Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsP21001 - Old Vs New Regime

P21001 - Old Vs New Regime

Uploaded by

brighulakephotosCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Lt2 - Iev - Ecsy ColaDocument11 pagesLt2 - Iev - Ecsy ColaMarcus McWile Morningstar100% (1)

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorumaNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- New Tax Regime Vs Old Calculator - by AssetYogiDocument7 pagesNew Tax Regime Vs Old Calculator - by AssetYogiGajendra HoleNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSACHIN REVEKARNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiNirav TailorNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiAnubhav KumarNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSarang AgrawalNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiVishalNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument3 pagesNew Tax Regime Vs Old Calculator by AssetYogiSukanta MondalNo ratings yet

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument4 pagesNew Tax Regime Vs Old Calculator by AssetYogijohnNo ratings yet

- Tax ComputationDocument3 pagesTax ComputationvinoraamNo ratings yet

- Tax Slabs - Exemptions - Ay 2022-23Document19 pagesTax Slabs - Exemptions - Ay 2022-23RatnaPrasadNalamNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- New Tax CalculatorDocument5 pagesNew Tax CalculatorDJNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocument15 pagesHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNo ratings yet

- Tax Calculator (Salaried Person) : Monthly Basic SalaryDocument5 pagesTax Calculator (Salaried Person) : Monthly Basic SalaryAbbas AliNo ratings yet

- Tax Sheet - A.Y 2024-25Document3 pagesTax Sheet - A.Y 2024-25bajajvanshica23No ratings yet

- FAQ On New Tax Regime - V3Document6 pagesFAQ On New Tax Regime - V3ash tiwariNo ratings yet

- Individual Income TaxationDocument8 pagesIndividual Income TaxationMarirose Sheena DomingoNo ratings yet

- Enterprise ValuationDocument3 pagesEnterprise ValuationParth MalikNo ratings yet

- Current Year Data:: Calculating Enterprise ValueDocument3 pagesCurrent Year Data:: Calculating Enterprise ValueParth MalikNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1rahulchauham0No ratings yet

- IT Amendment 2018 AttemptDocument14 pagesIT Amendment 2018 AttemptrakeshNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Computation of Total Incme and Tax Liability Income From Salary Income From House PropertyDocument1 pageComputation of Total Incme and Tax Liability Income From Salary Income From House PropertyshyamiliNo ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- Comprehensive Personal Tax CalculatorDocument48 pagesComprehensive Personal Tax CalculatorRaviNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Calculate TaxDocument8 pagesCalculate TaxPhilipp WiegandNo ratings yet

- Planed Cash Reciepts: Collection of Account RecievablesDocument11 pagesPlaned Cash Reciepts: Collection of Account RecievablesMani ManandharNo ratings yet

- Tax Calculator - NewDocument8 pagesTax Calculator - NewSabareesh AthiNo ratings yet

- Tax Computation FY 2020-21Document9 pagesTax Computation FY 2020-21kumar kartikeyaNo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- 12lpa Tax ComputationDocument1 page12lpa Tax ComputationSai KrishnaNo ratings yet

- Income Tax Rules FY2022-2023Document9 pagesIncome Tax Rules FY2022-2023CPKNo ratings yet

- IncomDocument48 pagesIncomMahendra BabuNo ratings yet

- Tea Villa CafeDocument8 pagesTea Villa CafeHarsh BaidNo ratings yet

- Tax Calculator 2022-2023Document3 pagesTax Calculator 2022-2023Entertainment StudioNo ratings yet

- Trade and Other Receivables p2Document48 pagesTrade and Other Receivables p2Camille G.No ratings yet

- 24q Salary DetailsDocument3 pages24q Salary Detailssourav.dey.bcom24No ratings yet

- Only Fill Yellow Cells: WorkingsDocument2 pagesOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1Kiran KumarNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Amount of Gross SalesDocument32 pagesAmount of Gross SalesMax Del valleNo ratings yet

- Choose Your Tax RegimeDocument3 pagesChoose Your Tax Regimejanesh singhNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorAbhi RamachandranNo ratings yet

- Amendment May - 2024Document5 pagesAmendment May - 2024VINOD KUMARNo ratings yet

- Taxation Class Test 3Document6 pagesTaxation Class Test 3ap.quatrroNo ratings yet

- Latest Casino Bonuses: Are you looking for the latest and greatest Canadian online casino bonuses? We have got you covered! Browse through our list of hand-picked bonuses and promotions selected especially for Canadians. Always get the most out of your casino experience!From EverandLatest Casino Bonuses: Are you looking for the latest and greatest Canadian online casino bonuses? We have got you covered! Browse through our list of hand-picked bonuses and promotions selected especially for Canadians. Always get the most out of your casino experience!No ratings yet

P21001 - Old Vs New Regime

P21001 - Old Vs New Regime

Uploaded by

brighulakephotos0 ratings0% found this document useful (0 votes)

1 views2 pagesOriginal Title

P21001 - Old vs New Regime

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesP21001 - Old Vs New Regime

P21001 - Old Vs New Regime

Uploaded by

brighulakephotosCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

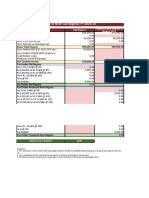

Gross Salary ₹ 700,000.

00

80C ₹ 160,000.00

80D ₹ 15,000.00

Particulars Old Regime New Regime

Income under the Head Salary ₹ 700,000.00 ₹ 700,000.00

Less: HRA ₹ -40,000.00 ₹ 0.00

Less: Standard Deduction ₹ -50,000.00 ₹ -50,000.00

Income from capital gains ₹ 65,000.00 ₹ 65,000.00

Income from other sources ₹ 2,500.00 ₹ 2,500.00

Gross Taxable Income ₹ 677,500.00 ₹ 717,500.00

Less: Chapter VI-A Deductions

80C ₹ 150,000.00 ₹ 0.00

80D ₹ 15,000.00 ₹ 0.00

Net Taxable Income ₹ 512,500.00 ₹ 717,500.00

Tax Compuatation:

Income Slab Old Regime New Regime

Less than 250,000 ₹ 0.00 ₹ 0.00

250,001 - 300,000 ₹ 2,500.00 ₹ 0.00

300,001 - 500,000 ₹ 10,000.00 ₹ 10,000.00

500,001 - 600,000 ₹ 2,500.00 ₹ 5,000.00

600,001 - 900,000 ₹ 0.00 ₹ 11,750.00

900,001 - 10,00,000 ₹ 0.00 ₹ 0.00

10,00,001 - 12,00,000 ₹ 0.00 ₹ 0.00

12,00,001 - 15,00,000 ₹ 0.00 ₹ 0.00

Above 15,00,000 ₹ 0.00 ₹ 0.00

Tax Payable on Total Income ₹ 15,000.00 ₹ 26,750.00

Less: Rebate ₹ 0.00 ₹ 0.00

Less: Marginal Relief in New Regime ₹ 0.00 ₹ -9,250.00

Tax after Rebate ₹ 15,000.00 ₹ 17,500.00

Add: Cess @4% ₹ 600.00 ₹ 700.00

Net Tax Payable ₹ 15,600 ₹ 18,200

Income Slab Old Regime New Regime

Less than 250,000 0% 0%

250,001 - 300,000 5% 0%

300,001 - 500,000 5% 5%

500,001 - 600,000 20% 5%

600,001 - 900,000 20% 10%

900,001 - 10,00,000 20% 15%

10,00,001 - 12,00,000 30% 15%

12,00,001 - 15,00,000 30% 20%

Above 15,00,000 30% 30%

You might also like

- Lt2 - Iev - Ecsy ColaDocument11 pagesLt2 - Iev - Ecsy ColaMarcus McWile Morningstar100% (1)

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorumaNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- New Tax Regime Vs Old Calculator - by AssetYogiDocument7 pagesNew Tax Regime Vs Old Calculator - by AssetYogiGajendra HoleNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSACHIN REVEKARNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiNirav TailorNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiAnubhav KumarNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSarang AgrawalNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiVishalNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument3 pagesNew Tax Regime Vs Old Calculator by AssetYogiSukanta MondalNo ratings yet

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument4 pagesNew Tax Regime Vs Old Calculator by AssetYogijohnNo ratings yet

- Tax ComputationDocument3 pagesTax ComputationvinoraamNo ratings yet

- Tax Slabs - Exemptions - Ay 2022-23Document19 pagesTax Slabs - Exemptions - Ay 2022-23RatnaPrasadNalamNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- New Tax CalculatorDocument5 pagesNew Tax CalculatorDJNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocument15 pagesHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNo ratings yet

- Tax Calculator (Salaried Person) : Monthly Basic SalaryDocument5 pagesTax Calculator (Salaried Person) : Monthly Basic SalaryAbbas AliNo ratings yet

- Tax Sheet - A.Y 2024-25Document3 pagesTax Sheet - A.Y 2024-25bajajvanshica23No ratings yet

- FAQ On New Tax Regime - V3Document6 pagesFAQ On New Tax Regime - V3ash tiwariNo ratings yet

- Individual Income TaxationDocument8 pagesIndividual Income TaxationMarirose Sheena DomingoNo ratings yet

- Enterprise ValuationDocument3 pagesEnterprise ValuationParth MalikNo ratings yet

- Current Year Data:: Calculating Enterprise ValueDocument3 pagesCurrent Year Data:: Calculating Enterprise ValueParth MalikNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1rahulchauham0No ratings yet

- IT Amendment 2018 AttemptDocument14 pagesIT Amendment 2018 AttemptrakeshNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Computation of Total Incme and Tax Liability Income From Salary Income From House PropertyDocument1 pageComputation of Total Incme and Tax Liability Income From Salary Income From House PropertyshyamiliNo ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- Comprehensive Personal Tax CalculatorDocument48 pagesComprehensive Personal Tax CalculatorRaviNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Calculate TaxDocument8 pagesCalculate TaxPhilipp WiegandNo ratings yet

- Planed Cash Reciepts: Collection of Account RecievablesDocument11 pagesPlaned Cash Reciepts: Collection of Account RecievablesMani ManandharNo ratings yet

- Tax Calculator - NewDocument8 pagesTax Calculator - NewSabareesh AthiNo ratings yet

- Tax Computation FY 2020-21Document9 pagesTax Computation FY 2020-21kumar kartikeyaNo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- 12lpa Tax ComputationDocument1 page12lpa Tax ComputationSai KrishnaNo ratings yet

- Income Tax Rules FY2022-2023Document9 pagesIncome Tax Rules FY2022-2023CPKNo ratings yet

- IncomDocument48 pagesIncomMahendra BabuNo ratings yet

- Tea Villa CafeDocument8 pagesTea Villa CafeHarsh BaidNo ratings yet

- Tax Calculator 2022-2023Document3 pagesTax Calculator 2022-2023Entertainment StudioNo ratings yet

- Trade and Other Receivables p2Document48 pagesTrade and Other Receivables p2Camille G.No ratings yet

- 24q Salary DetailsDocument3 pages24q Salary Detailssourav.dey.bcom24No ratings yet

- Only Fill Yellow Cells: WorkingsDocument2 pagesOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1Kiran KumarNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Amount of Gross SalesDocument32 pagesAmount of Gross SalesMax Del valleNo ratings yet

- Choose Your Tax RegimeDocument3 pagesChoose Your Tax Regimejanesh singhNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorAbhi RamachandranNo ratings yet

- Amendment May - 2024Document5 pagesAmendment May - 2024VINOD KUMARNo ratings yet

- Taxation Class Test 3Document6 pagesTaxation Class Test 3ap.quatrroNo ratings yet

- Latest Casino Bonuses: Are you looking for the latest and greatest Canadian online casino bonuses? We have got you covered! Browse through our list of hand-picked bonuses and promotions selected especially for Canadians. Always get the most out of your casino experience!From EverandLatest Casino Bonuses: Are you looking for the latest and greatest Canadian online casino bonuses? We have got you covered! Browse through our list of hand-picked bonuses and promotions selected especially for Canadians. Always get the most out of your casino experience!No ratings yet