Professional Documents

Culture Documents

Illustrative Problem Government Accounting Process

Illustrative Problem Government Accounting Process

Uploaded by

nagoralester0 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesIllustrative Problem Government Accounting Process

Illustrative Problem Government Accounting Process

Uploaded by

nagoralesterCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

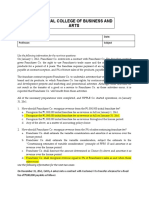

PROBLEM - BASIC RECORDING OF GOVERNMENT TRANSACTIONS AND

WORKSHEET PREPARATION

Entity DMV is a newly formed government agency. Entity DMV transactions and events

during the calendar year 2022 are as follows;

a. Received appropriation of ₱600,000

b. Received allotment of ₱550,000

c. Incurred obligations amounting to ₱540,000

d. Received Notice of Cash Allocation of ₱530,000

e. Accrued ₱80,000 salaries through granting, and liquidation of cash advance. The

breakdown of the salaries is as follows:

Salaries and Wages ₱70,000

Personal Economic Relief Allowance (PERA) 10,000

Gross Compensation 80,000

Withholding Tax 18,000

GSIS 4,000

Pag-ibig 1,000

Philhealth 2,000

Total Salary Deductions 25,000

f. Received Delivery of purchased office equipment worth ₱200,000. The equipment has

an estimated useful life of 5 years and a 5% residual value. Entity ADM recognizes

monthly depreciation every end of the month using the straight-line method. The

equipment is acquired on January 1, 2021.

g. Paid the accounts payable from the purchase of equipment in (f) above. Taxes withheld

amount to ₱12,000

h. Received delivery of purchased office supplies worth ₱100,000. The office supplies

were purchased through check. Taxes withheld amount to ₱5,000.

i. Issued office supplies worth ₱90,000 to end users.

J. Granted ₱20,000 cash advance to an employee for travelling expenses on an official

local travel. The employee liquidated ₱17,000 and remitted the excess cash advance.

k. Collected unbilled service income for Permit Fees of ₱40,000 and remitted ₱30,000 of

the total collection.

l. Paid water and electricity expenses amounting to ₱5,000 and ₱10,000 respectively.

Taxes withheld amount to ₱2,000.

m. Remitted the taxes withheld to the BIR

n. Remitted contribution to GSIS, PhilHealth and Pag-ibig.

Requirements:

1. Record the transactions and events above. If no journal entry is needed, state the

registry or other document where the transaction or event is recorded.

2. Post the transactions in the ledger. Use T-accounts

3. Prepare the unadjusted trial balance

4. Prepare the adjustments if any.

5. Prepare a complete worksheet showing columns for post-closing trial balance

6. Prepare the closing entries

You might also like

- Taxation First Preboard 93 - QuestionnaireDocument16 pagesTaxation First Preboard 93 - QuestionnaireAmeroden AbdullahNo ratings yet

- AFAR QuizDocument18 pagesAFAR QuizHans Even Dela Cruz100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- AA Chap 11 Rev May 2016Document3 pagesAA Chap 11 Rev May 2016jbsantos09No ratings yet

- AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSEDocument2 pagesAEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSEDrew BanlutaNo ratings yet

- Assignment Module 3Document2 pagesAssignment Module 3Drew BanlutaNo ratings yet

- Problem 3-7:worksheet PreparationDocument3 pagesProblem 3-7:worksheet PreparationMaria Erica AligamNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- Take Home Quiz 2Document6 pagesTake Home Quiz 2Jane Tuazon100% (1)

- Government Accounting QuestionsDocument12 pagesGovernment Accounting QuestionsJoana Poala AbunganNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- 2019 Level 1 CFASDocument8 pages2019 Level 1 CFASMary Angeline LopezNo ratings yet

- Fundamental - I WorksheetDocument3 pagesFundamental - I WorksheetuuuNo ratings yet

- Adjustments Quiz 1Document7 pagesAdjustments Quiz 1Sheena GaborNo ratings yet

- Far QualifyingDocument6 pagesFar QualifyingErica FlorentinoNo ratings yet

- PLP Government Accounting Final ExamDocument4 pagesPLP Government Accounting Final ExamApril ManjaresNo ratings yet

- ABC Company LTDDocument2 pagesABC Company LTDJackson MafumboNo ratings yet

- Assign. 2 Module 2Document9 pagesAssign. 2 Module 2Kristine VertucioNo ratings yet

- Adjusting Entries Asnwer KeyDocument19 pagesAdjusting Entries Asnwer KeyCATUGAL, LANCE ALECNo ratings yet

- Eos Cupfinal RoundDocument7 pagesEos Cupfinal RoundSheena Pearl AlinsanganNo ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Intermidate AssignmentDocument6 pagesIntermidate AssignmentTahir DestaNo ratings yet

- 13th NCR Cup Series 7 SGVDocument9 pages13th NCR Cup Series 7 SGVrcaa04No ratings yet

- Acctg 6c 1st Exam FinalDocument3 pagesAcctg 6c 1st Exam FinalJao FloresNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- BTAXREV Week 4 ACT185 Preferential Taxation 2Document16 pagesBTAXREV Week 4 ACT185 Preferential Taxation 2gatotkaNo ratings yet

- Activity Analyzing TransactionsDocument7 pagesActivity Analyzing TransactionsalexamajeranoNo ratings yet

- Statement of Financial Performance For The Year Ended 31st July 2018Document2 pagesStatement of Financial Performance For The Year Ended 31st July 2018Sanket PatelNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- Ifrs December 2020 EnglishDocument10 pagesIfrs December 2020 Englishjad NasserNo ratings yet

- Quiz Week 2 No AnswerDocument10 pagesQuiz Week 2 No AnswerKatherine EderosasNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- Q1 ReviewDocument8 pagesQ1 ReviewCZARINA COMPLENo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- Performance 2Document1 pagePerformance 2Kaye VillaflorNo ratings yet

- ACC300 Principles of AccountingDocument11 pagesACC300 Principles of AccountingG JhaNo ratings yet

- KF Eliminations For RMYCDocument8 pagesKF Eliminations For RMYCFranz Josef De GuzmanNo ratings yet

- Elimination Round QuestionnairesDocument5 pagesElimination Round Questionnairesmitakumo uwuNo ratings yet

- 93-09 - Capital AssetsDocument8 pages93-09 - Capital AssetsJuan Miguel UngsodNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- National College of Business and Arts: Name: Date: Professor: SubjectDocument8 pagesNational College of Business and Arts: Name: Date: Professor: SubjectAngelica CerioNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- 20 Regional Mid-Year Convention - Academic League Advanced Financial Accounting and Reporting CupDocument20 pages20 Regional Mid-Year Convention - Academic League Advanced Financial Accounting and Reporting CupAshNor RandyNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Marking) - Encircle The Right Answer in Multiple Choice QuestionsDocument4 pagesMarking) - Encircle The Right Answer in Multiple Choice QuestionsI.E. Business SchoolNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet