Professional Documents

Culture Documents

Wall Chart

Wall Chart

Uploaded by

joshuaedet841Copyright:

Available Formats

You might also like

- Boeing 777 CaseStudy SolutionDocument3 pagesBoeing 777 CaseStudy SolutionRohit Parnerkar80% (5)

- Tradding ChartDocument22 pagesTradding ChartMR GG7100% (15)

- Trading PatternsDocument8 pagesTrading PatternsJR 18067% (3)

- CM1 Mock Paper B 2021 Answers 12345Document44 pagesCM1 Mock Paper B 2021 Answers 12345vanessa8pangestuNo ratings yet

- FHB Checking Account Deposit SlipDocument1 pageFHB Checking Account Deposit Slipapi-314402585No ratings yet

- Top 10 Chart Patterns SlidesDocument14 pagesTop 10 Chart Patterns Slidesashokfacebook100% (12)

- Pollen Crypto BookDocument96 pagesPollen Crypto Bookjhffkl100% (1)

- Guide To Classic Chart PatternsDocument1 pageGuide To Classic Chart PatternsThato Mavuso100% (4)

- 2ND Chart Patterns For Price Action TradingDocument23 pages2ND Chart Patterns For Price Action TradingSandeep Reddy100% (3)

- Chart PatternsDocument10 pagesChart Patternsvvpvarun100% (2)

- T Bulkowski IdentifyingBearishChartPatternsDocument5 pagesT Bulkowski IdentifyingBearishChartPatternsbruced0812100% (2)

- Chart Patterns ForexDocument16 pagesChart Patterns Forexnishitsardhara83% (6)

- Screenshot 2022-05-30 at 10.00.37 PMDocument6 pagesScreenshot 2022-05-30 at 10.00.37 PMiqforxNo ratings yet

- Trade CoinDocument96 pagesTrade Coinvien100% (1)

- Technical Analysis BookDocument95 pagesTechnical Analysis BookvhmuddyNo ratings yet

- New Rich Text FormatDocument25 pagesNew Rich Text Formatpradeephd100% (1)

- 9 FIN555 Chap 9 & 10 Prings Smaller Price Pattern and Gaps and One and Two Price - Read-OnlyDocument23 pages9 FIN555 Chap 9 & 10 Prings Smaller Price Pattern and Gaps and One and Two Price - Read-OnlyMarisa MazananNo ratings yet

- GuideToClassicChartPatterns PDFDocument1 pageGuideToClassicChartPatterns PDFRenato100% (1)

- PATTERNSDocument9 pagesPATTERNSemmanuelomondi2944No ratings yet

- CRT PatternDocument10 pagesCRT PatternMD ASRAFUZZAMAN MAHTAF100% (1)

- Reversal Trends-SAPMDocument26 pagesReversal Trends-SAPMHeavy Gunner50% (2)

- 5.4 - Technical Analysis - Chart Patterns - Trading Crypto CourseDocument22 pages5.4 - Technical Analysis - Chart Patterns - Trading Crypto Course2f9p4bykt8100% (2)

- Major Market PatternsDocument30 pagesMajor Market PatternsTonderai Humanikwa100% (4)

- Technical Analysis 18022024Document76 pagesTechnical Analysis 18022024kaaviraj2020No ratings yet

- New Book Oficial EnglishDocument97 pagesNew Book Oficial EnglishAbolaji MuazNo ratings yet

- Classic Chart Patterns: A Quick Reference Guide For TradersDocument2 pagesClassic Chart Patterns: A Quick Reference Guide For TradersAbhay Pratap100% (1)

- 10 Price Action Bar Patterns You Must KnowDocument8 pages10 Price Action Bar Patterns You Must Knowbengotek100% (1)

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must KnowSudipto PaulNo ratings yet

- Chart Patterns: For Reddit NoobsDocument17 pagesChart Patterns: For Reddit NoobscorranNo ratings yet

- Point and Figure PatternsDocument12 pagesPoint and Figure PatternsRavi VarakalaNo ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must Knowjhonthor100% (1)

- Important Chart PatternsDocument8 pagesImportant Chart Patternspradeephd100% (2)

- Forex Charts TrendsDocument6 pagesForex Charts TrendsSimamkele Ntwanambi100% (2)

- Technical 102Document13 pagesTechnical 102Marchie VictorNo ratings yet

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Chart NotesDocument6 pagesChart NotesAmit Wadekar100% (6)

- Ultimate Price Action 2.0 - Day 2Document70 pagesUltimate Price Action 2.0 - Day 2nazimvmNo ratings yet

- Wedge and Head and Shoulders Charts PatternsDocument11 pagesWedge and Head and Shoulders Charts PatternsRemison YokoNo ratings yet

- Reversal PatternsDocument25 pagesReversal PatternsMunyaradzi Alka Musarurwa100% (3)

- 10 Price Action Bar Patterns You Must KnowDocument14 pages10 Price Action Bar Patterns You Must Knowsal8471100% (2)

- Chart Patterns and Pivot PointsDocument13 pagesChart Patterns and Pivot PointsYin Shen Goh100% (5)

- WOADocument15 pagesWOAtrinugrohoNo ratings yet

- SMTC Patterns - OverviewDocument54 pagesSMTC Patterns - OverviewVignesh BabuNo ratings yet

- JSW Steel - Technical Analysis ProjectDocument34 pagesJSW Steel - Technical Analysis ProjectSanjeedeep Mishra , 315No ratings yet

- Reversal Bar Pattern: What Does It Look Like?Document40 pagesReversal Bar Pattern: What Does It Look Like?Sen Hoa100% (1)

- Day - 2 Bullish Pattern PDFDocument46 pagesDay - 2 Bullish Pattern PDFrif.sap26No ratings yet

- 10 Chart Pattan Traders Should KnowDocument24 pages10 Chart Pattan Traders Should Knowstephen briggsNo ratings yet

- How To Trade Chart Patterns With Target and SL - Forex GDP - Trade With ConfidenDocument40 pagesHow To Trade Chart Patterns With Target and SL - Forex GDP - Trade With Confidenshashikant jambagi100% (4)

- TA of The Financial MarketDocument4 pagesTA of The Financial MarketStella FeliciaNo ratings yet

- Task 16Document14 pagesTask 16dasabhishek816No ratings yet

- Chart PatternsDocument32 pagesChart PatternsPraveen67% (3)

- Price ActionDocument11 pagesPrice ActionAhmad Farhan Ramli100% (1)

- D.Bolze - Crown PatternDocument5 pagesD.Bolze - Crown PatternamyNo ratings yet

- Basic Candlestick Formations: Indication That Price May Be Heading DownDocument11 pagesBasic Candlestick Formations: Indication That Price May Be Heading Downquentin oliverNo ratings yet

- Technical Analysis For Beginners - NewDocument16 pagesTechnical Analysis For Beginners - NewNitin KumarNo ratings yet

- Book PDFDocument70 pagesBook PDFaurox zahidNo ratings yet

- 7 Rejection Price PatternDocument7 pages7 Rejection Price PatternMuhammad Irwan Chong100% (1)

- Technical Chart Patterns CharacteristicsDocument10 pagesTechnical Chart Patterns Characteristicsd_stepien43098No ratings yet

- PennantsDocument3 pagesPennantstawhid anamNo ratings yet

- Chart PatternsDocument11 pagesChart PatternsAkash RohilaNo ratings yet

- Price Action Simplified by EmzetDocument25 pagesPrice Action Simplified by EmzetEmzet PremiseNo ratings yet

- Penny Stocks: The Art of Bottom Feeding: Penny Stock PlayersFrom EverandPenny Stocks: The Art of Bottom Feeding: Penny Stock PlayersRating: 5 out of 5 stars5/5 (2)

- Msci 607: Applied Economics For Management Lecture 02 (Production and Cost) SolutionsDocument8 pagesMsci 607: Applied Economics For Management Lecture 02 (Production and Cost) SolutionsRonak PatelNo ratings yet

- Nearest Pharmacy Delivery ServiceDocument5 pagesNearest Pharmacy Delivery ServiceJayanath SamarasingheNo ratings yet

- MAGNUM Screens BrochureDocument4 pagesMAGNUM Screens Brochurenarft narftNo ratings yet

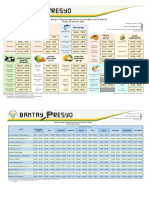

- Price Monitoring January 20 2023Document5 pagesPrice Monitoring January 20 2023Eihcir Yaj SerrobNo ratings yet

- 1 Makemytrip PDFDocument1 page1 Makemytrip PDFZusnsxnxNo ratings yet

- Class Xi (Economics) Cw-7)Document20 pagesClass Xi (Economics) Cw-7)Mythreyi VasudevanNo ratings yet

- SRQ B NGO RoleDocument2 pagesSRQ B NGO RoleJaia Cher (Chijktcs)No ratings yet

- Singapore's SuccessDocument14 pagesSingapore's SuccessKWEK SOCK QING REBECCANo ratings yet

- Bjarke IngelsDocument4 pagesBjarke IngelsananthukunnikrishnanNo ratings yet

- ACI 304.6R-91 Guide For The Use of Volumetric-MeasuringDocument14 pagesACI 304.6R-91 Guide For The Use of Volumetric-MeasuringMihai BanateanuNo ratings yet

- Force of Nature BrochureDocument20 pagesForce of Nature BrochureDerek DavisNo ratings yet

- Final PaperDocument9 pagesFinal PaperSuhardi 1910247902No ratings yet

- Flexible Budgets, Direct-Cost, Overhead Variances, and Management-1Document23 pagesFlexible Budgets, Direct-Cost, Overhead Variances, and Management-1Amit DeyNo ratings yet

- 1 - Ne - b2 Sety Leksykalne U5iDocument1 page1 - Ne - b2 Sety Leksykalne U5iAneta WalejewskaNo ratings yet

- 1.HOTEL DAN RESTORAN-OKUPASI 25 JAN 2019 - CompressedDocument71 pages1.HOTEL DAN RESTORAN-OKUPASI 25 JAN 2019 - CompressedMarcia RikumahuNo ratings yet

- Price Elasticity of Supply (PES)Document3 pagesPrice Elasticity of Supply (PES)eco2dayNo ratings yet

- Field Test of Construction MaterialsDocument25 pagesField Test of Construction MaterialsAntarjyami PradhanNo ratings yet

- Evaluation of Underground Storage Tank LinersDocument14 pagesEvaluation of Underground Storage Tank LinersAmanda Williams HensleyNo ratings yet

- Questionnaire SampleDocument4 pagesQuestionnaire SampleNadia Mohammad88% (58)

- Me Review Assignent - Arunima Viswanath - m200046msDocument4 pagesMe Review Assignent - Arunima Viswanath - m200046msARUNIMA VISWANATHNo ratings yet

- 17027405959014095ASO1Document1 page17027405959014095ASO1thinklikebrilliantNo ratings yet

- Law 4 Midterm Exam 1ST Sem Ay2017-18Document15 pagesLaw 4 Midterm Exam 1ST Sem Ay2017-18Uy SamuelNo ratings yet

- Constructability of Diagrid StructuresDocument5 pagesConstructability of Diagrid StructuresAdeniran OmobolanleNo ratings yet

- 24941-Article Text-29253-1-10-20180730Document11 pages24941-Article Text-29253-1-10-20180730Dhea Ratih KusumaningtyasNo ratings yet

- Metal Flooring, Stairways, Ladders, Platforms and Handrailing PDFDocument16 pagesMetal Flooring, Stairways, Ladders, Platforms and Handrailing PDFDennis RangwetsiNo ratings yet

- Pengaruh Motivasi Dan Displin Kerja Serta Gaya Kepemimpinan Terhadap Kinerja Kepolisian Di Polres BanyuasinDocument12 pagesPengaruh Motivasi Dan Displin Kerja Serta Gaya Kepemimpinan Terhadap Kinerja Kepolisian Di Polres BanyuasinI GEDE CANDRA ADI KUSUMANo ratings yet

- Acc 10 Syllabus PDFDocument2 pagesAcc 10 Syllabus PDFWilvyn TantongcoNo ratings yet

Wall Chart

Wall Chart

Uploaded by

joshuaedet841Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wall Chart

Wall Chart

Uploaded by

joshuaedet841Copyright:

Available Formats

10 CHART PATTERNS

EVERY PRO TRADER SHOULD KNOW

1 2 3 4 5

HEAD AND SHOULDERS INVERSE HEAD AND DOUBLE BOTTOM DOUBLE TOP CUP & HANDLE

Bearish. The head and shoulders pattern is SHOULDERS Bullish. The double bottom pattern looks Bearish. The double top pattern is the Bullish. The cup and handle pattern is a

characterised by a large peak with two similar to the letter W and indicates when the opposite of a double bottom. A double top continuation stock chart pattern that signals a

Bullish. The inverse head and shoulders

smaller peaks on either side. All three levels price has made two unsuccessful attempts at looks like the letter M. The trend enters a bullish market trend. It is the same as the

pattern is characterised by a large peak with

fall back to the same support level as the breaking through the support level. It is a reversal phase after failing to break through rounding bottom or saucer but features a

two smaller peaks on either side. All three

neckline. The trend is then likely to break out reversal chart pattern as it highlights a trend the resistance level twice, and the path of less handle after the rounding bottom. The handle

levels fall back to the same support level as

in a downward motion. reversal. resistance is lower. resembles a flag or pennant, and once

the neckline.

completed, you can see the market break out

in a bullish upwards trend.

6 7 8 9 10

ROUNDING TOP ROUNDING BOTTOM ASCENDING TRIANGLE DESCENDING TRIANGLE RISING WEDGE

Bearish. The rounding top pattern usually Bullish. In the rounding bottom pattern, the Bilateral. The ascending triangle pattern is a Bilateral. The descending triangle pattern Bearish & bullish. Wedge patterns are usually

indicates a bearish (downward) trend. It tends market is in a downtrend but then starts to bilateral pattern, meaning that the price could shows the price moving into smaller and reversal patterns. A rising wedge occurs when

to show that the market is losing strength, make a series of lows, higher than the break out from either side. A breakout is likely smaller ranges before the big breakout. Your the price makes multiple swings to new highs,

with each high being lower than the previous previous ones, which form the rounded where the triangle lines converge. The buy sell entry would be just below the support yet the price waves are getting smaller. This is

one. bottom or saucer. We then break out of the entry would be just above the resistance. You line. For the buy entry, buy above the bearish. The opposite is a falling wedge. The

cup and move higher. need to do the exact opposite for the sell resistance line. price typically breaks higher, so it is a bullish

entry: sell below the support line. pattern (for more details, please see the

ebook 10 Chart Patterns Every Pro Trader

Should Know).

71% of Deriv retail CFD accounts lose money.

For more information visit https://www.deriv.com. Deriv Investments (Europe) Limited (W Business Centre, Level 3, Triq Dun Karm, Birkirkara BKR 9033, Malta) is licensed and regulated in Malta by the Malta Financial Services Authority under the

Investment Services Act to provide investment services in the European Union.

The information contained in this document is for educational purposes only and is not intended as financial or investment advice.

You might also like

- Boeing 777 CaseStudy SolutionDocument3 pagesBoeing 777 CaseStudy SolutionRohit Parnerkar80% (5)

- Tradding ChartDocument22 pagesTradding ChartMR GG7100% (15)

- Trading PatternsDocument8 pagesTrading PatternsJR 18067% (3)

- CM1 Mock Paper B 2021 Answers 12345Document44 pagesCM1 Mock Paper B 2021 Answers 12345vanessa8pangestuNo ratings yet

- FHB Checking Account Deposit SlipDocument1 pageFHB Checking Account Deposit Slipapi-314402585No ratings yet

- Top 10 Chart Patterns SlidesDocument14 pagesTop 10 Chart Patterns Slidesashokfacebook100% (12)

- Pollen Crypto BookDocument96 pagesPollen Crypto Bookjhffkl100% (1)

- Guide To Classic Chart PatternsDocument1 pageGuide To Classic Chart PatternsThato Mavuso100% (4)

- 2ND Chart Patterns For Price Action TradingDocument23 pages2ND Chart Patterns For Price Action TradingSandeep Reddy100% (3)

- Chart PatternsDocument10 pagesChart Patternsvvpvarun100% (2)

- T Bulkowski IdentifyingBearishChartPatternsDocument5 pagesT Bulkowski IdentifyingBearishChartPatternsbruced0812100% (2)

- Chart Patterns ForexDocument16 pagesChart Patterns Forexnishitsardhara83% (6)

- Screenshot 2022-05-30 at 10.00.37 PMDocument6 pagesScreenshot 2022-05-30 at 10.00.37 PMiqforxNo ratings yet

- Trade CoinDocument96 pagesTrade Coinvien100% (1)

- Technical Analysis BookDocument95 pagesTechnical Analysis BookvhmuddyNo ratings yet

- New Rich Text FormatDocument25 pagesNew Rich Text Formatpradeephd100% (1)

- 9 FIN555 Chap 9 & 10 Prings Smaller Price Pattern and Gaps and One and Two Price - Read-OnlyDocument23 pages9 FIN555 Chap 9 & 10 Prings Smaller Price Pattern and Gaps and One and Two Price - Read-OnlyMarisa MazananNo ratings yet

- GuideToClassicChartPatterns PDFDocument1 pageGuideToClassicChartPatterns PDFRenato100% (1)

- PATTERNSDocument9 pagesPATTERNSemmanuelomondi2944No ratings yet

- CRT PatternDocument10 pagesCRT PatternMD ASRAFUZZAMAN MAHTAF100% (1)

- Reversal Trends-SAPMDocument26 pagesReversal Trends-SAPMHeavy Gunner50% (2)

- 5.4 - Technical Analysis - Chart Patterns - Trading Crypto CourseDocument22 pages5.4 - Technical Analysis - Chart Patterns - Trading Crypto Course2f9p4bykt8100% (2)

- Major Market PatternsDocument30 pagesMajor Market PatternsTonderai Humanikwa100% (4)

- Technical Analysis 18022024Document76 pagesTechnical Analysis 18022024kaaviraj2020No ratings yet

- New Book Oficial EnglishDocument97 pagesNew Book Oficial EnglishAbolaji MuazNo ratings yet

- Classic Chart Patterns: A Quick Reference Guide For TradersDocument2 pagesClassic Chart Patterns: A Quick Reference Guide For TradersAbhay Pratap100% (1)

- 10 Price Action Bar Patterns You Must KnowDocument8 pages10 Price Action Bar Patterns You Must Knowbengotek100% (1)

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must KnowSudipto PaulNo ratings yet

- Chart Patterns: For Reddit NoobsDocument17 pagesChart Patterns: For Reddit NoobscorranNo ratings yet

- Point and Figure PatternsDocument12 pagesPoint and Figure PatternsRavi VarakalaNo ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must Knowjhonthor100% (1)

- Important Chart PatternsDocument8 pagesImportant Chart Patternspradeephd100% (2)

- Forex Charts TrendsDocument6 pagesForex Charts TrendsSimamkele Ntwanambi100% (2)

- Technical 102Document13 pagesTechnical 102Marchie VictorNo ratings yet

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Chart NotesDocument6 pagesChart NotesAmit Wadekar100% (6)

- Ultimate Price Action 2.0 - Day 2Document70 pagesUltimate Price Action 2.0 - Day 2nazimvmNo ratings yet

- Wedge and Head and Shoulders Charts PatternsDocument11 pagesWedge and Head and Shoulders Charts PatternsRemison YokoNo ratings yet

- Reversal PatternsDocument25 pagesReversal PatternsMunyaradzi Alka Musarurwa100% (3)

- 10 Price Action Bar Patterns You Must KnowDocument14 pages10 Price Action Bar Patterns You Must Knowsal8471100% (2)

- Chart Patterns and Pivot PointsDocument13 pagesChart Patterns and Pivot PointsYin Shen Goh100% (5)

- WOADocument15 pagesWOAtrinugrohoNo ratings yet

- SMTC Patterns - OverviewDocument54 pagesSMTC Patterns - OverviewVignesh BabuNo ratings yet

- JSW Steel - Technical Analysis ProjectDocument34 pagesJSW Steel - Technical Analysis ProjectSanjeedeep Mishra , 315No ratings yet

- Reversal Bar Pattern: What Does It Look Like?Document40 pagesReversal Bar Pattern: What Does It Look Like?Sen Hoa100% (1)

- Day - 2 Bullish Pattern PDFDocument46 pagesDay - 2 Bullish Pattern PDFrif.sap26No ratings yet

- 10 Chart Pattan Traders Should KnowDocument24 pages10 Chart Pattan Traders Should Knowstephen briggsNo ratings yet

- How To Trade Chart Patterns With Target and SL - Forex GDP - Trade With ConfidenDocument40 pagesHow To Trade Chart Patterns With Target and SL - Forex GDP - Trade With Confidenshashikant jambagi100% (4)

- TA of The Financial MarketDocument4 pagesTA of The Financial MarketStella FeliciaNo ratings yet

- Task 16Document14 pagesTask 16dasabhishek816No ratings yet

- Chart PatternsDocument32 pagesChart PatternsPraveen67% (3)

- Price ActionDocument11 pagesPrice ActionAhmad Farhan Ramli100% (1)

- D.Bolze - Crown PatternDocument5 pagesD.Bolze - Crown PatternamyNo ratings yet

- Basic Candlestick Formations: Indication That Price May Be Heading DownDocument11 pagesBasic Candlestick Formations: Indication That Price May Be Heading Downquentin oliverNo ratings yet

- Technical Analysis For Beginners - NewDocument16 pagesTechnical Analysis For Beginners - NewNitin KumarNo ratings yet

- Book PDFDocument70 pagesBook PDFaurox zahidNo ratings yet

- 7 Rejection Price PatternDocument7 pages7 Rejection Price PatternMuhammad Irwan Chong100% (1)

- Technical Chart Patterns CharacteristicsDocument10 pagesTechnical Chart Patterns Characteristicsd_stepien43098No ratings yet

- PennantsDocument3 pagesPennantstawhid anamNo ratings yet

- Chart PatternsDocument11 pagesChart PatternsAkash RohilaNo ratings yet

- Price Action Simplified by EmzetDocument25 pagesPrice Action Simplified by EmzetEmzet PremiseNo ratings yet

- Penny Stocks: The Art of Bottom Feeding: Penny Stock PlayersFrom EverandPenny Stocks: The Art of Bottom Feeding: Penny Stock PlayersRating: 5 out of 5 stars5/5 (2)

- Msci 607: Applied Economics For Management Lecture 02 (Production and Cost) SolutionsDocument8 pagesMsci 607: Applied Economics For Management Lecture 02 (Production and Cost) SolutionsRonak PatelNo ratings yet

- Nearest Pharmacy Delivery ServiceDocument5 pagesNearest Pharmacy Delivery ServiceJayanath SamarasingheNo ratings yet

- MAGNUM Screens BrochureDocument4 pagesMAGNUM Screens Brochurenarft narftNo ratings yet

- Price Monitoring January 20 2023Document5 pagesPrice Monitoring January 20 2023Eihcir Yaj SerrobNo ratings yet

- 1 Makemytrip PDFDocument1 page1 Makemytrip PDFZusnsxnxNo ratings yet

- Class Xi (Economics) Cw-7)Document20 pagesClass Xi (Economics) Cw-7)Mythreyi VasudevanNo ratings yet

- SRQ B NGO RoleDocument2 pagesSRQ B NGO RoleJaia Cher (Chijktcs)No ratings yet

- Singapore's SuccessDocument14 pagesSingapore's SuccessKWEK SOCK QING REBECCANo ratings yet

- Bjarke IngelsDocument4 pagesBjarke IngelsananthukunnikrishnanNo ratings yet

- ACI 304.6R-91 Guide For The Use of Volumetric-MeasuringDocument14 pagesACI 304.6R-91 Guide For The Use of Volumetric-MeasuringMihai BanateanuNo ratings yet

- Force of Nature BrochureDocument20 pagesForce of Nature BrochureDerek DavisNo ratings yet

- Final PaperDocument9 pagesFinal PaperSuhardi 1910247902No ratings yet

- Flexible Budgets, Direct-Cost, Overhead Variances, and Management-1Document23 pagesFlexible Budgets, Direct-Cost, Overhead Variances, and Management-1Amit DeyNo ratings yet

- 1 - Ne - b2 Sety Leksykalne U5iDocument1 page1 - Ne - b2 Sety Leksykalne U5iAneta WalejewskaNo ratings yet

- 1.HOTEL DAN RESTORAN-OKUPASI 25 JAN 2019 - CompressedDocument71 pages1.HOTEL DAN RESTORAN-OKUPASI 25 JAN 2019 - CompressedMarcia RikumahuNo ratings yet

- Price Elasticity of Supply (PES)Document3 pagesPrice Elasticity of Supply (PES)eco2dayNo ratings yet

- Field Test of Construction MaterialsDocument25 pagesField Test of Construction MaterialsAntarjyami PradhanNo ratings yet

- Evaluation of Underground Storage Tank LinersDocument14 pagesEvaluation of Underground Storage Tank LinersAmanda Williams HensleyNo ratings yet

- Questionnaire SampleDocument4 pagesQuestionnaire SampleNadia Mohammad88% (58)

- Me Review Assignent - Arunima Viswanath - m200046msDocument4 pagesMe Review Assignent - Arunima Viswanath - m200046msARUNIMA VISWANATHNo ratings yet

- 17027405959014095ASO1Document1 page17027405959014095ASO1thinklikebrilliantNo ratings yet

- Law 4 Midterm Exam 1ST Sem Ay2017-18Document15 pagesLaw 4 Midterm Exam 1ST Sem Ay2017-18Uy SamuelNo ratings yet

- Constructability of Diagrid StructuresDocument5 pagesConstructability of Diagrid StructuresAdeniran OmobolanleNo ratings yet

- 24941-Article Text-29253-1-10-20180730Document11 pages24941-Article Text-29253-1-10-20180730Dhea Ratih KusumaningtyasNo ratings yet

- Metal Flooring, Stairways, Ladders, Platforms and Handrailing PDFDocument16 pagesMetal Flooring, Stairways, Ladders, Platforms and Handrailing PDFDennis RangwetsiNo ratings yet

- Pengaruh Motivasi Dan Displin Kerja Serta Gaya Kepemimpinan Terhadap Kinerja Kepolisian Di Polres BanyuasinDocument12 pagesPengaruh Motivasi Dan Displin Kerja Serta Gaya Kepemimpinan Terhadap Kinerja Kepolisian Di Polres BanyuasinI GEDE CANDRA ADI KUSUMANo ratings yet

- Acc 10 Syllabus PDFDocument2 pagesAcc 10 Syllabus PDFWilvyn TantongcoNo ratings yet