Professional Documents

Culture Documents

05 Mei Eng

05 Mei Eng

Uploaded by

Saham IhsgCopyright:

Available Formats

You might also like

- Charity Commssion Maharashtra Schedule Ix-A Ix - BDocument2 pagesCharity Commssion Maharashtra Schedule Ix-A Ix - Babhijit majarkhedeNo ratings yet

- IBanking Interview - LBO Model GuideDocument58 pagesIBanking Interview - LBO Model GuideElianaBakerNo ratings yet

- Rick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFDocument209 pagesRick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFanshul jain100% (4)

- REN AND SHINO PartnershipDocument23 pagesREN AND SHINO PartnershipDaneca Gallardo100% (1)

- 11Document137 pages11Alex liao100% (1)

- Laporan Keuangan Publikasi Bulanan Februari 2020 ENDocument4 pagesLaporan Keuangan Publikasi Bulanan Februari 2020 ENDewita DrhNo ratings yet

- Laporan Publikasi Bulan Apr 2023 Bhs InggrisDocument4 pagesLaporan Publikasi Bulan Apr 2023 Bhs InggrisAlfian Nur HudaNo ratings yet

- Bank Mayapada Liquidity Coverage Ratio LCR Report Q2 2019Document4 pagesBank Mayapada Liquidity Coverage Ratio LCR Report Q2 2019SAMUEL PATRICK LELINo ratings yet

- 2022 Q4 Laporan Publikasi Triwulanan - enDocument15 pages2022 Q4 Laporan Publikasi Triwulanan - enAndri MirzalNo ratings yet

- BRI Monthly Oct 2022Document5 pagesBRI Monthly Oct 2022Andri MirzalNo ratings yet

- List of Content: FINANCIAL STATEMENT - Asat30September2010 (Unaudited)Document17 pagesList of Content: FINANCIAL STATEMENT - Asat30September2010 (Unaudited)Aziz MuhammadNo ratings yet

- 6 Skin Pharmaceuticals Private Limited: Ordinary BusinessDocument15 pages6 Skin Pharmaceuticals Private Limited: Ordinary BusinessvineminaiNo ratings yet

- Lapkeu TW II 2023 EngDocument21 pagesLapkeu TW II 2023 EngNur Arif Setya HendraNo ratings yet

- I. Balance Sheet DEC 31ST, 2014 DEC 31ST, 2015Document1 pageI. Balance Sheet DEC 31ST, 2014 DEC 31ST, 2015WawerudasNo ratings yet

- ServletDocument498 pagesServletankit-malhotra-3456100% (1)

- Lap Keu AnzDocument14 pagesLap Keu AnzJennyfer ConneryNo ratings yet

- Deloitte & Touche Ernst & Young Bakr Abulkhair & Co. P.O. Box 1994 P.O. Box 442 Jeddah 21441 Jeddah 21411 Saudi Arabia Saudi ArabiaDocument20 pagesDeloitte & Touche Ernst & Young Bakr Abulkhair & Co. P.O. Box 1994 P.O. Box 442 Jeddah 21441 Jeddah 21411 Saudi Arabia Saudi ArabiaMona MohamedNo ratings yet

- Chapter 3 - Banking InstitutionsDocument37 pagesChapter 3 - Banking InstitutionsbaityamizalNo ratings yet

- Cashflow DDocument6 pagesCashflow DJatin JainNo ratings yet

- Published Mar 2023Document17 pagesPublished Mar 2023sei jrNo ratings yet

- Financial Report PT Paninvest TBK 30092021Document166 pagesFinancial Report PT Paninvest TBK 30092021rudiNo ratings yet

- Final PT CNSP TBK 31 Mar 2022Document48 pagesFinal PT CNSP TBK 31 Mar 2022Tekliway DOTcomNo ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- Standard Chartered Bank Kenya LTD - Financial Results For The Year Ended 31-Dec-2021Document12 pagesStandard Chartered Bank Kenya LTD - Financial Results For The Year Ended 31-Dec-2021K MNo ratings yet

- Guaranty Trust Holding Company PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024Document89 pagesGuaranty Trust Holding Company PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024frederick aivborayeNo ratings yet

- Sharp Investors Trading Services Limited Notes To The Financial Statement Liabilities (With 5-Year Outlook) Year Ended December 31,2014Document1 pageSharp Investors Trading Services Limited Notes To The Financial Statement Liabilities (With 5-Year Outlook) Year Ended December 31,2014Khaleel LynchNo ratings yet

- Far210 Fe Feb23Document8 pagesFar210 Fe Feb23ediza adhaNo ratings yet

- Lapkeu Q1 2022 ENG RevDocument2 pagesLapkeu Q1 2022 ENG RevAdriel ChristopherNo ratings yet

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Document14 pagesRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraNo ratings yet

- 119 PH Unit - Ledgers-1711778293278Document1 page119 PH Unit - Ledgers-1711778293278prince.elouisNo ratings yet

- Press 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Document28 pagesPress 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Anoushka LakhotiaNo ratings yet

- Malaysia Money Market Research & AnalysisDocument6 pagesMalaysia Money Market Research & AnalysisCynthia ChuaNo ratings yet

- PT Masi - 31 Dec 2020Document67 pagesPT Masi - 31 Dec 2020jf testNo ratings yet

- Neon Associates, (Hrishikesh Bijoy Das) Limit-Rs.20.00 LacsDocument36 pagesNeon Associates, (Hrishikesh Bijoy Das) Limit-Rs.20.00 LacsAjoydeepNo ratings yet

- Ca - FS23 697 707Document11 pagesCa - FS23 697 707thelilskywalkerNo ratings yet

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Document3 pagesNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7No ratings yet

- Structure, Functioning and Products of An Islamic Bank: (Enrollment No. 13BSPHH010275)Document54 pagesStructure, Functioning and Products of An Islamic Bank: (Enrollment No. 13BSPHH010275)Kiran KumarNo ratings yet

- National Judicial Academy MFDocument52 pagesNational Judicial Academy MFPavithra JNo ratings yet

- Jasch Industires LTDDocument6 pagesJasch Industires LTDAnugya GuptaNo ratings yet

- Other CreditorsDocument1 pageOther Creditorsselina2006dNo ratings yet

- Development AssignmentDocument19 pagesDevelopment AssignmentMuhammad hanzla mehmoodNo ratings yet

- BalanceFusionBBVA Eng Tcm927-346299Document267 pagesBalanceFusionBBVA Eng Tcm927-346299Huma RaoNo ratings yet

- SWL Offering ProspectusDocument243 pagesSWL Offering ProspectusRapulu UdohNo ratings yet

- Bisi 240331ieDocument80 pagesBisi 240331iebagirNo ratings yet

- IMCC 31.12.2023 FS - FinalDocument77 pagesIMCC 31.12.2023 FS - FinalBrian ManyauNo ratings yet

- XJX L30 P VOp P8 Yaso KP 0 Oyr Krcu APUf 1 VTQ Uo 3 K 5 GDocument2 pagesXJX L30 P VOp P8 Yaso KP 0 Oyr Krcu APUf 1 VTQ Uo 3 K 5 Gmarikadavid572No ratings yet

- Financial Statement SingerDocument13 pagesFinancial Statement SingerAnuja PasandulNo ratings yet

- DA OrderDocument2 pagesDA OrderDinakaran MNo ratings yet

- QDACVolQ3 2023 2024Document1 pageQDACVolQ3 2023 20248bsmk6r4nyNo ratings yet

- Principles & Practices of BankingDocument2 pagesPrinciples & Practices of BankingAditya KaushalNo ratings yet

- Test Questions in Fabm2 4th Qtr333Document3 pagesTest Questions in Fabm2 4th Qtr333Rosanno DavidNo ratings yet

- Institute of Commerce Studies Paper 2Document2 pagesInstitute of Commerce Studies Paper 2Ankit JainNo ratings yet

- Assignment Group 2Document3 pagesAssignment Group 2Sumukh KNo ratings yet

- 1700378027.9185524 - Bdcom 2023-2024 Q1Document13 pages1700378027.9185524 - Bdcom 2023-2024 Q1Anwar Hossain ReponNo ratings yet

- Icef Fy-2020-21 3Document8 pagesIcef Fy-2020-21 3Nishikant MishraNo ratings yet

- Financial Result For Half Year and Year Ended March 31 2018Document5 pagesFinancial Result For Half Year and Year Ended March 31 2018Vignesh VoraNo ratings yet

- Airtel BalancesheetDocument17 pagesAirtel BalancesheetISHA AGGARWALNo ratings yet

- IMperial Mines 2018.Q2 FSDocument30 pagesIMperial Mines 2018.Q2 FSKevin GullufsenNo ratings yet

- Unitech Brief Note 09-10-2023 11feb24Document54 pagesUnitech Brief Note 09-10-2023 11feb24jainanmol0410No ratings yet

- Tutorial 4 - QDocument3 pagesTutorial 4 - Qyingxean tanNo ratings yet

- Balance SheetDocument4 pagesBalance SheetPrasenjit BanerjeeNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Skydrugz LK Full Year 2023 6 Maret 2024Document21 pagesSkydrugz LK Full Year 2023 6 Maret 2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 4 Maret 2024Document6 pagesSkydrugz LK Full Year 2023 4 Maret 2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 5 Maret 2024Document12 pagesSkydrugz LK Full Year 2023 5 Maret 2024Saham IhsgNo ratings yet

- EXCL - Soon to Be Second Largest FBB ProviderDocument4 pagesEXCL - Soon to Be Second Largest FBB ProviderSaham IhsgNo ratings yet

- Rekap Saham Bank Skydrugz 29 Juni 2024Document202 pagesRekap Saham Bank Skydrugz 29 Juni 2024Saham IhsgNo ratings yet

- Harum Energy TBK Billingual Consol 31maret2024 PDFDocument131 pagesHarum Energy TBK Billingual Consol 31maret2024 PDFSaham IhsgNo ratings yet

- f-31645742-0 ARCI Public Expose 31645742 Lamp2 PDFDocument11 pagesf-31645742-0 ARCI Public Expose 31645742 Lamp2 PDFSaham IhsgNo ratings yet

- 许多年以后 - Few Years LaterDocument2 pages许多年以后 - Few Years LaterSaham IhsgNo ratings yet

- GoTo Investor Update Dec 2023 - UploadDocument6 pagesGoTo Investor Update Dec 2023 - UploadSaham IhsgNo ratings yet

- Technical Review - 280123Document20 pagesTechnical Review - 280123Saham IhsgNo ratings yet

- IFM Notes Unit 2Document15 pagesIFM Notes Unit 2Rubi ChoudharyNo ratings yet

- Corporate Finance GlossaryDocument10 pagesCorporate Finance Glossaryanmol2590No ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Profitability Turnover RatiosDocument32 pagesProfitability Turnover RatiosAnushka JindalNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- 01 Homework - Urbino Bsa - 4aDocument8 pages01 Homework - Urbino Bsa - 4aVeralou UrbinoNo ratings yet

- Feia Unit-03 Valuation of SecuritiesDocument7 pagesFeia Unit-03 Valuation of SecuritiesYoloNo ratings yet

- Partnership FormationDocument39 pagesPartnership FormationLe Ann Rhine MayantongNo ratings yet

- Intermediate Accounting: Shareholders' EquityDocument49 pagesIntermediate Accounting: Shareholders' EquityShuo Lu100% (1)

- MARKETING AND FINANCE (Réparé)Document22 pagesMARKETING AND FINANCE (Réparé)Hervé ObaNo ratings yet

- Notes On Treasury Shares Lump Sum SaleDocument2 pagesNotes On Treasury Shares Lump Sum SaleCharlotte AdoptanteNo ratings yet

- Book Value Per Share PresentationDocument22 pagesBook Value Per Share PresentationharoonameerNo ratings yet

- Intra Firm Three Stage DuPont AnalysisDocument2 pagesIntra Firm Three Stage DuPont AnalysisVimal AgrawalNo ratings yet

- Finance OverviewDocument9 pagesFinance OverviewRavi Chaurasia100% (1)

- Automobile Capital StructureDocument6 pagesAutomobile Capital StructureXiaozhou LiNo ratings yet

- S.Chapter 4. The Financial Statements Analyis v2Document44 pagesS.Chapter 4. The Financial Statements Analyis v2Ngọc HuyềnNo ratings yet

- Private Equity Basics by - Shahid AnwarDocument8 pagesPrivate Equity Basics by - Shahid Anwarvinaymaladi24No ratings yet

- Financial Performance of Indian Pharmaceutical Industry - A Case StudyDocument25 pagesFinancial Performance of Indian Pharmaceutical Industry - A Case Studyanon_544393415No ratings yet

- ACG LA Capital Connection Pitchbook 2012-Business SummariesDocument104 pagesACG LA Capital Connection Pitchbook 2012-Business SummariesMD ForgioneNo ratings yet

- International Accounting Standards: IAS 18 RevenueDocument21 pagesInternational Accounting Standards: IAS 18 RevenueMia CasasNo ratings yet

- Resume Ch.11 Consolidation TheoriesDocument3 pagesResume Ch.11 Consolidation TheoriesDwiki TegarNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Solution Performa - Mamta FashionsDocument3 pagesSolution Performa - Mamta FashionsGarimaBhandariNo ratings yet

- IAS 32 - Financial InstrumentsDocument28 pagesIAS 32 - Financial InstrumentsJaaNo ratings yet

- Slide 1: Your Coffee ShopDocument15 pagesSlide 1: Your Coffee ShopMahardika Agil Bima IINo ratings yet

- GDST - Annual Report 2018 PDFDocument148 pagesGDST - Annual Report 2018 PDFPutra AjaNo ratings yet

- Debt Securities Amortized Cost TheoryDocument2 pagesDebt Securities Amortized Cost Theorycristinelarita18No ratings yet

05 Mei Eng

05 Mei Eng

Uploaded by

Saham IhsgOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05 Mei Eng

05 Mei Eng

Uploaded by

Saham IhsgCopyright:

Available Formats

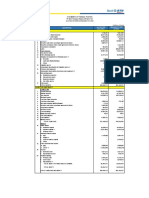

FINANCIAL STATEMENTS

PT BANK BTPN SYARIAH TBK

31 May 2024

MONTHLY STATEMENTS OF FINANCIAL POSITION MONTHLY STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

As of 31 May 2024 For The Periodes Ended 31 May 2024

(In Millions of Rupiah) (In Millions of Rupiah)

INDIVIDUAL INDIVIDUAL

No. DESCRIPTION No. DESCRIPTION

31 May 2024 1 January to

31 May 2024

ASSETS

OPERATING INCOME AND EXPENSES

1. Cash 468.198

A. Income & Expenses from Fund Management as Mudharib

2. Placements with Bank Indonesia 1.147.994

3. Placements with Other Banks 2.950 1. Income from Fund Management as Mudharib 2.287.260

a. Income from receivables

4. Spot and forward receivables -

i. Murabahah 2.064.760

5. Investments in marketable securities 8.750.945 ii. Istishna' -

6. Securities purchased under resale agreements (reverse repo) - iii. Multiservices ijarah -

iv. Ujrah -

7. Acceptance receivables -

v. Others -

8. Receivables b. Income from Financing

a. Murabahah receivables 10.404.734 i. Mudharabah -

b. Istishna’ receivables - ii. Musyarakah 573

iii. Others -

c. Multiservices ijarah receivables -

c. Income from ijarah -

d. Funds of qardh 161 d. Others 221.927

e. Ijarah receivables - Sharing for Investors -/- 213.845

9. a. 213.845

a. Mudharabah - b. -

b. Musyarakah 6.380 3. Net Income from Fund Management as Mudharib 2.073.415

c. Others - B. Operating Income and Expenses other than as Mudharib

10. Asset acquired for Ijarah - 1. -

11. Investment in share 297.000 2. -

12. 224.218 3. -

4. Gain/Loss on spot and forward transactions (realised) -

13. (958.717)

5. Gain/Loss on investment under equity method -

14. Salam - 6. Gain/Loss on foreign exchange translation -

15. Istishna’ assets in progress - 7. Bank income as mudharib in mudharabah muqayyadah -

Istishna’ Term -/- - 8. Dividend Income -

9. Commission/provision/fees and administration income 583

16. Inventory - 10. Other income 29.837

17. Intangible assets 211.238 11. Wadiah bonus expenses -/- 291

18. Fixed assets and equipments 376.970 12. 599.064

13. Losses related to operational risks -/- 3.457

19. Non-earning assets

14. -

a. Abandoned property - 15. 590.550

b. Foreclosed collaterals - 16. Promotion Expenses -/- 3.427

c. Suspense Accounts - 17. Other Expenses -/- 314.829

d. - Net Operating Income/Expenses (1.481.198)

20. Other Assets 327.375 OPERATING INCOME/EXPENSES 592.217

TOTAL ASSETS 21.259.446 NON-OPERATING INCOME/ EXPENSES

LIABILITIES AND EQUITIES 1. 3.232

2. Other non-operating income/expenses (886)

LIABILITIES

NON-OPERATING INCOME/ EXPENSES 2.346

1. Wadiah Deposits

a. Demand Deposits 3.130 CURRENT YEAR PROFIT/LOSS BEFORE TAX 594.563

b. Savings Deposits 2.103.039 Income taxes

2. a. Estimated current year tax (64.575)

b. Deferred tax income/expenses (64.970)

a. Demand Deposits -

CURRENT YEAR NET PROFIT/LOSS 465.018

b. Savings Deposits 745.558

c. Time Deposits 9.192.085 OTHER COMPREHENSIVE INCOME

3. Electronic Money - 1. Items that will not be reclassified to profit or loss

4. Liabilities to Bank Indonesia - a. Gain/Loss from revaluation of properties -

b. -

5. Liabilities to Other Banks -

c. Others -

6. Spot and forward payables - 2. Items that will be reclassified to profit or loss

7. Marketable securities issued 100.000 a.

8. Acceptance liabilities - -

b.

9. Fund Borrowings -

comprehensive income 91

10. Guarantee deposit - c. Others -

11. - OTHER COMPREHENSIVE INCOME FOR THE YEAR AFTER TAX 91

12. Other liabilities 435.441

TOTAL OTHER COMPREHENSIVE INCOME FOR THE YEAR 465.109

13. -

TOTAL LIABILITIES 12.579.253 MONTHLY STATEMENTS OF COMMITMENTS AND CONTIGENCIES

As of 31 May 2024

EQUITIES (In Millions of Rupiah)

14. Share capital INDIVIDUAL

No. DESCRIPTION

a. Authorized share capital 2.750.000

31 May 2024

b. Unpaid-in capital -/- (1.979.630)

I. COMMITMENT RECEIVABLES

c. Treasury stock -/- (24)

1. -

15. Additional paid-in capital

2. Foreign currency positions to be received from spot and forward transactions -

a. Agio 842.145 3. Others -

b. Disagio -/- - II. COMMITMENT PAYABLES

c. Capital contribution -

1.

d. Fund for paid up capital - a. Committed -

e. Others 20.916 b. Uncommitted 200.000

2 Outstanding irrevocable L/C -

16. Other comprehensive income

3 Foreign currency positions to be submitted for spot and forward transactions -

a. Gain 38.460 4 Others -

b. Loss -/- - III. CONTINGENT RECEIVABLES

17. Reserve

1. Guarantees received -

a. General reserve 145.000 2.

b. Appropriated reserve - a. Murabahah 41.725

b. Istishna' -

18.

c. Ijarah -

a. Previous years 6.938.705 d. -

b. Current year 465.018 e. Others -

3. Others -

c. Dividens paid -/- (540.397)

IV. CONTINGENT LIABILITIES

TOTAL EQUITIES 8.680.193

1. Guarantees issued -

TOTAL LIABILITIES AND EQUITIES 21.259.446 2. Others -

You might also like

- Charity Commssion Maharashtra Schedule Ix-A Ix - BDocument2 pagesCharity Commssion Maharashtra Schedule Ix-A Ix - Babhijit majarkhedeNo ratings yet

- IBanking Interview - LBO Model GuideDocument58 pagesIBanking Interview - LBO Model GuideElianaBakerNo ratings yet

- Rick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFDocument209 pagesRick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFanshul jain100% (4)

- REN AND SHINO PartnershipDocument23 pagesREN AND SHINO PartnershipDaneca Gallardo100% (1)

- 11Document137 pages11Alex liao100% (1)

- Laporan Keuangan Publikasi Bulanan Februari 2020 ENDocument4 pagesLaporan Keuangan Publikasi Bulanan Februari 2020 ENDewita DrhNo ratings yet

- Laporan Publikasi Bulan Apr 2023 Bhs InggrisDocument4 pagesLaporan Publikasi Bulan Apr 2023 Bhs InggrisAlfian Nur HudaNo ratings yet

- Bank Mayapada Liquidity Coverage Ratio LCR Report Q2 2019Document4 pagesBank Mayapada Liquidity Coverage Ratio LCR Report Q2 2019SAMUEL PATRICK LELINo ratings yet

- 2022 Q4 Laporan Publikasi Triwulanan - enDocument15 pages2022 Q4 Laporan Publikasi Triwulanan - enAndri MirzalNo ratings yet

- BRI Monthly Oct 2022Document5 pagesBRI Monthly Oct 2022Andri MirzalNo ratings yet

- List of Content: FINANCIAL STATEMENT - Asat30September2010 (Unaudited)Document17 pagesList of Content: FINANCIAL STATEMENT - Asat30September2010 (Unaudited)Aziz MuhammadNo ratings yet

- 6 Skin Pharmaceuticals Private Limited: Ordinary BusinessDocument15 pages6 Skin Pharmaceuticals Private Limited: Ordinary BusinessvineminaiNo ratings yet

- Lapkeu TW II 2023 EngDocument21 pagesLapkeu TW II 2023 EngNur Arif Setya HendraNo ratings yet

- I. Balance Sheet DEC 31ST, 2014 DEC 31ST, 2015Document1 pageI. Balance Sheet DEC 31ST, 2014 DEC 31ST, 2015WawerudasNo ratings yet

- ServletDocument498 pagesServletankit-malhotra-3456100% (1)

- Lap Keu AnzDocument14 pagesLap Keu AnzJennyfer ConneryNo ratings yet

- Deloitte & Touche Ernst & Young Bakr Abulkhair & Co. P.O. Box 1994 P.O. Box 442 Jeddah 21441 Jeddah 21411 Saudi Arabia Saudi ArabiaDocument20 pagesDeloitte & Touche Ernst & Young Bakr Abulkhair & Co. P.O. Box 1994 P.O. Box 442 Jeddah 21441 Jeddah 21411 Saudi Arabia Saudi ArabiaMona MohamedNo ratings yet

- Chapter 3 - Banking InstitutionsDocument37 pagesChapter 3 - Banking InstitutionsbaityamizalNo ratings yet

- Cashflow DDocument6 pagesCashflow DJatin JainNo ratings yet

- Published Mar 2023Document17 pagesPublished Mar 2023sei jrNo ratings yet

- Financial Report PT Paninvest TBK 30092021Document166 pagesFinancial Report PT Paninvest TBK 30092021rudiNo ratings yet

- Final PT CNSP TBK 31 Mar 2022Document48 pagesFinal PT CNSP TBK 31 Mar 2022Tekliway DOTcomNo ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- Standard Chartered Bank Kenya LTD - Financial Results For The Year Ended 31-Dec-2021Document12 pagesStandard Chartered Bank Kenya LTD - Financial Results For The Year Ended 31-Dec-2021K MNo ratings yet

- Guaranty Trust Holding Company PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024Document89 pagesGuaranty Trust Holding Company PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024frederick aivborayeNo ratings yet

- Sharp Investors Trading Services Limited Notes To The Financial Statement Liabilities (With 5-Year Outlook) Year Ended December 31,2014Document1 pageSharp Investors Trading Services Limited Notes To The Financial Statement Liabilities (With 5-Year Outlook) Year Ended December 31,2014Khaleel LynchNo ratings yet

- Far210 Fe Feb23Document8 pagesFar210 Fe Feb23ediza adhaNo ratings yet

- Lapkeu Q1 2022 ENG RevDocument2 pagesLapkeu Q1 2022 ENG RevAdriel ChristopherNo ratings yet

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Document14 pagesRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraNo ratings yet

- 119 PH Unit - Ledgers-1711778293278Document1 page119 PH Unit - Ledgers-1711778293278prince.elouisNo ratings yet

- Press 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Document28 pagesPress 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Anoushka LakhotiaNo ratings yet

- Malaysia Money Market Research & AnalysisDocument6 pagesMalaysia Money Market Research & AnalysisCynthia ChuaNo ratings yet

- PT Masi - 31 Dec 2020Document67 pagesPT Masi - 31 Dec 2020jf testNo ratings yet

- Neon Associates, (Hrishikesh Bijoy Das) Limit-Rs.20.00 LacsDocument36 pagesNeon Associates, (Hrishikesh Bijoy Das) Limit-Rs.20.00 LacsAjoydeepNo ratings yet

- Ca - FS23 697 707Document11 pagesCa - FS23 697 707thelilskywalkerNo ratings yet

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Document3 pagesNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7No ratings yet

- Structure, Functioning and Products of An Islamic Bank: (Enrollment No. 13BSPHH010275)Document54 pagesStructure, Functioning and Products of An Islamic Bank: (Enrollment No. 13BSPHH010275)Kiran KumarNo ratings yet

- National Judicial Academy MFDocument52 pagesNational Judicial Academy MFPavithra JNo ratings yet

- Jasch Industires LTDDocument6 pagesJasch Industires LTDAnugya GuptaNo ratings yet

- Other CreditorsDocument1 pageOther Creditorsselina2006dNo ratings yet

- Development AssignmentDocument19 pagesDevelopment AssignmentMuhammad hanzla mehmoodNo ratings yet

- BalanceFusionBBVA Eng Tcm927-346299Document267 pagesBalanceFusionBBVA Eng Tcm927-346299Huma RaoNo ratings yet

- SWL Offering ProspectusDocument243 pagesSWL Offering ProspectusRapulu UdohNo ratings yet

- Bisi 240331ieDocument80 pagesBisi 240331iebagirNo ratings yet

- IMCC 31.12.2023 FS - FinalDocument77 pagesIMCC 31.12.2023 FS - FinalBrian ManyauNo ratings yet

- XJX L30 P VOp P8 Yaso KP 0 Oyr Krcu APUf 1 VTQ Uo 3 K 5 GDocument2 pagesXJX L30 P VOp P8 Yaso KP 0 Oyr Krcu APUf 1 VTQ Uo 3 K 5 Gmarikadavid572No ratings yet

- Financial Statement SingerDocument13 pagesFinancial Statement SingerAnuja PasandulNo ratings yet

- DA OrderDocument2 pagesDA OrderDinakaran MNo ratings yet

- QDACVolQ3 2023 2024Document1 pageQDACVolQ3 2023 20248bsmk6r4nyNo ratings yet

- Principles & Practices of BankingDocument2 pagesPrinciples & Practices of BankingAditya KaushalNo ratings yet

- Test Questions in Fabm2 4th Qtr333Document3 pagesTest Questions in Fabm2 4th Qtr333Rosanno DavidNo ratings yet

- Institute of Commerce Studies Paper 2Document2 pagesInstitute of Commerce Studies Paper 2Ankit JainNo ratings yet

- Assignment Group 2Document3 pagesAssignment Group 2Sumukh KNo ratings yet

- 1700378027.9185524 - Bdcom 2023-2024 Q1Document13 pages1700378027.9185524 - Bdcom 2023-2024 Q1Anwar Hossain ReponNo ratings yet

- Icef Fy-2020-21 3Document8 pagesIcef Fy-2020-21 3Nishikant MishraNo ratings yet

- Financial Result For Half Year and Year Ended March 31 2018Document5 pagesFinancial Result For Half Year and Year Ended March 31 2018Vignesh VoraNo ratings yet

- Airtel BalancesheetDocument17 pagesAirtel BalancesheetISHA AGGARWALNo ratings yet

- IMperial Mines 2018.Q2 FSDocument30 pagesIMperial Mines 2018.Q2 FSKevin GullufsenNo ratings yet

- Unitech Brief Note 09-10-2023 11feb24Document54 pagesUnitech Brief Note 09-10-2023 11feb24jainanmol0410No ratings yet

- Tutorial 4 - QDocument3 pagesTutorial 4 - Qyingxean tanNo ratings yet

- Balance SheetDocument4 pagesBalance SheetPrasenjit BanerjeeNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Skydrugz LK Full Year 2023 6 Maret 2024Document21 pagesSkydrugz LK Full Year 2023 6 Maret 2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 4 Maret 2024Document6 pagesSkydrugz LK Full Year 2023 4 Maret 2024Saham IhsgNo ratings yet

- Skydrugz LK Full Year 2023 5 Maret 2024Document12 pagesSkydrugz LK Full Year 2023 5 Maret 2024Saham IhsgNo ratings yet

- EXCL - Soon to Be Second Largest FBB ProviderDocument4 pagesEXCL - Soon to Be Second Largest FBB ProviderSaham IhsgNo ratings yet

- Rekap Saham Bank Skydrugz 29 Juni 2024Document202 pagesRekap Saham Bank Skydrugz 29 Juni 2024Saham IhsgNo ratings yet

- Harum Energy TBK Billingual Consol 31maret2024 PDFDocument131 pagesHarum Energy TBK Billingual Consol 31maret2024 PDFSaham IhsgNo ratings yet

- f-31645742-0 ARCI Public Expose 31645742 Lamp2 PDFDocument11 pagesf-31645742-0 ARCI Public Expose 31645742 Lamp2 PDFSaham IhsgNo ratings yet

- 许多年以后 - Few Years LaterDocument2 pages许多年以后 - Few Years LaterSaham IhsgNo ratings yet

- GoTo Investor Update Dec 2023 - UploadDocument6 pagesGoTo Investor Update Dec 2023 - UploadSaham IhsgNo ratings yet

- Technical Review - 280123Document20 pagesTechnical Review - 280123Saham IhsgNo ratings yet

- IFM Notes Unit 2Document15 pagesIFM Notes Unit 2Rubi ChoudharyNo ratings yet

- Corporate Finance GlossaryDocument10 pagesCorporate Finance Glossaryanmol2590No ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Profitability Turnover RatiosDocument32 pagesProfitability Turnover RatiosAnushka JindalNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- 01 Homework - Urbino Bsa - 4aDocument8 pages01 Homework - Urbino Bsa - 4aVeralou UrbinoNo ratings yet

- Feia Unit-03 Valuation of SecuritiesDocument7 pagesFeia Unit-03 Valuation of SecuritiesYoloNo ratings yet

- Partnership FormationDocument39 pagesPartnership FormationLe Ann Rhine MayantongNo ratings yet

- Intermediate Accounting: Shareholders' EquityDocument49 pagesIntermediate Accounting: Shareholders' EquityShuo Lu100% (1)

- MARKETING AND FINANCE (Réparé)Document22 pagesMARKETING AND FINANCE (Réparé)Hervé ObaNo ratings yet

- Notes On Treasury Shares Lump Sum SaleDocument2 pagesNotes On Treasury Shares Lump Sum SaleCharlotte AdoptanteNo ratings yet

- Book Value Per Share PresentationDocument22 pagesBook Value Per Share PresentationharoonameerNo ratings yet

- Intra Firm Three Stage DuPont AnalysisDocument2 pagesIntra Firm Three Stage DuPont AnalysisVimal AgrawalNo ratings yet

- Finance OverviewDocument9 pagesFinance OverviewRavi Chaurasia100% (1)

- Automobile Capital StructureDocument6 pagesAutomobile Capital StructureXiaozhou LiNo ratings yet

- S.Chapter 4. The Financial Statements Analyis v2Document44 pagesS.Chapter 4. The Financial Statements Analyis v2Ngọc HuyềnNo ratings yet

- Private Equity Basics by - Shahid AnwarDocument8 pagesPrivate Equity Basics by - Shahid Anwarvinaymaladi24No ratings yet

- Financial Performance of Indian Pharmaceutical Industry - A Case StudyDocument25 pagesFinancial Performance of Indian Pharmaceutical Industry - A Case Studyanon_544393415No ratings yet

- ACG LA Capital Connection Pitchbook 2012-Business SummariesDocument104 pagesACG LA Capital Connection Pitchbook 2012-Business SummariesMD ForgioneNo ratings yet

- International Accounting Standards: IAS 18 RevenueDocument21 pagesInternational Accounting Standards: IAS 18 RevenueMia CasasNo ratings yet

- Resume Ch.11 Consolidation TheoriesDocument3 pagesResume Ch.11 Consolidation TheoriesDwiki TegarNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Solution Performa - Mamta FashionsDocument3 pagesSolution Performa - Mamta FashionsGarimaBhandariNo ratings yet

- IAS 32 - Financial InstrumentsDocument28 pagesIAS 32 - Financial InstrumentsJaaNo ratings yet

- Slide 1: Your Coffee ShopDocument15 pagesSlide 1: Your Coffee ShopMahardika Agil Bima IINo ratings yet

- GDST - Annual Report 2018 PDFDocument148 pagesGDST - Annual Report 2018 PDFPutra AjaNo ratings yet

- Debt Securities Amortized Cost TheoryDocument2 pagesDebt Securities Amortized Cost Theorycristinelarita18No ratings yet