Professional Documents

Culture Documents

FRM Certification Notes

FRM Certification Notes

Uploaded by

litee1983Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FRM Certification Notes

FRM Certification Notes

Uploaded by

litee1983Copyright:

Available Formats

Overview of FRM Certification

1. Purpose:

o The FRM certification is designed to equip professionals with the knowledge

and skills necessary to identify, assess, and manage risk in financial

institutions.

2. Target Audience:

o Risk managers

o Investment professionals

o Financial analysts

o Credit officers

o Regulatory risk analysts

3. Global Recognition:

o The FRM is internationally recognized and respected by banks, asset

management firms, consulting firms, and regulatory bodies.

Exam Structure

1. Two-Part Exam:

o FRM Part I:

Focuses on the tools used to assess financial risk.

Topics include Foundations of Risk Management, Quantitative

Analysis, Financial Markets and Products, and Valuation and Risk

Models.

o FRM Part II:

Emphasizes the application of risk management tools and techniques.

Topics include Market Risk Measurement and Management, Credit

Risk Measurement and Management, Operational Risk and Resiliency,

Liquidity and Treasury Risk Measurement and Management, Risk

Management and Investment Management, and Current Issues in

Financial Markets.

2. Exam Format:

o Multiple-choice questions.

o Both parts of the exam are typically administered twice a year, in May and

November.

Study Resources and Preparation

1. Official GARP Materials:

o GARP provides study guides, practice exams, and reading materials.

o Essential readings from textbooks and articles specified by GARP.

2. Third-Party Prep Providers:

o Numerous third-party providers offer study courses, practice exams, and

supplementary materials.

o Popular providers include Schweser, Bionic Turtle, and Wiley.

3. Study Time:

o GARP recommends 200–240 hours of preparation for each part of the exam.

o Actual study time may vary based on individual background and experience.

Certification Requirements

1. Passing Both Exams:

o Candidates must pass both Part I and Part II to earn the FRM certification.

o There is no requirement to pass both parts within a single year, but Part II can

only be taken after passing Part I.

2. Work Experience:

o Two years of relevant work experience in risk management or related fields.

o Experience can be obtained before or after passing the exams.

3. Maintaining Certification:

o Continuing Professional Development (CPD) is encouraged but not

mandatory.

o GARP provides resources and opportunities for CPD.

GARP: The Global Association of Risk Professionals

1. Role and Mission:

o GARP is a leading organization for risk professionals, providing education,

training, and a globally recognized certification.

o Their mission is to advance the risk profession through education, training,

and the promotion of best practices globally.

2. Membership Benefits:

o Access to a global network of risk professionals.

o Discounts on educational resources and events.

o Industry insights and updates through publications like the "Risk Intelligence"

journal and newsletters.

3. Events and Networking:

o GARP hosts events, webinars, and conferences to facilitate networking and

knowledge sharing among risk professionals.

o Regional chapters provide opportunities for local engagement.

Career Impact

1. Enhanced Credibility:

o Holding an FRM certification signals a high level of expertise and

commitment to professional development in the field of risk management.

2. Career Advancement:

o FRM certification can lead to career advancement opportunities in risk

management, including higher positions and increased responsibilities.

3. Global Opportunities:

o The FRM is recognized worldwide, opening up opportunities for international

careers in risk management.

In summary, the FRM certification from GARP is a comprehensive and globally respected

credential that validates expertise in financial risk management. It requires rigorous

preparation and provides significant career benefits for professionals in the financial sector.

4o

You might also like

- Edexcel ASA Level Business Student BookDocument545 pagesEdexcel ASA Level Business Student Booknarjis kassam50% (2)

- Managing The Global Supply Chain PDFDocument422 pagesManaging The Global Supply Chain PDFIsmael Guamani Mena100% (1)

- RSK2601 Complete Questions AnswersDocument84 pagesRSK2601 Complete Questions Answerswycliff branc100% (1)

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- HE Assignment Module 5 Market Size - Poland For Canvas-1Document3 pagesHE Assignment Module 5 Market Size - Poland For Canvas-1Kai ChengNo ratings yet

- Sap MM Training Manual Step by StepDocument252 pagesSap MM Training Manual Step by Stepyogi75% (4)

- Compliance Management PDFDocument4 pagesCompliance Management PDFtamanimoNo ratings yet

- Uber Competing As Market Leader in The U PDFDocument7 pagesUber Competing As Market Leader in The U PDFdedyNo ratings yet

- Northwell Inc SWOTDocument2 pagesNorthwell Inc SWOTPaul ACrackerNo ratings yet

- Report On Rafhan MaizeDocument14 pagesReport On Rafhan MaizeMalik Arslan Ahmad0% (1)

- IRM - International Certificate in Enterprise Risk ManagementDocument16 pagesIRM - International Certificate in Enterprise Risk ManagementAhmad Ezwan Mat DerisNo ratings yet

- FRM报考指南CG 092820Document24 pagesFRM报考指南CG 092820Kam Tai WongNo ratings yet

- Exam GuideDocument27 pagesExam GuidegohchuansinNo ratings yet

- Global Enterprise Risk Management Foundation ExamDocument12 pagesGlobal Enterprise Risk Management Foundation ExamIRM India100% (1)

- Preparing To The Financial Risk Manager FRM Certification Part Ii of GarpDocument4 pagesPreparing To The Financial Risk Manager FRM Certification Part Ii of GarpDALHI2014No ratings yet

- FRM Candidate Guide 2021Document24 pagesFRM Candidate Guide 2021GugaNo ratings yet

- FRM Program Manual 2015Document80 pagesFRM Program Manual 2015k_ij9658No ratings yet

- Financial Risk Manager - FRMDocument13 pagesFinancial Risk Manager - FRMDhaval JobanputraNo ratings yet

- International Certificate in Risk Management (Cirm)Document3 pagesInternational Certificate in Risk Management (Cirm)hafis82No ratings yet

- Fundamentals of Enterprise Risk Management Level 1Document12 pagesFundamentals of Enterprise Risk Management Level 1IRM IndiaNo ratings yet

- Garp FRM Candidate Guide 2015 11515Document20 pagesGarp FRM Candidate Guide 2015 11515Roy Malpica RojasNo ratings yet

- 012 Vie DPG 06Document104 pages012 Vie DPG 06MaryJoy Dela CruzNo ratings yet

- PRM Candidate GuideDocument20 pagesPRM Candidate GuideHasan SaeedNo ratings yet

- Rimap Body of KnowledgeDocument54 pagesRimap Body of KnowledgeAntónio Negreiros FernandesNo ratings yet

- FRM Exam Preparation Handbook 2012 PDFDocument15 pagesFRM Exam Preparation Handbook 2012 PDFDennis LoNo ratings yet

- FRM2023 Candidate Guide EnglishDocument20 pagesFRM2023 Candidate Guide EnglishShhshshshNo ratings yet

- Candidate Guide English FRM24Document20 pagesCandidate Guide English FRM24AashishNo ratings yet

- PRM Exam GuideDocument20 pagesPRM Exam Guidegkhare20% (1)

- Candidate Guide: Financial Risk ManagerDocument24 pagesCandidate Guide: Financial Risk ManagerVijay MadhaniNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part III - Financial MarketsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part III - Financial MarketsNo ratings yet

- FRM 2022 Candidate GuideDocument19 pagesFRM 2022 Candidate GuideYueng Mun SohNo ratings yet

- Structure of Audit DepartmentDocument5 pagesStructure of Audit Departmentikradine89No ratings yet

- FRMCG 033120 Web PDFDocument24 pagesFRMCG 033120 Web PDFRonit Singh KotwalNo ratings yet

- FRMCG 033120 Web PDFDocument24 pagesFRMCG 033120 Web PDFsanty86No ratings yet

- RT Risk Management StandardDocument10 pagesRT Risk Management StandardJohn KalvinNo ratings yet

- FRM 2012 May BrochureDocument15 pagesFRM 2012 May BrochureSachin SharmaNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part I - Finance TheoryFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part I - Finance TheoryNo ratings yet

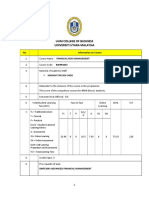

- Uum College of Business Universiti Utara MalaysiaDocument7 pagesUum College of Business Universiti Utara MalaysiaSyai GenjNo ratings yet

- Enterprise Risk ManagementDocument2 pagesEnterprise Risk Managementamirq4No ratings yet

- Advertisement 07-08-2018Document3 pagesAdvertisement 07-08-2018Sourabh EkboteNo ratings yet

- 2017 Foundations of Financial Risk Study GuideDocument8 pages2017 Foundations of Financial Risk Study Guidesujaysarkar85100% (1)

- "Gollis University Empowers Its Students As Professional Leaders Committed To Make ADocument10 pages"Gollis University Empowers Its Students As Professional Leaders Committed To Make AMuhumed Baari FaculNo ratings yet

- Professional Risk ManagementDocument14 pagesProfessional Risk ManagementIsmailNo ratings yet

- CHP Study GuideDocument12 pagesCHP Study GuideBudiman WibowoNo ratings yet

- JD - FS Risk Management (SR - Con-AM) PDFDocument3 pagesJD - FS Risk Management (SR - Con-AM) PDFAASIM AlamNo ratings yet

- Welcome To The CourseDocument5 pagesWelcome To The Coursetiaramaulinazhi1700No ratings yet

- Financial Risk Management - The Way ForwardDocument31 pagesFinancial Risk Management - The Way Forwardankit_85No ratings yet

- Candidate Guide: Financial Risk ManagerDocument24 pagesCandidate Guide: Financial Risk ManagerAvishek SaraogiNo ratings yet

- Candidate Guide: Financial Risk ManagerDocument24 pagesCandidate Guide: Financial Risk ManagerKamaNo ratings yet

- RSK2601 Complete Questions AnswersDocument84 pagesRSK2601 Complete Questions AnswersNonhlanhla PreciousNo ratings yet

- Financial Risk Manager - FRM in Egypt by Developers For Training and ConsultancyDocument3 pagesFinancial Risk Manager - FRM in Egypt by Developers For Training and ConsultancydevelopersegyptNo ratings yet

- PMI RMP UnichroneDocument12 pagesPMI RMP Unichronearsalannasir2013_119No ratings yet

- AFM S24-J25 Syllabus and Study Guide - FinalDocument20 pagesAFM S24-J25 Syllabus and Study Guide - Finalsachisachi3638No ratings yet

- M o R Foundation + Practitioner OutlineDocument2 pagesM o R Foundation + Practitioner Outlinespm90620% (1)

- Distance Learning - Regulatory Risk Reporting 2020Document9 pagesDistance Learning - Regulatory Risk Reporting 2020Ashish MathurNo ratings yet

- Risk Management Specialization OutlineDocument4 pagesRisk Management Specialization OutlineNadine ShaheenNo ratings yet

- Professional Certificate in Risk Management Eng. Outline-7Document4 pagesProfessional Certificate in Risk Management Eng. Outline-7mosoliman86No ratings yet

- Project Risk Management: Best Practice and Boundaries: Risk Doctor Training CourseDocument2 pagesProject Risk Management: Best Practice and Boundaries: Risk Doctor Training CourseDavid Alejandro Barreto KleyserNo ratings yet

- PRMIA: A Primer for Professional Operational Risk Managers in Financial ServicesFrom EverandPRMIA: A Primer for Professional Operational Risk Managers in Financial ServicesJonathan HowittNo ratings yet

- Financial Risk Management Course OutlineDocument3 pagesFinancial Risk Management Course OutlineFarooqChaudharyNo ratings yet

- FRMDocument6 pagesFRMAhmad Tawfiq DarabsehNo ratings yet

- 2020 FRM® Study GuideDocument31 pages2020 FRM® Study GuideJoshua AitkenNo ratings yet

- 6 Figure Jobs in Risk and Compliance Management and What It Takes To Get HiredDocument102 pages6 Figure Jobs in Risk and Compliance Management and What It Takes To Get HiredWubneh AlemuNo ratings yet

- FRM Study Guide 2020Document31 pagesFRM Study Guide 2020Yiu Wai YuenNo ratings yet

- Vdocuments - MX - VN Chief Credit Risk Officer Eng African Development Bank Chiefonly ApplicantsDocument2 pagesVdocuments - MX - VN Chief Credit Risk Officer Eng African Development Bank Chiefonly ApplicantsSakti AnupindiNo ratings yet

- PMD Pro (Project Management For Development Professionals) Guidance, Training and CertificationDocument25 pagesPMD Pro (Project Management For Development Professionals) Guidance, Training and CertificationSaad Javeed AuliaNo ratings yet

- PRMIA: Practices for Credit and Counterparty Credit Risk Management: A Primer for Professional Risk Managers in Financial ServicesFrom EverandPRMIA: Practices for Credit and Counterparty Credit Risk Management: A Primer for Professional Risk Managers in Financial ServicesNo ratings yet

- What Is Loan Syndication?Document2 pagesWhat Is Loan Syndication?mridul agarwalNo ratings yet

- Chapter 5 - Adding CapacityDocument4 pagesChapter 5 - Adding CapacityChinh Dao QuangNo ratings yet

- Indian Institute of Management, Indore Before You Startup: Sachidananda BenegalDocument11 pagesIndian Institute of Management, Indore Before You Startup: Sachidananda BenegalTANVI CHOUDHARY PGP 2021-23 BatchNo ratings yet

- Cox and Kings ReportDocument116 pagesCox and Kings ReportRitesh pandey100% (1)

- 2 - Accounting For Note ReceivableDocument10 pages2 - Accounting For Note ReceivableReese AyessaNo ratings yet

- Obongsan Cultural Village InsightsDocument11 pagesObongsan Cultural Village Insightshey peachNo ratings yet

- Final Annual Report 2021 31 May 2022Document336 pagesFinal Annual Report 2021 31 May 2022r dNo ratings yet

- Unorganised Workers' Social Security Act, 2008: Labour and Industrial LawDocument2 pagesUnorganised Workers' Social Security Act, 2008: Labour and Industrial LawaggarwalbhaveshNo ratings yet

- ToyotaDocument53 pagesToyotaFĂrhẳn ŞĂrwẳr100% (1)

- Capital Vedaa: Trading Manual Is A Ready Reckoner Guide Curated by The CapitalDocument10 pagesCapital Vedaa: Trading Manual Is A Ready Reckoner Guide Curated by The CapitalKanhaiyalal YogiNo ratings yet

- Recognize and Understand The Market - PPTDocument56 pagesRecognize and Understand The Market - PPTRodel laman100% (3)

- Process Flow - RKL - Procurement To PayDocument8 pagesProcess Flow - RKL - Procurement To PayRaul KarkyNo ratings yet

- FA II - Chapter 2 & 3 Part IDocument32 pagesFA II - Chapter 2 & 3 Part ISitra AbduNo ratings yet

- Bpi V Sarabia Manor Hotel 2013Document2 pagesBpi V Sarabia Manor Hotel 2013nathNo ratings yet

- Hris BenefitDocument11 pagesHris BenefitSabbir Matin ArnobNo ratings yet

- Solved Home S Currency Is The Peso and Trades at 1 PesoDocument1 pageSolved Home S Currency Is The Peso and Trades at 1 PesoM Bilal SaleemNo ratings yet

- Green Accounting Final PDFDocument51 pagesGreen Accounting Final PDFKlomoNo ratings yet

- 4-Stages of The Project Life CycleDocument36 pages4-Stages of The Project Life CycleHabo TareNo ratings yet

- Internship Report AICDocument4 pagesInternship Report AICgod of thunder ThorNo ratings yet

- Examiners' Report June 2014 IAL Accounting WAC02 01Document20 pagesExaminers' Report June 2014 IAL Accounting WAC02 01RafaNo ratings yet

- Anthony ViscidoDocument3 pagesAnthony Viscidoanthony_viscidoNo ratings yet

- Project Report: Honours of SEMESTER VI, 2021 in Accounting & Finance Under The University of Calcutta ONDocument20 pagesProject Report: Honours of SEMESTER VI, 2021 in Accounting & Finance Under The University of Calcutta ONBishal AdakNo ratings yet