Professional Documents

Culture Documents

Rogelio Pineda 100K

Rogelio Pineda 100K

Uploaded by

rpine35Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rogelio Pineda 100K

Rogelio Pineda 100K

Uploaded by

rpine35Copyright:

Available Formats

801 Grand Ave

Des Moines, IA 50309

F&G Gold

Life Insurance

Illustration

F&G Gold is a Flexible Premium Adjustable Death Benefit

Universal Life Insurance Policy with Index-Linked Interest

Wealth Transfer

Cash Value Accumulation

Living Benefits

Supplemental Riders

Prepared on October 20, 2021 for: Rogelio Pineda

Presented by: Please fill in name

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 1 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Narrative Summary

THIS IS AN ILLUSTRATION ONLY. AN ILLUSTRATION IS NOT INTENDED TO PREDICT ACTUAL

PERFORMANCE. INTEREST RATES, DIVIDENDS, OR VALUES THAT ARE SET FORTH IN THE ILLUSTRATION

ARE NOT GUARANTEED, EXCEPT FOR THOSE ITEMS CLEARLY LABELED AS GUARANTEED.

F&G Gold

This illustration is provided to help you understand the life insurance policy. This illustration is based on information that you

provided and on certain assumptions, some of which are not guaranteed. This illustration assumes that the currently

illustrated Non-Guaranteed Elements will continue unchanged for all years shown. This is not likely to occur, and actual

results may be more or less favorable than those shown.

The F&G Gold is a Flexible Premium Adjustable Life Insurance policy. This Individual Life Insurance policy will provide a

Death Benefit if the insured dies while the policy is in force. The actual amount payable in the event of death will be

decreased by any indebtedness to the Company. Premium payments are flexible and the owner may change the amount

and frequency of premium payments.

This illustration, or any other illustration, is not considered a proper written request for policy changes, termination of

benefits or election of options to purchase additional insurance.

Monthly No-Lapse Premium

Monthly No-Lapse Premium is the minimum premium required during the No-Lapse Period to keep your policy in effect. The

Monthly No-Lapse Premium for the policy illustrated is $55.00. The Monthly No-Lapse Premium may change depending on

changes to your policy or riders. If the sum of the premium, less loans and withdrawals, equals or exceeds the sum of all

Monthly No-Lapse Premiums beginning with the policy date, your policy will not enter the grace period for the duration

shown. At the end of the No-Lapse Period, the guaranteed Policy Values may be insufficient to keep the policy in effect

unless additional premium is paid. If you pay the Monthly No-Lapse Premium, the guarantee period is to Age 60.

No-Lapse Period

No-Lapse Period is the period during which the policy will not terminate for insufficient surrender value if certain conditions

are met. The No-Lapse Period to keep your policy in effect is to Age 60.

Guideline Premium Limitation

The Guideline Premium Limitation is the maximum premium allowed by the Internal Revenue Code. The Guideline

Premium Limitation is the greater of the Guideline Single Premium or the sum of the annual Guideline Level Premiums as of

the date of the calculation.

Guideline Level Premium

The Guideline Level Premium for this illustration is $6,187.25.

Guideline Single Premium

The Guideline Single Premium for this illustration is $32,306.73.

Death Benefit

This life insurance policy initially provides a Death Benefit as described in the policy. The initial Death Benefit provided is

assumed to be $100,000. The actual amount payable at death may be decreased by policy withdrawals or

outstanding loans, or increased by additional insurance benefits purchased. In addition, you may change Death

Benefit Options at any time after the first policy year.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 2 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Death Benefit Options

Option A: The Death Benefit is the greater of the Face Amount or the Account Value multiplied by the Death Benefit ratio.

Option B: The Death Benefit is the greater of the Face Amount plus the Account Value or the Account Value multiplied by

the Death Benefit ratio.

Face Amount

The initial Face Amount is the amount on which the Death Benefit is determined. The owner may increase the Face

Amount after the first policy anniversary. An increase requires proof of insurability and must be requested prior to the

insured's Age 81. Face Amount decreases are allowed after the third policy year .

Monthly Deductions

Each Monthly Deduction consists of the monthly Cost of Insurance, the Expense Charges, any charges for additional

benefits provided by riders and any charges for substandard premium Class rating.

Partial Withdrawals

The owner may make partial withdrawals after the first policy year up to the available withdrawal amount. There is a $25

withdrawal fee for each withdrawal. The minimum withdrawal amount is $500.

Future Policy Changes

Please note: Policy illustrations may be designed to show changes to your policy in the future. This could include the

changing or stopping of premium payments, a change in the death benefit option or the use of policy loans. Generally, future

policy changes are not automatically made by the company and require a specific request from the policyowner, unless

otherwise specified in your policy pages. Future changes displayed in an illustrations are intended to show how you may

consider utilizing the policy, however for most policy design features, these changes will not occur without your request in

order to allow you to have flexibility to use the policy to meet your changing needs. Please consult your licensed F&G

insurance agent for additional guidance.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 3 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Definitions of Illustration Column Headings and Key Terms

Age Age represents the owner's Age at the end of the Contract Year.

Contract Year Year is measured from the date of issue.

Planned The Planned Premium Outlay is the amount of premium which is planned to be paid during

Premium Outlay the lifetime of this policy. The first year Planned Premium Outlay is $1,596.00. The amount,

timing and frequency of premium payments may be varied, subject to the Guideline

Premium Limitation, as determined by the Internal Revenue Code and Regulations. This

illustration assumes that all payments are made as planned. The amount, timing and

frequency of premium payments will affect the Account Value and length of coverage.

Withdrawals / This is the amount borrowed or withdrawn from the policy at the beginning of the Contract

Loans Year.

Account Value The Account Value is the amount of value, in this insurance policy, before the deduction of

Surrender Charges, if applicable.

Surrender Value The Surrender Value is equal to the Account Value less any unpaid loans and loan interest;

less any surrender charge.

Net Death The Net Death Benefit is the amount payable under the Death Benefit Option in effect plus

Benefit any additional benefit provided by riders; less any unpaid loans and loan interest; less any

amount required to cover the monthly deductions through the month in which the death

occurred, unless that monthly deduction was waived by a rider.

Guaranteed The values that would result assuming guaranteed interest rates, guaranteed Expense

Assumptions Charges and guaranteed Cost of Insurance rates.

Guaranteed The benefits, values, credits and charges that are guaranteed at issue.

Elements

Mid-Point The values that would result assuming interest rates, Expense Charges and Cost of

Assumptions Insurance rates that are the average of the current and guaranteed rates. These

assumptions are not guaranteed.

Current The values that would result assuming current interest rates, current Expense Charges and

Assumptions current Cost of Insurance rates. These assumptions are not guaranteed.

Non-Guaranteed The values that would be generated using current, specified or midpoint assumptions.

Assumptions These assumptions are not guaranteed.

Non-Guaranteed The premiums, benefits, values, credits or charges (Non-Guaranteed Cost of Insurance

Elements rates, Expense Charges, Premium) under the illustrated policy that are not guaranteed or

cannot be determined at issue. Expense Charges and current interest rates are subject to

change by the Company. Actual results may be more or less favorable.

Expense Charge An Expense Charge that will be deducted from the Account Value each month.

Benchmark Index As described in Actuarial Guideline 49.A section D, the Benchmark Index Account is based

Account on the S&P 500® Index with a floor of 0% and a 100% participation rate.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 4 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Bonus A non-guaranteed Bonus, if available, may result in additional interest being credited to the

policy's account value. Bonuses may be associated with policy persistency, specific index

crediting strategies, or riders that may be available.

Cost of The amount the Company charges for providing life insurance coverage under the base

Insurance policy. The Cost of Insurance rates may be changed by the Company, subject to the

guaranteed Cost of Insurance rates as stated in your policy. Any change in the Cost of

Insurance rates will be on a uniform basis for insureds of the same Class.

Class The risk Class of the proposed insured used in preparing this illustration. The actual Class

will be determined when the application is underwritten and may vary from the illustrated

Class. If so, a revised illustration will be delivered with the policy.

CAP Rate The CAP Rate represents the maximum percentage increase that may be credited to the

index Account Value segment. The CAP Rate is declared in advance and is guaranteed for

each segment for 12 months from the segment's buy date.

Spread This rate is subtracted from any positive index percentage change prior to applying the PAR

rate and CAP Rate.

PAR The Participation rate which is the maximum percentage of the annual increase in the index

that will be credited.

Premium A percentage of each premium payment that is deducted from the premium payment

Expense Charge resulting in the Net Premium.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 5 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

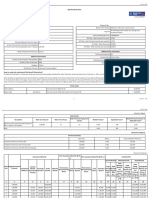

Numeric Summary

Guaranteed Non-Guaranteed Assumptions

Assumptions Fixed Midpoint Current

Net Net Net Net

Premium Surrender Death Surrender Death Surrender Death Surrender Death

Year Outlay Value Benefit Value Benefit Value Benefit Value Benefit

5 1,596 1,371 103,573 3,048 105,250 2,299 104,502 3,343 105,545

10 1,596 4,896 106,811 9,220 111,135 7,469 109,384 10,773 112,689

20 1,596 11,062 111,062 28,092 128,092 21,167 121,167 37,848 137,848

Age 70 1,596 10,595 110,595 36,867 136,867 26,001 126,001 55,594 155,594

Based on Guaranteed Assumptions, the illustration terminates in year: 34

Based on Fixed Assumptions, the illustration terminates in year: 44

Based on Midpoint Assumptions, the illustration terminates in year: 40

Based on Current Assumptions, the illustration terminates in year: 59

The Guaranteed columns show values and benefits assuming minimum guaranteed interest of 0.25% and the maximum

guaranteed Cost of Insurance rates and Expense Charges.

The Fixed columns show values assuming an interest rate of 4.25%, and that current charges will remain in effect

throughout the life of the policy. The Midpoint columns show values assuming an interest rate of 3.60%, which is midway

between the guaranteed and current rate, and uses an average of the current and guaranteed charges. The Current

columns show values and benefits assuming current interest of 6.94%, applicable bonus interest and that current charges

will remain in effect throughout the life of the policy.

Signature Statement

This illustration assumes that the currently illustrated Non-Guaranteed Elements will continue unchanged for all years

shown. This is not likely to occur, and actual results may be more or less favorable than those shown. The benefits and

values are not guaranteed. The assumptions on which they are based are subject to change by F&G Annuities & Life

Company.

I have read the summary and understand: (1) the description of the F&G Gold, a fixed indexed universal life insurance

product; (2) that I am applying for a fixed indexed life insurance product whose values may be affected by an external

index, but does not participate in any stock, bond, or equity investments; (3) that neither F&G Annuities & Life Company

nor my agent has made any guarantees or promises regarding future index values, index changes, index credits, or

interest rate for this insurance product.

I have received a copy of this illustration, and understand that any Non-Guaranteed Elements illustrated are subject to

change and could be higher or lower. The agent has told me that they are not guaranteed.

___________________________________________________ ________________

Owner Date

I certify that this illustration has been presented to the applicant and that I have explained that any Non-Guaranteed

Elements illustrated are subject to change. I have made no statements that are inconsistent with the illustration.

___________________________________________________ ________________

Authorized Company Representative Date

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 6 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Rider Description(s)

Over loan Protection Rider

This rider can prevent your life insurance policy from entering a lapse status as the result of outstanding loans that exceed your

Surrender Value. There is no Cost of Insurance charge for this rider. However, certain conditions must be met before the rider

can be exercised, and there is a one-time administrative fee when the rider is exercised. This rider may be exercised one time

during the lifetime of the life insurance contract to which it is attached.

Accelerated Benefit for Critical Illness Rider

This rider gives the policy owner access to 100% of the Death Benefit of the policy in which the rider is attached or $1,000,000,

whichever is less. The amount requested is called the Accelerated Amount. The amount paid, called the Accelerated Benefit is

less than the Accelerated Amount due to the amount being received before the death of the insured. The Accelerated Amount

is discounted to get a present value and future policy charges, a portion of the Loan Balance and a processing fee are

subtracted to determine the amount paid. The amount paid will vary based on the qualifying Covered Critical Illness and the

severity of the illness at time of claim. A higher severity will result in a higher Accelerated Benefit payment amount. There is no

Cost of Insurance charge for this rider. The Death Benefit, Surrender Value, any Loan Balance and Cost of Insurance charges

for the policy are reduced if you exercise this rider's benefit. The amount paid will never be less than the Surrender Value

associated with the Death Benefit that is requested to be accelerated. The accelerated benefit rider terminates when the policy

terminates, the benefit is paid or the owner request to have the rider cancelled. Sample calculations assume 100% of the policy

Death Benefit is accelerated up to the maximum. Certain conditions, as defined in the rider, must be met before the rider can be

exercised. For more information refer to the issued rider.

Accelerated Benefit for Terminal Illness Rider

This rider gives the policy owner access to 100% of the Death Benefit of the policy in which the rider is attached or $1,000,000,

whichever is less. The amount requested is called the Accelerated Amount. The amount paid, called the Accelerated Benefit is

less than the Accelerated Amount due to the amount being received before the death of the insured. The Accelerated Amount

is discounted with interest for 18 months and policy charges for next 18 months and a processing fee are subtracted to

determine the amount paid. To qualify, the insured must be diagnosed with a Terminal Illness such that a doctor certifies that

the insured is expected to live twenty-four months or less. There is no Cost of Insurance charge for this rider. The Death

Benefit and Cost of Insurance charges for the policy are reduced if you exercise this rider's benefit. The accelerated benefit

rider terminates when the policy terminates, the benefit is paid or the owner request to have the rider cancelled. Illustrated

calculations assume 100% of the policy Death Benefit is accelerated up to the maximum. Certain conditions, as defined in the

rider, must be met before the rider can be exercised. For more information refer to the issued rider.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 7 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Tabular Detail

Guaranteed ¹ Non-Guaranteed ² Non-Guaranteed ²

Assumptions Assumptions - Fixed Assumptions - Current

0.25% EOY Interest 4.25% EOY Interest 6.94% EOY

Planned

Premium Withdrawals/ Account Surrender Net Death Account Surrender Net Death Account Surrender Net Death

Age Year Outlay Loans Value Value Benefit Value Value Benefit Value Value Benefit

46 1 1,596 0 728 0 100,728 1,002 0 101,002 1,002 0 101,002

47 2 1,596 0 1,449 0 101,449 2,028 0 102,028 2,055 0 102,055

48 3 1,596 0 2,165 0 102,165 3,076 762 103,076 3,159 845 103,159

49 4 1,596 0 2,873 623 102,873 4,146 1,895 104,146 4,317 2,067 104,317

50 5 1,596 0 3,573 1,371 103,573 5,250 3,048 105,250 5,545 3,343 105,545

51 6 1,596 0 4,263 2,124 104,263 6,384 4,246 106,384 6,840 4,702 106,840

52 7 1,596 0 4,935 2,844 104,935 7,540 5,450 107,540 8,199 6,108 108,199

53 8 1,596 0 5,584 3,557 105,584 8,717 6,690 108,717 9,623 7,596 109,623

54 9 1,596 0 6,210 4,247 106,210 9,916 7,953 109,916 11,118 9,155 111,118

55 10 1,596 0 6,811 4,896 106,811 11,135 9,220 111,135 12,689 10,773 112,689

15,960 0

56 11 1,596 0 7,389 5,538 107,389 12,699 10,847 112,699 14,665 12,814 114,665

57 12 1,596 0 7,945 6,461 107,945 14,289 12,805 114,289 16,740 15,255 116,740

58 13 1,596 0 8,479 7,361 108,479 15,900 14,782 115,900 18,914 17,796 118,914

59 14 1,596 0 8,988 8,238 108,988 17,554 16,804 117,554 21,216 20,466 121,216

60 15 1,596 0 9,466 9,083 109,466 19,249 18,866 119,249 23,652 23,269 123,652

61 16 1,596 0 9,906 9,906 109,906 20,981 20,981 120,981 26,223 26,223 126,223

62 17 1,596 0 10,294 10,294 110,294 22,738 22,738 122,738 28,927 28,927 128,927

63 18 1,596 0 10,622 10,622 110,622 24,514 24,514 124,514 31,764 31,764 131,764

64 19 1,596 0 10,879 10,879 110,879 26,300 26,300 126,300 34,737 34,737 134,737

65 20 1,596 0 11,062 11,062 111,062 28,092 28,092 128,092 37,848 37,848 137,848

31,920 0

66 21 1,596 0 11,164 11,164 111,164 29,882 29,882 129,882 41,101 41,101 141,101

67 22 1,596 0 11,180 11,180 111,180 31,665 31,665 131,665 44,502 44,502 144,502

68 23 1,596 0 11,099 11,099 111,099 33,433 33,433 133,433 48,052 48,052 148,052

69 24 1,596 0 10,910 10,910 110,910 35,173 35,173 135,173 51,751 51,751 151,751

70 25 1,596 0 10,595 10,595 110,595 36,867 36,867 136,867 55,594 55,594 155,594

71 26 1,596 0 10,134 10,134 110,134 38,490 38,490 138,490 59,565 59,565 159,565

72 27 1,596 0 9,497 9,497 109,497 40,011 40,011 140,011 63,648 63,648 163,648

73 28 1,596 0 8,652 8,652 108,652 41,395 41,395 141,395 67,819 67,819 167,819

74 29 1,596 0 7,571 7,571 107,571 42,604 42,604 142,604 72,054 72,054 172,054

75 30 1,596 0 6,219 6,219 106,219 43,599 43,599 143,599 76,326 76,326 176,326

47,880 0

1 The Guaranteed columns show values and benefits assuming minimum guaranteed interest of 0.25% and the maximum guaranteed Cost of Insurance

rates and Expense Charges.

2 The Non-Guaranteed columns assume current Cost of Insurance rates, Expense Charges and bonus interest if applicable.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 8 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Tabular Detail

Guaranteed ¹ Non-Guaranteed ² Non-Guaranteed ²

Assumptions Assumptions - Fixed Assumptions - Current

0.25% EOY Interest 4.25% EOY Interest 6.94% EOY

Planned

Premium Withdrawals/ Account Surrender Net Death Account Surrender Net Death Account Surrender Net Death

Age Year Outlay Loans Value Value Benefit Value Value Benefit Value Value Benefit

76 31 1,596 0 4,569 4,569 104,569 44,343 44,343 144,343 80,610 80,610 180,610

77 32 1,596 0 2,591 2,591 102,591 44,796 44,796 144,796 84,878 84,878 184,878

78 33 1,596 0 251 251 100,251 44,911 44,911 144,911 89,094 89,094 189,094

79 34 1,596 0 0 0 0 44,627 44,627 144,627 93,210 93,210 193,210

80 35 1,596 0 0 0 0 43,867 43,867 143,867 97,160 97,160 197,160

81 36 1,596 0 0 0 0 42,536 42,536 142,536 100,857 100,857 200,857

82 37 1,596 0 0 0 0 40,531 40,531 140,531 104,206 104,206 204,206

83 38 1,596 0 0 0 0 37,733 37,733 137,733 107,094 107,094 207,094

84 39 1,596 0 0 0 0 33,996 33,996 133,996 109,375 109,375 209,375

85 40 1,596 0 0 0 0 29,144 29,144 129,144 110,872 110,872 210,872

63,840 0

86 41 1,596 0 0 0 0 22,978 22,978 122,978 111,380 111,380 211,380

87 42 1,596 0 0 0 0 15,270 15,270 115,270 110,660 110,660 210,660

88 43 1,596 0 0 0 0 5,775 5,775 105,775 108,446 108,446 208,446

89 44 1,596 0 0 0 0 0 0 0 104,476 104,476 204,476

90 45 1,596 0 0 0 0 0 0 0 100,123 100,123 200,123

91 46 1,596 0 0 0 0 0 0 0 95,456 95,456 195,456

92 47 1,596 0 0 0 0 0 0 0 90,452 90,452 190,452

93 48 1,596 0 0 0 0 0 0 0 85,086 85,086 185,086

94 49 1,596 0 0 0 0 0 0 0 79,332 79,332 179,332

95 50 1,596 0 0 0 0 0 0 0 73,163 73,163 173,163

79,800 0

96 51 1,596 0 0 0 0 0 0 0 66,548 66,548 166,548

97 52 1,596 0 0 0 0 0 0 0 59,456 59,456 159,456

98 53 1,596 0 0 0 0 0 0 0 51,850 51,850 151,850

99 54 1,596 0 0 0 0 0 0 0 43,696 43,696 143,696

100 55 1,596 0 0 0 0 0 0 0 34,953 34,953 134,953

101 56 1,596 0 0 0 0 0 0 0 25,578 25,578 125,578

102 57 1,596 0 0 0 0 0 0 0 15,526 15,526 115,526

103 58 1,596 0 0 0 0 0 0 0 4,747 4,747 104,747

104 59 1,596 0 0 0 0 0 0 0 0 0 0

1 The Guaranteed columns show values and benefits assuming minimum guaranteed interest of 0.25% and the maximum guaranteed Cost of Insurance

rates and Expense Charges.

2 The Non-Guaranteed columns assume current Cost of Insurance rates, Expense Charges and bonus interest if applicable.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 9 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Additional Information

Interest Crediting Options

Premium payments may be allocated between any of the following Interest Crediting Options:

Minimum Maximum Current Maximum

Interest Crediting Options 25-Year 25-Year Cap/Spread Illustrated

Allocation Average Average Rate Rate

S&P 500® Fixed Index Account 100% 4.39% 8.76% 11.50% 6.94% ¹

Gold Price Option 0% 3.73% 7.91% 15.00% 5.96% ¹

DJ US Real Estate Daily Risk Control 10% USD 1.50% ¹

0% N/A N/A 7.16%

Total Return Index

Barclays Trailblazer Sectors 5 PtP w/ Spread And 0% N/A N/A 0.00% 7.16%

165% PAR

100%

Fixed Rate 0% N/A N/A N/A 4.25%

¹ This rate is less than or equal to the average performance of the S&P 500® Index from all of the 25 year rolling periods over the last 65 years

when subjected to the current CAP Rates noted above and a 0.25% minimum.

The current values in this illustration assume an overall crediting rate of 6.94% which is the weighted average of the

assumed rates for each Account. The illustrated value for each Account Value segment may be capped at the

benchmark rate.

A Prospective Annual Interest Bonus credits an additional 0.25% to account value after 10 years; guaranteed as long

as current declared credited rates exceed guaranteed minimum. The bonus is credited to the declared rate and

indexed account value. The Prospective Annual Interest Bonus rate is not credited to the collateral account backing a

loan under the Fixed Loan option. We reserve the right not to pay this bonus.

The benchmark index account is a S&P 500® One-Year Annual PtP with 100% PAR w/ CAP Rate and a 0% floor. The

maximum illustrated rate for an available index cannot exceed the interest generated from the excess option budget

above the allowance generated by the lesser of 1) benchmark index account historical returns and 2) 145% of F&G

Annuities and Life’s portfolio rate net of investment expense and default risk charges.

The "S&P 500 Index" is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”)

and has been licensed for use by F&G Annuities & Life Company. Standard & Poor’s® and S&P® are registered

trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a

registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); These trademarks have been licensed

for use by SPDJI and sublicensed for certain purposes by F&G Annuities & Life Company. This Life Insurance product

is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such

parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability

for any errors, omissions, or interruptions of the S&P 500 Index.

It is important to note the DJ US Real Estate Daily Risk Control 10% USD Total Return Index was first calculated on

June 2, 2013. All index value information presented prior to this date for this index is created through back-testing.

Back-tested performance is not actual performance; it is hypothetical.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 10 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

The "DJ US Real Estate Daily Risk Control 10% USD Total Return Index" is a product of S&P Dow Jones Indices LLC,

a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by Fidelity & Guaranty Life Insurance

Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a

division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow

Jones”); These trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Fidelity &

Guaranty Life Insurance Company. This Life Insurance product is not sponsored, endorsed, sold or promoted by SPDJI,

Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the

advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the

DJ US Real Estate Daily Risk Control 10% USD Total Return Index.

It is important to note the Barclays Trailblazer Sectors 5 Index was first calculated on July 5, 2016. All index value

information presented prior to this date for this index is created through back-testing. Back-tested performance is not

actual performance; it is hypothetical.

Barclays Bank PLC and its affiliates ("Barclays") is not the issuer or producer of Index-Linked Universal Life Policies

and Barclays has no responsibilities, obligations or duties to contract owners of Index-Linked Universal Life Policies.

The Index is a trademark owned by Barclays Bank PLC and licensed for use by F&G Annuities & Life Company as the

Issuer of Index-Linked Universal Life Policies.

Additionally, with respect to the Gold Price, daily values are not available prior to 1968. All Gold Price information

presented prior to 1968 is based on annual back-tested information. Back-tested performance is not actual

performance; it is hypothetical.

ICE BENCHMARK ADMINISTRATION LIMITED MAKES NO WARRANTY, EXPRESS OR IMPLIED, EITHER AS

TO THE RESULTS TO BE OBTAINED FROM THE USE OF THE LBMA GOLD PRICE AND/OR THE FIGURE AT

WHICH THE LBMA GOLD PRICE STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DAY OR

OTHERWISE. ICE BENCHMARK ADMINISTRATION MAKES NO EXPRESS OR IMPLIED WARRANTIES OF

MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE FOR USE WITH RESPECT TO F&G GOLD.

PRECIOUS METALS LIMITED OWNS THE “LBMA GOLD PRICE” TRADE MARK.

Account Allocation Dates

Net premiums (total premium less applicable charges and expenses) will earn interest in a short-term Fixed Rate

Account until the next available account allocation date. Currently, this short-term account is crediting 4.25%.

Account Value allocation dates occur on the 15th of each month. Premiums received less than two business days

before the 15th will remain in the short-term Fixed Rate Account until the 15th of the following month. On the Account

Value allocation date, the net premium plus interest earned in the short-term Fixed Rate Account will be allocated

among the Fixed Rate Account, S&P 500® Fixed Indexed Account, Gold Price Option, DJ US Real Estate Daily Risk

Control 10% USD Total Return Index Account and Barclays Trailblazer Sectors 5 Point to Point with a Spread and PAR

option per your request.

Notification of any requested allocation changes must be provided at least 30 days prior to the Account Value

allocation anniversary date.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 11 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

How the Interest Crediting Works

Unless specified differently in the interest crediting strategy descriptions, interest is credited daily at a rate of 0.25%.

Additional interest may be credited on each segment anniversary date. The interest rate for the Fixed Rate Account will

be declared at the beginning of each 12-month crediting period. Interest is credited daily in the Fixed Rate Account at

a rate of 0.25%. The additional interest credited on the segment anniversary is equal to the declared annual rate less

the 0.25% that had been credited throughout the 12-month crediting period. The current rate for the Fixed Rate

Account is 4.25%.

The additional interest that may be credited to the indexed accounts is based on formulas linked to changes in an

external index over a 12-month period. Note that the 12-month crediting period is based upon the date the account

value is moved into an indexed account, not the calendar year or the policy year.

For the Barclays Trailblazer Sectors 5 Point to Point with a Spread and a PAR Account , interest is credited

daily at a rate of 0.25%. The additional interest is calculated by multiplying the end of crediting period Account Value by

the percentage change in the Barclays Trailblazer Sectors 5 Index over the same period of time, subject to a Spread

Rate, a Participation Rate and a minimum rate of 0.25%, less the 0.25% that had been credited throughout the

12-month crediting period. The Spread Rate and Participation Rate are set on each monthly account allocation date

and will be applied in the calculation of the interest credit at the end of the 12-month period. The current Spread Rate is

0.00% and the current Participation Rate is 165% meaning that this Account would earn interest equal to the

corresponding change in the Barclays Trailblazer Sectors 5 Index less the Spread Rate of 0.00% times by the

Participation Rate of 165%. If Barclays Trailblazer Sectors 5 Index experiences a decline over the 12-month crediting

period, no additional interest will be credited beyond the 0.25% that had been credited daily throughout the 12-month

crediting period. It is important to note that when the declared Participation Rate is greater than 100% and the Index

Change percentage at the end of the Index Crediting Period is zero or negative, no index interest credits will be applied

to the Account Value. Volatility control seeks to provide smoother returns and mitigate sharp market fluctuations. While

this type of strategy can lessen the impact of market downturns, it can also lessen the impact of market upturns,

potentially limiting upside potential.

For the DJ US Real Estate Daily Risk Control 10% USD Total Return Index Account, interest is credited daily at

a rate of 0.25%. The additional interest is calculated by multiplying the end of crediting period Account Value by the

percentage change in the DJ U.S. Real Estate Daily Risk Control 10% TR Index over the same period of time, subject

to an Index Interest Credit Adjustment Rate (Spread Rate) and a minimum rate of 0.25%, less the 0.25% that had been

credited throughout the 12-month crediting period. The Spread Rate is set on each monthly account allocation date

and will be applied in the calculation of the interest credit at the end of the 12-month period. The current Spread Rate is

1.50% meaning that this Account would earn interest equal to the corresponding change in the DJ U.S. Real Estate

Daily Risk Control 10% TR Index less the Spread Rate of 1.50%. If the DJ U.S. Real Estate Daily Risk Control 10% TR

Index experiences a decline over the 12-month crediting period, no additional interest will be credited beyond the

0.25% that had been credited daily throughout the 12-month crediting period. Volatility control seeks to provide

smoother returns and mitigate sharp market fluctuations. While this type of strategy can lessen the impact of market

downturns, it can also lessen the impact of market upturns, potentially limiting upside potential.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 12 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

For the S&P 500® Fixed Indexed Account, interest is credited daily at a rate of 0.25%. The additional interest is

calculated by multiplying the end of crediting year Account Value by the percentage change in the S&P 500® Index over

the same period of time, subject to a maximum rate (CAP Rate) and a minimum rate of 0.25%, less the 0.25% that had

been credited throughout the 12-month crediting period. The CAP Rate, guaranteed not to be less than 1.00%, is set

on each monthly segment crediting period. The current CAP Rate is 11.50%, meaning that this segment would earn

interest equal to the corresponding change in the S&P 500® Index up to a maximum of 11.50%. If the S&P 500® Index

experiences a decline over the 12-month crediting period, no additional interest will be credited beyond the 0.25% that

had been credited daily throughout the 12-month crediting period.

For the Gold Price Option, interest is credited daily at a rate of 0.25%. The additional interest is calculated by

multiplying the end of crediting year Account Value by the percentage change in the Gold Price over the same period of

time, subject to a maximum rate (CAP Rate) and a minimum rate of 0.25%, less the 0.25% that had been credited

throughout the 12-month crediting period. The CAP Rate, guaranteed not to be less than 1.00%, is set on each monthly

account allocation date and will be applied in the calculation of the interest credit at the end of the 12-month period.

The current CAP Rate is 15.00%, meaning that this Account would earn interest equal to the corresponding change in

the Gold Price up to a maximum of 15.00%. If the Gold Price experiences a decline over the 12-month crediting

period, no additional interest will be credited beyond the 0.25% that had been credited daily throughout the 12-month

crediting period.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 13 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Life Insurance Cost Information

Net Payment Cost Index at 5% Surrender Cost Index at 5%

Year Guaranteed Non-Guaranteed Guaranteed Non-Guaranteed

10 15.41 15.07 11.83 7.37

20 15.09 14.13 12.08 4.48

Projected annual cost indices are based upon assumed interest and current Cost of Insurance rates and are not

guaranteed. There are two types of cost indices: 1) Net Payment Cost Index which helps you compare your costs if you

don't give up your policy before its coverage ends; 2) Surrender Cost Index which helps you compare the costs

between two policies if you give up the policy and take out the Surrender Value.

Favorable Tax Treatment

In order to receive favorable federal tax treatments on distributions (including loans), a life insurance policy must satisfy

a 7-Pay Premium limitation during the first seven policy years. A new 7-year limitation will be imposed after certain

policy changes. Failure to satisfy this limitation would cause your policy to be considered a Modified Endowment

Contract (MEC). Distributions under a MEC are taxable to the extent there is a gain in the contract. In addition, with

certain exceptions, there is a non-deductible penalty tax equal to 10% of the taxable distribution, if a policy distribution

is made before Age 59 1/2. In any case, a gain in the contract is taxable upon full surrender of the policy. Based on the

initial 7-Pay Premium, the premiums illustrated during the first 7 policy years are within the limitation for favorable

status.

In order to receive favorable federal income tax treatment on the policy Death Benefit, the premium paid on a life

insurance policy must not exceed the maximum Guideline Premium Limitation. The limitation is equal to the greater of

(a) the Guideline Single Premium or (b) the cumulative sum of the Guideline Level Premiums paid annually. If the

maximum guideline premium limitation is exceeded, the policy will no longer be considered life insurance. The policy

owner will be taxed on the gain in the policy each year even if a cash distribution is not made. However, the policy

Death Benefit will generally be income tax-free when paid to the beneficiary.

The policy values displayed below reflect the assumptions at the date of issue and do not reflect any policy changes.

Target: $1,596.00 GL Single: $32,306.73

7-Pay: $7,370.89 GL Annual: $6,187.25

Monthly Min No-Lapse: $55.00

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 14 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Historical Performance Summary

The index account rates shown in this illustration are subject to a maximum regulatory rate, which is

based on the Benchmark Index Account as defined in Actuarial Guideline 49.A. The maximum

illustrated increase for all illustrated indices is the supplemental option budget plus the lesser of the 1)

Benchmark Index Account average from all of the 25 year rolling periods over the last 65 years when

subject to the current CAP Rates, PAR rates and Spread rates, and 2) 145% of F&G Annuities and

Life's portfolio rate less investment expense and default risk.

The following table shows the actual historical index price changes and corresponding hypothetical

index account increases using the guaranteed minimum rates and the current index CAP Rates, PAR

rates and Spread rates for the most recent 20-year period.

S&P 500® Gold Price Dow Jones Dow Jones Barclays Annual

Annual Point Annual Point to U.S. Annual Point to Barclays Point to Point

to Point Point 100% Real Estate Point 100% PAR Trailblazer with 0.00%

S&P 500® 100% PAR Gold PAR with Daily Risk with 1.50% Sectors 5 Spread and

Start Year End Year Index with 11.50% Price 15.00% CAP Control Spread Index 165% PAR

12/15/2000 12/15/2001 -13.55% 0.25% 2.74% 2.74% 9.85% 8.35% N/A N/A

12/15/2001 12/15/2002 -19.74% 0.25% 19.89% 15.00% 4.41% 2.91% N/A N/A

12/15/2002 12/15/2003 17.32% 11.50% 22.37% 15.00% 26.81% 25.31% N/A N/A

12/15/2003 12/15/2004 12.89% 11.50% 7.73% 7.73% 23.97% 22.47% N/A N/A

12/15/2004 12/15/2005 5.41% 5.41% 15.32% 15.00% 7.82% 6.32% 0.18% 0.30%

12/15/2005 12/15/2006 12.29% 11.50% 23.21% 15.00% 26.50% 25.00% 4.39% 7.25%

12/15/2006 12/15/2007 1.32% 1.32% 26.77% 15.00% -4.25% 0.25% -0.51% 0.25%

12/15/2007 12/15/2008 -39.93% 0.25% 4.46% 4.46% -2.53% 0.25% -5.60% 0.25%

12/15/2008 12/15/2009 27.56% 11.50% 35.84% 15.00% 11.04% 9.54% 2.66% 4.39%

12/15/2009 12/15/2010 11.49% 11.49% 23.77% 15.00% 10.25% 8.75% 7.42% 12.24%

12/15/2010 12/15/2011 -1.58% 0.25% 13.34% 13.34% 2.18% 0.68% 10.28% 16.97%

12/15/2011 12/15/2012 17.65% 11.50% 7.74% 7.74% 8.16% 6.66% 9.01% 14.86%

12/15/2012 12/15/2013 24.90% 11.50% -27.19% 0.25% 4.50% 3.00% 6.02% 9.94%

12/15/2013 12/15/2014 11.37% 11.37% -2.07% 0.25% 20.91% 19.41% 14.31% 23.61%

12/15/2014 12/15/2015 2.70% 2.70% -12.22% 0.25% 0.81% 0.25% -3.97% 0.25%

12/15/2015 12/15/2016 10.70% 10.70% 6.17% 6.17% 2.35% 0.85% 7.06% 11.65%

12/15/2016 12/15/2017 18.29% 11.50% 11.33% 11.33% 11.79% 10.29% 12.30% 20.30%

12/15/2017 12/15/2018 -4.85% 0.25% -1.03% 0.25% -4.34% 0.25% -7.53% 0.25%

12/15/2018 12/15/2019 25.35% 11.50% 19.03% 15.00% 13.00% 11.50% 15.78% 26.04%

12/15/2019 12/15/2020 15.77% 11.50% 25.22% 15.00% 1.73% 0.25% -0.11% 0.25%

10 Year Average 11.58% 8.17% 2.91% 6.78% 5.88% 5.14% 6.05% 12.03%

20 Year Average 5.31% 7.27% 10.10% 9.31% 8.36% 7.80% N/A N/A

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 15 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Charges & Expense

Non-Guaranteed Assumptions Current Interest of 6.94% End of Year

Planned Premium Rider

Premium Expense Cost of Expense Cost of Interest Account Surrender Net Death

Age Year Outlay Charge Insurance Charge Insurance Earned Value Value Benefit

46 1 1,596 120 58 420 0 3 1,002 0 101,002

47 2 1,596 120 76 420 0 73 2,055 0 102,055

48 3 1,596 120 99 420 0 147 3,159 845 103,159

49 4 1,596 120 121 420 0 223 4,317 2,067 104,317

50 5 1,596 120 132 420 0 304 5,545 3,343 105,545

51 6 1,596 120 150 420 0 389 6,840 4,702 106,840

52 7 1,596 120 176 420 0 478 8,199 6,108 108,199

53 8 1,596 120 205 420 0 572 9,623 7,596 109,623

54 9 1,596 120 232 420 0 672 11,118 9,155 111,118

55 10 1,596 120 263 420 0 776 12,689 10,773 112,689

15,960

56 11 1,596 120 300 120 0 921 14,665 12,814 114,665

57 12 1,596 120 345 120 0 1,063 16,740 15,255 116,740

58 13 1,596 120 396 120 0 1,214 18,914 17,796 118,914

59 14 1,596 120 425 120 0 1,371 21,216 20,466 121,216

60 15 1,596 120 457 120 0 1,537 23,652 23,269 123,652

61 16 1,596 120 497 120 0 1,712 26,223 26,223 126,223

62 17 1,596 120 550 120 0 1,897 28,927 28,927 128,927

63 18 1,596 120 611 120 0 2,093 31,764 31,764 131,764

64 19 1,596 120 681 120 0 2,297 34,737 34,737 134,737

65 20 1,596 120 757 120 0 2,511 37,848 37,848 137,848

31,920

66 21 1,596 120 839 120 0 2,737 41,101 41,101 141,101

67 22 1,596 120 926 120 0 2,970 44,502 44,502 144,502

68 23 1,596 120 1,022 120 0 3,216 48,052 48,052 148,052

69 24 1,596 120 1,129 120 0 3,472 51,751 51,751 151,751

70 25 1,596 120 1,253 120 0 3,739 55,594 55,594 155,594

71 26 1,596 120 1,400 120 0 4,015 59,565 59,565 159,565

72 27 1,596 120 1,574 120 0 4,300 63,648 63,648 163,648

73 28 1,596 120 1,779 120 0 4,593 67,819 67,819 167,819

74 29 1,596 120 2,015 120 0 4,894 72,054 72,054 172,054

75 30 1,596 120 2,282 120 0 5,197 76,326 76,326 176,326

47,880

76 31 1,596 120 2,576 120 0 5,503 80,610 80,610 180,610

77 32 1,596 120 2,898 120 0 5,810 84,878 84,878 184,878

78 33 1,596 120 3,255 120 0 6,115 89,094 89,094 189,094

79 34 1,596 120 3,656 120 0 6,416 93,210 93,210 193,210

80 35 1,596 120 4,116 120 0 6,710 97,160 97,160 197,160

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 16 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Charges & Expense

Non-Guaranteed Assumptions Current Interest of 6.94% End of Year

Planned Premium Rider

Premium Expense Cost of Expense Cost of Interest Account Surrender Net Death

Age Year Outlay Charge Insurance Charge Insurance Earned Value Value Benefit

81 36 1,596 120 4,650 120 0 6,991 100,857 100,857 200,857

82 37 1,596 120 5,260 120 0 7,253 104,206 104,206 204,206

83 38 1,596 120 5,958 120 0 7,489 107,094 107,094 207,094

84 39 1,596 120 6,767 120 0 7,691 109,375 109,375 209,375

85 40 1,596 120 7,706 120 0 7,848 110,872 110,872 210,872

63,840

86 41 1,596 120 8,795 120 0 7,947 111,380 111,380 211,380

87 42 1,596 120 10,050 120 0 7,973 110,660 110,660 210,660

88 43 1,596 120 11,480 120 0 7,909 108,446 108,446 208,446

89 44 1,596 120 13,062 120 0 7,737 104,476 104,476 204,476

90 45 1,596 120 13,158 120 0 7,449 100,123 100,123 200,123

91 46 1,596 120 13,158 120 0 7,135 95,456 95,456 195,456

92 47 1,596 120 13,158 120 0 6,797 90,452 90,452 190,452

93 48 1,596 120 13,158 120 0 6,436 85,086 85,086 185,086

94 49 1,596 120 13,158 120 0 6,048 79,332 79,332 179,332

95 50 1,596 120 13,158 120 0 5,633 73,163 73,163 173,163

79,800

96 51 1,596 120 13,158 120 0 5,187 66,548 66,548 166,548

97 52 1,596 120 13,158 120 0 4,709 59,456 59,456 159,456

98 53 1,596 120 13,158 120 0 4,196 51,850 51,850 151,850

99 54 1,596 120 13,158 120 0 3,647 43,696 43,696 143,696

100 55 1,596 120 13,158 120 0 3,058 34,953 34,953 134,953

101 56 1,596 120 13,158 120 0 2,427 25,578 25,578 125,578

102 57 1,596 120 13,158 120 0 1,750 15,526 15,526 115,526

103 58 1,596 120 13,158 120 0 1,023 4,747 4,747 104,747

104 59 1,596 0 0 0 0 0 0 0 0

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 17 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Charges & Expense

Guaranteed Assumptions Interest of 0.25% End of Year

Planned Premium Rider

Premium Expense Cost of Expense Cost of Interest Account Surrender Net Death

Age Year Outlay Charge Insurance Charge Insurance Earned Value Value Benefit

46 1 1,596 144 187 540 0 3 728 0 100,728

47 2 1,596 144 194 540 0 3 1,449 0 101,449

48 3 1,596 144 201 540 0 4 2,165 0 102,165

49 4 1,596 144 210 540 0 6 2,873 623 102,873

50 5 1,596 144 220 540 0 7 3,573 1,371 103,573

51 6 1,596 144 233 540 0 10 4,263 2,124 104,263

52 7 1,596 144 252 540 0 12 4,935 2,844 104,935

53 8 1,596 144 276 540 0 13 5,584 3,557 105,584

54 9 1,596 144 301 540 0 15 6,210 4,247 106,210

55 10 1,596 144 327 540 0 16 6,811 4,896 106,811

15,960

56 11 1,596 144 352 540 0 17 7,389 5,538 107,389

57 12 1,596 144 375 540 0 19 7,945 6,461 107,945

58 13 1,596 144 399 540 0 20 8,479 7,361 108,479

59 14 1,596 144 425 540 0 22 8,988 8,238 108,988

60 15 1,596 144 457 540 0 23 9,466 9,083 109,466

61 16 1,596 144 497 540 0 24 9,906 9,906 109,906

62 17 1,596 144 550 540 0 26 10,294 10,294 110,294

63 18 1,596 144 611 540 0 26 10,622 10,622 110,622

64 19 1,596 144 681 540 0 26 10,879 10,879 110,879

65 20 1,596 144 757 540 0 27 11,062 11,062 111,062

31,920

66 21 1,596 144 839 540 0 29 11,164 11,164 111,164

67 22 1,596 144 926 540 0 29 11,180 11,180 111,180

68 23 1,596 144 1,022 540 0 29 11,099 11,099 111,099

69 24 1,596 144 1,129 540 0 27 10,910 10,910 110,910

70 25 1,596 144 1,253 540 0 26 10,595 10,595 110,595

71 26 1,596 144 1,400 540 0 26 10,134 10,134 110,134

72 27 1,596 144 1,574 540 0 24 9,497 9,497 109,497

73 28 1,596 144 1,779 540 0 22 8,652 8,652 108,652

74 29 1,596 144 2,015 540 0 21 7,571 7,571 107,571

75 30 1,596 144 2,282 540 0 17 6,219 6,219 106,219

47,880

76 31 1,596 144 2,576 540 0 13 4,569 4,569 104,569

77 32 1,596 144 2,898 540 0 8 2,591 2,591 102,591

78 33 1,596 144 3,255 540 0 3 251 251 100,251

79 34 1,596 0 0 0 0 0 0 0 0

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 18 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

Wealth Transfer

Life Insurance Tax-Free Death Benefit

Initial Face Amount: $100,000

Cash Value Accumulation

Tax-Deferred Accumulation Policy has the potential to accumulate tax-deferred cash value that may

provide tax-free income distributions through the use of policy loans and

withdrawals for retirement income, college expenses or help with life's

emergencies.¹

At Age 70: $55,594 At Age 90: $100,123²

Living Benefits

Accelerated Death Benefits for: Critical Illness Amount available at age 70 (Minor): $55,594

Terminal Illness Amount available at age 70: $143,609

Critical Illness Rider

Terminal Illness Rider

The use of one benefit may reduce or eliminate other policy and rider benefits

Supplemental Riders

Added Benefits Included Rider

∙ OPR - Overloan Protection Rider

Optional Riders ³

∙ STR - Spousal Term Rider

∙ LTR - Primary Insured Level Term Life Insurance Rider

∙ CTR - Child Term Rider

∙ WMD - Waiver of Monthly Deduction

∙ ABR - Accidental Benefit Rider

Please refer to the basic illustration for guaranteed elements and other information.

¹ IRC §101(a)(1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning your individual situation. Policy

loans and withdrawals reduce the policy's cash value and death benefit and may result in a taxable event. Withdrawals up to basis paid into the contract

and loans thereafter will not create an immediate taxable event, but substantial tax ramifications could result upon contract lapse or surrender.

Surrender charges will reduce the policy's cash values in early years. Policy loans and withdrawals reduce the policy's cash value and death benefit and

may result in a taxable event.

² These values assume current charges and interest. Benefits and values are not guaranteed. The assumptions on which they are based, are subject to

change by the insurer and actual results may be more or less favorable than those shown.

³ Riders are optional and may require additional premium.

This presentation is not valid unless accompanied by a complete insurance company illustration. Please see the Ledger for guaranteed values and other

important information.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 19 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

Summary of Coverages Product: F&G Gold Face Amount: $100,000

Prepared for: State: CA Death Benefit Option: B (Increasing)

Rogelio Pineda Male, Age 45, Nontobacco Initial Premium: $133.00 Monthly

Riders: OPR CIR TIR

The Accelerated Benefit Riders (ABR)¹ offer you flexibility to access your

death benefit if you have a qualifying Terminal or Critical Illness.² The

non-guaranteed projected values are based on Rogelio Pineda.

Terminal Illness

As an example, if the full, available death benefit is accelerated, the discounted benefit for Rogelio Pineda would

be about $143,609 at age 70.

Critical Illness

The table below projects the approximate net amount paid if the full available death benefit is accelerated through the

Critical Illness Rider.

Attained Category 1 Category 2 Category 3 Category 4

Age Minor Moderate Severe Critical

50 16,026 26,710 51,010 76,791

60 23,269 44,769 73,822 96,418

70 55,594 71,091 97,183 124,531

80 97,160 97,160 113,291 152,183

The use of one benefit may reduce or eliminate other policy and rider benefits.

The sample benefits shown assume current accelerated benefits mortality tables, projected illustrated rate of 4.50% and an acceleration discount rate of

5.50%. The benefits and values shown above are not guaranteed. The assumptions on which they are based are subject to change by the insurer. Actual

results may be more or less favorable. This presentation is not valid unless accompanied by a complete insurance company illustration.

¹ Accelerated Benefit Riders are included, available with no additional premium, and may not be available in all states. Please refer to the Narrative

Summary for details regarding the Accelerated Benefit Riders available in the state selected for this presentation.

² The Terminal and Critical Illness riders are not available on policies approved with an underwriting rating greater than Table 4. The Terminal Illness and

Critical Illness riders are not available on any policies having temporary or permanent flat extra rating charges.

Option B contracts include the acceleration of death benefit and the pro-rata portion of the account value released upon request.

This is an illustration only, not an offer, contract, or promise of future policy performance. Coverage is subject to the terms and conditions of the policy.

This illustration is not valid without all 20 pages.

Agent: Please fill in name Page 20 of 20 10-6.1.0.4

October 20, 2021 ADV 2325 (Nov-2019) 19-1335 Form number: LPI-2003(1-19), ICC19-2003(1-19)

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Sun Smarter Life ClassicDocument7 pagesSun Smarter Life Classicpaul jan sarachoNo ratings yet

- Pest AnalysisDocument8 pagesPest Analysisapi-349360097100% (1)

- Intercontinental Hotels Group - Your Reservation ConfirmationDocument3 pagesIntercontinental Hotels Group - Your Reservation ConfirmationKathleen BuckleyNo ratings yet

- Agrodok-17-Cultivation of Tomato PDFDocument93 pagesAgrodok-17-Cultivation of Tomato PDFrpine3580% (5)

- Croatian Book MarketDocument16 pagesCroatian Book MarketMaNo ratings yet

- Bittoo Kaushik Rocksolid Term Plan 10164Document6 pagesBittoo Kaushik Rocksolid Term Plan 10164meet15062024No ratings yet

- Abhinash Khanra Rocksolid Term Plan 10167Document6 pagesAbhinash Khanra Rocksolid Term Plan 10167meet15062024No ratings yet

- Wilson Dana 54fDocument7 pagesWilson Dana 54fSelma T. WadeNo ratings yet

- Basilan R Startup 13092023140753Document4 pagesBasilan R Startup 13092023140753Rogelio EscobarNo ratings yet

- IllustrationDocument4 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Variable Life Insurance Proposal: 0PROP.07.4Document4 pagesVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNo ratings yet

- J.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页Document85 pagesJ.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页HungNo ratings yet

- Sustainability FormDocument1 pageSustainability Formsurya gokulNo ratings yet

- IllustrationDocument3 pagesIllustrationBujji Bangaram VelagaletiNo ratings yet

- IllustrationDocument2 pagesIllustrationRanjit PanigrahiNo ratings yet

- Reliance Health Gain Proposal FormDocument11 pagesReliance Health Gain Proposal FormdharamameNo ratings yet

- Quotation (100k)Document34 pagesQuotation (100k)Japol ArbanNo ratings yet

- Variable Life Insurance ProposalDocument7 pagesVariable Life Insurance ProposalAljunBaetiongDiazNo ratings yet

- 1684 - Hemal Patel PPT 7 - 845Document6 pages1684 - Hemal Patel PPT 7 - 845jdchandrapal4980No ratings yet

- State Life Insurance (Pakistan) - Golden Endovement UpdatedDocument8 pagesState Life Insurance (Pakistan) - Golden Endovement UpdatedAsim AliNo ratings yet

- Benefit Illustration-Metlife Major Illness Premium Back CoverDocument4 pagesBenefit Illustration-Metlife Major Illness Premium Back CoverGD SinghNo ratings yet

- Reliance Health Infinity Proposal Form NewDocument9 pagesReliance Health Infinity Proposal Form Newashwin_gajghateNo ratings yet

- IllustrationDocument2 pagesIllustrationGanesh Raaja NatarajanNo ratings yet

- Amrit Singh Rocksolid Term Plan 10169Document6 pagesAmrit Singh Rocksolid Term Plan 10169meet15062024No ratings yet

- Illustration (12) RRDocument1 pageIllustration (12) RRShub KumarNo ratings yet

- Mukesh Singh Term Plan 1 CR 10162Document6 pagesMukesh Singh Term Plan 1 CR 10162meet15062024No ratings yet

- The Illustration Is Not Part of Insurance Contract: Product Details A. InsuredDocument3 pagesThe Illustration Is Not Part of Insurance Contract: Product Details A. InsuredDeny KosasihNo ratings yet

- c549992e-cba1-4e32-9e08-7f8ff2a6d613Document7 pagesc549992e-cba1-4e32-9e08-7f8ff2a6d613vonamal985No ratings yet

- Umang DemoDocument7 pagesUmang DemoAvinash SinghNo ratings yet

- SmartPlatinaPlus08042022 535458Document3 pagesSmartPlatinaPlus08042022 535458Srigandh's WealthNo ratings yet

- Quotation No: E01282020154539546865 Product Suitability Assessment ReportDocument4 pagesQuotation No: E01282020154539546865 Product Suitability Assessment ReportSivakumar MettaNo ratings yet

- PDFDocument5 pagesPDFVaibhav SamelNo ratings yet

- Illustration (17) - 2023-12-16T143609.487Document2 pagesIllustration (17) - 2023-12-16T143609.487shailendra.goswamiNo ratings yet

- HDFC Life Immediate Annuity Benefit IllustrationsDocument2 pagesHDFC Life Immediate Annuity Benefit IllustrationsgitirNo ratings yet

- A Life Insurance Illustration: Narrative SummaryDocument11 pagesA Life Insurance Illustration: Narrative SummarylinotalleyNo ratings yet

- WeeNNglHvNqn1597554384894 PDFDocument1 pageWeeNNglHvNqn1597554384894 PDFM VARAPRASADREDDYNo ratings yet

- Berkshire Hathaway Balance Sheet Analysis (EXCELLENT)Document38 pagesBerkshire Hathaway Balance Sheet Analysis (EXCELLENT)Michael Cano LombardoNo ratings yet

- Grip Leaflet LatestDocument14 pagesGrip Leaflet LatestsaurabNo ratings yet

- Amit Grow Income10166Document5 pagesAmit Grow Income10166meet15062024No ratings yet

- BB050523125230716Document1 pageBB050523125230716chidambari SahooNo ratings yet

- Arjun KumarDocument5 pagesArjun Kumarmeet15062024No ratings yet

- 2021 Insurance Ma OutlookDocument32 pages2021 Insurance Ma Outlook7gs7gnc48tNo ratings yet

- State Farm Life Insurance Company DISCLOSUREDocument10 pagesState Farm Life Insurance Company DISCLOSUREapi-19229242No ratings yet

- GAP Quotation Turners-V1Document1 pageGAP Quotation Turners-V1anil playstationNo ratings yet

- Amardeep Icici Term Plan 11390Document6 pagesAmardeep Icici Term Plan 11390meet15062024No ratings yet

- Kamal Kumar Rakshak Smart 10164Document5 pagesKamal Kumar Rakshak Smart 10164meet15062024No ratings yet

- BABY SHARMA Active IncomeDocument8 pagesBABY SHARMA Active Incomeamitfeb19No ratings yet

- Singlife Elite TermDocument8 pagesSinglife Elite TermDaniel OonNo ratings yet

- Mr. Harish Chand: Endowment Plus' Is An Unmatched Unit LinkedDocument5 pagesMr. Harish Chand: Endowment Plus' Is An Unmatched Unit LinkedHarish ChandNo ratings yet

- Policy Math - 10-03-2024 - 10.14.49Document4 pagesPolicy Math - 10-03-2024 - 10.14.49Blaze Rapper AniketNo ratings yet

- SmartElite19072022 8468161Document3 pagesSmartElite19072022 8468161manishNo ratings yet

- SmartPlatinaPlus13072022 3826354Document3 pagesSmartPlatinaPlus13072022 3826354Srigandh's WealthNo ratings yet

- Karan Chadha GROWDocument5 pagesKaran Chadha GROWmeet15062024No ratings yet

- Ashutosh BI311254464Document5 pagesAshutosh BI311254464meet15062024No ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- FormsDocument18 pagesFormsvishan techNo ratings yet

- Canara HSBC (10 - 15)Document4 pagesCanara HSBC (10 - 15)AbhishekNo ratings yet

- Sanjeev Kumar Grow 10162Document3 pagesSanjeev Kumar Grow 10162meet15062024No ratings yet

- Form For Suitability AnalysisDocument19 pagesForm For Suitability AnalysismrinalbohraNo ratings yet

- Reating Lif: Child Protection Money Back PlanDocument2 pagesReating Lif: Child Protection Money Back PlanSanjay Ku AgrawalNo ratings yet

- Illustration - 2022-08-31T154243.769Document3 pagesIllustration - 2022-08-31T154243.769Soumen BeraNo ratings yet

- E - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Document2 pagesE - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Sabarish T ENo ratings yet

- Streblus Asper PDFDocument6 pagesStreblus Asper PDFrpine35No ratings yet

- Fruits 2Document3 pagesFruits 2rpine35No ratings yet

- Avocado ReportDocument22 pagesAvocado Reportrpine35No ratings yet

- Growing Vegetables in Containers: There Are 6 Major Considerations in Container GardeningDocument2 pagesGrowing Vegetables in Containers: There Are 6 Major Considerations in Container Gardeningrpine35No ratings yet

- Antixodant of Gynura ProcumbenDocument10 pagesAntixodant of Gynura Procumbenrpine35No ratings yet

- Chillipepper Capiscum Frutescens, Hdra LeafletDocument2 pagesChillipepper Capiscum Frutescens, Hdra Leafletrpine35No ratings yet

- Table 14.2: Vegetable Gardening at A Glance: How To Plant and StoreDocument2 pagesTable 14.2: Vegetable Gardening at A Glance: How To Plant and Storerpine35No ratings yet

- 16 - SST-Eng2007Document1 page16 - SST-Eng2007rpine35No ratings yet

- Chile Cost and Return Estimates, 2008: Guide Z-113Document4 pagesChile Cost and Return Estimates, 2008: Guide Z-113rpine35No ratings yet

- Case AnalysisDocument9 pagesCase AnalysisRai ChanNo ratings yet

- Aima0106 Strategy PaperDocument11 pagesAima0106 Strategy PaperMichael VersageNo ratings yet

- CÂU HỎI TRẮC NGHIỆM IRP 1Document4 pagesCÂU HỎI TRẮC NGHIỆM IRP 1Nhi PhanNo ratings yet

- Alan Shapiro and Peter Moles: International Financial Management 1st Edition John Wiley & Sons, IncDocument40 pagesAlan Shapiro and Peter Moles: International Financial Management 1st Edition John Wiley & Sons, Incdini6483No ratings yet

- Connect Southeast Michigan Financial AnalysisDocument45 pagesConnect Southeast Michigan Financial AnalysisAnonymous dp5b3X1NA0% (1)

- PDF26 2Document182 pagesPDF26 2Issac EbbuNo ratings yet

- The 3 Rules of Successful Swing TradingDocument12 pagesThe 3 Rules of Successful Swing TradingSandra Xavier100% (2)

- POSTTESTDocument4 pagesPOSTTESTJen BernardoNo ratings yet

- Decision Analysis:: Nur Aini MasrurohDocument28 pagesDecision Analysis:: Nur Aini MasrurohluqitraNo ratings yet

- Batangas City Rural Improvement Club: Page 1 of 18Document18 pagesBatangas City Rural Improvement Club: Page 1 of 18mary roseNo ratings yet

- Baby Anjali Manyam Journal 4 3470312 1898071800Document5 pagesBaby Anjali Manyam Journal 4 3470312 1898071800anjaNo ratings yet

- SPAMILTON Deal Sheet 21-22 - 50 50 SplitDocument1 pageSPAMILTON Deal Sheet 21-22 - 50 50 SplitJeremy Joseph EhlingerNo ratings yet

- ST-Weekly OptionsDocument40 pagesST-Weekly OptionsErnie DaysNo ratings yet

- JMET 2005 Original PaperDocument59 pagesJMET 2005 Original PaperBrian Williams0% (1)

- Export ManagementDocument32 pagesExport ManagementArun Mishra100% (1)

- Kirloskar Ferrous Industries Limited, KoppalDocument69 pagesKirloskar Ferrous Industries Limited, KoppalAmar G Patil0% (1)

- Ch4 Tendering ProceduresDocument14 pagesCh4 Tendering ProcedureshaNo ratings yet

- RELIGAREDocument29 pagesRELIGAREMurali KrishnaNo ratings yet

- Total Cost $15,000,000Document4 pagesTotal Cost $15,000,000Arianne Shae DomingoNo ratings yet

- Pivot Points and CandlesticksDocument4 pagesPivot Points and CandlesticksMisterSimpleNo ratings yet

- Solution To Exercise Strategic Analysis of Operating IncomeDocument4 pagesSolution To Exercise Strategic Analysis of Operating IncomeTONG, HANS KENNETH N.No ratings yet

- 6.1 - Government Economic Policies and ObjectivesDocument4 pages6.1 - Government Economic Policies and ObjectivesTYDK MediaNo ratings yet

- CON103 Assessment 3Document8 pagesCON103 Assessment 3john fordNo ratings yet

- Chapter - 8 - Cost-Volume-Profit Analysis - UETDocument19 pagesChapter - 8 - Cost-Volume-Profit Analysis - UETZia UddinNo ratings yet

- Sector Analysis of BFSI - Axis BankDocument11 pagesSector Analysis of BFSI - Axis BankAbhishek Kumawat (PGDM 18-20)No ratings yet

- Sample Food Business PlanDocument17 pagesSample Food Business Planhana_kimi_91No ratings yet

- ChapterDocument3 pagesChapterLê UyênNo ratings yet