Professional Documents

Culture Documents

Bank Reconciliation Statement - DPP 05 (Accounting)

Bank Reconciliation Statement - DPP 05 (Accounting)

Uploaded by

ashoknandi156Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation Statement - DPP 05 (Accounting)

Bank Reconciliation Statement - DPP 05 (Accounting)

Uploaded by

ashoknandi156Copyright:

Available Formats

12/19/23, 7:39 PM CA_DPP 5

CA

Sampurna June 2024

Accounting DPP: 5

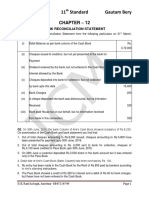

Bank Reconciliation Statement

Q1 From the following information, ascertain the Insurance premium paid by bank

Cash Book balance of Mr. Bajaj as on 31st as per standing instruction not 7,950

March, 2021: intimated

1. Debit balance as per Bank Pass Book Cash sales wrongly recorded in

Rs.3, 500 . the bank column of the Cash- 12,750

2. A cheque amounting to Rs.2, 500 deposited book

on 15th March, but the same was returned by Customer's cheque dishonoured

the Bank on 24th March for which no entry by bank not recorded in Cash- 6,500

was passed in the Cash Book. book

3. During March, two bills amounting to Wrong Credit given by bank 7,500

Rs.2, 500 and Rs.500 were collected by the Also show the bank balances that will

Bank but no entry was made in the Cash appear in the Trial Balance as on 31.3.2023

Book.

4. A bill for Rs.5, 000 due from Mr. Balaji Q3 On 30th September, 2023, the bank account of

previously discounted for Rs.4, 800 was Rohit , according to the bank column of the

dishonored. The Bank debited the account, cash book, was overdrawn to the extent of

but no entry was passed in the Cash Book. ₹16,124. An examination of the Cash book and

5. A Cheque for Rs.1, 500 was debited twice in Bank Statement reveals the following:

the cash book. A cheque for ₹22,28,000 deposited on 29th

September, 2023 was credited by the bank

Q2 From the following information (as on 31.3.2023), only on 3rd October, 2023.

prepare a Bank Reconciliation Statement after A payment by cheque for ₹36,000 has been

making necessary amendments in the Cash- entered twice in the Cash book.

book. On 29th September, 2023, the bank credited

an amount of ₹2,30,800 received from a

Particulars Amount (Rs.)

customer of Rohit , but the advice was not

Bank balance as per Cash Book

1,62,500 received by Rohit until 1st October, 2023.

(Dr.)

Bank charges amounting to ₹560 had not

Cheques deposited, but not yet

2,23,750 been entered in the cash book

credited

On 6th September, 2023, the bank credited ₹

Cheques issued but, not yet 60,000 to Rohit in error.

1,78,100

presented for payment A bill of exchange for ₹ 3,20,000 was

Bank charges debited by Bank discounted by Rohit with his bar. The bill was

625

but not recorded in Cash-book dishonoured on 28th September, 2023 but no

Dividend directly collected by entry has been made in the books of Rohit.

6,250

bank Cheques issued upto 30th September, 2023

but not presented for payment upto that

Android App | iOS App | PW Website

https://qbg-admin.penpencil.co/finalize-question-paper/preview -pdf 1/5

12/19/23, 7:39 PM CA_DPP 5

CA

date totalled ₹26,92,000. brought forward as credit balance in the

A bill payable of ₹4,00,000 had been paid by cash book.

the bank but was not enter in the cash book Of the total cheques amounting to ₹ 4,948

and bill receivable for ₹1,20,000 had been drawn in the last week of December, 2023,

discount, with the bank at a cost of ₹2,000 cheques aggregating ₹3,744 were encashed

which had also not been recorded cash in December, 2021.

book. Dividends of ₹ 14,000 collected by the bank

You are required: and fire insurance premium of ₹3,160 paid by

To show the appropriate rectifications required the bank were not recorded in the cash

in the cash book of Rohit , arrive at the correct book.

balance on 30th September, 2023 and to A Cheque issued to a creditor of ₹70,000

prepare a Bar Reconciliation Statement as on was recorded twice in the cash book.

that date. Bill for collection amounting to ₹21,200

credited by the bank on 21st December, 2023

Q4 The cash book of Mr.Ravi shows ₹1,04,160 as the

but no advice was received by Mr. Karan till

balance of bank as on 31st December, 2023 but

31st December, 2023.

you find that it does not agree with the balance

A Customer, who received a cash discount of

as per the bank passbook. On analysis, you

3% on his account of ₹24,000 paid a cheque

found the following discrepancies:

on 10th December, 2023 . The cashier

On 15th December, 2023 the payment, side

erroneously entered the gross amount in the

of the cash book was overcast by ₹ 4,000.

bank column of the cash book.

A Cheque for ₹47,200 issued on 6th

You are required to prepare the bank

December, 2023 was not taken in the bank

reconciliation statement as on 31st December,

Column.

2023.

On 20th December, 2023 the debit balance

of ₹3,384 as on the previous day, was

Android App | iOS App | PW Website

https://qbg-admin.penpencil.co/finalize-question-paper/preview -pdf 2/5

12/19/23, 7:39 PM CA_DPP 5

CA

Answer Key

Q1 Plus Minus final

Particulars balance)

(Rs.) (Rs.)

Overdraft as per Pass Book 1,68,750 1,68,750

3,500

(Debit)

Cheques deposited but Bank Reconciliation

2,500

returned on 24th March,2021 Statement as on 31 st March, 2023

Discounted bill from Mr. Plus Minus

5,000 Particulars

Balaji dishonored (Rs.) (Rs.)

Wrong debit in Cash book 1,500 Balance as per Cash

1,40,925

Bill collected by bank not Book (Dr.)

recorded in cash book (2,500 3,000 Cheques issued but not

1,78,100

+ 500) yet paid by Bank

Overdraft Balance as per Wrong Credit given by

2,500 7,500

Cash book Bank

9,000 9,000 Cheques deposited by

2,23,750

not yet realised by bank

Q2 Cash Book as on

Balance as per Pass

31.3.2023 (Bank Column) 1,02,775

book (Cr.)

(after making

3,26,525 3,26,525

necessary amendments)

Amount Amount Q3 Adjusted Cash

Particulars Particulars

( Rs. ) ( Rs. ) Book (Bank Column only)

To Amount Amount (

By Bank Particulars Particulars

Balance 1,62,500 625 ( Rs. ) Rs. )

charges a/c

b/d To

To Amount

Dividend By Insurance wrongly 36,000 By Bal. b/d 16,124

6,250 7,950

income premium a/c entered

a/c twice

By Cash To

Sales Customer By Bank

2,30,800 560

(wrongly 12,750 (Direct charges

recorded) Deposit)

a/c To Bills

By Customer

By Debtors receivable

1,18,000 (B/R 3,20,000

(cheque (1,20,000-

6,500 dishonoured)

dishonoured) 2,000)

a/c By Bills

To Bal c/d 3,51,884 4,00,000

By Balance 1,40,925 payable

c/d 7,36,684 7,36,684

(corrected/

Android App | iOS App | PW Website

https://qbg-admin.penpencil.co/finalize-question-paper/preview -pdf 3/5

12/19/23, 7:39 PM CA_DPP 5

CA

Bank Payment side of Cash

4,000

Reconciliation Statement book overcasted

as on 30th Debit balance of Cash

September, 2023 Book wrongly brought

6,768

Minus forward as credit

Particulars Plus (Rs.)

(Rs.) balance [₹3,384 × 2]

Overdraft as per Cheque drawn but not

adjusted cash book 3,51,884 encashed (₹4,948 - 1,204

(Cr.) ₹3,744)

Amount wrongly Dividend collected by

60,000 14,000

credited by bank Bank

Cheque issued but Cheque issued to

not presented for 26,92,000 creditor recorded twice 70,000

payment in the Cash Book

Cheque deposited Bill for collection

but not credited by 22,28,000 credited by Bank but not 21,200

bank recorded in Cash Book

Balance as per Pass Cheque issued but not

1,72,116 recorded in Bank 47,200

book (Cr.)

column of Cash Book

27,52,000 27,52,000

Insurance Premium paid

Q4 Bank 3,160

by Bank

Reconciliation Statement as on 31st Dec., 2023 Discount to customer

Plus Minus 720

erroneously recorded

Particulars

(Rs.) (Rs.) Cr. balance as per Cash

Dr. balance as per Cash 1,70,252

1,04,160 Book

Book

2,21,332 2,21,332

Android App | iOS App | PW Website

https://qbg-admin.penpencil.co/finalize-question-paper/preview -pdf 4/5

You might also like

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Answers of Cash and Cash Equivalents AssignmentDocument4 pagesAnswers of Cash and Cash Equivalents AssignmentGee Lysa Pascua Vilbar50% (2)

- Internal Job Posting PolicyDocument8 pagesInternal Job Posting PolicyDinesh GK100% (1)

- Unpredictable Yet Guided, Amoral Yet Normative: Arendt On Principled ActionDocument26 pagesUnpredictable Yet Guided, Amoral Yet Normative: Arendt On Principled ActionMark S Mark100% (1)

- Empower Our Neighborhoods V Guadagno, Docket # L 3148-11Document48 pagesEmpower Our Neighborhoods V Guadagno, Docket # L 3148-11FIXMYLOANNo ratings yet

- Blood Relationship As A Basis of Inheritance Under Islamic Law A Case Study of The Inner and Outer Circles of FamilyDocument206 pagesBlood Relationship As A Basis of Inheritance Under Islamic Law A Case Study of The Inner and Outer Circles of Familyisaac_naseerNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Bank Reconciliation Statement Previous Year QuestionDocument6 pagesBank Reconciliation Statement Previous Year QuestionSiddharth ThakurNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- 16772BRSDocument47 pages16772BRSSketch KathayatNo ratings yet

- Pay TM Loan StatementDocument1 pagePay TM Loan Statementsrinivas rao kNo ratings yet

- 1 - QPDocument7 pages1 - QPburtontris23No ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- BRS SCANNER by Nahta PDFDocument24 pagesBRS SCANNER by Nahta PDFVaidika JainNo ratings yet

- Accts Test - BRS & InventoriesDocument2 pagesAccts Test - BRS & Inventoriesprashanttiwari155282No ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Shahrukh - Summary SuitDocument12 pagesShahrukh - Summary SuitbarzNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- PST FA 2015 2023Document91 pagesPST FA 2015 2023PhilipNo ratings yet

- NW NSC Accounting P2 Eng QP Sept 2023Document15 pagesNW NSC Accounting P2 Eng QP Sept 2023lehlohonolomaile283No ratings yet

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Bank Reconciliation Statement NumericalDocument6 pagesBank Reconciliation Statement NumericalTejas RajNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet

- FA - Bank Rec. QuestionDocument2 pagesFA - Bank Rec. QuestionAshika JayaweeraNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- 12.foundation Accounting Fasttrack Handwritten Notes by CMA CS RohanNimbalkarDocument142 pages12.foundation Accounting Fasttrack Handwritten Notes by CMA CS RohanNimbalkarsnehajainsneha52No ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- Grade 11 Provincial Examination Accounting P2 (English) June 2023 Question PaperDocument11 pagesGrade 11 Provincial Examination Accounting P2 (English) June 2023 Question PaperRebotile MashaoNo ratings yet

- AUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredDocument4 pagesAUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredMary Rose CredoNo ratings yet

- Ca Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 MinutesDocument3 pagesCa Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 Minutesvanshikha.agarwal345No ratings yet

- Accounting p2 QP Gr12 Sept 2023 - EnglishDocument11 pagesAccounting p2 QP Gr12 Sept 2023 - Englishbrandon.tabaneNo ratings yet

- Statement - 652900 XXXX XXXX 2982 - 022023Document2 pagesStatement - 652900 XXXX XXXX 2982 - 022023Vikrant JaiswalNo ratings yet

- Presentation 1Document2 pagesPresentation 1zindabotNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- CA FND M23 - Cash Book QuestionsDocument4 pagesCA FND M23 - Cash Book QuestionsRaaja YoganNo ratings yet

- Cash & CE (Problem 45-48)Document4 pagesCash & CE (Problem 45-48)Elijah CaisipNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- CA Foundation - Test 4 Chapters - Answer PaperDocument8 pagesCA Foundation - Test 4 Chapters - Answer PaperKrishna SurekaNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- RM - Cash and Cash EquivalentsDocument3 pagesRM - Cash and Cash Equivalentsncaacademics.nfjpia2324No ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation Statement20232024s5r14leungjacobNo ratings yet

- 23 Accounts-RTP-DecemberDocument32 pages23 Accounts-RTP-Decemberjustinbieberm77No ratings yet

- Bank ReconciliationDocument4 pagesBank ReconciliationAmerisha Faura Meldegard PunzalanNo ratings yet

- QuickBooks Online for Beginners: A Quick Reference and Step-by-Step Guide to Mastering QuickBooks Online for Small Business Owners from Beginners to ExpertFrom EverandQuickBooks Online for Beginners: A Quick Reference and Step-by-Step Guide to Mastering QuickBooks Online for Small Business Owners from Beginners to ExpertNo ratings yet

- H100Manual PDFDocument33 pagesH100Manual PDFKang Ray MonthNo ratings yet

- Tragic Murder: The Hijab MartyrDocument3 pagesTragic Murder: The Hijab MartyrNami RaNo ratings yet

- Directory OfficersDocument44 pagesDirectory OfficersMehul BhanushaliNo ratings yet

- FIATA Reference Handbook 05-2014Document64 pagesFIATA Reference Handbook 05-2014Fwdr Livingston Obasi0% (1)

- 167 Ross Transport, Inc. V Crothers (Pagcaliwagan)Document2 pages167 Ross Transport, Inc. V Crothers (Pagcaliwagan)Jovelan EscañoNo ratings yet

- National Bankruptcy Services The LedgerDocument28 pagesNational Bankruptcy Services The LedgerOxigyneNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For Corporations Prob 4Document3 pagesSol. Man. - Chapter 15 - Accounting For Corporations Prob 4ruth san joseNo ratings yet

- GiftDocument9 pagesGiftCharan NNo ratings yet

- Ecotec Installation and Servicing Manual 261417Document88 pagesEcotec Installation and Servicing Manual 261417adrgrNo ratings yet

- 1107 Advantage Grout DotDocument2 pages1107 Advantage Grout DotWawanALKhatiryNo ratings yet

- Pros and Cons of Delegated LegislationDocument1 pagePros and Cons of Delegated LegislationNikhilesh MallickNo ratings yet

- BJMP and BFPDocument2 pagesBJMP and BFPMaelilah MampayNo ratings yet

- BACCHIOCCHI, Samuele - The Marriage CovenantDocument176 pagesBACCHIOCCHI, Samuele - The Marriage CovenantJohn Anthony Choquepuma LaccactaNo ratings yet

- PFRS 9Document6 pagesPFRS 9Beverly UrbaseNo ratings yet

- Questions and Answers: How Did The Chinese Use Fingerprints?Document4 pagesQuestions and Answers: How Did The Chinese Use Fingerprints?Kaye MarquezNo ratings yet

- Minutes of MDC Meeting February 2 2012 PDFDocument3 pagesMinutes of MDC Meeting February 2 2012 PDFPearly ShellNo ratings yet

- UntitledDocument5 pagesUntitleddedy gamingNo ratings yet

- Motion To UnsealDocument5 pagesMotion To UnsealNew York Post100% (1)

- Compliance Recall Code: 37M2: Country Beginning Model Year Ending Model Year VehicleDocument30 pagesCompliance Recall Code: 37M2: Country Beginning Model Year Ending Model Year VehicleAlin DanielNo ratings yet

- Bill Statement: Mobile Number 016-8152856Document6 pagesBill Statement: Mobile Number 016-8152856Nadzirah Erra A DNo ratings yet

- Calcium Nitrate Fertilizer PDFDocument2 pagesCalcium Nitrate Fertilizer PDForangebig100% (1)

- History of Labor LawDocument7 pagesHistory of Labor LawKalela HamimNo ratings yet

- Blaw SoftDocument596 pagesBlaw Softjonathan tanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHARSHIT CHAUHANNo ratings yet