Professional Documents

Culture Documents

New Format Exam Q Far510 - Dec 2016

New Format Exam Q Far510 - Dec 2016

Uploaded by

Athira RidwanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Format Exam Q Far510 - Dec 2016

New Format Exam Q Far510 - Dec 2016

Uploaded by

Athira RidwanCopyright:

Available Formats

CONFIDENTIAL 1 AC/DEC 2016/FAR510

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

COURSE : FINANCIAL ACCOUNTING AND REPORTING 3

COURSE CODE : FAR510

EXAMINATION : DECEMBER 2016

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of four (4) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of :

i) the Question Paper

ii) an Answer Booklet – provided by the Faculty

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 8 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/DEC 2016/FAR510

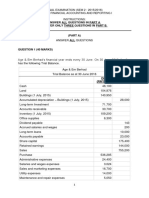

QUESTION 1

DB Manufacturing Bhd is an established company where the nature of business is

manufacturing and marketing of leather goods. Provided below is the trial balance of the

company as at 30 June 2016:

Dr Cr

RM'000 RM'000

Freehold land at valuation on 1 July 2015 46,970

Building at valuation on 1 July 2015 45,000

Plant and machinery at cost on 1 July 2015 22,980

Accumulated depreciation as at 1 July 2015:

Building 5,000

Plant and machinery 9,192

Investment property 24,600

Intangible asset 18,784

Inventory at cost on 30 June 2016 18,380

Trade and other receivables 9,009

Bank 11,770

Ordinary share capital 50,000

Non-redeemable preference share capital 13,000

Revaluation reserve of freehold land at 1 July 2015 1,500

Revaluation reserve of building at 1 July 2015 1,000

Retained earnings at 1 July 2015 17,676

Long-term loan 12,300

Trade and other payables 4,798

Deferred tax 7,484

Revenue 632,300

Cost of sales 246,702

Rental income 6,000

Selling and distribution expenses 191,700

Administrative expenses 100,120

Finance costs 1,485

Preference dividend paid 250

Ordinary dividend paid 500

Tax paid 22,000

760,250 760,250

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/DEC 2016/FAR510

The following additional information have not been accounted for by the company.

1. Freehold land and building were revalued on 30 June 2016 at their fair values of

RM48,470,000 and RM35,000,000 respectively. The remaining useful life of the

building was 40 years as at 1 July 2015. The freehold land and building have been

revalued before, but the company did not make an annual transfer from revaluation

reserve to retained earnings.

The property, plant and equipment are depreciated on a straight-line basis over an

estimated useful life as follows:

Building 50 years

Plant and machinery 10 years

Depreciations are calculated based on monthly basis and to be charged to

administrative expenses except for depreciation on plant and machinery which is to

be charged to cost of sales. The freehold land is not depreciated.

2. One of the machinery costing RM5,000,000 (carrying value of RM3,000,000) was

sold at RM3,500,000 on 1 July 2015. The machinery has a remaining useful life of 6

years as at that date. The machinery was immediately leaseback by the company

with the following terms:

Lease term 5 years

Annual lease payment RM1,000,000

The first lease payment is payable on 30 June 2016. Interest is to be allocated over

the lease term using the sum-of-digits method. The ownership of the machinery will

not be transferred to DB Manufacturing Bhd at the end of the lease term.

3. The company acquired an imported machinery on 1 January 2016 for EUR40,000.

Half of the amount was paid by the company at the date of acquisition by issuing new

ordinary shares and the balance is still unpaid. The exchange rates were as follows:

1 January 2016 EUR1 = RM4.50

30 June 2016 EUR1 = RM4.80

4. Inventories costing RM380,000 was valued at 30% below cost because the design

was outdated.

5. The tax expense for the year was estimated at RM23,500,000 inclusive of a

decrease in deferred tax of RM300,000.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/DEC 2016/FAR510

Required:

Prepare the following financial statements for DB Manufacturing Bhd in accordance with

MFRS101 Presentation of Financial Statements and other relevant Malaysian Financial

Reporting Standards:

a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 30

June 2016. (Disclosure of Earnings Per Share is required)

(10 marks)

b. Statement of Changes in Equity for the year ended 30 June 2016.

(5 marks)

c. Statement of Financial Position as at 30 June 2016. (A note on property, plant and

equipment is required)

(15 marks)

(Total: 30 marks)

QUESTION 2

On 1 January 2013, Jitu Bhd received a government grant of RM5,000,000 for the purchase

of a machinery costing RM8,000,000. The useful life of the machinery was five (5) years.

The company adopts the deferred income method for the treatment of the government grant.

On 1 January 2015, the company fails to comply with the conditions attached to the grant by

the government.

On 1 July 2013, Jitu Bhd started construction of a 10-storey building in Gurun. The building

will be rented to third parties when it is completed. The building was expected to have a

useful life of 50 years with no salvage value.

In order to finance part of the construction, Jitu Bhd obtained a 3-year term loan of

RM15,000,000 from a local bank on 1 May 2013. The effective interest rate was 8% per

annum. On 1 January 2014, Jitu Bhd suspended the construction of the building due to

shortage of raw materials for 3 months. Since the construction was suspended, the company

temporarily invested part of the money on 1 January 2014 in a 6-month fixed deposit that

earned an interest income of RM300,000. The construction recommenced on 1 April 2014

after the raw materials were available for construction.

The building was finally completed on 30 September 2015 and was ready for its intended

use. The costs of construction excluding borrowing cost were RM28,000,000. The

construction cost also include rectification cost of RM100,000.

The newly completed building was rented out to third parties on 1 January 2016. However,

there are still many vacant units. The company then decided to occupy the vacant units.

The fair value of the building as at that date was RM30,000,000 and RM31,000,000 on 30

June 2016.

The company’s policy is to adopt revaluation model for property and fair value model for

investment property.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/DEC 2016/FAR510

Jitu Bhd has a plant which meets the criteria for classification as ‘held for sale’ in the

financial statements as at 30 June 2015. Due to the advancement in technology and new

technology plant being introduced in the market, Jitu Bhd’s plant is not up to mark. Jitu Bhd

is still committed to sell the plant, thus on 1 March 2016 decided to make modifications and

technological changes to the plant so that the plant will be competitive with the new plant in

the market. It will also increase the production capacity of the plant. The modification works

will take 6 months to complete. The modification cost will increase the carrying amount and

the company is not willing to reduce the price to it fair value. The plant was not sold as at 30

June 2016.

Required:

a. State the accounting treatment for the government grant for the year ended 30 June

2015, in accordance with MFRS 120 Accounting for Government Grants and

Disclosure of Government Assistance.

(5 marks)

b. List the costs that constitute the initial cost of the building upon completion.

(5 marks)

c. Discuss briefly the classification of the building based on the relevant Malaysian

Financial Reporting Standards.

(5 marks)

d. Explain briefly the accounting treatment for the change in fair value of the building

during the year ended 30 June 2016.

(Assuming that the building qualify as an investment property)

(5 marks)

e. Discuss whether the plant that was initially classified as ‘held for sale’ can still be

classified as ‘held for sale’ during the year ended 30 June 2016 in accordance with

MFRS 5 Non-Current Assets Held for Sale and Discontinued Operations.

(5 marks)

(Total: 25 marks)

QUESTION 3

FQue Beverages Bhd had successfully launched a new product, “AWAKE”, in January 2014.

“AWAKE” is an energy drink targeted for health conscious adults. The company spent

RM1,500,000 to develop the product which meets the criteria for capitalisation. The

company decided to amortize the cost for five years since it was confident that it can

penetrate the market as one of the top energy drink in Asia.

In July 2014, the business development unit of the company planned to produce another

health drink. The target market is for students by selling the idea of a drink for a fit body and

can sustained memory. The drink will be a low sugar and low caffeinated drink since the

company believed that students nowadays are also health conscious.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/DEC 2016/FAR510

A concept testing was run in September 2014 to get consumers’ feedback. A focus group of

15 students from various universities and colleges were interviewed to collect their feedback

on the idea of the product. An online focus group was also carried out to get a good

representative of the target market feedback. This test was carried out for three months and

the total cost of the whole process was RM50,000. The unit prepared a proposal and the

project was called “B’POWER” where a presentation of the test results and product

specification was conducted. The management agreed with the idea and concept presented,

and has given permission to begin product development.

The project was passed to the development unit on 1 January 2015. The company hired a

food chemist to help formulate the drink. The chemist was paid an annual salary of

RM150,000. Three lab assistants and two employees were also assigned to help in

developing the drink and they were paid monthly salaries of RM15,500. Until 30 June 2015,

the company had spent RM250,000 for ingredients, tasting and quality control.

Based on the tasting and quality test on the samples carried out in June 2015, the drink was

rejected since it did not meet the market standard and this might affect the future sales of the

drink. However, the company still continue to improve the taste and quality of the drink until

they succeeded in end of March 2016.

The drink was later named “B’POWER”. The company spent an additional RM720,000 on

ingredients, tasting and quality control before commercial production. “B-POWER” was

manufactured and launched into the market on 1 July 2016. The expected future economic

benefit from the new drink “B’POWER” is RM800,000.

However, on 1 May 2016, product “AWAKE” was withdrawn from the market after receiving

complaints from consumers due to the side effects of the product.

Required:

a. Explain briefly the disclosure for the amount spent on the test conducted by the

company before the drink “B’POWER” was developed.

(5 marks)

b. Discuss briefly the accounting treatment for the development cost incurred for project

“B’POWER” for the year ended 30 June 2015 and 30 June 2016. (Calculations for

the cost are not required)

(5 marks)

c. Calculate the development cost that can be recognised as an intangible asset for

project “B’POWER” for the year ended 30 June 2016.

(5 marks)

d. Comment on the accounting treatment for product “AWAKE” for the year ended 30

June 2016.

(5 marks)

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/DEC 2016/FAR510

QUESTION 4

Given below are the summarised statement of financial position of Picturesque Bhd.

Statement of financial position as at 30 June

2016 2015

RM’000 RM’000

Non-current assets:

Property, plant and equipment 8,496 6,672

Investment property 900 720

Current assets:

Short-term investment 60 -

Inventory 1,824 1,200

Trade receivables 1,056 864

Bank 1,804 -

Non-current assets held for sale 360 -

14,500 9,456

Equity:

Ordinary share capital 6,540 4,200

Asset revaluation reserve 1,380 840

Retained profits 4,512 2,160

Non-current liabilities:

Deferred tax 240 168

Finance Lease liability 420 520

Long term loan 100 -

Current liabilities:

Tax Payable 108 96

Finance lease liability 60 80

Interest payable 144 108

Trade payables 996 684

Bank overdraft - 600

14,500 9,456

Additional information:

1. Profit before tax is arrived at after charging finance cost of RM87,000 and

depreciation of RM360,000.The tax expense for the year is RM1,104,000.

2. The following information were related to property, plant and equipment during the

financial year ended 30 June 2016 :

A new equipment was acquired for RM240,000 and payment was made through

issue of ordinary shares.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/DEC 2016/FAR510

A plant with a carrying amount of RM420,000 was reclassified as ‘held for sale’

during the year.

The land was revalued resulting in a surplus of RM780,000.

The building was also revalued resulting in a deficit of RM240,000. The building has

a surplus of RM300,000 from previous revaluation.

3. During the year, the investment property valued at RM720,000 has been reclassified

as a property, plant and equipment. The fair value at the date of change in use was

RM714,000. The fair value model was adopted for the investment property.

4. The short-term investment qualifies as a cash equivalent.

5. Interim dividend of RM384,000 was paid during the year.

Required:

a. Prepare the statement of cash flows for the year ended 30 June 2016 using the

indirect method.

(20 marks)

b. Analyse the reasons that resulted in a positive inflow during the year ended 30 June

2016 from an overdraft during the year ended 30 June 2015.

(5 marks)

(Total: 25 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Bdaw2103-Basic of Financial AccountingDocument18 pagesBdaw2103-Basic of Financial AccountingSimon RajNo ratings yet

- ICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFDocument427 pagesICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFOptimal Management Solution100% (5)

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- FAR460 - Feb 2021 - Q - Set 1Document7 pagesFAR460 - Feb 2021 - Q - Set 1Ahmad Adlan Bin RosliNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Auditing Problem - Preweek: Cordillera Career Development College College of AccountancyDocument42 pagesAuditing Problem - Preweek: Cordillera Career Development College College of AccountancyGi Ne VaNo ratings yet

- MC 1-PPE (Students) - A202Document5 pagesMC 1-PPE (Students) - A202lim qsNo ratings yet

- Bkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Document4 pagesBkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Rubiatul Adawiyah33% (3)

- Chapter 7 Capital Allocation Between The Risky Asset and The Risk-Free AssetDocument47 pagesChapter 7 Capital Allocation Between The Risky Asset and The Risk-Free AssetLika ChanturiaNo ratings yet

- New Format Exam Q Far510 - Dec 2015Document8 pagesNew Format Exam Q Far510 - Dec 2015Athira RidwanNo ratings yet

- Question Far270 Feb2021Document9 pagesQuestion Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Far270 Q Feb2021 FaDocument9 pagesFar270 Q Feb2021 Fa2024786333No ratings yet

- Answer All Questions in Part A. Answer Only Three Questions in Part BDocument16 pagesAnswer All Questions in Part A. Answer Only Three Questions in Part BHazim BadrinNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- QuestionsDocument7 pagesQuestionsFariha NazamNo ratings yet

- FAR460 Jan 24Document8 pagesFAR460 Jan 24wan idharNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- Far410 Dec 2019Document8 pagesFar410 Dec 2019NurulHuda Auni Binti Ab RahmanNo ratings yet

- Far410 (Jan 2018)Document8 pagesFar410 (Jan 2018)nurathirahNo ratings yet

- May 2021 Path SkillsDocument139 pagesMay 2021 Path Skillsbusolajuliet601No ratings yet

- Far210 Jan2024 QDocument8 pagesFar210 Jan2024 QafiqahNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument9 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Do Not Turn Over This Page Until Instructed by The InvigilatorDocument9 pagesDo Not Turn Over This Page Until Instructed by The InvigilatorShawn LiewNo ratings yet

- Q Far270 July2021 - Set 1Document8 pagesQ Far270 July2021 - Set 1nafisah rahmanNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 3Document4 pagesUniversiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 3KAY PHINE NGNo ratings yet

- FA Dec 2018Document8 pagesFA Dec 2018Shawn LiewNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- Bs 320 TutorialDocument4 pagesBs 320 TutorialPrince Daniels TutorNo ratings yet

- Past Year Far460 - Dec 2014Document7 pagesPast Year Far460 - Dec 2014Alief Zazman100% (1)

- Tutorial MFRS 101 Presentation Financial StatementDocument4 pagesTutorial MFRS 101 Presentation Financial StatementashabalqisNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082No ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- FAR560 GROUP PROJECT & PRESENTATION MAY2020 Q AmendedDocument7 pagesFAR560 GROUP PROJECT & PRESENTATION MAY2020 Q AmendedftnNo ratings yet

- Final Exam July 2021 QQDocument8 pagesFinal Exam July 2021 QQLampard AimanNo ratings yet

- Answer All Questions in Part A. Answer Only Three Questions in Part BDocument9 pagesAnswer All Questions in Part A. Answer Only Three Questions in Part BHazim BadrinNo ratings yet

- UKAF1083 FA2 - Sept 2017 Adapted A.Q1 B.Q1a B.Q2aDocument7 pagesUKAF1083 FA2 - Sept 2017 Adapted A.Q1 B.Q1a B.Q2a--bolabolaNo ratings yet

- Financial Accounting and Reporting: IFRS - 2017 June QPDocument8 pagesFinancial Accounting and Reporting: IFRS - 2017 June QPMarchella LukitoNo ratings yet

- Financial Accounting and Reporting: IFRS - 2016 June QPDocument11 pagesFinancial Accounting and Reporting: IFRS - 2016 June QPMarchella LukitoNo ratings yet

- QQAA GREEN TECH Comprehensive ExampleDocument7 pagesQQAA GREEN TECH Comprehensive ExampleZulhelmy NazriNo ratings yet

- IFRS 5 Final 10112023 094140amDocument6 pagesIFRS 5 Final 10112023 094140amSidra MumtazNo ratings yet

- A8 Audit of Prepayments, Ip and Other NciDocument7 pagesA8 Audit of Prepayments, Ip and Other NciKezNo ratings yet

- FAR210 - July 2023 - QDocument8 pagesFAR210 - July 2023 - QafiqahNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320NURAISHA AIDA ATANNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- ACCT6034 MID RCQuestionDocument5 pagesACCT6034 MID RCQuestionOshin MenNo ratings yet

- BAC1614 - 2110 - Final ExaminationDocument9 pagesBAC1614 - 2110 - Final ExaminationNABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Tutorial Week 3 Questions 1Document6 pagesTutorial Week 3 Questions 1Shermaine WanNo ratings yet

- Financial Reporting LessonDocument4 pagesFinancial Reporting LessonPrince Daniels TutorNo ratings yet

- Open ReSA B45 FAR Final PB Exam Questions Answers SolutionsDocument21 pagesOpen ReSA B45 FAR Final PB Exam Questions Answers SolutionsZOEZEL ANNLEIH LAYONGNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- UKAF4034-ACR-Tutorial 4-Q BasicConsoDocument7 pagesUKAF4034-ACR-Tutorial 4-Q BasicConsotan JiayeeNo ratings yet

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDocument26 pagesARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Assignment/ Tugasan - Basics of Financial AccountingDocument15 pagesAssignment/ Tugasan - Basics of Financial AccountingShasha LovelyNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 29apr24 - Teori Cash Flow - StudentsDocument9 pages29apr24 - Teori Cash Flow - Studentssisilia rachelNo ratings yet

- FUNDAMENTALS OF ABM 1 Section 7Document13 pagesFUNDAMENTALS OF ABM 1 Section 7Allysa Kim RubisNo ratings yet

- Horizontal&Vertical Analysis Sample ProblemDocument3 pagesHorizontal&Vertical Analysis Sample ProblemGenner RazNo ratings yet

- FMI - PPT - Seminar (Week) 09 (Aug 2023)Document62 pagesFMI - PPT - Seminar (Week) 09 (Aug 2023)Kwan Kwok AsNo ratings yet

- Working Capital - LupinDocument13 pagesWorking Capital - Lupinprashantrikame1234No ratings yet

- UntitledDocument15 pagesUntitledemielyn lafortezaNo ratings yet

- Research Report On: Cash Flow Statement Analysis of Reliance Industries LimitedDocument112 pagesResearch Report On: Cash Flow Statement Analysis of Reliance Industries Limitedpan cardNo ratings yet

- Audited Consolidated Financial Statements As of December 31 2019Document113 pagesAudited Consolidated Financial Statements As of December 31 2019garciarhodjeannemarthaNo ratings yet

- IAS 1 - Financial StatementsDocument7 pagesIAS 1 - Financial StatementsJOEL VARGHESE CHACKO 2011216No ratings yet

- QuestionsDocument4 pagesQuestionschris0% (1)

- Chapter 12 Lower of Cost and Net Realizable ValueDocument1 pageChapter 12 Lower of Cost and Net Realizable ValueDanielleNo ratings yet

- Bài tập chương 5Document6 pagesBài tập chương 5Tử Đằng NguyễnNo ratings yet

- Accounting What The Numbers Mean Marshall 10th Edition Test BankDocument27 pagesAccounting What The Numbers Mean Marshall 10th Edition Test BankEricaPhillipsaszpc100% (44)

- Sa 500Document10 pagesSa 500Vaibhav BajajNo ratings yet

- Chap 13 Cash Flow Estimation and Risk AnalysisDocument20 pagesChap 13 Cash Flow Estimation and Risk AnalysisNur Ain SyazwaniNo ratings yet

- Goodwill and Human Capital ValuationDocument2 pagesGoodwill and Human Capital ValuationTekebaNo ratings yet

- Optimizing COGS - Ali Acc ManagerDocument38 pagesOptimizing COGS - Ali Acc ManagerasesmensbiNo ratings yet

- Chapter 3 Fs AnalysisDocument8 pagesChapter 3 Fs AnalysisYlver John YepesNo ratings yet

- MMW Module 9Document3 pagesMMW Module 9Kristine MartinezNo ratings yet

- Capital Market TheoryDocument25 pagesCapital Market Theoryiqra sarfarazNo ratings yet

- EFAMA Asset Management Report 2022Document62 pagesEFAMA Asset Management Report 2022AnnabelNo ratings yet

- Corporate Governance and FinanceDocument112 pagesCorporate Governance and FinanceNoemi CambrigliaNo ratings yet

- Financial Statements MIS and Financial KPIsDocument67 pagesFinancial Statements MIS and Financial KPIsDevanand TayadeNo ratings yet

- The 100 Top-Performing Large Hedge Funds - BloombergDocument16 pagesThe 100 Top-Performing Large Hedge Funds - BloombergMustaqimYusofNo ratings yet

- Cash Flow Statement PT - NandiDocument1 pageCash Flow Statement PT - NandiHelena KambongelaNo ratings yet

- Chapter 5.SVDocument73 pagesChapter 5.SVHương ViệtNo ratings yet

- JASMIN PLC Final Project ProposalDocument38 pagesJASMIN PLC Final Project ProposalAderajew TsegayeNo ratings yet

- Topic03 - Capital AllocationDocument49 pagesTopic03 - Capital Allocationmatthiaskoerner19No ratings yet

- CF TTR Quiz-1 SolutionDocument5 pagesCF TTR Quiz-1 SolutionNitesh BurnwalNo ratings yet