Professional Documents

Culture Documents

Screenshot 2024-06-17 at 9.35.35 PM

Screenshot 2024-06-17 at 9.35.35 PM

Uploaded by

ariolacharmaine06Copyright:

Available Formats

You might also like

- Semi Detailed Lesson Plan DIASS (Humss) (Demo)Document5 pagesSemi Detailed Lesson Plan DIASS (Humss) (Demo)Nildy Ponteras100% (4)

- Huawei HCIA-IoT v. 2.5 Evaluation QuestionsDocument77 pagesHuawei HCIA-IoT v. 2.5 Evaluation Questionstest oneNo ratings yet

- Windspeed Distribution and Characteristics in NigeriaDocument6 pagesWindspeed Distribution and Characteristics in NigeriaDenis AkingbasoNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- Epitome CompanyDocument2 pagesEpitome CompanyAnswer Key 019No ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Document 27032023Document4 pagesDocument 27032023maldupNo ratings yet

- MTP 10 16 Answers 1694780069Document13 pagesMTP 10 16 Answers 1694780069jiotv0050No ratings yet

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnNo ratings yet

- Pg-11-7 Book Valuve: Assignment Capital BudgetingDocument9 pagesPg-11-7 Book Valuve: Assignment Capital BudgetingIffi RaniNo ratings yet

- Revaluation and ImpairmentDocument14 pagesRevaluation and ImpairmentKyle PereiraNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Aspek Keuangan BenangDocument12 pagesAspek Keuangan Benangabdul manafNo ratings yet

- Construction ContractsDocument17 pagesConstruction ContractsCeline Marie AntonioNo ratings yet

- Fuel Delivery by Drone Using AI - BudgetDocument1 pageFuel Delivery by Drone Using AI - BudgetyoselynNo ratings yet

- 2018-04-24 BOQ Soil Improvement Blok HDocument1 page2018-04-24 BOQ Soil Improvement Blok HM Reza Fatchul HaritsNo ratings yet

- TBDLDocument2 pagesTBDLDicimulacion, Angelica P.No ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- Forda Reviewer IA - MidtermDocument18 pagesForda Reviewer IA - MidtermAltessa Lyn ContigaNo ratings yet

- AccountDocument4 pagesAccountthuhadt.yes20No ratings yet

- 1 Best Project ReportDocument17 pages1 Best Project ReportfundzerodhaNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- DepletionDocument2 pagesDepletionFria Mae Aycardo AbellanoNo ratings yet

- Project Orderslip Mori Lt35 Ranggada Re02Document5 pagesProject Orderslip Mori Lt35 Ranggada Re02Arland AsraNo ratings yet

- FS - LandscapeDocument9 pagesFS - LandscapeMekay OcasionesNo ratings yet

- 30 1 To 30 4Document2 pages30 1 To 30 4Away To PonderNo ratings yet

- Budget Film Grab DriftDocument9 pagesBudget Film Grab Drifteisya mzriNo ratings yet

- 2nd Monthly AssessmentDocument58 pages2nd Monthly AssessmentMichale JacomillaNo ratings yet

- MTP 12 25 Answers 1697029886Document13 pagesMTP 12 25 Answers 1697029886harshallahotNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Consolidated FinancialDocument21 pagesConsolidated FinancialMaria Raven Joy Espartinez ValmadridNo ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Quali Review Interim Reporting Complete SolutionDocument7 pagesQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanNo ratings yet

- Final Slide of PresentationDocument27 pagesFinal Slide of PresentationShekh FaridNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Budget SolutionDocument19 pagesBudget Solutionmohammad bilalNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- Activity Cost BehaviorDocument28 pagesActivity Cost BehaviorCPAREVIEWNo ratings yet

- Government Grant DiscussionDocument2 pagesGovernment Grant DiscussionMoonchaserNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Group 7 - Class 1 - FADocument5 pagesGroup 7 - Class 1 - FAthuhadt.yes20No ratings yet

- PA1 Group1 P10Document8 pagesPA1 Group1 P10Phuong Nguyen MinhNo ratings yet

- 1 Best Project ReportDocument17 pages1 Best Project Reportratans31No ratings yet

- 5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016Document6 pages5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016agustadivNo ratings yet

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- Sums On Investing ActivityDocument3 pagesSums On Investing ActivitypuxvashuklaNo ratings yet

- Worksheet To PostClosing Trial BalanceDocument11 pagesWorksheet To PostClosing Trial BalanceLemuel DioquinoNo ratings yet

- Lecture 2 - Practice AnswerDocument9 pagesLecture 2 - Practice AnswerBhunesh KumarNo ratings yet

- MC Solution Pages 2 61 To 2 66Document8 pagesMC Solution Pages 2 61 To 2 66sumagpangkeannecleinNo ratings yet

- A Investment in Website Development: B-I Office & Operating ExpensesDocument15 pagesA Investment in Website Development: B-I Office & Operating ExpensesvaibhavmahajanNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Problem 4Document11 pagesProblem 4Caila Nicole ReyesNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Biasong, Geraldine M. (Prelim)Document11 pagesBiasong, Geraldine M. (Prelim)geraldine biasongNo ratings yet

- Cost Incurred Estimated Cost To Complete: Gross Profit, Revenues, and Costs of ConstructionDocument12 pagesCost Incurred Estimated Cost To Complete: Gross Profit, Revenues, and Costs of ConstructionJasmine Nouvel Soriaga CruzNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Rohit K ADocument13 pagesRohit K Awlv rajNo ratings yet

- GCV - SRV Overhauling and Calibration - Automation & Control Engineering ForumDocument1 pageGCV - SRV Overhauling and Calibration - Automation & Control Engineering Forumعبدالسلام المبروك ابوزنادNo ratings yet

- Study Guide For Tanizaki Jun'ichirō "The Secret" (Himitsu, 1911, Tr. A. Chambers)Document3 pagesStudy Guide For Tanizaki Jun'ichirō "The Secret" (Himitsu, 1911, Tr. A. Chambers)BeholdmyswarthyfaceNo ratings yet

- Tourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun SongDocument13 pagesTourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun Song韩意颜No ratings yet

- This Study Resource Was: Example On Steam Pipe InsulationDocument3 pagesThis Study Resource Was: Example On Steam Pipe InsulationRamses Uriel Torres CanoNo ratings yet

- SUBWAY EditedDocument13 pagesSUBWAY Editedsonaxiv697No ratings yet

- Scalor and Vector DefinitionsDocument28 pagesScalor and Vector Definitionsmuhammad zeeshanNo ratings yet

- LinguaPix Database 2021Document14 pagesLinguaPix Database 2021Francisco Ahumada MéndezNo ratings yet

- Indiahacks Algorithm2Document8 pagesIndiahacks Algorithm2Nitesh SahniNo ratings yet

- Computer Controlled Heat Exchanger Service Module - Ht30XcDocument12 pagesComputer Controlled Heat Exchanger Service Module - Ht30XcEmonbeifo EfosasereNo ratings yet

- Nokia MEC in 5G White Paper enDocument13 pagesNokia MEC in 5G White Paper enarushi sharmaNo ratings yet

- About Querying The RMAN MetadataDocument26 pagesAbout Querying The RMAN MetadatautpalbasakNo ratings yet

- TR - Dressmaking NC IIDocument60 pagesTR - Dressmaking NC IIMR. CHRISTIAN DACORONNo ratings yet

- 4.3 Introduction To Database ManagementDocument14 pages4.3 Introduction To Database ManagementppghoshinNo ratings yet

- Chinese Class Survey (Completed)Document4 pagesChinese Class Survey (Completed)Yibing ZhangNo ratings yet

- THE ESSENCE OF TRUE WorshipDocument2 pagesTHE ESSENCE OF TRUE WorshipErwin Mark PobleteNo ratings yet

- 22 10691 - BPSU CAT Confirmation SlipDocument1 page22 10691 - BPSU CAT Confirmation SlipJoryan VenturaNo ratings yet

- Catalogue Product M-Plus FilterDocument40 pagesCatalogue Product M-Plus FilterAdrian Samuel ThenochNo ratings yet

- The First Lesson Plan ShapesDocument2 pagesThe First Lesson Plan Shapesapi-374751355No ratings yet

- 2019 Summer Model Answer Paper (Msbte Study Resources)Document34 pages2019 Summer Model Answer Paper (Msbte Study Resources)arvi.sardarNo ratings yet

- Note On Marsh Crocodile, Presentation On Marsh Crocodile or Marsh Crocodile LifeDocument18 pagesNote On Marsh Crocodile, Presentation On Marsh Crocodile or Marsh Crocodile LifeKirfan 123No ratings yet

- Hemorrhagic Disease of NewbornDocument29 pagesHemorrhagic Disease of NewbornLittleThingsInside100% (1)

- English 301 SyllabusDocument14 pagesEnglish 301 Syllabusapi-231902454No ratings yet

- Prelims-Arche 4 Sy 2122-StudentsDocument3 pagesPrelims-Arche 4 Sy 2122-StudentsAaron CansinoNo ratings yet

- List of Delegates - Sep. 14 Bali 2017: Publist Salut. Surname First Name Company Title Phone Email EscortDocument6 pagesList of Delegates - Sep. 14 Bali 2017: Publist Salut. Surname First Name Company Title Phone Email EscortNetty yuliartiNo ratings yet

- Chapter 4 Manual Assembly LinesDocument49 pagesChapter 4 Manual Assembly LinesRohit WadhwaniNo ratings yet

- Introduction To The Data Ethics CompassDocument21 pagesIntroduction To The Data Ethics CompassManjulika TiwariNo ratings yet

Screenshot 2024-06-17 at 9.35.35 PM

Screenshot 2024-06-17 at 9.35.35 PM

Uploaded by

ariolacharmaine06Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot 2024-06-17 at 9.35.35 PM

Screenshot 2024-06-17 at 9.35.35 PM

Uploaded by

ariolacharmaine06Copyright:

Available Formats

Answer & Explanation Solved by veriTed expert Rated Helpful

Answered by StephCam_00

REVALUATION SURPLUS JAN 1 2020

LAND 5,000,000.00

BUILDING 20,000,000.00

MACHINERY 5,000,000.00

EQUIPMENT 1,200,000.00

TOTAL 31,200,000.00

DEPRECIATION EXPENSE DEC REPLACEMENT

REMAINING LIFE COMPUTATION DEPRECIATION

2020 COST

NOT NOT

LAND 10,000,000.00

DEPRECIATED DEPRECIATED -

39,600,000/22

BUILDING 39,600,000.00 (25-3)=22 YEARS 1,800,000.00

years

MACHINERY 6,000,000.00 (5-3)=2 YEARS 6,000,000/2 years 3,000,000.00

EQUIPMENT 2,940,000.00 (10-3)= 7 YEARS 2,940,000/7 years 420,000.00

TOTAL 5,220,000.00

realization of surplus REVALUATION SURPLUS REMAINING LIFE COMPUTATION REVALUATION GAIN

LAND 5,000,000.00 -

BUILDING 17,600,000.00 (25-3)=22 YEARS 17,600,000/22 800,000.00

MACHINERY 2,000,000.00 (5-3)=2 YEARS 2,000,000/2 1,000,000.00

EQUIPMENT 840,000.00 (10-3)= 7 YEARS 840,000/7 120,000.00

TOTAL 1,920,000.00

DEBIT CREDIT

REVALUATION SURPLUS 6,920,000.00

REVALUATION GAIN 6,920,000.00

CREDITED TO RETAINED EARNINGS

REPLACEMENT COST AT JAN 1 2020 DEPRECIATION 2020 CARRYING AMOUNT DEC 31 2020

LAND 10,000,000.00 NO DEPRECIATION 10,000,000.00

MACHINERY 39,600,000.00 1,800,000.00 37,800,000.00

LAND 6,000,000.00 3,000,000.00 3,000,000.00

EQUIPMENT 2,940,000.00 420,000.00 2,520,000.00

TOTAL 53,320,000.00

Step-by-step explanation

STEP 1 GET THE CARRYING AMOUNT OF THE ASSET AT JAN 1 2020 ( DEPRECIATED FOR 3YEARS SINCE ASSET WAS

ACQUIRED JAN 2017)

LAND is not depreciated

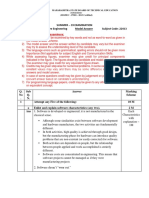

Image transcription text

COMPUTATION COMPUTATION MACHINERY COST given 10,000,000.00 EQUIPMENT COST

given 3,000,000.00 (10,000,000/5 years)*3 (3,000,000/10 ACCUMULATED DEPRECIATION

years (6,000,000.00) ACCUMULATED DEPRECIATION years) *3 years (900,000.00 ... Show more

STEP 2: GET THE REPLACEMENT COST OF THE ASSETS WITH THE GIVEN % OF INCREASE

INCREASE BY

REPLACEMENT

CARRYING AMOUNT (CARRYING AMOUNT x increase COMPUTATION

COST

by %)

LAND 100% 5,000,000.00 (5,000,000+5,000,000)

5,000,000.00 10,000,000.00

building 80% 20,000,000.00 (25,000,000+20,000,000)

25,000,000.00 45,000,000.00

machinery 50% 5,000,000.00 (3,000,000+5,000,000)

10,000,000.00 15,000,000.00

equipment 40% 1,200,000.00 (3,000,000+1,200,000)

3,000,000.00 4,200,000.00

TOTAL

43,000,000.00

STEP 3: SINCE WE KNOW THE REPLACEMENT COST AND PERCENTAGE ACCUMULATED DEPRECIATION WE CAN

MULTIPLY THIS TO ASSET REPLACEMENT COST TO GET ITS UPDATE JAN 1 2020 REPLACEMENT COST

Image transcription text

COMPUTATION REPLACEMENT COST COMPUTATION REPLACEMENT COST MACHINERY

COST 15,000,000.00 EQUIPMENT COST 4,200,000.00 ACCUMULATED DEPRECIATION

15,000,000*.60 (9,000,000.00) ACCUMULATED DEPRECIATION 4,200,000*.30 (1,2... Show more

STEP 4: WE CAN SOLVE FOR REVALUATION SURPLUS NOW (COSTrREPLACEMENT COST)

Image transcription text

REPLACEMENT COST REVALUATION SURPLUS LAND 5,000,000.00 10,000,000.00

5,000,000.00 BUILDING 25,000,000.00 45,000,000.00 20,000,000.00 ACCUMULATED

DEPRECIATION (3,000,000.00) (5,400,000.00) (2,400,000.00) CARRYING AMOUN... Show more

STEP 5: IN COMPUTING DEPRECIATION FOR DEC 31 2020, WE USE THE REPLACEMENT COST AT JAN 1 2020 DIVIDE

BY THE REMAINING LIFE OF THE ASSET

land is not depreciated

Image transcription text

REPLACEMENT DEPRECIATION EXPENSE DEC 2020 COST REMAINING LIFE COMPUTATION

DEPRECIATION LAND 10,000,000.00 NOT DEPRECIATED NOT DEPRECIATED BUILDING

39,600,000.00 (25-3)=22 YEARS 39,600,000/22 years 1,800,000.00 MACHINERY 6...

Show more

ti

STEP 6: IN COMPUTING REVALUATION GAIN FOR DEC 31 2020, WE USE THE REVALUATION SURPLUS COST AT JAN 1

2020 DIVIDE BY THE REMAINING LIFE OF THE ASSET

land is not realized

Image transcription text

REVALUATION realization of surplus SURPLUS REMAINING LIFE COMPUTATION REVALUATION

GAIN LAND 5,000,000.00 BUILDING 17,600,000.00 (25-3)=22 YEARS 17,600,000/22

800,000.00 MACHINERY 2,000,000.00 (5-3)=2 YEARS 2,000,000/2 1,000,000.00 ... Show more

Student reviews 100% (3 ratings)

Is this answer helpful? Helpful Unhelpful •

You might also like

- Semi Detailed Lesson Plan DIASS (Humss) (Demo)Document5 pagesSemi Detailed Lesson Plan DIASS (Humss) (Demo)Nildy Ponteras100% (4)

- Huawei HCIA-IoT v. 2.5 Evaluation QuestionsDocument77 pagesHuawei HCIA-IoT v. 2.5 Evaluation Questionstest oneNo ratings yet

- Windspeed Distribution and Characteristics in NigeriaDocument6 pagesWindspeed Distribution and Characteristics in NigeriaDenis AkingbasoNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- Epitome CompanyDocument2 pagesEpitome CompanyAnswer Key 019No ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Document 27032023Document4 pagesDocument 27032023maldupNo ratings yet

- MTP 10 16 Answers 1694780069Document13 pagesMTP 10 16 Answers 1694780069jiotv0050No ratings yet

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnNo ratings yet

- Pg-11-7 Book Valuve: Assignment Capital BudgetingDocument9 pagesPg-11-7 Book Valuve: Assignment Capital BudgetingIffi RaniNo ratings yet

- Revaluation and ImpairmentDocument14 pagesRevaluation and ImpairmentKyle PereiraNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Aspek Keuangan BenangDocument12 pagesAspek Keuangan Benangabdul manafNo ratings yet

- Construction ContractsDocument17 pagesConstruction ContractsCeline Marie AntonioNo ratings yet

- Fuel Delivery by Drone Using AI - BudgetDocument1 pageFuel Delivery by Drone Using AI - BudgetyoselynNo ratings yet

- 2018-04-24 BOQ Soil Improvement Blok HDocument1 page2018-04-24 BOQ Soil Improvement Blok HM Reza Fatchul HaritsNo ratings yet

- TBDLDocument2 pagesTBDLDicimulacion, Angelica P.No ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- Forda Reviewer IA - MidtermDocument18 pagesForda Reviewer IA - MidtermAltessa Lyn ContigaNo ratings yet

- AccountDocument4 pagesAccountthuhadt.yes20No ratings yet

- 1 Best Project ReportDocument17 pages1 Best Project ReportfundzerodhaNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- DepletionDocument2 pagesDepletionFria Mae Aycardo AbellanoNo ratings yet

- Project Orderslip Mori Lt35 Ranggada Re02Document5 pagesProject Orderslip Mori Lt35 Ranggada Re02Arland AsraNo ratings yet

- FS - LandscapeDocument9 pagesFS - LandscapeMekay OcasionesNo ratings yet

- 30 1 To 30 4Document2 pages30 1 To 30 4Away To PonderNo ratings yet

- Budget Film Grab DriftDocument9 pagesBudget Film Grab Drifteisya mzriNo ratings yet

- 2nd Monthly AssessmentDocument58 pages2nd Monthly AssessmentMichale JacomillaNo ratings yet

- MTP 12 25 Answers 1697029886Document13 pagesMTP 12 25 Answers 1697029886harshallahotNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Consolidated FinancialDocument21 pagesConsolidated FinancialMaria Raven Joy Espartinez ValmadridNo ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Quali Review Interim Reporting Complete SolutionDocument7 pagesQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanNo ratings yet

- Final Slide of PresentationDocument27 pagesFinal Slide of PresentationShekh FaridNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Budget SolutionDocument19 pagesBudget Solutionmohammad bilalNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- Activity Cost BehaviorDocument28 pagesActivity Cost BehaviorCPAREVIEWNo ratings yet

- Government Grant DiscussionDocument2 pagesGovernment Grant DiscussionMoonchaserNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Group 7 - Class 1 - FADocument5 pagesGroup 7 - Class 1 - FAthuhadt.yes20No ratings yet

- PA1 Group1 P10Document8 pagesPA1 Group1 P10Phuong Nguyen MinhNo ratings yet

- 1 Best Project ReportDocument17 pages1 Best Project Reportratans31No ratings yet

- 5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016Document6 pages5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016agustadivNo ratings yet

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- Sums On Investing ActivityDocument3 pagesSums On Investing ActivitypuxvashuklaNo ratings yet

- Worksheet To PostClosing Trial BalanceDocument11 pagesWorksheet To PostClosing Trial BalanceLemuel DioquinoNo ratings yet

- Lecture 2 - Practice AnswerDocument9 pagesLecture 2 - Practice AnswerBhunesh KumarNo ratings yet

- MC Solution Pages 2 61 To 2 66Document8 pagesMC Solution Pages 2 61 To 2 66sumagpangkeannecleinNo ratings yet

- A Investment in Website Development: B-I Office & Operating ExpensesDocument15 pagesA Investment in Website Development: B-I Office & Operating ExpensesvaibhavmahajanNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Problem 4Document11 pagesProblem 4Caila Nicole ReyesNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Biasong, Geraldine M. (Prelim)Document11 pagesBiasong, Geraldine M. (Prelim)geraldine biasongNo ratings yet

- Cost Incurred Estimated Cost To Complete: Gross Profit, Revenues, and Costs of ConstructionDocument12 pagesCost Incurred Estimated Cost To Complete: Gross Profit, Revenues, and Costs of ConstructionJasmine Nouvel Soriaga CruzNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Rohit K ADocument13 pagesRohit K Awlv rajNo ratings yet

- GCV - SRV Overhauling and Calibration - Automation & Control Engineering ForumDocument1 pageGCV - SRV Overhauling and Calibration - Automation & Control Engineering Forumعبدالسلام المبروك ابوزنادNo ratings yet

- Study Guide For Tanizaki Jun'ichirō "The Secret" (Himitsu, 1911, Tr. A. Chambers)Document3 pagesStudy Guide For Tanizaki Jun'ichirō "The Secret" (Himitsu, 1911, Tr. A. Chambers)BeholdmyswarthyfaceNo ratings yet

- Tourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun SongDocument13 pagesTourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun Song韩意颜No ratings yet

- This Study Resource Was: Example On Steam Pipe InsulationDocument3 pagesThis Study Resource Was: Example On Steam Pipe InsulationRamses Uriel Torres CanoNo ratings yet

- SUBWAY EditedDocument13 pagesSUBWAY Editedsonaxiv697No ratings yet

- Scalor and Vector DefinitionsDocument28 pagesScalor and Vector Definitionsmuhammad zeeshanNo ratings yet

- LinguaPix Database 2021Document14 pagesLinguaPix Database 2021Francisco Ahumada MéndezNo ratings yet

- Indiahacks Algorithm2Document8 pagesIndiahacks Algorithm2Nitesh SahniNo ratings yet

- Computer Controlled Heat Exchanger Service Module - Ht30XcDocument12 pagesComputer Controlled Heat Exchanger Service Module - Ht30XcEmonbeifo EfosasereNo ratings yet

- Nokia MEC in 5G White Paper enDocument13 pagesNokia MEC in 5G White Paper enarushi sharmaNo ratings yet

- About Querying The RMAN MetadataDocument26 pagesAbout Querying The RMAN MetadatautpalbasakNo ratings yet

- TR - Dressmaking NC IIDocument60 pagesTR - Dressmaking NC IIMR. CHRISTIAN DACORONNo ratings yet

- 4.3 Introduction To Database ManagementDocument14 pages4.3 Introduction To Database ManagementppghoshinNo ratings yet

- Chinese Class Survey (Completed)Document4 pagesChinese Class Survey (Completed)Yibing ZhangNo ratings yet

- THE ESSENCE OF TRUE WorshipDocument2 pagesTHE ESSENCE OF TRUE WorshipErwin Mark PobleteNo ratings yet

- 22 10691 - BPSU CAT Confirmation SlipDocument1 page22 10691 - BPSU CAT Confirmation SlipJoryan VenturaNo ratings yet

- Catalogue Product M-Plus FilterDocument40 pagesCatalogue Product M-Plus FilterAdrian Samuel ThenochNo ratings yet

- The First Lesson Plan ShapesDocument2 pagesThe First Lesson Plan Shapesapi-374751355No ratings yet

- 2019 Summer Model Answer Paper (Msbte Study Resources)Document34 pages2019 Summer Model Answer Paper (Msbte Study Resources)arvi.sardarNo ratings yet

- Note On Marsh Crocodile, Presentation On Marsh Crocodile or Marsh Crocodile LifeDocument18 pagesNote On Marsh Crocodile, Presentation On Marsh Crocodile or Marsh Crocodile LifeKirfan 123No ratings yet

- Hemorrhagic Disease of NewbornDocument29 pagesHemorrhagic Disease of NewbornLittleThingsInside100% (1)

- English 301 SyllabusDocument14 pagesEnglish 301 Syllabusapi-231902454No ratings yet

- Prelims-Arche 4 Sy 2122-StudentsDocument3 pagesPrelims-Arche 4 Sy 2122-StudentsAaron CansinoNo ratings yet

- List of Delegates - Sep. 14 Bali 2017: Publist Salut. Surname First Name Company Title Phone Email EscortDocument6 pagesList of Delegates - Sep. 14 Bali 2017: Publist Salut. Surname First Name Company Title Phone Email EscortNetty yuliartiNo ratings yet

- Chapter 4 Manual Assembly LinesDocument49 pagesChapter 4 Manual Assembly LinesRohit WadhwaniNo ratings yet

- Introduction To The Data Ethics CompassDocument21 pagesIntroduction To The Data Ethics CompassManjulika TiwariNo ratings yet