Professional Documents

Culture Documents

IAS 34 - Interim Financial Reporting

IAS 34 - Interim Financial Reporting

Uploaded by

Tope JohnCopyright:

Available Formats

You might also like

- Interim Financial ReportingDocument10 pagesInterim Financial ReportingJoyce Ann Agdippa Barcelona100% (1)

- Cpa Australia Financial Reporting Notes PDFDocument11 pagesCpa Australia Financial Reporting Notes PDFpriyank100% (1)

- CHAPTER 12 - Interim Financial ReportingDocument47 pagesCHAPTER 12 - Interim Financial ReportingChristian Gatchalian100% (1)

- Summary of IAS 1Document8 pagesSummary of IAS 1Vikash Hurrydoss100% (1)

- Interim Financial ReportingDocument9 pagesInterim Financial ReportingNelly GomezNo ratings yet

- Interim Financial ReportingDocument6 pagesInterim Financial ReportingKimberly AsuncionNo ratings yet

- Interim ReportingDocument21 pagesInterim ReportingKAYLA SHANE GONZALESNo ratings yet

- Interim Financial StatmentsDocument22 pagesInterim Financial StatmentsHimanshu GaurNo ratings yet

- Toa ReportingDocument36 pagesToa ReportingMakoy BixenmanNo ratings yet

- Interim ReportingDocument3 pagesInterim ReportingNadie LrdNo ratings yet

- CFAS - Interim Reporting (IAS 34)Document38 pagesCFAS - Interim Reporting (IAS 34)asdfghjkl156111No ratings yet

- Chapter 5 - Standard 34Document15 pagesChapter 5 - Standard 34Pooja D AcharyaNo ratings yet

- Interim Financial ReportingDocument5 pagesInterim Financial ReportingRaymond F. GoodNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingBernie Mojico CaronanNo ratings yet

- Pas 34 Interim Financial Reporting Group 15Document56 pagesPas 34 Interim Financial Reporting Group 15Faker MejiaNo ratings yet

- Objective of IAS 34Document3 pagesObjective of IAS 34Prince KaharianNo ratings yet

- (VALIX) InterimDocument22 pages(VALIX) InterimMae100% (1)

- Interim Financial Reporting: Overview: Course Materials: Objective of Ias 34Document17 pagesInterim Financial Reporting: Overview: Course Materials: Objective of Ias 34Tricia Rozl PimentelNo ratings yet

- Periods Information To Be Presented by Interim Financial StatementsDocument2 pagesPeriods Information To Be Presented by Interim Financial StatementsPrincess Camilla SmithNo ratings yet

- PAS 34 Interim ReportingDocument5 pagesPAS 34 Interim Reportingjapvivi ceceNo ratings yet

- Cfas Pas 34 & 10 and Pfrs 1Document11 pagesCfas Pas 34 & 10 and Pfrs 1Tunas CareyNo ratings yet

- IAS34:Interim Financial ReportingDocument37 pagesIAS34:Interim Financial ReportingTanvir HossainNo ratings yet

- Module 5Document4 pagesModule 5Karen GarciaNo ratings yet

- Ac510wk14Document64 pagesAc510wk14Niño Mendoza Mabato100% (2)

- PAS 34 Interim Financial Reporting: Learning ObjectivesDocument5 pagesPAS 34 Interim Financial Reporting: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Ifrs 1:: First-Time Adoption ofDocument17 pagesIfrs 1:: First-Time Adoption ofEshetieNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingsharbularsNo ratings yet

- Date Development Comments: Reporting PublishedDocument4 pagesDate Development Comments: Reporting PublishedJuan TañamorNo ratings yet

- IAS 34 Interim Financial ReportingDocument4 pagesIAS 34 Interim Financial Reportingmusic niNo ratings yet

- C12 - Interim Financial ReportingDocument65 pagesC12 - Interim Financial ReportingKlare JimenoNo ratings yet

- As 25Document6 pagesAs 25abhishekkapse654No ratings yet

- Ias34 en PDFDocument9 pagesIas34 en PDFAgnieszka KsnNo ratings yet

- Chapter 19 Interim ReportingDocument6 pagesChapter 19 Interim ReportingEllen MaskariñoNo ratings yet

- Interim Financial ReportingDocument27 pagesInterim Financial ReportingChristelle LopezNo ratings yet

- AMLC, VAT, Interim Segment ReportingDocument27 pagesAMLC, VAT, Interim Segment ReportingChes THGNo ratings yet

- Pas 34Document17 pagesPas 34rena chavezNo ratings yet

- PAS 1 - Presentation of FS For LMSDocument72 pagesPAS 1 - Presentation of FS For LMSnot funny didn't laughNo ratings yet

- ADEVA - Assignment Discussions On Interim Financial ReportingDocument3 pagesADEVA - Assignment Discussions On Interim Financial ReportingMaria Kathreena Andrea AdevaNo ratings yet

- Ias 34Document11 pagesIas 34Shah Kamal100% (1)

- What Are Form and Content of Interim Reports?Document5 pagesWhat Are Form and Content of Interim Reports?Princess Camilla SmithNo ratings yet

- Toa Lecrure 6 Ias 34Document3 pagesToa Lecrure 6 Ias 34Rachel LeachonNo ratings yet

- IAS 34 Interim ReportingDocument8 pagesIAS 34 Interim ReportingChrisNo ratings yet

- Topic I - Financial StatementsDocument13 pagesTopic I - Financial StatementsSean William CareyNo ratings yet

- Interim Financial Reporting: IAS Standard 34Document18 pagesInterim Financial Reporting: IAS Standard 34JorreyGarciaOplasNo ratings yet

- Interim Checklist DisclosdADsureDocument15 pagesInterim Checklist DisclosdADsuretim_rattanaNo ratings yet

- Chapter 05Document11 pagesChapter 05RJ SajeebNo ratings yet

- 04 - Notes On Interim ReportingDocument2 pages04 - Notes On Interim ReportingLalaine ReyesNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingPaula De RuedaNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document18 pagesInterim Financial Reporting: International Accounting Standard 34mon14monNo ratings yet

- Summary of IAS 34Document6 pagesSummary of IAS 34Mae Gamit LaglivaNo ratings yet

- Cfas Final NotesDocument7 pagesCfas Final NotesAngelica SandraNo ratings yet

- IAS 34 Interim Financial ReportingDocument4 pagesIAS 34 Interim Financial ReportingKelvumNo ratings yet

- Pas 34Document2 pagesPas 34MMBRIMBAPNo ratings yet

- IAS DEtailsDocument101 pagesIAS DEtailsMorshedul AlamNo ratings yet

- FAR - Interim Financial ReportingDocument9 pagesFAR - Interim Financial ReportingIra CuñadoNo ratings yet

- Also Refer: IFRIC 10 Interim Financial Reporting and ImpairmentDocument36 pagesAlso Refer: IFRIC 10 Interim Financial Reporting and ImpairmentMark Gelo WinchesterNo ratings yet

- Assignment in Interim ReportingDocument3 pagesAssignment in Interim ReportingVevien Anne AbarcaNo ratings yet

- Ias 01Document5 pagesIas 01linger lingerNo ratings yet

- IAS 34: Interim Financial ReportingDocument8 pagesIAS 34: Interim Financial ReportingcolleenyuNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- EPD - ArgamassaDocument10 pagesEPD - ArgamassaDanielle DiasNo ratings yet

- Socta2021 1Document108 pagesSocta2021 1Chalapathi PapudesiNo ratings yet

- Flash CourierDocument19 pagesFlash Couriereaglewatch99No ratings yet

- Enterprise AI Transformation in 2024Document128 pagesEnterprise AI Transformation in 2024avinashr139No ratings yet

- Tax Circular Dated 27.2.18Document4 pagesTax Circular Dated 27.2.18Mahendra SharmaNo ratings yet

- Social Work Tools and Techniques FinalDocument12 pagesSocial Work Tools and Techniques Finalkiki0% (1)

- Effects of Social Media On The Younger GenerationDocument1 pageEffects of Social Media On The Younger Generationhimanshu vermaNo ratings yet

- DHyE Bidding Document For Hiring of Vehicle IssuedDocument18 pagesDHyE Bidding Document For Hiring of Vehicle IssuedPrince AndersonNo ratings yet

- Lectura Duarte-Vidal Et Al. 2021Document31 pagesLectura Duarte-Vidal Et Al. 2021Daniel Vargas ToroNo ratings yet

- Ebcl Part 1Document72 pagesEbcl Part 1Aman GuttaNo ratings yet

- Gemini Air CargoDocument34 pagesGemini Air CargoMichael PietrobonoNo ratings yet

- IA Sample Monica SL 22 25 7Document15 pagesIA Sample Monica SL 22 25 7Saket GudimellaNo ratings yet

- 537 4756 1 PB PDFDocument5 pages537 4756 1 PB PDFRe LNo ratings yet

- International Human Resource Management 8Th Edition Peter Dowling Online Ebook Texxtbook Full Chapter PDFDocument69 pagesInternational Human Resource Management 8Th Edition Peter Dowling Online Ebook Texxtbook Full Chapter PDFalison.austin795100% (9)

- Deed of SaleDocument2 pagesDeed of SaleSu SanNo ratings yet

- Power BI - Revenue - Industry Agnostic Revenue - Analysis - Step-by-Step GuideDocument15 pagesPower BI - Revenue - Industry Agnostic Revenue - Analysis - Step-by-Step GuideGian Carlo Gonzales AnastacioNo ratings yet

- Formulas To Know For EXAM: Activity & Project Duration FormulasDocument5 pagesFormulas To Know For EXAM: Activity & Project Duration FormulasMMNo ratings yet

- Dhruvika Patel ResumeDocument1 pageDhruvika Patel Resumeapi-708984934No ratings yet

- LENCIONI Weekly Tactical Meeting TemplateDocument2 pagesLENCIONI Weekly Tactical Meeting Templatedaniela.schittengruberNo ratings yet

- MPBF Other MethodsDocument10 pagesMPBF Other Methodskaren sunilNo ratings yet

- Pricing StrategyDocument15 pagesPricing StrategySean Catalia100% (1)

- 3 Benedicto V IACDocument2 pages3 Benedicto V IACkarlNo ratings yet

- AD CODE Registration LetterDocument1 pageAD CODE Registration LetterVarun Singh50% (2)

- Terms of Business: Define The FollowingDocument3 pagesTerms of Business: Define The FollowingBetyou WannaNo ratings yet

- Test Bank For Contemporary Logistics 11 e 11th Edition 0132953463Document4 pagesTest Bank For Contemporary Logistics 11 e 11th Edition 0132953463Joel Slama100% (40)

- Confirmation ReceiptDocument2 pagesConfirmation ReceiptCustodio JamalNo ratings yet

- Capital Market Capital Market: BY BYDocument93 pagesCapital Market Capital Market: BY BYNeha ChandrasekharNo ratings yet

- Proposed CEMEA 2022 2Document226 pagesProposed CEMEA 2022 2Jayme-Lea VanderschootNo ratings yet

- Conceptual Framework Module 5Document3 pagesConceptual Framework Module 5Jaime LaronaNo ratings yet

- MOD 00-56 Safety MGMT 01000600Document140 pagesMOD 00-56 Safety MGMT 01000600htdvulNo ratings yet

IAS 34 - Interim Financial Reporting

IAS 34 - Interim Financial Reporting

Uploaded by

Tope JohnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 34 - Interim Financial Reporting

IAS 34 - Interim Financial Reporting

Uploaded by

Tope JohnCopyright:

Available Formats

IAS 34: INTERIM FINANCIAL REPORTING

INTRODUCTION

IAS 34 Interim Financial Reporting applies when an entity prepares an interim financial report,

without a particular mandate as to when an entity should prepare such a report. The standard

prescribes the minimum content for an interim financial report, and also outlines the recognition,

measurement and disclosure requirements for interim financial reports.

IAS 34 was issued in June 1998 and became effective from periods beginning on or after 1

January, 1999. The standard has gone through several amendments as a consequence of the

amendment of other relating standards such as IAS 1, IFRS 8 among others.

IAS 34 does not contain any rule as to which entities should publish interim financial reports, or

the frequency of interim reporting. This is usually stipulated by national regulations which may

vary from one country/jurisdiction, to the other.

The standard however encourages publicly-traded entities;

• to provide interim financial reports at least as of the end of the first half of their financial

year; and

• to make their interim financial reports available no later than 60 days after the end of the

interim period.

Definitions

Interim Period; this is the financial reporting period shorter than a full financial year

Interim Financial Reporting; this is a financial report containing either a complete set or a set of

condensed financial statement for an interim period.

Forms and content of interim financial statements

According to IAS 34, the minimum required component of an interim financial report includes;

• a condensed statement of financial position; this should include as a minimum, each of

the major aspects of assets and equity as were in the SOFP in the previous financial year.

Thus, providing a summary of the economic resources and its financial structure.

• condensed statement of profit or loss and other comprehensive income; this should

include at minimum each of the component item of income and expenses as shown in

profit or loss for the previous financial year, together with the EPS and diluted EPS. It is

presented as either;

- a condensed single statement; or

- a condensed separate income statement and a condensed statement of

comprehensive income

• condensed statement of cash flows

• condensed statement of changes in equity

• selected explanatory notes

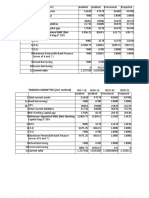

Periods required to be presented

IAS 34 requires interim reports to include interim financial statements for the periods listed in

the table below;

Statement Current Comparative

Statement of financial position End of current interim period End of immediately

preceding financial

year

Statement of comprehensive Current interim period and Comparable interim

Income(where applicable, cumulatively for the year-to-date period & year-to-date

statement of separate income of immediately prece-

statement) ding financial year

Statement of changes in equity Cumulatively for the current finan- Comparable Y-T-D

cial year-to-date of immediately pre-

ceding financial year

Statement of cash flows Cumulatively for the current finan- Comparable Y-T-D

cial year-to-date of immediately pre-

ceding financial year

Illustrative Example 1

Meerakul is an incorporated entity seeking to be listed on the NYSE. Illustrates the statements

required to be presented in its half-yearly interim financial reports if it has 31 December, 20X8

year end.

Illustrative Example 2

Same as above, except that its prepared quarterly with the same year end.

You might also like

- Interim Financial ReportingDocument10 pagesInterim Financial ReportingJoyce Ann Agdippa Barcelona100% (1)

- Cpa Australia Financial Reporting Notes PDFDocument11 pagesCpa Australia Financial Reporting Notes PDFpriyank100% (1)

- CHAPTER 12 - Interim Financial ReportingDocument47 pagesCHAPTER 12 - Interim Financial ReportingChristian Gatchalian100% (1)

- Summary of IAS 1Document8 pagesSummary of IAS 1Vikash Hurrydoss100% (1)

- Interim Financial ReportingDocument9 pagesInterim Financial ReportingNelly GomezNo ratings yet

- Interim Financial ReportingDocument6 pagesInterim Financial ReportingKimberly AsuncionNo ratings yet

- Interim ReportingDocument21 pagesInterim ReportingKAYLA SHANE GONZALESNo ratings yet

- Interim Financial StatmentsDocument22 pagesInterim Financial StatmentsHimanshu GaurNo ratings yet

- Toa ReportingDocument36 pagesToa ReportingMakoy BixenmanNo ratings yet

- Interim ReportingDocument3 pagesInterim ReportingNadie LrdNo ratings yet

- CFAS - Interim Reporting (IAS 34)Document38 pagesCFAS - Interim Reporting (IAS 34)asdfghjkl156111No ratings yet

- Chapter 5 - Standard 34Document15 pagesChapter 5 - Standard 34Pooja D AcharyaNo ratings yet

- Interim Financial ReportingDocument5 pagesInterim Financial ReportingRaymond F. GoodNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingBernie Mojico CaronanNo ratings yet

- Pas 34 Interim Financial Reporting Group 15Document56 pagesPas 34 Interim Financial Reporting Group 15Faker MejiaNo ratings yet

- Objective of IAS 34Document3 pagesObjective of IAS 34Prince KaharianNo ratings yet

- (VALIX) InterimDocument22 pages(VALIX) InterimMae100% (1)

- Interim Financial Reporting: Overview: Course Materials: Objective of Ias 34Document17 pagesInterim Financial Reporting: Overview: Course Materials: Objective of Ias 34Tricia Rozl PimentelNo ratings yet

- Periods Information To Be Presented by Interim Financial StatementsDocument2 pagesPeriods Information To Be Presented by Interim Financial StatementsPrincess Camilla SmithNo ratings yet

- PAS 34 Interim ReportingDocument5 pagesPAS 34 Interim Reportingjapvivi ceceNo ratings yet

- Cfas Pas 34 & 10 and Pfrs 1Document11 pagesCfas Pas 34 & 10 and Pfrs 1Tunas CareyNo ratings yet

- IAS34:Interim Financial ReportingDocument37 pagesIAS34:Interim Financial ReportingTanvir HossainNo ratings yet

- Module 5Document4 pagesModule 5Karen GarciaNo ratings yet

- Ac510wk14Document64 pagesAc510wk14Niño Mendoza Mabato100% (2)

- PAS 34 Interim Financial Reporting: Learning ObjectivesDocument5 pagesPAS 34 Interim Financial Reporting: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Ifrs 1:: First-Time Adoption ofDocument17 pagesIfrs 1:: First-Time Adoption ofEshetieNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingsharbularsNo ratings yet

- Date Development Comments: Reporting PublishedDocument4 pagesDate Development Comments: Reporting PublishedJuan TañamorNo ratings yet

- IAS 34 Interim Financial ReportingDocument4 pagesIAS 34 Interim Financial Reportingmusic niNo ratings yet

- C12 - Interim Financial ReportingDocument65 pagesC12 - Interim Financial ReportingKlare JimenoNo ratings yet

- As 25Document6 pagesAs 25abhishekkapse654No ratings yet

- Ias34 en PDFDocument9 pagesIas34 en PDFAgnieszka KsnNo ratings yet

- Chapter 19 Interim ReportingDocument6 pagesChapter 19 Interim ReportingEllen MaskariñoNo ratings yet

- Interim Financial ReportingDocument27 pagesInterim Financial ReportingChristelle LopezNo ratings yet

- AMLC, VAT, Interim Segment ReportingDocument27 pagesAMLC, VAT, Interim Segment ReportingChes THGNo ratings yet

- Pas 34Document17 pagesPas 34rena chavezNo ratings yet

- PAS 1 - Presentation of FS For LMSDocument72 pagesPAS 1 - Presentation of FS For LMSnot funny didn't laughNo ratings yet

- ADEVA - Assignment Discussions On Interim Financial ReportingDocument3 pagesADEVA - Assignment Discussions On Interim Financial ReportingMaria Kathreena Andrea AdevaNo ratings yet

- Ias 34Document11 pagesIas 34Shah Kamal100% (1)

- What Are Form and Content of Interim Reports?Document5 pagesWhat Are Form and Content of Interim Reports?Princess Camilla SmithNo ratings yet

- Toa Lecrure 6 Ias 34Document3 pagesToa Lecrure 6 Ias 34Rachel LeachonNo ratings yet

- IAS 34 Interim ReportingDocument8 pagesIAS 34 Interim ReportingChrisNo ratings yet

- Topic I - Financial StatementsDocument13 pagesTopic I - Financial StatementsSean William CareyNo ratings yet

- Interim Financial Reporting: IAS Standard 34Document18 pagesInterim Financial Reporting: IAS Standard 34JorreyGarciaOplasNo ratings yet

- Interim Checklist DisclosdADsureDocument15 pagesInterim Checklist DisclosdADsuretim_rattanaNo ratings yet

- Chapter 05Document11 pagesChapter 05RJ SajeebNo ratings yet

- 04 - Notes On Interim ReportingDocument2 pages04 - Notes On Interim ReportingLalaine ReyesNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingPaula De RuedaNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document18 pagesInterim Financial Reporting: International Accounting Standard 34mon14monNo ratings yet

- Summary of IAS 34Document6 pagesSummary of IAS 34Mae Gamit LaglivaNo ratings yet

- Cfas Final NotesDocument7 pagesCfas Final NotesAngelica SandraNo ratings yet

- IAS 34 Interim Financial ReportingDocument4 pagesIAS 34 Interim Financial ReportingKelvumNo ratings yet

- Pas 34Document2 pagesPas 34MMBRIMBAPNo ratings yet

- IAS DEtailsDocument101 pagesIAS DEtailsMorshedul AlamNo ratings yet

- FAR - Interim Financial ReportingDocument9 pagesFAR - Interim Financial ReportingIra CuñadoNo ratings yet

- Also Refer: IFRIC 10 Interim Financial Reporting and ImpairmentDocument36 pagesAlso Refer: IFRIC 10 Interim Financial Reporting and ImpairmentMark Gelo WinchesterNo ratings yet

- Assignment in Interim ReportingDocument3 pagesAssignment in Interim ReportingVevien Anne AbarcaNo ratings yet

- Ias 01Document5 pagesIas 01linger lingerNo ratings yet

- IAS 34: Interim Financial ReportingDocument8 pagesIAS 34: Interim Financial ReportingcolleenyuNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- EPD - ArgamassaDocument10 pagesEPD - ArgamassaDanielle DiasNo ratings yet

- Socta2021 1Document108 pagesSocta2021 1Chalapathi PapudesiNo ratings yet

- Flash CourierDocument19 pagesFlash Couriereaglewatch99No ratings yet

- Enterprise AI Transformation in 2024Document128 pagesEnterprise AI Transformation in 2024avinashr139No ratings yet

- Tax Circular Dated 27.2.18Document4 pagesTax Circular Dated 27.2.18Mahendra SharmaNo ratings yet

- Social Work Tools and Techniques FinalDocument12 pagesSocial Work Tools and Techniques Finalkiki0% (1)

- Effects of Social Media On The Younger GenerationDocument1 pageEffects of Social Media On The Younger Generationhimanshu vermaNo ratings yet

- DHyE Bidding Document For Hiring of Vehicle IssuedDocument18 pagesDHyE Bidding Document For Hiring of Vehicle IssuedPrince AndersonNo ratings yet

- Lectura Duarte-Vidal Et Al. 2021Document31 pagesLectura Duarte-Vidal Et Al. 2021Daniel Vargas ToroNo ratings yet

- Ebcl Part 1Document72 pagesEbcl Part 1Aman GuttaNo ratings yet

- Gemini Air CargoDocument34 pagesGemini Air CargoMichael PietrobonoNo ratings yet

- IA Sample Monica SL 22 25 7Document15 pagesIA Sample Monica SL 22 25 7Saket GudimellaNo ratings yet

- 537 4756 1 PB PDFDocument5 pages537 4756 1 PB PDFRe LNo ratings yet

- International Human Resource Management 8Th Edition Peter Dowling Online Ebook Texxtbook Full Chapter PDFDocument69 pagesInternational Human Resource Management 8Th Edition Peter Dowling Online Ebook Texxtbook Full Chapter PDFalison.austin795100% (9)

- Deed of SaleDocument2 pagesDeed of SaleSu SanNo ratings yet

- Power BI - Revenue - Industry Agnostic Revenue - Analysis - Step-by-Step GuideDocument15 pagesPower BI - Revenue - Industry Agnostic Revenue - Analysis - Step-by-Step GuideGian Carlo Gonzales AnastacioNo ratings yet

- Formulas To Know For EXAM: Activity & Project Duration FormulasDocument5 pagesFormulas To Know For EXAM: Activity & Project Duration FormulasMMNo ratings yet

- Dhruvika Patel ResumeDocument1 pageDhruvika Patel Resumeapi-708984934No ratings yet

- LENCIONI Weekly Tactical Meeting TemplateDocument2 pagesLENCIONI Weekly Tactical Meeting Templatedaniela.schittengruberNo ratings yet

- MPBF Other MethodsDocument10 pagesMPBF Other Methodskaren sunilNo ratings yet

- Pricing StrategyDocument15 pagesPricing StrategySean Catalia100% (1)

- 3 Benedicto V IACDocument2 pages3 Benedicto V IACkarlNo ratings yet

- AD CODE Registration LetterDocument1 pageAD CODE Registration LetterVarun Singh50% (2)

- Terms of Business: Define The FollowingDocument3 pagesTerms of Business: Define The FollowingBetyou WannaNo ratings yet

- Test Bank For Contemporary Logistics 11 e 11th Edition 0132953463Document4 pagesTest Bank For Contemporary Logistics 11 e 11th Edition 0132953463Joel Slama100% (40)

- Confirmation ReceiptDocument2 pagesConfirmation ReceiptCustodio JamalNo ratings yet

- Capital Market Capital Market: BY BYDocument93 pagesCapital Market Capital Market: BY BYNeha ChandrasekharNo ratings yet

- Proposed CEMEA 2022 2Document226 pagesProposed CEMEA 2022 2Jayme-Lea VanderschootNo ratings yet

- Conceptual Framework Module 5Document3 pagesConceptual Framework Module 5Jaime LaronaNo ratings yet

- MOD 00-56 Safety MGMT 01000600Document140 pagesMOD 00-56 Safety MGMT 01000600htdvulNo ratings yet