Professional Documents

Culture Documents

The Importance of Financial Literacy

The Importance of Financial Literacy

Uploaded by

robinsjohn538Copyright:

Available Formats

You might also like

- Unit 1 Lesson 3Document3 pagesUnit 1 Lesson 3Naitsirhc Imacc100% (3)

- Surgical Cheat SheetDocument9 pagesSurgical Cheat SheetderekmiguelsmithNo ratings yet

- Grant Proposal ChecklistDocument3 pagesGrant Proposal ChecklistMichael Jones100% (1)

- Simple Biodata FormatDocument1 pageSimple Biodata FormatSayanDas71% (280)

- Essay 3 - The Importance of Financial Literacy in Today's WorldDocument2 pagesEssay 3 - The Importance of Financial Literacy in Today's WorldJoyll ThomasNo ratings yet

- UNIT1 Sec (Finance For Everyone)Document12 pagesUNIT1 Sec (Finance For Everyone)hiTesh bishTNo ratings yet

- Personal Financial Planning Unit 1Document16 pagesPersonal Financial Planning Unit 1Shafi ChoudharyNo ratings yet

- The Psychology of Money at 18Document20 pagesThe Psychology of Money at 18Aayush TripatiNo ratings yet

- Business enDocument8 pagesBusiness enTarundiaz 1No ratings yet

- Why FincorpDocument1 pageWhy FincorptanshlinkedinNo ratings yet

- Financial LiteracyDocument6 pagesFinancial LiteracyJannah Manalo Dela LunaNo ratings yet

- LX - Islamic Jurisprudence LL.MDocument10 pagesLX - Islamic Jurisprudence LL.MServant Of Muhammad SAWNo ratings yet

- B&I MicrofinanceDocument3 pagesB&I MicrofinanceYashika ANo ratings yet

- Blank 7Document19 pagesBlank 7Kallem SatishreddyNo ratings yet

- Wealth ManagementDocument53 pagesWealth Managementshraddha singhNo ratings yet

- September 2020 NewsletterDocument30 pagesSeptember 2020 NewsletterAnonymous FnM14a0No ratings yet

- Proposal For Microloan Partnership and Salary ServicesDocument2 pagesProposal For Microloan Partnership and Salary Servicesabdiselammohamed6No ratings yet

- Chap 1 PF Understanding Personal Finance GarmanDocument20 pagesChap 1 PF Understanding Personal Finance Garmanngokhanhnam2704No ratings yet

- AFM Textbook UpdatedDocument397 pagesAFM Textbook UpdatedFaithful nongeraiNo ratings yet

- Financial Education Initiatives of Bangko Sentral NG PilipinasDocument37 pagesFinancial Education Initiatives of Bangko Sentral NG PilipinasSassa IndominationNo ratings yet

- Graphics 9 14-18Document3 pagesGraphics 9 14-18api-533699223No ratings yet

- FINANCIAL-LITERACY Power Point PresentationDocument56 pagesFINANCIAL-LITERACY Power Point PresentationLeri Cerenado Aliliran75% (4)

- Chapter 4 - Financial LiteracyDocument30 pagesChapter 4 - Financial Literacyqueeniehingpit1997No ratings yet

- Financial PlanningDocument17 pagesFinancial PlanningJiten LahoriNo ratings yet

- 01 Title MergedDocument225 pages01 Title MergedRuben ChristopherNo ratings yet

- Empowerment TechnologiesDocument22 pagesEmpowerment TechnologiesLuxury KennNo ratings yet

- Financial Planning: Unit-IDocument17 pagesFinancial Planning: Unit-ISocio Fact'sNo ratings yet

- Financial LiteracyDocument10 pagesFinancial LiteracyJoshua Karl Tampos FabrigaNo ratings yet

- Introduction To FinanceDocument8 pagesIntroduction To FinanceLilacNo ratings yet

- BENLAC Financial LiteracyDocument3 pagesBENLAC Financial LiteracyBritney Dwight UlayaoNo ratings yet

- Financial Literacy: Reporters: Cerado, Fredisvenda Allyssa M. Josol, Kum Hyeon S. Venus, Jennifer G. Yambao, MaribethDocument17 pagesFinancial Literacy: Reporters: Cerado, Fredisvenda Allyssa M. Josol, Kum Hyeon S. Venus, Jennifer G. Yambao, MaribethAbby Yambao100% (1)

- Benlac 2Document13 pagesBenlac 2lalainejimenez235No ratings yet

- Basic-Concepts-And-Importance-Of-Financial-Management 1Document21 pagesBasic-Concepts-And-Importance-Of-Financial-Management 1api-282405468No ratings yet

- Module # Topics 4: Unit 4Document15 pagesModule # Topics 4: Unit 4ANNA MARY GINTORONo ratings yet

- Department of Education: Pagturian/Sipit Saburan Mangyan SchoolDocument6 pagesDepartment of Education: Pagturian/Sipit Saburan Mangyan SchoolDorothea Lou PeliñoNo ratings yet

- Rich Minds Genesis Final Edition - Black BookDocument78 pagesRich Minds Genesis Final Edition - Black Bookshaikhfiza1336No ratings yet

- Abm 4 Module 13 14Document5 pagesAbm 4 Module 13 14Argene AbellanosaNo ratings yet

- Guide To Financial PlanningDocument48 pagesGuide To Financial Planningalok_singh_51100% (1)

- Ede PDFDocument14 pagesEde PDFRUGVEDNo ratings yet

- Finance Article 2Document2 pagesFinance Article 2cindybriggs989No ratings yet

- GREGORIOTersoJr - Chapter 5Document5 pagesGREGORIOTersoJr - Chapter 5Terso GregorioNo ratings yet

- SKMF MiagaoDocument10 pagesSKMF MiagaocmpaguntalanNo ratings yet

- Portfolio Construction Forum Backgrounder FinologyDocument22 pagesPortfolio Construction Forum Backgrounder FinologyPankaj VermaNo ratings yet

- Reviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLDocument3 pagesReviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLJenalyn Miranda Cayanan - Marayag100% (1)

- Banking Regulation - PPT (Philippine Banking Laws) TTHDocument20 pagesBanking Regulation - PPT (Philippine Banking Laws) TTHTerso GregorioNo ratings yet

- Financial Literacy: Jessie B. LorenzoDocument23 pagesFinancial Literacy: Jessie B. LorenzoRichelda Dizon100% (2)

- Financial Literacy in India - A New Way ForwardDocument15 pagesFinancial Literacy in India - A New Way Forwardaditya sahooNo ratings yet

- Financial Literacy - Recent Research Findings: Financial History Workshop, Vienna September 2019Document32 pagesFinancial Literacy - Recent Research Findings: Financial History Workshop, Vienna September 2019Jelou CuestasNo ratings yet

- Personal FinanceDocument5 pagesPersonal FinanceFred Jaff Fryan RosalNo ratings yet

- Introduction - Basic Ideas of FinanceDocument3 pagesIntroduction - Basic Ideas of FinanceJade Ann ConstantinoNo ratings yet

- 4 A Study of Mutual Funds As An Investment Option in Personal Finance of College Teachers at BangaloreDocument10 pages4 A Study of Mutual Funds As An Investment Option in Personal Finance of College Teachers at BangaloreSebastian LawranceNo ratings yet

- Mastering Finances: A Comprehensive Guide to Personal FinanceFrom EverandMastering Finances: A Comprehensive Guide to Personal FinanceNo ratings yet

- SSRN Id2934855Document18 pagesSSRN Id2934855YogashiniNo ratings yet

- Journal of Advanced Computing and Communication Technologies (ISSNDocument5 pagesJournal of Advanced Computing and Communication Technologies (ISSNzoe regina castroNo ratings yet

- Happy Nivesh ProjectDocument61 pagesHappy Nivesh ProjectPranali ahirraoNo ratings yet

- The Importance of Financial LiteracyDocument2 pagesThe Importance of Financial Literacysuneel66229No ratings yet

- Engage: Financial LiteracyDocument6 pagesEngage: Financial Literacylusty brenNo ratings yet

- Financial LiteracyDocument18 pagesFinancial LiteracyMarisca Consigna CabaronNo ratings yet

- Business Finance: Short Term and Long Term FundsDocument13 pagesBusiness Finance: Short Term and Long Term FundsAlma A Cerna100% (3)

- Financial Literacy Strategy 2019Document32 pagesFinancial Literacy Strategy 2019sompasongNo ratings yet

- Studu On Financial LiteracyDocument76 pagesStudu On Financial LiteracyFYBAF A-1007 BHANDARI AMANNo ratings yet

- SEBI Financial Education Booklet English 02122021053656Document73 pagesSEBI Financial Education Booklet English 02122021053656JayNo ratings yet

- EDUC 328 Module 08 Task and Requirement No. 3Document5 pagesEDUC 328 Module 08 Task and Requirement No. 3Kim MierNo ratings yet

- Field Work Report For 2nd and 3rd YearDocument10 pagesField Work Report For 2nd and 3rd YearAnanta ChaliseNo ratings yet

- Year 7 Poetry B QuestionsDocument3 pagesYear 7 Poetry B QuestionsShi Hang CHANNo ratings yet

- CHC33015-AC-Subject 6-AWB-FV-v1.2Document34 pagesCHC33015-AC-Subject 6-AWB-FV-v1.2Nkosana Ngwenya100% (1)

- Project Management Module 4 ScriptDocument35 pagesProject Management Module 4 Scriptgustavo_baez_19No ratings yet

- Concept of Community Immersion 11-14-15Document21 pagesConcept of Community Immersion 11-14-15Franz Thelen Lozano CariñoNo ratings yet

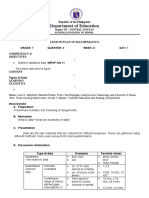

- Department of Education: Lesson Plan in MathematicsDocument2 pagesDepartment of Education: Lesson Plan in MathematicsShiera SaletreroNo ratings yet

- Poster On Real Time Face Recognition - Team RhetoriciansDocument1 pagePoster On Real Time Face Recognition - Team RhetoriciansAbdullah Al FahimNo ratings yet

- JRF Advertisement 2023 ICMR AMSDocument4 pagesJRF Advertisement 2023 ICMR AMSDebraj Dhar PurkayasthaNo ratings yet

- Mastering Astronomy Homework 2 AnswersDocument7 pagesMastering Astronomy Homework 2 Answersqjckfwhlf100% (1)

- SHS GRADE 11 EMPOWERMENT TECHNOLOGY 2ND Q - WEEK 1-8 LatestDocument45 pagesSHS GRADE 11 EMPOWERMENT TECHNOLOGY 2ND Q - WEEK 1-8 LatestJobelle TabinasNo ratings yet

- NRL R1-Pacific RacingDocument1 pageNRL R1-Pacific RacingjoanalcarazNo ratings yet

- The Development of Educational SpecificationsDocument44 pagesThe Development of Educational SpecificationsCharlane GenalocNo ratings yet

- Grade 10 Daily Lesson LOGDocument3 pagesGrade 10 Daily Lesson LOGjaramieNo ratings yet

- My Homework Lesson 2 Read and Write Multi-Digit NumbersDocument7 pagesMy Homework Lesson 2 Read and Write Multi-Digit Numbersh45nhdnd100% (1)

- The Importance of SLA (Introduction)Document3 pagesThe Importance of SLA (Introduction)Rizky Allivia LarasatiNo ratings yet

- On Teaching A Language Principles and Priorities in MethodologyDocument33 pagesOn Teaching A Language Principles and Priorities in MethodologyYour Local MemeistNo ratings yet

- Icct Colleges: Health & Safety Agreement Form (HSAF)Document1 pageIcct Colleges: Health & Safety Agreement Form (HSAF)Eugene AcasioNo ratings yet

- Analysis of First-Year Music Teachers' Advice To Music Education StudentsDocument8 pagesAnalysis of First-Year Music Teachers' Advice To Music Education StudentsCatherine LeeNo ratings yet

- Adolescents and GraffitiDocument7 pagesAdolescents and GraffitiLuz AFNo ratings yet

- Measuring The Effectiveness RS-5Document7 pagesMeasuring The Effectiveness RS-5Jan Frederik Valkenberg CastroNo ratings yet

- Lesson Plan Egypt 1Document4 pagesLesson Plan Egypt 1OswaldNo ratings yet

- Psyc 208Document9 pagesPsyc 208anubhavpratikNo ratings yet

- MOD44Document1 pageMOD44Aurea Jasmine DacuycuyNo ratings yet

- Target Client List For Family PlanningDocument3 pagesTarget Client List For Family PlanningGwendareign ElizanNo ratings yet

- Pre Test For Writing Descriptive ParagraphDocument3 pagesPre Test For Writing Descriptive ParagraphAnugrah FotocopyNo ratings yet

- Internship Report (R)Document29 pagesInternship Report (R)PRAMOD SAVANTNo ratings yet

The Importance of Financial Literacy

The Importance of Financial Literacy

Uploaded by

robinsjohn538Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Importance of Financial Literacy

The Importance of Financial Literacy

Uploaded by

robinsjohn538Copyright:

Available Formats

The Importance of Financial Literacy

Introduction

Financial literacy is crucial for making informed decisions about personal nances. Understanding

nancial concepts and managing money effectively can lead to nancial stability and independence.

Key Components of Financial Literacy

1. Budgeting: Creating and adhering to a budget helps track income and expenses, ensuring

nancial stability.

2. Saving and Investing: Knowledge of saving strategies and investment options can help

grow wealth over time.

3. Debt Management: Understanding how to manage and reduce debt is essential for nancial

health.

4. Credit Scores: Knowing how credit scores work and how to maintain a good score is

important for accessing credit and loans.

Bene ts of Financial Literacy

1. Informed Decision Making: Financial literacy enables individuals to make better nancial

decisions, avoiding pitfalls such as high-interest debt.

2. Financial Independence: Proper nancial management leads to independence and reduces

reliance on external nancial support.

3. Preparedness for Emergencies: Financially literate individuals are better prepared for

unexpected expenses and emergencies.

Ways to Improve Financial Literacy

1. Education and Courses: Taking nancial literacy courses online or in-person to build

knowledge.

2. Financial Planning Tools: Using tools and apps to manage nances and track spending.

3. Professional Advice: Seeking advice from nancial advisors for personalized nancial

planning.

Conclusion

Financial literacy is an essential life skill that empowers individuals to manage their money

effectively and achieve nancial goals. By improving nancial literacy, individuals can enhance

their nancial well-being and security.

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

fi

You might also like

- Unit 1 Lesson 3Document3 pagesUnit 1 Lesson 3Naitsirhc Imacc100% (3)

- Surgical Cheat SheetDocument9 pagesSurgical Cheat SheetderekmiguelsmithNo ratings yet

- Grant Proposal ChecklistDocument3 pagesGrant Proposal ChecklistMichael Jones100% (1)

- Simple Biodata FormatDocument1 pageSimple Biodata FormatSayanDas71% (280)

- Essay 3 - The Importance of Financial Literacy in Today's WorldDocument2 pagesEssay 3 - The Importance of Financial Literacy in Today's WorldJoyll ThomasNo ratings yet

- UNIT1 Sec (Finance For Everyone)Document12 pagesUNIT1 Sec (Finance For Everyone)hiTesh bishTNo ratings yet

- Personal Financial Planning Unit 1Document16 pagesPersonal Financial Planning Unit 1Shafi ChoudharyNo ratings yet

- The Psychology of Money at 18Document20 pagesThe Psychology of Money at 18Aayush TripatiNo ratings yet

- Business enDocument8 pagesBusiness enTarundiaz 1No ratings yet

- Why FincorpDocument1 pageWhy FincorptanshlinkedinNo ratings yet

- Financial LiteracyDocument6 pagesFinancial LiteracyJannah Manalo Dela LunaNo ratings yet

- LX - Islamic Jurisprudence LL.MDocument10 pagesLX - Islamic Jurisprudence LL.MServant Of Muhammad SAWNo ratings yet

- B&I MicrofinanceDocument3 pagesB&I MicrofinanceYashika ANo ratings yet

- Blank 7Document19 pagesBlank 7Kallem SatishreddyNo ratings yet

- Wealth ManagementDocument53 pagesWealth Managementshraddha singhNo ratings yet

- September 2020 NewsletterDocument30 pagesSeptember 2020 NewsletterAnonymous FnM14a0No ratings yet

- Proposal For Microloan Partnership and Salary ServicesDocument2 pagesProposal For Microloan Partnership and Salary Servicesabdiselammohamed6No ratings yet

- Chap 1 PF Understanding Personal Finance GarmanDocument20 pagesChap 1 PF Understanding Personal Finance Garmanngokhanhnam2704No ratings yet

- AFM Textbook UpdatedDocument397 pagesAFM Textbook UpdatedFaithful nongeraiNo ratings yet

- Financial Education Initiatives of Bangko Sentral NG PilipinasDocument37 pagesFinancial Education Initiatives of Bangko Sentral NG PilipinasSassa IndominationNo ratings yet

- Graphics 9 14-18Document3 pagesGraphics 9 14-18api-533699223No ratings yet

- FINANCIAL-LITERACY Power Point PresentationDocument56 pagesFINANCIAL-LITERACY Power Point PresentationLeri Cerenado Aliliran75% (4)

- Chapter 4 - Financial LiteracyDocument30 pagesChapter 4 - Financial Literacyqueeniehingpit1997No ratings yet

- Financial PlanningDocument17 pagesFinancial PlanningJiten LahoriNo ratings yet

- 01 Title MergedDocument225 pages01 Title MergedRuben ChristopherNo ratings yet

- Empowerment TechnologiesDocument22 pagesEmpowerment TechnologiesLuxury KennNo ratings yet

- Financial Planning: Unit-IDocument17 pagesFinancial Planning: Unit-ISocio Fact'sNo ratings yet

- Financial LiteracyDocument10 pagesFinancial LiteracyJoshua Karl Tampos FabrigaNo ratings yet

- Introduction To FinanceDocument8 pagesIntroduction To FinanceLilacNo ratings yet

- BENLAC Financial LiteracyDocument3 pagesBENLAC Financial LiteracyBritney Dwight UlayaoNo ratings yet

- Financial Literacy: Reporters: Cerado, Fredisvenda Allyssa M. Josol, Kum Hyeon S. Venus, Jennifer G. Yambao, MaribethDocument17 pagesFinancial Literacy: Reporters: Cerado, Fredisvenda Allyssa M. Josol, Kum Hyeon S. Venus, Jennifer G. Yambao, MaribethAbby Yambao100% (1)

- Benlac 2Document13 pagesBenlac 2lalainejimenez235No ratings yet

- Basic-Concepts-And-Importance-Of-Financial-Management 1Document21 pagesBasic-Concepts-And-Importance-Of-Financial-Management 1api-282405468No ratings yet

- Module # Topics 4: Unit 4Document15 pagesModule # Topics 4: Unit 4ANNA MARY GINTORONo ratings yet

- Department of Education: Pagturian/Sipit Saburan Mangyan SchoolDocument6 pagesDepartment of Education: Pagturian/Sipit Saburan Mangyan SchoolDorothea Lou PeliñoNo ratings yet

- Rich Minds Genesis Final Edition - Black BookDocument78 pagesRich Minds Genesis Final Edition - Black Bookshaikhfiza1336No ratings yet

- Abm 4 Module 13 14Document5 pagesAbm 4 Module 13 14Argene AbellanosaNo ratings yet

- Guide To Financial PlanningDocument48 pagesGuide To Financial Planningalok_singh_51100% (1)

- Ede PDFDocument14 pagesEde PDFRUGVEDNo ratings yet

- Finance Article 2Document2 pagesFinance Article 2cindybriggs989No ratings yet

- GREGORIOTersoJr - Chapter 5Document5 pagesGREGORIOTersoJr - Chapter 5Terso GregorioNo ratings yet

- SKMF MiagaoDocument10 pagesSKMF MiagaocmpaguntalanNo ratings yet

- Portfolio Construction Forum Backgrounder FinologyDocument22 pagesPortfolio Construction Forum Backgrounder FinologyPankaj VermaNo ratings yet

- Reviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLDocument3 pagesReviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLJenalyn Miranda Cayanan - Marayag100% (1)

- Banking Regulation - PPT (Philippine Banking Laws) TTHDocument20 pagesBanking Regulation - PPT (Philippine Banking Laws) TTHTerso GregorioNo ratings yet

- Financial Literacy: Jessie B. LorenzoDocument23 pagesFinancial Literacy: Jessie B. LorenzoRichelda Dizon100% (2)

- Financial Literacy in India - A New Way ForwardDocument15 pagesFinancial Literacy in India - A New Way Forwardaditya sahooNo ratings yet

- Financial Literacy - Recent Research Findings: Financial History Workshop, Vienna September 2019Document32 pagesFinancial Literacy - Recent Research Findings: Financial History Workshop, Vienna September 2019Jelou CuestasNo ratings yet

- Personal FinanceDocument5 pagesPersonal FinanceFred Jaff Fryan RosalNo ratings yet

- Introduction - Basic Ideas of FinanceDocument3 pagesIntroduction - Basic Ideas of FinanceJade Ann ConstantinoNo ratings yet

- 4 A Study of Mutual Funds As An Investment Option in Personal Finance of College Teachers at BangaloreDocument10 pages4 A Study of Mutual Funds As An Investment Option in Personal Finance of College Teachers at BangaloreSebastian LawranceNo ratings yet

- Mastering Finances: A Comprehensive Guide to Personal FinanceFrom EverandMastering Finances: A Comprehensive Guide to Personal FinanceNo ratings yet

- SSRN Id2934855Document18 pagesSSRN Id2934855YogashiniNo ratings yet

- Journal of Advanced Computing and Communication Technologies (ISSNDocument5 pagesJournal of Advanced Computing and Communication Technologies (ISSNzoe regina castroNo ratings yet

- Happy Nivesh ProjectDocument61 pagesHappy Nivesh ProjectPranali ahirraoNo ratings yet

- The Importance of Financial LiteracyDocument2 pagesThe Importance of Financial Literacysuneel66229No ratings yet

- Engage: Financial LiteracyDocument6 pagesEngage: Financial Literacylusty brenNo ratings yet

- Financial LiteracyDocument18 pagesFinancial LiteracyMarisca Consigna CabaronNo ratings yet

- Business Finance: Short Term and Long Term FundsDocument13 pagesBusiness Finance: Short Term and Long Term FundsAlma A Cerna100% (3)

- Financial Literacy Strategy 2019Document32 pagesFinancial Literacy Strategy 2019sompasongNo ratings yet

- Studu On Financial LiteracyDocument76 pagesStudu On Financial LiteracyFYBAF A-1007 BHANDARI AMANNo ratings yet

- SEBI Financial Education Booklet English 02122021053656Document73 pagesSEBI Financial Education Booklet English 02122021053656JayNo ratings yet

- EDUC 328 Module 08 Task and Requirement No. 3Document5 pagesEDUC 328 Module 08 Task and Requirement No. 3Kim MierNo ratings yet

- Field Work Report For 2nd and 3rd YearDocument10 pagesField Work Report For 2nd and 3rd YearAnanta ChaliseNo ratings yet

- Year 7 Poetry B QuestionsDocument3 pagesYear 7 Poetry B QuestionsShi Hang CHANNo ratings yet

- CHC33015-AC-Subject 6-AWB-FV-v1.2Document34 pagesCHC33015-AC-Subject 6-AWB-FV-v1.2Nkosana Ngwenya100% (1)

- Project Management Module 4 ScriptDocument35 pagesProject Management Module 4 Scriptgustavo_baez_19No ratings yet

- Concept of Community Immersion 11-14-15Document21 pagesConcept of Community Immersion 11-14-15Franz Thelen Lozano CariñoNo ratings yet

- Department of Education: Lesson Plan in MathematicsDocument2 pagesDepartment of Education: Lesson Plan in MathematicsShiera SaletreroNo ratings yet

- Poster On Real Time Face Recognition - Team RhetoriciansDocument1 pagePoster On Real Time Face Recognition - Team RhetoriciansAbdullah Al FahimNo ratings yet

- JRF Advertisement 2023 ICMR AMSDocument4 pagesJRF Advertisement 2023 ICMR AMSDebraj Dhar PurkayasthaNo ratings yet

- Mastering Astronomy Homework 2 AnswersDocument7 pagesMastering Astronomy Homework 2 Answersqjckfwhlf100% (1)

- SHS GRADE 11 EMPOWERMENT TECHNOLOGY 2ND Q - WEEK 1-8 LatestDocument45 pagesSHS GRADE 11 EMPOWERMENT TECHNOLOGY 2ND Q - WEEK 1-8 LatestJobelle TabinasNo ratings yet

- NRL R1-Pacific RacingDocument1 pageNRL R1-Pacific RacingjoanalcarazNo ratings yet

- The Development of Educational SpecificationsDocument44 pagesThe Development of Educational SpecificationsCharlane GenalocNo ratings yet

- Grade 10 Daily Lesson LOGDocument3 pagesGrade 10 Daily Lesson LOGjaramieNo ratings yet

- My Homework Lesson 2 Read and Write Multi-Digit NumbersDocument7 pagesMy Homework Lesson 2 Read and Write Multi-Digit Numbersh45nhdnd100% (1)

- The Importance of SLA (Introduction)Document3 pagesThe Importance of SLA (Introduction)Rizky Allivia LarasatiNo ratings yet

- On Teaching A Language Principles and Priorities in MethodologyDocument33 pagesOn Teaching A Language Principles and Priorities in MethodologyYour Local MemeistNo ratings yet

- Icct Colleges: Health & Safety Agreement Form (HSAF)Document1 pageIcct Colleges: Health & Safety Agreement Form (HSAF)Eugene AcasioNo ratings yet

- Analysis of First-Year Music Teachers' Advice To Music Education StudentsDocument8 pagesAnalysis of First-Year Music Teachers' Advice To Music Education StudentsCatherine LeeNo ratings yet

- Adolescents and GraffitiDocument7 pagesAdolescents and GraffitiLuz AFNo ratings yet

- Measuring The Effectiveness RS-5Document7 pagesMeasuring The Effectiveness RS-5Jan Frederik Valkenberg CastroNo ratings yet

- Lesson Plan Egypt 1Document4 pagesLesson Plan Egypt 1OswaldNo ratings yet

- Psyc 208Document9 pagesPsyc 208anubhavpratikNo ratings yet

- MOD44Document1 pageMOD44Aurea Jasmine DacuycuyNo ratings yet

- Target Client List For Family PlanningDocument3 pagesTarget Client List For Family PlanningGwendareign ElizanNo ratings yet

- Pre Test For Writing Descriptive ParagraphDocument3 pagesPre Test For Writing Descriptive ParagraphAnugrah FotocopyNo ratings yet

- Internship Report (R)Document29 pagesInternship Report (R)PRAMOD SAVANTNo ratings yet