Professional Documents

Culture Documents

Oecd Theories of Harm in Digital Mergers Robertson June2023 230622093055 77620def

Oecd Theories of Harm in Digital Mergers Robertson June2023 230622093055 77620def

Uploaded by

Tamta Margvelashvili0 ratings0% found this document useful (0 votes)

2 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views8 pagesOecd Theories of Harm in Digital Mergers Robertson June2023 230622093055 77620def

Oecd Theories of Harm in Digital Mergers Robertson June2023 230622093055 77620def

Uploaded by

Tamta MargvelashviliCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

Digital Merger Control:

Adapting Theories of Harm

Viktoria H.S.E. Robertson

@VRobCompLaw

OECD COMPETITION COMMITTEE, 16 JUNE 2023

Introduction

Why have not more digital mergers been challenged?

1. No competition problem

2. No jurisdiction

Turnover thresholds Transaction value thresholds

Market share thresholds Referrals EU Member States Commission

3. No appropriate theories of harm

2 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023) Picture: pixabay.com

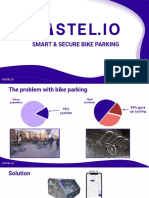

Digital Mergers in Europe

69 national European digital & tech

merger cases, by theories of harm

Only horizontal theories of harm

3% Horizontal and vertical theories of harm

7%

4%

Horizontal and conglomerate theories of harm

4%

44% Horizontal, vertical and conglomerate theories

12% of harm

Only vertical theories of harm

26% Vertical and conglomerate theories of harm

Only conglomerate theories of harm

Source: Robertson, Report to the

European Commission (2022)

3 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023)

Status Quo: Horizontal Concerns

Case Study 1: Same Digital Case Study 2: Assuaging

Merger – Different Assessments Horizontal Concerns

eBay/Adevinta (2020/2021) Presence of Big Tech

• Axel Springer/Concept Multimédia (FR

• AT 2018)

• DE • DPG/Sanoma (NL 2020)

• UK • Booster/Liftoff (IRL 2021)

• Turnitin/Ouriginal Group (ES 2021)

Digital market characteristics

• Merger prevents tipping (Axel

Springer/Immowelt, DE 2015)

• Multi-homing of users (Axel

Springer/Immowelt, DE 2015; Parship, DE

2015; Glovoappro/Foodpanda, RO 2021)

4 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023)

Status Quo: Vertical Concerns

Case Study 3: Input Foreclosure Case Study 4: Access to Data

in Meta/Giphy Through Vertical Integration

Input foreclosure Rockaway Capital/Heureka (CZ

• (i) ability and 2016)

• (ii) incentive to engage in foreclosure, Sully System/CENEJE (SI 2018)

• (iii) effects on downstream competition Sanoma/Iddink (NL 2019)

UK (2022) divestiture Uber International/GPC Computer

AT (2022) access requirement Software (UK 2021)

esure/Gocompare.com (UK 2015)

5 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023)

Status Quo: Conglomerate Concerns

Case Study 5: Bundling Case Study 6: Are Conglomerate

Strategies Theories of Harm Enough?

Frequently post-merger bundling Greek Delivery Hero case (2022)

no credible threat to competition Assessed purely in relation to

Axel Springer/Concept Multimédia conglomerate concerns (!)

(FR 2018) Required commitments

Sanoma/Iddink (NL 2019)

Blackbaud/Giving (UK 2017)

6 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023)

Conclusions

Traditional theories of harm remain focal point of substantive assessment in digital

mergers

Possible to adapt traditional theories of harm to digital market environments

But in practice, there appears to be a limit where ecosystem theories of harm

would need to be fully incorporated

Going forward, focus on:

1. Digital ecosystem theories of harm

2. Data advantages

3. Coherent interaction between merger control &

control of market power

7 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023) Picture: pixabay.com

Competition Law and Digitalization Group

Welthandelsplatz 1, 1020 Vienna, Austria

UNIV.-PROF. MAG. DR.

VIKTORIA H.S.E. ROBERTSON,

MJUR (OXON)

T +43-1-313 36-6630

viktoria.robertson@wu.ac.at

www.complawhub.eu

@VRobCompLaw

8 ROBERTSON, OECD COMPETITION COMMITTEE (16 JUNE 2023)

You might also like

- Demo Math Grade 4 CotDocument4 pagesDemo Math Grade 4 CotALLYN83% (18)

- A Digital Supply Chain Twin For Managing The Disruption Risks and Resilience in The Era of Industry 4 0Document15 pagesA Digital Supply Chain Twin For Managing The Disruption Risks and Resilience in The Era of Industry 4 0OUAFI KheireddineNo ratings yet

- PFClean5 0Document224 pagesPFClean5 0naving100% (1)

- Serial Dilution MethodDocument3 pagesSerial Dilution Methoddraneesh75% (4)

- 1 s2.0 S0360835223002863 MainDocument22 pages1 s2.0 S0360835223002863 MainFranzola FranNo ratings yet

- Renault CEO Calls For Auto European Plan To Protect Against Onslaught of EVs From China'Document19 pagesRenault CEO Calls For Auto European Plan To Protect Against Onslaught of EVs From China'Maria MeranoNo ratings yet

- World of Industries 3 - 2020Document20 pagesWorld of Industries 3 - 2020ZamfirMarianNo ratings yet

- The Generative Ai Challenges For Competition AuthoritiesDocument8 pagesThe Generative Ai Challenges For Competition AuthoritiesNome CognomeNo ratings yet

- Robotisation Race in Europe The Robotisation ChainDocument19 pagesRobotisation Race in Europe The Robotisation ChainAyoub MOHTARAMNo ratings yet

- Platforms and The Pandemic A Case Study of FashionDocument7 pagesPlatforms and The Pandemic A Case Study of FashionMUHAMMAD ABDULLAH 014No ratings yet

- A Drone Hop From The Local Shop Where Could Drone D - 2022 - Transportation ResDocument14 pagesA Drone Hop From The Local Shop Where Could Drone D - 2022 - Transportation ResjurnaltejoNo ratings yet

- Dealroom - Platform-Launch-European-StartupsDocument23 pagesDealroom - Platform-Launch-European-Startupsunreal2No ratings yet

- Big TechDocument41 pagesBig Techvamsi jaaduNo ratings yet

- Digital Technologies and Firm PerformanceDocument27 pagesDigital Technologies and Firm PerformanceSh. Khurram AbidNo ratings yet

- Nokia GRI Content Index 2019uuDocument16 pagesNokia GRI Content Index 2019uuLucas SloniakNo ratings yet

- International Journal of Computer Integrated Manufacturing PDFDocument15 pagesInternational Journal of Computer Integrated Manufacturing PDFbrf1365No ratings yet

- Industry 4.0 Adoption Challenges and Benefits For SMEsDocument12 pagesIndustry 4.0 Adoption Challenges and Benefits For SMEsRakshith SNo ratings yet

- 2022 Future Workforce Executive SummaryDocument9 pages2022 Future Workforce Executive SummaryibnucholdunNo ratings yet

- Digital Economic Policy The Economics of Digital Markets From A European Union Perspective Mario Mariniello Full ChapterDocument52 pagesDigital Economic Policy The Economics of Digital Markets From A European Union Perspective Mario Mariniello Full Chapterflorence.hernandez892100% (7)

- 1 s2.0 S2666791622000070 MainDocument6 pages1 s2.0 S2666791622000070 Mainizralaimin02No ratings yet

- Consumer Acceptance of Drone DeliveryDocument25 pagesConsumer Acceptance of Drone DeliveryZohra MerchantNo ratings yet

- Impacto of Blockchain On AviationDocument12 pagesImpacto of Blockchain On AviationjuanNo ratings yet

- Big Data in TelecomDocument35 pagesBig Data in TelecomManikantan GopalakrishnanNo ratings yet

- Buildingplatformecosystemsforiot Exploringtheimpactonindustrial AgefirmsDocument18 pagesBuildingplatformecosystemsforiot Exploringtheimpactonindustrial Agefirmsshayneyue2324No ratings yet

- Solar Industry - Designing A Digital Platform To Fo - 231019 - 135801Document13 pagesSolar Industry - Designing A Digital Platform To Fo - 231019 - 135801wipdchospdswczfcxgNo ratings yet

- Applied Artificial Intelligence For Predicting C - 2021 - Machine Learning WithDocument15 pagesApplied Artificial Intelligence For Predicting C - 2021 - Machine Learning Withjagath kumaraNo ratings yet

- Ecuaciones de Bellman FinanzasDocument10 pagesEcuaciones de Bellman FinanzasMiguel Angel PerezNo ratings yet

- Blocking The Chain - Industrial Food Chain Concentration, Big Data Platforms and Food Sovereignty SolutionsDocument44 pagesBlocking The Chain - Industrial Food Chain Concentration, Big Data Platforms and Food Sovereignty SolutionsCinthia FloresNo ratings yet

- On Cloud Computing and Applications To IT and Economics: N. B. OkeloDocument5 pagesOn Cloud Computing and Applications To IT and Economics: N. B. OkeloerpublicationNo ratings yet

- 2021 PTS Event ReportDocument15 pages2021 PTS Event ReportMilouse GrebNo ratings yet

- Relationships Between Industry 10 1108 - IJOA 04 2020 2120Document35 pagesRelationships Between Industry 10 1108 - IJOA 04 2020 2120Akim FrankNo ratings yet

- Geoinformatics 2009-4Document64 pagesGeoinformatics 2009-4api-280102665No ratings yet

- Frvir 03 961236Document24 pagesFrvir 03 961236Ankit VermaNo ratings yet

- 10 1108 - SCM 09 2020 0485Document22 pages10 1108 - SCM 09 2020 0485Ph Ghadeer MajedNo ratings yet

- Geoinformatics 2009 Vol06Document76 pagesGeoinformatics 2009 Vol06protogeografoNo ratings yet

- Disclosures About Algorithmic Decision Making 2023 InternationalDocument13 pagesDisclosures About Algorithmic Decision Making 2023 InternationalEman AbasiryNo ratings yet

- 2021 - Chiarini - Industry 4 0 Technologies in The Manufacturing Sector Are We Sure They Are All RelevantDocument14 pages2021 - Chiarini - Industry 4 0 Technologies in The Manufacturing Sector Are We Sure They Are All Relevantahmed said elshenawyNo ratings yet

- СМ6 УБ22Document21 pagesСМ6 УБ22СергейNo ratings yet

- Transactions in GIS - 2021 - Noardo - Reference Study of IFC Software Support The GeoBIM Benchmark 2019 Part IDocument37 pagesTransactions in GIS - 2021 - Noardo - Reference Study of IFC Software Support The GeoBIM Benchmark 2019 Part INuratifah ZaharudinNo ratings yet

- 5th Regional Log Forum 2024 Hai Phong (DR Thomas SIM) 28052024 ABRIDGEDDocument98 pages5th Regional Log Forum 2024 Hai Phong (DR Thomas SIM) 28052024 ABRIDGEDnhung.tttNo ratings yet

- Safety For Mobile Robotic Systems A Systematic Mapping Study From A Software Engineering PerspectiveDocument30 pagesSafety For Mobile Robotic Systems A Systematic Mapping Study From A Software Engineering PerspectiveAaqibRNo ratings yet

- Disruptive Technologies A 2021 UpdateDocument37 pagesDisruptive Technologies A 2021 UpdateCTRM CenterNo ratings yet

- Aviation 2035: Scenarios For Value Chain Recomposition and Value Sharing in Aviation Post The Era of Hyper-CompetitionDocument32 pagesAviation 2035: Scenarios For Value Chain Recomposition and Value Sharing in Aviation Post The Era of Hyper-CompetitionYudi NurahmatNo ratings yet

- E GMP PR1 0008Document21 pagesE GMP PR1 0008CHARAF ZINADINo ratings yet

- Jeremy MillardDocument5 pagesJeremy MillardNicolás Escobar GarciaNo ratings yet

- Rastel - Io PitchDeck RubikGarage DD PDFDocument11 pagesRastel - Io PitchDeck RubikGarage DD PDFAlexandru ConstantinNo ratings yet

- Business Models of IoT - From Suppliers To CustomerDocument53 pagesBusiness Models of IoT - From Suppliers To CustomerTuan100% (1)

- PiracyDocument11 pagesPiracySiddharth GandotraNo ratings yet

- Attachment 0Document6 pagesAttachment 0stangrunt11No ratings yet

- Social Sustainability in The Development of Service RobotsDocument10 pagesSocial Sustainability in The Development of Service RobotsMarkoNo ratings yet

- Digcomp at Work 090720 1Document106 pagesDigcomp at Work 090720 1Ainhoa GaNo ratings yet

- Discussion Paper On Energy Saving Insurance For 14 March International FGDDocument25 pagesDiscussion Paper On Energy Saving Insurance For 14 March International FGDdayu giriantariNo ratings yet

- A European Approach To Artificial IntelligenceDocument24 pagesA European Approach To Artificial IntelligenceSunil Kumar100% (1)

- After Broadband: Imagining Hyperconnected FuturesDocument26 pagesAfter Broadband: Imagining Hyperconnected FuturesPaula SastreNo ratings yet

- SBTi Power Sector 15C Guide FINALDocument18 pagesSBTi Power Sector 15C Guide FINALSireethus SaovaroNo ratings yet

- WSP - Net Zero X Vision Zero-Integrated Through ITSDocument9 pagesWSP - Net Zero X Vision Zero-Integrated Through ITSMotasem MiqdadNo ratings yet

- World Intellectual Property Indicators 2023Document205 pagesWorld Intellectual Property Indicators 2023Jimenez Vargas Jorge AntonioNo ratings yet

- Smart Innovation Norway Company Presentation (Short Presentation As Partner)Document12 pagesSmart Innovation Norway Company Presentation (Short Presentation As Partner)smuftahNo ratings yet

- Calculating The Carbon Footprint of Streaming MediaDocument11 pagesCalculating The Carbon Footprint of Streaming MediaRyanNo ratings yet

- Biobased Materials Webinar PresentationDocument50 pagesBiobased Materials Webinar PresentationSaskiaNo ratings yet

- Can Supply Chain Risk Management Practices Mitigate The DisruptionDocument12 pagesCan Supply Chain Risk Management Practices Mitigate The DisruptionChiara TrentinNo ratings yet

- Wipo Pub 941 2021Document232 pagesWipo Pub 941 2021LeninPaúlMejíaAguirreNo ratings yet

- Digitalisation in Europe 2022-2023: Evidence from the EIB Investment SurveyFrom EverandDigitalisation in Europe 2022-2023: Evidence from the EIB Investment SurveyNo ratings yet

- Nooni Et Al. 2014Document19 pagesNooni Et Al. 2014rendi saputraNo ratings yet

- Saarthi - Excel AssignmentDocument17 pagesSaarthi - Excel AssignmentBHUMIT KATARIANo ratings yet

- 1970 (198p) Light and Electromagnetism Project Physics Text and Handbook 4 1970Document198 pages1970 (198p) Light and Electromagnetism Project Physics Text and Handbook 4 1970jgf31No ratings yet

- Cover LetterDocument1 pageCover Letterdamjad583No ratings yet

- 10 1108 - Bij 03 2023 0131Document19 pages10 1108 - Bij 03 2023 0131Teguh SetiawanNo ratings yet

- Performance Comparison of Sequential Quick Sort and Parallel Quick Sort AlgorithmsDocument9 pagesPerformance Comparison of Sequential Quick Sort and Parallel Quick Sort AlgorithmsWidya UtamiNo ratings yet

- Work Experience: Birth Date: Birth Place: Age: Civil Status: Nationality: Height: Language SpokenDocument2 pagesWork Experience: Birth Date: Birth Place: Age: Civil Status: Nationality: Height: Language SpokenJohn De LeonNo ratings yet

- Sony - Micro System - Cmthpz9Document40 pagesSony - Micro System - Cmthpz9SoniaSegerMercedesNo ratings yet

- Catalog 2024 - Rom Honey - Meli Feli - PreviewDocument18 pagesCatalog 2024 - Rom Honey - Meli Feli - PreviewcecautituincasameaNo ratings yet

- EthernetDocument37 pagesEthernetUrvarshi GhoshNo ratings yet

- Mapex 2009 UK CatalogueDocument13 pagesMapex 2009 UK Cataloguenarainc0% (1)

- 5 MVA Trans EstimateDocument2 pages5 MVA Trans EstimateSanjay RoutNo ratings yet

- Acculan 3ti Ga677Document146 pagesAcculan 3ti Ga677LowayNo ratings yet

- Module17 Question OnlyDocument50 pagesModule17 Question OnlysyahirazaihadNo ratings yet

- Material Safety Data Sheet: Poly Aluminium ChlorideDocument4 pagesMaterial Safety Data Sheet: Poly Aluminium Chloridehinur awaNo ratings yet

- Chapter Review Guide QuestionsDocument1 pageChapter Review Guide QuestionsRick RanteNo ratings yet

- PIERRE VAN DEN BERGHE: A Socio-Biological PerspectiveDocument7 pagesPIERRE VAN DEN BERGHE: A Socio-Biological PerspectivejrsduranNo ratings yet

- Hef 4516 BTDocument10 pagesHef 4516 BTAdam SchwemleinNo ratings yet

- DLL CreativeNonfiction - Q4 - W33 S.Y. 22-23Document3 pagesDLL CreativeNonfiction - Q4 - W33 S.Y. 22-23Michael Oliver MercadoNo ratings yet

- The Lang 20W Class-A Mosfet AmplifierDocument7 pagesThe Lang 20W Class-A Mosfet AmplifiermoisesNo ratings yet

- ThinnerDocument9 pagesThinnerirfan vpNo ratings yet

- The RMIT University 2012 Postgraduate Program GuideDocument80 pagesThe RMIT University 2012 Postgraduate Program GuideRMIT University100% (1)

- A Thesis 2Document56 pagesA Thesis 2Miftahul JannahNo ratings yet

- 8th LA Midterms Study GuideDocument12 pages8th LA Midterms Study GuideIts AbbiNo ratings yet

- Aspek Hukum Pada Profesi Akuntan Publik: Wisnu WijayantoDocument16 pagesAspek Hukum Pada Profesi Akuntan Publik: Wisnu WijayantoDettia fitriNo ratings yet

- Weddingday Font Billy Argel Fonts FontSpaceDocument1 pageWeddingday Font Billy Argel Fonts FontSpaceStacey MutesiNo ratings yet

- HVAC Value EngineeringDocument2 pagesHVAC Value EngineeringamarandmoazNo ratings yet