Professional Documents

Culture Documents

Public Economics, MSC, Afltd 2024

Public Economics, MSC, Afltd 2024

Uploaded by

Ehtsham Ul HaqCopyright:

Available Formats

You might also like

- CB2 Booklet 1Document114 pagesCB2 Booklet 1Somya AgrawalNo ratings yet

- End-Semester PoeDocument6 pagesEnd-Semester PoePriyanshu KumarNo ratings yet

- ISD ECO101 (Approved)Document25 pagesISD ECO101 (Approved)danesh babaNo ratings yet

- 3576 - Download - S.Y.B.com. Business Economics III-IV AutoDocument9 pages3576 - Download - S.Y.B.com. Business Economics III-IV AutoMit AdhvaryuNo ratings yet

- PhotoDocument1 pagePhotoAnkur GuptaNo ratings yet

- 2015-2022 GDDocument6 pages2015-2022 GDSailesh WaranNo ratings yet

- Public Sector Economics, MSC, Afltd 2023Document1 pagePublic Sector Economics, MSC, Afltd 2023Ehtsham Ul HaqNo ratings yet

- Study Material XII EconomicsDocument52 pagesStudy Material XII EconomicsuniquekoshishNo ratings yet

- Azərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiDocument5 pagesAzərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiNihad PashazadeNo ratings yet

- 3 2 English BDocument222 pages3 2 English BDeepak SinghNo ratings yet

- (Old Paper) Public Sector EconomicsDocument1 page(Old Paper) Public Sector EconomicsEhtsham Ul HaqNo ratings yet

- MBA (Spring 13)Document39 pagesMBA (Spring 13)Affan WassafNo ratings yet

- ECON F211 - POE HandoutDocument4 pagesECON F211 - POE HandoutzelylvudbnspqyocdyNo ratings yet

- Question BankDocument2 pagesQuestion BankRishbah TyagiNo ratings yet

- 2022 20231015BP3899Document8 pages2022 20231015BP3899Lets Crack UPSCNo ratings yet

- UPDATED - SYLLABUS-ECONTAX (2) .OdtDocument5 pagesUPDATED - SYLLABUS-ECONTAX (2) .OdtPrecilla ZoletaNo ratings yet

- Assignment GE (2023)Document2 pagesAssignment GE (2023)Lakshay PantNo ratings yet

- Outline For Basic EconomicsDocument4 pagesOutline For Basic EconomicsJayne Aruna-NoahNo ratings yet

- Economics Syllabus PDFDocument10 pagesEconomics Syllabus PDFNolram LeuqarNo ratings yet

- Hyman 10e IM TB Ch02Document9 pagesHyman 10e IM TB Ch02john brownNo ratings yet

- Chap 02Document8 pagesChap 02Thuỳ DươngNo ratings yet

- HSS 101 - Economics HandbookDocument4 pagesHSS 101 - Economics HandbookAditya PriyadarshiNo ratings yet

- BSC Economics - UOMDocument7 pagesBSC Economics - UOMCatherine MichukiNo ratings yet

- Mec-006 EngDocument33 pagesMec-006 EngnitikanehiNo ratings yet

- CBSE Supporting Material Economics Class 12 2013Document152 pagesCBSE Supporting Material Economics Class 12 2013ChandraMENo ratings yet

- Economics Course Outline LAW ECON 1101Document3 pagesEconomics Course Outline LAW ECON 1101Farooq e AzamNo ratings yet

- ECOP101B Student PacerDocument10 pagesECOP101B Student PacerGift SimauNo ratings yet

- Test Bank For Public Finance A Contemporary Application of Theory To Policy 10 Edition David N HymanDocument38 pagesTest Bank For Public Finance A Contemporary Application of Theory To Policy 10 Edition David N Hymanpernelturnus6ipv3t100% (17)

- Solutions Baumol Chs 1 13 PDFDocument59 pagesSolutions Baumol Chs 1 13 PDFTy-Shana MaximeaNo ratings yet

- Course Outline MicroeconomicsDocument4 pagesCourse Outline MicroeconomicsArish KhanNo ratings yet

- Economics Module Book Edition Version 2013Document159 pagesEconomics Module Book Edition Version 2013Terence Lo100% (2)

- Eco-Q. BankDocument108 pagesEco-Q. BankdhirendrasisodiaNo ratings yet

- Econ 3070, Intermediate Microeconomics, Is A Pre-Requisite For The Course and Is Rigorous EnforcedDocument12 pagesEcon 3070, Intermediate Microeconomics, Is A Pre-Requisite For The Course and Is Rigorous Enforcednguyen thieu quangNo ratings yet

- 2024-ECON101 Part 1 Outline 2024Document7 pages2024-ECON101 Part 1 Outline 2024fanelemkhwanazi2No ratings yet

- Syllabus-Public Economics ECO 3729Document3 pagesSyllabus-Public Economics ECO 3729Suditi TandonNo ratings yet

- 2018 22Document4 pages2018 22Sailesh WaranNo ratings yet

- Eco101 Iso (L)Document31 pagesEco101 Iso (L)jingen0203No ratings yet

- Economics OLEVELSDocument5 pagesEconomics OLEVELSYu Yu Maw100% (1)

- CBSE Class 12 Economics Sample Paper (For 2014)Document19 pagesCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperNo ratings yet

- Mba 103Document1 pageMba 103Deepak TamboliNo ratings yet

- Jai Hind College Basantsing Institute of Science & J.T.Lalvani College of Commerce (Autonomous)Document7 pagesJai Hind College Basantsing Institute of Science & J.T.Lalvani College of Commerce (Autonomous)Mahek JainNo ratings yet

- 5.principles of Micro EconomicsDocument4 pages5.principles of Micro Economicschhassan3133No ratings yet

- RI Mikroekonomi BIDocument9 pagesRI Mikroekonomi BImeenarojaNo ratings yet

- BBA BIM BBM 2nd Semester Model Question AllDocument22 pagesBBA BIM BBM 2nd Semester Model Question AllGLOBAL I.Q.No ratings yet

- M01 Raga3989 17 Ism C01Document13 pagesM01 Raga3989 17 Ism C01Steven HurstNo ratings yet

- Annexure-172. B.COM. PROGRAMME GE COURSESDocument5 pagesAnnexure-172. B.COM. PROGRAMME GE COURSES8717878740No ratings yet

- Economics of Social ProblemsDocument3 pagesEconomics of Social ProblemsRob OxobyNo ratings yet

- Tugas 02 - MakroDocument1 pageTugas 02 - MakroMantraDebosaNo ratings yet

- Course Syllabus Summer 2023 Eco1010 ADocument7 pagesCourse Syllabus Summer 2023 Eco1010 ALizy BeeNo ratings yet

- Session Topic Subject Coverage/ Case Expected To / Will Learn ToDocument2 pagesSession Topic Subject Coverage/ Case Expected To / Will Learn ToKaran VijayvargiyaNo ratings yet

- Question Bank Economics - Micro and StatisticsDocument21 pagesQuestion Bank Economics - Micro and StatisticsAvijit RoyNo ratings yet

- MEC-002 ENG-D16 CompressedDocument2 pagesMEC-002 ENG-D16 Compressedaaastha85No ratings yet

- This Paper Consists of 3 Pages. 2. Answer ANY FOUR (4) Questions. 3. All Questions Carry Equal MarksDocument3 pagesThis Paper Consists of 3 Pages. 2. Answer ANY FOUR (4) Questions. 3. All Questions Carry Equal MarksMichelNo ratings yet

- AP Microeconomics SDG 2020 DCDocument13 pagesAP Microeconomics SDG 2020 DClinhNo ratings yet

- Eco FinalDocument56 pagesEco Finalmhtmahi222No ratings yet

- Lecture 1 and 2 - MacroeconomicsDocument35 pagesLecture 1 and 2 - Macroeconomicsshubham solankiNo ratings yet

- CMAP Public Sector Economics Course Outline (Revised July 2020)Document23 pagesCMAP Public Sector Economics Course Outline (Revised July 2020)bngimor_158047917No ratings yet

- HL English Paper 1 2015 Nov - MSDocument17 pagesHL English Paper 1 2015 Nov - MSPRINCE JHALANINo ratings yet

- Question Paper 3.4 Eco-I Second Assesment TestDocument2 pagesQuestion Paper 3.4 Eco-I Second Assesment TestAkanksha BohraNo ratings yet

- Quiz 2 Micro Economics Summer 2022Document1 pageQuiz 2 Micro Economics Summer 2022Ehtsham Ul HaqNo ratings yet

- Paper Formate Part-IIDocument1 pagePaper Formate Part-IIEhtsham Ul HaqNo ratings yet

- Ehtsham Ul Haq, (PUblic Sector Economics)Document1 pageEhtsham Ul Haq, (PUblic Sector Economics)Ehtsham Ul HaqNo ratings yet

- ECN316 Lec1 - Introduction - HODocument19 pagesECN316 Lec1 - Introduction - HOEhtsham Ul HaqNo ratings yet

- (Old Paper) Islamic EconomicsDocument1 page(Old Paper) Islamic EconomicsEhtsham Ul HaqNo ratings yet

- Paper Setting Rules: Course/ContentsDocument1 pagePaper Setting Rules: Course/ContentsEhtsham Ul HaqNo ratings yet

- Human Brain Drain and Its Impact On EducDocument22 pagesHuman Brain Drain and Its Impact On EducEhtsham Ul HaqNo ratings yet

- MSC 2 PresenatationDocument2 pagesMSC 2 PresenatationEhtsham Ul HaqNo ratings yet

- The Greek Brain DrainDocument23 pagesThe Greek Brain DrainEhtsham Ul HaqNo ratings yet

- Chapter 4 Brain Drain Global Lives BookDocument322 pagesChapter 4 Brain Drain Global Lives BookEhtsham Ul HaqNo ratings yet

- Mirpur University of Science and TechnologyDocument11 pagesMirpur University of Science and TechnologyEhtsham Ul HaqNo ratings yet

- Medical Brain Drain How Why WhereDocument16 pagesMedical Brain Drain How Why WhereEhtsham Ul HaqNo ratings yet

- EconomicsDocument1 pageEconomicsEhtsham Ul HaqNo ratings yet

- PresentationDocument9 pagesPresentationEhtsham Ul HaqNo ratings yet

Public Economics, MSC, Afltd 2024

Public Economics, MSC, Afltd 2024

Uploaded by

Ehtsham Ul HaqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Public Economics, MSC, Afltd 2024

Public Economics, MSC, Afltd 2024

Uploaded by

Ehtsham Ul HaqCopyright:

Available Formats

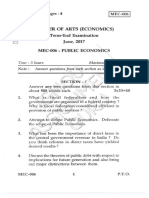

MIRPUR UNIVERSITY OF SCIENCE AND TECHNOLOGY (MUST), MIRPUR

Subject: Public Sector Economics M.Sc. Economics Time: 03 Hours.

Part-II

Paper: Supply 2023/Annual24 Max. Marks:100

NOTE: Attempt any five (05) questions. All questions carry equal marks. (20×5=100)

Q.1. Differentiate between public goods and private goods. Provide examples of pure public goods and semi-

public goods.

Q.2. Write a detailed note on the different types of taxes in Pakistan. What are the challenges of low tax

revenue in Pakistan and suggest measures to enhance the tax-to-GDP ratio?

Q.3. What is Pareto Efficiency? Explain with an example how Pareto Improvement can be achieved in a public

policy context.

Q.4. What are the Externalities? What are possible solutions of the problem of Externalities?

Q.5. Discuss the principles of tax shifting and incidence. How do elasticity of demand and supply affect who

bears the burden of a tax??

Q.6. Define fiscal deficit. Why has reducing the fiscal deficit been challenging in Pakistan? Discuss the

economic issues involved in deficit financing.

Q.7. Explain the Ricardian view of public debt. Compare it with the traditional view and discuss the internal

and external debt problems faced by Pakistan.

Q.8. Analyze the determinants of tax shifting under partial equilibrium conditions. How does tax incidence

analysis help in understanding the impacts of tax shifting on prices?

MUST/M.A./P-II/A24/C

You might also like

- CB2 Booklet 1Document114 pagesCB2 Booklet 1Somya AgrawalNo ratings yet

- End-Semester PoeDocument6 pagesEnd-Semester PoePriyanshu KumarNo ratings yet

- ISD ECO101 (Approved)Document25 pagesISD ECO101 (Approved)danesh babaNo ratings yet

- 3576 - Download - S.Y.B.com. Business Economics III-IV AutoDocument9 pages3576 - Download - S.Y.B.com. Business Economics III-IV AutoMit AdhvaryuNo ratings yet

- PhotoDocument1 pagePhotoAnkur GuptaNo ratings yet

- 2015-2022 GDDocument6 pages2015-2022 GDSailesh WaranNo ratings yet

- Public Sector Economics, MSC, Afltd 2023Document1 pagePublic Sector Economics, MSC, Afltd 2023Ehtsham Ul HaqNo ratings yet

- Study Material XII EconomicsDocument52 pagesStudy Material XII EconomicsuniquekoshishNo ratings yet

- Azərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiDocument5 pagesAzərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiNihad PashazadeNo ratings yet

- 3 2 English BDocument222 pages3 2 English BDeepak SinghNo ratings yet

- (Old Paper) Public Sector EconomicsDocument1 page(Old Paper) Public Sector EconomicsEhtsham Ul HaqNo ratings yet

- MBA (Spring 13)Document39 pagesMBA (Spring 13)Affan WassafNo ratings yet

- ECON F211 - POE HandoutDocument4 pagesECON F211 - POE HandoutzelylvudbnspqyocdyNo ratings yet

- Question BankDocument2 pagesQuestion BankRishbah TyagiNo ratings yet

- 2022 20231015BP3899Document8 pages2022 20231015BP3899Lets Crack UPSCNo ratings yet

- UPDATED - SYLLABUS-ECONTAX (2) .OdtDocument5 pagesUPDATED - SYLLABUS-ECONTAX (2) .OdtPrecilla ZoletaNo ratings yet

- Assignment GE (2023)Document2 pagesAssignment GE (2023)Lakshay PantNo ratings yet

- Outline For Basic EconomicsDocument4 pagesOutline For Basic EconomicsJayne Aruna-NoahNo ratings yet

- Economics Syllabus PDFDocument10 pagesEconomics Syllabus PDFNolram LeuqarNo ratings yet

- Hyman 10e IM TB Ch02Document9 pagesHyman 10e IM TB Ch02john brownNo ratings yet

- Chap 02Document8 pagesChap 02Thuỳ DươngNo ratings yet

- HSS 101 - Economics HandbookDocument4 pagesHSS 101 - Economics HandbookAditya PriyadarshiNo ratings yet

- BSC Economics - UOMDocument7 pagesBSC Economics - UOMCatherine MichukiNo ratings yet

- Mec-006 EngDocument33 pagesMec-006 EngnitikanehiNo ratings yet

- CBSE Supporting Material Economics Class 12 2013Document152 pagesCBSE Supporting Material Economics Class 12 2013ChandraMENo ratings yet

- Economics Course Outline LAW ECON 1101Document3 pagesEconomics Course Outline LAW ECON 1101Farooq e AzamNo ratings yet

- ECOP101B Student PacerDocument10 pagesECOP101B Student PacerGift SimauNo ratings yet

- Test Bank For Public Finance A Contemporary Application of Theory To Policy 10 Edition David N HymanDocument38 pagesTest Bank For Public Finance A Contemporary Application of Theory To Policy 10 Edition David N Hymanpernelturnus6ipv3t100% (17)

- Solutions Baumol Chs 1 13 PDFDocument59 pagesSolutions Baumol Chs 1 13 PDFTy-Shana MaximeaNo ratings yet

- Course Outline MicroeconomicsDocument4 pagesCourse Outline MicroeconomicsArish KhanNo ratings yet

- Economics Module Book Edition Version 2013Document159 pagesEconomics Module Book Edition Version 2013Terence Lo100% (2)

- Eco-Q. BankDocument108 pagesEco-Q. BankdhirendrasisodiaNo ratings yet

- Econ 3070, Intermediate Microeconomics, Is A Pre-Requisite For The Course and Is Rigorous EnforcedDocument12 pagesEcon 3070, Intermediate Microeconomics, Is A Pre-Requisite For The Course and Is Rigorous Enforcednguyen thieu quangNo ratings yet

- 2024-ECON101 Part 1 Outline 2024Document7 pages2024-ECON101 Part 1 Outline 2024fanelemkhwanazi2No ratings yet

- Syllabus-Public Economics ECO 3729Document3 pagesSyllabus-Public Economics ECO 3729Suditi TandonNo ratings yet

- 2018 22Document4 pages2018 22Sailesh WaranNo ratings yet

- Eco101 Iso (L)Document31 pagesEco101 Iso (L)jingen0203No ratings yet

- Economics OLEVELSDocument5 pagesEconomics OLEVELSYu Yu Maw100% (1)

- CBSE Class 12 Economics Sample Paper (For 2014)Document19 pagesCBSE Class 12 Economics Sample Paper (For 2014)cbsesamplepaperNo ratings yet

- Mba 103Document1 pageMba 103Deepak TamboliNo ratings yet

- Jai Hind College Basantsing Institute of Science & J.T.Lalvani College of Commerce (Autonomous)Document7 pagesJai Hind College Basantsing Institute of Science & J.T.Lalvani College of Commerce (Autonomous)Mahek JainNo ratings yet

- 5.principles of Micro EconomicsDocument4 pages5.principles of Micro Economicschhassan3133No ratings yet

- RI Mikroekonomi BIDocument9 pagesRI Mikroekonomi BImeenarojaNo ratings yet

- BBA BIM BBM 2nd Semester Model Question AllDocument22 pagesBBA BIM BBM 2nd Semester Model Question AllGLOBAL I.Q.No ratings yet

- M01 Raga3989 17 Ism C01Document13 pagesM01 Raga3989 17 Ism C01Steven HurstNo ratings yet

- Annexure-172. B.COM. PROGRAMME GE COURSESDocument5 pagesAnnexure-172. B.COM. PROGRAMME GE COURSES8717878740No ratings yet

- Economics of Social ProblemsDocument3 pagesEconomics of Social ProblemsRob OxobyNo ratings yet

- Tugas 02 - MakroDocument1 pageTugas 02 - MakroMantraDebosaNo ratings yet

- Course Syllabus Summer 2023 Eco1010 ADocument7 pagesCourse Syllabus Summer 2023 Eco1010 ALizy BeeNo ratings yet

- Session Topic Subject Coverage/ Case Expected To / Will Learn ToDocument2 pagesSession Topic Subject Coverage/ Case Expected To / Will Learn ToKaran VijayvargiyaNo ratings yet

- Question Bank Economics - Micro and StatisticsDocument21 pagesQuestion Bank Economics - Micro and StatisticsAvijit RoyNo ratings yet

- MEC-002 ENG-D16 CompressedDocument2 pagesMEC-002 ENG-D16 Compressedaaastha85No ratings yet

- This Paper Consists of 3 Pages. 2. Answer ANY FOUR (4) Questions. 3. All Questions Carry Equal MarksDocument3 pagesThis Paper Consists of 3 Pages. 2. Answer ANY FOUR (4) Questions. 3. All Questions Carry Equal MarksMichelNo ratings yet

- AP Microeconomics SDG 2020 DCDocument13 pagesAP Microeconomics SDG 2020 DClinhNo ratings yet

- Eco FinalDocument56 pagesEco Finalmhtmahi222No ratings yet

- Lecture 1 and 2 - MacroeconomicsDocument35 pagesLecture 1 and 2 - Macroeconomicsshubham solankiNo ratings yet

- CMAP Public Sector Economics Course Outline (Revised July 2020)Document23 pagesCMAP Public Sector Economics Course Outline (Revised July 2020)bngimor_158047917No ratings yet

- HL English Paper 1 2015 Nov - MSDocument17 pagesHL English Paper 1 2015 Nov - MSPRINCE JHALANINo ratings yet

- Question Paper 3.4 Eco-I Second Assesment TestDocument2 pagesQuestion Paper 3.4 Eco-I Second Assesment TestAkanksha BohraNo ratings yet

- Quiz 2 Micro Economics Summer 2022Document1 pageQuiz 2 Micro Economics Summer 2022Ehtsham Ul HaqNo ratings yet

- Paper Formate Part-IIDocument1 pagePaper Formate Part-IIEhtsham Ul HaqNo ratings yet

- Ehtsham Ul Haq, (PUblic Sector Economics)Document1 pageEhtsham Ul Haq, (PUblic Sector Economics)Ehtsham Ul HaqNo ratings yet

- ECN316 Lec1 - Introduction - HODocument19 pagesECN316 Lec1 - Introduction - HOEhtsham Ul HaqNo ratings yet

- (Old Paper) Islamic EconomicsDocument1 page(Old Paper) Islamic EconomicsEhtsham Ul HaqNo ratings yet

- Paper Setting Rules: Course/ContentsDocument1 pagePaper Setting Rules: Course/ContentsEhtsham Ul HaqNo ratings yet

- Human Brain Drain and Its Impact On EducDocument22 pagesHuman Brain Drain and Its Impact On EducEhtsham Ul HaqNo ratings yet

- MSC 2 PresenatationDocument2 pagesMSC 2 PresenatationEhtsham Ul HaqNo ratings yet

- The Greek Brain DrainDocument23 pagesThe Greek Brain DrainEhtsham Ul HaqNo ratings yet

- Chapter 4 Brain Drain Global Lives BookDocument322 pagesChapter 4 Brain Drain Global Lives BookEhtsham Ul HaqNo ratings yet

- Mirpur University of Science and TechnologyDocument11 pagesMirpur University of Science and TechnologyEhtsham Ul HaqNo ratings yet

- Medical Brain Drain How Why WhereDocument16 pagesMedical Brain Drain How Why WhereEhtsham Ul HaqNo ratings yet

- EconomicsDocument1 pageEconomicsEhtsham Ul HaqNo ratings yet

- PresentationDocument9 pagesPresentationEhtsham Ul HaqNo ratings yet