Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsDiscover Funds To Grow My Wealth 27 Nov 2022 1120

Discover Funds To Grow My Wealth 27 Nov 2022 1120

Uploaded by

sure_8086Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- Krugmans Macroeconomics For The AP Course Third Edition Ebook PDF VersionDocument62 pagesKrugmans Macroeconomics For The AP Course Third Edition Ebook PDF Versionmaria.goldstein994100% (51)

- Aggressive Growth Funds 29 Aug 2020 1922Document6 pagesAggressive Growth Funds 29 Aug 2020 1922Ankit GoelNo ratings yet

- Discover Funds To Grow My Wealth 23 Jan 2024 1554Document6 pagesDiscover Funds To Grow My Wealth 23 Jan 2024 1554sowntharyagbmNo ratings yet

- Top Rated Funds 09 Aug 2023 1039Document30 pagesTop Rated Funds 09 Aug 2023 1039prakashtestscreenNo ratings yet

- Top Rated Funds 08 Oct 2023 0837Document30 pagesTop Rated Funds 08 Oct 2023 0837ashish singhNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- LoanchartDocument2 pagesLoanchartAmit KumarNo ratings yet

- Consolidated Balance Sheet: As at 31st March, 2016Document15 pagesConsolidated Balance Sheet: As at 31st March, 2016Saswata ChoudhuryNo ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- Daksh Agarwal FSA&BV Project On Ratio Analysis of United BreweriesDocument42 pagesDaksh Agarwal FSA&BV Project On Ratio Analysis of United Breweriesdaksh.agarwal180No ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- AFS Ratio AssignmentDocument26 pagesAFS Ratio AssignmentaartiNo ratings yet

- SKF IndiaDocument12 pagesSKF IndiaKartik Maheshwari HolaniNo ratings yet

- Trading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Document3 pagesTrading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Dani SetiawanNo ratings yet

- Eicher MotorsDocument10 pagesEicher MotorsAbhishek KothariNo ratings yet

- PUBLIC SECTOR BANKS Consolidated Balance SheetsDocument2 pagesPUBLIC SECTOR BANKS Consolidated Balance SheetsJogenderNo ratings yet

- Production (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Document5 pagesProduction (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Merwin Jansen LadringanNo ratings yet

- Hindustan Zinc Ltd. Shivam VermaDocument37 pagesHindustan Zinc Ltd. Shivam Vermashivam vermaNo ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public SectorDocument4 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public Sectorprasadkh90No ratings yet

- Please Do Not Make Any Changes To This Sheet: Company Name Itc LTD Latest Version Current Version MetaDocument18 pagesPlease Do Not Make Any Changes To This Sheet: Company Name Itc LTD Latest Version Current Version Metapg23sanjana.kumariNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- Did 08Document139 pagesDid 08nelson jose romero montielNo ratings yet

- Income Statement-2014Quarterly - in MillionsDocument6 pagesIncome Statement-2014Quarterly - in MillionsHKS TKSNo ratings yet

- AFS Term ProjectDocument16 pagesAFS Term Projectabdul.fattaahbakhsh29No ratings yet

- Shriram FinanceDocument14 pagesShriram Financesuraj pNo ratings yet

- JSW EnergyDocument10 pagesJSW EnergySchiner's ListNo ratings yet

- Fsa ExcelDocument19 pagesFsa Excelmail.psychdemon10No ratings yet

- World Currency Composition of Official Foreign Exchange ReservesDocument4 pagesWorld Currency Composition of Official Foreign Exchange ReservesRajesh NsNo ratings yet

- Payment Table For Personal Financing-I For Private Sector Variable Rate (Promo) FY2022Document4 pagesPayment Table For Personal Financing-I For Private Sector Variable Rate (Promo) FY2022Ahmad Nazifi AbdullahNo ratings yet

- Nilkamal Student DataDocument13 pagesNilkamal Student DataGurupreet MathaduNo ratings yet

- Abdul Fattaah Basil Aliza Final VersionDocument19 pagesAbdul Fattaah Basil Aliza Final Versionabdul.fattaahbakhsh29No ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Vodafone IdeaDocument9 pagesVodafone IdeaRadhaNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- Value Research Stock AdvisorDocument5 pagesValue Research Stock AdvisortansnvarmaNo ratings yet

- Oil IndiaDocument10 pagesOil India0000No ratings yet

- NHPC LTDDocument9 pagesNHPC LTDMit chauhanNo ratings yet

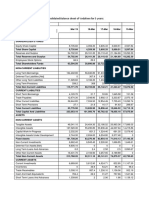

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDocument5 pagesVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNo ratings yet

- S. S. Crushers: Particulars Amount Cost of The ProjectDocument11 pagesS. S. Crushers: Particulars Amount Cost of The Projectpatan nazeerNo ratings yet

- India Cements FADocument154 pagesIndia Cements FARohit KumarNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Sundaram FinanceDocument10 pagesSundaram Finance2k20dmba111 SanchitjayeshNo ratings yet

- Formula 1 Aramco Magyar Nagydíj 2022 - Budapest: Race History ChartDocument14 pagesFormula 1 Aramco Magyar Nagydíj 2022 - Budapest: Race History ChartRahil JadhaniNo ratings yet

- Valuation of Bank (Part-4) - Task 22Document10 pagesValuation of Bank (Part-4) - Task 22snithisha chandranNo ratings yet

- Month Deposit (USD) Profit WD USD Realisasi MAXDocument23 pagesMonth Deposit (USD) Profit WD USD Realisasi MAXditaNo ratings yet

- Asian Paints - ScreenerDocument33 pagesAsian Paints - ScreenerRamesh ReddyNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Case2k20dmba111 SanchitjayeshNo ratings yet

- Coca-Cola Co: FinancialsDocument6 pagesCoca-Cola Co: FinancialsSibghaNo ratings yet

- Economic Indicators Regression - Rev-01Document6 pagesEconomic Indicators Regression - Rev-01Muhammad LatifNo ratings yet

- Multiple Regression Juni 2019 (R 0.94)Document20 pagesMultiple Regression Juni 2019 (R 0.94)Multindo Barra KaryaNo ratings yet

- Bajaj FinanceDocument10 pagesBajaj FinanceJeniffer RayenNo ratings yet

- Team Arthaniti - K J Somaiya Institute of ManagementDocument22 pagesTeam Arthaniti - K J Somaiya Institute of Managementpratyay gangulyNo ratings yet

- Compare Common Size Balance Sheet (Dabur & Itc)Document4 pagesCompare Common Size Balance Sheet (Dabur & Itc)gunn RastogiNo ratings yet

- IndicesDocument2 pagesIndiceswulfdugNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Syllabus - Political Economy Institutions Odd 2324Document9 pagesSyllabus - Political Economy Institutions Odd 2324Daffa M ZidanNo ratings yet

- Reflection Paper MARKET AND STATEDocument2 pagesReflection Paper MARKET AND STATEjohn karloNo ratings yet

- Global Economy: Ivy Charrize Caseres Angel Braceros Class 3ADocument21 pagesGlobal Economy: Ivy Charrize Caseres Angel Braceros Class 3ACrislyn DavidNo ratings yet

- Shraddha Sharda: Contacts EducationDocument1 pageShraddha Sharda: Contacts Educationbhavya.biyaniNo ratings yet

- Usw Arbtc Expo Mar STB 15 Rev00 PDFDocument89 pagesUsw Arbtc Expo Mar STB 15 Rev00 PDFnoufalNo ratings yet

- Local LiteratureDocument1 pageLocal LiteratureRenato dotesNo ratings yet

- Forex Calendar at Forex Factory PDFDocument7 pagesForex Calendar at Forex Factory PDFRamalingam Rathinasabapathy EllappanNo ratings yet

- A. True B. False True 1 BNKG - CFFT.3.LO: 3.2.3 - LO: 3.2.3: Answer: Points: Learning ObjectivesDocument21 pagesA. True B. False True 1 BNKG - CFFT.3.LO: 3.2.3 - LO: 3.2.3: Answer: Points: Learning ObjectivesLê Đặng Minh ThảoNo ratings yet

- World Bank SubsidiariesDocument23 pagesWorld Bank Subsidiariesanmaya agarwalNo ratings yet

- Guidely'S Special Free Bundle Pdfs - Data Interpretation (English Version) For Sbi Po, Ibps Po/ Clerk Prelims Exams 2021Document13 pagesGuidely'S Special Free Bundle Pdfs - Data Interpretation (English Version) For Sbi Po, Ibps Po/ Clerk Prelims Exams 2021barikart3No ratings yet

- Advantages and Limitations of AccountingDocument3 pagesAdvantages and Limitations of AccountingDivisha AgarwalNo ratings yet

- Chapter 2Document28 pagesChapter 2irenep banhan21No ratings yet

- MEPCO Online Consumer BillDocument2 pagesMEPCO Online Consumer BillDanielNo ratings yet

- LME Monthly Average PricesDocument4 pagesLME Monthly Average PricesParade SitumorangNo ratings yet

- Balance of Payments and Sri Lanka Case StudyDocument14 pagesBalance of Payments and Sri Lanka Case StudyAkshay khóseNo ratings yet

- Talk About It 1Document2 pagesTalk About It 1NinaNo ratings yet

- Coinbase Otra Vieja)Document40 pagesCoinbase Otra Vieja)Fer QuintanaNo ratings yet

- Aviation Benefits 2020Document96 pagesAviation Benefits 2020קאסטרא אַדריאַןNo ratings yet

- A Different Way of WorkingDocument2 pagesA Different Way of Workingpoltel5No ratings yet

- Document PDF 4bf1 b301 f5 0Document6 pagesDocument PDF 4bf1 b301 f5 0CarterNo ratings yet

- S C Volume The Forgotten Oscillator PDFDocument6 pagesS C Volume The Forgotten Oscillator PDFkosurugNo ratings yet

- Ldis and RapidsDocument28 pagesLdis and RapidsRheii EstandarteNo ratings yet

- Imports of Goods and ServicesDocument79 pagesImports of Goods and ServicesAdnan MurtovicNo ratings yet

- Contact Number of Relief Commissioner Office Chennai and Government Revenue DepartmentDocument9 pagesContact Number of Relief Commissioner Office Chennai and Government Revenue DepartmentTricolor C ANo ratings yet

- Assessment 001: CHTM37 - Current Practices in The Visitor EconomyDocument10 pagesAssessment 001: CHTM37 - Current Practices in The Visitor EconomyAltaf KhanNo ratings yet

- Case Study EnronDocument15 pagesCase Study EnronPawar Shirish PrakashNo ratings yet

- Cafefrance - Karate KidDocument5 pagesCafefrance - Karate KidArianne AlmerinoNo ratings yet

- Conditional Deed of Sale of Motor VehicleDocument2 pagesConditional Deed of Sale of Motor VehicleMae ErilloNo ratings yet

- Purchasing Lecture For SCM Class 1Document42 pagesPurchasing Lecture For SCM Class 1aamirjewaniNo ratings yet

Discover Funds To Grow My Wealth 27 Nov 2022 1120

Discover Funds To Grow My Wealth 27 Nov 2022 1120

Uploaded by

sure_80860 ratings0% found this document useful (0 votes)

1 views6 pagesOriginal Title

Discover Funds to Grow My Wealth 27 Nov 2022 1120

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views6 pagesDiscover Funds To Grow My Wealth 27 Nov 2022 1120

Discover Funds To Grow My Wealth 27 Nov 2022 1120

Uploaded by

sure_8086Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 6

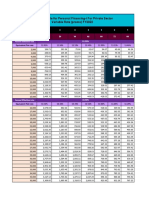

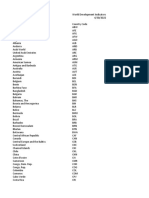

Value Research

Generate on: 27-Nov-2022 11:20

Discover Funds to Grow my Wealth

Fund Name Rating VR Opinion Category

Canara Robeco Flexi Cap 4 Unlock Equity: Flexi Cap

HDFC Retirement Savings 5 Unlock Equity: Flexi Cap

ICICI Prudential Focused 4 Unlock Equity: Flexi Cap

ICICI Prudential Retireme 4 Unlock Equity: Flexi Cap

IDBI Flexi Cap Fund - Dir 4 Unlock Equity: Flexi Cap

IIFL Focused Equity Fund 5 Unlock Equity: Flexi Cap

Mirae Asset Focused Fund 5 Unlock Equity: Flexi Cap

PGIM India Flexi Cap Fun 5 Unlock Equity: Flexi Cap

Parag Parikh Flexi Cap Fu 5 Unlock Equity: Flexi Cap

SBI Focused Equity Fund 4 Unlock Equity: Flexi Cap

Sundaram Focused Fund - 4 Unlock Equity: Flexi Cap

Union Flexi Cap Fund - D 4 Unlock Equity: Flexi Cap

Union Focused Fund - Dir 4 Unlock Equity: Flexi Cap

UTI Flexi Cap Fund - Dire 4 Unlock Equity: Flexi Cap

Axis Growth Opportunitie 4 Unlock Equity: Large & MidCap

Canara Robeco Emerging E 4 Unlock Equity: Large & MidCap

Edelweiss Large & Mid Ca 5 Unlock Equity: Large & MidCap

Kotak Equity Opportuniti 4 Unlock Equity: Large & MidCap

Mirae Asset Emerging Blu 5 Unlock Equity: Large & MidCap

Motilal Oswal Large and 4 Unlock Equity: Large & MidCap

Quant Large and Mid Cap 5 Unlock Equity: Large & MidCap

SBI Large & Midcap Fund 4 Unlock Equity: Large & MidCap

Tata Large & Mid Cap Fun 4 Unlock Equity: Large & MidCap

ICICI Prudential Value Di 4 Unlock Equity: Value Oriented

Invesco India Contra Fund 4 Unlock Equity: Value Oriented

Kotak India EQ Contra Fu 4 Unlock Equity: Value Oriented

SBI Contra Fund - Direct 5 Unlock Equity: Value Oriented

UTI Value Opportunities 4 Unlock Equity: Value Oriented

1 Year Returns (%) 1 Year Returns (growth o1 Year SIP Returns (%) 1 Year SIP Returns (gro

2.05 1,02,055 11.06 1,26,846

9.00 1,08,998 19.74 1,32,066

8.16 1,08,164 19.12 1,31,695

3.61 1,03,609 10.99 1,26,801

3.87 1,03,867 12.11 1,27,485

2.71 1,02,710 15.18 1,29,340

-3.84 96,165 5.60 1,23,492

-2.01 97,989 7.86 1,24,890

-2.81 97,192 5.63 1,23,509

-8.07 91,930 3.55 1,22,222

2.03 1,02,026 13.26 1,28,178

1.36 1,01,362 11.98 1,27,401

1.44 1,01,442 11.74 1,27,257

-9.97 90,027 -0.61 1,19,615

-5.84 94,165 -0.37 1,19,768

2.14 1,02,140 10.37 1,26,422

5.19 1,05,187 14.96 1,29,205

9.94 1,09,945 17.21 1,30,554

0.60 1,00,598 9.27 1,25,751

2.48 1,02,478 17.68 1,30,836

11.60 1,11,598 24.20 1,34,704

9.94 1,09,944 20.32 1,32,409

11.59 1,11,589 24.01 1,34,595

13.70 1,13,696 22.37 1,33,626

5.94 1,05,937 17.22 1,30,565

9.11 1,09,113 18.98 1,31,617

14.39 1,14,392 25.88 1,35,688

5.33 1,05,328 15.29 1,29,406

3 Year Returns (%) 3 Year Returns (growth o3 Year SIP Returns (%) 3 Year SIP Returns (gro

19.63 1,71,215 20.46 4,84,341

24.16 1,91,385 28.73 5,41,812

23.19 1,86,949 26.03 5,22,551

20.89 1,76,681 27.39 5,32,210

19.60 1,71,072 22.74 4,99,782

22.07 1,81,918 23.63 5,05,856

19.50 1,70,647 20.92 4,87,472

25.88 1,99,465 24.63 5,12,811

24.11 1,91,171 22.20 4,96,079

16.40 1,57,711 18.14 4,68,987

19.66 1,71,353 21.50 4,91,338

19.76 1,71,786 22.15 4,95,782

19.21 1,69,410 21.19 4,89,262

18.09 1,64,678 16.14 4,56,024

20.72 1,75,929 19.47 4,77,792

21.69 1,80,188 22.48 4,98,008

20.94 1,76,881 23.90 5,07,717

20.21 1,73,721 23.36 5,04,036

21.29 1,78,432 22.61 4,98,869

19.99 1,72,744 24.14 5,09,387

26.45 2,02,167 30.65 5,55,741

22.06 1,81,833 27.48 5,32,837

19.62 1,71,163 24.53 5,12,094

25.61 1,98,193 30.35 5,53,549

20.18 1,73,558 23.00 5,01,586

19.24 1,69,547 23.92 5,07,854

31.53 2,27,531 37.49 6,07,405

19.32 1,69,874 22.30 4,96,774

5 Year Returns (%) 5 Year Returns (growth o5 Year SIP Returns (%) 5 Year SIP Returns (gro

14.88 2,00,088 18.01 9,37,905

14.74 1,98,843 21.49 10,20,353

14.02 1,92,730 19.70 9,77,193

-- -- -- --

13.37 1,87,267 17.97 9,36,857

16.83 2,17,662 21.64 10,23,809

-- -- -- --

16.42 2,13,877 21.72 10,25,867

17.53 2,24,213 20.76 10,02,395

13.69 1,89,957 16.33 9,00,348

14.06 1,93,058 18.36 9,45,782

13.97 1,92,261 18.35 9,45,538

-- -- -- --

14.42 1,96,078 15.82 8,89,111

-- -- -- --

13.44 1,87,842 18.62 9,51,878

14.58 1,97,453 19.29 9,67,398

13.78 1,90,698 19.06 9,62,118

15.09 2,01,940 19.93 9,82,507

-- -- -- --

15.32 2,03,936 23.35 10,66,773

14.05 1,92,940 20.54 9,97,189

14.04 1,92,872 19.42 9,70,506

14.95 2,00,716 22.00 10,32,953

13.82 1,91,043 18.21 9,42,425

14.87 1,99,962 18.82 9,56,400

15.04 2,01,518 25.85 11,32,550

13.45 1,87,978 17.88 9,34,903

10 Year Returns (%) 10 Year Returns (growth10 Year SIP Returns (%) 10 Year SIP Returns (gr

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

-- -- -- --

Exp. Ratio (%)

0.49

0.85

0.59

1.22

1.17

0.90

0.57

0.31

0.76

0.70

1.48

1.07

1.61

0.91

0.54

0.58

0.49

0.59

0.69

0.67

0.56

1.07

0.90

1.22

0.62

0.83

1.04

1.19

You might also like

- Krugmans Macroeconomics For The AP Course Third Edition Ebook PDF VersionDocument62 pagesKrugmans Macroeconomics For The AP Course Third Edition Ebook PDF Versionmaria.goldstein994100% (51)

- Aggressive Growth Funds 29 Aug 2020 1922Document6 pagesAggressive Growth Funds 29 Aug 2020 1922Ankit GoelNo ratings yet

- Discover Funds To Grow My Wealth 23 Jan 2024 1554Document6 pagesDiscover Funds To Grow My Wealth 23 Jan 2024 1554sowntharyagbmNo ratings yet

- Top Rated Funds 09 Aug 2023 1039Document30 pagesTop Rated Funds 09 Aug 2023 1039prakashtestscreenNo ratings yet

- Top Rated Funds 08 Oct 2023 0837Document30 pagesTop Rated Funds 08 Oct 2023 0837ashish singhNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- LoanchartDocument2 pagesLoanchartAmit KumarNo ratings yet

- Consolidated Balance Sheet: As at 31st March, 2016Document15 pagesConsolidated Balance Sheet: As at 31st March, 2016Saswata ChoudhuryNo ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- Daksh Agarwal FSA&BV Project On Ratio Analysis of United BreweriesDocument42 pagesDaksh Agarwal FSA&BV Project On Ratio Analysis of United Breweriesdaksh.agarwal180No ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- AFS Ratio AssignmentDocument26 pagesAFS Ratio AssignmentaartiNo ratings yet

- SKF IndiaDocument12 pagesSKF IndiaKartik Maheshwari HolaniNo ratings yet

- Trading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Document3 pagesTrading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Dani SetiawanNo ratings yet

- Eicher MotorsDocument10 pagesEicher MotorsAbhishek KothariNo ratings yet

- PUBLIC SECTOR BANKS Consolidated Balance SheetsDocument2 pagesPUBLIC SECTOR BANKS Consolidated Balance SheetsJogenderNo ratings yet

- Production (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Document5 pagesProduction (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Merwin Jansen LadringanNo ratings yet

- Hindustan Zinc Ltd. Shivam VermaDocument37 pagesHindustan Zinc Ltd. Shivam Vermashivam vermaNo ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public SectorDocument4 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public Sectorprasadkh90No ratings yet

- Please Do Not Make Any Changes To This Sheet: Company Name Itc LTD Latest Version Current Version MetaDocument18 pagesPlease Do Not Make Any Changes To This Sheet: Company Name Itc LTD Latest Version Current Version Metapg23sanjana.kumariNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- Did 08Document139 pagesDid 08nelson jose romero montielNo ratings yet

- Income Statement-2014Quarterly - in MillionsDocument6 pagesIncome Statement-2014Quarterly - in MillionsHKS TKSNo ratings yet

- AFS Term ProjectDocument16 pagesAFS Term Projectabdul.fattaahbakhsh29No ratings yet

- Shriram FinanceDocument14 pagesShriram Financesuraj pNo ratings yet

- JSW EnergyDocument10 pagesJSW EnergySchiner's ListNo ratings yet

- Fsa ExcelDocument19 pagesFsa Excelmail.psychdemon10No ratings yet

- World Currency Composition of Official Foreign Exchange ReservesDocument4 pagesWorld Currency Composition of Official Foreign Exchange ReservesRajesh NsNo ratings yet

- Payment Table For Personal Financing-I For Private Sector Variable Rate (Promo) FY2022Document4 pagesPayment Table For Personal Financing-I For Private Sector Variable Rate (Promo) FY2022Ahmad Nazifi AbdullahNo ratings yet

- Nilkamal Student DataDocument13 pagesNilkamal Student DataGurupreet MathaduNo ratings yet

- Abdul Fattaah Basil Aliza Final VersionDocument19 pagesAbdul Fattaah Basil Aliza Final Versionabdul.fattaahbakhsh29No ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Vodafone IdeaDocument9 pagesVodafone IdeaRadhaNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- Value Research Stock AdvisorDocument5 pagesValue Research Stock AdvisortansnvarmaNo ratings yet

- Oil IndiaDocument10 pagesOil India0000No ratings yet

- NHPC LTDDocument9 pagesNHPC LTDMit chauhanNo ratings yet

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDocument5 pagesVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNo ratings yet

- S. S. Crushers: Particulars Amount Cost of The ProjectDocument11 pagesS. S. Crushers: Particulars Amount Cost of The Projectpatan nazeerNo ratings yet

- India Cements FADocument154 pagesIndia Cements FARohit KumarNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Sundaram FinanceDocument10 pagesSundaram Finance2k20dmba111 SanchitjayeshNo ratings yet

- Formula 1 Aramco Magyar Nagydíj 2022 - Budapest: Race History ChartDocument14 pagesFormula 1 Aramco Magyar Nagydíj 2022 - Budapest: Race History ChartRahil JadhaniNo ratings yet

- Valuation of Bank (Part-4) - Task 22Document10 pagesValuation of Bank (Part-4) - Task 22snithisha chandranNo ratings yet

- Month Deposit (USD) Profit WD USD Realisasi MAXDocument23 pagesMonth Deposit (USD) Profit WD USD Realisasi MAXditaNo ratings yet

- Asian Paints - ScreenerDocument33 pagesAsian Paints - ScreenerRamesh ReddyNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Case2k20dmba111 SanchitjayeshNo ratings yet

- Coca-Cola Co: FinancialsDocument6 pagesCoca-Cola Co: FinancialsSibghaNo ratings yet

- Economic Indicators Regression - Rev-01Document6 pagesEconomic Indicators Regression - Rev-01Muhammad LatifNo ratings yet

- Multiple Regression Juni 2019 (R 0.94)Document20 pagesMultiple Regression Juni 2019 (R 0.94)Multindo Barra KaryaNo ratings yet

- Bajaj FinanceDocument10 pagesBajaj FinanceJeniffer RayenNo ratings yet

- Team Arthaniti - K J Somaiya Institute of ManagementDocument22 pagesTeam Arthaniti - K J Somaiya Institute of Managementpratyay gangulyNo ratings yet

- Compare Common Size Balance Sheet (Dabur & Itc)Document4 pagesCompare Common Size Balance Sheet (Dabur & Itc)gunn RastogiNo ratings yet

- IndicesDocument2 pagesIndiceswulfdugNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Syllabus - Political Economy Institutions Odd 2324Document9 pagesSyllabus - Political Economy Institutions Odd 2324Daffa M ZidanNo ratings yet

- Reflection Paper MARKET AND STATEDocument2 pagesReflection Paper MARKET AND STATEjohn karloNo ratings yet

- Global Economy: Ivy Charrize Caseres Angel Braceros Class 3ADocument21 pagesGlobal Economy: Ivy Charrize Caseres Angel Braceros Class 3ACrislyn DavidNo ratings yet

- Shraddha Sharda: Contacts EducationDocument1 pageShraddha Sharda: Contacts Educationbhavya.biyaniNo ratings yet

- Usw Arbtc Expo Mar STB 15 Rev00 PDFDocument89 pagesUsw Arbtc Expo Mar STB 15 Rev00 PDFnoufalNo ratings yet

- Local LiteratureDocument1 pageLocal LiteratureRenato dotesNo ratings yet

- Forex Calendar at Forex Factory PDFDocument7 pagesForex Calendar at Forex Factory PDFRamalingam Rathinasabapathy EllappanNo ratings yet

- A. True B. False True 1 BNKG - CFFT.3.LO: 3.2.3 - LO: 3.2.3: Answer: Points: Learning ObjectivesDocument21 pagesA. True B. False True 1 BNKG - CFFT.3.LO: 3.2.3 - LO: 3.2.3: Answer: Points: Learning ObjectivesLê Đặng Minh ThảoNo ratings yet

- World Bank SubsidiariesDocument23 pagesWorld Bank Subsidiariesanmaya agarwalNo ratings yet

- Guidely'S Special Free Bundle Pdfs - Data Interpretation (English Version) For Sbi Po, Ibps Po/ Clerk Prelims Exams 2021Document13 pagesGuidely'S Special Free Bundle Pdfs - Data Interpretation (English Version) For Sbi Po, Ibps Po/ Clerk Prelims Exams 2021barikart3No ratings yet

- Advantages and Limitations of AccountingDocument3 pagesAdvantages and Limitations of AccountingDivisha AgarwalNo ratings yet

- Chapter 2Document28 pagesChapter 2irenep banhan21No ratings yet

- MEPCO Online Consumer BillDocument2 pagesMEPCO Online Consumer BillDanielNo ratings yet

- LME Monthly Average PricesDocument4 pagesLME Monthly Average PricesParade SitumorangNo ratings yet

- Balance of Payments and Sri Lanka Case StudyDocument14 pagesBalance of Payments and Sri Lanka Case StudyAkshay khóseNo ratings yet

- Talk About It 1Document2 pagesTalk About It 1NinaNo ratings yet

- Coinbase Otra Vieja)Document40 pagesCoinbase Otra Vieja)Fer QuintanaNo ratings yet

- Aviation Benefits 2020Document96 pagesAviation Benefits 2020קאסטרא אַדריאַןNo ratings yet

- A Different Way of WorkingDocument2 pagesA Different Way of Workingpoltel5No ratings yet

- Document PDF 4bf1 b301 f5 0Document6 pagesDocument PDF 4bf1 b301 f5 0CarterNo ratings yet

- S C Volume The Forgotten Oscillator PDFDocument6 pagesS C Volume The Forgotten Oscillator PDFkosurugNo ratings yet

- Ldis and RapidsDocument28 pagesLdis and RapidsRheii EstandarteNo ratings yet

- Imports of Goods and ServicesDocument79 pagesImports of Goods and ServicesAdnan MurtovicNo ratings yet

- Contact Number of Relief Commissioner Office Chennai and Government Revenue DepartmentDocument9 pagesContact Number of Relief Commissioner Office Chennai and Government Revenue DepartmentTricolor C ANo ratings yet

- Assessment 001: CHTM37 - Current Practices in The Visitor EconomyDocument10 pagesAssessment 001: CHTM37 - Current Practices in The Visitor EconomyAltaf KhanNo ratings yet

- Case Study EnronDocument15 pagesCase Study EnronPawar Shirish PrakashNo ratings yet

- Cafefrance - Karate KidDocument5 pagesCafefrance - Karate KidArianne AlmerinoNo ratings yet

- Conditional Deed of Sale of Motor VehicleDocument2 pagesConditional Deed of Sale of Motor VehicleMae ErilloNo ratings yet

- Purchasing Lecture For SCM Class 1Document42 pagesPurchasing Lecture For SCM Class 1aamirjewaniNo ratings yet