Professional Documents

Culture Documents

Research2Guidance - The Pharmas Rush Into AI - Whitepaper - Feb 2024

Research2Guidance - The Pharmas Rush Into AI - Whitepaper - Feb 2024

Uploaded by

Julieta JouannyCopyright:

Available Formats

You might also like

- Pharmaceutical Marketing A Guide PDFDocument39 pagesPharmaceutical Marketing A Guide PDFSomya SrivastavaNo ratings yet

- IVT Network - The FDA CGMP Inspection Is Coming - Make The Best of It - 2016-02-05Document18 pagesIVT Network - The FDA CGMP Inspection Is Coming - Make The Best of It - 2016-02-05marwaNo ratings yet

- Speciality Chemicals Magazine - February 2019 PDFDocument68 pagesSpeciality Chemicals Magazine - February 2019 PDFkaoru9010-1No ratings yet

- Role of Artificial Intelligence in Pharmaceutical IndustryDocument3 pagesRole of Artificial Intelligence in Pharmaceutical IndustryRohith KNo ratings yet

- Getting The Dose Right: A Digital Prescription For The Pharma IndustryDocument8 pagesGetting The Dose Right: A Digital Prescription For The Pharma IndustryVinita VasanthNo ratings yet

- CB Insights - Big Tech in PharmaDocument63 pagesCB Insights - Big Tech in Pharmamayankverma189131No ratings yet

- Top 10 Innovation Trends in 2024Document14 pagesTop 10 Innovation Trends in 2024anu15may05No ratings yet

- Key Trends Affecting Pharmacy AdministrationDocument5 pagesKey Trends Affecting Pharmacy AdministrationPeter NdiraguNo ratings yet

- ai 2Document9 pagesai 2Maulidia lestariNo ratings yet

- How Pharma Analytics Is Helping Pharma Companies Stay Ahead in The GameDocument2 pagesHow Pharma Analytics Is Helping Pharma Companies Stay Ahead in The GameRagavendra RagsNo ratings yet

- AI The New Frontier in Healthcare InnovationDocument7 pagesAI The New Frontier in Healthcare Innovationmarcus phuaNo ratings yet

- BDocument1 pageBAmit SoniNo ratings yet

- AI and Signal Detection in Pharmacovigilance - PharmaWatchDocDocument1 pageAI and Signal Detection in Pharmacovigilance - PharmaWatchDocvivek rakhaNo ratings yet

- CRM - Pharma PresentationDocument40 pagesCRM - Pharma PresentationVineesh Sasidharan100% (1)

- Data Driven Digital Transformation Pharma Sales and Marketing - Executive Brief - 3554enDocument3 pagesData Driven Digital Transformation Pharma Sales and Marketing - Executive Brief - 3554enSanchan KumarNo ratings yet

- V7 CMS23 - 037 2024 Pharma Trend ReportDocument60 pagesV7 CMS23 - 037 2024 Pharma Trend Reportthanhloyal100% (1)

- Nagesh AnnaDocument14 pagesNagesh Annasuprithas946No ratings yet

- Chetana Digital Marketing FinalDocument62 pagesChetana Digital Marketing FinalVenugopal VutukuruNo ratings yet

- Journal Pre-Proof: Drug Discovery TodayDocument19 pagesJournal Pre-Proof: Drug Discovery TodayDiana LeonNo ratings yet

- Tech Idea DimeADozen - Ai - Your AI ToolkitDocument1 pageTech Idea DimeADozen - Ai - Your AI ToolkitFrancis CaraballoNo ratings yet

- 88Document1 page88rahul chaudharyNo ratings yet

- Pharmaceutical Marketing (Pharm 305) Assignment: RD STDocument4 pagesPharmaceutical Marketing (Pharm 305) Assignment: RD STAvi shekNo ratings yet

- The Impact of Artificial Inteelligence On Medical InnovationDocument8 pagesThe Impact of Artificial Inteelligence On Medical InnovationdindaNo ratings yet

- The Top 5 Trends Shaping The Future of Digital Health: April 2018Document15 pagesThe Top 5 Trends Shaping The Future of Digital Health: April 2018DuongThaoNo ratings yet

- AI in PharmacyDocument18 pagesAI in PharmacyPoornima BalakrishnanNo ratings yet

- Use of Artificial Intelligence in Drug Discovery and Its DevelopmentDocument13 pagesUse of Artificial Intelligence in Drug Discovery and Its DevelopmentSuraj KumarNo ratings yet

- Digital Channels in Pharma Fad or FutureDocument3 pagesDigital Channels in Pharma Fad or FutureManoj JosephNo ratings yet

- Special Report: Biometrics in HealthcareDocument19 pagesSpecial Report: Biometrics in HealthcareStephen MayhewNo ratings yet

- The Road To Digital Success in Pharma - McKinsey & CompanyDocument10 pagesThe Road To Digital Success in Pharma - McKinsey & CompanyharshalNo ratings yet

- Impact of Artificial Intelligence On Pharm Technology A ReviewDocument5 pagesImpact of Artificial Intelligence On Pharm Technology A ReviewEditor IJTSRDNo ratings yet

- Serialization - Traceability and Big Data in The Pharmaceutical Industry PDFDocument19 pagesSerialization - Traceability and Big Data in The Pharmaceutical Industry PDFBúp CassieNo ratings yet

- Deloite Pharma and Connected PatientDocument40 pagesDeloite Pharma and Connected PatientBobAdlerNo ratings yet

- 2021.12.14 - The Big Tech in Pharma ReportDocument66 pages2021.12.14 - The Big Tech in Pharma ReportChris Surya SudjiantoNo ratings yet

- Deloitte CH LSHC Digital Transformation Sandbox en 200715Document19 pagesDeloitte CH LSHC Digital Transformation Sandbox en 200715Marija BanjavčićNo ratings yet

- Focus Finance - ER Report - PfizerDocument12 pagesFocus Finance - ER Report - PfizerVinay SohalNo ratings yet

- AI 2121: Ai in Action: Exploring Application and ImpactDocument16 pagesAI 2121: Ai in Action: Exploring Application and Impactirene.payadNo ratings yet

- 2 49 1628334248 4ijesrdec20214Document4 pages2 49 1628334248 4ijesrdec20214TJPRC PublicationsNo ratings yet

- Applications of AI in Pharmacy Practice A Look at Hospital and Community SettingsDocument5 pagesApplications of AI in Pharmacy Practice A Look at Hospital and Community SettingsBenjel AndayaNo ratings yet

- A Study On Digital Transformation and Its Effectiveness at Pfizer OrganizationDocument11 pagesA Study On Digital Transformation and Its Effectiveness at Pfizer OrganizationAditya NeelNo ratings yet

- Artificial Intelligence in Drug Discovery and DevelopmentDocument3 pagesArtificial Intelligence in Drug Discovery and DevelopmentKim KraliNo ratings yet

- Commercial Analytics and It's Defining Role in Pharma MarketingDocument8 pagesCommercial Analytics and It's Defining Role in Pharma MarketingKanika VermaNo ratings yet

- 6 Ways Pharmaceutical Companies Are Using Data Analytics To Drive Innovation & ValueDocument11 pages6 Ways Pharmaceutical Companies Are Using Data Analytics To Drive Innovation & ValueDeven MaliNo ratings yet

- 6544f60884188 Health Blues Case Study Sandee C For IIM Ranchi 2023Document4 pages6544f60884188 Health Blues Case Study Sandee C For IIM Ranchi 2023Divyansh SaxenaNo ratings yet

- Lifesciences Case - FinalDocument4 pagesLifesciences Case - FinalmohiniNo ratings yet

- Using Ai & Machine Learning To Drive Commercial Success in The EuDocument16 pagesUsing Ai & Machine Learning To Drive Commercial Success in The EuBasava Raj RNo ratings yet

- Biopharma Path To Value With Generative AiDocument12 pagesBiopharma Path To Value With Generative AidominiqueNo ratings yet

- Brand ManagmentDocument32 pagesBrand ManagmentTasbir MohammadNo ratings yet

- Digital Transformation of Pharmaceutical PDFDocument4 pagesDigital Transformation of Pharmaceutical PDFGanesh JeengarNo ratings yet

- Digital Transformatio Nof Pharmaceuticals AndhealthcareDocument5 pagesDigital Transformatio Nof Pharmaceuticals AndhealthcareBeate IgemannNo ratings yet

- Assignment Product and Brand ManagementDocument7 pagesAssignment Product and Brand ManagementYogesh GirgirwarNo ratings yet

- How To Solve Make The Supply Chain Safe From Counterfeit Drugs?Document2 pagesHow To Solve Make The Supply Chain Safe From Counterfeit Drugs?Ayan DevNo ratings yet

- Pharmaceutical Sector DigitalizationDocument6 pagesPharmaceutical Sector DigitalizationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Microsoft WP DT PLSMTDocument4 pagesMicrosoft WP DT PLSMTHarini SrinivasanNo ratings yet

- An Aid in Informed Decision Making: Business Intelligence in PharmaDocument3 pagesAn Aid in Informed Decision Making: Business Intelligence in PharmaSatpal SinghNo ratings yet

- Life Science Analytics Market - Global Industry Analysis, Size, Share, Growth, Trends, and ForecastDocument2 pagesLife Science Analytics Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecastsurendra choudharyNo ratings yet

- Hexa Research IncDocument5 pagesHexa Research Incapi-293819200No ratings yet

- Artificial Intelligence in Drug Manufacturing: Center For Drug Evaluation and ResearchDocument17 pagesArtificial Intelligence in Drug Manufacturing: Center For Drug Evaluation and ResearchHoàng Ngọc AnhNo ratings yet

- Jvion Award Write Up FinalDocument17 pagesJvion Award Write Up FinalNoo IqNo ratings yet

- Business Intelligence: Name Course Institution DateDocument7 pagesBusiness Intelligence: Name Course Institution Datepeter keitanyNo ratings yet

- Leading Pharmaceutical Innovation: How to Win the Life Science RaceFrom EverandLeading Pharmaceutical Innovation: How to Win the Life Science RaceNo ratings yet

- Outsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessFrom EverandOutsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessNo ratings yet

- Adequacy of Pharmacological Information Provided in Pharmaceutical Drug Advertisements in African Medical JournalsDocument8 pagesAdequacy of Pharmacological Information Provided in Pharmaceutical Drug Advertisements in African Medical JournalsNurafwa AdamNo ratings yet

- Analisis Farmakoekonomi Peresepan Antibiotika Ceftriaxone Dan Ceftazidime Pada Pasien Bedah Sesar Di Rumah Sakit Panti Rini YogyakartaDocument8 pagesAnalisis Farmakoekonomi Peresepan Antibiotika Ceftriaxone Dan Ceftazidime Pada Pasien Bedah Sesar Di Rumah Sakit Panti Rini YogyakartaMutiara Natasha FabanyoNo ratings yet

- Diah Natalia, Pharm-Diploma, B.SC, Apt: Permata Street # 22, Rt. 004/012 Kebon Pala-Makasar, Jakarta 13650, IndonesiaDocument8 pagesDiah Natalia, Pharm-Diploma, B.SC, Apt: Permata Street # 22, Rt. 004/012 Kebon Pala-Makasar, Jakarta 13650, IndonesiaRhea AnggareniNo ratings yet

- SWOT BoxDocument2 pagesSWOT BoxMd Hasnain0% (1)

- 2021.12.14 - The Big Tech in Pharma ReportDocument66 pages2021.12.14 - The Big Tech in Pharma ReportChris Surya SudjiantoNo ratings yet

- Notice: Human Drugs: Drug Products Withdrawn From Sale For Reasons Other Than Safety or Effectiveness— Celestone Soluspan Injection and Celestone InjectionDocument2 pagesNotice: Human Drugs: Drug Products Withdrawn From Sale For Reasons Other Than Safety or Effectiveness— Celestone Soluspan Injection and Celestone InjectionJustia.comNo ratings yet

- Resep KapsulDocument6 pagesResep KapsulMas AwangNo ratings yet

- GiodeDocument43 pagesGiodebgtbingoNo ratings yet

- Resume M PharmDocument7 pagesResume M Pharmshirisha.samala89No ratings yet

- Dopunska Lista Lijekova Web Primjena 24.12.Document339 pagesDopunska Lista Lijekova Web Primjena 24.12.Hrvoje PavelićNo ratings yet

- 1 Fruergaard Advanced Aseptic Processing ISPEDocument57 pages1 Fruergaard Advanced Aseptic Processing ISPEamerican_guy10100% (1)

- Global Pharmaceutical R&D PipelineDocument28 pagesGlobal Pharmaceutical R&D PipelinePharmaTopics PaulNo ratings yet

- Pharmace EthiopiaDocument7 pagesPharmace EthiopiaSivaraman Vasudevan100% (1)

- Ey in Vivo A Road Map To Strategic Drug Prices Subheader PDFDocument11 pagesEy in Vivo A Road Map To Strategic Drug Prices Subheader PDFsteveshowmanNo ratings yet

- Balois Elijah John R. Pdis 211 Lab E4Document11 pagesBalois Elijah John R. Pdis 211 Lab E4Michelle Elisha CartanoNo ratings yet

- TERM PAPER GlaxoSmithKline Bangladesh LimitedDocument36 pagesTERM PAPER GlaxoSmithKline Bangladesh LimitedTanvirNo ratings yet

- Value-Based Pricing in Pharmaceuticals: Hype or Hope?Document14 pagesValue-Based Pricing in Pharmaceuticals: Hype or Hope?VishalNo ratings yet

- Product Quality ComplaintsDocument82 pagesProduct Quality ComplaintsNiranjan SinghNo ratings yet

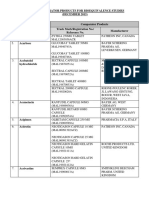

- Malaysia-NPRA List of Comparator Products For Bioequivalence Studies December 2015Document47 pagesMalaysia-NPRA List of Comparator Products For Bioequivalence Studies December 2015Noples RozaliaNo ratings yet

- Bio WorldDocument198 pagesBio Worldmc_goaNo ratings yet

- Merger & Acquisitions: Group - 01 Ghanshyam Jhanwar (F2020008) Jeenia Bhadra (F2020009) Nikhilesh Joshi (F2020015)Document11 pagesMerger & Acquisitions: Group - 01 Ghanshyam Jhanwar (F2020008) Jeenia Bhadra (F2020009) Nikhilesh Joshi (F2020015)Nikhilesh JoshiNo ratings yet

- Production and Formulation of Cosmetics, Cleaners, Drugs, Soaps and Detergents PDFDocument84 pagesProduction and Formulation of Cosmetics, Cleaners, Drugs, Soaps and Detergents PDFfarkad rawiNo ratings yet

- Health Law Final - D&C 40Document32 pagesHealth Law Final - D&C 40tanyaverma2589No ratings yet

- BTS Pharma Sales AcceleratorDocument3 pagesBTS Pharma Sales AcceleratorRahul TanwarNo ratings yet

- Bonus Product Sales April-2023Document3 pagesBonus Product Sales April-2023Mahbub Alam SarkerNo ratings yet

- PharmTech June WMDocument52 pagesPharmTech June WMAbdullah Al MamunNo ratings yet

- Federation of Medical and Sales Representatives' Associations of India - News - May - 15Document4 pagesFederation of Medical and Sales Representatives' Associations of India - News - May - 15Arun KoolwalNo ratings yet

- Individuals PMBJPDocument20 pagesIndividuals PMBJPSarthak GoelNo ratings yet

Research2Guidance - The Pharmas Rush Into AI - Whitepaper - Feb 2024

Research2Guidance - The Pharmas Rush Into AI - Whitepaper - Feb 2024

Uploaded by

Julieta JouannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research2Guidance - The Pharmas Rush Into AI - Whitepaper - Feb 2024

Research2Guidance - The Pharmas Rush Into AI - Whitepaper - Feb 2024

Uploaded by

Julieta JouannyCopyright:

Available Formats

1

The Pharma‘s Rush into

Artificial Intelligence (AI)

The AI partnerships of the top pharmaceutical

companies

Whitepaper

February 2024

©Research2Guidance 2024 – The Pharma’s Rush into AI - https://research2guidance.com/

KEY TAKEAWAYS FROM PHARMA’S RUSH INTO AI

❖ PHARMA COMPANIES ARE RUSHING INTO DEPLOYING AI VIA PARTNERSHIPS: 139 AI

partnerships, investments, and acquisitions, have been signed by the top 10 pharma

companies screened in this report since 2021.

❖ DRUG DISCOVERY AND DIAGNOSTICS & MONITORING PARTNERSHIPS ARE THE MOST

TARGETED AREA OF AI COLLABORATIONS AMONG BIG PHARMA: 43% of AI

collaborations closed by 10 pharma companies since 2021 are targeting drug discovery

and development, followed by 32% targeting diagnostics and monitoring.

❖ AI COLLABORATIONS FOR KNOWLEDGE MANAGEMENT, SUPPLY CHAIN OPTIMIZATION,

MARKETING, AND REGULATORY & POST-APPROVAL SUBMISSIONS NEED MORE

EXPLORATION: The AI collaborations targeting these domains among the 10 pharma

companies are still very few compared to drug discovery, diagnostics, and clinical trials.

❖ ASTRAZENECA IS THE COMPANY WITH MOST AI COLLABORATIONS SINCE 2021: 86% of

AstraZeneca’s AI collaborations are with innovative drug discovery and diagnostics

solution providers, such as SandboxAQ, Absci, and Qureight.

❖ PREFERRED AI PARTNERS ARE PATH AI, LUNIT, OWKIN, TEMPUS, AND GOOGLE:

Partnerships with these companies have been used to expedite drug development, detect

new molecules, understand disease characteristics, and streamline research functions in

pharma industry.

❖ BIG TECH IS BECOMING MORE RELEVANT WITH THE AI HYPE: IBM, Google, Amazon, and

Microsoft are the big tech companies selected by 4 out of 10 big pharma companies in the

report for AI collaborations in drug development and diagnostics since 2021.

❖ NEED FOR A STATE-OF-THE-ART AI PARTNERSHIP APPROACH: The number of

collaborations pharma companies have formed in the last three years underscores the

need for an efficient and systematic approach to partnerships from prioritizing AI use

cases, to scouting and selection, and to building and growing partnerships.

©Research2Guidance 2023- Digital Health Business Outlook 2023 - https://research2guidance.com/

3

THE RUSH INTO ARTIFICIAL INTELLIGENCE BY PHARMA

Artificial intelligence (AI), simulating human intelligence in computers through embedded algorithms,

has seen significant advancements, especially in recent decades. The integration of Machine Learning

(ML), Big Data analysis, Deep Learning, and Natural Language Processing (NLP) has notably enhanced

AI's ability to learn from vast structured and unstructured health data.

In the current era, AI has transformed healthcare, improving diagnostic accuracy through image

interpretation, streamlining patient assessments while analysing data from wearables and sensors,

and enabling early intervention with timely alerts in remote patient monitoring. AI-powered digital

health solutions now address treatment adherence challenges with personalized reminders,

educational materials, and behavioral nudges.

Adding to this momentum, AI got its recent big boost with the hype surrounding the new GenAI tool

ChatGPT by the end of 2022.

The pharmaceutical sector is also witnessing a surge in the adoption of new AI technologies across

various facets. Reacting to the recent hype around AI and GenAI, major pharma companies have not

only embraced AI with multiple internal projects, but have been actively seeking partnerships for AI,

establishing a trend that reshapes the industry's technological landscape.

In fact, 139 collaboration deals, that have been closed by 10 big pharma companies over the last

three years, are a clear indication of the growing adoption of AI in the industry. Examining the

distribution of these collaborations across various AI use cases reveals that the pharma companies

are actively engaging with AI solution providers to enhance diverse aspects of their operations.

Drug discovery and development has been the primary focus, making up 43% of AI collaborations

among the 10 major pharmaceutical companies since 2021. This is followed by AI collaborations in

diagnostics and monitoring (32%), and clinical trials optimization and insights generation (14%).

Other use cases within AI collaborations, such as knowledge management, supply chain optimization,

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

4

or marketing, have not seen significant exploration through partnerships compared to the top 3 use

cases over the last three years.

In this whitepaper, we navigate through the surge in AI adoption in the pharma industry, examining

the AI use cases in the pharma domains, understanding the impact of AI collaborations from 10 big

pharma companies since 2021 in driving innovation, and finally discuss a collaboration strategy

framework for the pharma with the help of R2GConnect global digital health and technology scouting

platform.

PHARMA-CENTRIC USE CASES OF ARTIFICIAL INTELLIGENCE

AI has already made its way through the domains of pharmaceutical companies and reshaping the

conventional ways of working in the industry.

Following on that, the use cases of AI solutions in the pharmaceutical industry can be grouped under

8 main categories:

1. Drug Discovery and Development: AI accelerates early-stage research at pharma by efficiently

reviewing extensive medical literature, sifting through vast EMRs to identify patient

populations, comprehending disease characteristics, aiding in the identification of new drug

targets and repurposing drugs for new therapeutic areas. Furthermore, AI fosters the

development of personalized medicine and innovative treatments, analyzing genetic data,

detecting new biomarkers across diseases, and developing targeted treatments for patients.

2. Clinical Trials & Insights Generation: AI algorithms enhance the clinical trial processes for

pharma by predicting the likelihood of success, forecasting challenges, expediting patient

recruitment, and remotely monitoring patients while collecting data through wearables and

sensors. AI’s capabilities in generating synthetic control arms and digital twins of the recruited

patients also ease up the launch of RCT studies with smaller patient groups. Lastly, AI

technologies are incorporated for clinical study report generation to shorten the time for

submission.

3. Diagnostics & Monitoring: To enhance the efficiency and accuracy of disease detection and

characteristics, pharma companies leverage AI solutions in diagnostics and monitoring as well.

Image recognition, monitoring disease progressions in patients and data analytics competencies

of AI enables pharmaceutical firms to streamline clinical trial processes, optimize patient

monitoring, and develop targeted treatments.

4. Regulatory & Post-approval Submission: AI solutions also help the Pharma with streamlining

the document review process, automating data extraction, and ensuring compliance with

regulatory guidelines. In the post-market surveillance, AI-powered solutions help with adverse

event detection, flagging safety issues, and analyzing real-world data. In these processes,

intelligent solutions are particularly useful for tasks like summarizing research papers, creating

standardized reports, or assisting in the preparation of regulatory documents.

5. Marketing & Commercial Insights Generation: To improve the effectiveness of marketing and

commercial strategies, pharma companies benefit from AI for customer segmentation, sales

forecasting, competitive intelligence, content personalization, and social media analysis. By

analyzing vast datasets, AI solutions conduct sentiment analyses, predict market trends and

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

5

demands for therapies, and help with optimization of the marketing strategies based on real-

time insights.

6. Supply Chain & Manufacture Optimization: AI optimizes pharmaceutical supply chains with

predictive maintenance for manufacturing equipment, ensuring uninterrupted production. It

also enables precise demand forecasting, minimizing waste, and responding swiftly to market

fluctuations for efficient inventory management, enhancing operational efficiency.

7. Internal Knowledge Management: AI transforms internal knowledge management with

advanced tools for data analysis, organization, and retrieval. Utilizing NLP and machine learning,

it efficiently categorizes and structures the Pharma’s internal data, facilitating quick and

accurate information retrieval. This streamlined knowledge management enhances

collaboration, decision-making, and innovation within the organization, fostering a more agile

pharmaceutical enterprise.

8. Digital Health & Care Delivery: Digital health solutions, incorporating AI technologies, become

preferred partners for pharmaceutical companies, providing access to extensive real-time

patient data, streamlining clinical trials through patient monitoring apps, collecting data from

wearables, supporting preventive care initiatives, and enhancing treatment adherence through

personalized reminders and materials.

From drug discovery and development to diagnostics, post market studies, generating commercial

insights and better utilizing internal knowledge, AI stands as a catalyst for innovation, efficiency, and

improved therapy development in the pharma industry.

BIG PHARMA COMPANIES ARE DRIVING AI INNOVATION WITH

PARTNERSHIPS

AI and ML have exerted a significant influence on the pharmaceutical sector, with companies having

leveraged these technologies for many years. The development of new technologies, such as

Generative AI (GenAI), has further propelled the deployment of AI within pharmaceutical companies.

In the last three years, major pharmaceutical players have intensified their focus on AI mainly by

strategic partnerships, internal infrastructure development, investments, and acquisitions.

Some pharmaceutical companies stand out due to increased activity involving various AI solution

providers.

1. BRISTOL MYERS SQUIBB DEVELOPS A PARTNERSHIP ECOSYSTEM

FOR AI IN A RANGE OF USE CASES

Bristol Myers Squibb (BMS) has integrated AI and ML solutions across various areas of its operations,

with a primary focus on establishing partnerships with AI solution providers to streamline drug

discovery and development.

Most recently, BMS collaborated with VantAI, committing $674 million USD, leveraging the

company's expertise in GenAI and deep learning for molecular glue design.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

6

Another significant deal worth billions was sealed with Exscientia in 2021 to leverage AI to speed up

the drug discovery in oncology and immunology, with BMS committing a total of $1.2 billion USD

contingent on milestone achievements.

Examining other AI and ML use cases at BMS, the partnership with Okra.AI, initiated in 2018 and

expanded in 2022, entails the utilization of OKRA.AI's platform to connect and generate insights from

multiple datasets, supporting BMS's commercial teams. Additionally, collaborations with digital

health solution providers like Temedica aim to efficiently launch AI-powered digital companion

solutions.

To increase its capacity in using AI for clinical trial design, execution, and precision, Owkin has

become not only BMS’s but also other big pharma companies first choice. BMS also invested in

Owkin’s equity round and provided over $100 million USD contingent on milestone achievements.

Diagnostics and monitoring are other areas that BMS has invested resources to utilize AI, together

with its partners like Viz.ai and Elekta over the recent years.

Overall, Bristol Myers Squibb strategically pursues multiple partnerships to harness the potential of

artificial intelligence, aiming to expedite drug discovery, support marketing and commercial

activities, enhance clinical trial processes, improve patient care, and advance precision medicine. The

company typically commits upfront financial investments in its strategic partnerships with AI solution

providers and deepen its ties with the AI partners with further expansion of partnerships.

2. BAYER’S STRATEGIC ALLIANCES ARE TO USE AI IN DIAGNOSTICS

Bayer's AI strategy encompasses a combination of partnerships, acquisitions, investments, and the

establishment of its radiology solutions marketplace, Calantic Digital Solutions over the last few

years.

In 2022, the company introduced its vendor-neutral cloud-based platform, Calantic, which hosts an

increasing number of solutions. These solutions contribute to disease detection and the identification

of patterns in patient journeys with the help of AI and ML.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

7

Bayer further strengthened its AI capabilities by acquiring the UK-based medical imaging company,

Blackford Analysis, as a wholly owned subsidiary in 2023, expanding its access to a diverse clinical

application ecosystem centred around imaging and analytics.

In addition to its focus on AI-powered diagnostics and monitoring solutions, Bayer has actively

pursued partnerships and investments in digital health solutions leveraging AI technologies. Through

initiatives of Leaps by Bayer and G4A accelerator programs, the company strategically collaborates

with solution providers like Woebot Health to drive innovation supported by AI technologies.

With the launch of a new Precision Health business unit in Consumer Health division, it is expected

that Bayer will have increasing number of partnerships in the case of digital health alongside its

diagnostics portfolio.

Over the last year, Bayer has also collaborated with Recursion and Google Cloud in 2023 to

accelerate its drug discovery. Leveraging Recursion's AI platform, Bayer focuses on identifying new

treatment targets for various cancer types. Simultaneously, Google Cloud also provides Bayer with

access to advanced AI and ML applications with Google’s high performance computing power to help

identify novel drug targets and utilize Vertex AI and Med-PaLM 2 to analyze large datasets and

generate insights.

Another noteworthy partnership of Bayer is the one with Altis Labs in 2023, focusing on using digital

twins in clinical trials, by automatically analysing imaging data from past and current clinical trials

using prognostic AI models.

Bayer's recent AI strategies demonstrate a heightened focus on diagnostics and monitoring, marked

by various collaborations, and the expansion of its radiology business with the introduction of the

Calantic marketplace. Beyond financial support in partnerships, the pharmaceutical giant contributes

to the development and enhancement of AI solutions through funding and mentorship provided by

Leaps by Bayer and G4A.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

8

3. SANOFI ADOPTS AI BEYOND DRUG DISCOVERY AND RESEARCH

Sanofi is another pharma company which utilizes AI mostly in drug discovery and clinical trials, but

recently they also ramped up the use cases of AI for knowledge management at the company, and in

their initiatives with digital health solution providers.

In the drug research and development, the company collaborates with range of AI solution providers

in different disease areas. Recently, Sanofi signed a deal with Aqemia, committing $140 million USD,

to utilize advanced physics algorithms and GenAI in drug discovery.

The company has also acquired Amunix Pharmaceuticals for over $1 billion USD, to accelerate and

expand development of innovative medicines for oncology patients.

Owkin stands out as one of Sanofi's preferred partners in the clinical trials domain as well, utilizing

de-identified patient data to predict treatment responses for different patient profiles.

Another interesting use case of AI at Sanofi came up with integration of company-wide AI solution

called plai, developed in partnerships with Aily Labs. The solution helps with decision-making in

different Sanofi departments, such as by predicting low inventory in supply chain or finding the right

trial sites for targets in the clinical research.

Over the past two years, Sanofi has allocated resources to invest in digital health companies such as

Hillo. The integration of Hillo's digital twin AI solution and monitoring platform with Sanofi's

connected insulin pens contributes to personalized medicine offered by the company. In 2022, Sanofi

US’s also signed a deal with DarioHealth which aims to leverage the Dario platform for developing

enhanced digital health solutions, though not AI-specific.

Furthermore, Sanofi has launched the Open Innovation Portal through its Consumer Healthcare unit,

inviting external solution providers to address challenges in consumer health and collaboratively

develop innovative self-management health solutions.

Sanofi stands as a rare example in the pharma industry, having developed and implemented an AI

solution across all company divisions to generate insights for a range of operations. This strategic

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

9

move surpasses the focus on partnerships and acquisitions solely targeting drug discovery and R&D

activities. By integrating AI into supply chain management, clinical research, digital health solutions,

as well as drug discovery, Sanofi is committed to increase the use cases of AI in the company.

4. PFIZER BENEFITS AI IN MULTIPLE USE CASES WITH PARTNERS

Pfizer, similar to the other pharma giants, has been using AI for many years now, but the company

recently focused on the partnerships in drug discovery, diagnostics, and monitoring.

One of the most recent collaborations of Pfizer is with Tempus, allowing access to de-identified

patient datasets, clinical trial matching solution, and companion diagnostics offerings from Tempus.

Like Bayer, Pfizer has also signed a deal with Google Cloud in 2023 to adopt its AI solutions to

increase speed and precision in identification of drug targets.

In the diagnostics and monitoring segment, Pfizer has acquired solution provider ResApp for $116

million USD, a company which deployed AI for diagnosing a range of respiratory conditions like

asthma or pneumonia. Additionally, both the research and development partnerships with Ultromics

and Anumana focus on detecting cardiac conditions with the help of AI.

To accelerate the clinical development and time to market of the therapies, Pfizer stroke a deal with

Saama Technologies in 2020 and then expanded it in 2024 recently. Saama’s AI offerings are helping

Pfizer with faster data review and reconciliation.

Pfizer has also been collaborating with the AI-powered digital health solution providers like Ada

Health and Alex Therapeutics, to develop new digital health offerings, companion solutions and

increase patients’ access to care with the help of AI.

Last but not least, Pfizer is also known by its partnership with Amazon Web Services (AWS), to embed

the latter’s analytics, ML and cloud data warehousing solutions to Pfizer laboratory, clinical

manufacturing and clinical supple chain efforts.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

10

To fuel the innovation with AI further, Pfizer also leverages its Healthcare Hub for partnering,

creating proof-of-concepts and feasibility studies with AI experts in various fields to boost efficiency

in its supply chain, research and development. In 2021, Pfizer, AstraZeneca, Merck and Teva have

also joined forces with Amazon Web Services and Israel Biotech Fund and founded AION Labs to

invest in early-stage startup teams focused on AI and computational biology in drug discovery and

development.

Looking broadly on Pfizer’s AI strategy development over the past few years, it is evident that the

company has strategically prioritized partnerships to propel advancements in drug discovery,

diagnostics, and monitoring. These collaborations, spanning across diverse domains such as clinical

trial matching, respiratory diagnostics, and cardiac condition detection, reflect Pfizer's commitment

to leveraging AI for comprehensive enhancements in different disease areas.

5. ASTRAZENECA BETS BIG ON AI WITH BILLIONS-WORTH

ACQUISITION AND GROWING NUMBER OF PARTNERSHIPS

AstraZeneca is actively engaging with various stakeholders, including startups, research institutions,

and technology companies, to leverage AI for diverse applications, ranging from drug discovery and

development to disease diagnosis.

Over the last year, AstraZeneca collaborated mostly with the AI experts in drug discovery and

diagnostics. For instance, the partnership with SandboxAQ, spin-off from Alphabet, aims to deploy

quantum technology as a solution to the problems in drug discovery. Additionally, a $840 million deal

with Verge in 2023 also targets drug discovery through AI in rare neurogenerative diseases.

AstraZeneca went beyond signing strategic partnerships and signed the acquisition of Alexion

Pharmaceutical in 2021, worth $39 billion USD, aimed to bring home AI-powered drug development

expertise in rare diseases.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

11

In the diagnostics segment, the company partnered with a range of AI experts in different disease

areas, such as Qureight in respiratory, Idoven in cardiovascular or Sophia Genetics in oncology, for

early diagnosis of patients, understanding disease characteristics in different patient groups, and

driving personalized medicine.

Furthermore, to accelerate clinical trials and data collection from patients, AstraZeneca has firstly

sold its AMAZE platform to HUMA in 2022, made investments in the company, and then rolled its

sleeves to co-develop companion apps with HUMA for the patients to get connected in decentralized

clinical trials.

Recently also to accelerate submissions and navigate through the changing regulatory landscapes,

AstraZeneca collaborated with SAS to enable data re-use and automate statistical analysis for clinical

and post-approval submissions.

Overall, AstraZeneca's emphasis on partnering with AI experts in drug discovery and diagnostics is

evident based on the number of partnerships, acquisitions, and investments it has committed to in

just the last three years. This strategic commitment positions AstraZeneca at the forefront of utilizing

AI to drive innovation across various facets of healthcare, ranging from precision medicine to

decentralized clinical trials.

6. ELI LILLY ACCELERATES DRUG DISCOVERY & CLINICAL TRIALS

SOLUTIONS VIA AI PARTNERSHIPS

Eli Lilly has strategically focused on forming partnerships in the past three years, emphasizing the

integration of AI technology to streamline and expedite drug discovery processes.

In a recent collaboration with Isomorphic Labs, the drug discovery-focused spinout of Google's

DeepMind division, Eli Lilly committed an upfront investment of $45 million USD and a total of $1.7

billion USD contingent upon milestone achievements. This partnership aims to advance research in

small molecule therapeutics against multiple targets.

Additionally, Eli Lilly joined forces with XtalPi in 2023, leveraging XtalPi’s integrated AI capabilities

and robotics platform for de novo drug design and candidate identification for undisclosed targets.

While Eli Lilly's recent forays into AI-powered diagnostics and monitoring solutions are relatively

limited compared to peers like AstraZeneca or Bayer in previous years, the company has still made

notable strides in this domain. Collaborating with Tempus in 2022, Eli Lilly expanded access to

genomic testing for patients with thyroid cancer and non-small cell lung cancer. In the same year, Eli

Lilly partnered with Quanterix to discover Alzheimer’s disease biomarkers and develop in vitro

diagnostics.

A significant move by Eli Lilly involves the out-licensing of their AI-powered sensor cloud platform,

Magnol.AI, for clinical trials. This platform collects real-time raw data from wearables and devices,

offering a comprehensive database of digital biomarkers crucial for clinical trials.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

12

Furthermore, the collaboration with Yseop in 2022, akin to Sanofi, focuses on enhancing the

generation of regulatory submission-ready reports.

Eli Lilly's commitment to AI-backed drug discovery and development is evident in its substantial

investments, reaching billions, in various solution partners before 2021. The company continues to

navigate the evolving landscape of AI collaborations to drive innovation and efficiency in

pharmaceutical research and development.

7. JANSSEN EMBRACES AI IN DRUG DISCOVERY, RESEARCH &

DIAGNOSTICS

Since 2021, Janssen has cultivated its AI ecosystem with a balanced focus on forging partnerships and

making investments in drug discovery, diagnostics, and clinical trials optimization.

Augmenting its innovation capacity, the company also has a global innovation hub JLABS for startups

to get access to resources and expertise from J&J, and launches innovation challenges, QuickFire

Challenge, to find and accelerate transforming healthcare innovations.

In the drug discovery space, a significant partnership was formed in 2022 with XtalPi, facilitated by

the company's innovation lab. This collaboration aims to expedite the drug development process,

from identifying small molecule hits for specific targets to their efficient development, testing, and

analysis.

In 2023, Janssen made strategic investments, notably in ArteraAI, a cancer therapy personalization

and testing company seeking to predict therapy benefits and patient prognosis. A preceding

collaboration with Paige focused on evaluating an AI-powered biomarker test designed to predict

actionable genomic alterations in bladder cancer.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

13

For clinical trials and insights generation, Janssen, in late 2023, partnered with Atropos Health for the

analysis of real-world data. This collaboration aims to generate evidence for research, address unmet

needs, and accelerate hypothesis testing.

In a parallel move, Janssen invested in real-world data and AI solutions, collaborating with companies

like Verana Health. These investments aim to expedite insights generation from de-identified and

unstructured data, informing the company's research and development projects. A prior partnership

with Verana Health in 2021 also focused on prostate cancer and ophthalmology areas.

Janssen has embraced collaborations with innovative entities to streamline drug discovery processes,

personalize cancer therapies, and generate real-world insights for clinical research. With initiatives

like JLABS and the QuickFire Challenge, the company actively fosters innovation, find partners and

accelerates transformative healthcare solutions.

8. BOEHRINGER INGELHEIM GOES TO BIG TECH TO IMPLEMENT AI

IN DRUG DEVELOPMENT

Over the past three years, Boehringer Ingelheim (BI) strategically engaged with major tech players

such as IBM and Google, integrating AI solutions into its drug discovery processes.

Partnering with Google, BI pioneers the deployment of computer-aided drug design and in silico

modelling using Google’s Quantum AI, establishing itself as the first pharma company to collaborate

with Google in quantum computing. Additionally, BI's collaboration with IBM in 2023 involves

leveraging GenAI to accelerate antibody discovery and development.

BI has broadened its AI partner ecosystem, collaborating with various diagnostics experts like

RetinAI. Using RetinAI's data management platform and AI models, BI focuses on predicting

geographic atrophy progression and delving into biomarkers and patient subgroups. Another notable

partnership is with Zeiss Medical Technology, aiming to develop predictive analytics for early

detection of eye diseases using ZEISS’s cloud-connected devices and AI-assisted analysis.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

14

BI has further demonstrated its commitment to the diagnostics sector by leading funding rounds for

startups like Brainomix and Aignostics.

Internally, BI has implemented AI solutions for knowledge management, streamlining research and

development. Leveraging AI-backed data analysis, cloud software services, and applications from

Veeva and Cognizant, BI consolidates clinical, regulatory, and quality functions into a unified

platform. Additionally, the collaboration with Cap Gemini resulted in a custom AI and ML-based

analytics platform, enhancing BI's data utilization and insights derivation.

Overall, Boehringer Ingelheim's strategic partnerships and internal AI initiatives underscore its

commitment to leveraging cutting-edge technologies for drug discovery, diagnostics, and knowledge

management.

9. ROCHE BROADENS AI DIAGNOSTICS ECOSYSTEM WITH

PARTNERSHIPS

Roche has actively embraced partnerships with AI diagnostics companies, with a notable focus on

expanding its diagnostic and monitoring capabilities through the navify brand introduced in 2022.

This next-generation point-of-care software solution consolidates diagnostics and monitoring in a

unified platform.

In 2023, Roche introduced the navify Algorithm Suite, empowering medical professionals with AI

algorithms for identifying patients at risk of various diseases, including cancer, cardiac, and lung

conditions. Collaborations with AWS and Ibex further enhance Roche's capabilities, integrating AI

algorithms from Ibex into the navify Digital Pathology software platform hosted on the AWS

platform.

In a strategic move with PathAI, Roche aims to develop AI-powered digital pathology algorithms for

its companion diagnostics business, with deployment planned on the navify Digital Pathology

platform. The company is also committed to advancing early diagnosis, as evidenced by the 2022

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

15

Memorandum of Understanding with Microsoft, focusing on Middle Eastern markets to explore AI

solutions for optimizing patients' journeys post-treatment.

Similar to Boehringer Ingelheim’s partnership with IBM, Roche has also forged alliances to leverage

GenAI technologies for drug discovery. Roche-Genentech’s partnership with Nvidia in 2023 aims to

design new kinds of molecules for drugs by harnessing Roche’s extensive datasets to train GenAI

algorithms leveraging Nvidia’s DGX Cloud supercomputer and BioNeMo services.

Lastly, Roche’s diagnostics division has chosen Lark Health in 2022 to launch a heart health program

delivering AI-driven virtual care and coaching.

In summary, from diagnostic breakthroughs embedded within the navify platform to pioneering drug

discovery with GenAI technologies, Roche, since 2021, navigates the evolving pharma landscape with

a commitment to innovation fostered by strategic partnerships.

10. GLAXOSMITHKLEIN’S PARTNERSHIPS FOR AI ARE FOCUSED ON

DRUG DISCOVERY AND DIAGNOSTICS

GlaxoSmithKline (GSK) has extended its AI strategy development to forge partnerships in drug

development and diagnostics since 2021.

Collaborating with PathAI in 2022, GSK aims to expedite research and drug development programs in

oncology and NASH by using PathAI’s digital pathology solutions for new insights generation.

Additionally, GSK's long-standing partnership with Viome Life Sciences, initiated in 2019 and

expanded in 2021, focuses on understanding the root causes of chronic diseases and cancer,

leveraging Viome's mRNA technology and AI platform during the early research phase.

In the diagnostics, GSK partnered with Deep 6 AI and Rutgers’ Robert Wood Barnabad Health System

to develop AI and NLP algorithms to detect worsening COPD signs from EMR data. In collaboration

with Progentec, GSK is also doing research and develop to assess the use of new AI powered clinical

tools in measurements and management of lupus.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

16

Utilizing the AI, ML and real-world data repositories of Tempus since 2020, GSK has streamlined

clinical trial design, patient enrolment, and identification of new drug targets.

Furthermore, GSK has piloted AI and ML-backed digital twin technology in its manufacturing

capabilities, developed in partnership with ATOS and Siemens in 2021. The technology aids in fine-

tuning production by providing simulated insights based on real-world data generated from a

computerized replica of the manufacturing process for vaccines.

Overall, GSK’s collaborations for AI encompasses use cases in drug development, diagnostics, clinical

trial optimization and manufacturing. From forging alliances with AI leaders like PathAI and Viome to

piloting cutting-edge technologies in manufacturing with ATOS and Siemens, GSK actively embraces

the transformative potential of AI.

IT IS ALL ABOUT SELECTING THE RIGHT USE CASE AND FINDING THE

RIGHT PARTNER

From the analysis on the AI focused partnerships, acquisitions, and investments of the pharma giants

over the last three years, it is evident that collaboration is a relevant approach to build and use AI

solutions in the industry. The pharma companies have already started building their ecosystems for

AI integration for many years, and now they are getting even more active to drive innovation with AI

partnerships.

Not only for drug development processes of the pharma, but also to optimize the operational

processes internally, Pharma is looking out for AI partners.

To find the right AI partner, companies should follow a phased approach.

Phase 1: Defining the AI use case(s)

The aim here is to select the areas in which the greatest benefit from AI solutions can be expected

for the company. The decisive factor is to what extent the technology can already achieve sufficiently

good results today or in the next 1-2 years.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

17

The R2G's AI partner selection framework proceeds in steps. First, the possible use cases are

determined. For this purpose, internal ideation workshops are held. These are supported by

competitor benchmarks (“For which use cases do our direct competitors use AI?”) and then

prioritized for the first time.

In the next step, an initial feasibility check will be carried out. The question is “Is there sufficient

evidence that the AI technology or the AI solutions on the market deliver good results to realize the

expected benefits of the use case?

The order of the use cases is then recorded in the AI roadmap based on the expected benefits and

the feasibility assessment.

Phase 2: The AI partner selection

The selection of the future AI partner(s) typically begins with an extensive scouting of the available

solutions, their evaluation in several steps (shortlisting), the subsequent approach and invitation to

initial partnership discussions and negotiations with 2-3 possible partners.

R2G's approach relies on the world's largest database of digital health companies worldwide,

R2GConnect. AI partnership requests including the selection criteria are formulated directly as

briefings. Digital health companies respond with detailed applications and expressions of their

interest in a partnership. R2Gconnect is growing quickly. As of October 2022, more than 8,000 digital

health companies have registered on the platform. With every briefing, new companies are added.

Projects that use R2GConnect receive a list of detailed applications evaluated based on the selection

criteria.

Phase 3: The partnership modelling and setup

More than half of the partnerships in digital health sector fail (R2G: “Partnerships in Digital Health –

2023”). The three main reasons of the failed partnerships are the lack of a partnership strategy

(“What do I want from my partner and what can I bring to the partnership?”), time-consuming and

cumbersome decision-making processes, and unrealistic & mismatched expectations.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

18

In order to massively increase the chances for success in AI partnerships right from the start, R2G has

developed a systematic partnership modelling process that starts during partner selection.

Concrete term sheets are created with the last 2-3 candidates, which already reflect all the essential

aspects of the possible partnership. This includes understanding what each partner expects from the

other in the partnership and is willing to contribute, the definition of the roles and responsibilities in

the partnership, the implementation plan as well as the financial and legal aspects of the partnership.

The prepared term sheets can also be used to justify the choice of partner internally. In addition, a

risk/benefit analysis is carried out to support decision-making. The time that it takes to draw a final

contract can be significantly reduced through this process, and the project can start quickly.

Phase 4: Get started, piloting and upscaling

In this phase of the partnership, the first thing is to set up the project teams correctly. The provision

of resources in sufficient capacity is crucial here. Team building measures make the start easier for

more complex and larger projects. Efficient monitoring ensures transparency during the partnership

and enables timely countermeasures if problems arise. The pilot or development phase typically lasts

between 3-6 months. Afterwards, a first AI solution (MVP) should be available.

As the pharmaceutical companies actively cultivate their AI ecosystems, partnerships have become

inevitable and essential for navigating and driving innovation. However, the challenge lies in finding

the right AI partner, and developing an effective collaboration strategy, without being caught up in

its hype. Finding the right strategic partner could take months if not years, and benefiting from global

digital health scouting platforms such as R2GConnect can significantly expedite this process. This

approach ensures a systematic and informed selection of AI partners, fostering successful

collaborations and maximizing the impact of AI solutions across pharmaceutical operations.

R2G has already guided a number of pharmaceutical companies through the process of successful

partnerships. Contact us for an initial exchange about your AI project.

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

19

Terms of White Paper Re-Use

We invite you to share the download link from change without notice. Any third-party using

www.research2guidance.com, social media or this report must not rely on its information

file sharing platforms like SlideShare onto solely but must carry their own due diligence to

which Research2Guidance has uploaded the verify the author’s information.

report. For permission to distribute the report

Research2Guidance disclaims all implied

document (PDF) within your contact base or its

warranties: including, without limitation,

content, please contact us in advance.

warranties of merchantability or fitness for a

Thereafter, provided that you mention

particular purpose.

Research2Guidance as its author, feel free to

mention the report, cite parts of the results or Limitation on Liability:

re-use graphics. In no event will Research2Guidance, its

Representations, Warranties and Disclaimer: affiliates or representatives be liable to you for

any special, incidental, consequential, punitive,

Research2Guidance offers the report as it is

or exemplary damages or lost profits arising

and makes no representations or warranties of

out of this license or the use of the work.

any kind concerning the work; express, implied,

statutory or otherwise. Research2Guidance Termination:

considers the information in this report This license and the rights granted hereunder

reliable, but states that it should not be relied will terminate automatically upon any breach

upon as such. by you of the terms of this license.

Opinions stated in this report are researched Research2Guidance

by the author as it is and might be subject to

ABOUT RESEARCH2GUIDANCE:

Research2Guidance is a consulting and market research company focusing

exclusively on digital health. We provide strategy advising, competitor evaluations,

and market sizing services to global clients across the spectrum of healthcare

delivery, including MedTech companies, health plans, pharma, and start-ups. We are

convinced that digitization will revolutionize healthcare around the world and

provide the market intelligence and strategic advice to help make this happen.

Berlin, Germany, +49 (0)30 400 42 432

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

Melis Ince

Sr. Digital Health Analyst & Consultant

melis.ince@research2guidance.com

Ralf Jahns

Managing Director

ralf.jahns@research2guidance.com

©Research2Guidance 2024- The Pharma’s Rush into AI - https://research2guidance.com/

You might also like

- Pharmaceutical Marketing A Guide PDFDocument39 pagesPharmaceutical Marketing A Guide PDFSomya SrivastavaNo ratings yet

- IVT Network - The FDA CGMP Inspection Is Coming - Make The Best of It - 2016-02-05Document18 pagesIVT Network - The FDA CGMP Inspection Is Coming - Make The Best of It - 2016-02-05marwaNo ratings yet

- Speciality Chemicals Magazine - February 2019 PDFDocument68 pagesSpeciality Chemicals Magazine - February 2019 PDFkaoru9010-1No ratings yet

- Role of Artificial Intelligence in Pharmaceutical IndustryDocument3 pagesRole of Artificial Intelligence in Pharmaceutical IndustryRohith KNo ratings yet

- Getting The Dose Right: A Digital Prescription For The Pharma IndustryDocument8 pagesGetting The Dose Right: A Digital Prescription For The Pharma IndustryVinita VasanthNo ratings yet

- CB Insights - Big Tech in PharmaDocument63 pagesCB Insights - Big Tech in Pharmamayankverma189131No ratings yet

- Top 10 Innovation Trends in 2024Document14 pagesTop 10 Innovation Trends in 2024anu15may05No ratings yet

- Key Trends Affecting Pharmacy AdministrationDocument5 pagesKey Trends Affecting Pharmacy AdministrationPeter NdiraguNo ratings yet

- ai 2Document9 pagesai 2Maulidia lestariNo ratings yet

- How Pharma Analytics Is Helping Pharma Companies Stay Ahead in The GameDocument2 pagesHow Pharma Analytics Is Helping Pharma Companies Stay Ahead in The GameRagavendra RagsNo ratings yet

- AI The New Frontier in Healthcare InnovationDocument7 pagesAI The New Frontier in Healthcare Innovationmarcus phuaNo ratings yet

- BDocument1 pageBAmit SoniNo ratings yet

- AI and Signal Detection in Pharmacovigilance - PharmaWatchDocDocument1 pageAI and Signal Detection in Pharmacovigilance - PharmaWatchDocvivek rakhaNo ratings yet

- CRM - Pharma PresentationDocument40 pagesCRM - Pharma PresentationVineesh Sasidharan100% (1)

- Data Driven Digital Transformation Pharma Sales and Marketing - Executive Brief - 3554enDocument3 pagesData Driven Digital Transformation Pharma Sales and Marketing - Executive Brief - 3554enSanchan KumarNo ratings yet

- V7 CMS23 - 037 2024 Pharma Trend ReportDocument60 pagesV7 CMS23 - 037 2024 Pharma Trend Reportthanhloyal100% (1)

- Nagesh AnnaDocument14 pagesNagesh Annasuprithas946No ratings yet

- Chetana Digital Marketing FinalDocument62 pagesChetana Digital Marketing FinalVenugopal VutukuruNo ratings yet

- Journal Pre-Proof: Drug Discovery TodayDocument19 pagesJournal Pre-Proof: Drug Discovery TodayDiana LeonNo ratings yet

- Tech Idea DimeADozen - Ai - Your AI ToolkitDocument1 pageTech Idea DimeADozen - Ai - Your AI ToolkitFrancis CaraballoNo ratings yet

- 88Document1 page88rahul chaudharyNo ratings yet

- Pharmaceutical Marketing (Pharm 305) Assignment: RD STDocument4 pagesPharmaceutical Marketing (Pharm 305) Assignment: RD STAvi shekNo ratings yet

- The Impact of Artificial Inteelligence On Medical InnovationDocument8 pagesThe Impact of Artificial Inteelligence On Medical InnovationdindaNo ratings yet

- The Top 5 Trends Shaping The Future of Digital Health: April 2018Document15 pagesThe Top 5 Trends Shaping The Future of Digital Health: April 2018DuongThaoNo ratings yet

- AI in PharmacyDocument18 pagesAI in PharmacyPoornima BalakrishnanNo ratings yet

- Use of Artificial Intelligence in Drug Discovery and Its DevelopmentDocument13 pagesUse of Artificial Intelligence in Drug Discovery and Its DevelopmentSuraj KumarNo ratings yet

- Digital Channels in Pharma Fad or FutureDocument3 pagesDigital Channels in Pharma Fad or FutureManoj JosephNo ratings yet

- Special Report: Biometrics in HealthcareDocument19 pagesSpecial Report: Biometrics in HealthcareStephen MayhewNo ratings yet

- The Road To Digital Success in Pharma - McKinsey & CompanyDocument10 pagesThe Road To Digital Success in Pharma - McKinsey & CompanyharshalNo ratings yet

- Impact of Artificial Intelligence On Pharm Technology A ReviewDocument5 pagesImpact of Artificial Intelligence On Pharm Technology A ReviewEditor IJTSRDNo ratings yet

- Serialization - Traceability and Big Data in The Pharmaceutical Industry PDFDocument19 pagesSerialization - Traceability and Big Data in The Pharmaceutical Industry PDFBúp CassieNo ratings yet

- Deloite Pharma and Connected PatientDocument40 pagesDeloite Pharma and Connected PatientBobAdlerNo ratings yet

- 2021.12.14 - The Big Tech in Pharma ReportDocument66 pages2021.12.14 - The Big Tech in Pharma ReportChris Surya SudjiantoNo ratings yet

- Deloitte CH LSHC Digital Transformation Sandbox en 200715Document19 pagesDeloitte CH LSHC Digital Transformation Sandbox en 200715Marija BanjavčićNo ratings yet

- Focus Finance - ER Report - PfizerDocument12 pagesFocus Finance - ER Report - PfizerVinay SohalNo ratings yet

- AI 2121: Ai in Action: Exploring Application and ImpactDocument16 pagesAI 2121: Ai in Action: Exploring Application and Impactirene.payadNo ratings yet

- 2 49 1628334248 4ijesrdec20214Document4 pages2 49 1628334248 4ijesrdec20214TJPRC PublicationsNo ratings yet

- Applications of AI in Pharmacy Practice A Look at Hospital and Community SettingsDocument5 pagesApplications of AI in Pharmacy Practice A Look at Hospital and Community SettingsBenjel AndayaNo ratings yet

- A Study On Digital Transformation and Its Effectiveness at Pfizer OrganizationDocument11 pagesA Study On Digital Transformation and Its Effectiveness at Pfizer OrganizationAditya NeelNo ratings yet

- Artificial Intelligence in Drug Discovery and DevelopmentDocument3 pagesArtificial Intelligence in Drug Discovery and DevelopmentKim KraliNo ratings yet

- Commercial Analytics and It's Defining Role in Pharma MarketingDocument8 pagesCommercial Analytics and It's Defining Role in Pharma MarketingKanika VermaNo ratings yet

- 6 Ways Pharmaceutical Companies Are Using Data Analytics To Drive Innovation & ValueDocument11 pages6 Ways Pharmaceutical Companies Are Using Data Analytics To Drive Innovation & ValueDeven MaliNo ratings yet

- 6544f60884188 Health Blues Case Study Sandee C For IIM Ranchi 2023Document4 pages6544f60884188 Health Blues Case Study Sandee C For IIM Ranchi 2023Divyansh SaxenaNo ratings yet

- Lifesciences Case - FinalDocument4 pagesLifesciences Case - FinalmohiniNo ratings yet

- Using Ai & Machine Learning To Drive Commercial Success in The EuDocument16 pagesUsing Ai & Machine Learning To Drive Commercial Success in The EuBasava Raj RNo ratings yet

- Biopharma Path To Value With Generative AiDocument12 pagesBiopharma Path To Value With Generative AidominiqueNo ratings yet

- Brand ManagmentDocument32 pagesBrand ManagmentTasbir MohammadNo ratings yet

- Digital Transformation of Pharmaceutical PDFDocument4 pagesDigital Transformation of Pharmaceutical PDFGanesh JeengarNo ratings yet

- Digital Transformatio Nof Pharmaceuticals AndhealthcareDocument5 pagesDigital Transformatio Nof Pharmaceuticals AndhealthcareBeate IgemannNo ratings yet

- Assignment Product and Brand ManagementDocument7 pagesAssignment Product and Brand ManagementYogesh GirgirwarNo ratings yet

- How To Solve Make The Supply Chain Safe From Counterfeit Drugs?Document2 pagesHow To Solve Make The Supply Chain Safe From Counterfeit Drugs?Ayan DevNo ratings yet

- Pharmaceutical Sector DigitalizationDocument6 pagesPharmaceutical Sector DigitalizationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Microsoft WP DT PLSMTDocument4 pagesMicrosoft WP DT PLSMTHarini SrinivasanNo ratings yet

- An Aid in Informed Decision Making: Business Intelligence in PharmaDocument3 pagesAn Aid in Informed Decision Making: Business Intelligence in PharmaSatpal SinghNo ratings yet

- Life Science Analytics Market - Global Industry Analysis, Size, Share, Growth, Trends, and ForecastDocument2 pagesLife Science Analytics Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecastsurendra choudharyNo ratings yet

- Hexa Research IncDocument5 pagesHexa Research Incapi-293819200No ratings yet

- Artificial Intelligence in Drug Manufacturing: Center For Drug Evaluation and ResearchDocument17 pagesArtificial Intelligence in Drug Manufacturing: Center For Drug Evaluation and ResearchHoàng Ngọc AnhNo ratings yet

- Jvion Award Write Up FinalDocument17 pagesJvion Award Write Up FinalNoo IqNo ratings yet

- Business Intelligence: Name Course Institution DateDocument7 pagesBusiness Intelligence: Name Course Institution Datepeter keitanyNo ratings yet

- Leading Pharmaceutical Innovation: How to Win the Life Science RaceFrom EverandLeading Pharmaceutical Innovation: How to Win the Life Science RaceNo ratings yet

- Outsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessFrom EverandOutsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessNo ratings yet

- Adequacy of Pharmacological Information Provided in Pharmaceutical Drug Advertisements in African Medical JournalsDocument8 pagesAdequacy of Pharmacological Information Provided in Pharmaceutical Drug Advertisements in African Medical JournalsNurafwa AdamNo ratings yet

- Analisis Farmakoekonomi Peresepan Antibiotika Ceftriaxone Dan Ceftazidime Pada Pasien Bedah Sesar Di Rumah Sakit Panti Rini YogyakartaDocument8 pagesAnalisis Farmakoekonomi Peresepan Antibiotika Ceftriaxone Dan Ceftazidime Pada Pasien Bedah Sesar Di Rumah Sakit Panti Rini YogyakartaMutiara Natasha FabanyoNo ratings yet

- Diah Natalia, Pharm-Diploma, B.SC, Apt: Permata Street # 22, Rt. 004/012 Kebon Pala-Makasar, Jakarta 13650, IndonesiaDocument8 pagesDiah Natalia, Pharm-Diploma, B.SC, Apt: Permata Street # 22, Rt. 004/012 Kebon Pala-Makasar, Jakarta 13650, IndonesiaRhea AnggareniNo ratings yet

- SWOT BoxDocument2 pagesSWOT BoxMd Hasnain0% (1)

- 2021.12.14 - The Big Tech in Pharma ReportDocument66 pages2021.12.14 - The Big Tech in Pharma ReportChris Surya SudjiantoNo ratings yet

- Notice: Human Drugs: Drug Products Withdrawn From Sale For Reasons Other Than Safety or Effectiveness— Celestone Soluspan Injection and Celestone InjectionDocument2 pagesNotice: Human Drugs: Drug Products Withdrawn From Sale For Reasons Other Than Safety or Effectiveness— Celestone Soluspan Injection and Celestone InjectionJustia.comNo ratings yet

- Resep KapsulDocument6 pagesResep KapsulMas AwangNo ratings yet

- GiodeDocument43 pagesGiodebgtbingoNo ratings yet

- Resume M PharmDocument7 pagesResume M Pharmshirisha.samala89No ratings yet

- Dopunska Lista Lijekova Web Primjena 24.12.Document339 pagesDopunska Lista Lijekova Web Primjena 24.12.Hrvoje PavelićNo ratings yet

- 1 Fruergaard Advanced Aseptic Processing ISPEDocument57 pages1 Fruergaard Advanced Aseptic Processing ISPEamerican_guy10100% (1)

- Global Pharmaceutical R&D PipelineDocument28 pagesGlobal Pharmaceutical R&D PipelinePharmaTopics PaulNo ratings yet

- Pharmace EthiopiaDocument7 pagesPharmace EthiopiaSivaraman Vasudevan100% (1)

- Ey in Vivo A Road Map To Strategic Drug Prices Subheader PDFDocument11 pagesEy in Vivo A Road Map To Strategic Drug Prices Subheader PDFsteveshowmanNo ratings yet

- Balois Elijah John R. Pdis 211 Lab E4Document11 pagesBalois Elijah John R. Pdis 211 Lab E4Michelle Elisha CartanoNo ratings yet

- TERM PAPER GlaxoSmithKline Bangladesh LimitedDocument36 pagesTERM PAPER GlaxoSmithKline Bangladesh LimitedTanvirNo ratings yet

- Value-Based Pricing in Pharmaceuticals: Hype or Hope?Document14 pagesValue-Based Pricing in Pharmaceuticals: Hype or Hope?VishalNo ratings yet

- Product Quality ComplaintsDocument82 pagesProduct Quality ComplaintsNiranjan SinghNo ratings yet

- Malaysia-NPRA List of Comparator Products For Bioequivalence Studies December 2015Document47 pagesMalaysia-NPRA List of Comparator Products For Bioequivalence Studies December 2015Noples RozaliaNo ratings yet

- Bio WorldDocument198 pagesBio Worldmc_goaNo ratings yet

- Merger & Acquisitions: Group - 01 Ghanshyam Jhanwar (F2020008) Jeenia Bhadra (F2020009) Nikhilesh Joshi (F2020015)Document11 pagesMerger & Acquisitions: Group - 01 Ghanshyam Jhanwar (F2020008) Jeenia Bhadra (F2020009) Nikhilesh Joshi (F2020015)Nikhilesh JoshiNo ratings yet

- Production and Formulation of Cosmetics, Cleaners, Drugs, Soaps and Detergents PDFDocument84 pagesProduction and Formulation of Cosmetics, Cleaners, Drugs, Soaps and Detergents PDFfarkad rawiNo ratings yet

- Health Law Final - D&C 40Document32 pagesHealth Law Final - D&C 40tanyaverma2589No ratings yet

- BTS Pharma Sales AcceleratorDocument3 pagesBTS Pharma Sales AcceleratorRahul TanwarNo ratings yet

- Bonus Product Sales April-2023Document3 pagesBonus Product Sales April-2023Mahbub Alam SarkerNo ratings yet

- PharmTech June WMDocument52 pagesPharmTech June WMAbdullah Al MamunNo ratings yet

- Federation of Medical and Sales Representatives' Associations of India - News - May - 15Document4 pagesFederation of Medical and Sales Representatives' Associations of India - News - May - 15Arun KoolwalNo ratings yet

- Individuals PMBJPDocument20 pagesIndividuals PMBJPSarthak GoelNo ratings yet