Professional Documents

Culture Documents

Re Leas Able Docs Hilton Ventures 090711

Re Leas Able Docs Hilton Ventures 090711

Uploaded by

sarah127Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Re Leas Able Docs Hilton Ventures 090711

Re Leas Able Docs Hilton Ventures 090711

Uploaded by

sarah127Copyright:

Available Formats

USDA ..t..

-s:

Un....................... of AgrIcuIt...

...... Development

State OffIce

June 15, 2007

Stephen A. LaRoque, Executive Director

Piedmont Development Company, Inc.

POBox 1034

2213 Hull Road Suite 8

Kinston, NC 28503

Re; Hilton Partnership

Dear Mr. LaRoque:

We have reviewed the 5150,000.00 loan request submitted by Mark Hilton- individual and Tony

Hilton - individual for the purpose of fmancing working capital for real estate leasing business. The

business will retain 2 and create 1 jobs residents in Catawba and surrounding counties.

Based on the infonnation provided, the total project cost is 5205,000.00. This project includes working

capital needs and unit acquisition in the amount of 5205,000.00. This represents 1000.4 ofthe project

cost.

Therefore, the Intennediary Relending Program loan in the amount of$lJv.

'

VV\.1"vv

ECDC-RLF in the amount of525,OOO.OO (12.19%) and applicant contribution

will constitute 100% ofthe project cost. This also meets the 75125 criteria U"'..;"'AA ....,.,.

4274-D section 331 (b) (2).

The project based on the infonnation submitted has been classified as a Categorical Exclusion

and all applicable certifications have been received .

.wo6 Bland Road, Suita 280 Raleigh. North Carolina 27609

Phone: (019) 8734000 Fax: (018) TDD: (818) 873-2003 Web:

Commltlild to the Mute of nal CXII'JII1unHIeL

I

'l '.,

,

Please provide our office with the applicable copies of the loan documents immediately after the loan

for Mark Hilton- individual and Tony Hilton - individual has been closed.

Sincerely,

GEORGE L. VITAL

Business Program Specialist

Attachments

PDC

Piedmont Development Company, loc. PO Bos 1034 Kinston, N.C. 18503

Phone 251-527-3399 Fax 151-517-3799

June 15, 2007

Mr. George Vital

USDA Rural Development

Suite 260

4405 Bland Road

Raleigh, NC 27609

Dear Mr. Vital:

Re: Hilton Partnership

I am submitting documentation for a $150,000.00 IRP loan request by Hilton Partnership. This

is a real estate investment partnership located at 1351 Northern Drive. Conover, Catawba

County, NC. Loan funds will be used for the purchase of 41 mobile home rental units. This

loan will accompany an additional loan from ECDC for $25,000.00. These loans will account for

85% of the total project costs. The borrower is Hilton Partnership. They have been in this

business since2002. This loan will create one new job and save two existing jobs for a total of

three jobs. .

The project is located in and will serve a rural area as defined by Rural Business Cooperative

Service. The proceeds will be used for an eligible project that complies with Rural Business

Cooperative Service statutes, and regulations. We have determined that no conflict of interest

exists between the borrower, Rural Business Cooperative Service, and East Carolina

Development Company, Inc.

The Board of Directors of Piedmont Development Development Company, Inc. has approved

this loan as submitted to

amount of $150,000

new job.

I am on this loan to the applicant in the

five years. This loan will help create 3

Sincerely,

East carolina Development Company, Inc. is an equal opportunity lender.

IRP-16

Stephen LaRoque

Executive Director

enclosures

East Carolina Development Company. Inc. is an equal opportunity lender.

IRP16

o

o

.'

FORM 1940 - 20

C. 117 (6)

REQUEST FOR ENVIRONMENTAL INFORMATION

Project Name _____ ______

Location 1351 Northern Drive, Conover, NC

Item 1a. Has a Federal, State, or Local Environmental Statement or Analysis been prepared for

this project 0 Yes No

1b. If "No", provide the information requested in instructions as EXHIBIT I.

Item 2. The State Historic Preservation Officer (SHPO) has been provided a detailed project

description and has been requested to submit comments to the appropriate FmHA Office.

Yes @ Date description submitted to SHPO

(...J

eJ

f"k'"1 ay,ittf

Item 3. Are any of the following land uses or environmental resources either to be effected by the

proposal or located within or adjacent to the project site(s)? (Check appropriate box for

every item of the checklist).

Yes No Unknown

1 Industrial

0

Iv!

0

2 Commercial

0 0 0

3 Residential [2j

0 0

4 Agricultural

0

[2J

0

5 Grazing

0

Iv!

0

6 Mining, Quarrying

0 0 0

7 Forests

0

I vi

0

8 Recreational

0

Ivl

0

9 Transportation

0 U2J 0

10 Parks

0 ua 0

11 Hospitals

0 U2J 0

12 Schools

0

Ivl

0

13 Open Spaces

0

Ivl

0

14 Aquifer Recharge Area

0

Ivl

0

15 Steep Slopes

0 U2l 0

16 Wildlife Refuge

0

Iv!

0

17 Shoreline

0 0 0

o

Yes No Unknown

18 Beaches

D 0 D

19 Dunes

D

[2J

D

20 Estuary

D G2J D

21 Wetlands

D

Ivl

D

22 Floodplain

D

Ivl

D

23 Wilderness

D ~ D

(designated or proposed under the Wilderness Act)

24 Wild or Scenic River

D ~ D

(proposed or designated under the Wild and

Scenic Rivers Act)

25 Historical, Archeological Sites

D ~ D

(Listed on the National Registry of Historic Places

or which may be eligible for listing)

26 Critical Habitats

D

[Z]

D

(endangered/threatened species)

27 Wildlife

D

[2]

D

28 Air Quality

D

Ivl

D

29 Solid Waste management

D

[ZJ

D

30 Energy Supplies

D

[0

D

31 Natural Landmark

D ~ D

(Listed on National Registry of Natural Landmarks)

32 Coastal Barrier Resources System

D 0 D

Item 4. Are any facilities under your ownership, lease, or supervision to be utilized in the

accomplishment of this project, either listed or under consideration for listing on the

Environmental Protection Agency's list of Violating Facilities?

DYes IXI No

~ ~

OS/24/07

~ M a r k Hilton (Date)

o

Position 3

USDA-FmHA

1. Description

Form FmHA 1940-22 a. Name of Project:

(Rev. 6-88)

Hilton Partnership

b. Project Number:

Piedmont Development

ENVIRONMENTAL CHECKLIST FOR RBEGIIRP

CATEGORICAL EXCLUSIONS

c. Location:

Conover, NC

2. Protected Resources

For the below listed land uses or environmental resources, the undersigned

has checked Column A to indicate those that are present within the site(s) of the

proposed action. Column B has been checked for those that are within the

action's area of environmental impact, such as the areas adjacent to the

proposed site(s). Column C has been checked for those land uses and environ

mental resources that will be affected by the proposed action, as defined in

Section 1940.317. (Check appropriate box or circle, as provided. If a check

appears in any circle in column A, B, or C, the environmental assessment for

a Class I action must be completed).

a. Wetlands .........................................................................................

b. Floodplains with existing structure( s) ............... __ .................... __ . __ .. __ ...... _

c. Floodplains without existing structure(s)

d. Wilderness (designated or proposed under the Wilderness Act) ..... ______.... __ .

e. Wild or Scenic River (proposed or designated under the Wild and .................

Scenic Rivers Act)

f. Historical, Archeological Sites (listed on the National Register

Historic Places or which may be eligible for listing)

g. Critical Habitat or Endangered/Threatened Species (listed or proposed) .. __ ..

h. Coastal Barrier included in Coastal Barrier Resources System ..................._

Natural Landmark (listed on National Registry ofNatural Landmarks) .........

j.

Important Farmlands .. __ .. _ ...... __ . __ ....___.................. _...... __ .. __ .................... _

k. Prime Forest Lands... _ ........................................ ___........ ___ ........ ____ .... __

I. Prime Rangeland ............. --..................- ......----- ...... - ................. - .....

m. Approved Coastal Zone Management Area __ ....................... __ ................ __

n. Sole Source Aquifer Recharge Area ......................................................

(designated by Environmental Protection Agency)

o. State Water Quality Standard .............................................................

.A..

Located on

Proposed

Site(s)

Yes No

0 ~

0 ~

0 ~

0

~

0

~

0

0

~

0 ~

0 ~

0 ~

0 ~

0 ~

0

~

0

~

.a .c.

Located within Affected by

Actions's Area of

Proposed

Environmental

Impact

Action

Yes No Yes No

0 ~ 0 ~

0 ~ 0

~

0 ~ 0 ~

0 ~ 0 ~

0 ~ 0 ~

0 0

0 ~ 0 ~

0 ~ 0 ~

0 ~ 0 ~

0 ~ 0 ~

0 ~ 0 ~

0 ~ 0 ~

0 ~ 0

~

0 ~ 0 ~

0

..

Page 2

o

3. Compliance With Highly Erodible Land and Wetland Conservation Requirements

DYes No This action is subject to the highly erodible land and wetland conservation requirements contained in Exhibit

M of FmHA Instruction 1940-G.

If "yes' is checked, complete (a), (b), (c), and (d).

a. Attached as Exhibit __ is a completed Form SCS-CPA-026 which documents the following:

DYes D No Highly erodible land is present on the farm property.

DYes D No Wetland is present on the farm property.

DYes D No Converted wetland is present on the farm property.

b. DYes D No This action qualifies for the following exemption allowed under Exhibit M:

c. DYes D No The applicant must complete the following requirements prior to approval of the action in order to retain or

regain its eligibility for FmHA financial assistance:

d. 0 Yes D No Under the requirements of Exhibit M, the applicant's proposed activities are eligible for FmHA financial

assistance.

4. Finding

This proposal meets, in terms of its size and components, the criteria for a categorical exclusion as defined in Sections 1940.3 10

and 1940.317. As indicated in item 2 above, the proposal does not affect any important land uses or environmental resources

th ould subject it ion as a categorical exclusion. Finally, the proposal is neither a phase nor segment of a pro-

j ieh when vi ();:,e " mee"h"equi.emen" of a catogo.ieal oxclusion pc< Section 1940 .317 (d).

(*Signature of Preparer)

George L. Vital- Business Program

Speciali t

(Date)

Zeb Steven Byrd - Director- Business Coop. Services

(Title)

* See Section 1940.302 for listing of FmHA officials authorized to prepare this form. See Section 1940.316 for when a concurring official's signature is

required and who is authorized to sign as the concurring official. 'US.GPO 1995.655.009122512

C.114

o

NO CONFLICT OF INTEREST

BETWEEN

PIEDMONT DEVELOPMENT COMPANY, INC.

AND

HILTON PARTNERSHIP

Piedmont Development Company, Inc., and its principal officers, including immediate family holds

no legal or financial interest or influence in the ultimate recipient. Hilton Partnership

The ultimate recipient. Hilton Partnership . its principal officers. including

immediate family, hold no legal or financial interest in Piedmont Development Company. Inc.

Stephen LaRoque, Executive Director

Piedmont Development Company. Inc.

Mark Hilton

Hilton Partnership

05/24/07

(Date)

o

BANK REJECTION ANDIOR COMMITMENT LETTER

HILTON PARTNERSHIP

"The loan is not otherwise available on reasonable (Le., usual and customary) rates and terms from

private sources or other Federal, State or local program$. The intermediary and ultimate recipient

are unable to finance the proposed project from their own resources or through commercial credit

or other Federal, State, or local programs at reasonable rates and terms."

Bank Rejection Letters from:

CAPITAL BANK

BANK OF GRANITE

Mark Hilton

05/24/07

(Date)

Stephen LaRoque, Executive Director

05/24/07

(Date)

o

RIGHT TO REQUEST SPECIFIC REASONS FOR CREDIT DENIAL

May 29,2007

RE: Commercial Loan Request

Application Date: April 25, 2007

Amount: $205,000.00

Purpose: To purchase 41 mobile homes

Collateral: 41 individual mobile homes

Dear Mark Hilton:, :'.

Thank you for applying to us for the above referenced loan request. After carefully reviewing your

application, we are sorry to advise you that we cannot grant a loan to you at this time.

If you would like a statement of specific reasons why your application was denied, please contact our

compliance officer at the address listed below. We will provide you with the statement of reasons within

30 days after receiving your request.

Capital Bank

Attn: TERESA GRIGSBY

333 Fayetteville Street, Suite 400

Raleigh, NC 27601

(919) 645-6370

D We obtained information from a consumer reporting agency as part of our consideration of your

application, its name, address, and toll free number is listed below. The reporting agency played no

part in our decision and is unable to supply specific reasons why we have denied credit to you. You

have the right under the Fair Credit Reporting Act to know the information contained in your credit file

at the consumer reporting agency. You have a right to a free copy of your report from the reporting

agency, if you request it no later than 60 days after you receive this notice. In addition, if you find that

any information contained in the report you receive is inaccurate or incomplete, you have the right to

dispute the matter with the reporting agency. You can find out about the information contained in your

file by contacting:

D Equlfax Consumer Relations D Experlan D TransUnlon

P.O. Box 740241 P.O. Box 2002 P.O. Box 1000

Atlanta, GA 30374 Allen, TX 75013 Chester, PA 19022

(800) 685-1111 (888) 397-3742 (800) 888-4213

www.eguifax.com www.experian.com www.transunion.com

[K] Our credit decision was based In whole or in part on information obtained from an affiliate or from an

outside source other than a consumer reporting agency. Under the Fair Credit Reporting Act, you have

the right to make a written request, no later than sixty (60) days after you received this notice, for

disclosure of the nature of this information.

Name: M. Kent Walker Title: Commercial Relationship Mgr.

EQUAL CREDIT OPPORTUNITY ACT NOTICE

The federal Equal Credit Opportunity Act prohibits creditors from discrimination against credit applicants

on the basis of race, color, religion, national origin, sex marital status, age (provided the applicant has the

capacity to enter into a binding contract); because all or part of the applicant's income derives from any

public assistance program; or because the applicant has in good faith exercised any right under the

Consumer Credit Protection Act. The federal agency that administers compliance with this law

concerning this creditor is:

FDIC Consumer Response Center

2345 Grand Ave

Suite 100

Kansas City, MO 64108

o NOTICE OF ACTION TAKEN {}

PRINCIPAL FOR CREDIT DENIAL, TERMltIn"ION, CHANGE

OR OTHER ACTION TAKEN CONCERNING CREDIT

BANK OF GRANITE Date 5/29/07

Address

PO Box 1567

Conover NC 28613

Applicant Mark K Hilton NOTICE: The federal Equal Opportunity Act prohibits creditors from discriminating

Applicant

against credit applicants on the basis of race, color, religion, national origin, sex,

Mailing Address

City. State. Zip

1351 Northern Dr NW

Conover NC 28613

marital status, age (provided the applicant has the capacity to enter into a binding

contract); because all or part of the applicant's income derives from any public

assistance program; or because the applicant has in good faith exercised any right

under the Consumer Credit Protection Act. The federal agency that administers

compliance with this law concerning this creditor is

Federal Deposit Insurance Corporation

Consumer Response Center

2345 Grand Boulevard, Suite 100

Kansas City, Missouri 64108

Thank you for your application.

Description of Account, Transaction, or Requested Credit Loan to purchase mobile homes

Based on your application. we must inform you that

o We are unable to make a decision on your application because the following information is missing

Please provide the requested information to us by so that we may give your application further consideration.

o We are unable to offer you credit on the terms that you requested. We can, however, offer you credit on the following terms

If this offer is acceptable to you, please notify us by

[8] We regret that we are unable to approve your request for the following reason(s):

o Credit application incomplete 0 Length of employment o No credit file

o Insufficient number of credit 0 Unable to verify employment o Limited credit experience

references provided 0 Temporary or irregular employment o Poor credit performance with us

o Unacceptable type of credit 0 Unable to verify income o Delinquent past or present credit obligations

references provided 0 Income inSUfficient for amount with others

o Unable to verify credit references of credit requested o Garnishment, attachment, foreclosure, repossession,

o Length of residence 0 Excessive obligations in relation collection action or judgement

o Temporary residence to income o Bankruptcy

o Unable to verify residence 0 Sufficient unsecured credit for o Slow or past due in trade or loan payments

reported income

[8] Value or type of collateral not sufficient

o Other, specify

If you have any questions regarding this notice, you should contact Vicki A Lovett

Telephone 828-464-4539

o Our credit decision was based in whole or in part on information obtained in a report from the consumer reporting agency listed below. You have a

right under the Fair Credit Reporting Act to know the information contained in your credit file at the consumer reporting agency. The reporting agency

played no part in our deCision and is unable to supply specific reasons why we have denied credit to you. You also have a right to a free copy of your

report from the reporting agency. if you request it no later than 60 days after you receive this notice. In addition, if you find any information contained in

the report that you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency.

Name: EaUIFAX CREDIT INFORMATION SERVICES, INC.

Address: 1150 Lake Hearn Drive Suite 460, Atlanta, GA 30374-0241

Telephone: 1-800-685-1111

o Our credit decision was based in whole or in part on information obtained from an affiliate or from an outside source other than a consumer reporting

agency. Under the Fair Credit Reporting Act, you have the right to make a written request, no later than 60 days after you receive this notice, for

disclosure of the nature of this information.

o NOTICE OF RIGHT TO RECEIVE COPY OF APPRAISAL

You have the right to a copy of the appraisal report used in connection with your application for credit. If you wish to receive a copy, please write to us at

the mailing address we have provided. We must hear from you no later than 90 days after we notify you about the action taken on your credit

application or your withdrawal of your application. In your letter, include the following information: date of application, name(s) of loan applicant(s).

property address, and your current mailing address.

o

FORM 1940 - Q

LOBBYING FORM

BETWEEN

PIEDMONT DEVELOPMENT COMPANY, INC.

AND

HILTON PARTNERSHIP

The undersigned states that to the best of his or her knowledge and belief that if any funds have

been paid or will be paid to any person for influencing or attempting to influence an officer or

employee of any agency, a Member of Congress, or an employee of a Member of Congress in

connection with this commitment providing for the United States to insure or guarantee a loan, the

undersigned shall complete and submit Standard Form-LLL, "Disclosure Form to Report Lobbying,"

in accordance with its instructions.

Submission of this statement is a prerequisite for making or entering into this transaction imposed

by section 1352, title 31, US Code. Any person who fails to file the required statement shall be

subject to a civil penalty of not less than $10,000 and not more than $100,000 for each such failure.

Mark Hilton

Piedmont Development Company, Inc. Hilton Partnership

~ ~ , ~

05/24/07

(Date)

C.114

o

NO CONFLICT OF INTEREST

BETWEEN

PIEDMONT DEVELOPMENT COMPANY, INC.

AND

HILTON PARTNERSHIP

Piedmont Development Company, Inc., and its principal officers, including immediate family holds

no legal or financial interest or influence in the ultimate recipient. Hilton Partnership

The ultimate recipient, Hilton Partnership , its principal officers, including

immediate family, hold no legal or financial interest in Piedmont Development Company, Inc.

~

Piedmont Development Company, Inc.

Mark Hilton

Hilton Partnership

05/24/07

(Date)

o

C,128

CERTIFICATION OF ELIGIBILITY AND COMPLIANCE

BETWEEN

EAST CAROLINA DEVELOPMENT COMPANY, INC.

AND

HILTON PARTNERSHIP

Piedmont Development Company, Inc., hereby certifies that Hilton Partnership

is an eligible recipient. the proposed loan is for eligible purposes, and the proposed loan complies

with all applicable statutes and regulations.

~

Piedmont Development Company, Inc.

Mark Hilton

Hilton Partnership

05/24/07

(Date)

o

C. 118 (A) (7) (IV)

CERTIFICATION OF FLOOD PLAIN STATUS

The undersigned hereby certifies that the property to be purchased and or collateralized by the

proposed loan is not located in a flood hazard zone as defined by the US Department of Housing

and Urban Development.

05/24/07

Mark Hilton (Date)

Hilton Partnership

o

o

RURAL CERTIFICATION

The undersigned hereby certifies that the assistance requested in the application will be used to

carry out activities or projects located in or servicing residents of a rural area. "Rural Area" shall

mean all territory of a state that is not within the outer boundary of any city having a population of

twenty-five thousand or more and its immediate adjacent urban area with a population density of

more than one hundred persons per square mile as determined by the Secretary of Agriculture

according to the latest Decennial Census.

Stephen LaRoque, Executive Director

Piedmont Development Company, Inc.

Mark Hilton

Hilton Partnership

05/24/07

(Date)

o

o

C. 117 (C)

NONDISCRIMINATION CERTIFICATION

The undersigned does hereby certify that the applicant organization does not deny services,

employment, or membership to persons based on political preference, race, religion, age, sex,

sexual preference, disability, or marital status.

05/24/07

Mark Hilton (Date)

Hilton Partnership

o

CITIZENSHIP CERTIFICATION

I hereby certify that I am a United States Citizen.

05/24/07

Mark Hilton (Date)

Hilton Partnership

You might also like

- Brewery Business Plan PDFDocument25 pagesBrewery Business Plan PDFZamir Hades100% (2)

- Green Island Nature Reserve and Recreational AreaDocument12 pagesGreen Island Nature Reserve and Recreational AreaMary LandersNo ratings yet

- Kalinowski V Blue Wave Et Al CompliantDocument10 pagesKalinowski V Blue Wave Et Al CompliantZachary DeLucaNo ratings yet

- Retaining Wall DetailDocument9 pagesRetaining Wall DetailRonald KahoraNo ratings yet

- DMC 2007-11 PDFDocument14 pagesDMC 2007-11 PDFMarch Ellene100% (1)

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Design Thinking and Innovation at AppleDocument15 pagesDesign Thinking and Innovation at AppleAmit Chaudhary100% (1)

- The Voice of The MountainDocument46 pagesThe Voice of The MountainSG Valdez0% (1)

- La Brea Initial Study - Negative DeclarationDocument25 pagesLa Brea Initial Study - Negative DeclarationMatt BaumeNo ratings yet

- Growing Greener II ReportDocument132 pagesGrowing Greener II ReportPAHouseGOPNo ratings yet

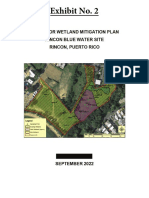

- Exhibit 2 - Wetland Mitigation Plan - Calrincon Corp Vs EPADocument13 pagesExhibit 2 - Wetland Mitigation Plan - Calrincon Corp Vs EPALa Isla OesteNo ratings yet

- Tioga Southern Tier RFA STAIEP-011516 FinalDocument14 pagesTioga Southern Tier RFA STAIEP-011516 FinalCody DemingNo ratings yet

- 2004-3 City Internal Payments 9.27.2007Document15 pages2004-3 City Internal Payments 9.27.2007Brian DaviesNo ratings yet

- Enp Mock Exam-Part 4Document202 pagesEnp Mock Exam-Part 4Wacky Amora ValenciaNo ratings yet

- 2004-3 Area 2 MR Construction Agreement. 10.16.2006pdfDocument34 pages2004-3 Area 2 MR Construction Agreement. 10.16.2006pdfBrian DaviesNo ratings yet

- Friday, August 12, 2011 MemosDocument32 pagesFriday, August 12, 2011 MemosDallasObserverNo ratings yet

- 005 RP en - 3Document35 pages005 RP en - 3Nouman Alam SiddiquiNo ratings yet

- Lanesboro Stone Dam RepairDocument5 pagesLanesboro Stone Dam RepairSenateDFLNo ratings yet

- Petition For Writ of Mandate and Complaint For Injunctive and Declaratory ReliefDocument30 pagesPetition For Writ of Mandate and Complaint For Injunctive and Declaratory ReliefAmanda Kay RhoadesNo ratings yet

- JCRA JR Transportation Berry Lane PKDocument50 pagesJCRA JR Transportation Berry Lane PKDale HardmanNo ratings yet

- MacFarlane v. City of DenverDocument14 pagesMacFarlane v. City of DenverMichael_Lee_RobertsNo ratings yet

- Post Disaster AnalysisDocument43 pagesPost Disaster AnalysisShiene MarieNo ratings yet

- LTR 12.18Document5 pagesLTR 12.18Brian DaviesNo ratings yet

- GHCDC MAD SCI Engeneers ReportDocument117 pagesGHCDC MAD SCI Engeneers ReportGGHMADNo ratings yet

- Wilderness Battlefield Coalition Letter To Orange County Planning CommissionDocument6 pagesWilderness Battlefield Coalition Letter To Orange County Planning CommissionpecvaNo ratings yet

- 1/21 Lucerne LIMDocument37 pages1/21 Lucerne LIMEva LeongNo ratings yet

- BGW - EIA Scoping Report - 20200714Document231 pagesBGW - EIA Scoping Report - 20200714Nasir AryaniNo ratings yet

- Four Lakes Task Force Recovery Restoration Plan 9.10.2020Document18 pagesFour Lakes Task Force Recovery Restoration Plan 9.10.2020Devon Louise KesslerNo ratings yet

- Revelstoke Craft Distillery ApplicationDocument33 pagesRevelstoke Craft Distillery ApplicationAlexCooperRTRNo ratings yet

- Rover Pipeline Public CommentsDocument366 pagesRover Pipeline Public CommentsWilliam BempNo ratings yet

- 823412-LIM - Land Information Memorandum 27 SequoiaDocument38 pages823412-LIM - Land Information Memorandum 27 SequoiaEva LeongNo ratings yet

- Answer - Hidden EP Quiz 11Document15 pagesAnswer - Hidden EP Quiz 11Reymond IgayaNo ratings yet

- Hidden EP Quiz 11Document12 pagesHidden EP Quiz 11Reymond IgayaNo ratings yet

- YESAB's 2018 Decision Regarding Placer Project in Indian River WatershedDocument50 pagesYESAB's 2018 Decision Regarding Placer Project in Indian River WatershedThe NarwhalNo ratings yet

- CPV Prairie Dock Solar SUP Application Filing 09.14.2022Document406 pagesCPV Prairie Dock Solar SUP Application Filing 09.14.2022ЛазарВесићNo ratings yet

- CMS Report 1 PDFDocument24 pagesCMS Report 1 PDFRecordTrac - City of OaklandNo ratings yet

- Watersmart: Water and Energy Efficiency Grants: FY Funding Opportunity Announcement#: Bor-Do-F0LlDocument22 pagesWatersmart: Water and Energy Efficiency Grants: FY Funding Opportunity Announcement#: Bor-Do-F0LlShannanAdamsNo ratings yet

- Special People V CandaDocument5 pagesSpecial People V CandaTom SumawayNo ratings yet

- ReportDocument7 pagesReportRecordTrac - City of OaklandNo ratings yet

- Council Report On Proposed Kangaroo Flat SubdivisionDocument20 pagesCouncil Report On Proposed Kangaroo Flat SubdivisionJoe HinchliffeNo ratings yet

- 2-Planning Justification ReportDocument52 pages2-Planning Justification ReportWajidSyedNo ratings yet

- 1477 Policy Framework For CompDocument33 pages1477 Policy Framework For CompNhung PhamNo ratings yet

- Gulf Restoration Network LawsuitDocument38 pagesGulf Restoration Network LawsuitabossoneNo ratings yet

- Print Preview - Final Application: Project Name and LocationDocument34 pagesPrint Preview - Final Application: Project Name and LocationRyan SloanNo ratings yet

- Staff Report - Tax Reimbursement Agreement - NWQ LLC NT EditsDocument5 pagesStaff Report - Tax Reimbursement Agreement - NWQ LLC NT EditsThe Salt Lake TribuneNo ratings yet

- House Hearing, 112TH Congress - Richard H. Poff Federal Building Renovation: Is It Costing The Taxpayer Too Much?Document59 pagesHouse Hearing, 112TH Congress - Richard H. Poff Federal Building Renovation: Is It Costing The Taxpayer Too Much?Scribd Government DocsNo ratings yet

- Sample Non-Construction Project Narrative: Digital Aerial Photography of The XYZ CoastDocument11 pagesSample Non-Construction Project Narrative: Digital Aerial Photography of The XYZ CoastKenPyMellizaNo ratings yet

- Pacific Region: Application Form Type (Select Only One Type)Document5 pagesPacific Region: Application Form Type (Select Only One Type)mizz_chettonkNo ratings yet

- Community Involvement Plan, Updated October 2011Document25 pagesCommunity Involvement Plan, Updated October 2011EPA Region 7 (Midwest)No ratings yet

- Report of The Joint Review Panel: Site C Clean Energy ProjectDocument471 pagesReport of The Joint Review Panel: Site C Clean Energy ProjectThe Globe and Mail100% (1)

- TC3 Residents TC3 Residents: Please Note: Page 14 Added After The Presentation Took PlaceDocument16 pagesTC3 Residents TC3 Residents: Please Note: Page 14 Added After The Presentation Took PlaceBill GinivanNo ratings yet

- 110307-4 - Drainage Report86187Document245 pages110307-4 - Drainage Report86187Brandon J. HuffmanNo ratings yet

- Angel Court - 2009 VADocument162 pagesAngel Court - 2009 VADavid LayfieldNo ratings yet

- HUD Environmental AssessmentDocument58 pagesHUD Environmental AssessmentIndiana Public Media NewsNo ratings yet

- SRH-1D Users Manual 3 - 0Document227 pagesSRH-1D Users Manual 3 - 0skylineshareNo ratings yet

- Biz Park Info Cambridge Gen Ctte Jan 7 2013Document39 pagesBiz Park Info Cambridge Gen Ctte Jan 7 2013WR_RecordNo ratings yet

- Flood ApDocument62 pagesFlood ApAnthony VegaNo ratings yet

- Binder3 - Kalb Responsive Records PDFDocument142 pagesBinder3 - Kalb Responsive Records PDFRecordTrac - City of OaklandNo ratings yet

- Initial Study and Environmental Review ChecklistDocument21 pagesInitial Study and Environmental Review ChecklistRecordTrac - City of OaklandNo ratings yet

- OMB Decision On PL110080Document22 pagesOMB Decision On PL110080mikeboosNo ratings yet

- The Community Preservation Act in Northampton Summary, 11-3-11Document5 pagesThe Community Preservation Act in Northampton Summary, 11-3-11Adam Rabb CohenNo ratings yet

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of ChinaNo ratings yet

- Reviving Lakes and Wetlands in People's Republic of China, Volume 3: Best Practices and Prospects for the Sanjiang Plain WetlandsFrom EverandReviving Lakes and Wetlands in People's Republic of China, Volume 3: Best Practices and Prospects for the Sanjiang Plain WetlandsNo ratings yet

- ??? Chris "The Legend" Sain - Journey To $100kDocument9 pages??? Chris "The Legend" Sain - Journey To $100kengkjNo ratings yet

- St. Joseph School of Baliuag: 2. Risk-TakerDocument2 pagesSt. Joseph School of Baliuag: 2. Risk-TakerRosette CapillasNo ratings yet

- Fundamentals of Human Resource Management: Decenzo and RobbinsDocument16 pagesFundamentals of Human Resource Management: Decenzo and RobbinsShihab Ansari AzharNo ratings yet

- Past Year Acw 482 - Analysis and Development of Accounting Information System June 08Document7 pagesPast Year Acw 482 - Analysis and Development of Accounting Information System June 08Nabila69No ratings yet

- Module 2 Contemporary WorldDocument10 pagesModule 2 Contemporary WorldMaevel CantigaNo ratings yet

- Atmega8 Uc: Uart !!!Document16 pagesAtmega8 Uc: Uart !!!malhiavtarsinghNo ratings yet

- AMV Convert InstructionDocument6 pagesAMV Convert Instructionchilly111No ratings yet

- Charles - 2002 - Internal Erosion in European Embankment Dams PDFDocument16 pagesCharles - 2002 - Internal Erosion in European Embankment Dams PDFrabhishekpatNo ratings yet

- Statellite Communication NotesDocument50 pagesStatellite Communication Notessathish14singhNo ratings yet

- Customer Service For Fire DeptsDocument81 pagesCustomer Service For Fire Deptstrinhvonga7289No ratings yet

- Hazards and Risks 8Document22 pagesHazards and Risks 8Judith Bernadez-EspenidoNo ratings yet

- Empowerment of Rural Women Through Micro Finance and Activities of Self Help GroupDocument3 pagesEmpowerment of Rural Women Through Micro Finance and Activities of Self Help GroupEditor IJARSHNo ratings yet

- Establishing A Continuous Professional Learning Culture-Shanaye Packineau-WilliamsDocument6 pagesEstablishing A Continuous Professional Learning Culture-Shanaye Packineau-Williamsapi-529462240No ratings yet

- Manual HF GeneratorsDocument50 pagesManual HF GeneratorsHưng Phạm VănNo ratings yet

- WRM Paper Nov 29 17 PDFDocument12 pagesWRM Paper Nov 29 17 PDFSuraj VedpathakNo ratings yet

- Osu! Keyboard: Step 1: Materials and ExplanationsDocument14 pagesOsu! Keyboard: Step 1: Materials and ExplanationsCata LystNo ratings yet

- ORACLE Security Solution: Ray ShihDocument71 pagesORACLE Security Solution: Ray ShihabidouNo ratings yet

- Gssi Radan 7 ManualDocument273 pagesGssi Radan 7 ManualMD. NASIF HOSSAIN IMONNo ratings yet

- Unit 12 Strategic Option PDFDocument15 pagesUnit 12 Strategic Option PDFPradip HamalNo ratings yet

- AutoCAD 2020 Brochure PDFDocument2 pagesAutoCAD 2020 Brochure PDFVictor KlassenNo ratings yet

- Motion To Dismiss ChargesDocument61 pagesMotion To Dismiss ChargesTim KnaussNo ratings yet

- Computational Science Iccs 2018 2018 2Document881 pagesComputational Science Iccs 2018 2018 2nabeelkhaliq323No ratings yet

- SENPLUSDocument178 pagesSENPLUSNateshNo ratings yet

- 1.12 Anitei Craif Model de Diagnoză A Culturii OrganizaţionaleDocument17 pages1.12 Anitei Craif Model de Diagnoză A Culturii OrganizaţionaleOana Mateescu100% (1)

- The $25,000,000,000 Eigenvector: The Linear Algebra Behind GoogleDocument13 pagesThe $25,000,000,000 Eigenvector: The Linear Algebra Behind Googlebob sedgeNo ratings yet

- Shimogga District Forest Working Plan2001-2002 Sagar Division PDFDocument367 pagesShimogga District Forest Working Plan2001-2002 Sagar Division PDFVeerendra R Patil AdvocateNo ratings yet