Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsPCI DSS V4.0 Control Objectives and Requirements

PCI DSS V4.0 Control Objectives and Requirements

Uploaded by

yoursnayakCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- NIS2 Versus ISO27001 - 2022 Versus CIS v8Document5 pagesNIS2 Versus ISO27001 - 2022 Versus CIS v8Vagabond PakistanNo ratings yet

- Stone, Nancy J - Introduction To Human Factors - Applying Psychology To Design-CRC Press Taylor & Francis Group (2018)Document425 pagesStone, Nancy J - Introduction To Human Factors - Applying Psychology To Design-CRC Press Taylor & Francis Group (2018)gioeffe100% (1)

- Navigating PCI DSS v4.0Document24 pagesNavigating PCI DSS v4.0Ivan DoriNo ratings yet

- Telrock SaaS PCI DSS 3.2.1 Responsibility Matrix Updated June 2021Document13 pagesTelrock SaaS PCI DSS 3.2.1 Responsibility Matrix Updated June 2021Noki ChannelNo ratings yet

- BSIA Cyber Secure It January 2019Document16 pagesBSIA Cyber Secure It January 2019nsadnanNo ratings yet

- Adobe Scan Oct 11, 2023Document21 pagesAdobe Scan Oct 11, 2023Siddhant SrivastavaNo ratings yet

- PCI DSS4 Control ListDocument12 pagesPCI DSS4 Control Listkhushbu gargNo ratings yet

- Comparison of PCI DSS and ISO IEC 27001 Standards Joa Eng 0116Document5 pagesComparison of PCI DSS and ISO IEC 27001 Standards Joa Eng 0116penumudi233No ratings yet

- CIS Controls V7.0.1-EBOOK - Parte10Document2 pagesCIS Controls V7.0.1-EBOOK - Parte10sensoketNo ratings yet

- ISO 27001 - Clause 12Document3 pagesISO 27001 - Clause 12pankajNo ratings yet

- Security and Privacy Approach of Cloud Computing EnvironmentDocument4 pagesSecurity and Privacy Approach of Cloud Computing Environment9797047233No ratings yet

- Generic Data Center and Network Operations WorkplanDocument55 pagesGeneric Data Center and Network Operations WorkplanJenniferNo ratings yet

- CIS Controls V7.0.1-EBOOK - Parte9Document2 pagesCIS Controls V7.0.1-EBOOK - Parte9sensoketNo ratings yet

- Software Defined Networking To Support TDocument14 pagesSoftware Defined Networking To Support TLeng Hour lengNo ratings yet

- ArctiqDC Security Threats and Threat Mitigations - 0Document41 pagesArctiqDC Security Threats and Threat Mitigations - 0sayed.shoaib hussainiNo ratings yet

- Improving Security in A Virtual Network by Using Attribute Based Encryption AlgorithmDocument6 pagesImproving Security in A Virtual Network by Using Attribute Based Encryption AlgorithmAditi BhattacharjeeNo ratings yet

- Usage of Embedded Systems For Dos Attack Protection: I. Dodig, D. Cafuta, V. SrukDocument5 pagesUsage of Embedded Systems For Dos Attack Protection: I. Dodig, D. Cafuta, V. SrukSandeep SamantNo ratings yet

- 7137 CompleteMonitoring EG 20230921 WebDocument15 pages7137 CompleteMonitoring EG 20230921 WebTamai Aisea AniseNo ratings yet

- Computing Unit 7 IT Systems Security and Encryption C - DDocument18 pagesComputing Unit 7 IT Systems Security and Encryption C - Dmelvinnana16No ratings yet

- Securing Saas at Scale: Cloud EssentialsDocument12 pagesSecuring Saas at Scale: Cloud Essentialsitsnithin_tsNo ratings yet

- Best Practices For Database SecurityDocument12 pagesBest Practices For Database SecurityAbdullah S. Ben SaeedNo ratings yet

- Deloitte-Cn-Tech-Cloud-Security-Solution - Cyber and CloudDocument23 pagesDeloitte-Cn-Tech-Cloud-Security-Solution - Cyber and CloudloversatriskNo ratings yet

- Managed Security MonitoringDocument3 pagesManaged Security MonitoringMorganNo ratings yet

- Data Base AdministrationDocument3 pagesData Base AdministrationjellobaysonNo ratings yet

- Data Security in Cloud ComputingDocument5 pagesData Security in Cloud ComputingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ModuleDocument12 pagesModulettuhkbNo ratings yet

- IT-Cyber-Security-PolicyDocument14 pagesIT-Cyber-Security-PolicyAleck KitNo ratings yet

- 1.8 Introduction To Networks - Network SecurityDocument3 pages1.8 Introduction To Networks - Network SecurityCristian MoralesNo ratings yet

- Applicability of Blockchain For Synchrophasor NetworkDocument4 pagesApplicability of Blockchain For Synchrophasor Networkashwa1No ratings yet

- Tlik107c R1Document9 pagesTlik107c R1sample nameNo ratings yet

- Application of Co-Operative Encryption To Clouds For Data Security-2018-01-10-7Document4 pagesApplication of Co-Operative Encryption To Clouds For Data Security-2018-01-10-7International Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Paper 42-Security Issues in Software Defined NetworkingDocument6 pagesPaper 42-Security Issues in Software Defined NetworkingJalal MontazeryNo ratings yet

- Audit of Universitys IT Network Security Controls 15-16-2Document26 pagesAudit of Universitys IT Network Security Controls 15-16-2jeithvpnNo ratings yet

- Data Com NetworksDocument6 pagesData Com NetworksGenasky LegaspiNo ratings yet

- K Avian Pour 2017Document4 pagesK Avian Pour 2017Adeel TahirNo ratings yet

- NCRA Report For Sierra Leone MainDocument5 pagesNCRA Report For Sierra Leone MainmckenzieblaqNo ratings yet

- Information Involved in Electronic Messaging Shall Be AppropriDocument8 pagesInformation Involved in Electronic Messaging Shall Be AppropriSara CruzNo ratings yet

- Agents of Digital Change: Securing The Digital EnterpriseDocument9 pagesAgents of Digital Change: Securing The Digital EnterpriseSpin InfluenceNo ratings yet

- C-Org Midterm ReviewerDocument7 pagesC-Org Midterm ReviewerDen-Earl De DiosNo ratings yet

- SocialDocument8 pagesSocialArnold BernasNo ratings yet

- HW SD-WAN 05 SecurityDocument42 pagesHW SD-WAN 05 Securityxem phimNo ratings yet

- Chapter 1fundamental of Software SecurityDocument7 pagesChapter 1fundamental of Software SecurityhaileNo ratings yet

- Security of DBMSDocument6 pagesSecurity of DBMSAshour MostafaNo ratings yet

- Security Enhancement and Data Integrity Checking in Multi-Cloud StorageDocument5 pagesSecurity Enhancement and Data Integrity Checking in Multi-Cloud StorageInternational Journal of Scientific Research in Science, Engineering and Technology ( IJSRSET )No ratings yet

- Security Issues in Cloud Computing: Kalyani D. Kadam Sonia K. Gajre R. L. PaikraoDocument5 pagesSecurity Issues in Cloud Computing: Kalyani D. Kadam Sonia K. Gajre R. L. Paikraoetylr mailNo ratings yet

- Chapter 6 - Network Security - Quick ReferenceDocument5 pagesChapter 6 - Network Security - Quick Referenceargus1881No ratings yet

- Optiv Accelerating Cloud InfographicDocument1 pageOptiv Accelerating Cloud InfographicLmoreiraNo ratings yet

- Chapter OneDocument27 pagesChapter OneBethelhem YetwaleNo ratings yet

- Security Analysis As Software-Defined Security For SDN EnvironmentDocument6 pagesSecurity Analysis As Software-Defined Security For SDN EnvironmentForloopNo ratings yet

- Huawei FusionCloud Desktop Solution Overview Presentation (For Governments)Document56 pagesHuawei FusionCloud Desktop Solution Overview Presentation (For Governments)HUMANMANNo ratings yet

- Datacenter and Cloud Security - Unit 3Document43 pagesDatacenter and Cloud Security - Unit 3Ujjawal TripathiNo ratings yet

- BalaBit Comply ISO 27011Document6 pagesBalaBit Comply ISO 27011ziaire.natanaelNo ratings yet

- Database Encryption - An Overview of Contemporary Challenges and Design ConsiderationsDocument6 pagesDatabase Encryption - An Overview of Contemporary Challenges and Design ConsiderationsKRediNo ratings yet

- Cloud 2Document1 pageCloud 2Abhishek DangolNo ratings yet

- PCI DSS Policies and ProceduresDocument38 pagesPCI DSS Policies and Proceduresjustforfun2009No ratings yet

- CSC 5301 - Paper - DB & DW SecurityDocument17 pagesCSC 5301 - Paper - DB & DW SecurityMohamedNo ratings yet

- Distributed Intrusion Detection System Using Blockchain and Cloud Computing InfrastructureDocument5 pagesDistributed Intrusion Detection System Using Blockchain and Cloud Computing InfrastructureTseagaye BiresawNo ratings yet

- Corporate Information Security Governance Policy (IT-InFOSEC-CP001) Public FacingDocument2 pagesCorporate Information Security Governance Policy (IT-InFOSEC-CP001) Public Facingmyinves00No ratings yet

- Icas4124b R1Document11 pagesIcas4124b R1ቡዜ የውብነሽ ልጅNo ratings yet

- SDN Security Issues and Mitigation TechniquesDocument10 pagesSDN Security Issues and Mitigation TechniquesBabar SaeedNo ratings yet

- Ground Floor LayoutDocument1 pageGround Floor LayoutDEVEN GEETNo ratings yet

- Anxiety Free - Stop Worrying and - McKeown, PatrickDocument237 pagesAnxiety Free - Stop Worrying and - McKeown, PatrickLoboCamon100% (1)

- 1 s2.0 S0045653519308616 MainDocument18 pages1 s2.0 S0045653519308616 MainBianca Elena AzanfireNo ratings yet

- Useful Info For Tourists in NepalDocument14 pagesUseful Info For Tourists in NepalBishal SharmaNo ratings yet

- BS en Iso Iec 80079-38-2016Document66 pagesBS en Iso Iec 80079-38-2016MstefNo ratings yet

- Takayasu S Arter It IsDocument5 pagesTakayasu S Arter It IsButarbutar MelvaNo ratings yet

- AKSA CUMMINS (700-1410 kVA) PDFDocument2 pagesAKSA CUMMINS (700-1410 kVA) PDFYacine Meziani100% (1)

- Silicon NPN Darlington Power Transistor BDW93C: DescriptionDocument2 pagesSilicon NPN Darlington Power Transistor BDW93C: DescriptionSergio Brida100% (1)

- Lecture 5 Aditya SirDocument39 pagesLecture 5 Aditya Sirankur soniNo ratings yet

- 02-Citizens-Charter (1) EODocument3 pages02-Citizens-Charter (1) EOAgustin MharieNo ratings yet

- CyclamenDocument50 pagesCyclamenLAUM1No ratings yet

- Lecture 1 Study and Design of Primary and Secondary DistributionDocument74 pagesLecture 1 Study and Design of Primary and Secondary DistributionJade Albert G. FalladoNo ratings yet

- Eng Tabela Alergenów Tabela KolorDocument1 pageEng Tabela Alergenów Tabela KolorAleksandra MyślińskaNo ratings yet

- BS 476 Class 0Document8 pagesBS 476 Class 0Tomek BudaNo ratings yet

- Bread and Pastry Production ReviewerDocument2 pagesBread and Pastry Production ReviewerKhrister TorresNo ratings yet

- Conservation Philosophy and Activities of The International Elephant FoundationDocument9 pagesConservation Philosophy and Activities of The International Elephant Foundationcipoy 98No ratings yet

- Chapter 13 - Heat TransferDocument54 pagesChapter 13 - Heat Transfernagmajerald17No ratings yet

- Kronoxonic EN 2018Document12 pagesKronoxonic EN 2018vladimirmarkovski8119No ratings yet

- Analog and Digital Dry Block Heaters PDFDocument140 pagesAnalog and Digital Dry Block Heaters PDFAdam MazurekNo ratings yet

- HIPOT TestersDocument4 pagesHIPOT TesterspassworsNo ratings yet

- Attappady and Its Indigenous People An O PDFDocument20 pagesAttappady and Its Indigenous People An O PDFCreative space create the spaceNo ratings yet

- PharmacyDocument20 pagesPharmacyRajJoshiNo ratings yet

- Anant Kumar Antu: Profile SummeryDocument4 pagesAnant Kumar Antu: Profile SummerymkoelrealNo ratings yet

- Chapter 4 Investments in Debt Securities and Other Long-Term InvestmentDocument11 pagesChapter 4 Investments in Debt Securities and Other Long-Term Investmentpapajesus papaNo ratings yet

- Kluber Unisilkon L 250 L Special Lubricating Grease Ptfe DatasheetDocument2 pagesKluber Unisilkon L 250 L Special Lubricating Grease Ptfe DatasheetHigh Tech Katlane100% (1)

- Effective Parent Consultation in Play TherapyDocument14 pagesEffective Parent Consultation in Play TherapyMich García Villa100% (1)

- Munn Inc Had The Following Intangible Account Balance at DecemberDocument1 pageMunn Inc Had The Following Intangible Account Balance at DecemberHassan JanNo ratings yet

- Case Study - : The Chubb CorporationDocument6 pagesCase Study - : The Chubb Corporationtiko bakashviliNo ratings yet

- Ch.4 Lesson (1) EasyDocument12 pagesCh.4 Lesson (1) EasyShahd WaelNo ratings yet

PCI DSS V4.0 Control Objectives and Requirements

PCI DSS V4.0 Control Objectives and Requirements

Uploaded by

yoursnayak0 ratings0% found this document useful (0 votes)

1 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pagePCI DSS V4.0 Control Objectives and Requirements

PCI DSS V4.0 Control Objectives and Requirements

Uploaded by

yoursnayakCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

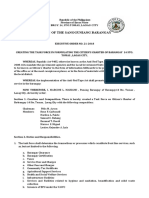

12.

1 A comprehensive information security

PCI DSS v4.0 Control Objectives and Requirements

policy that governs and provides direction for

protection of the entity’s information assets is

known and current.

12.2 Acceptable use policies for end-user

technologies are defined and implemented.

12.3 Risks to the cardholder data

environment are formally identified,

evaluated, and managed.

12. Support

12.4 PCI DSS compliance is managed.

Information

1.1 Processes and mechanisms for installing and

12.5 PCI DSS scope is documented and validated. Security with Maintain an maintaining network security controls are defined and

Organizational

Information understood.

12.6 Security awareness education is an Policies and

ongoing activity. Programs. Security Policy 1.2 Network security controls (NSCs)

are configured and maintained.

12.7 Personnel are screened to reduce risks 1. Install and

from insider threats. Maintain Network 1.3 Network access to and from the cardholder data

Security Controls. environment is restricted.

12.8 Risk to information assets associated Build and

with third-party service provider (TPSP)

relationships is managed.

Maintain a 1.4 Network connections between trusted and

untrusted networks are controlled.

Secure

12.9 Third-party service providers (TPSPs)

support their customers’ PCI DSS compliance.

Network and 1.5 Risks to the CDE from computing devices that are able

to connect to both untrusted networks and the CDE are

Systems mitigated.

12.10 Suspected and confirmed security

incidents that could impact the CDE are 2.1 Processes and mechanisms for applying secure

responded to immediately configurations to all system components are defined and

understood.

2. Apply Secure

10.1 Processes and mechanisms for logging and Configurations to All 2.2 System components are

monitoring all access to system components and System Components configured and managed securely.

cardholder data are defined and documented.

2.3 Wireless environments are

10.2 Audit logs are implemented to support the configured and managed securely.

detection of anomalies and suspicious activity, and

the forensic analysis of events.

10. Log and Monitor 3.1 Processes and mechanisms for protecting stored

10.3 Audit logs are protected from destruction and account data are defined and understood.

unauthorized modifications. All Access to

System 3.2 Storage of account data is kept to a minimum.

10.4 Audit logs are reviewed to identify anomalies or Components and

suspicious activity. Cardholder Data. 3.3 Sensitive authentication data (SAD) is not stored after

authorization.

10.5 Audit log history is retained and available for

analysis. 3. Protect 3.4 Access to displays of full PAN and ability to copy cardholder

Stored Account data are restricted.

10.6 Time-synchronization mechanisms support

consistent time settings across all systems. Regularly Data

3.5 Primary account number (PAN) is secured

10.7 Failures of critical security control systems are

Monitor wherever it is stored.

detected, reported, and responded to promptly. and Test 3.6 Cryptographic keys used to

Networks Protect protect stored account data are

PCI DSS v4.0

11.1 Processes and mechanisms for regularly testing secured.

security of systems and networks are defined and Account

understood.

Data 3.7 Where cryptography is used to protect stored account data, key

management processes and procedures covering all aspects of the key

11.2 Wireless access points are identified and lifecycle are defined and implemented.

monitored, and unauthorized wireless access points are

addressed. 4. Protect Cardholder

11. Test Security Data with Strong 4.1 Processes and mechanisms for protecting cardholder data with

11.3 External and internal vulnerabilities are regularly of Systems and strong cryptography during transmission over open, public networks are

identified, prioritized, and addressed.

Cryptography During

Networks Transmission Over defined and documented.

Regularly. Open, Public Networks.

11.4 External and internal penetration testing is 4.2 PAN is protected with strong

regularly performed, and exploitable vulnerabilities and cryptography during transmission

security weaknesses are corrected.

11.5 Network intrusions and unexpected file changes

5.1 Processes and mechanisms for protecting all systems and networks from

are detected and responded to.

malicious software are defined and understood.

5. Protect All

11.6 Unauthorized changes on payment pages are Systems and 5.2 Malicious software (malware) is prevented, or detected and

detected and responded to. Networks from addressed.

Malicious

Software. 5.3 Anti-malware mechanisms and

7. Restrict Access processes are active, maintained,

7.1 Processes and mechanisms for restricting access to

system components and cardholder data by business

to System Maintain a and monitored.

Components and

need to know are defined and understood.

Cardholder Data

Vulnerability 5.4 Anti-phishing mechanisms protect users against phishing

7.2 Access to system components and data is by Business Need Management attacks.

appropriately defined and assigned. to Know. Program 6.1 Processes and mechanisms for developing and maintaining

secure systems and software are defined and understood.

7.3 Access to system components and data is

managed via an access control system(s).

6.2 Bespoke and custom software

6. Develop and are developed securely.

8.1 Processes and mechanisms for identifying users Maintain Secure

and authenticating access to system components are Systems and 6.3 Security vulnerabilities are

defined and understood.

Software. identified and addressed.

8.2 User identification and related accounts for users

and administrators are strictly managed throughout an Implement 6.4 Public-facing web applications

are protected against attacks.

account’s lifecycle.

8. Identify Users Strong

8.3 Strong authentication for users and administrators and Authenticate Access 6.5 Changes to all system

Access to System components are managed securely.

is established and managed. Control

Components.

8.4 Multi-factor authentication (MFA) is implemented to Measures

secure access into the CDE

8.5 Multi-factor authentication (MFA) systems are

configured to prevent misuse.

8.6 Use of application and system accounts and

associated authentication factors is strictly managed.

9.1 Processes and mechanisms for restricting physical

access to cardholder data are defined and understood.

9.2 Physical access controls manage entry into

facilities and systems containing cardholder data.

9. Restrict

9.3 Physical access for personnel and visitors is Physical Access to

authorized and managed. Cardholder Data.

9.4 Media with cardholder data is securely stored,

accessed, distributed, and destroyed.

9.5 Point of interaction (POI) devices are protected from

tampering and unauthorized substitution.

Ref : https://www.pcisecuritystandards.org/document_library/

You might also like

- NIS2 Versus ISO27001 - 2022 Versus CIS v8Document5 pagesNIS2 Versus ISO27001 - 2022 Versus CIS v8Vagabond PakistanNo ratings yet

- Stone, Nancy J - Introduction To Human Factors - Applying Psychology To Design-CRC Press Taylor & Francis Group (2018)Document425 pagesStone, Nancy J - Introduction To Human Factors - Applying Psychology To Design-CRC Press Taylor & Francis Group (2018)gioeffe100% (1)

- Navigating PCI DSS v4.0Document24 pagesNavigating PCI DSS v4.0Ivan DoriNo ratings yet

- Telrock SaaS PCI DSS 3.2.1 Responsibility Matrix Updated June 2021Document13 pagesTelrock SaaS PCI DSS 3.2.1 Responsibility Matrix Updated June 2021Noki ChannelNo ratings yet

- BSIA Cyber Secure It January 2019Document16 pagesBSIA Cyber Secure It January 2019nsadnanNo ratings yet

- Adobe Scan Oct 11, 2023Document21 pagesAdobe Scan Oct 11, 2023Siddhant SrivastavaNo ratings yet

- PCI DSS4 Control ListDocument12 pagesPCI DSS4 Control Listkhushbu gargNo ratings yet

- Comparison of PCI DSS and ISO IEC 27001 Standards Joa Eng 0116Document5 pagesComparison of PCI DSS and ISO IEC 27001 Standards Joa Eng 0116penumudi233No ratings yet

- CIS Controls V7.0.1-EBOOK - Parte10Document2 pagesCIS Controls V7.0.1-EBOOK - Parte10sensoketNo ratings yet

- ISO 27001 - Clause 12Document3 pagesISO 27001 - Clause 12pankajNo ratings yet

- Security and Privacy Approach of Cloud Computing EnvironmentDocument4 pagesSecurity and Privacy Approach of Cloud Computing Environment9797047233No ratings yet

- Generic Data Center and Network Operations WorkplanDocument55 pagesGeneric Data Center and Network Operations WorkplanJenniferNo ratings yet

- CIS Controls V7.0.1-EBOOK - Parte9Document2 pagesCIS Controls V7.0.1-EBOOK - Parte9sensoketNo ratings yet

- Software Defined Networking To Support TDocument14 pagesSoftware Defined Networking To Support TLeng Hour lengNo ratings yet

- ArctiqDC Security Threats and Threat Mitigations - 0Document41 pagesArctiqDC Security Threats and Threat Mitigations - 0sayed.shoaib hussainiNo ratings yet

- Improving Security in A Virtual Network by Using Attribute Based Encryption AlgorithmDocument6 pagesImproving Security in A Virtual Network by Using Attribute Based Encryption AlgorithmAditi BhattacharjeeNo ratings yet

- Usage of Embedded Systems For Dos Attack Protection: I. Dodig, D. Cafuta, V. SrukDocument5 pagesUsage of Embedded Systems For Dos Attack Protection: I. Dodig, D. Cafuta, V. SrukSandeep SamantNo ratings yet

- 7137 CompleteMonitoring EG 20230921 WebDocument15 pages7137 CompleteMonitoring EG 20230921 WebTamai Aisea AniseNo ratings yet

- Computing Unit 7 IT Systems Security and Encryption C - DDocument18 pagesComputing Unit 7 IT Systems Security and Encryption C - Dmelvinnana16No ratings yet

- Securing Saas at Scale: Cloud EssentialsDocument12 pagesSecuring Saas at Scale: Cloud Essentialsitsnithin_tsNo ratings yet

- Best Practices For Database SecurityDocument12 pagesBest Practices For Database SecurityAbdullah S. Ben SaeedNo ratings yet

- Deloitte-Cn-Tech-Cloud-Security-Solution - Cyber and CloudDocument23 pagesDeloitte-Cn-Tech-Cloud-Security-Solution - Cyber and CloudloversatriskNo ratings yet

- Managed Security MonitoringDocument3 pagesManaged Security MonitoringMorganNo ratings yet

- Data Base AdministrationDocument3 pagesData Base AdministrationjellobaysonNo ratings yet

- Data Security in Cloud ComputingDocument5 pagesData Security in Cloud ComputingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ModuleDocument12 pagesModulettuhkbNo ratings yet

- IT-Cyber-Security-PolicyDocument14 pagesIT-Cyber-Security-PolicyAleck KitNo ratings yet

- 1.8 Introduction To Networks - Network SecurityDocument3 pages1.8 Introduction To Networks - Network SecurityCristian MoralesNo ratings yet

- Applicability of Blockchain For Synchrophasor NetworkDocument4 pagesApplicability of Blockchain For Synchrophasor Networkashwa1No ratings yet

- Tlik107c R1Document9 pagesTlik107c R1sample nameNo ratings yet

- Application of Co-Operative Encryption To Clouds For Data Security-2018-01-10-7Document4 pagesApplication of Co-Operative Encryption To Clouds For Data Security-2018-01-10-7International Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Paper 42-Security Issues in Software Defined NetworkingDocument6 pagesPaper 42-Security Issues in Software Defined NetworkingJalal MontazeryNo ratings yet

- Audit of Universitys IT Network Security Controls 15-16-2Document26 pagesAudit of Universitys IT Network Security Controls 15-16-2jeithvpnNo ratings yet

- Data Com NetworksDocument6 pagesData Com NetworksGenasky LegaspiNo ratings yet

- K Avian Pour 2017Document4 pagesK Avian Pour 2017Adeel TahirNo ratings yet

- NCRA Report For Sierra Leone MainDocument5 pagesNCRA Report For Sierra Leone MainmckenzieblaqNo ratings yet

- Information Involved in Electronic Messaging Shall Be AppropriDocument8 pagesInformation Involved in Electronic Messaging Shall Be AppropriSara CruzNo ratings yet

- Agents of Digital Change: Securing The Digital EnterpriseDocument9 pagesAgents of Digital Change: Securing The Digital EnterpriseSpin InfluenceNo ratings yet

- C-Org Midterm ReviewerDocument7 pagesC-Org Midterm ReviewerDen-Earl De DiosNo ratings yet

- SocialDocument8 pagesSocialArnold BernasNo ratings yet

- HW SD-WAN 05 SecurityDocument42 pagesHW SD-WAN 05 Securityxem phimNo ratings yet

- Chapter 1fundamental of Software SecurityDocument7 pagesChapter 1fundamental of Software SecurityhaileNo ratings yet

- Security of DBMSDocument6 pagesSecurity of DBMSAshour MostafaNo ratings yet

- Security Enhancement and Data Integrity Checking in Multi-Cloud StorageDocument5 pagesSecurity Enhancement and Data Integrity Checking in Multi-Cloud StorageInternational Journal of Scientific Research in Science, Engineering and Technology ( IJSRSET )No ratings yet

- Security Issues in Cloud Computing: Kalyani D. Kadam Sonia K. Gajre R. L. PaikraoDocument5 pagesSecurity Issues in Cloud Computing: Kalyani D. Kadam Sonia K. Gajre R. L. Paikraoetylr mailNo ratings yet

- Chapter 6 - Network Security - Quick ReferenceDocument5 pagesChapter 6 - Network Security - Quick Referenceargus1881No ratings yet

- Optiv Accelerating Cloud InfographicDocument1 pageOptiv Accelerating Cloud InfographicLmoreiraNo ratings yet

- Chapter OneDocument27 pagesChapter OneBethelhem YetwaleNo ratings yet

- Security Analysis As Software-Defined Security For SDN EnvironmentDocument6 pagesSecurity Analysis As Software-Defined Security For SDN EnvironmentForloopNo ratings yet

- Huawei FusionCloud Desktop Solution Overview Presentation (For Governments)Document56 pagesHuawei FusionCloud Desktop Solution Overview Presentation (For Governments)HUMANMANNo ratings yet

- Datacenter and Cloud Security - Unit 3Document43 pagesDatacenter and Cloud Security - Unit 3Ujjawal TripathiNo ratings yet

- BalaBit Comply ISO 27011Document6 pagesBalaBit Comply ISO 27011ziaire.natanaelNo ratings yet

- Database Encryption - An Overview of Contemporary Challenges and Design ConsiderationsDocument6 pagesDatabase Encryption - An Overview of Contemporary Challenges and Design ConsiderationsKRediNo ratings yet

- Cloud 2Document1 pageCloud 2Abhishek DangolNo ratings yet

- PCI DSS Policies and ProceduresDocument38 pagesPCI DSS Policies and Proceduresjustforfun2009No ratings yet

- CSC 5301 - Paper - DB & DW SecurityDocument17 pagesCSC 5301 - Paper - DB & DW SecurityMohamedNo ratings yet

- Distributed Intrusion Detection System Using Blockchain and Cloud Computing InfrastructureDocument5 pagesDistributed Intrusion Detection System Using Blockchain and Cloud Computing InfrastructureTseagaye BiresawNo ratings yet

- Corporate Information Security Governance Policy (IT-InFOSEC-CP001) Public FacingDocument2 pagesCorporate Information Security Governance Policy (IT-InFOSEC-CP001) Public Facingmyinves00No ratings yet

- Icas4124b R1Document11 pagesIcas4124b R1ቡዜ የውብነሽ ልጅNo ratings yet

- SDN Security Issues and Mitigation TechniquesDocument10 pagesSDN Security Issues and Mitigation TechniquesBabar SaeedNo ratings yet

- Ground Floor LayoutDocument1 pageGround Floor LayoutDEVEN GEETNo ratings yet

- Anxiety Free - Stop Worrying and - McKeown, PatrickDocument237 pagesAnxiety Free - Stop Worrying and - McKeown, PatrickLoboCamon100% (1)

- 1 s2.0 S0045653519308616 MainDocument18 pages1 s2.0 S0045653519308616 MainBianca Elena AzanfireNo ratings yet

- Useful Info For Tourists in NepalDocument14 pagesUseful Info For Tourists in NepalBishal SharmaNo ratings yet

- BS en Iso Iec 80079-38-2016Document66 pagesBS en Iso Iec 80079-38-2016MstefNo ratings yet

- Takayasu S Arter It IsDocument5 pagesTakayasu S Arter It IsButarbutar MelvaNo ratings yet

- AKSA CUMMINS (700-1410 kVA) PDFDocument2 pagesAKSA CUMMINS (700-1410 kVA) PDFYacine Meziani100% (1)

- Silicon NPN Darlington Power Transistor BDW93C: DescriptionDocument2 pagesSilicon NPN Darlington Power Transistor BDW93C: DescriptionSergio Brida100% (1)

- Lecture 5 Aditya SirDocument39 pagesLecture 5 Aditya Sirankur soniNo ratings yet

- 02-Citizens-Charter (1) EODocument3 pages02-Citizens-Charter (1) EOAgustin MharieNo ratings yet

- CyclamenDocument50 pagesCyclamenLAUM1No ratings yet

- Lecture 1 Study and Design of Primary and Secondary DistributionDocument74 pagesLecture 1 Study and Design of Primary and Secondary DistributionJade Albert G. FalladoNo ratings yet

- Eng Tabela Alergenów Tabela KolorDocument1 pageEng Tabela Alergenów Tabela KolorAleksandra MyślińskaNo ratings yet

- BS 476 Class 0Document8 pagesBS 476 Class 0Tomek BudaNo ratings yet

- Bread and Pastry Production ReviewerDocument2 pagesBread and Pastry Production ReviewerKhrister TorresNo ratings yet

- Conservation Philosophy and Activities of The International Elephant FoundationDocument9 pagesConservation Philosophy and Activities of The International Elephant Foundationcipoy 98No ratings yet

- Chapter 13 - Heat TransferDocument54 pagesChapter 13 - Heat Transfernagmajerald17No ratings yet

- Kronoxonic EN 2018Document12 pagesKronoxonic EN 2018vladimirmarkovski8119No ratings yet

- Analog and Digital Dry Block Heaters PDFDocument140 pagesAnalog and Digital Dry Block Heaters PDFAdam MazurekNo ratings yet

- HIPOT TestersDocument4 pagesHIPOT TesterspassworsNo ratings yet

- Attappady and Its Indigenous People An O PDFDocument20 pagesAttappady and Its Indigenous People An O PDFCreative space create the spaceNo ratings yet

- PharmacyDocument20 pagesPharmacyRajJoshiNo ratings yet

- Anant Kumar Antu: Profile SummeryDocument4 pagesAnant Kumar Antu: Profile SummerymkoelrealNo ratings yet

- Chapter 4 Investments in Debt Securities and Other Long-Term InvestmentDocument11 pagesChapter 4 Investments in Debt Securities and Other Long-Term Investmentpapajesus papaNo ratings yet

- Kluber Unisilkon L 250 L Special Lubricating Grease Ptfe DatasheetDocument2 pagesKluber Unisilkon L 250 L Special Lubricating Grease Ptfe DatasheetHigh Tech Katlane100% (1)

- Effective Parent Consultation in Play TherapyDocument14 pagesEffective Parent Consultation in Play TherapyMich García Villa100% (1)

- Munn Inc Had The Following Intangible Account Balance at DecemberDocument1 pageMunn Inc Had The Following Intangible Account Balance at DecemberHassan JanNo ratings yet

- Case Study - : The Chubb CorporationDocument6 pagesCase Study - : The Chubb Corporationtiko bakashviliNo ratings yet

- Ch.4 Lesson (1) EasyDocument12 pagesCh.4 Lesson (1) EasyShahd WaelNo ratings yet