Professional Documents

Culture Documents

Financial Statements

Financial Statements

Uploaded by

kc28843Copyright:

Available Formats

You might also like

- IWT Conscious Spending Plan 2023Document12 pagesIWT Conscious Spending Plan 2023GEO654No ratings yet

- Ia Vol 3 Valix 2019 SolmanDocument105 pagesIa Vol 3 Valix 2019 Solmanxeth agas86% (7)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasRizquita DhindaNo ratings yet

- 2020 Beximco and Renata Ratio AnalysisDocument18 pages2020 Beximco and Renata Ratio AnalysisRahi Mun100% (2)

- Cash FlowDocument9 pagesCash Flowshreyanshi sharmaNo ratings yet

- Unit 10 - Cash Flow AnalysisDocument26 pagesUnit 10 - Cash Flow Analysisqwertyytrewq12No ratings yet

- Cahs Flow StatementDocument18 pagesCahs Flow Statementtaniya17No ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementPranay SinghNo ratings yet

- Statement of Cash FlowDocument24 pagesStatement of Cash FlowMylene Santiago100% (1)

- Unit Ii Accounting PDFDocument11 pagesUnit Ii Accounting PDFMo ToNo ratings yet

- Statement of Changes in Financial Position: Cash Flow StatementDocument25 pagesStatement of Changes in Financial Position: Cash Flow StatementCharu Arora100% (1)

- Section 7Document30 pagesSection 7Abata BageyuNo ratings yet

- Accounting Assignment 2Document4 pagesAccounting Assignment 2Laddie LMNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementSwapnil ManeNo ratings yet

- 4 Statement of Cash FlowsDocument13 pages4 Statement of Cash FlowsNabi ParkNo ratings yet

- SCF - 3rd YrDocument27 pagesSCF - 3rd YrA.J. Chua100% (1)

- Cash Follow Statement (1) - 2Document17 pagesCash Follow Statement (1) - 2Gkgolam KibriaNo ratings yet

- Cash Flow Statement NotesDocument8 pagesCash Flow Statement NotesAbdullahNo ratings yet

- Chapter 13 PowerPointDocument89 pagesChapter 13 PowerPointcheuleee100% (1)

- CTRL Vol4Document19 pagesCTRL Vol4Roberto SanchezNo ratings yet

- Pas 7Document11 pagesPas 7Princess Jullyn ClaudioNo ratings yet

- Cash Flow StatementDocument24 pagesCash Flow StatementSHENUNo ratings yet

- Finacc 2 IvDocument36 pagesFinacc 2 IvMarielle De LeonNo ratings yet

- Understanding Cash Flow StatementDocument3 pagesUnderstanding Cash Flow StatementImran IdrisNo ratings yet

- Statement of Cash FlowsDocument26 pagesStatement of Cash Flowslascona.christinerheaNo ratings yet

- Chapter 4-Statement of Cash FlowsDocument3 pagesChapter 4-Statement of Cash FlowsDan GalvezNo ratings yet

- CASH FLOW StudentsDocument14 pagesCASH FLOW StudentsJirehJohnG.ArafolNo ratings yet

- Statement of Cash FlowsDocument84 pagesStatement of Cash Flowsknarfylunjas15No ratings yet

- AFM Unit 4 CASH FLOW TheoryDocument5 pagesAFM Unit 4 CASH FLOW TheoryMr. N. KARTHIKEYAN Asst Prof MBANo ratings yet

- Cash Flow AnalysisDocument15 pagesCash Flow AnalysisElvie Abulencia-BagsicNo ratings yet

- Finacial Statement Analysis Cash Flow Statement and Its AnalysisDocument8 pagesFinacial Statement Analysis Cash Flow Statement and Its AnalysisLeomarc LavaNo ratings yet

- Unit 4 Cash Flow StatementDocument26 pagesUnit 4 Cash Flow Statementjatin4verma-2No ratings yet

- Cash Flow StatementDocument26 pagesCash Flow StatementADITI BISWASNo ratings yet

- Cash Flow Analysis ExcercisesDocument6 pagesCash Flow Analysis Excercisesmax zeneNo ratings yet

- Chap 11cash FlowDocument6 pagesChap 11cash FlowAlton D'silvaNo ratings yet

- Flow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atDocument36 pagesFlow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atLong NguyenNo ratings yet

- CashDocument37 pagesCashanand chawanNo ratings yet

- Fundamentals of Accountancy, Business, and ManagementDocument16 pagesFundamentals of Accountancy, Business, and ManagementAraNo ratings yet

- Unit 1Document23 pagesUnit 1Katlego ThaboNo ratings yet

- Cash Flow Statement Wit SumDocument27 pagesCash Flow Statement Wit SumSunay KhaireNo ratings yet

- IAS 7-Statements of Cash FlowsDocument41 pagesIAS 7-Statements of Cash Flowstmandikutse04No ratings yet

- Statement of Cash FlowsDocument9 pagesStatement of Cash FlowsNini yaludNo ratings yet

- Cash and Fund Flow StatementDocument6 pagesCash and Fund Flow StatementAsma SaeedNo ratings yet

- Chapter: - 8Document16 pagesChapter: - 8Kanu SubramanianNo ratings yet

- Cash Flow Statement AnalysisDocument29 pagesCash Flow Statement AnalysisCASAQUIT, IRA LORAINENo ratings yet

- Cash Flow ReportingDocument90 pagesCash Flow Reportingkristane ingrid arcayeraNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDeepalaxmi BhatNo ratings yet

- Chapter 6 Satatement of Cash FlowsDocument28 pagesChapter 6 Satatement of Cash FlowsCabdiraxmaan GeeldoonNo ratings yet

- Cash Flow Statements: by CA. Pramod Prabhu. S.HDocument17 pagesCash Flow Statements: by CA. Pramod Prabhu. S.HsonibijuNo ratings yet

- Satish FinalDocument79 pagesSatish FinalAnonymous MhCdtwxQINo ratings yet

- Financial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbDocument41 pagesFinancial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbmukul3087_305865623No ratings yet

- Analusis of Financial StatementDocument28 pagesAnalusis of Financial StatementAjaykumar MauryaNo ratings yet

- Analysis of Financial Statements Cash Flow Analysis: Prof. Priyanka Oza Mms Sem IiDocument21 pagesAnalysis of Financial Statements Cash Flow Analysis: Prof. Priyanka Oza Mms Sem IiSujit AdulkarNo ratings yet

- International Accounting Standard 7 Statement of Cash FlowsDocument8 pagesInternational Accounting Standard 7 Statement of Cash Flowsইবনুল মাইজভাণ্ডারীNo ratings yet

- 2022 Sem 1 ACC10007 Topic 3Document45 pages2022 Sem 1 ACC10007 Topic 3JordanNo ratings yet

- 21 Ch. 21 - Statement of Cash Flows - S2015Document27 pages21 Ch. 21 - Statement of Cash Flows - S2015zhouzhu211100% (1)

- Of Cash and Which Are Subject To An Insignificant Risk of Changes in ValueDocument2 pagesOf Cash and Which Are Subject To An Insignificant Risk of Changes in ValueJMClosedNo ratings yet

- Atp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsDocument17 pagesAtp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsTwain JonesNo ratings yet

- Cash Flow Statement Direct MethodDocument20 pagesCash Flow Statement Direct MethodMidsy De la Cruz100% (1)

- Cash Flow StatementDocument2 pagesCash Flow Statementmark_torreonNo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementHemant kumar JhaNo ratings yet

- Theory - CASH FLOW ANALYSISDocument7 pagesTheory - CASH FLOW ANALYSISShahina KhanNo ratings yet

- Group8 Stone Container Corporation Final PDFDocument7 pagesGroup8 Stone Container Corporation Final PDFRahul BhatiaNo ratings yet

- KK KKKKKDocument14 pagesKK KKKKKCarlo VillanNo ratings yet

- Part Two: Financial Accounting: An IntroductionDocument139 pagesPart Two: Financial Accounting: An IntroductionRobel Habtamu100% (1)

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument40 pagesChapter 10 Accounting Cycle of A Merchandising BusinessOmelkhair YahyaNo ratings yet

- 2011 Bar Examination Questionnaire For Commercial Law Set ADocument37 pages2011 Bar Examination Questionnaire For Commercial Law Set Achiji chzzzmeowNo ratings yet

- Dhanuka Laboratories LimitedDocument8 pagesDhanuka Laboratories LimitedDarshanNo ratings yet

- The Oriental Insurance Company LTDDocument7 pagesThe Oriental Insurance Company LTDSri KamalNo ratings yet

- CMA MCQ MergedDocument224 pagesCMA MCQ Mergedsaikat karmakarNo ratings yet

- Sebenta Inglês AplicadoDocument30 pagesSebenta Inglês AplicadoJoana PimentelNo ratings yet

- Accounting Adjustments 1Document71 pagesAccounting Adjustments 1vukicevic.ivan5No ratings yet

- Portfolio For Personal FinanceDocument7 pagesPortfolio For Personal FinanceSharon SagerNo ratings yet

- Cma ProjectDocument14 pagesCma ProjectAbhishek SaravananNo ratings yet

- Credit Analysis-Medlife: 1. Description of The LoanDocument20 pagesCredit Analysis-Medlife: 1. Description of The LoanAlexandraNo ratings yet

- LAPORAN KEUANGAN PT Unilever Indonesia TBKDocument12 pagesLAPORAN KEUANGAN PT Unilever Indonesia TBKNesya NandaNo ratings yet

- Lending in Finance WorldDocument18 pagesLending in Finance WorldMeesam NaqviNo ratings yet

- Discussions On Chapter 2Document13 pagesDiscussions On Chapter 2Norren Thea VlogsNo ratings yet

- Solution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonDocument8 pagesSolution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonRalphLaneifrte100% (85)

- 12 Indemnity & Guarantee Bailment & PledgeDocument38 pages12 Indemnity & Guarantee Bailment & PledgeMUHMMAD ARSALAN 13728No ratings yet

- Topic 4Document7 pagesTopic 4mintchoco98No ratings yet

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- S Pinkerton Statement of Financial PositionDocument6 pagesS Pinkerton Statement of Financial PositionFindley MaringkaNo ratings yet

- Bank/Financial Instituion/ Company: Process Flow Chart of Asset SecuritisationDocument1 pageBank/Financial Instituion/ Company: Process Flow Chart of Asset Securitisationsudhir.kochhar3530No ratings yet

- Investment in Equity SecuritiesDocument11 pagesInvestment in Equity SecuritiesnikNo ratings yet

- Islamic Financial Accounting Standard-2 Ijarah: Interpretation and ImplementationDocument23 pagesIslamic Financial Accounting Standard-2 Ijarah: Interpretation and Implementationhammad067No ratings yet

- Ch02 Financial Statements, Taxes, and Cash FlowsDocument34 pagesCh02 Financial Statements, Taxes, and Cash FlowsAndrew BruceNo ratings yet

- DK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsDocument67 pagesDK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsPython The SnakeNo ratings yet

Financial Statements

Financial Statements

Uploaded by

kc28843Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements

Financial Statements

Uploaded by

kc28843Copyright:

Available Formats

Financial Statements

Summarized Statement Format

Purposes and Uses

The purpose of the SCF is to provide information about the sources of cash (i.e., cash

receipts) and cash equivalents and the uses (i.e., cash disbursements) of cash and cash

equivalents. The cash basis is used because investors, creditors, shareholders, vendors,

regulators, taxing entites, and other interested parties need information about the entity's

available cash and cash needs (i.e., ability to pay obligations, dividends, etc.). Information

concerning an entity's cash inflows and outflows during the period aids in the assessment of

an entity's liquidity (how quickly items are converted into cash) and solvency (ability to

satisfy debt requirements). The statement can also provide answers to questions such as:

• How successful are the entity's operations at generating cash?

• Why is there a difference between net income and operating cash flows?

• Is the entity using investments to strengthen its operating capacity?

• Will vendors receive payments in a timely manner?

• Will the entity have the cash to make tax payments when they come due?

• Is cash being generated to cover future dividend payments?

• Why did the dividend payments not match the level of income earned?

• Will the entity have enough cash available to cover its principal and interest debt

obligations?

• How much outside financing is it using to support operations?

• How much cash was brought in because of operations as opposed to external

financing by

• using debt or equity, or both?

• Was cash used to purchase treasury stock?

Compiled by CA Aashish B Chandak

• Is the entity building up its investment in long-term assets or liquidating them?

• What is the possibility of generating future cash inflows?

• Are those future cash flows able to satisfy the entity's obligations to its creditors?

Components and Classifications

The SCF includes three major sections: operating activities, investing activities, and

financing activities, and a separate schedule of significant noncash investing and financing

activities.

Operating Activities

The operating activities section relates to transactions involved in the production of goods

and the delivery of services to customers. Operating activities consist of cash receipts and

disbursements from transactions reported on the income statement and related to current

assets and liabilities, except those classified as investing or financing activities. Examples

include sales of products/services, payments to employees, inventory purchases, payment and

receipt of interest, purchases and sales of trading securities (if classified as current), payments

of account payables, and receipts of accounts receivable.

Investing Activities

This section includes cash flows from the purchase or sale of non-current assets. Some

examples are:

• making loans to other entities (cash outflow);

• purchasing (cash outflow) or disposing of (cash inflow) trading securities (if classified

as non-current), available-for-sale securities, and held-to-maturity investment

securities.

• acquiring (cash outflow) or disposing of (cash inflow) property, plant, and equipment

(productive assets); and

• acquiring another entity under the acquisition method using cash (cash outflow). The

payment for the acquisition is shown net of the cash acquired.

Compiled by CA Aashish B Chandak

Financing Activities

Financing activities include cash flows from non-current liability (creditor-oriented) and

equity (owner-oriented) transactions. Examples include:

• Non-current Liability (Creditor-Oriented) Activities

Obtaining resources from creditors, such as issuing bonds, notes, and other borrowings

(cash inflow).

Payments of principal (not interest, which is part of the operating activities section) on

amounts borrowed (cash outflow).

• Equity (Owner-Oriented) Activities

Obtaining resources from owners, such as issuing stock (cash inflow).

Providing owners with a return on their investment, such as paying cash dividends or

repurchasing stock (cash outflow).

Q.1 Cash Flow Classifications

Compiled by CA Aashish B Chandak

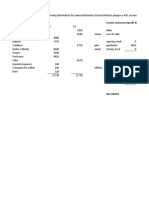

Q.2 Cash Flow from Operations

Facts: Fryar Corp., a wholesaler-retailer, is in the process of preparing its statement of cash

flows using the following balance sheet and income statement information for Year 2.

Required: Prepare the operating section of the statement of cash flows using the

indirect method from the following data.

Compiled by CA Aashish B Chandak

Q.3 Cash Flow from Investing and Financing

Facts: Fryar Corp. had the following investing and financing transactions during the period:

1. Equipment was sold that had a cost of $30,000 and accumulated depreciation of

$10,000. The equipment was sold for a $15,000 gain.

2. A building was sold at the beginning of the year at book value. The building had an

original cost of $120,000 with $40,000 of accumulated depreciation.

3. A note payable was issued in exchange for land in the amount of $100,000.

4. The company borrowed $60,000 by issuing a long-term note payable.

5. A $5,000 loss was recorded from the retirement of bonds, which the company had

previously issued. The net carrying value on the books at the time of retirement was

$100,000.

6. A purchase of held-to-maturity securities for $55,000 was made at the end of the

current year. The face value of these securities was $50,000.

7. A finance lease obligation was used to acquire equipment on the last day of the year.

The present value is equal to $125,000 and no down payment was required.

8. Sale of trading securities at $23,000 originally purchased at face value for $20,000.

9. Declaration and payment of a $10,000 cash dividend to common stockholders.

Required: Prepare the investing activities section and the financing activities section for the

year. Assume that investments in trading securities are classified as non-current assets.

Compiled by CA Aashish B Chandak

Q.4

Compiled by CA Aashish B Chandak

You might also like

- IWT Conscious Spending Plan 2023Document12 pagesIWT Conscious Spending Plan 2023GEO654No ratings yet

- Ia Vol 3 Valix 2019 SolmanDocument105 pagesIa Vol 3 Valix 2019 Solmanxeth agas86% (7)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasRizquita DhindaNo ratings yet

- 2020 Beximco and Renata Ratio AnalysisDocument18 pages2020 Beximco and Renata Ratio AnalysisRahi Mun100% (2)

- Cash FlowDocument9 pagesCash Flowshreyanshi sharmaNo ratings yet

- Unit 10 - Cash Flow AnalysisDocument26 pagesUnit 10 - Cash Flow Analysisqwertyytrewq12No ratings yet

- Cahs Flow StatementDocument18 pagesCahs Flow Statementtaniya17No ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementPranay SinghNo ratings yet

- Statement of Cash FlowDocument24 pagesStatement of Cash FlowMylene Santiago100% (1)

- Unit Ii Accounting PDFDocument11 pagesUnit Ii Accounting PDFMo ToNo ratings yet

- Statement of Changes in Financial Position: Cash Flow StatementDocument25 pagesStatement of Changes in Financial Position: Cash Flow StatementCharu Arora100% (1)

- Section 7Document30 pagesSection 7Abata BageyuNo ratings yet

- Accounting Assignment 2Document4 pagesAccounting Assignment 2Laddie LMNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementSwapnil ManeNo ratings yet

- 4 Statement of Cash FlowsDocument13 pages4 Statement of Cash FlowsNabi ParkNo ratings yet

- SCF - 3rd YrDocument27 pagesSCF - 3rd YrA.J. Chua100% (1)

- Cash Follow Statement (1) - 2Document17 pagesCash Follow Statement (1) - 2Gkgolam KibriaNo ratings yet

- Cash Flow Statement NotesDocument8 pagesCash Flow Statement NotesAbdullahNo ratings yet

- Chapter 13 PowerPointDocument89 pagesChapter 13 PowerPointcheuleee100% (1)

- CTRL Vol4Document19 pagesCTRL Vol4Roberto SanchezNo ratings yet

- Pas 7Document11 pagesPas 7Princess Jullyn ClaudioNo ratings yet

- Cash Flow StatementDocument24 pagesCash Flow StatementSHENUNo ratings yet

- Finacc 2 IvDocument36 pagesFinacc 2 IvMarielle De LeonNo ratings yet

- Understanding Cash Flow StatementDocument3 pagesUnderstanding Cash Flow StatementImran IdrisNo ratings yet

- Statement of Cash FlowsDocument26 pagesStatement of Cash Flowslascona.christinerheaNo ratings yet

- Chapter 4-Statement of Cash FlowsDocument3 pagesChapter 4-Statement of Cash FlowsDan GalvezNo ratings yet

- CASH FLOW StudentsDocument14 pagesCASH FLOW StudentsJirehJohnG.ArafolNo ratings yet

- Statement of Cash FlowsDocument84 pagesStatement of Cash Flowsknarfylunjas15No ratings yet

- AFM Unit 4 CASH FLOW TheoryDocument5 pagesAFM Unit 4 CASH FLOW TheoryMr. N. KARTHIKEYAN Asst Prof MBANo ratings yet

- Cash Flow AnalysisDocument15 pagesCash Flow AnalysisElvie Abulencia-BagsicNo ratings yet

- Finacial Statement Analysis Cash Flow Statement and Its AnalysisDocument8 pagesFinacial Statement Analysis Cash Flow Statement and Its AnalysisLeomarc LavaNo ratings yet

- Unit 4 Cash Flow StatementDocument26 pagesUnit 4 Cash Flow Statementjatin4verma-2No ratings yet

- Cash Flow StatementDocument26 pagesCash Flow StatementADITI BISWASNo ratings yet

- Cash Flow Analysis ExcercisesDocument6 pagesCash Flow Analysis Excercisesmax zeneNo ratings yet

- Chap 11cash FlowDocument6 pagesChap 11cash FlowAlton D'silvaNo ratings yet

- Flow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atDocument36 pagesFlow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atLong NguyenNo ratings yet

- CashDocument37 pagesCashanand chawanNo ratings yet

- Fundamentals of Accountancy, Business, and ManagementDocument16 pagesFundamentals of Accountancy, Business, and ManagementAraNo ratings yet

- Unit 1Document23 pagesUnit 1Katlego ThaboNo ratings yet

- Cash Flow Statement Wit SumDocument27 pagesCash Flow Statement Wit SumSunay KhaireNo ratings yet

- IAS 7-Statements of Cash FlowsDocument41 pagesIAS 7-Statements of Cash Flowstmandikutse04No ratings yet

- Statement of Cash FlowsDocument9 pagesStatement of Cash FlowsNini yaludNo ratings yet

- Cash and Fund Flow StatementDocument6 pagesCash and Fund Flow StatementAsma SaeedNo ratings yet

- Chapter: - 8Document16 pagesChapter: - 8Kanu SubramanianNo ratings yet

- Cash Flow Statement AnalysisDocument29 pagesCash Flow Statement AnalysisCASAQUIT, IRA LORAINENo ratings yet

- Cash Flow ReportingDocument90 pagesCash Flow Reportingkristane ingrid arcayeraNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDeepalaxmi BhatNo ratings yet

- Chapter 6 Satatement of Cash FlowsDocument28 pagesChapter 6 Satatement of Cash FlowsCabdiraxmaan GeeldoonNo ratings yet

- Cash Flow Statements: by CA. Pramod Prabhu. S.HDocument17 pagesCash Flow Statements: by CA. Pramod Prabhu. S.HsonibijuNo ratings yet

- Satish FinalDocument79 pagesSatish FinalAnonymous MhCdtwxQINo ratings yet

- Financial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbDocument41 pagesFinancial Accounting - Information For Decisions - Session 9 - Chapter 11 PPT HmugGnI6jbmukul3087_305865623No ratings yet

- Analusis of Financial StatementDocument28 pagesAnalusis of Financial StatementAjaykumar MauryaNo ratings yet

- Analysis of Financial Statements Cash Flow Analysis: Prof. Priyanka Oza Mms Sem IiDocument21 pagesAnalysis of Financial Statements Cash Flow Analysis: Prof. Priyanka Oza Mms Sem IiSujit AdulkarNo ratings yet

- International Accounting Standard 7 Statement of Cash FlowsDocument8 pagesInternational Accounting Standard 7 Statement of Cash Flowsইবনুল মাইজভাণ্ডারীNo ratings yet

- 2022 Sem 1 ACC10007 Topic 3Document45 pages2022 Sem 1 ACC10007 Topic 3JordanNo ratings yet

- 21 Ch. 21 - Statement of Cash Flows - S2015Document27 pages21 Ch. 21 - Statement of Cash Flows - S2015zhouzhu211100% (1)

- Of Cash and Which Are Subject To An Insignificant Risk of Changes in ValueDocument2 pagesOf Cash and Which Are Subject To An Insignificant Risk of Changes in ValueJMClosedNo ratings yet

- Atp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsDocument17 pagesAtp 106 LPM Accounting - Topic 5 - Statement of Cash FlowsTwain JonesNo ratings yet

- Cash Flow Statement Direct MethodDocument20 pagesCash Flow Statement Direct MethodMidsy De la Cruz100% (1)

- Cash Flow StatementDocument2 pagesCash Flow Statementmark_torreonNo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementHemant kumar JhaNo ratings yet

- Theory - CASH FLOW ANALYSISDocument7 pagesTheory - CASH FLOW ANALYSISShahina KhanNo ratings yet

- Group8 Stone Container Corporation Final PDFDocument7 pagesGroup8 Stone Container Corporation Final PDFRahul BhatiaNo ratings yet

- KK KKKKKDocument14 pagesKK KKKKKCarlo VillanNo ratings yet

- Part Two: Financial Accounting: An IntroductionDocument139 pagesPart Two: Financial Accounting: An IntroductionRobel Habtamu100% (1)

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument40 pagesChapter 10 Accounting Cycle of A Merchandising BusinessOmelkhair YahyaNo ratings yet

- 2011 Bar Examination Questionnaire For Commercial Law Set ADocument37 pages2011 Bar Examination Questionnaire For Commercial Law Set Achiji chzzzmeowNo ratings yet

- Dhanuka Laboratories LimitedDocument8 pagesDhanuka Laboratories LimitedDarshanNo ratings yet

- The Oriental Insurance Company LTDDocument7 pagesThe Oriental Insurance Company LTDSri KamalNo ratings yet

- CMA MCQ MergedDocument224 pagesCMA MCQ Mergedsaikat karmakarNo ratings yet

- Sebenta Inglês AplicadoDocument30 pagesSebenta Inglês AplicadoJoana PimentelNo ratings yet

- Accounting Adjustments 1Document71 pagesAccounting Adjustments 1vukicevic.ivan5No ratings yet

- Portfolio For Personal FinanceDocument7 pagesPortfolio For Personal FinanceSharon SagerNo ratings yet

- Cma ProjectDocument14 pagesCma ProjectAbhishek SaravananNo ratings yet

- Credit Analysis-Medlife: 1. Description of The LoanDocument20 pagesCredit Analysis-Medlife: 1. Description of The LoanAlexandraNo ratings yet

- LAPORAN KEUANGAN PT Unilever Indonesia TBKDocument12 pagesLAPORAN KEUANGAN PT Unilever Indonesia TBKNesya NandaNo ratings yet

- Lending in Finance WorldDocument18 pagesLending in Finance WorldMeesam NaqviNo ratings yet

- Discussions On Chapter 2Document13 pagesDiscussions On Chapter 2Norren Thea VlogsNo ratings yet

- Solution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonDocument8 pagesSolution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonRalphLaneifrte100% (85)

- 12 Indemnity & Guarantee Bailment & PledgeDocument38 pages12 Indemnity & Guarantee Bailment & PledgeMUHMMAD ARSALAN 13728No ratings yet

- Topic 4Document7 pagesTopic 4mintchoco98No ratings yet

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- S Pinkerton Statement of Financial PositionDocument6 pagesS Pinkerton Statement of Financial PositionFindley MaringkaNo ratings yet

- Bank/Financial Instituion/ Company: Process Flow Chart of Asset SecuritisationDocument1 pageBank/Financial Instituion/ Company: Process Flow Chart of Asset Securitisationsudhir.kochhar3530No ratings yet

- Investment in Equity SecuritiesDocument11 pagesInvestment in Equity SecuritiesnikNo ratings yet

- Islamic Financial Accounting Standard-2 Ijarah: Interpretation and ImplementationDocument23 pagesIslamic Financial Accounting Standard-2 Ijarah: Interpretation and Implementationhammad067No ratings yet

- Ch02 Financial Statements, Taxes, and Cash FlowsDocument34 pagesCh02 Financial Statements, Taxes, and Cash FlowsAndrew BruceNo ratings yet

- DK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsDocument67 pagesDK Goel Solutions Class 11 Accountancy Chapter 23 - Accounts From Incomplete RecordsPython The SnakeNo ratings yet