Professional Documents

Culture Documents

Corporate Reporting Assignment (IIL)

Corporate Reporting Assignment (IIL)

Uploaded by

Areeba IftikharOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Reporting Assignment (IIL)

Corporate Reporting Assignment (IIL)

Uploaded by

Areeba IftikharCopyright:

Available Formats

INTERNATIONAL INDUSTRIES LIMITED (IIL)

PERFORMANCE ANALYSIS

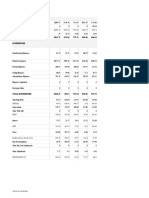

KEY INDICATORS 2023 2022 2021 2020 2019 2018

PROFITABILITY RATIO

Gross profit ratio % 15.19 13.45 17.79 8.96 12.32 16.4

Net profit to sales % 4.57 3.39 8.83 -0.49 4.35 7.8

EBITDA margin to sales % 13.44 10.76 15.6 8.18 11.15 14

Cost to income ratio Times 0.94 1.09 0.68 2.31 1.15 0.8

Operating leverages % -0.2 -0.65 3.71 2.75 -0.84 0.42

Return on equity with surplus on revaluation of F.A % 13.07 14.17 30.92 -1.62 15.95 28.7

Return on equity without surplus on revaluation of F.A % 16.34 17.92 36.43 -1.98 19.34 35.1

Return on capital employed % 11.44 12.62 25.64 -1.21 11.46 19.4

Return on total assets % 6.1 5.3 12.8 -0.5 5.2 9.5

Shareholders fund ratio % 46.8 37.4 41.4 31 32.9 33.1

LIQUIDITY RATIO

Current ratio Times 1.33 1.16 1.29 0.99 1.1 1.16

Quick/Asid test ratio Times 0.29 0.21 0.3 0.29 0.26 0.25

Cash to current liability Times -0.09 -0.4 -0.34 -0.42 -0.36 -0.42

Cash flow from operations to sales Times 0.25 -0.05 0.06 0.04 0.05 -0.02

TURNOVER RATIOS

Inventory turnover ratio Times 2.2 2.8 3 2.4 2.7 2.7

Inventory turnover ratio in days Days 167 131 121 151 134 133

Debtor turnover ratio Times 19.4 24 25.8 20.4 28.7 29.8

Debtor turnover in days Days 19 15 14 18 13 12

Creditor turnover ratio Times 15.8 40.4 17.8 12.7 20.7 14.8

Creditor turnover ratio in days Days 23 9 21 29 18 2

Total assets turnover ratio Times 13 14 14 1 12 12

Fixed assets turnover ratio Times 3.3 4 3.7 2.4 2.8 2.8

operating cycle in days Days 163 137 115 141 129 121

Capital employed turnover ratio Times 2.5 3.2 2.9 2.5 2.6 2.5

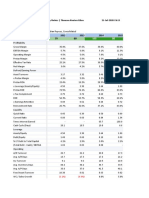

INVESTMENT /MARKET RATIO

Earning per share-basic and diluted Rs. 23.36 18.38 41.38 -4.6 18.26 28.75

Price earning ratio Times 3.14 5.64 5.1 -19.93 4.22 8.07

Dividend yield % 13.65 9.64 4.74 - 8.43 3.66

Dividend payout % 42.81 54.39 24.17 - 30.12 29.56

Dividend per share Rs. 10 10 10 - 5.5 8.5

Bonus shares % - - - - 1 -

Dividend cover Times 2.34 1.84 4.14 - 3.32 3.38

Market value per share at the end of the year Rs. 73.24 103.73 211.02 92 77.07 231

Market value per share high during the year Rs. 119.75 219.6 242.5 121 247.97 377

Market value per share low during the year Rs. 62.4 90.6 92.1 64 71.25 203

Price to book ratio Times 0.13 0.15 0.41 0.19 0.15 0.5

Break-up value per share-inncluding revaluation surplus Rs. 195 182 151 109 126 114

Break-up value per share-excluding revaluation surplus Rs. 142 129 119 81 96 86

CAPITAL STRUCTURE RATIO 1.4

Financial leverage ratio % 1.1 1.7 5.7 2.2 2 2

Weight avg cost of debt % 15 8.1 214 12.2 7.9 4.5

Net assets per share Rs. 267 253 59:41:00 150 172 153

Total debt : Equity ratio 53:47:00 63:37:00 9.1 69:31:00 67:33:00 67:33:00

Interest cover Times 2.9 4.5 1 3.1 8.8

VALUE ADDITION 2,605

Employees as remuneration Rs. millions 2,887 2,862 21,205 2,109 2,192 2,163

Government as taxes Rs. millions 22,245 26,067 1,319 14,497 18,497 16,789

Shareholders as dividends Rs. millions 989 1,055 7,399 659 659 1,019

Retained within the business Rs. millions 3,620 3,679 1,567 2,510 2,510 4,249

Financial charges to providers of finance Rs. millions 4,024 2,504 2,214 2,214 981

EMPLOYEE PRODUCTIVITY RATIO 601

Production per employee Tons 239 498 60 466 625 613

Revenue per employee Rs. millions 62 73 1.3 38 42 38

Spares inventory as % of assets cost % 1.7 1.3 2.9 1.4 1.3 1.1

Maintenance cost as % of operating expenses % 2.8 2.4 2.5 3.1 3.4

OUR CUSTOMERS In an era where customer expectations and demands are continually evolving, IIL has embarked on a

transformative journey by redefining its strategy to embrace a customer-centric approach. This strategic

shift is designed to reinforce IIL's commitment to placing customers at the epicenter of its operations,

thereby fostering stronger relationships, delivering tailored solutions, and driving sustainable growth.

IIL’s customer-centric approach is underpinned by a comprehensive strategy that encompasses four key

areas, each contributing to an enhanced customer experience and strengthened partnerships.

CUSTOMER AWARENESS IIL has engaged in a range of proactive and targeted in-market activities. These activities include

participation in market events, where the company has the opportunity to showcase its innovative

products, forge connections, and gain firsthand insights into market trends. Additionally, IIL has invested

in market branding initiatives to ensure that its value proposition resonates strongly with customers.

Furthermore, personalized one-on-one corner meetings have been instrumental in fostering deeper

connections, enabling the company to better understand customer needs and tailor solutions

DIGITAL TRANSFORMATION To streamline its operations and elevate customer

interactions, IIL has embraced digital transformation. A pivotal step in this direction was the deployment of a

state-of-the-art Customer Relationship Management (CRM) system. This robust platform facilitates seamless

communication and collaboration among the sales and marketing teams, ensuring that crucial customer

information is centralized and easily accessible. By diligently tracking customer interactions, inquiries,

VALUE-ADDED PRODUCTS IIL recognizes that the modern marketplace demands solutions that are not only of high quality but also

tailored to specific customer requirements. In response, the company has pivoted towards offering

value-added products that cater to diverse needs. By engaging customers in meaningful consultations,

IIL collaborates closely to understand their challenges and aspirations. IIL delivers customized products

that align seamlessly with customer goals. This bespoke approach not only differentiates IIL from

competitors but also solidifies its position as a trusted partner, dedicated to helping customers achieve

their objectives.

CONTINUOUS ENGAGEMENT At the core of IIL’s customer-centric approach is a commitment to ongoing engagement. This involves

actively listening to customer feedback, analysing market trends, and remaining attuned to evolving

preferences. Regular communication channels, including surveys and feedback mechanisms, enable IIL

to continuously refine its offerings and services. By staying connected with customers, the company

ensures that its solutions remain relevant, impactful, and aligned with the ever-changing landscape

You might also like

- 6 Holly Fashion Case StudyDocument3 pages6 Holly Fashion Case StudyCaramalau Mirela-Georgiana0% (1)

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Profitability Ratio: KPI'sDocument4 pagesProfitability Ratio: KPI'sdanyalNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- Black Gold - AnalysisDocument12 pagesBlack Gold - AnalysisAbdulrahman DhabaanNo ratings yet

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareNo ratings yet

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Working Excel - BASFDocument3 pagesWorking Excel - BASFVikin JainNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- FM205 CaseDocument33 pagesFM205 CaseAastik RockzzNo ratings yet

- Jamaica Broilers Group RatiosDocument93 pagesJamaica Broilers Group RatiosJasmine JacksonNo ratings yet

- Keppel Pacific Oak US REIT Financial StatementsDocument155 pagesKeppel Pacific Oak US REIT Financial StatementsAakashNo ratings yet

- 2022 01 Bucher Annual-Report 2022 EN 0Document152 pages2022 01 Bucher Annual-Report 2022 EN 0mohammades2006No ratings yet

- NationDocument1 pageNationbiawa1100% (2)

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Baskin RobbinsDocument2 pagesBaskin RobbinsArshad MohammedNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Landmark CaseDocument22 pagesLandmark CaseLauren KlaassenNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- RanbaxyDocument2 pagesRanbaxyamit_sachdevaNo ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- Ankita CFDocument3 pagesAnkita CFRahul YadavNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Ashok Leyland Limited: RatiosDocument6 pagesAshok Leyland Limited: RatiosAbhishek BhattacharjeeNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Tarson Products (Woking Sheet - FRA)Document9 pagesTarson Products (Woking Sheet - FRA)RR AnalystNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- Group3 - DIY - Garware Wall Ropes - Stock PitchDocument5 pagesGroup3 - DIY - Garware Wall Ropes - Stock PitchBhushanam BharatNo ratings yet

- Ratio Analysis: Profitability RatiosDocument5 pagesRatio Analysis: Profitability RatiosATANU ROYCHOUDHURYNo ratings yet

- Bav 2Document3 pagesBav 2Aakash SinghalNo ratings yet

- Housing Ratio PDFDocument2 pagesHousing Ratio PDFAbdul Khaliq ChoudharyNo ratings yet

- Akash 5yr PidiliteDocument9 pagesAkash 5yr PidiliteAkash Didharia100% (1)

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- FIN254 Project Final AbcDocument37 pagesFIN254 Project Final AbcSazzad66No ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- State Bank of India: Key Financial Ratios - in Rs. Cr.Document4 pagesState Bank of India: Key Financial Ratios - in Rs. Cr.zubairkhan7No ratings yet

- CV Case 3Document40 pagesCV Case 3neelakanta srikarNo ratings yet

- Valuation, Case #KEL790Document40 pagesValuation, Case #KEL790neelakanta srikarNo ratings yet

- UntitledDocument15 pagesUntitledIshu SainiNo ratings yet

- Murree Brewery: Beverage IndustryDocument12 pagesMurree Brewery: Beverage Industrykinza bashirNo ratings yet

- Valuation Index GroupDocument2 pagesValuation Index Groupbaongan23062003No ratings yet

- 915 529 Supplement Landmark XLS ENGDocument32 pages915 529 Supplement Landmark XLS ENGPaco ColínNo ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- Pas 12 Income TaxesDocument9 pagesPas 12 Income TaxesAllegria AlamoNo ratings yet

- Analisis Rasio PT Nippon Indosari Corpindo TBKDocument3 pagesAnalisis Rasio PT Nippon Indosari Corpindo TBKAkilNo ratings yet

- BUSN 2nd Edition Kelly Test Bank 1Document37 pagesBUSN 2nd Edition Kelly Test Bank 1sandra100% (39)

- Lecture 9.1Document34 pagesLecture 9.1Lyeba KhanNo ratings yet

- Financial Management Week 3 CompressedDocument77 pagesFinancial Management Week 3 Compressedamira alyNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Unclaimed Peerless InsuranceDocument8 pagesUnclaimed Peerless InsurancejeevanreddyvkNo ratings yet

- (FMDFINA) Bridging Blaze FMDFINA ReviewerDocument24 pages(FMDFINA) Bridging Blaze FMDFINA Reviewerseokyung2021No ratings yet

- Financial Analysis With Microsoft Excel 6th Edition Mayes Solutions ManualDocument24 pagesFinancial Analysis With Microsoft Excel 6th Edition Mayes Solutions Manualaramaismablative2ck3100% (20)

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- CapitalisationDocument13 pagesCapitalisationHarish PatilNo ratings yet

- Passive Equity Portfolio Management CH2-3Document23 pagesPassive Equity Portfolio Management CH2-3Mhmd ZaraketNo ratings yet

- Chapter 6 Smart Accounting QuestionDocument5 pagesChapter 6 Smart Accounting QuestionDanish AqashahNo ratings yet

- Financial Accounting 2022Document6 pagesFinancial Accounting 2022Haryana AaleNo ratings yet

- 2021 Tulip Mock QuestionsDocument17 pages2021 Tulip Mock QuestionsSophie ChopraNo ratings yet

- Nexus Select Trust IPO GeoDocument8 pagesNexus Select Trust IPO GeoRahul NimmagaddaNo ratings yet

- Intermediate Accounting Canadian Canadian 6th Edition Beechy Solutions ManualDocument59 pagesIntermediate Accounting Canadian Canadian 6th Edition Beechy Solutions Manualconatusimploded.bi6q100% (26)

- Certificate in Securities Ed16Document366 pagesCertificate in Securities Ed16Tim XUNo ratings yet

- Unit 3 Tutorial Worksheet (Session 1)Document15 pagesUnit 3 Tutorial Worksheet (Session 1)MingxNo ratings yet

- 6021-P2-Lembar Kerja (TH 2022)Document41 pages6021-P2-Lembar Kerja (TH 2022)Nurul Jennah AgustinNo ratings yet

- MCQ 6019 TestDocument38 pagesMCQ 6019 TestpathiranapremabanduNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Roll No. ..................................... : Part-I 1Document8 pagesRoll No. ..................................... : Part-I 1ssNo ratings yet

- FABM2 Module 7 Darl DelimaDocument27 pagesFABM2 Module 7 Darl DelimaFaye LañadaNo ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- Slm-Iii Sem - Corpo AccountingDocument304 pagesSlm-Iii Sem - Corpo AccountingAlbin K BijuNo ratings yet

- Godrej Consumer Products Research ReportDocument4 pagesGodrej Consumer Products Research Reportharshjalan2002No ratings yet

- Analyzing Reverse Merger in India Ease in Tax Implication PDFDocument13 pagesAnalyzing Reverse Merger in India Ease in Tax Implication PDFDhruv TiwariNo ratings yet

- LT Foods HDFC Research ReportDocument14 pagesLT Foods HDFC Research ReportjayNo ratings yet

- AFAR QuestionnaireDocument7 pagesAFAR QuestionnaireShenna Mae LibradaNo ratings yet