Professional Documents

Culture Documents

IMT TruEarth

IMT TruEarth

Uploaded by

Harish DasariCopyright:

Available Formats

You might also like

- TruEarth Case AnalysisDocument3 pagesTruEarth Case AnalysisSurya Bakshi60% (10)

- Tru EarthDocument5 pagesTru EarthSiddharthNo ratings yet

- IMT TruEarthDocument5 pagesIMT TruEarthRuxshin WatchmakerNo ratings yet

- Truearth Healthy Foods Marketing Case AnalysisDocument7 pagesTruearth Healthy Foods Marketing Case AnalysisDeepikaNo ratings yet

- TruEarth Question 4Document2 pagesTruEarth Question 4Vaibhav Brajesh100% (6)

- TruEarth Submission TemplateDocument5 pagesTruEarth Submission TemplateNikhil kumar100% (1)

- Truearth Healthy Foods - Market Research For A New Product IntroductionDocument4 pagesTruearth Healthy Foods - Market Research For A New Product IntroductionAviral SankhyadharNo ratings yet

- The Book of GeeseDocument222 pagesThe Book of GeeseChristopher AllenNo ratings yet

- TRUEARTHDocument2 pagesTRUEARTHJavier Andres Mora ArteagaNo ratings yet

- Truearth AssignmentDocument8 pagesTruearth AssignmentParas JatanaNo ratings yet

- Group1 SectionA Case1Document5 pagesGroup1 SectionA Case1Gopichand AthukuriNo ratings yet

- Pizza Purchase Volume Estimate Trail Purchase Intent Non - Customers CustomersDocument3 pagesPizza Purchase Volume Estimate Trail Purchase Intent Non - Customers CustomersAnjali SharmaNo ratings yet

- Nestle Case Analysis FinalDocument6 pagesNestle Case Analysis FinalSandeep Kumar100% (1)

- TruEarth Healthy Foods Analysis PDFDocument4 pagesTruEarth Healthy Foods Analysis PDFMridula Hari100% (2)

- A Case Study On NestleDocument5 pagesA Case Study On NestleAshwini Sharma100% (1)

- Nestlé Refrigerated Foods Contadina Pasta and Pizza Case Analysis - Adam Madacsi HRYRTQDocument7 pagesNestlé Refrigerated Foods Contadina Pasta and Pizza Case Analysis - Adam Madacsi HRYRTQmadadam880% (1)

- Barangay Pansol: BackgroundDocument4 pagesBarangay Pansol: BackgroundCristina Rocas-BisqueraNo ratings yet

- Compare NPD Process With Cucina Fresca NPD ProcessDocument3 pagesCompare NPD Process With Cucina Fresca NPD ProcessNishwrathNo ratings yet

- IMT TruEarthDocument5 pagesIMT TruEarthRajivNo ratings yet

- Truearth Healthy Foods:: Market Research For A New ProductDocument8 pagesTruearth Healthy Foods:: Market Research For A New ProductYogendra RathoreNo ratings yet

- Parameters Pasta PizzaDocument8 pagesParameters Pasta PizzaDivyanshu KishoreNo ratings yet

- IMT TruEarthDocument7 pagesIMT TruEarthsukhvindertaakNo ratings yet

- IMT TruEarthDocument7 pagesIMT TruEarthRahul BaudhNo ratings yet

- Case Study On Truearth Healthy Foods: Market Research For A New Product Introduction by Rishit Ghosh Fpb2123/165Document9 pagesCase Study On Truearth Healthy Foods: Market Research For A New Product Introduction by Rishit Ghosh Fpb2123/165Rishit GhoshNo ratings yet

- IMT TruEarthDocument7 pagesIMT TruEarthBioworld LicensingNo ratings yet

- TruEarth Submission TemplateDocument14 pagesTruEarth Submission TemplateNikita KheterpalNo ratings yet

- Truearth Healthy Foods: Marketing Management - IiDocument4 pagesTruearth Healthy Foods: Marketing Management - IivinodNo ratings yet

- TruEarth Question 4Document2 pagesTruEarth Question 4Sharvaree TawareNo ratings yet

- Tarun Singh Chauhan - IMT - TruEarthDocument5 pagesTarun Singh Chauhan - IMT - TruEarthtarun8.singhNo ratings yet

- Gaganpreet Kaur TruEarthDocument6 pagesGaganpreet Kaur TruEarthGagan KathuriaNo ratings yet

- Truearth Healthy Foods: Market Research For A New Product: ASE Nalysis EportDocument4 pagesTruearth Healthy Foods: Market Research For A New Product: ASE Nalysis EportBitan RoyNo ratings yet

- IMT TruEarthDocument8 pagesIMT TruEarthAlpesh KhilariNo ratings yet

- IMT TruearthDocument7 pagesIMT TruearthAkash PatelNo ratings yet

- Nestlé Refrigerated Foods (A) :contadina Pasta & Pizza: Case DiscussionDocument27 pagesNestlé Refrigerated Foods (A) :contadina Pasta & Pizza: Case DiscussionAkshitaNo ratings yet

- Research ProblemsDocument7 pagesResearch ProblemsGrace ChanNo ratings yet

- TruEarth Case AnalysisDocument3 pagesTruEarth Case Analysisneeraj_ghs679No ratings yet

- TruEarth Case AnalysisDocument3 pagesTruEarth Case AnalysisAman SankrityayanNo ratings yet

- TruEarth Case AnalysisDocument3 pagesTruEarth Case AnalysisAman SankrityayanNo ratings yet

- Whole Grain PizzaDocument5 pagesWhole Grain PizzaDigital AsthaNo ratings yet

- Truearth Healthy Foods: Market Research For A New Product IntroductionDocument5 pagesTruearth Healthy Foods: Market Research For A New Product IntroductionFree Guy100% (1)

- Truearth Case StudyDocument7 pagesTruearth Case StudyPrashanthi Priyanka Reddy100% (2)

- Nestle Refrigerated Foods - FinalDocument6 pagesNestle Refrigerated Foods - FinalSaurabh Natu75% (4)

- Ap02 - Ev04 Implementación de Una Encuesta en Idioma InglésDocument10 pagesAp02 - Ev04 Implementación de Una Encuesta en Idioma InglésHeiler Andrés Grosso MottaNo ratings yet

- TruEarth Healthy FoodsDocument4 pagesTruEarth Healthy FoodsMAHASHWETANo ratings yet

- IMT TruEarthDocument5 pagesIMT TruEarthMayuri ZalaNo ratings yet

- Trueearth Healthy Foods: Case AnalysisDocument5 pagesTrueearth Healthy Foods: Case AnalysisAkshaySagarNo ratings yet

- Marketing AssignmentDocument17 pagesMarketing Assignmentaashita.rastogiNo ratings yet

- Nestle Refrigerated Products-Case Analysis: Ans 1: Estimated Demand For Two Pizza OptionsDocument7 pagesNestle Refrigerated Products-Case Analysis: Ans 1: Estimated Demand For Two Pizza Optionssumit sahay100% (2)

- AB2 - TruearthDocument8 pagesAB2 - TruearthSatyajit sahooNo ratings yet

- TruEarth SWOT AnalysisDocument5 pagesTruEarth SWOT Analysisdeepim4No ratings yet

- Marketing Management - TruEarth Health Foods CaseDocument6 pagesMarketing Management - TruEarth Health Foods Casesmithmelina100% (2)

- TruEarth Healthy Foods AnalysisDocument4 pagesTruEarth Healthy Foods AnalysisAnkit Gohil100% (1)

- Cucina FrescaDocument5 pagesCucina FrescaAditya Singh KanwarNo ratings yet

- 2022 Economic Uncertainty Ads Playbook En-Us Oct24Document17 pages2022 Economic Uncertainty Ads Playbook En-Us Oct24alejandra sánchezNo ratings yet

- Esempio 30a - Knorr Marketing Research AdevDocument22 pagesEsempio 30a - Knorr Marketing Research AdevNehal NagahNo ratings yet

- TruEarth Case ReportDocument1 pageTruEarth Case Reportkhopdi_number1100% (2)

- Fresh Pasta and Sauce - Cucina FrescaDocument8 pagesFresh Pasta and Sauce - Cucina FrescaSambhav VermaNo ratings yet

- TruEarth PizzaDocument5 pagesTruEarth PizzaPranay SinhaNo ratings yet

- Squash StickDocument56 pagesSquash StickDanah Jane GarciaNo ratings yet

- The Aisles Have Eyes: How Retailers Track Your Shopping, Strip Your Privacy, and Define Your PowerFrom EverandThe Aisles Have Eyes: How Retailers Track Your Shopping, Strip Your Privacy, and Define Your PowerRating: 3.5 out of 5 stars3.5/5 (12)

- Commonwealth Statutory Declaration FormDocument4 pagesCommonwealth Statutory Declaration FormHarish DasariNo ratings yet

- Kids Wear Standard Size ChartDocument1 pageKids Wear Standard Size ChartHarish DasariNo ratings yet

- EBSCO FullText 2024 02 25Document5 pagesEBSCO FullText 2024 02 25Harish DasariNo ratings yet

- Threat Modeling ManifestoDocument3 pagesThreat Modeling ManifestoHarish DasariNo ratings yet

- WTW 2020 New Zealand Insurance Market UpdateDocument36 pagesWTW 2020 New Zealand Insurance Market UpdateHarish DasariNo ratings yet

- Azure Security Benchmark v3.0Document290 pagesAzure Security Benchmark v3.0Harish DasariNo ratings yet

- Guide To Cyber Threat ModellingDocument28 pagesGuide To Cyber Threat ModellingHarish DasariNo ratings yet

- Russian Word ListDocument147 pagesRussian Word Listexcaliber4No ratings yet

- Influence of School Feeding Program On Academic PDFDocument47 pagesInfluence of School Feeding Program On Academic PDFAnonymous lPRteiRJNo ratings yet

- Reading For Standardized Test Weekly Assignment 2Document3 pagesReading For Standardized Test Weekly Assignment 2Fathin IrawanNo ratings yet

- Parag Project On Parag Milk PDFDocument99 pagesParag Project On Parag Milk PDFAshish ChaubeyNo ratings yet

- Guidance For Industry: ANDA Submissions - Content and Format of Abbreviated New Drug ApplicationsDocument32 pagesGuidance For Industry: ANDA Submissions - Content and Format of Abbreviated New Drug ApplicationsJagdish ChanderNo ratings yet

- Sample BusinessPlanDocument26 pagesSample BusinessPlanZane BevsNo ratings yet

- Garden Plan For Partial ShadeDocument2 pagesGarden Plan For Partial Shadeteamfaction100% (1)

- Investigative Project. Garlic As AntibacterialDocument4 pagesInvestigative Project. Garlic As AntibacterialVasanthakumar shanmugamNo ratings yet

- Standard For Luncheon Meat CODEX STAN 89-1981 Adopted in 1981. Revision: 1991, 2014 and 2015Document4 pagesStandard For Luncheon Meat CODEX STAN 89-1981 Adopted in 1981. Revision: 1991, 2014 and 2015Thanh Tâm TrầnNo ratings yet

- Englishs MSCDocument55 pagesEnglishs MSCAgnichandra SubediNo ratings yet

- Three 81 MenuDocument13 pagesThree 81 Menudasaman471No ratings yet

- TLE 8 - Technology and Livelihood Education 8 Learning TasksDocument5 pagesTLE 8 - Technology and Livelihood Education 8 Learning TasksLizetteZaideNo ratings yet

- Amoebosol CapsuleDocument3 pagesAmoebosol Capsulehk_scribdNo ratings yet

- Durian and Mangosteen Orchards-: North Queensland Nutrition SurveyDocument79 pagesDurian and Mangosteen Orchards-: North Queensland Nutrition SurveySirapote SantatiwutNo ratings yet

- Domino's Pizza: Crisis Communication StrategiesDocument10 pagesDomino's Pizza: Crisis Communication Strategiesaman jainNo ratings yet

- Lista Empresas Costa 2018Document23 pagesLista Empresas Costa 2018Yeimith NieblesNo ratings yet

- Kata Kerja, Kata Sifat, Kata BendaDocument40 pagesKata Kerja, Kata Sifat, Kata BendaThomas PramuditaNo ratings yet

- Kayem Foods, Inc.Document4 pagesKayem Foods, Inc.Wei Zhang100% (1)

- Asam Arakhidonat STZDocument6 pagesAsam Arakhidonat STZAlmas TNo ratings yet

- Test: Chapter 25 - Cheese: Multiple-Choice QuestionsDocument6 pagesTest: Chapter 25 - Cheese: Multiple-Choice QuestionsShahin Kauser ZiaudeenNo ratings yet

- Cereals: Dietary ImportanceDocument9 pagesCereals: Dietary Importanceajay sharmaNo ratings yet

- Tài Liệu Học Hè Cho 2K1Document68 pagesTài Liệu Học Hè Cho 2K1Alex TranNo ratings yet

- 4000 Essential English Words, Book 4 PDFDocument192 pages4000 Essential English Words, Book 4 PDFChinese Class100% (5)

- Region 1Document79 pagesRegion 1symba leiNo ratings yet

- Pachacuti Inca YupanquiDocument2 pagesPachacuti Inca YupanquiFranciscoGonzalezNo ratings yet

- LC Revisi Group 3Document16 pagesLC Revisi Group 3Ilham Fauzi Noer PutraNo ratings yet

- MM SunfeastDocument7 pagesMM SunfeastApoorva PattnaikNo ratings yet

- Estudiante: Johan Montaño Suarez Grado: 9-1 ActividadDocument2 pagesEstudiante: Johan Montaño Suarez Grado: 9-1 ActividadJohan MontañoNo ratings yet

IMT TruEarth

IMT TruEarth

Uploaded by

Harish DasariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMT TruEarth

IMT TruEarth

Uploaded by

Harish DasariCopyright:

Available Formats

Name Harish Dasari

Question 1

Whole grain pizza Fresh pasta and sauce

Conducted BASES II study for in-depth Conducted BASES I study to assess

concept survey and in-home product usage consumer awareness and intent to purchase.

test.

Focus group discussions were conducted

Taste test was conducted by providing Did not incorporate actual taste test.

sample kit and got feedback after 7-10 days.

Repeat purchase and estimated sales was Repeat purchase were estimated using

identified using the customer surveys and consumer reaction to fresh whole grain pasta

taste test interviews. concept and prior experience with fresh

pasta and other gourmet and healthy foods.

Created three scenarios mediocre average

and excellent product and estimated repeat

rate based on its experience with other food

products.

300 mall intercept interviews to compare Conducted 300 concept tests in various cities

TruEarth concept with takeout and other to understand the purchase intent and

refrigerated pizzas. concept likes and dislikes.

Internal - General Use

BASES conducted interviews in seven cities

over the age of 18.

Also interviewed respondents who No in-depth interviews were conducted.

purchased the Cucina Fresca pasta and sauce Consumer reaction was gathered for the

in past year. concept appeal and product satisfaction.

Both the methods use the interviews to understand the consumer purchase intent and likes &

dislikes, but BASES II test was more robust as it incorporated in-depth surveys with taste

test. Taste test was not conducted for pasta and sauces. A taste test for a consumable item

could be very crucial as it can accurately predict the consumer reaction and can very well

decide the product acceptance in the market.

Question 2

Exhibit 7 insights.

1. A total of 60% of respondents showed interest in buying the Pizza. 18% said they

would definitely buy and 43% said they would probably buy the Pizza. Industry rule of

thumb is that 80% of respondent who say, “Definitely would buy” and 30% of

respondents who say “Probably would buy” the product would actually buy the

product. Going by that theory. We can say the total pizza concept purchase intent is

18*80%+43*30% = 26.95%. So, the trial rate is around 27%. This means 27% of the

target market would buy the product at least once.

2. A higher number(79%) of existing Truearth customers(who have bought one or more

of Truearth products) would buy the refrigerated pizza than non Truearth

Internal - General Use

customers(39%) because of the brand loyalty, trust and expectations that Truearth built

among its customers.

3. Mean likeability and mean price/value - Existing Truearth customers like the pizza

product more this could be because of the trust and loyalty of the brand. But the price

per value of TruEarth customers are similar to that of non-customers which means the

price of Pizza was equal to or higher than the competitors.

Comparing with Exhibit 3 Purchase intent

Total Trial rate Mean Likeability Price/Value

Pizza(Exhibit 7) 60% 27% 3.7 3.0

Pasta(Exhibit 3) 76% 36.3% 4.1 3.2

1. The pasta purchase intent(76%) is more than that of Pizza(60%). This is because

TruEarth already has an existing pasta product, and the product is well tested and

successful.

2. Similarly, the trial rate of the pasta is greater than the Pizza. Which means more

consumers would buy the pasta at least once than pizza.

3. Mean likeability and mean price/value rating is also higher for pasta than the pizza.

The values are as above. So, people like TruEarth pasta more than the Pizza line.

4. Unlike fresh Pasta from whole grain and sauce which had to be compared with fresh

pasta industry, there is no available data for pasta with whole grain to compare. Pizza

had a lot of competition even from big player like Kraft and Nestle. This made market

research and purchase intent of Pizza to be compared with overall Pizza eaters.

5. Purchase intent of pizza for existing Truearth customers was higher than Cucina Fresca

but the non-customers of TruEarth were not very eager to buy the new line of Pizza

product from the company. This is because:

Internal - General Use

a. Truearth customers were happy with existing line of products and a trust was

built with the company.

b. But when combined with non Truearth customers the overall purchase intent

reduced as there was a tough competition in pizza and non-customers were not

so much inclined towards Pizza from Truearth.

Question 3

3A:

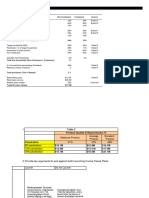

Since the market penetration ranges from 5-15%. Worst case scenario would be with market

penetration at lowest(5%) and product quality is excellent as the cost of making an excellent

product is more compared to making a mediocre pizza. For an excellent product the product

repurchasing % is 49% which can be gathered from Exhibit 5.

The overall predicted sales revenue in the worst case is 13.6M.

Non-

Customers Source

Customers

Definitely would buy 15% 26% Exhibit 7

% of "Definites" who actually buy 80% 80% Exhibit 5

"Definite" Purchases 12% 21%

Probably would buy 39% 53% Exhibit 7

% of "Probables" who actually buy 30% 30% Exhibit 5

"Probable" Purchases 12% 16%

Trial Rate ("Definite" + "Probable") 24% 37%

Target households (MM) 58.8 58.8 Table B

Penetration, % of target households 95% 5% Table B

Awareness of pizza product 12% 50% Table B

ACV distribution 40% 40% Table B

Adjusted Trial Households 0.6 0.2

Total trial households (non-Customers +

0.9

Customers)

Internal - General Use

% of households repurchasing 49% Exhibit 5

Repeat purchase occasions Table B

2

Total purchases (Trial + Repeat)

1.7

Retail selling price $12.38 Table B

Retail sales revenue $20.9M

Retailer gross margin 35% Case text

TruEarth sales revenue $13.6M

3B:Since the market penetration ranges from 5-15%. The best-case scenario is 15%

penetration . For an excellent product quality, the product repurchasing is at 21% which is for

the excellent product, and this can be gathered from Exhibit 5.

The overall predicted sales revenue in the best case is 19.4M.

Non-

Customers Source

Customers

Definitely would buy 15% 26% Exhibit 7

% of "Definites" who actually buy 80% 80% Exhibit 5

"Definite" Purchases 12% 21%

Probably would buy 39% 53% Exhibit 7

% of "Probables" who actually buy 30% 30% Exhibit 5

"Probable" Purchases 12% 16%

Trial Rate ("Definite" + "Probable") 24% 37%

Target households (MM) 58.8 58.8 Table B

Penetration, % of target households 85% 15% Table B

Awareness of pizza product 12% 50% Table B

ACV distribution 40% 40% Table B

Adjusted Trial Households 0.6 0.6

Total trial households (non-Customers +

1.2

Customers)

% of households repurchasing 49% Exhibit 5

Repeat purchase occasions Table B

2

Internal - General Use

Total purchases (Trial + Repeat)

2.4

Retail selling price $12.38 Table B

Retail sales revenue $29.8M

Retailer gross margin 35% Case text

TruEarth sales revenue $19.4M

Question 4

The two pizza categories that TruEarth whole grain pizza compete against is Takeout Pizza

and Refrigerated Pizza. This can be inferred from Exhibit 6.

Advantages of TruEarth Pizza

1. TruEarth pizzas are made with high-quality ingredients compared to other refrigerator

pizzas.

2. TruEarth pizzas are made with healthy ingredients compared to both Takeout pizzas

and other refrigerated pizzas.

3. Also, the pizza was made for the whole family.

4. Easiest to prepare compared to other refrigerated pizza.

Disadvantages of TruEarth Pizza

1. TruEarth Pizza does not taste as fresh as takeout pizza but is better than other

refrigerated pizzas.

2. Also, TruEarth offered less varieties of pizzas compared to takeout.

3. TruEarth pizzas were less convenient to purchase as people have to go to supermarket

to buy the product and also involve some amount of preparation. Whereas takeout

pizzas would be delivered to home.

Internal - General Use

Question 5

According to Exhibit 9, 59 people were unfavorable to the product. Out of which 68%(45% -

Too expensive and 23% - More expensive than the restaurant or takeout) of the people thought

it was expensive. But only 9% of the people who were in favor of the Pizza felt that price was

not expensive. Looking at the suggested improvements, 26% of favorable people and 35% of

unfavorable respondents suggested to lower the prices. This clearly indicates that the TruEarth

Pizza was overpriced.

Internal - General Use

According to Exhibit 10, TruEarth whole grain pizza average retail price is being projected at

$12.38. Which according to Exhibit 9 is expensive. If $12.38 is set the retail price, 12.6% of

the total respondents who preferred refrigerated pizza were favorable in buying and the rest are

not. Also, the mean price of all the different customer segment is less than the retail

price($12.38) of pizza.

So it can be concluded that whole grain pizza was over priced and expensive. The actual price

should be in the range of $9-10(Mean price of unfavorable to product to Mean price of

favorable to product). Considering the cost of production and the margins to be met, TruEarth

should take a call.

Internal - General Use

Question 6

SWOT analysis can be done to take strategic decision on whether TruEarth should launch the

Pizza. SWOT is a technique used to determine Strengths, Weaknesses, Opportunities and

Threats. This gives a better and clear picture for the management to make a decision.

Strengths:

• Company uses only high-quality ingredients with health conscience in mind as it is

using whole grain crust.

• There is no pizza product in market which uses whole grains. Company has first

mover advantage.

• The required investment for the production is low, as much of the investment in

machinery and distribution was already made for Cucina Fresca pastas. Which is an

existing successful product.

• Company needs to make an excess of $12 million dollars to meet the return

requirements. And according to BASES studies numbers are positive.

• TruEarth has built a good reputation and loyalty amongst the customers with Cucina

Fresca pasta. So, brand awareness is an added advantage.

• Refrigerated pizza is considered better than frozen one.

• The product is healthy and convenient.

Weaknesses:

• Toppings were sold separately and so it could be inconvenience and could become

more expensive.

• The pizza is expensive compared to competitor.

• Limited variety compared to competitors.

Opportunities:

• Market of pizza industry is large, larger than pasta.

Internal - General Use

• Use the good will and reliability of the brand name which can easily be used for pizza

business.

• Pizza is considered unhealthy. Consumers are looking for healthy options. This could

provide an opportunity for TruEarth to introduce healthy option of pizza.

• Market is increasing for home meals replacement as more consumers do not have time

to cook home food but are looking for healthy food options.

Threats:

• Competition is more from frozen pizza producers like Nestle and Kraft

• A lot of takeout restaurants producing fresh pizza.

• Rigazzi an immediate competitor is also trying out pizza product and could introduce

very soon.

Quantitative

To meet the company’s return requirement wholesale volumes of pizza needed to exceed $12

million.

Based on the market penetration and product quality, it is estimated that TruEarth with worst

case scenario would have market penetration at lowest(5%) and with product quality excellent

as the cost of making an excellent product is more compared to making a mediocre pizza. For

an excellent product the product repurchasing % is 49% which can be gathered from Exhibit 5.

The overall predicted sales revenue in the worst case is 13.6M which is higher than estimated

returns of $12 million.

Conclusion

1. Annual pizza sales in United states in 2007 was $53 billion. Refrigerated Pizza market

in $5.8 billion which is bigger than pasta business. So pizza business is lucrative.

2. Low investment as existing pasta equipment can be re-tooled.

Internal - General Use

3. Pizza with whole grain option is a new concept and can very well be accepted,

provided the taste is also at par with regular takeout pizza.

4. People are more health conscious but also love the have pizza atleast once a month.

With all the above factors put to gather, launching the pizza is advisable provided the pricing

is tweaked a little bit, introduce more variety options, and launch the product as soon as

possible, beating Rigazzi.

Internal - General Use

You might also like

- TruEarth Case AnalysisDocument3 pagesTruEarth Case AnalysisSurya Bakshi60% (10)

- Tru EarthDocument5 pagesTru EarthSiddharthNo ratings yet

- IMT TruEarthDocument5 pagesIMT TruEarthRuxshin WatchmakerNo ratings yet

- Truearth Healthy Foods Marketing Case AnalysisDocument7 pagesTruearth Healthy Foods Marketing Case AnalysisDeepikaNo ratings yet

- TruEarth Question 4Document2 pagesTruEarth Question 4Vaibhav Brajesh100% (6)

- TruEarth Submission TemplateDocument5 pagesTruEarth Submission TemplateNikhil kumar100% (1)

- Truearth Healthy Foods - Market Research For A New Product IntroductionDocument4 pagesTruearth Healthy Foods - Market Research For A New Product IntroductionAviral SankhyadharNo ratings yet

- The Book of GeeseDocument222 pagesThe Book of GeeseChristopher AllenNo ratings yet

- TRUEARTHDocument2 pagesTRUEARTHJavier Andres Mora ArteagaNo ratings yet

- Truearth AssignmentDocument8 pagesTruearth AssignmentParas JatanaNo ratings yet

- Group1 SectionA Case1Document5 pagesGroup1 SectionA Case1Gopichand AthukuriNo ratings yet

- Pizza Purchase Volume Estimate Trail Purchase Intent Non - Customers CustomersDocument3 pagesPizza Purchase Volume Estimate Trail Purchase Intent Non - Customers CustomersAnjali SharmaNo ratings yet

- Nestle Case Analysis FinalDocument6 pagesNestle Case Analysis FinalSandeep Kumar100% (1)

- TruEarth Healthy Foods Analysis PDFDocument4 pagesTruEarth Healthy Foods Analysis PDFMridula Hari100% (2)

- A Case Study On NestleDocument5 pagesA Case Study On NestleAshwini Sharma100% (1)

- Nestlé Refrigerated Foods Contadina Pasta and Pizza Case Analysis - Adam Madacsi HRYRTQDocument7 pagesNestlé Refrigerated Foods Contadina Pasta and Pizza Case Analysis - Adam Madacsi HRYRTQmadadam880% (1)

- Barangay Pansol: BackgroundDocument4 pagesBarangay Pansol: BackgroundCristina Rocas-BisqueraNo ratings yet

- Compare NPD Process With Cucina Fresca NPD ProcessDocument3 pagesCompare NPD Process With Cucina Fresca NPD ProcessNishwrathNo ratings yet

- IMT TruEarthDocument5 pagesIMT TruEarthRajivNo ratings yet

- Truearth Healthy Foods:: Market Research For A New ProductDocument8 pagesTruearth Healthy Foods:: Market Research For A New ProductYogendra RathoreNo ratings yet

- Parameters Pasta PizzaDocument8 pagesParameters Pasta PizzaDivyanshu KishoreNo ratings yet

- IMT TruEarthDocument7 pagesIMT TruEarthsukhvindertaakNo ratings yet

- IMT TruEarthDocument7 pagesIMT TruEarthRahul BaudhNo ratings yet

- Case Study On Truearth Healthy Foods: Market Research For A New Product Introduction by Rishit Ghosh Fpb2123/165Document9 pagesCase Study On Truearth Healthy Foods: Market Research For A New Product Introduction by Rishit Ghosh Fpb2123/165Rishit GhoshNo ratings yet

- IMT TruEarthDocument7 pagesIMT TruEarthBioworld LicensingNo ratings yet

- TruEarth Submission TemplateDocument14 pagesTruEarth Submission TemplateNikita KheterpalNo ratings yet

- Truearth Healthy Foods: Marketing Management - IiDocument4 pagesTruearth Healthy Foods: Marketing Management - IivinodNo ratings yet

- TruEarth Question 4Document2 pagesTruEarth Question 4Sharvaree TawareNo ratings yet

- Tarun Singh Chauhan - IMT - TruEarthDocument5 pagesTarun Singh Chauhan - IMT - TruEarthtarun8.singhNo ratings yet

- Gaganpreet Kaur TruEarthDocument6 pagesGaganpreet Kaur TruEarthGagan KathuriaNo ratings yet

- Truearth Healthy Foods: Market Research For A New Product: ASE Nalysis EportDocument4 pagesTruearth Healthy Foods: Market Research For A New Product: ASE Nalysis EportBitan RoyNo ratings yet

- IMT TruEarthDocument8 pagesIMT TruEarthAlpesh KhilariNo ratings yet

- IMT TruearthDocument7 pagesIMT TruearthAkash PatelNo ratings yet

- Nestlé Refrigerated Foods (A) :contadina Pasta & Pizza: Case DiscussionDocument27 pagesNestlé Refrigerated Foods (A) :contadina Pasta & Pizza: Case DiscussionAkshitaNo ratings yet

- Research ProblemsDocument7 pagesResearch ProblemsGrace ChanNo ratings yet

- TruEarth Case AnalysisDocument3 pagesTruEarth Case Analysisneeraj_ghs679No ratings yet

- TruEarth Case AnalysisDocument3 pagesTruEarth Case AnalysisAman SankrityayanNo ratings yet

- TruEarth Case AnalysisDocument3 pagesTruEarth Case AnalysisAman SankrityayanNo ratings yet

- Whole Grain PizzaDocument5 pagesWhole Grain PizzaDigital AsthaNo ratings yet

- Truearth Healthy Foods: Market Research For A New Product IntroductionDocument5 pagesTruearth Healthy Foods: Market Research For A New Product IntroductionFree Guy100% (1)

- Truearth Case StudyDocument7 pagesTruearth Case StudyPrashanthi Priyanka Reddy100% (2)

- Nestle Refrigerated Foods - FinalDocument6 pagesNestle Refrigerated Foods - FinalSaurabh Natu75% (4)

- Ap02 - Ev04 Implementación de Una Encuesta en Idioma InglésDocument10 pagesAp02 - Ev04 Implementación de Una Encuesta en Idioma InglésHeiler Andrés Grosso MottaNo ratings yet

- TruEarth Healthy FoodsDocument4 pagesTruEarth Healthy FoodsMAHASHWETANo ratings yet

- IMT TruEarthDocument5 pagesIMT TruEarthMayuri ZalaNo ratings yet

- Trueearth Healthy Foods: Case AnalysisDocument5 pagesTrueearth Healthy Foods: Case AnalysisAkshaySagarNo ratings yet

- Marketing AssignmentDocument17 pagesMarketing Assignmentaashita.rastogiNo ratings yet

- Nestle Refrigerated Products-Case Analysis: Ans 1: Estimated Demand For Two Pizza OptionsDocument7 pagesNestle Refrigerated Products-Case Analysis: Ans 1: Estimated Demand For Two Pizza Optionssumit sahay100% (2)

- AB2 - TruearthDocument8 pagesAB2 - TruearthSatyajit sahooNo ratings yet

- TruEarth SWOT AnalysisDocument5 pagesTruEarth SWOT Analysisdeepim4No ratings yet

- Marketing Management - TruEarth Health Foods CaseDocument6 pagesMarketing Management - TruEarth Health Foods Casesmithmelina100% (2)

- TruEarth Healthy Foods AnalysisDocument4 pagesTruEarth Healthy Foods AnalysisAnkit Gohil100% (1)

- Cucina FrescaDocument5 pagesCucina FrescaAditya Singh KanwarNo ratings yet

- 2022 Economic Uncertainty Ads Playbook En-Us Oct24Document17 pages2022 Economic Uncertainty Ads Playbook En-Us Oct24alejandra sánchezNo ratings yet

- Esempio 30a - Knorr Marketing Research AdevDocument22 pagesEsempio 30a - Knorr Marketing Research AdevNehal NagahNo ratings yet

- TruEarth Case ReportDocument1 pageTruEarth Case Reportkhopdi_number1100% (2)

- Fresh Pasta and Sauce - Cucina FrescaDocument8 pagesFresh Pasta and Sauce - Cucina FrescaSambhav VermaNo ratings yet

- TruEarth PizzaDocument5 pagesTruEarth PizzaPranay SinhaNo ratings yet

- Squash StickDocument56 pagesSquash StickDanah Jane GarciaNo ratings yet

- The Aisles Have Eyes: How Retailers Track Your Shopping, Strip Your Privacy, and Define Your PowerFrom EverandThe Aisles Have Eyes: How Retailers Track Your Shopping, Strip Your Privacy, and Define Your PowerRating: 3.5 out of 5 stars3.5/5 (12)

- Commonwealth Statutory Declaration FormDocument4 pagesCommonwealth Statutory Declaration FormHarish DasariNo ratings yet

- Kids Wear Standard Size ChartDocument1 pageKids Wear Standard Size ChartHarish DasariNo ratings yet

- EBSCO FullText 2024 02 25Document5 pagesEBSCO FullText 2024 02 25Harish DasariNo ratings yet

- Threat Modeling ManifestoDocument3 pagesThreat Modeling ManifestoHarish DasariNo ratings yet

- WTW 2020 New Zealand Insurance Market UpdateDocument36 pagesWTW 2020 New Zealand Insurance Market UpdateHarish DasariNo ratings yet

- Azure Security Benchmark v3.0Document290 pagesAzure Security Benchmark v3.0Harish DasariNo ratings yet

- Guide To Cyber Threat ModellingDocument28 pagesGuide To Cyber Threat ModellingHarish DasariNo ratings yet

- Russian Word ListDocument147 pagesRussian Word Listexcaliber4No ratings yet

- Influence of School Feeding Program On Academic PDFDocument47 pagesInfluence of School Feeding Program On Academic PDFAnonymous lPRteiRJNo ratings yet

- Reading For Standardized Test Weekly Assignment 2Document3 pagesReading For Standardized Test Weekly Assignment 2Fathin IrawanNo ratings yet

- Parag Project On Parag Milk PDFDocument99 pagesParag Project On Parag Milk PDFAshish ChaubeyNo ratings yet

- Guidance For Industry: ANDA Submissions - Content and Format of Abbreviated New Drug ApplicationsDocument32 pagesGuidance For Industry: ANDA Submissions - Content and Format of Abbreviated New Drug ApplicationsJagdish ChanderNo ratings yet

- Sample BusinessPlanDocument26 pagesSample BusinessPlanZane BevsNo ratings yet

- Garden Plan For Partial ShadeDocument2 pagesGarden Plan For Partial Shadeteamfaction100% (1)

- Investigative Project. Garlic As AntibacterialDocument4 pagesInvestigative Project. Garlic As AntibacterialVasanthakumar shanmugamNo ratings yet

- Standard For Luncheon Meat CODEX STAN 89-1981 Adopted in 1981. Revision: 1991, 2014 and 2015Document4 pagesStandard For Luncheon Meat CODEX STAN 89-1981 Adopted in 1981. Revision: 1991, 2014 and 2015Thanh Tâm TrầnNo ratings yet

- Englishs MSCDocument55 pagesEnglishs MSCAgnichandra SubediNo ratings yet

- Three 81 MenuDocument13 pagesThree 81 Menudasaman471No ratings yet

- TLE 8 - Technology and Livelihood Education 8 Learning TasksDocument5 pagesTLE 8 - Technology and Livelihood Education 8 Learning TasksLizetteZaideNo ratings yet

- Amoebosol CapsuleDocument3 pagesAmoebosol Capsulehk_scribdNo ratings yet

- Durian and Mangosteen Orchards-: North Queensland Nutrition SurveyDocument79 pagesDurian and Mangosteen Orchards-: North Queensland Nutrition SurveySirapote SantatiwutNo ratings yet

- Domino's Pizza: Crisis Communication StrategiesDocument10 pagesDomino's Pizza: Crisis Communication Strategiesaman jainNo ratings yet

- Lista Empresas Costa 2018Document23 pagesLista Empresas Costa 2018Yeimith NieblesNo ratings yet

- Kata Kerja, Kata Sifat, Kata BendaDocument40 pagesKata Kerja, Kata Sifat, Kata BendaThomas PramuditaNo ratings yet

- Kayem Foods, Inc.Document4 pagesKayem Foods, Inc.Wei Zhang100% (1)

- Asam Arakhidonat STZDocument6 pagesAsam Arakhidonat STZAlmas TNo ratings yet

- Test: Chapter 25 - Cheese: Multiple-Choice QuestionsDocument6 pagesTest: Chapter 25 - Cheese: Multiple-Choice QuestionsShahin Kauser ZiaudeenNo ratings yet

- Cereals: Dietary ImportanceDocument9 pagesCereals: Dietary Importanceajay sharmaNo ratings yet

- Tài Liệu Học Hè Cho 2K1Document68 pagesTài Liệu Học Hè Cho 2K1Alex TranNo ratings yet

- 4000 Essential English Words, Book 4 PDFDocument192 pages4000 Essential English Words, Book 4 PDFChinese Class100% (5)

- Region 1Document79 pagesRegion 1symba leiNo ratings yet

- Pachacuti Inca YupanquiDocument2 pagesPachacuti Inca YupanquiFranciscoGonzalezNo ratings yet

- LC Revisi Group 3Document16 pagesLC Revisi Group 3Ilham Fauzi Noer PutraNo ratings yet

- MM SunfeastDocument7 pagesMM SunfeastApoorva PattnaikNo ratings yet

- Estudiante: Johan Montaño Suarez Grado: 9-1 ActividadDocument2 pagesEstudiante: Johan Montaño Suarez Grado: 9-1 ActividadJohan MontañoNo ratings yet