Rs. 8359.00 [Rs. Eight Thousand Three Hundred and Fifty Nine Only] has been deposited

to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of account,

documents, TDS statements, TDS deposited and other available records.

Place GURGAON

Date 09-Jun-2017 (Signature of person responsible for deduction of Tax)

Designation: MANAGER Full Name:OMKAR ANAND

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

U Unmatched

details in bank match with details of deposit in TDS / TCS statement

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

P Provisional

verification of payment details submitted by Pay and Accounts Officer (PAO)

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

F Final mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

O Overbooked amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Digitally signed by OMKAR ANAND

Date: 09.06.2017 13:59:25 +05:30

Page 2 of 2

You might also like

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Crane e A4Document0 pagesCrane e A4DikacukNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- CTS FormB16 202021Document6 pagesCTS FormB16 202021Milind MoreNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form 16ADocument4 pagesForm 16AniranjansankaNo ratings yet

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- Ddopm6840n 2021-22Document2 pagesDdopm6840n 2021-22Gaurav MishraNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Servlet ControllerDocument7 pagesServlet ControllerSurender SharmaNo ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Buqpk7858h 2021-22Document2 pagesBuqpk7858h 2021-22Rahul AryanNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- GBVPM5241K 2020 21Document6 pagesGBVPM5241K 2020 21Nishant RoyNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Form 16 FY 2018-19 PDFDocument9 pagesForm 16 FY 2018-19 PDFSujata ChoudharyNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- DFCPS4106B Ay201920 16 Unsigned PDFDocument6 pagesDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- PDFReports PDFDocument6 pagesPDFReports PDFAnonymous NzCr2mvNo ratings yet

- Auvpb1446l 2018-19Document2 pagesAuvpb1446l 2018-19Sunil SharmaNo ratings yet

- Form16 18 19Document9 pagesForm16 18 19rushigadhave12No ratings yet

- పెరుగుదల - వికాస నియమాలుDocument6 pagesపెరుగుదల - వికాస నియమాలుIliyas GNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Attpp2455j 2021-22Document2 pagesAttpp2455j 2021-22Aditya PLNo ratings yet

- Akapr2160g 2019-20Document2 pagesAkapr2160g 2019-20Satyanarayana Sharma ValluriNo ratings yet

- G CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFDocument2 pagesG CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFjay krishnaNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- BJCPK1678J 2018-19Document2 pagesBJCPK1678J 2018-19AnbarasanNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- Akshay - Dev@vedanta - Co.in F16Document10 pagesAkshay - Dev@vedanta - Co.in F16Akshay DevNo ratings yet

- Form16 ANNPM2039F 40000516 PDFDocument8 pagesForm16 ANNPM2039F 40000516 PDFDr. Pankaj MishraNo ratings yet

- Form16 Part ADocument2 pagesForm16 Part ATrinadh CheemaladinneNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- BSBPG6820L 2020-21Document2 pagesBSBPG6820L 2020-21Arun PVNo ratings yet

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form16 488Document4 pagesForm16 488karpaga prasannaNo ratings yet

- Form No. 16: Part ADocument9 pagesForm No. 16: Part ArakehsNo ratings yet

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiNo ratings yet

- Form16 SignedDocument7 pagesForm16 SignedrajNo ratings yet

- HTMLReportsDocument7 pagesHTMLReportsPushpraj ThakurNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part APlay GoogleNo ratings yet

- Form 16Document6 pagesForm 16Ashwani KumarNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- R.C.C Project Upto Plinth Level: Abstract SheetDocument10 pagesR.C.C Project Upto Plinth Level: Abstract SheetVivÊk Síngh PâlNo ratings yet

- Bio ResonanceDocument32 pagesBio ResonanceJuan Pablo RosasNo ratings yet

- Tugas2 M. Ismeth B. INGDocument2 pagesTugas2 M. Ismeth B. INGtugaskls12xpaNo ratings yet

- 19/05/2021 Visit Date 39Y/Male Age & Gender Med110222452 Customerid MR.L Venkatachalam CustomernameDocument5 pages19/05/2021 Visit Date 39Y/Male Age & Gender Med110222452 Customerid MR.L Venkatachalam Customernamesyed imranNo ratings yet

- PWC Stock Based Compensation Second EditionDocument392 pagesPWC Stock Based Compensation Second EditionmzurzdcoNo ratings yet

- Nutrition Support in Critically Ill PatientDocument19 pagesNutrition Support in Critically Ill PatienttantoNo ratings yet

- Authentication of Instruments and Documents Without The Philippine IslandsDocument19 pagesAuthentication of Instruments and Documents Without The Philippine Islandswakadu095068No ratings yet

- The Old Man and Two GoatsDocument13 pagesThe Old Man and Two GoatshassNo ratings yet

- PushkalavatiDocument5 pagesPushkalavatiSana KhanNo ratings yet

- Political Dynasty: A Political InequalityDocument11 pagesPolitical Dynasty: A Political InequalityAngelNo ratings yet

- Computer Organization & Computer Organization & Computer Organization & Computer Organization & Assembly Languages Assembly LanguagesDocument119 pagesComputer Organization & Computer Organization & Computer Organization & Computer Organization & Assembly Languages Assembly LanguagesEdel Karlo Sibidal ZarasateNo ratings yet

- Adf Common TermsDocument2 pagesAdf Common TermsPearl NardoNo ratings yet

- 7.sericulture at RSRSDocument22 pages7.sericulture at RSRSSamuel DavisNo ratings yet

- Manual de Motor Fuera de Borda Mercury XP 115 ProDocument150 pagesManual de Motor Fuera de Borda Mercury XP 115 ProGestión De MantenimientoNo ratings yet

- Alternator 2 PDFDocument2 pagesAlternator 2 PDFvictoverNo ratings yet

- Carlsberg Sustainability Report 2018Document62 pagesCarlsberg Sustainability Report 2018Mike MichaelidesNo ratings yet

- Sync3 U6 STDocument6 pagesSync3 U6 STAna CondeNo ratings yet

- Short Story Analysis - The Doctor's Word by R.K. NarayanDocument1 pageShort Story Analysis - The Doctor's Word by R.K. Narayanjay pal0% (1)

- Doctrina Basica Usaf PDFDocument118 pagesDoctrina Basica Usaf PDFMirko Rodríguez ClaureNo ratings yet

- Describing People The Composition Should Be Divided in Three PartsDocument3 pagesDescribing People The Composition Should Be Divided in Three Partsrrrosaco100% (1)

- Textual MetafunctionDocument8 pagesTextual MetafunctionAniOrtiz100% (1)

- Polycarbonate Tube Chemical Resistance GuideDocument1 pagePolycarbonate Tube Chemical Resistance GuideInmaNo ratings yet

- Grove Music Online: Bar FormDocument3 pagesGrove Music Online: Bar Formedition58No ratings yet

- AP World History Summer AssignmentDocument9 pagesAP World History Summer AssignmentAnonymous tvG8tBNo ratings yet

- Quantum Hall EffectsDocument131 pagesQuantum Hall EffectsArmando IdarragaNo ratings yet

- Out of Hospital Cardiac Arrest in Kuala Lumpur: Incidence Adherence To Protocol and Issues: A Mixed Method StudyDocument10 pagesOut of Hospital Cardiac Arrest in Kuala Lumpur: Incidence Adherence To Protocol and Issues: A Mixed Method Studythabuty 21No ratings yet

- Big-Data-Ai-Ml-And-Data-Protection ICO - UKDocument114 pagesBig-Data-Ai-Ml-And-Data-Protection ICO - UKluanprotazioNo ratings yet

- Rafael Valencia Goyzueta Yessica Huanto Machicado Algebra Linial E Mat 103Document8 pagesRafael Valencia Goyzueta Yessica Huanto Machicado Algebra Linial E Mat 103Abraham Saire ChoqueNo ratings yet

- Ebs-250 Handjet-Hand Held Portable Inkjet Stencil Marking Leading MarksDocument4 pagesEbs-250 Handjet-Hand Held Portable Inkjet Stencil Marking Leading Marksapi-581452247No ratings yet