Professional Documents

Culture Documents

BDSC

BDSC

Uploaded by

davis felixCopyright:

Available Formats

You might also like

- 98 Instructions FSTDocument3 pages98 Instructions FSTChristopher Dunlap97% (33)

- Form 26asDocument6 pagesForm 26asSubramanyam JonnaNo ratings yet

- Bir DVS 2020Document310 pagesBir DVS 2020samuel sioteNo ratings yet

- Rollover FormDocument3 pagesRollover FormJonNo ratings yet

- TAXATION Finals ReviewerDocument38 pagesTAXATION Finals ReviewerJunivenReyUmadhay100% (1)

- PT. Mitra BestariDocument35 pagesPT. Mitra BestariLauzia Fadhila NareswariNo ratings yet

- Modes of Acquiring Land TitlesDocument3 pagesModes of Acquiring Land TitlesJune Alapa100% (1)

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- DownloadDocument1 pageDownloadSam BojanglesNo ratings yet

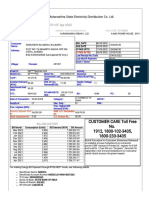

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDDocument2 pagesBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonNo ratings yet

- GSTR-2A - B2B InvoicesDocument16 pagesGSTR-2A - B2B InvoicesGirish LunaviyaNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Amypp6165b 2023Document4 pagesAmypp6165b 2023sandeep kumarNo ratings yet

- Gasbill 2049452051 202302 20230313223937 PDFDocument1 pageGasbill 2049452051 202302 20230313223937 PDFBLACK SQUADNo ratings yet

- File OpenDocument1 pageFile OpenAbdul MoizNo ratings yet

- Factory Feb BillDocument3 pagesFactory Feb BillSumit AgarwalNo ratings yet

- Centro West JanDocument8 pagesCentro West JanJan Mikel G. GloriaNo ratings yet

- March, 2023 Domestic: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 493556555496Document1 pageMarch, 2023 Domestic: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 493556555496Khalil juttNo ratings yet

- Ahopa5302n 2024Document4 pagesAhopa5302n 2024ankit ankit singhNo ratings yet

- RBL Credit Card Statement - UnlockedDocument2 pagesRBL Credit Card Statement - UnlockedDipra DasNo ratings yet

- Champapur Boundray 1Document1 pageChampapur Boundray 1ashokumar.scbNo ratings yet

- Phase-2 MSEDCL-1Document3 pagesPhase-2 MSEDCL-1ninad joshiNo ratings yet

- GST Invoice Format No. 20Document1 pageGST Invoice Format No. 20email2suryazNo ratings yet

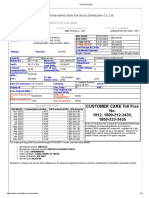

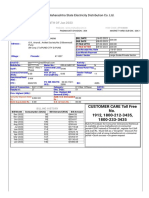

- Bill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435Document2 pagesBill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435AMolNo ratings yet

- Unpaid BillsDocument1 pageUnpaid Billsvillanuevaarabela17No ratings yet

- Gasbill 7292181000 202402 20240302090954Document1 pageGasbill 7292181000 202402 20240302090954Muhammad RizwanNo ratings yet

- CheckPointSupportQuote List PriceDocument29 pagesCheckPointSupportQuote List PriceckahbshfkbNo ratings yet

- Hirpk7232l 2023Document4 pagesHirpk7232l 2023Hasan KhanNo ratings yet

- Summary and Transaction HistoryDocument20 pagesSummary and Transaction HistorySatria NugrahaNo ratings yet

- Gasbill 2639372819 202311 20231207211553Document1 pageGasbill 2639372819 202311 20231207211553shoaib ullahNo ratings yet

- Jefferies Bond AnnouncementDocument1 pageJefferies Bond AnnouncementAllie M GrayNo ratings yet

- Gasbill 2454650000 202301 20230207122337Document1 pageGasbill 2454650000 202301 20230207122337Haffi Ur RehmanNo ratings yet

- ATTBill 4487 Sep2022Document6 pagesATTBill 4487 Sep2022Вероніка АнійчинNo ratings yet

- JAYME, Marx Yuri - 2BSMA-B - PAYROLLDocument42 pagesJAYME, Marx Yuri - 2BSMA-B - PAYROLLMarx Yuri JaymeNo ratings yet

- 26 (As) Aacpv6651q 2024Document5 pages26 (As) Aacpv6651q 2024AravamudhanNo ratings yet

- 2021 Douglas County Budget PresentationDocument43 pages2021 Douglas County Budget PresentationinforumdocsNo ratings yet

- Cbups3653j 2023Document4 pagesCbups3653j 2023CPA Business OutsourcingNo ratings yet

- GGGG GGGG GGGGGDocument4 pagesGGGG GGGG GGGGGKothapalliGuruManiKantaNo ratings yet

- FLBPM9189P 2024Document4 pagesFLBPM9189P 2024ANKURNo ratings yet

- Bill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435Document2 pagesBill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435AMolNo ratings yet

- Gasbill 3622988824 202305 20230604115618Document1 pageGasbill 3622988824 202305 20230604115618gdrive.r859abNo ratings yet

- Qasim ContractorDocument3 pagesQasim ContractorMuhammad Anas HassanNo ratings yet

- Gasbill 3814346712 202311 20231127092235Document1 pageGasbill 3814346712 202311 20231127092235nooruddin219No ratings yet

- 2402 O02invDocument2 pages2402 O02invKenny Diego ChenNo ratings yet

- 1HT - LTIP E-BillDocument2 pages1HT - LTIP E-BillAtul DeshmukhNo ratings yet

- Leuva DivyankDocument3 pagesLeuva DivyankANISH SHAIKHNo ratings yet

- FTO Transaction Details: The Mahatma Gandhi National Rural Employment Guarantee Act 06-Sep-2020 03:37:24 PMDocument6 pagesFTO Transaction Details: The Mahatma Gandhi National Rural Employment Guarantee Act 06-Sep-2020 03:37:24 PMM Irfan NaikNo ratings yet

- Cbops9538j 2021Document4 pagesCbops9538j 2021Nirav ChauhanNo ratings yet

- FB County Tax Statement-2022Document1 pageFB County Tax Statement-2022Sageer AbdullaNo ratings yet

- 20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFDocument6 pages20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFEdjon AndalNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportANTHONI FERNANDESNo ratings yet

- 0968RSV (Odisha)Document1 page0968RSV (Odisha)talabirachp siteNo ratings yet

- HT - LTIP E-Bill Kulkarni SirDocument3 pagesHT - LTIP E-Bill Kulkarni Sirpramod DudhaneNo ratings yet

- Cqips5715a 2023Document4 pagesCqips5715a 2023Sneha SharmaNo ratings yet

- Ahwpl0214g 2023Document5 pagesAhwpl0214g 2023cagopalofficebackupNo ratings yet

- W Xgygvuo Cgu T8 T OwDocument1 pageW Xgygvuo Cgu T8 T OwGovardhan VPNo ratings yet

- Gasbill 6961113608 202402 20240227212825Document1 pageGasbill 6961113608 202402 20240227212825John CarterNo ratings yet

- Gasbill 3327960000 202403 20240330194632Document1 pageGasbill 3327960000 202403 20240330194632shonodadashonushonuNo ratings yet

- Gasbill 1638637664 202312 20240129095416Document1 pageGasbill 1638637664 202312 20240129095416kk2884663No ratings yet

- PrintDocument1 pagePrintwsi.laredofacturasNo ratings yet

- Shekinah Grace School PangasinanDocument6 pagesShekinah Grace School PangasinanNellow M. TaberaraNo ratings yet

- Maharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022Document4 pagesMaharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022MAHA LAXMINo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Financing Transport Connectivity in the BIMSTEC RegionFrom EverandFinancing Transport Connectivity in the BIMSTEC RegionNo ratings yet

- Asian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificFrom EverandAsian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificNo ratings yet

- Taxation CasesDocument296 pagesTaxation CasesshelNo ratings yet

- Form W-9 and Instructions Request For Taxpayer Identification Number andDocument20 pagesForm W-9 and Instructions Request For Taxpayer Identification Number andnormlegerNo ratings yet

- City Business Permit 2012Document1 pageCity Business Permit 2012Claire BarnesNo ratings yet

- B/U Dorsuma GanderbalDocument2 pagesB/U Dorsuma GanderbalImran_firdousi100% (1)

- Integration Format of The PTU Joint CommissionDocument5 pagesIntegration Format of The PTU Joint CommissionScribdTranslationsNo ratings yet

- Sales & Service TaxDocument13 pagesSales & Service TaxWeiling TanNo ratings yet

- TaxxxxDocument3 pagesTaxxxxGlaiza CelNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- Formulir Penjaringan Siswa BaruDocument299 pagesFormulir Penjaringan Siswa BaruUz KurniawanNo ratings yet

- Boat BillDocument1 pageBoat BillSparshul JandialNo ratings yet

- Problem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseDocument4 pagesProblem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseSamerNo ratings yet

- Ugc Arrears ProceedingsDocument3 pagesUgc Arrears ProceedingsdrgmraoNo ratings yet

- 121 Pilmico-Mauri Foods Corp Vs CIRDocument2 pages121 Pilmico-Mauri Foods Corp Vs CIRJJ Val100% (2)

- SMART Pensions Booklet 2021-2022Document6 pagesSMART Pensions Booklet 2021-2022Julian Tierno MagroNo ratings yet

- Generally, Any Real-Estate Transfer Exceeding $100 in Value Within Michigan Is Subject To Transfer Tax. However, There Are Notable ExemptionsDocument2 pagesGenerally, Any Real-Estate Transfer Exceeding $100 in Value Within Michigan Is Subject To Transfer Tax. However, There Are Notable ExemptionsAdebayo EmmanuelNo ratings yet

- Note 6 Situs (Sources) of IncomeDocument3 pagesNote 6 Situs (Sources) of IncomeJason Robert MendozaNo ratings yet

- Maxicare Digest Attach After Page 66Document1 pageMaxicare Digest Attach After Page 66twenty19 lawNo ratings yet

- GST@FAQ Builders 09.10.2017Document10 pagesGST@FAQ Builders 09.10.2017NIKHIL KASATNo ratings yet

- Income From Other Sources-NotesDocument4 pagesIncome From Other Sources-Notes6804 Anushka GhoshNo ratings yet

- Types of Adjusting Entries (CH 4)Document5 pagesTypes of Adjusting Entries (CH 4)Ashna KoshalNo ratings yet

- RR 10-76Document4 pagesRR 10-76Althea Angela GarciaNo ratings yet

- Partnership Operations Enabling AssessmentDocument3 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- Invoice LifeDocument1 pageInvoice Lifelondon2gowdaNo ratings yet

- ACT Invoice BillDocument2 pagesACT Invoice BillRahul Christopher EvansNo ratings yet

- Latest Development in Indirect TaxDocument15 pagesLatest Development in Indirect TaxMuthuprakash.TNo ratings yet

BDSC

BDSC

Uploaded by

davis felixOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BDSC

BDSC

Uploaded by

davis felixCopyright:

Available Formats

PAR #0428 POR LOT 17 BLK 1 (208) 287-7243

COUNTRY CLUB SUB NO 02 dguerrera@adacounty.id.gov

PAR A ROS 13291 5404 W TARGEE ST

#0426S BOISE ID 83705

WILLIAMS CRIS D June 26, 2023

WILLIAMS MARIA A

2226 E SOLITUDE CT 01-6

BOISE ID 83712

R1580260428

RES LOT OR TRACT 0.161 0 0 177,000

177, 000

0 177,000

0.161 0 0 177, 000 0

0

0 0 0 177,000

177, 000

177,000

2023

COLLEGE OF WESTERN IDAHO (208) 562-3291 6-8-2023

MOSQUITO ABATEMENT (208) 577-4646 7-25-2023

BOISE CITY (208) 972-8147 7-11-2023

SCHOOL DISTRICT NO. 1 (208) 472-2607 6-12-2023

ADA COUNTY HIGHWAY DIST (208) 387-6100 8-23-2023

EMERGENCYMEDICAL (208) 287-2975 7-25-2023

ADA COUNTY (208) 287-7000 7-25-2023

AssessmentsreflectMARKET VALUE as of 1/1/23; for Homestead

and PropertyTax Reductionquestionscall (208) 287-7200.

BDSC05-149767-0002782

Your Property Value

Legislative Changes and the Impact on Your Taxes

LEGISLATIVE UPDATE: Hi, I’m Rebecca Arnold, your

Ada County Assessor.

In 2023, Property Tax Relief was passed by the Idaho

I'm honored to serve you, and all

Legislature that will affect the amount of property

the residents of Ada County. I

taxes you pay.

believe deeply in the importance of

We know your time is valuable so we’ve provided public service and I am honored to

you with a condensed and easy-to-understand be given the opportunity to serve

synopsis of House Bill (HB) 292. The purpose of the you as the first female Ada County Assessor. Providing

legislature’s tax “overhaul” bill is to reduce the excellent public service is of utmost importance to me, and

property tax burden for owners, without shifting costs

I believe that we can deliver fair and equitable assessments

between types of property.

along with providing excellent service to our community.

The infusion of state monies will provide measurable Please let us know if we can be of any assistance.

tax relief by year's end. This legislation creates a

property tax relief fund for homeowners who own RESIDENTIAL MARKET UPDATE:

and occupy their home, allocates funding for school

facilities and to pay down school bonds, and adds The Ada County housing market continued its historic

provisions for excess funds from the state to be increase until peaking around May 2022, after which

allocated for additional property tax relief for all residential market conditions began to decline – slowly at

property owners. HB292 also increases the income first, and then more rapidly after the summer months.

and property-value thresholds for the Property Tax While the decrease in residential market activity since

Reduction Program (formerly known as “Circuit summer 2022 has been significant, annual assessments

Breaker”). This will make the program more follow a strict, statutory January 1st date-of-value. Due to

accessible to seniors and disabled property owners. the timing of assessments, last year’s value did not

To get the most out of HB292, new homeowners, or capture 2022’s peak market conditions, and 2023

those that have recently purchased a home, make assessments may not fully reflect the market change that

sure you have the Homestead Exemption (aka occurred between 2022’s peak and January 1st 2023.

Homeowner's Exemption) on your owner-occupied,

primary dwelling. Qualifications for the Homestead What does all this mean for residential property owners?

Exemption must be met by the second Monday in Most single family residential property owners will see

July. lower assessed values this year. Activity in the market that

has occurred since the first of this year through the end of

If you have already qualified for the Homestead

2023 will be considered for next year's assessments. Our

Exemption on your primary dwelling, you do not

staff is continually monitoring market conditions to ensure

need to apply again.

fairness and equity in our assessments.

The County Treasurer will mail property tax bills in

November. While it’s still too early to know how much

HB292 will benefit Ada County property owners, it Scan the QR codes below to:

appears promising.

Learn about Property Read an analysis

The legislature also passed HB258, which provides Tax relief options about HB292

further property tax reduction benefits to veterans

with 100% service-connected, permanent disabilities.

This bill allows for one-time application rather than

annual re-qualification.

Need more information?

Visit https://adacounty.id.gov/assessor/

Please direct all value-related questions to appraisal staff by telephone or email listed on your notice.

If an in-person discussion is required, please call your appraiser to schedule an appointment.

You might also like

- 98 Instructions FSTDocument3 pages98 Instructions FSTChristopher Dunlap97% (33)

- Form 26asDocument6 pagesForm 26asSubramanyam JonnaNo ratings yet

- Bir DVS 2020Document310 pagesBir DVS 2020samuel sioteNo ratings yet

- Rollover FormDocument3 pagesRollover FormJonNo ratings yet

- TAXATION Finals ReviewerDocument38 pagesTAXATION Finals ReviewerJunivenReyUmadhay100% (1)

- PT. Mitra BestariDocument35 pagesPT. Mitra BestariLauzia Fadhila NareswariNo ratings yet

- Modes of Acquiring Land TitlesDocument3 pagesModes of Acquiring Land TitlesJune Alapa100% (1)

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- DownloadDocument1 pageDownloadSam BojanglesNo ratings yet

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDDocument2 pagesBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonNo ratings yet

- GSTR-2A - B2B InvoicesDocument16 pagesGSTR-2A - B2B InvoicesGirish LunaviyaNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Amypp6165b 2023Document4 pagesAmypp6165b 2023sandeep kumarNo ratings yet

- Gasbill 2049452051 202302 20230313223937 PDFDocument1 pageGasbill 2049452051 202302 20230313223937 PDFBLACK SQUADNo ratings yet

- File OpenDocument1 pageFile OpenAbdul MoizNo ratings yet

- Factory Feb BillDocument3 pagesFactory Feb BillSumit AgarwalNo ratings yet

- Centro West JanDocument8 pagesCentro West JanJan Mikel G. GloriaNo ratings yet

- March, 2023 Domestic: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 493556555496Document1 pageMarch, 2023 Domestic: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 493556555496Khalil juttNo ratings yet

- Ahopa5302n 2024Document4 pagesAhopa5302n 2024ankit ankit singhNo ratings yet

- RBL Credit Card Statement - UnlockedDocument2 pagesRBL Credit Card Statement - UnlockedDipra DasNo ratings yet

- Champapur Boundray 1Document1 pageChampapur Boundray 1ashokumar.scbNo ratings yet

- Phase-2 MSEDCL-1Document3 pagesPhase-2 MSEDCL-1ninad joshiNo ratings yet

- GST Invoice Format No. 20Document1 pageGST Invoice Format No. 20email2suryazNo ratings yet

- Bill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435Document2 pagesBill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435AMolNo ratings yet

- Unpaid BillsDocument1 pageUnpaid Billsvillanuevaarabela17No ratings yet

- Gasbill 7292181000 202402 20240302090954Document1 pageGasbill 7292181000 202402 20240302090954Muhammad RizwanNo ratings yet

- CheckPointSupportQuote List PriceDocument29 pagesCheckPointSupportQuote List PriceckahbshfkbNo ratings yet

- Hirpk7232l 2023Document4 pagesHirpk7232l 2023Hasan KhanNo ratings yet

- Summary and Transaction HistoryDocument20 pagesSummary and Transaction HistorySatria NugrahaNo ratings yet

- Gasbill 2639372819 202311 20231207211553Document1 pageGasbill 2639372819 202311 20231207211553shoaib ullahNo ratings yet

- Jefferies Bond AnnouncementDocument1 pageJefferies Bond AnnouncementAllie M GrayNo ratings yet

- Gasbill 2454650000 202301 20230207122337Document1 pageGasbill 2454650000 202301 20230207122337Haffi Ur RehmanNo ratings yet

- ATTBill 4487 Sep2022Document6 pagesATTBill 4487 Sep2022Вероніка АнійчинNo ratings yet

- JAYME, Marx Yuri - 2BSMA-B - PAYROLLDocument42 pagesJAYME, Marx Yuri - 2BSMA-B - PAYROLLMarx Yuri JaymeNo ratings yet

- 26 (As) Aacpv6651q 2024Document5 pages26 (As) Aacpv6651q 2024AravamudhanNo ratings yet

- 2021 Douglas County Budget PresentationDocument43 pages2021 Douglas County Budget PresentationinforumdocsNo ratings yet

- Cbups3653j 2023Document4 pagesCbups3653j 2023CPA Business OutsourcingNo ratings yet

- GGGG GGGG GGGGGDocument4 pagesGGGG GGGG GGGGGKothapalliGuruManiKantaNo ratings yet

- FLBPM9189P 2024Document4 pagesFLBPM9189P 2024ANKURNo ratings yet

- Bill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435Document2 pagesBill of Supply For The Month of Apr 2018: Customer Care Toll Free No. 1912, 1800-102-3435, 1800-233-3435AMolNo ratings yet

- Gasbill 3622988824 202305 20230604115618Document1 pageGasbill 3622988824 202305 20230604115618gdrive.r859abNo ratings yet

- Qasim ContractorDocument3 pagesQasim ContractorMuhammad Anas HassanNo ratings yet

- Gasbill 3814346712 202311 20231127092235Document1 pageGasbill 3814346712 202311 20231127092235nooruddin219No ratings yet

- 2402 O02invDocument2 pages2402 O02invKenny Diego ChenNo ratings yet

- 1HT - LTIP E-BillDocument2 pages1HT - LTIP E-BillAtul DeshmukhNo ratings yet

- Leuva DivyankDocument3 pagesLeuva DivyankANISH SHAIKHNo ratings yet

- FTO Transaction Details: The Mahatma Gandhi National Rural Employment Guarantee Act 06-Sep-2020 03:37:24 PMDocument6 pagesFTO Transaction Details: The Mahatma Gandhi National Rural Employment Guarantee Act 06-Sep-2020 03:37:24 PMM Irfan NaikNo ratings yet

- Cbops9538j 2021Document4 pagesCbops9538j 2021Nirav ChauhanNo ratings yet

- FB County Tax Statement-2022Document1 pageFB County Tax Statement-2022Sageer AbdullaNo ratings yet

- 20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFDocument6 pages20200731-0100001646-SMCC-Mall North Wing-TECHNOMARINE ENTERPRISES PHILS INC PDFEdjon AndalNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportANTHONI FERNANDESNo ratings yet

- 0968RSV (Odisha)Document1 page0968RSV (Odisha)talabirachp siteNo ratings yet

- HT - LTIP E-Bill Kulkarni SirDocument3 pagesHT - LTIP E-Bill Kulkarni Sirpramod DudhaneNo ratings yet

- Cqips5715a 2023Document4 pagesCqips5715a 2023Sneha SharmaNo ratings yet

- Ahwpl0214g 2023Document5 pagesAhwpl0214g 2023cagopalofficebackupNo ratings yet

- W Xgygvuo Cgu T8 T OwDocument1 pageW Xgygvuo Cgu T8 T OwGovardhan VPNo ratings yet

- Gasbill 6961113608 202402 20240227212825Document1 pageGasbill 6961113608 202402 20240227212825John CarterNo ratings yet

- Gasbill 3327960000 202403 20240330194632Document1 pageGasbill 3327960000 202403 20240330194632shonodadashonushonuNo ratings yet

- Gasbill 1638637664 202312 20240129095416Document1 pageGasbill 1638637664 202312 20240129095416kk2884663No ratings yet

- PrintDocument1 pagePrintwsi.laredofacturasNo ratings yet

- Shekinah Grace School PangasinanDocument6 pagesShekinah Grace School PangasinanNellow M. TaberaraNo ratings yet

- Maharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022Document4 pagesMaharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022MAHA LAXMINo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Financing Transport Connectivity in the BIMSTEC RegionFrom EverandFinancing Transport Connectivity in the BIMSTEC RegionNo ratings yet

- Asian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificFrom EverandAsian Economic Integration Report 2023: Advancing Digital Services Trade in Asia and the PacificNo ratings yet

- Taxation CasesDocument296 pagesTaxation CasesshelNo ratings yet

- Form W-9 and Instructions Request For Taxpayer Identification Number andDocument20 pagesForm W-9 and Instructions Request For Taxpayer Identification Number andnormlegerNo ratings yet

- City Business Permit 2012Document1 pageCity Business Permit 2012Claire BarnesNo ratings yet

- B/U Dorsuma GanderbalDocument2 pagesB/U Dorsuma GanderbalImran_firdousi100% (1)

- Integration Format of The PTU Joint CommissionDocument5 pagesIntegration Format of The PTU Joint CommissionScribdTranslationsNo ratings yet

- Sales & Service TaxDocument13 pagesSales & Service TaxWeiling TanNo ratings yet

- TaxxxxDocument3 pagesTaxxxxGlaiza CelNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- Formulir Penjaringan Siswa BaruDocument299 pagesFormulir Penjaringan Siswa BaruUz KurniawanNo ratings yet

- Boat BillDocument1 pageBoat BillSparshul JandialNo ratings yet

- Problem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseDocument4 pagesProblem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseSamerNo ratings yet

- Ugc Arrears ProceedingsDocument3 pagesUgc Arrears ProceedingsdrgmraoNo ratings yet

- 121 Pilmico-Mauri Foods Corp Vs CIRDocument2 pages121 Pilmico-Mauri Foods Corp Vs CIRJJ Val100% (2)

- SMART Pensions Booklet 2021-2022Document6 pagesSMART Pensions Booklet 2021-2022Julian Tierno MagroNo ratings yet

- Generally, Any Real-Estate Transfer Exceeding $100 in Value Within Michigan Is Subject To Transfer Tax. However, There Are Notable ExemptionsDocument2 pagesGenerally, Any Real-Estate Transfer Exceeding $100 in Value Within Michigan Is Subject To Transfer Tax. However, There Are Notable ExemptionsAdebayo EmmanuelNo ratings yet

- Note 6 Situs (Sources) of IncomeDocument3 pagesNote 6 Situs (Sources) of IncomeJason Robert MendozaNo ratings yet

- Maxicare Digest Attach After Page 66Document1 pageMaxicare Digest Attach After Page 66twenty19 lawNo ratings yet

- GST@FAQ Builders 09.10.2017Document10 pagesGST@FAQ Builders 09.10.2017NIKHIL KASATNo ratings yet

- Income From Other Sources-NotesDocument4 pagesIncome From Other Sources-Notes6804 Anushka GhoshNo ratings yet

- Types of Adjusting Entries (CH 4)Document5 pagesTypes of Adjusting Entries (CH 4)Ashna KoshalNo ratings yet

- RR 10-76Document4 pagesRR 10-76Althea Angela GarciaNo ratings yet

- Partnership Operations Enabling AssessmentDocument3 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- Invoice LifeDocument1 pageInvoice Lifelondon2gowdaNo ratings yet

- ACT Invoice BillDocument2 pagesACT Invoice BillRahul Christopher EvansNo ratings yet

- Latest Development in Indirect TaxDocument15 pagesLatest Development in Indirect TaxMuthuprakash.TNo ratings yet