Professional Documents

Culture Documents

AFAR - Points To Remember

AFAR - Points To Remember

Uploaded by

colandogangela18Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR - Points To Remember

AFAR - Points To Remember

Uploaded by

colandogangela18Copyright:

Available Formats

PARTNERSHIP

A. FORMATION

1. closing of temporary withdrawals @ year-end to capital account

2. advances to partners (pship receivable) vs. advances from partners (pship liability)

3. capital ratio vs. profit ratio

4. NCA measurement hierarchy: (AFAC)

i. agreed value

ii. FMV

iii. appraised value

iv. carrying value/BV

5. services = memo entry

6. TCC = TAC full investment approach / bonus method

TCC > TAC

TCC < TAC

7. Industrial partner = GR: NO share in net LOSS;

except: if waived

profit = i. agreement

ii. just and equitable share

8. accumulated depreciation = NOT carried forward 0

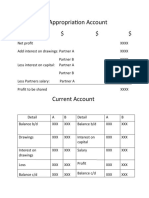

B. OPERATION

1. salaries and interest = time proportioned

2. bonus basis: positive

3. if B/I/S = profit distribution, (NY = before deduction of B/I/S)

if B/I/S = treated as expense, (NY = after deduction of B/I/S)

share in NY = no B/I/S

total income in partnership = included B/I/S

o share in NY = B/I/S is not included in computation

o capital balance = B/I/S is included in computation

4. Beginning Capital Total adjusted capital

add: Additional investments add: adjusted liabilities

less: Capital withdrawals (permanent) Total Assets

Ending Capital after closing

5. Weighted Average Capital computation: let “n” be:

Investment (Permanent Withdrawal) no. of months to 12/31 Total

xx (xx) n/12 xxx

6. “WAC” vs “Annual WAC”

**illustration: March to December

WAC = n/10 x interest% x 10/12

AWAC = n/12 x interest%

7. if remainder = negative:

i. agreement

ii. loss ratio

iii. profit ratio

8. allocation of profit (order of priority; insofar as available)

upto extent of NY only (no remainder)

9. if silent, bonus = before S/I/B

10. if 2 years:

Year 2

Y2 (A-L) ending beginning Y1

Y1 + Y2 permanent drawings additional investments Y1 + Y2

Net Income, Y1 & Y2 (cumulative)

divide by : 2 = NY per year (for profit distribution)

11. if bonus% = separated (2 or more partners)

add both, one computation only; then divide accordingly to P/L ratio

12. if there is minimum amount for share in NY:

NY is given = squeeze

NY is being asked = allocate to other partners

13. after allocation of allowances (problem 25 PDJ)

14. if there are 2 options (problem 12 & 13 PDJ)

C. DISSOLUTION

1. ADMISSION OF A PARTNER

(i) No Dissolution - Assignment of Interest

A(80%) B(20%) C(¼) TOTAL

ax bx xxx

(¼ax) ¼ax 0

axx bxx cxx xxx

(ii) Dissolution - Admission by Purchase [“purchased”, “invests but money goes to original partners” ]

A(80%) B(20%) C(¼) TOTAL

ax bx xxx

(¼ax) (¼bx) ¼ab 0

axx bxx cxx xxx

**revaluation/adjustments are recognized

A(80%) B(20%) C(¼) TOTAL paid by C

ax bx xxx x 1/4 = C’s interest (C’s interest)

reval80% reval20% revaluation gain ➗ ¼ = revaluation

axx bxx xxx ***if loss = no revaluation (0)

(¼ax) (¼bx) cash paid 0

axx bxx cxx xxx

(iii) Dissolution - Admission by Investment

A(80%) B(20%) C(¼) TOTAL

TIC ax bx invested xxx

bonus -- + bonus 80% ; 20% -- + diff 0

TAC axx bxx ¼xxx xxx

2. RETIREMENT OF A PARTNER

o sell to outsider

o sell to remaining partner(s)

o sell to the partnership

interest of retiring partner:

capital balance (addtl investement & withdrawals)

P/L from last closing

loans and advances to (from ) the partnership

correction of accounting errors

revaluation of pship assets

3. DEATH OR INCAPACITY OF A PARTNER

4. INCORPORATION OF PARTNERSHIP

You might also like

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Ias 1Document7 pagesIas 1ADEYANJU AKEEMNo ratings yet

- Notes To Partnership Liquidation Final PDFDocument6 pagesNotes To Partnership Liquidation Final PDFKristel SumabatNo ratings yet

- Market Need Analysis Define The Market Need For The New BusinessDocument2 pagesMarket Need Analysis Define The Market Need For The New BusinessCarmela De Juan100% (3)

- Vat-Value Added Tax (Uae) : Naeem IqbalDocument64 pagesVat-Value Added Tax (Uae) : Naeem IqbalAlex ko100% (1)

- Fa11 14Document48 pagesFa11 14adisty astrianiNo ratings yet

- Notes To Partnership Liquidation FinalDocument2 pagesNotes To Partnership Liquidation FinalKristel SumabatNo ratings yet

- P2 NotesDocument13 pagesP2 NotesJayrick James AriscoNo ratings yet

- P2 NotesDocument13 pagesP2 NotesJayrick James AriscoNo ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsgetyourapronreadyNo ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- Format YA 2022Document2 pagesFormat YA 2022sharifah nurshahira sakinaNo ratings yet

- Cash Flow - Format & Problems - 2020Document3 pagesCash Flow - Format & Problems - 2020aaryaNo ratings yet

- Lecture 4Document6 pagesLecture 4ahmedgalalabdalbaath2003No ratings yet

- Statement of Cash FlowDocument6 pagesStatement of Cash FlowNhel AlvaroNo ratings yet

- Partnerships: Igcse - Accounting (9-1) - Mahdi SamdaniDocument5 pagesPartnerships: Igcse - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- Cash Flows StatementsDocument4 pagesCash Flows StatementsMae-shane SagayoNo ratings yet

- IAS 7 - Cashflow StatementsDocument64 pagesIAS 7 - Cashflow StatementsDawar Hussain (WT)No ratings yet

- Conceptual Framework and Acctg Standards 1.9: SolutionDocument4 pagesConceptual Framework and Acctg Standards 1.9: SolutionKrissa Mae LongosNo ratings yet

- Ya2022 - Format Tax Computation Trust BodyDocument4 pagesYa2022 - Format Tax Computation Trust BodyDaniel HaziqNo ratings yet

- Cash Flow Statement Mcqs With AnswerDocument25 pagesCash Flow Statement Mcqs With Answermahesh patilNo ratings yet

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- PartnershipDocument6 pagesPartnershipshafayat177No ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet

- Summary of Basic Conso TechniquesDocument5 pagesSummary of Basic Conso Techniquesutary4s3No ratings yet

- Parcorp OutlineDocument3 pagesParcorp OutlineLia JaneNo ratings yet

- Cash Flow - Format 2021Document3 pagesCash Flow - Format 2021Roy YadavNo ratings yet

- Acc407 CH7 PartnershipDocument26 pagesAcc407 CH7 PartnershipBATRISYIA AMANI MUHAMMAD HALIMNo ratings yet

- Partnership OperationsDocument2 pagesPartnership OperationsKristel SumabatNo ratings yet

- Partnership Dissolution G7Document47 pagesPartnership Dissolution G7Erika PanganNo ratings yet

- AFAR - Until Conso FS HeyheiDocument31 pagesAFAR - Until Conso FS Heyheimisonim.eNo ratings yet

- Consolidated Statement of Financial PositionDocument29 pagesConsolidated Statement of Financial PositionTinashe ZhouNo ratings yet

- Note 2 - Trusts (Excluding Unit Trusts)Document7 pagesNote 2 - Trusts (Excluding Unit Trusts)Nur Dina AbsbNo ratings yet

- Topic 6 Partnership: 6.1 FormationDocument5 pagesTopic 6 Partnership: 6.1 FormationxxpjulxxNo ratings yet

- Accounting Formats For Cambridge Igcse CompressDocument11 pagesAccounting Formats For Cambridge Igcse Compresslegendza010No ratings yet

- Problem 1: SolutionDocument4 pagesProblem 1: Solutionpapa1No ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Preparation of Published Financial StatementsDocument19 pagesPreparation of Published Financial StatementsRuth Nyawira100% (1)

- Form PDF 169865780070823Document9 pagesForm PDF 169865780070823sinchanasrinivas1390No ratings yet

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document18 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Stella SabaoanNo ratings yet

- Ias 1Document8 pagesIas 1daniloorestmarijaniNo ratings yet

- FA2 Chapter 4-Partnership-LiquidationDocument20 pagesFA2 Chapter 4-Partnership-LiquidationAyren Dela CruzNo ratings yet

- Accounts Dav SolutionDocument7 pagesAccounts Dav SolutionTBG ARMYYTNo ratings yet

- Test Your Knowledge (EVA Calculation) 20X7 20X6 Millions MillionsDocument2 pagesTest Your Knowledge (EVA Calculation) 20X7 20X6 Millions MillionsTitus MutambuNo ratings yet

- Key To Correction Theory ProblemDocument13 pagesKey To Correction Theory ProblemEdogawa SherlockNo ratings yet

- Cash Flow Statement Format 2021Document5 pagesCash Flow Statement Format 2021VV MusicNo ratings yet

- General Purpose Financial StatementDocument10 pagesGeneral Purpose Financial Statementfaith olaNo ratings yet

- AST 4-Partnership DissolutionDocument9 pagesAST 4-Partnership DissolutionMarvin MercadoNo ratings yet

- Chapter 9 Ptx1033/Personal TaxDocument10 pagesChapter 9 Ptx1033/Personal TaxNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Accounting For PartershipDocument7 pagesAccounting For Partershipwairimuesther506No ratings yet

- Income Statement and Statement of Financial Position Prepared byDocument7 pagesIncome Statement and Statement of Financial Position Prepared byFakhrul IslamNo ratings yet

- Partnership LiquidationDocument4 pagesPartnership LiquidationMelanie RuizNo ratings yet

- Chapter 23 - Personal Taxation - January 2024Document23 pagesChapter 23 - Personal Taxation - January 2024Aikal HakimNo ratings yet

- 24 EPS s18Document75 pages24 EPS s18Bennie KingNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- Projected P&L and BSDocument9 pagesProjected P&L and BSbipin kumarNo ratings yet

- Grade 12 Income Statement AdjustmentsDocument51 pagesGrade 12 Income Statement Adjustmentsrefilwemagolego34No ratings yet

- 12 Acc. QB Ch. 2Document27 pages12 Acc. QB Ch. 2Himanshu K. SinghNo ratings yet

- Entity Y: Problem 4: Activity 2Document11 pagesEntity Y: Problem 4: Activity 2Christine Eunice RaymondeNo ratings yet

- Topic 7 OF ACCONTINGDocument11 pagesTopic 7 OF ACCONTINGCharlesNo ratings yet

- Quiz 2 Joint ArrangementsDocument4 pagesQuiz 2 Joint ArrangementsJane Gavino100% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- MKTG 303 - Consumer Behaviour: Semester 2 2022Document62 pagesMKTG 303 - Consumer Behaviour: Semester 2 2022Karen ZhangNo ratings yet

- Perdue CaseDocument18 pagesPerdue CaseAbhishek UpadhyayNo ratings yet

- SPACE Matrix Strategic Management MethodDocument3 pagesSPACE Matrix Strategic Management MethodsaeedNo ratings yet

- Chap 12Document23 pagesChap 12Maria SyNo ratings yet

- Corp Gov - TybmsDocument46 pagesCorp Gov - TybmsNurdayantiNo ratings yet

- FMEA: Failure Modes and Effects AnalysisDocument24 pagesFMEA: Failure Modes and Effects AnalysisAlvaro CotaquispeNo ratings yet

- Adv MediaDocument44 pagesAdv MediaFRANCIS JOSEPHNo ratings yet

- Lbs/hrs/units Peso: Fill Up Details (ENCODE) Encoding Area Standard CostDocument5 pagesLbs/hrs/units Peso: Fill Up Details (ENCODE) Encoding Area Standard CostBetchang AquinoNo ratings yet

- Magazine Invest IndonesiaDocument76 pagesMagazine Invest IndonesiaJ.T HalohoNo ratings yet

- Literature Review: The Effect of Online Shops On Consumer: Shopping SatisfactionDocument6 pagesLiterature Review: The Effect of Online Shops On Consumer: Shopping Satisfactionsamantha beatrice apinesNo ratings yet

- P Siva Sankar SBI Statement2Document15 pagesP Siva Sankar SBI Statement2pulapa umamaheswara raoNo ratings yet

- La OpalaDocument28 pagesLa OpalaYash PoddarNo ratings yet

- SQE - Basic AccountingDocument30 pagesSQE - Basic AccountingCristinaNo ratings yet

- Agroindustri Kerupuk BawangDocument8 pagesAgroindustri Kerupuk BawangGrace AngelinaNo ratings yet

- Guppy TradersDocument25 pagesGuppy TradersnepherNo ratings yet

- Accounts Question Paper 1Document4 pagesAccounts Question Paper 1Muskan AgrawalNo ratings yet

- Digital Operating Systems - The Next Generation of Production SystemsDocument13 pagesDigital Operating Systems - The Next Generation of Production Systemston_bela4911No ratings yet

- Project Report On Daraz: Submitted ToDocument45 pagesProject Report On Daraz: Submitted ToShahadat HossainNo ratings yet

- Problem 1: The Accounts of Basudev Manufactures Ltd. For The Year Ended 31st December 1988 Show The FollowingDocument6 pagesProblem 1: The Accounts of Basudev Manufactures Ltd. For The Year Ended 31st December 1988 Show The FollowingrashNo ratings yet

- Solutions Solution Manual10Document96 pagesSolutions Solution Manual10Panit Taesica100% (3)

- The Accounting Cycle: Accruals and DeferralsDocument70 pagesThe Accounting Cycle: Accruals and DeferralsNajat Abizeid SamahaNo ratings yet

- Fdot Staff Hour Estimation Worksheet PackageDocument136 pagesFdot Staff Hour Estimation Worksheet PackagelfamelNo ratings yet

- Ib Business and Management Command TermsDocument2 pagesIb Business and Management Command TermsParul KNo ratings yet

- Zara Is A Brand Which Deals in Clothing and AccessoriesDocument2 pagesZara Is A Brand Which Deals in Clothing and AccessoriesAmna FarooqNo ratings yet

- Sap Fico Guru99Document63 pagesSap Fico Guru99sreevanisathyaNo ratings yet

- Taylormade Renewables Limited: Rating AdvisoryDocument8 pagesTaylormade Renewables Limited: Rating AdvisoryNirdesh Kumar RaviNo ratings yet

- The Relationship Between Corporate Strategy and Capital StructureDocument2 pagesThe Relationship Between Corporate Strategy and Capital StructureAnonymous DR0y6OXufA0% (1)