Professional Documents

Culture Documents

Activity Lease Part 2 A

Activity Lease Part 2 A

Uploaded by

Eric GuapinCopyright:

Available Formats

You might also like

- Chapter 02 Outline - Modern Real Estate Practice, 18th EditionDocument4 pagesChapter 02 Outline - Modern Real Estate Practice, 18th Editionmyname1015100% (1)

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Answer: C - 465,000Document9 pagesAnswer: C - 465,000kyle G50% (2)

- Example Exercise Lease Acctg With AnsDocument28 pagesExample Exercise Lease Acctg With AnsPrince Avena AquinoNo ratings yet

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocument3 pagesSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacNo ratings yet

- Orca Share Media1577676523240Document4 pagesOrca Share Media1577676523240Jayr BVNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- WeWork Pitch Deck Series D PDFDocument51 pagesWeWork Pitch Deck Series D PDFdont-wantNo ratings yet

- Compressed Notes On SPP & Architect's GuidelinesDocument65 pagesCompressed Notes On SPP & Architect's GuidelinesManny Inocencio100% (12)

- Activity Lease Part 1Document1 pageActivity Lease Part 1Eric GuapinNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- IA2 AssignmentDocument2 pagesIA2 AssignmentJobelle Marie MahNo ratings yet

- SEATWORK - Chapter 11 - 16Document8 pagesSEATWORK - Chapter 11 - 16Kheajoy99 KimNo ratings yet

- MODULE 1 Midterm FAR 3 LeasesDocument31 pagesMODULE 1 Midterm FAR 3 LeasesKezNo ratings yet

- Lobrigas Unit5 Topic1 AssessmentDocument3 pagesLobrigas Unit5 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Lessee Accounting: Right To Control The Use of An AssetDocument33 pagesLessee Accounting: Right To Control The Use of An AssetJohn Mark FernandoNo ratings yet

- Accounting For LeasesDocument6 pagesAccounting For LeasesJohn Ferd M. FerminNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- Finance Lease LesseeDocument11 pagesFinance Lease LesseeAngel Queen Marino SamoragaNo ratings yet

- Chapter 10 Lease AccountingDocument6 pagesChapter 10 Lease AccountingCasinas Kyana LouisseNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Assignment Ppfrs 16Document3 pagesAssignment Ppfrs 16Joseph DoctoNo ratings yet

- SW-UPDATED-Leases PrintDocument2 pagesSW-UPDATED-Leases PrintMikaela Joy FloraNo ratings yet

- Lease Accounting 2021Document5 pagesLease Accounting 2021Just JhexNo ratings yet

- Leases: Lease Part 1Document10 pagesLeases: Lease Part 1ZyxNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Leases Part 2Document40 pagesLeases Part 2Danica RamosNo ratings yet

- Operating LeaseDocument7 pagesOperating Leasesantosashleymay7No ratings yet

- Problem Solving-LeaseDocument2 pagesProblem Solving-LeasegadingancielomarieNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- Quiz 1 Leases PDFDocument4 pagesQuiz 1 Leases PDFken aysonNo ratings yet

- Lease Problem With SolutionDocument19 pagesLease Problem With SolutionJeane Mae Boo100% (1)

- 21 Finance Lease LesseeDocument3 pages21 Finance Lease LesseeTinNo ratings yet

- FAR QUIZ 1 - ProblemsDocument4 pagesFAR QUIZ 1 - ProblemsAEHYUN YENVYNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- 2 - ACG015 - Intermediate Accounting Part 3 - QuestionnaireDocument5 pages2 - ACG015 - Intermediate Accounting Part 3 - Questionnairedavis lizardaNo ratings yet

- Accounting 8 - ReviewerDocument4 pagesAccounting 8 - ReviewerAshley David AligonsaNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Leases Part 3 - Other Accounting IssuesDocument33 pagesLeases Part 3 - Other Accounting IssuesDanica RamosNo ratings yet

- Problem 1: True or FalseDocument4 pagesProblem 1: True or FalseJohn Ace Madriaga50% (6)

- FINANCE LEASE-lecture and ExercisesDocument10 pagesFINANCE LEASE-lecture and ExercisesJamie CantubaNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- Quiz Far LeaseDocument2 pagesQuiz Far Leasefrancis dungcaNo ratings yet

- Quiz On Pfrs 16 LeaseDocument4 pagesQuiz On Pfrs 16 LeaseCielo Mae Parungo56% (16)

- ACC 211 - Seventh QuizzerDocument1 pageACC 211 - Seventh QuizzerKate FernandezNo ratings yet

- Discussion Problems - Lessor AccountingDocument4 pagesDiscussion Problems - Lessor AccountingangelapearlrNo ratings yet

- Direct Financing Lease-LessorDocument2 pagesDirect Financing Lease-LessororillosachristoperjohnNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Seatwork On LeasesDocument1 pageSeatwork On Leasesmitakumo uwuNo ratings yet

- Act1106-Leased Asset-LesseeDocument2 pagesAct1106-Leased Asset-LesseeorillosachristoperjohnNo ratings yet

- LeasesDocument3 pagesLeasesAngelica Rome EnriquezNo ratings yet

- Chapter 21Document18 pagesChapter 21Ardilla Noor Paramashanti Wirahadikusuma100% (1)

- 22 Finance Lease LessorDocument3 pages22 Finance Lease LessorAllegria AlamoNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- Sales&leasebackDocument15 pagesSales&leasebackeulhiemae arong0% (1)

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Finals - SeatWorkDocument1 pageFinals - SeatWorkDan RyanNo ratings yet

- Promoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3From EverandPromoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3No ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismFrom EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismNo ratings yet

- OM Operation MGT Mod 4 Forecasting and SchedulingDocument5 pagesOM Operation MGT Mod 4 Forecasting and SchedulingEric GuapinNo ratings yet

- OM Operation Management Module Two 2Document6 pagesOM Operation Management Module Two 2Eric GuapinNo ratings yet

- Day 1 - Team BravoDocument13 pagesDay 1 - Team BravoEric GuapinNo ratings yet

- Group Work-Team BravoDocument28 pagesGroup Work-Team BravoEric GuapinNo ratings yet

- Team Bravo-Event TaskDocument7 pagesTeam Bravo-Event TaskEric GuapinNo ratings yet

- Land Title and Deeds ReviewerDocument2 pagesLand Title and Deeds ReviewerPauline Vistan Garcia100% (1)

- Lecture 1Document15 pagesLecture 1Anne AlyasNo ratings yet

- Tenancy Agreement 41 Greenwich Park Street London Se10 9ltDocument26 pagesTenancy Agreement 41 Greenwich Park Street London Se10 9ltw1933194No ratings yet

- Digest 2 Tiosejo vs. AngDocument1 pageDigest 2 Tiosejo vs. AngErvien A. MendozaNo ratings yet

- 1 LIHTC-Form-3-1 1 2021Document19 pages1 LIHTC-Form-3-1 1 2021PawPaul MccoyNo ratings yet

- Balaji Printing Solution ReportDocument10 pagesBalaji Printing Solution ReportYusuf AnsariNo ratings yet

- Fixed Asset Accounting and Management Procedures Manual: Revised December 2005 IDocument164 pagesFixed Asset Accounting and Management Procedures Manual: Revised December 2005 IDessie TarekegnNo ratings yet

- Bit Mesra M.arch SyllabusDocument22 pagesBit Mesra M.arch SyllabusniteshNo ratings yet

- Law On Property ReviewerDocument102 pagesLaw On Property ReviewerELEENAMICHAELA TORRESNo ratings yet

- Rental Listings in Roseville CA - 140 Rentals ZillowDocument1 pageRental Listings in Roseville CA - 140 Rentals ZillowChristine SparksNo ratings yet

- EU Directives SummaryDocument2 pagesEU Directives SummaryAndres HidalgoNo ratings yet

- Carmel Parking CorrespondenceDocument33 pagesCarmel Parking CorrespondenceL. A. PatersonNo ratings yet

- Spa Benchmark Report Full Year 2020Document5 pagesSpa Benchmark Report Full Year 2020Rupsayar DasNo ratings yet

- Specimen Specimen: Tenancy AgreementDocument4 pagesSpecimen Specimen: Tenancy AgreementYawson ElvisNo ratings yet

- What Types of Building Are There in Your City?Document2 pagesWhat Types of Building Are There in Your City?NganNo ratings yet

- Sublease AgreementDocument15 pagesSublease AgreementJoebell VillanuevaNo ratings yet

- Efr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYDocument22 pagesEfr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYjonathanNo ratings yet

- #Plumeria - GodrejWoods - Tower PlansDocument13 pages#Plumeria - GodrejWoods - Tower Plansprateek scrubingNo ratings yet

- Comparison..pledge, Mortgage, AntichresisDocument2 pagesComparison..pledge, Mortgage, AntichresisElfin Kenneth Puentespina0% (1)

- Hand Book For Civil EngineersDocument171 pagesHand Book For Civil EngineersWahid MarwatNo ratings yet

- Finding An Apartment ProjectDocument3 pagesFinding An Apartment Projectapi-288395661No ratings yet

- HS 330 1-1Document231 pagesHS 330 1-1MCP MarkNo ratings yet

- Caveat On Kyadondo Block 189 Plot 761Document3 pagesCaveat On Kyadondo Block 189 Plot 761SimonPrinceSemagandaNo ratings yet

- 31 PNB Vs CA, Et Al., G.R. No. 66715, Sept 18, 1990Document2 pages31 PNB Vs CA, Et Al., G.R. No. 66715, Sept 18, 1990RubenNo ratings yet

- December 2023 HomeLet Rental Index ReportDocument18 pagesDecember 2023 HomeLet Rental Index ReportjohnbullasNo ratings yet

- Pigao v. Rabanillo, 488 SCRA 547 (2006)Document9 pagesPigao v. Rabanillo, 488 SCRA 547 (2006)Carie LawyerrNo ratings yet

- 2023 Geronimo Delos Reyes OctoberDocument8 pages2023 Geronimo Delos Reyes Octoberウォーカー スカイラーNo ratings yet

Activity Lease Part 2 A

Activity Lease Part 2 A

Uploaded by

Eric GuapinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity Lease Part 2 A

Activity Lease Part 2 A

Uploaded by

Eric GuapinCopyright:

Available Formats

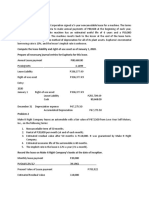

ACTIVITY NO.

6 -LEASES- Part 2 A

PROBLEM 1

On January 1, 2023, RED Company, lessee, leased a machine with the following pertinent information:

Fixed rental payment at the end of each year P 900,000

Lease term 10 years

Useful life of machine 12 years

Incremental borrowing rate 14%

Implicit interest rate 12%

Present value of an ordinary annuity of 1 for 10 periods at

14% 5.216

12% 5.650

Present value of 1 for 10 periods at

14% 0.270

12% 0.322

RED Company had the option to purchase the machine upon the lease expiration on January 1, 2033 by paying

P600,000. The lessee is reasonably certain to exercise the purchase option at the commencement date of the lease.

The estimated residual value of the machine at the end of the 12-year useful life is P700,000.

Questions:

1.1 Carrying amount of Right of use asset -12/31/23? _______________________________

1.2 Carrying amount of Lease liability – 12/31/23? ___________________________

1.3 If purchase option is not exercised, Loss on finance lease should be at what amount? ______________________

PROBLEM 2

On January 1, 2023, Relax Company, a lessee, leased an equipment with the following information:

Fixed annual payment at the end of each lease year P 900,000

Lease term 4 years

Useful life of equipment 5 years

Implicit interest rate 10%

Present value of an ordinary annuity of 1 for 4 periods at 10% 3.16987

Present value of 1 for 4 periods at 10% 0.683

Relax Company guaranteed a P300,000 residual value on Dec. 31, 2026 to the lessor.

Questions:

2.1 Carrying amount of lease liability -12/31/23? ____________________________

2.2 Carrying amount of Right of use asset-12/31/23? ________________________

2.3 If the fair value of equipment is only P200,000 end the end of lease term, how much is the loss on finance lease?

_____________________________

PROBLEM 3

On January 1, 2023, an entity entered into a lease of building with the following information:

Annual rental payable at the end of each year P600,000

Lease term 5 years

Useful life of building 20 years

Implicit interest rate 10%

PV of an ordinary annuity of 1 at 10% for 5 periods 3.791

The lease contained an option for the lessee to extend for a further 5 years. At the commencement date, the exercise of

the extension option is not reasonably certain.

After 3 years on January 1, 2026, the lessee decided to extend the lease for a further 5 years.

New annual rental payable at the end of each year P700,000

New implicit interest rate 8%

PV of an ordinary annuity of 1 at 8% for 5 periods 3.993

PV of 1 at 8% for 2 periods 0.857

PV of an ordinary annuity of 1 at 8% for 2 periods 1.783

Questions:

3.1 Carrying amount of Right of use asset -12/31/23 Financial statement? ________________________

3.2 Carrying amount of Lease liability -Jan. 1, 2026 after remeasurement? _______________________

3.3 Depreciation expense -12/31/2026 Financial statement? _________________________

*Round-off two decimal places

* Deadline : June 21 ; 10:00 pm.

You might also like

- Chapter 02 Outline - Modern Real Estate Practice, 18th EditionDocument4 pagesChapter 02 Outline - Modern Real Estate Practice, 18th Editionmyname1015100% (1)

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Answer: C - 465,000Document9 pagesAnswer: C - 465,000kyle G50% (2)

- Example Exercise Lease Acctg With AnsDocument28 pagesExample Exercise Lease Acctg With AnsPrince Avena AquinoNo ratings yet

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocument3 pagesSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacNo ratings yet

- Orca Share Media1577676523240Document4 pagesOrca Share Media1577676523240Jayr BVNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- WeWork Pitch Deck Series D PDFDocument51 pagesWeWork Pitch Deck Series D PDFdont-wantNo ratings yet

- Compressed Notes On SPP & Architect's GuidelinesDocument65 pagesCompressed Notes On SPP & Architect's GuidelinesManny Inocencio100% (12)

- Activity Lease Part 1Document1 pageActivity Lease Part 1Eric GuapinNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- IA2 AssignmentDocument2 pagesIA2 AssignmentJobelle Marie MahNo ratings yet

- SEATWORK - Chapter 11 - 16Document8 pagesSEATWORK - Chapter 11 - 16Kheajoy99 KimNo ratings yet

- MODULE 1 Midterm FAR 3 LeasesDocument31 pagesMODULE 1 Midterm FAR 3 LeasesKezNo ratings yet

- Lobrigas Unit5 Topic1 AssessmentDocument3 pagesLobrigas Unit5 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Lessee Accounting: Right To Control The Use of An AssetDocument33 pagesLessee Accounting: Right To Control The Use of An AssetJohn Mark FernandoNo ratings yet

- Accounting For LeasesDocument6 pagesAccounting For LeasesJohn Ferd M. FerminNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- Finance Lease LesseeDocument11 pagesFinance Lease LesseeAngel Queen Marino SamoragaNo ratings yet

- Chapter 10 Lease AccountingDocument6 pagesChapter 10 Lease AccountingCasinas Kyana LouisseNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Assignment Ppfrs 16Document3 pagesAssignment Ppfrs 16Joseph DoctoNo ratings yet

- SW-UPDATED-Leases PrintDocument2 pagesSW-UPDATED-Leases PrintMikaela Joy FloraNo ratings yet

- Lease Accounting 2021Document5 pagesLease Accounting 2021Just JhexNo ratings yet

- Leases: Lease Part 1Document10 pagesLeases: Lease Part 1ZyxNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Leases Part 2Document40 pagesLeases Part 2Danica RamosNo ratings yet

- Operating LeaseDocument7 pagesOperating Leasesantosashleymay7No ratings yet

- Problem Solving-LeaseDocument2 pagesProblem Solving-LeasegadingancielomarieNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- Quiz 1 Leases PDFDocument4 pagesQuiz 1 Leases PDFken aysonNo ratings yet

- Lease Problem With SolutionDocument19 pagesLease Problem With SolutionJeane Mae Boo100% (1)

- 21 Finance Lease LesseeDocument3 pages21 Finance Lease LesseeTinNo ratings yet

- FAR QUIZ 1 - ProblemsDocument4 pagesFAR QUIZ 1 - ProblemsAEHYUN YENVYNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- 2 - ACG015 - Intermediate Accounting Part 3 - QuestionnaireDocument5 pages2 - ACG015 - Intermediate Accounting Part 3 - Questionnairedavis lizardaNo ratings yet

- Accounting 8 - ReviewerDocument4 pagesAccounting 8 - ReviewerAshley David AligonsaNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Leases Part 3 - Other Accounting IssuesDocument33 pagesLeases Part 3 - Other Accounting IssuesDanica RamosNo ratings yet

- Problem 1: True or FalseDocument4 pagesProblem 1: True or FalseJohn Ace Madriaga50% (6)

- FINANCE LEASE-lecture and ExercisesDocument10 pagesFINANCE LEASE-lecture and ExercisesJamie CantubaNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- Quiz Far LeaseDocument2 pagesQuiz Far Leasefrancis dungcaNo ratings yet

- Quiz On Pfrs 16 LeaseDocument4 pagesQuiz On Pfrs 16 LeaseCielo Mae Parungo56% (16)

- ACC 211 - Seventh QuizzerDocument1 pageACC 211 - Seventh QuizzerKate FernandezNo ratings yet

- Discussion Problems - Lessor AccountingDocument4 pagesDiscussion Problems - Lessor AccountingangelapearlrNo ratings yet

- Direct Financing Lease-LessorDocument2 pagesDirect Financing Lease-LessororillosachristoperjohnNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Seatwork On LeasesDocument1 pageSeatwork On Leasesmitakumo uwuNo ratings yet

- Act1106-Leased Asset-LesseeDocument2 pagesAct1106-Leased Asset-LesseeorillosachristoperjohnNo ratings yet

- LeasesDocument3 pagesLeasesAngelica Rome EnriquezNo ratings yet

- Chapter 21Document18 pagesChapter 21Ardilla Noor Paramashanti Wirahadikusuma100% (1)

- 22 Finance Lease LessorDocument3 pages22 Finance Lease LessorAllegria AlamoNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- Sales&leasebackDocument15 pagesSales&leasebackeulhiemae arong0% (1)

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Finals - SeatWorkDocument1 pageFinals - SeatWorkDan RyanNo ratings yet

- Promoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3From EverandPromoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3No ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismFrom EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismNo ratings yet

- OM Operation MGT Mod 4 Forecasting and SchedulingDocument5 pagesOM Operation MGT Mod 4 Forecasting and SchedulingEric GuapinNo ratings yet

- OM Operation Management Module Two 2Document6 pagesOM Operation Management Module Two 2Eric GuapinNo ratings yet

- Day 1 - Team BravoDocument13 pagesDay 1 - Team BravoEric GuapinNo ratings yet

- Group Work-Team BravoDocument28 pagesGroup Work-Team BravoEric GuapinNo ratings yet

- Team Bravo-Event TaskDocument7 pagesTeam Bravo-Event TaskEric GuapinNo ratings yet

- Land Title and Deeds ReviewerDocument2 pagesLand Title and Deeds ReviewerPauline Vistan Garcia100% (1)

- Lecture 1Document15 pagesLecture 1Anne AlyasNo ratings yet

- Tenancy Agreement 41 Greenwich Park Street London Se10 9ltDocument26 pagesTenancy Agreement 41 Greenwich Park Street London Se10 9ltw1933194No ratings yet

- Digest 2 Tiosejo vs. AngDocument1 pageDigest 2 Tiosejo vs. AngErvien A. MendozaNo ratings yet

- 1 LIHTC-Form-3-1 1 2021Document19 pages1 LIHTC-Form-3-1 1 2021PawPaul MccoyNo ratings yet

- Balaji Printing Solution ReportDocument10 pagesBalaji Printing Solution ReportYusuf AnsariNo ratings yet

- Fixed Asset Accounting and Management Procedures Manual: Revised December 2005 IDocument164 pagesFixed Asset Accounting and Management Procedures Manual: Revised December 2005 IDessie TarekegnNo ratings yet

- Bit Mesra M.arch SyllabusDocument22 pagesBit Mesra M.arch SyllabusniteshNo ratings yet

- Law On Property ReviewerDocument102 pagesLaw On Property ReviewerELEENAMICHAELA TORRESNo ratings yet

- Rental Listings in Roseville CA - 140 Rentals ZillowDocument1 pageRental Listings in Roseville CA - 140 Rentals ZillowChristine SparksNo ratings yet

- EU Directives SummaryDocument2 pagesEU Directives SummaryAndres HidalgoNo ratings yet

- Carmel Parking CorrespondenceDocument33 pagesCarmel Parking CorrespondenceL. A. PatersonNo ratings yet

- Spa Benchmark Report Full Year 2020Document5 pagesSpa Benchmark Report Full Year 2020Rupsayar DasNo ratings yet

- Specimen Specimen: Tenancy AgreementDocument4 pagesSpecimen Specimen: Tenancy AgreementYawson ElvisNo ratings yet

- What Types of Building Are There in Your City?Document2 pagesWhat Types of Building Are There in Your City?NganNo ratings yet

- Sublease AgreementDocument15 pagesSublease AgreementJoebell VillanuevaNo ratings yet

- Efr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYDocument22 pagesEfr Vol 57 No 4 December 2019 Addressing Housing Deficit in Nigeria Issues, Challenges and Prospects Moore BEAUTYjonathanNo ratings yet

- #Plumeria - GodrejWoods - Tower PlansDocument13 pages#Plumeria - GodrejWoods - Tower Plansprateek scrubingNo ratings yet

- Comparison..pledge, Mortgage, AntichresisDocument2 pagesComparison..pledge, Mortgage, AntichresisElfin Kenneth Puentespina0% (1)

- Hand Book For Civil EngineersDocument171 pagesHand Book For Civil EngineersWahid MarwatNo ratings yet

- Finding An Apartment ProjectDocument3 pagesFinding An Apartment Projectapi-288395661No ratings yet

- HS 330 1-1Document231 pagesHS 330 1-1MCP MarkNo ratings yet

- Caveat On Kyadondo Block 189 Plot 761Document3 pagesCaveat On Kyadondo Block 189 Plot 761SimonPrinceSemagandaNo ratings yet

- 31 PNB Vs CA, Et Al., G.R. No. 66715, Sept 18, 1990Document2 pages31 PNB Vs CA, Et Al., G.R. No. 66715, Sept 18, 1990RubenNo ratings yet

- December 2023 HomeLet Rental Index ReportDocument18 pagesDecember 2023 HomeLet Rental Index ReportjohnbullasNo ratings yet

- Pigao v. Rabanillo, 488 SCRA 547 (2006)Document9 pagesPigao v. Rabanillo, 488 SCRA 547 (2006)Carie LawyerrNo ratings yet

- 2023 Geronimo Delos Reyes OctoberDocument8 pages2023 Geronimo Delos Reyes Octoberウォーカー スカイラーNo ratings yet