Professional Documents

Culture Documents

CN Summary

CN Summary

Uploaded by

20010126817Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CN Summary

CN Summary

Uploaded by

20010126817Copyright:

Available Formats

SARANSH Transfer Pricing

TRANSFER PRICING

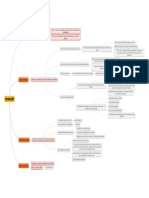

Chapter X: Special provisions relating to Avoidance of Tax [Transfer Pricing provisions]

Income should arise from Income to be Computation of income as per ALP

computed should have the effect of ↑ing taxable

having regard to income or ↓ing loss computed

International Specified domestic ALP

Transaction transaction (SDT)

Transaction is in the ALP is the price Nature & class

Transaction Either or nature of- applied/ proposed to of International

between 2 both of a Purchase, sale or be applied in a Transaction and

or more AEs AEs lease of – transaction between SDT

should tangible or persons other than Class(es) of AEs,

be NRs intangible AEs in functions

property uncontrolled performed,

b Provision of conditions assets employed

services & risks assumed

c Lending or (FAR)

borrowing of Availability,

money coverage &

d Any other ALP to be computed reliability of data

transaction as per most Factors for required for

having a bearing appropriate method selecting application of

on profits, (MAM) amongst MAM the method

income, losses or prescribed methods Degree of

assets of AEs comparability

Transaction between the

including a mutual International

agreement or The price so Transaction and

arrangement between determined SDT &

Is more than one No

two or more AEs for is the ALP uncontrolled

price is determined

allocation of cost or transaction

by the MAM?

exp. incurred w.r.t a Extent to which

benefit, service or reliable &

Yes

facility provided to accurate

any AE. adjustments can

Whether the MAM No Arithmetic be made to a/c

selected is CUP, mean of all for differences

RPM, CPM or values between

TNMM? included in International

Yes the dataset Transaction and

would be SDT &

Does the dataset

the ALP comparable

constructed have 6 No uncontrolled

or more entries?

transaction

Yes

(CUT)

If the transaction Range Concept to be If the

applied i.e., arm’s Nature, extent &

price is within this transaction

length range starting reliability of

range, the same will price is outside

from 35th percentile assumptions

be deemed to be the this range, the

of the dataset to the required to be

ALP ALP would be

65th percentile of the made in

the median of

dataset to be application of a

constructed the dataset

method

© ICAI BOS(A) 174

SARANSH Transfer Pricing

Associated Enterprises (AEs) [Section 92A(1)]

Condition Example

(1) An enterprise which participates, Where A Ltd. directly participates in the management of

directly or indirectly, or through one B Ltd. and B Ltd. directly participates in the management

or more intermediaries, in: of C Ltd. In such situation, A Ltd. has direct participation

• management of the other in management of B Ltd. but has an indirect participation

enterprise, or in management of C Ltd.

• control of other enterprise, or A B C

• capital of other enterprise

In such scenario, both B Ltd. and C Ltd. would be AE of A

Ltd.

(2) If one or more persons participates, Mr. A directly has control in A Ltd. and B Ltd. In such a

directly or indirectly, or through scenario, both A Ltd. & B Ltd. are associated enterprises

one or more intermediaries in: since there is a common person i.e., Mr. A, who controls

• management/control/capital both entities A Ltd. & B Ltd.

of the two different enterprises

Then, those two enterprises are AEs.

Deemed Associated Enterprises [Section 92A(2)]

Condition Situation Example

Substantial One enterprise holds 26% or A Ltd. holds 33% of Voting Power in B Ltd. and B Ltd.

voting power more of the voting power, holds 80% Voting Power in C Ltd.

directly or indirectly, in the 33% 80%

A B C

other enterprise.

In above situation, A Ltd. holds 26% or more voting

power in B Ltd., directly and in C Ltd. indirectly (i.e.,

through B Ltd.). Therefore, both B Ltd. & C Ltd. are

deemed associated enterprises of A Ltd.

Substantial Any person or enterprise Mr. A holds 40% of voting power in both X Ltd. and Y

voting power holds 26% or more of the Ltd. where neither X Ltd. has any holding in Y Ltd.

in two voting power, directly or nor Y Ltd. has any holding in X Ltd.

entities by indirectly, in each of two Mr. A

common different enterprises. 40% 40%

person

X Ltd. Y Ltd.

In this situation, since Mr. A directly holds 40% of

voting power in both X Ltd. and Y Ltd., X Ltd. & Y

Ltd. will be deemed associated enterprises.

Advancing of One enterprise advances Book Value of total assets of Y Ltd. is ` 100 crores. X

substantial loan to the other enterprise Ltd. advances loan of ` 60 crores to Y Ltd.

sum of money of an amount of 51% or In this case, X Ltd. advances loan of ` 60 crores to Y

© ICAI BOS(A) 175

SARANSH Transfer Pricing

more of the book value of Ltd, which is 60% of the book value of total assets of Y

the total assets of other Ltd. Hence, X Ltd. & Y Ltd. are deemed associated

enterprise. enterprises.

Guaranteeing One enterprise guarantees P Inc. has total loan of 1 million dollars from XYZ

borrowings 10% or more of the total Bank of America. Out of that, A Ltd., an Indian

borrowings of the other company, guarantees 20% of total borrowings in case

enterprise. of any default made by P Inc. In such case, since A

Ltd. guarantees 20% of total borrowings of P Inc., P

Inc. and A Ltd. are deemed associated enterprises.

Appointment One enterprise appoints X Ltd. has 15 directors on its Board. Out of that, Y

of majority more than half of the board Ltd. has appointed 8 directors. In such case, X Ltd.

directors of of directors or members of and Y Ltd. are deemed associated enterprises.

other the governing board, or one

enterprise or more executive directors

or executive members of the

governing board of other

enterprise.

Appointment More than half of the Mr. A appointed 9 directors out of 15 directors of X

of majority directors or members of the Ltd. and appointed 2 executive directors on the board

directors of governing board, or one or of Y Ltd. In such case, since a common person i.e.,

two different more of the executive Mr. A appointed more than half of the directors in X

enterprises by directors or members of the Ltd. and appointed 2 executive directors in Y Ltd.,

same governing board of each of both X Ltd. and Y Ltd. are deemed associated

person(s) the two enterprises are enterprises.

appointed by the same

person(s).

Dependence The manufacture or processing of goods or articles or business carried out by one

on intangibles enterprise is wholly dependent (i.e. 100%) on the know-how, patents, copyrights,

w.r.t which trade-marks, licenses, franchises or any other business or commercial rights of

other similar nature, or any data, documentation, drawing or specification relating to any

enterprise has patent, invention, model, design, secret formula or process, of which the other entity

exclusive is the owner or in respect of which the other enterprise has exclusive rights.

rights

Dependence 90% or more of raw materials and consumables required for the manufacture or

on raw processing of goods or articles carried out by one enterprise, are supplied by the

material other enterprise, or by persons specified by the other enterprise, where the prices and

supplied by other conditions relating to the supply are influenced by such other enterprise.

other

enterprise

Dependence The goods or articles manufactured or processed by one enterprise, are sold to the

on sale other enterprise or to persons specified by the other enterprise, and the prices and

other conditions relating thereto are influenced by such other enterprise.

© ICAI BOS(A) 176

SARANSH Transfer Pricing

Control by Where one enterprise is Mr. A and Mr. B are relatives. Mr. A has control over

common controlled by an individual, X Ltd. and Mr. B has control over Y Ltd. Therefore,

individual the other enterprise is also both X Ltd. and Y Ltd. will be deemed associated

controlled by such enterprises.

individual or his relative or

jointly by such individual

and his relatives.

Control by Where one enterprise is

HUF Member of

HUF or controlled by a HUF and the HUF/ Relative of

member other enterprise is member of such

thereof controlled by a member of HUF

such HUF or by relative of a Control Control

member of such HUF or

jointly by such member and A Ltd. B Ltd.

his relative.

A Ltd & B Ltd are deemed associated enterprises.

Interest in a Where one enterprise is a firm, AoPs or Bols, the other enterprise holds 10% or more

firm, AoPs or interest in firm/AoPs/BoIs.

BoIs

Mutual There exists between the two enterprises, any relationship of mutual interest, as may

interest be prescribed.

relationship

INTERNATIONAL TRANSACTION [SECTION 92B]

a transaction

As per section between two or more transaction in the nature

92B, an international associated of:

transaction means enterprises, either or

both of whom are

non-residents; and

•sale/purchase/lease of tangible property; or

•sale/purchase/lease of intangible property; or

•provision of services; or

•lending/borrowing money; or

•any other transaction having a bearing on profits,

income, losses or assets of such enterprises; or

•mutual agreement or arrangement between two or

more associated enterprises for the allocation or

apportionment of, or any contribution to, any cost

or expense incurred or to be incurred in

connection with a benefit, service or facility

provided or to be provided to any one or more of

such enterprises.

© ICAI BOS(A) 177

SARANSH Transfer Pricing

DEEMED INTERNATIONAL TRANSACTION

Mr. B C Inc.

(Associated

A Ltd (Unrelated

Enterprise

party)

of A Ltd.)

Agreement for sale of Product Agreement for sale of product X

X entered into on 1/6/2023 entered into on 30/5/2023

Transaction between A Ltd. and Mr. B is deemed to be an international transaction

between associated enterprises, whether or not Mr. B is a non-resident.

SPECIFIED DOMESTIC TRANSACTION

Specified Domestic Transaction (SDT) shall mean any of the following transactions, not

being an international transaction

any transfer of

any transaction goods or

referred to in services

section 80A i.e., referred to in However,

inter-unit section 80- these

any

transfer of IA(8) i.e., transactions

transaction, any business

goods and inter-unit any business are not

any business referred to in transacted

services by an transfer of transacted SDT in

transacted any other between a co-

undertaking or goods or between a case the

between the section under operative

unit or services company aggregate

assessee Chapter VI-A society opting

enterprise or between opting for of such

carrying on or section for section any other

eligible eligible section transactions

eligible 10AA, to 115BAE and prescribed

business to business and 115BAB and entered

business and which person with transaction

other business other person with into by the

other person provisions of whom the co-

carried on by business, whom the assessee in

as referred to section 80- operative

the assessee or where the company has the P.Y.

section 80- IA(8) or society has

vice versa, for consideration close does not

IA(10) section 80- close

consideration for transfer connection exceed

IA(10) are connection

not does not ` 20 crore.

applicable

corresponding correspond

to the market with the

value on the market value

date of transfer of goods and

services

© ICAI BOS(A) 178

SARANSH Transfer Pricing

METHODS FOR COMPUTING ALP [SECTION 92C]

CUP Resale Price Cost Plus Profit Split Method Transactional Net Margin

Method Method Method (PSM) Method (TNMM)

(RPM) (CPM)

This method This method This method This method is applied Compute Net Profit (NP) margin of

is applied is applied is generally where there is transfer of the enterprise from International

where there where item applied where unique intangibles or in Transaction or specified domestic

are similar obtained from semi-finished multiple International transactions with AE having regard

transaction(s) AE is resold to goods are Transactions or specified to cost incurred/sales effected/ assets

between unrelated sold to AEs domestic transactions employed

unconnected party

parties

Identify Identify the Identify direct Determine combined NP Compute the NP margin realised

price in a Resale Price & indirect cost of the AEs arising out of by the enterprise or unrelated

comparable (RP) at which of production International Transaction enterprise in a CUCT by applying

uncontrolled the item is incurred for or specified domestic the same base

transaction resold to property transactions

(CUCT) unrelated transferred or

party services

provided to

AE

Reduce the RP Determine Evaluate the relative Adjust NP margin realised from

by the normal normal GP contribution of each CUCT to a/c for differences

Gross Profit mark up to enterprise to the earning affecting NP margin in the OM

(GP) margin such costs by of combined NP on the

on CUCT & an unrelated basis of FAR

expenditure enter in

incurred CUCT

(customs

duty) w.r.t.

purchase

Adjust the Adjust the Adjust the Split the combined NP Compare NP margin relative to

price for price for normal GP amongst the enterprise in costs/sales/assets of the AE with

material functional & mark-up for proportion to market NP margin of uncontrolled party

differences other functional returns; & residual profits in comparable transactions

in terms of differences and other in proportion to their

contract, materially differences relative contribution

credit, affecting GP materially

transport margin in affecting GP

etc. open market mark-up in

(OM) OM

Adjusted Adjusted price Total Costs ALP to be determined on Adjusted NP margin taken into

price is ALP is ALP ↑d by the basis of profit A/c to arrive at ALP

adjusted apportioned

mark up =

ALP

© ICAI BOS(A) 179

SARANSH Transfer Pricing

DETERMINATION OF THE MOST APPROPRIATE METHOD

(i) The nature and class of the international transaction or specified domestic

transaction;

(ii) The class, or classes of associated enterprises entering into the transaction and the

functions performed by them staking into account assets employed or to be

employed and risks assumed by such enterprises;

(iii) The availability, coverage and reliability of data necessary for application of the

Factors for method;

selecting (iv) The degree of comparability existing between the international transaction or the

specified domestic transaction and the uncontrolled transaction and between the

the most enterprises entering into such transactions;

appropriate (v) The extent to which reliable and accurate adjustments can be made to account for

difference, if any, between the international transaction or the specified domestic

method transaction and the comparable uncontrolled transaction or between the enterprises

entering into such transactions;

(vi) The nature, extent and reliability of assumptions required to be made in application

of a method.

MANNER OF COMPUTATION OF ARM’S LENGTH PRICE [THIRD PROVISO TO

SECTION 92C(2)]

In case of an international transaction or specified domestic transaction undertaken on or after 1.4.2014,

where more than one price is determined by the most appropriate method, the ALP would be computed

in the prescribed manner specified in Rule 10CA.

Determination of arm’s length price using one of the prescribed methods

As per range concept, if prescribed

The price thus determined is Yes Whether a No conditions are satisfied,

the arm’s length price single price is

arrived at? (or)

By applying Arithmetic Mean in

any other case

•Most appropriate method selected is comparable uncontrolled price method,

When to apply

resale price method, cost plus method or transactional net margin method and

range concept?

•The dataset constructed has six or more entries.

•Arrange the values in the dataset in the ascending order.

•Where the actual transaction price falls within 35th and 65th percentile of the

How to apply? dataset, the value of transaction will be accepted to be arm's length price.

• Where the transfer price does not fall within the above range, then median of

dataset shall be taken as the Arm's Length price.

© ICAI BOS(A) 180

SARANSH Transfer Pricing

Range concept not However, if the variation between ALP so

applicable [Rule 10CA(7)] determined and price at which the

•Where the most appropriate international transaction or specified

method is profit split method domestic transaction has actually been

or any other method or the undertaken

dataset has less than 6 entries, •does not exceed such % exceeding 3% of the latter,

•the ALP shall be the as may be notified by the Central Government,

arithmetical mean of all the •the price at which the international transaction or

values included in the dataset. specified domestic transaction has actually been

undertaken would be the ALP

No deduction u/s 10AA or Chapter VI-A would be allowed in respect of the additional income

computed by the AO having regard to the ALP determined by him.

REFERENCE TO TRANSFER PRICING OFFICER [SECTION 92CA]

AO has the option to TPO shall pass

make reference to TPO The order of TPO is

order at least 60 binding on AO and

for computation of days before the

ALP of an international AO shall proceed to

expiry of the time compute the TI in

transaction or specified limit under section

domestic transaction. conformity with the

153 or section 153B ALP determined by

This option is not, for making an order

however, available to TPO.

of assessment by the

the assessee. AO.

After considering the TPO has power to

AO has to take the evidence, documents, etc. rectify his order u/s

previous approval of produced by the assessee and 154 if any mistake

the Principal after considering the apparent from the

Commissioner of material gathered by him, record is noticed. If

Income-tax (PCIT)/ the TPO has to pass an order such rectification is

Commissioner of determining ALP. He has to made, AO has to

Income-tax (CIT) send a copy of his order to rectify the

before making such AO as well as the assessee. assessment order to

a reference. bring it in

conformity with the

same.

The TPO can also determine the ALP of

international transaction not referred by

TPO would serve a the AO for which the transfer pricing

notice to the assessee provisions shall apply as if such transaction

requiring him to is referred to the TPO by the AO.

produce on a date

specified in the notice, •International transaction which is

any evidence on which subsequently identified by the TPO

the assessee relied in during the course of proceedings or

support of the •International transaction in respect of

computation of ALP which the assessee has not furnished the

made by him in relation report from an accountant u/s 92E and

to international such transaction subsequently identified

transaction or specified by the TPO during the course of

domestic transaction. proceeding

© ICAI BOS(A) 181

SARANSH Transfer Pricing

ADVANCE PRICING AGREEMENTS [SECTIONS 92CC & 92CD]

Advance An agreement between a taxpayer and a taxing

Pricing authority on an appropriate transfer pricing

Agreement methodology for a set of transactions over a

(APA) fixed period of time in future.

CBDT (with the approval of the Central Government) may enter into an APA

with any person determining

ALP or specifying the manner in income referred to in section 9(1)(i), or

specifying the manner in which said income is

which the ALP is to be determined

to be determined, as is reasonably attributable

of an international transaction to be to the operations carried out in India by or on

entered into by that person behalf of that person, being a non-resident

Provisions of APA to Binding nature of

Validity of APA Not binding of APA

apply APA

The provisions of The APA so entered

the APA shall into shall be binding

on:

override the

provisions of The APA shall be •the person in whose

section 92C valid for such case, and in respect The APA shall not

(Computation of of the transaction in

period as specified be binding if there

relation to which, the

ALP as per most in the agreement, is any change in law

APA has been

appropriate which shall in no entered into; and or facts having

method) or section case exceed five bearing on such

•the the PCIT or CIT

92CA (Reference to consecutive and the income-tax APA.

TPO) which are previous years authorities

applicable for subordinate to him,

determination of in respect of the said

ALP person and the said

transaction.

© ICAI BOS(A) 182

SARANSH Transfer Pricing

The application may be filed at

Application for APA

In respect of transactions before the first day of the

which are of continuing nature previous year relevant to the first

from dealings that are already

any time -

assessment year for which the

occuring application is made

In respect of remaining before undertaking the

transactions transaction

Applicable Fee for application for APA

The application has to be accompanied by proof of payment of fees as given below:

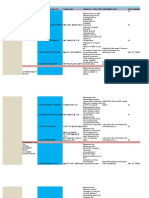

Amount of international taxation entered into or proposed to be undertaken in Fee

respect of which agreement is proposed during the proposed period of

agreement

Amount ≤ ` 100 crores ` 10 lakhs

Amount > ` 100 crores but not exceeding ≤ ` 200 crores ` 15 lakhs

Amount > ` 200 crores ` 20 lakhs

Annual in quadruplicate

compliance

for each year covered in the agreement

Report

The assessee shall - within 30 days of the due date of filing income-tax return for that year, or

furnish an annual - within 90 days of entering into an agreement,

compliance whichever is later.

report

The TPO having the jurisdiction over the assessee shall

carry out the compliance audit of the agreement for each of

the year covered in the agreement.

Compliance Audit

of APA [Rule 10P]

The compliance audit report shall be furnished by the TPO

within 6 months from the end of the month in which the

Annual Compliance Report is received by the TPO.

© ICAI BOS(A) 183

SARANSH Transfer Pricing

Roll back in APA Scheme [Section 92CC(9A)]

APA may provide for determining the

ALP or specifying the manner in which ALP income referred to in section 9(1)(i), or specifying the

is to be determined in relation to an manner in which the said income is to be determined, as

international transaction entered into by the is reasonably attributable to the operations carried out in

person India by or on behalf of that person, being a non-resident

during any period not exceeding four PYs preceding

the first of the PYs for which the APA applies in

respect of the international transaction to be undertaken

Meaning of Rollback year

Any previous year, falling within the period not exceeding four previous years, preceding the first of the

five consecutive previous years for which the APA applies.

Conditions for applying for rollback provisions Non-applicability of Rollback provision

International transaction is same as If the determination of ALP of the said

international transaction to which APA international transaction for the said year

(other than the rollback provision) applies; has been subject matter of an appeal before

ROI for the relevant rollback year has been or the Appellate Tribunal and the Appellate

is furnished before the due date u/s 139(1); Tribunal has passed an order disposing of

such appeal at any time before signing of

Report in respect of international transaction

the agreement

had been furnished u/s 92E;

OR

the applicability of rollback provision has

been requested by the applicant for all the the application of rollback provision has

rollback years and the effect of reducing the total income or

increasing the loss, as declared in the ROI.

the applicant has made an application seeking

rollback.

Time limit for filling application for rollback provision

The applicant may furnish along with the application for advance pricing agreement, the request for

rollback provision with proof of payment of an additional fee of ` 5 lakh.

© ICAI BOS(A) 184

SARANSH Transfer Pricing

Procedure for giving effect to rollback provision of an Agreement

(i) Furnish modified ROI in respect of a rollback year along with the proof of payment of any

additional tax arising as a consequence of rollback provision.

(ii) Furnish modified return in respect of rollback year along with the modified return to be furnished

in respect of first of the previous years for which APA has been requested in the application.

(iii) Withdraw the appeal filed by the applicant, if any, which is pending before the Commissioner

(Appeals), Appellate Tribunal or the High Court for a rollback year, on the issue which is the

subject matter of the rollback provision for that year, to the extent of the subject covered under

APA before furnishing the modified return.

(iv) Withdraw the appeal filed by the AO or the PCIT or CIT, if any, which is pending before the

Appellate Tribunal or the High Court for a rollback year, on the issue which is subject matter of the

rollback provision for that year, to the extent of the subject covered under the agreement within three

months of filing of modified return by the applicant.

(v) The applicant, the AO or the PCIT or the CIT, shall inform the Dispute Resolution Panel or the

Commissioner (Appeals) or the Appellate Tribunal or the High Court, as the case may be, the fact

of an agreement containing rollback provision having been entered into along with a copy of the

same.

PENALTY FOR FAILURE TO COMPLY WITH TP PROVISIONS

Section Nature of default Penalty

270A(9) Failure to report any international transaction or deemed 200% of the tax payable

international transaction to which the provision of Chapter X on under-reported

applies would constitute ‘misreporting of income’ income

271BA Failure to furnish a report from an accountant as required under ` 1 lakh

section 92E

271G Failure to furnish information or document as required by 2% of the value of the

Assessing Officer or CIT(A) u/s 92D(3) within 10 days from the international

date of receipt of notice or extended period not exceeding 30 days, transaction or specified

as the case may be. domestic transaction

for each failure

271AA (1) Failure to keep and maintain any such document and 2% of the value of each

information as required by section 92D(1)/(2); such international

(2) Failure to report such international transaction or specified transaction or specified

domestic transaction which is required to be reported; or domestic transaction

(3) Maintaining or furnishing any incorrect information or

document.

Notes:

The penalty u/s 271AA is in addition and not in substitution of penalty u/s 271BA.

If the assessee proves that there was reasonable cause for the failure, no penalty would be

leviable under section 271BA, 271G and 271AA.

© ICAI BOS(A) 185

SARANSH Transfer Pricing

SECONDARY ADJUSTMENT [SECTION 92CE]

•The determination of transfer price in accordance

Primary adjustment (PA) with the arm’s length principle resulting in an

to a transfer price increase in the TI or reduction in the loss, as the

case may be, of the assessee.

•An adjustment in the books of accounts of the

assessee and its AE to reflect that the actual

Secondary adjustment allocation of profits between the assessee and its

AE are consistent with the TP determined as a

(SA) result of PA, thereby removing the imbalance

between cash account and actual profit of the

assessee.

Where the primary adjustment to TP:

•has been made suo motu by the assessee in his ROI or

Cases where •made by the AO has been accepted by the assessee; or

secondary •is determined by an APA or

adjustment has to be

•is made as per the Safe harbour rules or

made by the assessee

•is arising as a result of resolution of an assessment by way

of the MAP under an agreement entered into u/s 90 or

90A for avoidance of double taxation.

No requirement of secondary adjustment in certain cases

If primary adjustment made in any P.Y. The primary adjustment is made in respect

OR

does not exceed ` 1 crore of A.Y.2016-17 or an earlier A.Y.

Actual value

Arms’ Length

of

Excess Money Price in primary

international

adjustment

transaction

If not repatriated within such time, it

The excess money or has to be repatriated to

would be deemed as advance to such AE

part thereof which is India within the prescribed

and interest on such advance would be

available with the AE limit

computed in prescribed manner.

© ICAI BOS(A) 186

SARANSH Transfer Pricing

Time limit for repatriation of excess money or part thereof [Rule 10CB(1)]

Case Time limit for Period from which

repatriation of excess interest is chargeable

money i.e., on or on excess money or part

before 90 days from thereof which is not

repatriated

(i) Where primary adjustment to transfer the due date of filing the due date of filing of

price has been made suo-motu by the of return u/s 139(1) return u/s 139(1)

assessee in his ROI

(ii) If primary adjustment to transfer price as the date of the said the date of the said order

determined in the order of the AO or the order

appellate authority has been accepted by

the assessee

(iii) Where primary adjustment to transfer

price is determined by an APA entered

into by the assessee u/s 92CC for a P.Y. -

• If the APA has been entered into on the date of filing of the due date of filing of

or before the due date of filing of return u/s 139(1) return u/s 139(1)

return for the relevant P.Y.

• If the APA has been entered into on The end of the month the end of the month in

or after the due date of filing of return in which the APA has which the APA has been

for the relevant P.Y. been entered into entered into

(iv) Where option has been exercised by the the due date of filing the due date of filing of

assessee as per safe harbor rules u/s 92CB of return u/s 139(1) return u/s 139(1)

(v) Where the primary adjustment to the the date of giving the date of giving effect

transfer price is determined by a resolution effect by the A.O. by the A.O. under Rule

arrived at under MAP under a DTAA has under Rule 44H to 44H to such resolution

been entered into u/s 90 or 90A such resolution

Rate of interest for the purpose of computation on interest on excess money [Rule 10CB(2)]

Rule 10CB(2) prescribes the rate at which the per annum interest income shall be computed in case

of failure to repatriate the excess money or part thereof within the above time limit.

Case Rate

Where international transaction is At the one year marginal cost of fund lending rate of SBI as on 1st

denominated in Indian rupee April of the relevant previous year + 3.25%

Where international transaction is At six month London Interbank Offered Rate (LIBOR) as on 30th

denominated in foreign currency September of the relevant previous year + 3.00%

Note – The rate of exchange for the calculation of the value of international transaction denominated in

foreign currency shall be the TTBR of such currency on the last day of the previous year in which such

international transaction was undertaken.

© ICAI BOS(A) 187

SARANSH Transfer Pricing

Option to pay additional income-tax, if the excess money not repatriated

Where the excess money or part Where additional income-tax is so

thereof has not been repatriated

within the prescribed time, the paid by the assessee, he will not be

assessee has the option to pay required to make secondary

additional income-tax @ 20.9664% adjustment and compute interest

(i.e., tax@18% plus surcharge@12%

plus cess@4%) on such excess money from the date of payment of such

or part thereof. tax.

Limitation of interest deduction [Section 94B]

Is the borrower an Indian company or a PE of a Foreign company?

Yes No

Is the borrower a bank or Insurance Yes Section 94B would not apply

company or notified NBFC?

No

Is the lender a PE in India of a non-

resident engaged in the business of Yes

banking?

No

Does the interest paid to NR AE exceed No

` 1 crore?

Yes Meaning of Excess interest

Excess Interest not allowable as

deduction

Interest paid or payable to non-resident associated

Disallowed interest can be carried enterprise* in excess of 30% of EBITDA or interest

forward for 8 AYs for deduction against paid or payable to AE for that previous year,

PGBP income to the extent of maximum whichever is lower

allowable interest expenses

*“Total interest paid or payable” may be interpreted as interest paid or payable to non-resident

associated enterprise as per the intent expressed in section 94B(1) and also the Explanatory

Memorandum to the Finance Bill, 2017.

© ICAI BOS(A) 188

You might also like

- IFRS US GAAP Difference CFA LEVEL 1 PDFDocument7 pagesIFRS US GAAP Difference CFA LEVEL 1 PDFRahul AgarwalNo ratings yet

- Using Digital Maturity Model & Metrics: 30 Strategic Kpis For Digital Transformation (Gb1013 V1.0.1)Document1 pageUsing Digital Maturity Model & Metrics: 30 Strategic Kpis For Digital Transformation (Gb1013 V1.0.1)Vijay Kumar100% (1)

- Tcs Bancs Global Securities Processing Platform: Custody BrokerageDocument4 pagesTcs Bancs Global Securities Processing Platform: Custody BrokerageShubham Pal100% (1)

- EY Data Analytics Global Trade FocusDocument37 pagesEY Data Analytics Global Trade FocusHannah LeNo ratings yet

- Annual Report of IOCL 157Document1 pageAnnual Report of IOCL 157Nikunj ParmarNo ratings yet

- The Strategic Choice To Optimise Your Daily OperationsDocument6 pagesThe Strategic Choice To Optimise Your Daily OperationsTueNo ratings yet

- TP Reading NotesDocument54 pagesTP Reading Notes20010126817No ratings yet

- Tudy Buddy: Ifrs 15 - Revenue From Contracts With CustomersDocument2 pagesTudy Buddy: Ifrs 15 - Revenue From Contracts With CustomersAbdullah Al Amin MubinNo ratings yet

- MEASUREMENT BASES and Other Important RemindersDocument2 pagesMEASUREMENT BASES and Other Important RemindersShaina Monique RangasanNo ratings yet

- Transfer PricingDocument39 pagesTransfer PricingAum Swastik PandaNo ratings yet

- PWC Tiag Perspectives On Ifrs 15Document4 pagesPWC Tiag Perspectives On Ifrs 15Firas AbsaNo ratings yet

- Transfer Pricing A Quick Run Through 1668336077 PDFDocument16 pagesTransfer Pricing A Quick Run Through 1668336077 PDFHafisMohammedSahibNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Wecreased.: Bubble Sheet or Your WersDocument9 pagesWecreased.: Bubble Sheet or Your Wersmaria ronoraNo ratings yet

- Transaction Code.153Document2 pagesTransaction Code.153Kamran MallickNo ratings yet

- Changes To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingDocument1 pageChanges To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingMuhammad KholiqNo ratings yet

- Solar Netmeter Flow ChartDocument1 pageSolar Netmeter Flow ChartSamanth KedamNo ratings yet

- Price Transparency emr4MD v9.10Document6 pagesPrice Transparency emr4MD v9.10kiranNo ratings yet

- Global Securities Platform 22Document4 pagesGlobal Securities Platform 22satya teja pithaniNo ratings yet

- Ifrs 15Document109 pagesIfrs 15gauravNo ratings yet

- MEASUREMENT BASES and Other Important RemindersDocument2 pagesMEASUREMENT BASES and Other Important RemindersShaina Monique RangasanNo ratings yet

- Ey Integration Costs Mergers and AcquisitionsDocument5 pagesEy Integration Costs Mergers and AcquisitionsSURYA KANT PRASADNo ratings yet

- Ac 506 - Pas 16Document1 pageAc 506 - Pas 16Rome SibuyasNo ratings yet

- TP 1Document2 pagesTP 1simm170226No ratings yet

- LCM OPM 2016 Thrivikram PDFDocument39 pagesLCM OPM 2016 Thrivikram PDFsanjayid1980No ratings yet

- GDPR DataDocument43 pagesGDPR DataaaNo ratings yet

- Annual Report of IOCL 158Document1 pageAnnual Report of IOCL 158Nikunj ParmarNo ratings yet

- Transfer PricingDocument98 pagesTransfer PricingMAHESH JAINNo ratings yet

- Audit of Insurance CompaniesDocument15 pagesAudit of Insurance CompaniesYoung MetroNo ratings yet

- Leveraging LDTI Regulatory IntersectionsDocument12 pagesLeveraging LDTI Regulatory IntersectionsmikfrancisNo ratings yet

- IND AS 108 OS Revision NotesDocument3 pagesIND AS 108 OS Revision NotesSatish VermaNo ratings yet

- Revision - Summary of IFRS - SBRDocument40 pagesRevision - Summary of IFRS - SBRPhạm Thu HuyềnNo ratings yet

- Federal Register / Vol. 87, No. 130 / Friday, July 8, 2022 / NoticesDocument2 pagesFederal Register / Vol. 87, No. 130 / Friday, July 8, 2022 / NoticesSunny SinghNo ratings yet

- Full Download PDF of Intermediate Accounting 9th Edition (Ebook PDF) All ChapterDocument43 pagesFull Download PDF of Intermediate Accounting 9th Edition (Ebook PDF) All Chapterundinewaad100% (12)

- Return On Net Assets Pait/Net Assets X 100Document18 pagesReturn On Net Assets Pait/Net Assets X 100neuroemg100% (1)

- Accounting & FinanceDocument57 pagesAccounting & Financemani_selvaNo ratings yet

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- Concept Map ECDocument2 pagesConcept Map ECkat kaleNo ratings yet

- Ey Mergers and Acquisitions Integration Costs ReportDocument5 pagesEy Mergers and Acquisitions Integration Costs ReportRahul PandeyNo ratings yet

- Losses Vis-A-Vis Transfer PricingDocument10 pagesLosses Vis-A-Vis Transfer PricingChirag ShahNo ratings yet

- IND As 16 Revision Notes HWDocument6 pagesIND As 16 Revision Notes HWSuman SharmaNo ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- FR Chapter 3Document137 pagesFR Chapter 3Dheeraj TurpunatiNo ratings yet

- TP Cheat SheetDocument1 pageTP Cheat SheetRobbie AkaChopa 'Season Ramadhan'No ratings yet

- Cost Accounting Nature of Costs/Cost Volume Profit Analysis IDocument25 pagesCost Accounting Nature of Costs/Cost Volume Profit Analysis IMackenzie Heart Obien0% (1)

- Standardized Approach For Counterparty Credit RiskDocument2 pagesStandardized Approach For Counterparty Credit RiskjalutukNo ratings yet

- ReviewDocument11 pagesReviewVARSHA SUKUMARNo ratings yet

- GBU TP Guideline Revised Final December 2022Document26 pagesGBU TP Guideline Revised Final December 2022Gabriela GuglielmettiNo ratings yet

- Field Report Via ImagesDocument13 pagesField Report Via ImagesAbera TeshomeNo ratings yet

- Software License and Maintenance Pricing Principles - Best Practices and Case StudiesDocument35 pagesSoftware License and Maintenance Pricing Principles - Best Practices and Case StudiesasthapriyamvadaNo ratings yet

- Img 0001Document1 pageImg 0001rista21031986No ratings yet

- Hedge Effectiveness Testing: Using Regression AnalysisDocument5 pagesHedge Effectiveness Testing: Using Regression AnalysisRakesh JainNo ratings yet

- GEHRIMED Costs and Limitations 2015 2 PDFDocument4 pagesGEHRIMED Costs and Limitations 2015 2 PDFSpit FireNo ratings yet

- Adobe Scan 02-Feb-2022Document4 pagesAdobe Scan 02-Feb-2022Khyati PatelNo ratings yet

- Fraud in TelecomsDocument8 pagesFraud in TelecomsMuhammad IslamNo ratings yet

- Cloud Computering System Acctg TreatmentDocument14 pagesCloud Computering System Acctg TreatmentYi CindyNo ratings yet

- The Insurer of The Future Workers CompensationDocument2 pagesThe Insurer of The Future Workers CompensationFilipe Tavares S. de OliveiraNo ratings yet

- DT RevDocument40 pagesDT RevHagere EthiopiaNo ratings yet

- Ind As - 2 Chapter 1 Ind As 115 Revenue From CustomerDocument7 pagesInd As - 2 Chapter 1 Ind As 115 Revenue From CustomerHdpNo ratings yet

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- V1 Exam 2 PMDocument31 pagesV1 Exam 2 PMNeerajNo ratings yet

- HYnv 7 JjyDocument2 pagesHYnv 7 JjyAdrian WardNo ratings yet

- ICARE-Preweek-AFAR-Part 1Document6 pagesICARE-Preweek-AFAR-Part 1john paul100% (1)

- Examination Paper: Do Not Open This Question Paper Until InstructedDocument10 pagesExamination Paper: Do Not Open This Question Paper Until InstructedNikesh MunankarmiNo ratings yet

- Manufacturing AkaunDocument36 pagesManufacturing AkaunEira JairaNo ratings yet

- Applying Location Factors For Conceptual Cost EstimationDocument3 pagesApplying Location Factors For Conceptual Cost EstimationBramJanssen76100% (1)

- Certification Training Program Syllabus 2023Document67 pagesCertification Training Program Syllabus 2023iadi putroNo ratings yet

- Short Call ButterflyDocument2 pagesShort Call ButterflypkkothariNo ratings yet

- Aliko Dangote FR (Anglais (Britannique) )Document1 pageAliko Dangote FR (Anglais (Britannique) )Oliver VADELEUXNo ratings yet

- EditDocument9 pagesEditSyed HassanNo ratings yet

- Decision Making Process, Look ConclusionDocument13 pagesDecision Making Process, Look ConclusionSheikh Nazmul HudaNo ratings yet

- E Commerce Project Naan MudhalvanDocument25 pagesE Commerce Project Naan Mudhalvanlakshmikandhan342No ratings yet

- India Supply Chain ChallengesDocument4 pagesIndia Supply Chain ChallengesGarima KumariNo ratings yet

- Ch10 Roth3eDocument83 pagesCh10 Roth3etaghavi1347No ratings yet

- Changing Role of GovernmentDocument4 pagesChanging Role of GovernmentishuNo ratings yet

- A Modified FMEA Approach ToDocument24 pagesA Modified FMEA Approach ToFuandika Fadhila RahmanNo ratings yet

- Affiliate Marketing: by Alekya TVL DM-05-060Document11 pagesAffiliate Marketing: by Alekya TVL DM-05-060alekyaiiiiNo ratings yet

- Brand Stewardship: by Karl D. SpeakDocument13 pagesBrand Stewardship: by Karl D. SpeakSandrine RolandNo ratings yet

- Agreement For The Renovation of Guiguinto Store: Know All Men by This PresentsDocument2 pagesAgreement For The Renovation of Guiguinto Store: Know All Men by This PresentsluckyNo ratings yet

- Oct 2022 QPDocument32 pagesOct 2022 QPYuvipro gidwaniNo ratings yet

- ROLE OF MNC's IN INDIADocument2 pagesROLE OF MNC's IN INDIADevesh ShuklaNo ratings yet

- TCWD Assignment Week 3Document3 pagesTCWD Assignment Week 3Gabriel MarianoNo ratings yet

- Defense Mechanism Against Hostile TakeoversDocument7 pagesDefense Mechanism Against Hostile Takeoversyoungarien100% (1)

- DocxDocument5 pagesDocxKaran TrivediNo ratings yet

- A Design of A DSS For SCRM (Thesis)Document98 pagesA Design of A DSS For SCRM (Thesis)ramiraliNo ratings yet

- Groups Analysis Case Submission: SAP Building A Leading Technology BrandDocument3 pagesGroups Analysis Case Submission: SAP Building A Leading Technology BrandAbhi MNo ratings yet

- Maf661 Tuto Chapter 6 July2022Document2 pagesMaf661 Tuto Chapter 6 July2022SITI NURHIDAYAH BINTI AZMEENo ratings yet

- CBA of Electric CarDocument15 pagesCBA of Electric CarNyingtob Pema NorbuNo ratings yet

- Referral Partner Agreement - EntomorvDocument15 pagesReferral Partner Agreement - EntomorvVenkatesh RamanNo ratings yet

- MGT314: PRODUCTION Management: Final Report On: British American Tobacco Section: 10 Group ProjectDocument31 pagesMGT314: PRODUCTION Management: Final Report On: British American Tobacco Section: 10 Group ProjectFahim HasnatNo ratings yet