Professional Documents

Culture Documents

VAT 201 Return

VAT 201 Return

Uploaded by

umar.arshad.caOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT 201 Return

VAT 201 Return

Uploaded by

umar.arshad.caCopyright:

Available Formats

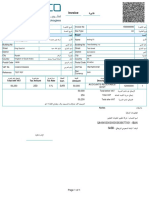

- 230005795372إﻗﺮار ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ VAT 201 Return

Taxpayer Information

ﻣﻌﻠﻮﻣﺎت داﻓﻌﻲ اﻟﴬاﺋﺐ

VAT Return Period

TRN

ﻓﱰة اﻹﻗﺮار اﻟﴬﻳﺒﻲ ﻟﴬﻳﺒﺔ اﻟﻘﻴﻤﺔ 104032083800003 01/06/2023 - 31/08/2023

رﻗﻢ ﺗﺴﺠﻴﻞ اﻟﴬﻳﺒﺔ

اﳌﻀﺎﻓﺔ

Legal Name of

MAINGI RESTAURANT & CAFE VAT Stagger Stagger 2 – Quarterly (Mar

)Entity(English

اﻟﻔﱰة اﻟﴬﻳﺒﻴﺔ ﻟﴬﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ L.L.C )to Feb

اﻻﺳﻢ اﻟﻘﺎﻧﻮﻲﻧ ﻟﻠﻜﻴﺎن ﺑﺎﻟﻠﻐﺔ اﻹﻧﺠﻠﻴﺰﻳﺔ

Legal Name of Entity VAT Return Due Date

)(Arabic ﺗﺎرﻳﺦ اﺳﺘﺤﻘﺎق إﻗﺮار ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ ﻣﻄﻌﻢ وﻣﻘﻬﻰ ﻣﻴﻨﻐﻰ ذ.م.م 28/09/2023

اﻻﺳﻢ اﻟﻘﺎﻧﻮﻲﻧ ﻟﻠﻜﻴﺎن ﺑﺎﻟﻠﻐﺔ اﻟﻌﺮﺑﻴﺔ اﳌﻀﺎﻓﺔ

Shop No. G 02, Business Bay,

Address Tax Year End

Dubai, Dubai, 00000, Dubai, 29/02/2024

ﻋﻨﻮان ﻧﻬﺎﻳﺔ اﻟﺴﻨﺔ اﻟﴬﻳﺒﻴﺔ

+971504015320

VAT on Sales and All Other outputs

ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ ﻋﲆ اﳌﺒﻴﻌﺎت وﺟﻤﻴﻊ اﳌﺨﺮﺟﺎت اﻷﺧﺮى

VAT Amount

Amount Adjustment

Description )(AED

)(AED )(AED

وﺻﻒ ﻗﻴﻤﺔ ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ

اﳌﺒﻠﻎ )درﻫﻢ( ﺗﺴﻮﻳﺔ )درﻫﻢ(

)درﻫﻢ(

1a Standard Rated Supplies in Abu Dhabi

0.00 0.00 0.00

أ اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ أﺑﻮ ﻇﺒﻲ

1b Standard Rated Supplies in Dubai

183.83 9.19 0.00

ب اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ دﻲﺑ

1c Standard Rated Supplies in Sharjah

0.00 0.00 0.00

ج اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ اﻟﺸﺎرﻗﺔ

1d Standard Rated Supplies in Ajman

0.00 0.00 0.00

د اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ ﻋﺠﺎﻤن

1e Standard Rated Supplies in Umm Al Quwain

0.00 0.00 0.00

ه اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ أم اﻟﻘﻴﻮﻳﻦ

www.tax.gov.ae @uaetax

| Federal Authority ﻫﻴﺌﺔ اﺗﺤﺎدﻳﺔ

This is a system generated document and does not need to be signed. The Taxpayer is solely responsible for the usage of this document. FTA cannot be held liable for

any damage caused to the Taxpayer or recipient of this document.

ﻫﺬه وﺛﻴﻘﺔ ﺗﻢ إﻧﺸﺎؤﻫﺎ ﺑﻮاﺳﻄﺔ اﻟﻨﻈﺎم وﻻ ﺗﺤﺘﺎج إﱃ اﻟﺘﻮﻗﻴﻊ .داﻓﻊ اﻟﴬاﺋﺐ ﻫﻮ اﳌﺴﺆول اﻟﻮﺣﻴﺪ ﻋﻦ اﺳﺘﺨﺪام ﻫﺬه اﻟﻮﺛﻴﻘﺔ .ﻻ ﻤﻳﻜﻦ أن ﺗﻜﻮن اﻟﻬﻴﺌﺔ اﻻﺗﺤﺎدﻳﺔ ﻟﻠﴬاﺋﺐ ﻣﺴﺆوﻟﺔ ﻋﻦ أي ﴐر ﻳﻠﺤﻖ ﺑﺪاﻓﻌﻲ اﻟﴬاﺋﺐ أو ﻣﺘﻠﻘﻲ ﻫﺬه اﻟﻮﺛﻴﻘﺔ.

1f Standard Rated Supplies in Ras Al Khaimah

0.00 0.00 0.00

و اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ رأس اﻟﺨﻴﻤﺔ

1g Standard Rated Supplies in Fujairah

0.00 0.00 0.00

ز اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ اﻟﻔﺠﺮﻴة

2 Tax Refunds provided to Tourists under the Tax

Refunds for Tourists Scheme 0.00 0.00

اﳌﺒﺎﻟﻎ اﻟﺘﻲ ﺗﻢ ردﻫﺎ ﻟﻠﺴﻴﺎح ﺑﻨﺎء ﻋﲆ ﻧﻈﺎم رد اﻟﴬﻳﺒﺔ ﻟﻠﺴﻴﺎح

3 Supplies subject to the reverse charge provisions

0.00 0.00

ﺗﺨﻀﻊ اﻟﺘﻮرﻳﺪات ﻷﺣﻜﺎم اﻻﺣﺘﺴﺎب اﻟﻌﻜﴘ

4 Zero Rated Supplies

0.00

ﺗﻮرﻳﺪات ﺧﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻟﺼﻔﺮﻳﺔ

5 Exempt Supplies

0.00

اﻟﺘﻮرﻳﺪات اﳌﻌﻔﺎة

6 Goods imported into the UAE

0.00 0.00

اﻟﺒﻀﺎﺋﻊ اﻟﻮاردة إﱃ اﻟﺪوﻟﺔ

7 Adjustments to goods imported into the UAE

0.00 0.00

ﺗﺴﻮﻳﺔ ﻋﲆ اﻟﺒﻀﺎﺋﻊ اﳌﺴﺘﻮردة إﱃ دوﻟﺔ اﻹﻣﺎرات اﻟﻌﺮﺑﻴﺔ اﳌﺘﺤﺪة

8 Totals

183.83 9.19 0.00

اﳌﺠﻤﻮع

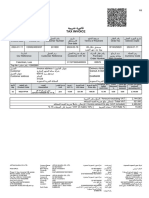

VAT on Expenses and All Other Inputs

ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ ﻋﲆ اﳌﺒﻴﻌﺎت وﺟﻤﻴﻊ اﳌﺨﺮﺟﺎت اﻷﺧﺮى

VAT Amount

Amount Adjustment

Description (AED)

(AED) (AED)

وﺻﻒ ﻗﻴﻤﺔ ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ

(اﳌﺒﻠﻎ )درﻫﻢ (ﺗﺴﻮﻳﺔ )درﻫﻢ

()درﻫﻢ

9 Standard Rated Expenses

47,290.32 2,364.52 0.00

اﻟﻨﻔﻘﺎت اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ

10 Supplies subject to the reverse charge provisions

0.00 0.00

ﺗﺨﻀﻊ اﻟﺘﻮرﻳﺪات ﻷﺣﻜﺎم اﻻﺣﺘﺴﺎب اﻟﻌﻜﴘ

11 Totals

47,290.32 2,364.52 0.00

اﳌﺠﻤﻮع

www.tax.gov.ae @uaetax

Federal Authority | ﻫﻴﺌﺔ اﺗﺤﺎدﻳﺔ

This is a system generated document and does not need to be signed. The Taxpayer is solely responsible for the usage of this document. FTA cannot be held liable for

any damage caused to the Taxpayer or recipient of this document.

. ﻻ ﻤﻳﻜﻦ أن ﺗﻜﻮن اﻟﻬﻴﺌﺔ اﻻﺗﺤﺎدﻳﺔ ﻟﻠﴬاﺋﺐ ﻣﺴﺆوﻟﺔ ﻋﻦ أي ﴐر ﻳﻠﺤﻖ ﺑﺪاﻓﻌﻲ اﻟﴬاﺋﺐ أو ﻣﺘﻠﻘﻲ ﻫﺬه اﻟﻮﺛﻴﻘﺔ. داﻓﻊ اﻟﴬاﺋﺐ ﻫﻮ اﳌﺴﺆول اﻟﻮﺣﻴﺪ ﻋﻦ اﺳﺘﺨﺪام ﻫﺬه اﻟﻮﺛﻴﻘﺔ.ﻫﺬه وﺛﻴﻘﺔ ﺗﻢ إﻧﺸﺎؤﻫﺎ ﺑﻮاﺳﻄﺔ اﻟﻨﻈﺎم وﻻ ﺗﺤﺘﺎج إﱃ اﻟﺘﻮﻗﻴﻊ

Amount

Net VAT Due

(AED)

ﺻﺎﰲ ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ اﳌﺴﺘﺤﻘﺔ

(اﳌﺒﻠﻎ )درﻫﻢ

12 Total Value of due tax for the period

9.19

(إﺟﺎﻤﱄ ﻗﻴﻤﺔ اﻟﴬﻳﺒﺔ اﳌﺴﺘﺤﻘﺔ ﻋﻦ اﻟﻔﱰة )درﻫﻢ

13 Total Value of recoverable tax for the period

2,364.52

(إﺟﺎﻤﱄ ﻗﻴﻤﺔ اﻟﴬﻳﺒﺔ اﻟﻘﺎﺑﻠﺔ ﻟﻼﺳﱰداد ﻟﻠﻔﱰة )درﻫﻢ

14 Payable tax for the period

-2,355.33

(اﻟﴬﻳﺒﺔ اﳌﺴﺘﺤﻘﺔ اﻟﺪﻓﻊ ﻋﻦ اﻟﻔﱰة )درﻫﻢ

Do you wish to request a refund for the above amount of excess recoverable tax ?

ﻫﻞ ﺗﺮﻏﺐ ﰲ ﻃﻠﺐ اﺳﱰداد اﳌﺒﻠﻎ اﳌﺬﻛﻮر أﻋﻼه ﻣﻦ اﻟﴬﻳﺒﺔ اﻟﺰاﺋﺪة اﻟﻘﺎﺑﻠﺔ ﻟﻼﺳﱰداد؟

No

Profit Margin Scheme

ﻫﺎﻣﺶ اﻟﺮﺑﺢ

Did you apply the profit margin scheme in respect of any supplies made during the tax period?

ﻫﻞ ﻗﻤﺖ ﺑﺘﻄﺒﻴﻖ ﻧﻈﺎم ﻫﺎﻣﺶ اﻟﺮﺑﺢ ﻓﻴﺎﻤ ﻳﺘﻌﻠﻖ ﺑﺄي ﺗﻮرﻳﺪات ﺗﻢ إﺟﺮاؤﻫﺎ ﺧﻼل اﻟﻔﱰة اﻟﴬﻳﺒﻴﺔ؟

No

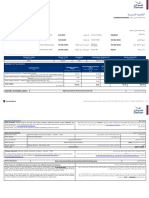

Authorised Signatory

اﳌﻔﻮﺿﻦﻴ ﺑﺎﻟﺘﻮﻗﻴﻊ

Name in English Varun Maingi Dinesh Chandra Name in Arabic

ﻓﺎرون ﻣﻴﻨﻐﻰ دﻳﻨﻴﺶ ﺷﺎﻧﺪرا ﻣﻴﻨﻐﻰ

اﻻﺳﻢ ﺑﺎﻻﻧﺠﻠﻴﺰﻳﺔ Maingi اﻻﺳﻢ ﺑﺎﻟﻌﺮﻲﺑ

Mobile Country Code Mobile Number

+971 504015320

رﻣﺰ اﻟﺪوﻟﺔ رﻗﻢ اﻟﻬﺎﺗﻒ

Date of Submission Email Address

28/09/2023 VARUN1STER@GMAIL.COM

ﺗﺎرﻳﺦ اﻟﺘﻘﺪﻳﻢ اﻟﱪﻳﺪ اﻹﻟﻜﱰوﻲﻧ

Date and time when this document was generated

05/03/2024 18:07:22

اﻟﺘﺎرﻳﺦ واﻟﻮﻗﺖ اﻟﺬي ﺗﻢ ﻓﻴﻪ إﻧﺸﺎء ﻫﺬا اﳌﺴﺘﻨﺪ

www.tax.gov.ae @uaetax

Federal Authority | ﻫﻴﺌﺔ اﺗﺤﺎدﻳﺔ

This is a system generated document and does not need to be signed. The Taxpayer is solely responsible for the usage of this document. FTA cannot be held liable for

any damage caused to the Taxpayer or recipient of this document.

. ﻻ ﻤﻳﻜﻦ أن ﺗﻜﻮن اﻟﻬﻴﺌﺔ اﻻﺗﺤﺎدﻳﺔ ﻟﻠﴬاﺋﺐ ﻣﺴﺆوﻟﺔ ﻋﻦ أي ﴐر ﻳﻠﺤﻖ ﺑﺪاﻓﻌﻲ اﻟﴬاﺋﺐ أو ﻣﺘﻠﻘﻲ ﻫﺬه اﻟﻮﺛﻴﻘﺔ. داﻓﻊ اﻟﴬاﺋﺐ ﻫﻮ اﳌﺴﺆول اﻟﻮﺣﻴﺪ ﻋﻦ اﺳﺘﺨﺪام ﻫﺬه اﻟﻮﺛﻴﻘﺔ.ﻫﺬه وﺛﻴﻘﺔ ﺗﻢ إﻧﺸﺎؤﻫﺎ ﺑﻮاﺳﻄﺔ اﻟﻨﻈﺎم وﻻ ﺗﺤﺘﺎج إﱃ اﻟﺘﻮﻗﻴﻊ

You might also like

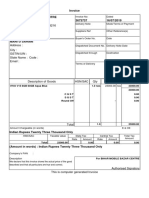

- Payslip 2021 2022 3 hf092728 HDBFSDocument1 pagePayslip 2021 2022 3 hf092728 HDBFSKhamalesh C.ANo ratings yet

- 1226262836Document1 page1226262836Asamir AlHaidar0% (3)

- Receipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiDocument1 pageReceipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiNasser AltuwaijriNo ratings yet

- VIVODocument1 pageVIVOMontu ShaniNo ratings yet

- Tax Invoice: Customer Information Store InformationDocument1 pageTax Invoice: Customer Information Store InformationSafaa Saied50% (2)

- Next Gen Pharma: (Original For Recipient) Sold byDocument2 pagesNext Gen Pharma: (Original For Recipient) Sold bydarpajNo ratings yet

- How To Compute and Prepare The Quarterly Income Tax ReturnsDocument4 pagesHow To Compute and Prepare The Quarterly Income Tax ReturnsTwoo Phil100% (5)

- VAT 201 ReturnDocument3 pagesVAT 201 ReturnSatyanarayana BalusaNo ratings yet

- VAT 201 ReturnDocument3 pagesVAT 201 ReturnRonses ChannelNo ratings yet

- Invoice -شركة سلام البناء للمقاولاتDocument2 pagesInvoice -شركة سلام البناء للمقاولاتMuhammad Daniyal100% (1)

- Vu - 01663671385683Document1 pageVu - 01663671385683salman AlbulukNo ratings yet

- 1ed82dd0 56051Document1 page1ed82dd0 56051Ahmed ElhawaryNo ratings yet

- Invoice -مكتب الخليج للاستشارات الهندسيةDocument2 pagesInvoice -مكتب الخليج للاستشارات الهندسيةMuhammad DaniyalNo ratings yet

- Vendor Cliam PDFDocument1 pageVendor Cliam PDFManoj KumarNo ratings yet

- VAT Return TemplateDocument6 pagesVAT Return Templatenasar_kottopadamNo ratings yet

- Mahran Arabian Company For Industry Saudi Arabia Jiddah, Saudi Arabia, Second Industrial City - Street 46 - Plot No 3752, 22244 0536677050Document1 pageMahran Arabian Company For Industry Saudi Arabia Jiddah, Saudi Arabia, Second Industrial City - Street 46 - Plot No 3752, 22244 0536677050Quality DepartmentNo ratings yet

- Sillan Khajuria 1Document1 pageSillan Khajuria 1jaiswallgouravNo ratings yet

- Invoice Form 9870528Document4 pagesInvoice Form 9870528va.amazonsellercentralNo ratings yet

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Document2 pagesVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47No ratings yet

- Noon Doc 80038888Document2 pagesNoon Doc 80038888Hisham HussainNo ratings yet

- شركة جوتن السعودية المحدودة CD5024003037Document2 pagesشركة جوتن السعودية المحدودة CD5024003037alrashdydecorationNo ratings yet

- Aditya Birla Money Limited: Client Code Branch Code Demat A/C NumberDocument3 pagesAditya Birla Money Limited: Client Code Branch Code Demat A/C Numbersankarkala13No ratings yet

- Invoice - Badeeb - 2135 - 2024 05 12 09 44 12Document1 pageInvoice - Badeeb - 2135 - 2024 05 12 09 44 12mohmmadhalak512No ratings yet

- Invoice - 2021-06-08T002801.878Document1 pageInvoice - 2021-06-08T002801.878Quality DepartmentNo ratings yet

- Lulua InvoiceDocument1 pageLulua InvoiceUmair SarwarNo ratings yet

- Easy GSTDocument1 pageEasy GSTAshish PathakNo ratings yet

- Iff 03bdapk0147g4z5 022024Document4 pagesIff 03bdapk0147g4z5 022024SANJEEV KUMARNo ratings yet

- Payment Voucher: هيبيرض ةروتاف TAX InvoiceDocument2 pagesPayment Voucher: هيبيرض ةروتاف TAX InvoiceM ANo ratings yet

- GSTR9 27aasfp7032r1za 032020Document9 pagesGSTR9 27aasfp7032r1za 032020sharad agarwalNo ratings yet

- Exceptional Broadband Bill - April2022Document1 pageExceptional Broadband Bill - April2022Raju JhaNo ratings yet

- Jarir InvoiceDocument1 pageJarir Invoicerana141129No ratings yet

- COPY TAX INVOICE : JISH ContributionDocument7 pagesCOPY TAX INVOICE : JISH Contributionfx64s8hnxpNo ratings yet

- QuotationDocument1 pageQuotationManish DassNo ratings yet

- Vat ReturnDocument2 pagesVat ReturnJyothish KumarNo ratings yet

- Flights:: اﻟ ر ﺣ ﻼ ت: Dear Passenger, Thanks for your paymentDocument1 pageFlights:: اﻟ ر ﺣ ﻼ ت: Dear Passenger, Thanks for your paymentCrazed NinjaNo ratings yet

- VAT 201 - VAT Returns: Taxable Person DetailsDocument2 pagesVAT 201 - VAT Returns: Taxable Person Detailsankit surtiNo ratings yet

- Check - INVOICE 12600000799Document2 pagesCheck - INVOICE 12600000799Ronei DelinaNo ratings yet

- BillForAccount AspxDocument1 pageBillForAccount AspxImran Muhammed SahirNo ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- Invoice - 2021-06-08T003040.941Document1 pageInvoice - 2021-06-08T003040.941Quality DepartmentNo ratings yet

- Lazurde Invoice - NN166Document1 pageLazurde Invoice - NN166diskhard91No ratings yet

- Lulua InvoiceDocument1 pageLulua InvoiceUmair SarwarNo ratings yet

- Flight Invoice A9120303364Document2 pagesFlight Invoice A9120303364Jatinder Singh GillNo ratings yet

- Invoice: 315 Marvella Corridor Vip Road Vesu Surat GSTIN NO-24BYXPK0658L1ZR 8866783067Document1 pageInvoice: 315 Marvella Corridor Vip Road Vesu Surat GSTIN NO-24BYXPK0658L1ZR 8866783067KaranNo ratings yet

- Habeeb Water BillDocument1 pageHabeeb Water Billpraveen kumarNo ratings yet

- Invoice Form 9606099Document4 pagesInvoice Form 9606099Xx-DΞΛDSH0T-xXNo ratings yet

- Template Expense Report - With VATDocument8 pagesTemplate Expense Report - With VATLiz AnNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchershindesandeep1526No ratings yet

- Alinma ReportDocument1 pageAlinma ReportmashaelalnoumanNo ratings yet

- InvoiceDocument1 pageInvoicepjjephNo ratings yet

- Invoice No - 1022: (Original For Recipient)Document1 pageInvoice No - 1022: (Original For Recipient)Divya Prakash SharmaNo ratings yet

- Draf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument4 pagesDraf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesSinghal 220000No ratings yet

- Order - SO393Document2 pagesOrder - SO393Sameer KhanNo ratings yet

- GST SALES A - 9259-A - 23-Nov-23Document1 pageGST SALES A - 9259-A - 23-Nov-23prabhat088No ratings yet

- Order - SO326Document1 pageOrder - SO326Sameer KhanNo ratings yet

- Lulua InvoiceDocument1 pageLulua InvoiceUmair SarwarNo ratings yet

- Invoice - STS 661Document1 pageInvoice - STS 661Shafi KpNo ratings yet

- Tax Invoice: Customer Information Store InformationDocument2 pagesTax Invoice: Customer Information Store InformationMohamed Zedan100% (1)

- MDB - 1 BillForAccountDocument1 pageMDB - 1 BillForAccountBahauddinZekriaNo ratings yet

- Simple GST Invoice For Single Rate of Goods and ServicesDocument8 pagesSimple GST Invoice For Single Rate of Goods and ServicesKM computer & online workNo ratings yet

- Icv Excel Sheet-MoiatDocument361 pagesIcv Excel Sheet-MoiatbswarajbhutadaNo ratings yet

- Insurance Receipt For Tax LatestDocument1 pageInsurance Receipt For Tax Latestthetrilight2023No ratings yet

- Personal Tax ChecklistDocument4 pagesPersonal Tax Checklistben.hoangNo ratings yet

- Mccann 2004 - Best Places': Interurban Competition, Quality of Life and Popular Media DiscourseDocument22 pagesMccann 2004 - Best Places': Interurban Competition, Quality of Life and Popular Media DiscourseRicardo Hernández MonteroNo ratings yet

- Panasonic Carbon India Co. LimitedDocument6 pagesPanasonic Carbon India Co. Limitedsub_zer01No ratings yet

- 4506t - WORD Version (Request For Transcript of Tax Returns)Document4 pages4506t - WORD Version (Request For Transcript of Tax Returns)Jeff ColeNo ratings yet

- Murphy and Nagel The Myth of Ownership PDFDocument239 pagesMurphy and Nagel The Myth of Ownership PDFDaisy Anita SusiloNo ratings yet

- StMarks SeWa Neg Grapevine Classic Round 4Document94 pagesStMarks SeWa Neg Grapevine Classic Round 4EmronNo ratings yet

- Question Bank, 9th SemesterDocument34 pagesQuestion Bank, 9th SemesterSubhodip MalakarNo ratings yet

- Course Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentDocument8 pagesCourse Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentPATATASNo ratings yet

- Financial Analysis Summary MIDIDocument28 pagesFinancial Analysis Summary MIDIKarmichael SultanaNo ratings yet

- V6 After Budget 2023 New Tax Regime Vs Old Tax RegimeDocument20 pagesV6 After Budget 2023 New Tax Regime Vs Old Tax RegimegunagaliNo ratings yet

- Wings Mine Solutions India Private LimitedDocument5 pagesWings Mine Solutions India Private LimitedswapnilNo ratings yet

- (OAVM) .: Ushik Digitally Signed byDocument45 pages(OAVM) .: Ushik Digitally Signed byAnjan KumarNo ratings yet

- Tax CertificateDocument3 pagesTax CertificateSharpReXNo ratings yet

- Gst66 Fill 13eDocument2 pagesGst66 Fill 13eJeff MNo ratings yet

- Offer Letter - Sagar Ravindra JhaDocument11 pagesOffer Letter - Sagar Ravindra JhaSagar JhaNo ratings yet

- Liabilities - Overview Accrual and Deferred Revenue - Handout PresentationDocument15 pagesLiabilities - Overview Accrual and Deferred Revenue - Handout PresentationZaira PerezNo ratings yet

- 2-13-23 Town Board Meeting MinutesDocument3 pages2-13-23 Town Board Meeting MinuteswatsondeedindeedNo ratings yet

- AKM 1 - CH 4Document76 pagesAKM 1 - CH 4Fauziah AbdunnafiNo ratings yet

- Cash FlowsDocument15 pagesCash FlowsAkshat DwivediNo ratings yet

- Local Government TaxationDocument48 pagesLocal Government Taxationjan erwin ceroNo ratings yet

- The City of Calgary: Tax Installment Payment PlanDocument2 pagesThe City of Calgary: Tax Installment Payment PlanMykel VelasquezNo ratings yet

- Global Mobility COVID-19 Global Tracker: Last Update: 11 March 2021Document181 pagesGlobal Mobility COVID-19 Global Tracker: Last Update: 11 March 2021pippo1980No ratings yet

- Particulars Year Ended 31 March, 2020: Income Statement For Birla Corporation LTDDocument24 pagesParticulars Year Ended 31 March, 2020: Income Statement For Birla Corporation LTDSomil GuptaNo ratings yet

- IFAP Newsletter April 2011Document54 pagesIFAP Newsletter April 2011Shakir Mahboob KhanNo ratings yet

- Engineering Economic: Bhesh R Kanel, CoordinatorDocument21 pagesEngineering Economic: Bhesh R Kanel, Coordinatorharry potterNo ratings yet

- Political Interference and Institutional Performance of Cross River State Water Board Limited, NigeriaDocument13 pagesPolitical Interference and Institutional Performance of Cross River State Water Board Limited, NigeriaAnonymous izrFWiQNo ratings yet