Professional Documents

Culture Documents

Company Accounts (2) - Practice 2

Company Accounts (2) - Practice 2

Uploaded by

s2019152Copyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Shareholders' Equity - ExercisesDocument5 pagesShareholders' Equity - Exercisesjooo0% (1)

- Company Accounts (2) - Practice 5Document1 pageCompany Accounts (2) - Practice 5s2019152No ratings yet

- Company Accounts (2) - Practice 3Document1 pageCompany Accounts (2) - Practice 3s2019152No ratings yet

- Cs Executive Company Accounts Test Paper: Mohit Educomp Pvt. LTDDocument3 pagesCs Executive Company Accounts Test Paper: Mohit Educomp Pvt. LTDRounak BasuNo ratings yet

- Accounts Test Paper 22.06.19Document2 pagesAccounts Test Paper 22.06.19Rounak BasuNo ratings yet

- CM11 3C CacDocument2 pagesCM11 3C CacHaRiPrIyA JaYaKuMaRNo ratings yet

- Company Accounts (2) - Practice 4Document1 pageCompany Accounts (2) - Practice 4s2019152No ratings yet

- The Indian Institute of Planning and Management Advanced Accounting Re-Examination AssignmentDocument4 pagesThe Indian Institute of Planning and Management Advanced Accounting Re-Examination AssignmentravirrkNo ratings yet

- Accounting: Premium Test Paper-2Document3 pagesAccounting: Premium Test Paper-2hfdghdhNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- 20092018090907893chapter18 RedemptionofPreferenceSharesDocument2 pages20092018090907893chapter18 RedemptionofPreferenceSharesAbdifatah SaidNo ratings yet

- 325 PDFDocument10 pages325 PDFAashish SarotiaNo ratings yet

- Company Accounts (2) - Practice 1Document2 pagesCompany Accounts (2) - Practice 1s2019152No ratings yet

- Far410 Tutorial Chapter 4Document2 pagesFar410 Tutorial Chapter 4syuhadahNo ratings yet

- No - of Printed PagesDocument4 pagesNo - of Printed PagesRiteshHPatelNo ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- ACC601 Lecture 4 TutorialsDocument3 pagesACC601 Lecture 4 TutorialsJoe MajchrzakNo ratings yet

- Accounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsDocument9 pagesAccounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsbinuNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- 12 Amalgamation NotesDocument12 pages12 Amalgamation NoteskautiNo ratings yet

- Far160 Pyq TQ3 Co Intro IssueDocument6 pagesFar160 Pyq TQ3 Co Intro IssueFauziah MustaphaNo ratings yet

- Financial Accounting and Reporting I: Additional Practice QuestionsDocument34 pagesFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- FAR 410 Topic 3: EquityDocument4 pagesFAR 410 Topic 3: EquityAmzarNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- Week 12 Tutorial Questions Companies AF101Document4 pagesWeek 12 Tutorial Questions Companies AF101Silo KetenilagiNo ratings yet

- MBA-5107, Short QuestionsDocument2 pagesMBA-5107, Short QuestionsShajib GaziNo ratings yet

- Shares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDocument106 pagesShares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDaksh YadavNo ratings yet

- QB Ii PDFDocument45 pagesQB Ii PDFabid hussainNo ratings yet

- Disclosure of Share Capital in Balance Sheet of CompanyDocument3 pagesDisclosure of Share Capital in Balance Sheet of Companyabhayku1689No ratings yet

- Account - 2Document6 pagesAccount - 2kakajumaNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- Document From SimranDocument10 pagesDocument From Simransimran0bt21No ratings yet

- Accounting Ipcc May10 Paper1Document55 pagesAccounting Ipcc May10 Paper1Luvangel HeartNo ratings yet

- Chapter 6Document5 pagesChapter 6Tshering DemaNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Accf3114 4Document10 pagesAccf3114 4Krishna 11No ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Specific Financial Reporting Ac413 May19aDocument4 pagesSpecific Financial Reporting Ac413 May19aAnishahNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- CA Inter Adv Account Q MTP 2 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 2 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- MC 9 Equity A201 StudentDocument4 pagesMC 9 Equity A201 StudentKkk.sssNo ratings yet

- Eco-14 - e - PDFDocument3 pagesEco-14 - e - PDFMehak GoyalNo ratings yet

- Company AccountsDocument3 pagesCompany AccountsYATTIN KHANNANo ratings yet

- Shares Class PPT Sunil PandaDocument60 pagesShares Class PPT Sunil Pandadollpees01No ratings yet

- A221 MC 9 - StudentDocument4 pagesA221 MC 9 - StudentNajihah RazakNo ratings yet

- CA Final FR Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Final FR Q MTP 2 May 2024 Castudynotes ComAudit UserNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- ECO-14 - ENG - CompressedDocument4 pagesECO-14 - ENG - CompressedYzNo ratings yet

- Soalan Tutorial Liabiliti Bukan SemasaDocument5 pagesSoalan Tutorial Liabiliti Bukan Semasaa194900No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

Company Accounts (2) - Practice 2

Company Accounts (2) - Practice 2

Uploaded by

s2019152Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Accounts (2) - Practice 2

Company Accounts (2) - Practice 2

Uploaded by

s2019152Copyright:

Available Formats

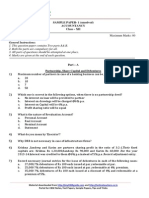

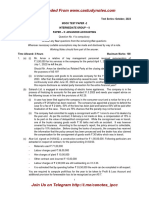

Chapter 29: Company Accounts (2) - Issue of Shares and Loan Notes

Practice 2

Royal CFC Bhd. has an authorized capital of 300,000 Ordinary Shares of RM 1 each.

200,000 Ordinary Shares had been issued at par and fully paid up on 31 December 2018.

On 1 January 2019, the directors decided to issue the “REMAINING” ordinary shares of

RM 1 each at a premium of RM 0.60 per share, in accordance with the Company’s Articles

which payable as follows:

2019 RM

Jan 15 Application 0.50

Mar 1 Allotment , including premium 0.80

Jun 1 First and Final Call ?

The response from the public was very encouraging. Application for 190,000 shares had been

received. The company decided to deal with them as follows:

(i) 30 applicants applying 1,000 shares each were being rejected and refunded.

(ii) To accept in full applications for 40,000 shares.

(iii) To allot the remaining shares on the basis of one share for every two shares applied

for.

(iv) The excess application monies from the successful applicants were applied to the

allotment.

The balance of the allotment monies were fully received on 15 March 2019.

All the payments due on first and final call were paid in full except for an applicant who was

allotted 5,000 shares failed to pay the amount due.

You are required to:

(a) explain what is the aforesaid term “REMAINING” refer to;

(b) calculate the “Excess Application Monies”;

(c) calculate the “Total Monies Refunded” to the 30 unsuccessful applicants;

(d) record the above issuance of shares in General Journal in the books of Royal CFC

Bhd., without narration.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Shareholders' Equity - ExercisesDocument5 pagesShareholders' Equity - Exercisesjooo0% (1)

- Company Accounts (2) - Practice 5Document1 pageCompany Accounts (2) - Practice 5s2019152No ratings yet

- Company Accounts (2) - Practice 3Document1 pageCompany Accounts (2) - Practice 3s2019152No ratings yet

- Cs Executive Company Accounts Test Paper: Mohit Educomp Pvt. LTDDocument3 pagesCs Executive Company Accounts Test Paper: Mohit Educomp Pvt. LTDRounak BasuNo ratings yet

- Accounts Test Paper 22.06.19Document2 pagesAccounts Test Paper 22.06.19Rounak BasuNo ratings yet

- CM11 3C CacDocument2 pagesCM11 3C CacHaRiPrIyA JaYaKuMaRNo ratings yet

- Company Accounts (2) - Practice 4Document1 pageCompany Accounts (2) - Practice 4s2019152No ratings yet

- The Indian Institute of Planning and Management Advanced Accounting Re-Examination AssignmentDocument4 pagesThe Indian Institute of Planning and Management Advanced Accounting Re-Examination AssignmentravirrkNo ratings yet

- Accounting: Premium Test Paper-2Document3 pagesAccounting: Premium Test Paper-2hfdghdhNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- 20092018090907893chapter18 RedemptionofPreferenceSharesDocument2 pages20092018090907893chapter18 RedemptionofPreferenceSharesAbdifatah SaidNo ratings yet

- 325 PDFDocument10 pages325 PDFAashish SarotiaNo ratings yet

- Company Accounts (2) - Practice 1Document2 pagesCompany Accounts (2) - Practice 1s2019152No ratings yet

- Far410 Tutorial Chapter 4Document2 pagesFar410 Tutorial Chapter 4syuhadahNo ratings yet

- No - of Printed PagesDocument4 pagesNo - of Printed PagesRiteshHPatelNo ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- ACC601 Lecture 4 TutorialsDocument3 pagesACC601 Lecture 4 TutorialsJoe MajchrzakNo ratings yet

- Accounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsDocument9 pagesAccounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsbinuNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- 12 Amalgamation NotesDocument12 pages12 Amalgamation NoteskautiNo ratings yet

- Far160 Pyq TQ3 Co Intro IssueDocument6 pagesFar160 Pyq TQ3 Co Intro IssueFauziah MustaphaNo ratings yet

- Financial Accounting and Reporting I: Additional Practice QuestionsDocument34 pagesFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- FAR 410 Topic 3: EquityDocument4 pagesFAR 410 Topic 3: EquityAmzarNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- Week 12 Tutorial Questions Companies AF101Document4 pagesWeek 12 Tutorial Questions Companies AF101Silo KetenilagiNo ratings yet

- MBA-5107, Short QuestionsDocument2 pagesMBA-5107, Short QuestionsShajib GaziNo ratings yet

- Shares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDocument106 pagesShares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDaksh YadavNo ratings yet

- QB Ii PDFDocument45 pagesQB Ii PDFabid hussainNo ratings yet

- Disclosure of Share Capital in Balance Sheet of CompanyDocument3 pagesDisclosure of Share Capital in Balance Sheet of Companyabhayku1689No ratings yet

- Account - 2Document6 pagesAccount - 2kakajumaNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- Document From SimranDocument10 pagesDocument From Simransimran0bt21No ratings yet

- Accounting Ipcc May10 Paper1Document55 pagesAccounting Ipcc May10 Paper1Luvangel HeartNo ratings yet

- Chapter 6Document5 pagesChapter 6Tshering DemaNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Accf3114 4Document10 pagesAccf3114 4Krishna 11No ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Specific Financial Reporting Ac413 May19aDocument4 pagesSpecific Financial Reporting Ac413 May19aAnishahNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- CA Inter Adv Account Q MTP 2 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 2 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- MC 9 Equity A201 StudentDocument4 pagesMC 9 Equity A201 StudentKkk.sssNo ratings yet

- Eco-14 - e - PDFDocument3 pagesEco-14 - e - PDFMehak GoyalNo ratings yet

- Company AccountsDocument3 pagesCompany AccountsYATTIN KHANNANo ratings yet

- Shares Class PPT Sunil PandaDocument60 pagesShares Class PPT Sunil Pandadollpees01No ratings yet

- A221 MC 9 - StudentDocument4 pagesA221 MC 9 - StudentNajihah RazakNo ratings yet

- CA Final FR Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Final FR Q MTP 2 May 2024 Castudynotes ComAudit UserNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- ECO-14 - ENG - CompressedDocument4 pagesECO-14 - ENG - CompressedYzNo ratings yet

- Soalan Tutorial Liabiliti Bukan SemasaDocument5 pagesSoalan Tutorial Liabiliti Bukan Semasaa194900No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet