Professional Documents

Culture Documents

Asmeret Meles Anneoxotion

Asmeret Meles Anneoxotion

Uploaded by

nigussieabagazCopyright:

Available Formats

You might also like

- Zlib - Pub Supply Chain Management For EngineersDocument234 pagesZlib - Pub Supply Chain Management For EngineersMohit kapoorNo ratings yet

- Chapter 2 Audit of Receivables and SalesDocument19 pagesChapter 2 Audit of Receivables and SalesKez MaxNo ratings yet

- Chandni Devani Co-Operative Banking Its Credit Appraisal MechanismDocument20 pagesChandni Devani Co-Operative Banking Its Credit Appraisal MechanismManasi VichareNo ratings yet

- Credit Management Overview and Principles of LendingDocument44 pagesCredit Management Overview and Principles of LendingTavneet Singh100% (2)

- The History of MontblancDocument4 pagesThe History of MontblancRajiv EtcNo ratings yet

- Advertising Age - Hispanic Fact PackDocument31 pagesAdvertising Age - Hispanic Fact Packdrummestudcom0% (1)

- Abebe MengistuDocument8 pagesAbebe MengistunigussieabagazNo ratings yet

- Double S PLC-Annex - OD-Renw-Apr-2023Document7 pagesDouble S PLC-Annex - OD-Renw-Apr-2023nigussieabagazNo ratings yet

- TangomalkDocument6 pagesTangomalknigussieabagazNo ratings yet

- Annex 2323Document8 pagesAnnex 2323nigussieabagazNo ratings yet

- Credit Appraisal & Port. MGT Laf No. Wb/Crm/Nd/0044/23Document7 pagesCredit Appraisal & Port. MGT Laf No. Wb/Crm/Nd/0044/23nigussieabagazNo ratings yet

- Andualem AnnexDocument7 pagesAndualem AnnexnigussieabagazNo ratings yet

- AMT Trading PLC 2024Document9 pagesAMT Trading PLC 2024nigussieabagazNo ratings yet

- AnnexDocument9 pagesAnnexnigussieabagazNo ratings yet

- Meskerem Kidane FinalDocument16 pagesMeskerem Kidane FinallikmezekerNo ratings yet

- Azmeraw AnnexDocument14 pagesAzmeraw AnnexnigussieabagazNo ratings yet

- GoushDocument12 pagesGoushnigussieabagazNo ratings yet

- AnnexDocument10 pagesAnnexnigussieabagazNo ratings yet

- Export 2Document13 pagesExport 2nigussieabagazNo ratings yet

- RamaraDocument11 pagesRamaranigussieabagazNo ratings yet

- E MedhinDocument9 pagesE MedhinnigussieabagazNo ratings yet

- AbatneheDocument13 pagesAbatnehenigussieabagazNo ratings yet

- Annex Desalegn2 Onetime Pre ShipmentDocument12 pagesAnnex Desalegn2 Onetime Pre ShipmentnigussieabagazNo ratings yet

- BazetoDocument13 pagesBazetonigussieabagazNo ratings yet

- AfroDocument5 pagesAfronigussieabagazNo ratings yet

- Muhaba ShewmoloDocument11 pagesMuhaba Shewmolosabrinzo zomaNo ratings yet

- Bisrat TadesseDocument9 pagesBisrat TadessenigussieabagazNo ratings yet

- Abel DanielDocument7 pagesAbel Danielfirehiwotmisganaw3No ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- Functional TrainingDocument46 pagesFunctional TrainingRaushan KumarNo ratings yet

- Cpfdac Loan Application Form IDocument6 pagesCpfdac Loan Application Form IMayita Calderon GómezNo ratings yet

- AHMEE00735693Document2 pagesAHMEE00735693mrfaster04757No ratings yet

- Hinglaj Light Renewal 2018Document4 pagesHinglaj Light Renewal 2018jitendra tirthyaniNo ratings yet

- Credit ManagementDocument13 pagesCredit ManagementAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- GCC 2013-14Document7 pagesGCC 2013-14Noble MeshakNo ratings yet

- Training On NBE Directives and Enat Credit OperationDocument61 pagesTraining On NBE Directives and Enat Credit Operationaddisu bezaNo ratings yet

- Escrow Account Request LetterDocument5 pagesEscrow Account Request LetterAnpriya BalodhiNo ratings yet

- Firehiwote Shimelis Follow Up-1Document21 pagesFirehiwote Shimelis Follow Up-1Melak YizengawNo ratings yet

- BEFTNDocument2 pagesBEFTNAyren Jahan BinduNo ratings yet

- Insta Loan Application Form UpdateDocument1 pageInsta Loan Application Form UpdateMd Abed Ur RahmanNo ratings yet

- Annex APPEALDocument4 pagesAnnex APPEALnigussieabagazNo ratings yet

- Cash Credit (H), Loan Procedure Over National Bank Limited, Khulna BranchDocument19 pagesCash Credit (H), Loan Procedure Over National Bank Limited, Khulna BranchShuvro Kumar Paul50% (2)

- Daily Accounts Sheet - 2021 - KAVDocument3 pagesDaily Accounts Sheet - 2021 - KAVvictoriavows8No ratings yet

- Test Your Progress BookDocument14 pagesTest Your Progress BookarunapecNo ratings yet

- Wa0022.Document8 pagesWa0022.viphainhumNo ratings yet

- Original: Your Credit Score and The Price You Pay For CreditDocument26 pagesOriginal: Your Credit Score and The Price You Pay For CreditMaritza CardonaNo ratings yet

- Guideline MudarabalequidityDocument5 pagesGuideline MudarabalequidityIslam BankNo ratings yet

- Client Account Course Workbook: Version: 2021-001 Last Modified: December 23, 2021Document29 pagesClient Account Course Workbook: Version: 2021-001 Last Modified: December 23, 2021Agamveer GillNo ratings yet

- Understanding The Credit Department of A BankDocument6 pagesUnderstanding The Credit Department of A Bankzubair07077371No ratings yet

- Draft CA Formats For SubmissionDocument4 pagesDraft CA Formats For SubmissionAnpriya BalodhiNo ratings yet

- 149389131Document1 page149389131sandeepsharmaocmdual2022No ratings yet

- CAR LOAN-Consolidated Guidelines 45-2021Document77 pagesCAR LOAN-Consolidated Guidelines 45-2021Sanjay GondwalNo ratings yet

- Transaction HeaderDocument3 pagesTransaction HeaderWaleed AljackNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- G K TradingDocument28 pagesG K Tradingdjpatel10No ratings yet

- Digital Customer Copy: I Confirm ThatDocument2 pagesDigital Customer Copy: I Confirm ThatTarun KumarNo ratings yet

- Annexure Ii Standardised Format For BGDocument5 pagesAnnexure Ii Standardised Format For BGNishit Marvania100% (1)

- Model DPR For End Borrower DIDF Scheme 05 Jan2018Document52 pagesModel DPR For End Borrower DIDF Scheme 05 Jan2018muthukrishnanNo ratings yet

- Promotion Practice SetDocument90 pagesPromotion Practice SetPUNEET KR MISHRANo ratings yet

- Wa0007.Document9 pagesWa0007.viphainhumNo ratings yet

- FEDGL05030000410 GPCDocument2 pagesFEDGL05030000410 GPCTarun kumarNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Ermias Lera Lenda Business PlanDocument23 pagesErmias Lera Lenda Business PlannigussieabagazNo ratings yet

- Active Outstanding Import LC - Active Outstanding Import LCDocument3 pagesActive Outstanding Import LC - Active Outstanding Import LCnigussieabagazNo ratings yet

- SPREEDSHEETDocument27 pagesSPREEDSHEETnigussieabagazNo ratings yet

- Double S PLC-Annex - OD-Renw-Apr-2023Document7 pagesDouble S PLC-Annex - OD-Renw-Apr-2023nigussieabagazNo ratings yet

- Tekle Assefa Busienss PlanDocument28 pagesTekle Assefa Busienss PlannigussieabagazNo ratings yet

- Iso 9001 2008 HindiDocument32 pagesIso 9001 2008 HindiNilesh D PatilNo ratings yet

- The Right Way To Fire Someone-HSB H02NMGDocument9 pagesThe Right Way To Fire Someone-HSB H02NMGDileep WarrierNo ratings yet

- OM-Chapter 4Document37 pagesOM-Chapter 4Almaz Getachew0% (1)

- MORE Supermarket, Little World Mall, KhargharDocument24 pagesMORE Supermarket, Little World Mall, KhargharAbhinav PrajapatiNo ratings yet

- Ferreycorp Audited Financial Statements 2020Document84 pagesFerreycorp Audited Financial Statements 2020Eduardo ArcosNo ratings yet

- Presentación de RainTree Febrero de 2023Document3 pagesPresentación de RainTree Febrero de 2023La Silla VacíaNo ratings yet

- Merchant Rates 2019 2020 Oct 2019Document11 pagesMerchant Rates 2019 2020 Oct 2019rh007No ratings yet

- Change in Designated Managing Partners & Partners (For Partnership Firms)Document25 pagesChange in Designated Managing Partners & Partners (For Partnership Firms)Sãmpãth Kûmãř kNo ratings yet

- Turcotte de Bellefeuille Den Hond 2007Document16 pagesTurcotte de Bellefeuille Den Hond 2007fleursinga16No ratings yet

- SRB Working Tarrif 2022 23Document19 pagesSRB Working Tarrif 2022 23Noman ejazNo ratings yet

- Full Download PDF of (Original PDF) Management by Christopher P. Neck All ChapterDocument43 pagesFull Download PDF of (Original PDF) Management by Christopher P. Neck All Chapterprillaaguil100% (6)

- Session 1-4 Introduction To RetailingDocument48 pagesSession 1-4 Introduction To RetailingShakeeb HashmiNo ratings yet

- NIDHI-EIR GuidelineDocument15 pagesNIDHI-EIR GuidelineAdarsh KumarNo ratings yet

- Concrete Construction Article PDF Strategic Planning For ContractorsDocument4 pagesConcrete Construction Article PDF Strategic Planning For ContractorsMohammed NizamNo ratings yet

- Leseprobe PDFDocument14 pagesLeseprobe PDFGovarthanan GopalanNo ratings yet

- Furniture & Homeware - Indonesia - Statista Market ForecastDocument13 pagesFurniture & Homeware - Indonesia - Statista Market ForecastSales InteriorquNo ratings yet

- The Opportunity: Light As A Service® Case Study: Syncreon NiederaulaDocument1 pageThe Opportunity: Light As A Service® Case Study: Syncreon NiederaulaSalah ZyadaNo ratings yet

- Muthu Resume (3) ..Document2 pagesMuthu Resume (3) ..arun kNo ratings yet

- Virtually Present Others and Their Influence On Complainants' Follow-Ups and Firm ResponseDocument15 pagesVirtually Present Others and Their Influence On Complainants' Follow-Ups and Firm ResponseAlessandro ComaiNo ratings yet

- TMOE SyllabusDocument2 pagesTMOE SyllabusDhaivat SridharNo ratings yet

- Organisation DevelopmentDocument55 pagesOrganisation DevelopmentKAYNo ratings yet

- Unibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxDocument17 pagesUnibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxMiguel RamosNo ratings yet

- Breakeven AnalysisDocument38 pagesBreakeven AnalysisJennel AbillaNo ratings yet

- 2017 Myceb Annual ReportDocument23 pages2017 Myceb Annual ReportMohamad Zaki AhmadNo ratings yet

- BobaTrader - Full Options Daytrading GuideDocument33 pagesBobaTrader - Full Options Daytrading Guideprakashrnc100% (1)

- HR C&B Senior Officer (HCB) : Job DescriptionDocument2 pagesHR C&B Senior Officer (HCB) : Job DescriptionnataliasulistyoNo ratings yet

- Adizes 1976 Mismanagement StylesDocument16 pagesAdizes 1976 Mismanagement StylesMavy BouityNo ratings yet

Asmeret Meles Anneoxotion

Asmeret Meles Anneoxotion

Uploaded by

nigussieabagazCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asmeret Meles Anneoxotion

Asmeret Meles Anneoxotion

Uploaded by

nigussieabagazCopyright:

Available Formats

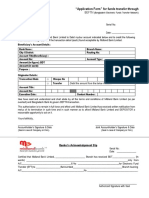

Credit Analysis & Portfolio Management

Annex for LAF No WB/CRM/038/2023

1. Applicant’s Basic Information:

Borrower/Applicant: Asmeret Melese Woldegiorgis Date Business Established: 2013 E.C

Branch: Date Credit Relationship Started:

Business Address: Wuhalimat Total Applicant’s Credit Exposure:

Region: AA City/Town: A.A. S.city: Yeka Sister Company’s Credit Exposure: Nil

Wereda: 07 H.No. 452 Credit Exposure Grand Total:

Customer Classification: Previous Credit Risk Grade:

Corporate Current Credit Risk Grade: C

Commercial Risk grade of sister company(s): NA

Reason for change of Grade (in short): -

Ownership: Sole proprietorship Collateral to loan ratio:

Business/Economic Sector: Import Credit Facility Utilization: Poor

Business type/Line: Import of vehicles and spareparts Policy Exception:

Trade License No.: YK/AA/14/672/5776427/2013 Yes No

x x

Renewed up to: 2023 If Yes state

Briefly:_______________________________

___

TIN: 0001299107 PERFORMERS :

Financial Statement: CRM : Henok Tefera

Audited up to: July 07, 2021; July 07, 2022

CA : Dawit Haile

Provisional for:

Credit Approving Committee

Auditor:

CAC –1 CAC –2 CAC –3

x

Opinion: Unqualified Qualified Disclaimer

x x x CAC –4 Loan Workout

x x

As at: 07/07/22

Paid up Capital: 10,000,000.00 Date Application Received:

By CRM :

Capital Employed: 15,937,000.00

Tangible Net Worth: Birr 15,937,000.00 By CA:

Sales :Birr 45,618,000.00 Date document Completed :-

Operating Profit ratio: 13.3% Date analysis Completed :

Net profit ratio: 8.7% Decision Date:______________________

Current Ratio: 4.5

Bank Debt/TNW ratio:-

Total liability/TNW ratio: 0.18

Net Profit/Loss: 3,971,000.00

Working Capital Requirement/Birr Sales:

2. Credit Request:

Asmeret Melese Woldegiorgis Bole Branch January 26, 2023

6

Credit Analysis & Portfolio Management

Annex for LAF No WB/CRM/038/2023

The applicant, in its letter dated 16/05/2015 E.C., has requested customs bond guarantees of

Birr 5,810,704.56 and Birr 2,700,000.00 both for a period of Birr 90 days.

3. Purpose of the Request:

Guarantee the unpaid customs bond on imported tyres in favor of Ethiopian Customs

commission.

4. Collateral:

The applicant has pledged to offer the following buildings and machineries as collateral for

the newly requested preshipment facility. These collateral are also held for the outstanding

credit facilities.

4.1. Building

Date

Construction Estimated Estimate Estimate

Collatera Description Value Location Value Value d d by

*Commercial Building owned

by Gebrewahid Alemayehu,

located in Shire town, Kebele

05, Ownership Certificate No. Bereket

186-301-2002 36,272,951.22 4,095,000.00 40,367,951.22 02/12/19 Halefom

* The building is held as collateral for three term loans granted in the name of GABA Sheraro

PLC, GBAS Import Export PLC, and Robel Gebrewahid alemayehu.

Collateral coverage ratio:

Estimated Collateral value ………………………….………….40,367,951.22

Outstanding credit facilities (for which the collateral is held):

GABA Sheraro PLC…………………………………………1,940,431.76

GBAS Import Export Wholesale PLC……………………..14,875,319.33

Robel Gebrewahid Alemayehu………….…………………8,975,320.93

Outstanding loan balance…………………..……….………..25,791,072.02

Newly requested customs bond guarantee……………………8,510,704.56

Outstanding loan balance + Newly requested guarantee….34,301,776.58

Loan to Collateral gap…………………………………………..6,066,174.42

Loan to Collateral ratio……………………………………….. 1.17:1

The collateral pledged by the applicant can fully secure both the outstanding credit facility in the

name of her spouse and the newly requested customs bond guarantee.

5. Management/Owner of the business:

Asmeret Melese Woldegiorgis Bole Branch January 26, 2023

6

Credit Analysis & Portfolio Management

Annex for LAF No WB/CRM/038/2023

5.1. Ownership

Ato Asmeret Melese Woldegiorgis is a businesswoman who has been engaged in the

importing of vehicles and spare parts with a capital of Birrr 10,000,000.00 since 30/06/2013

E.C.

5.2. Management Profile

As per the due diligence from the CRM, the applicant experienced in the line of business.

5.3. Current Business Activities

The applicant is currently engaged in the import of vehicles and spare parts.

6. Credit Exposure:

6.1 With our bank

The applicant has no active credit relationship with Wegagen Bank S.C.

6.2 With Other Banks

As per the credit information generated from NBE’s database center under the enquiry ID No.

1833747 and 1833748 dated 25/01/2023, the applicant and her spouse have credit relationship

with other banks is as follows.

Active Credit facilities with other banks

Borrower Bank Type of Amount/Limit Date Expiry O/S balance Status

facility granted Granted date

Asmeret Melese Awash T/L 12,000,000.00 01/11/22 01/11/25 12,166,849.32 Pass

Asmeret Melese Lion T/L 2,175,000.00 14/04/16 26/03/23 223.04 Pass

Total

14,175,000.00 12,167,072.36

7. Account Performance:

The applicant is a holder of current account and overdraft account at Addis

International Bank S.C. the utilization of which is summarized below.

7.1 CURRENT ACCOUNT utilization at WEGAGEN BANK S.C.

Bank Type of account/Period Highest Credit Credit turnover

Wegagen Bank S.C. Current Account 3,000,020.30 9,635,587.13

10/06/22 -25/01/23

8. Financial Statement Analysis:

Asmeret Melese Woldegiorgis Bole Branch January 26, 2023

6

Credit Analysis & Portfolio Management

Annex for LAF No WB/CRM/038/2023

The applicant has submitted Audited financial statements for the year ended July 2021;

and 2022 (audited by Solomon Demena, which is an authorized auditor). As per results

obtained from the financial spread sheet, the following ratio analysis is carried out:-

Activity Ratio/Year 07/07/21 07/07/22

Net Sales (‘000) 25,395 45,618

Net Sales Gr. Rate (%) 79.63%

Profitability ratio

Net profit ‘’000’’ 1,967 3,971

Operating profit margin 11.81% 13.33%

Net profit margin 7.75% 8.70%

Liquidity Ratio

Current Ratio: 7.23 4.53

Quick Asset Ratio: 4.98 1.62

Leverage Ratio

Tangible Net Worth ‘’000’’ 11,967 15,937

Total Liabilities /TNW 0.16 0.18

The business has registered an excellent sales performance during the recent one year as

compared with the preceding year.

The applicant’s business is liquid in that it can cover currently maturing financial

obligations from cash and cash equivalent current assets.

The company is moderately geared as measured by the debt to equity & debt to asset ratio.

The company yielded positive profit margin during the past two consecutive years.

9. Request Assessment:

The applicant, in its letter dated 16/05/2015 E.C., has requested customs bond guarantees of

Birr 5,810,704.56 and Birr 2,700,000.00 both for a period of Birr 90 days.

Facts and findings

o The applicant is licensed to engage in the import business.

o The applicant is engaged in a business with sound financial standing.

Asmeret Melese Woldegiorgis Bole Branch January 26, 2023

6

Credit Analysis & Portfolio Management

Annex for LAF No WB/CRM/038/2023

o The applicant’s spouse is a long time customer of our bank both as a borrower and a

depositor.

o The applicant has pledged to offer a building in the name of her spouse which is located

in Shire town. The building is held as collateral for her spouse’s outstanding credit

facilities at our bank and is the very building in which Wegagen Bank opened one of its

branches in Shire town.

o According to the CRM, the pledged collateral which is already registered for

Gebrewahid Alemayehu’s loans cannot be registered for the newly requested guarantee

facility because the appropriate government organ is not rendering registration service

due to the current political situation in the region.

o Taking into account the afore-mentioned analysis, the credit analyst recommends that

the customs bond guarantee shall be issued on the condition that the pledged collateral is

subsequently registered once the appropriate government organ resumes normal operation in the

town.

10. Bases of Recommendation:

Strong points

The applicant’s business has sound overall financial standing.

The applicant has acquired sufficient experience in the line of business.

The applicant’s account utilization at our bank shows that she is a potential depositor.

The applicant has pledged to offer dependable collateral to secure the loan.

Weak points

The applicant is new to our bank and we are therefore unable to know her repayment habit.

11. Recommendation of the credit analyst

Based on the foregoing analysis, I recommend granting customs bond guarantees of Birr

5,810,704.56 (Five million eight hundred ten thousand seven hundred four birr and fifty six

cents) and Birr 2,700,000.00 (Two million seven hundred thousand birr) both in favor of

Asmeret Melese Woldegiorgis Bole Branch January 26, 2023

6

Credit Analysis & Portfolio Management

Annex for LAF No WB/CRM/038/2023

Ethiopian Customs Commission for a period of 90 days at the prevailing commission rate on

clean basis.

Condition: -

o Commission income should be fully collected in advance.

Prepared by Reviewed by

_____________ _____________

Dawit Haile Michael H/giorgis

Credit Analyst Manager – Credit Analysis

Asmeret Melese Woldegiorgis Bole Branch January 26, 2023

6

You might also like

- Zlib - Pub Supply Chain Management For EngineersDocument234 pagesZlib - Pub Supply Chain Management For EngineersMohit kapoorNo ratings yet

- Chapter 2 Audit of Receivables and SalesDocument19 pagesChapter 2 Audit of Receivables and SalesKez MaxNo ratings yet

- Chandni Devani Co-Operative Banking Its Credit Appraisal MechanismDocument20 pagesChandni Devani Co-Operative Banking Its Credit Appraisal MechanismManasi VichareNo ratings yet

- Credit Management Overview and Principles of LendingDocument44 pagesCredit Management Overview and Principles of LendingTavneet Singh100% (2)

- The History of MontblancDocument4 pagesThe History of MontblancRajiv EtcNo ratings yet

- Advertising Age - Hispanic Fact PackDocument31 pagesAdvertising Age - Hispanic Fact Packdrummestudcom0% (1)

- Abebe MengistuDocument8 pagesAbebe MengistunigussieabagazNo ratings yet

- Double S PLC-Annex - OD-Renw-Apr-2023Document7 pagesDouble S PLC-Annex - OD-Renw-Apr-2023nigussieabagazNo ratings yet

- TangomalkDocument6 pagesTangomalknigussieabagazNo ratings yet

- Annex 2323Document8 pagesAnnex 2323nigussieabagazNo ratings yet

- Credit Appraisal & Port. MGT Laf No. Wb/Crm/Nd/0044/23Document7 pagesCredit Appraisal & Port. MGT Laf No. Wb/Crm/Nd/0044/23nigussieabagazNo ratings yet

- Andualem AnnexDocument7 pagesAndualem AnnexnigussieabagazNo ratings yet

- AMT Trading PLC 2024Document9 pagesAMT Trading PLC 2024nigussieabagazNo ratings yet

- AnnexDocument9 pagesAnnexnigussieabagazNo ratings yet

- Meskerem Kidane FinalDocument16 pagesMeskerem Kidane FinallikmezekerNo ratings yet

- Azmeraw AnnexDocument14 pagesAzmeraw AnnexnigussieabagazNo ratings yet

- GoushDocument12 pagesGoushnigussieabagazNo ratings yet

- AnnexDocument10 pagesAnnexnigussieabagazNo ratings yet

- Export 2Document13 pagesExport 2nigussieabagazNo ratings yet

- RamaraDocument11 pagesRamaranigussieabagazNo ratings yet

- E MedhinDocument9 pagesE MedhinnigussieabagazNo ratings yet

- AbatneheDocument13 pagesAbatnehenigussieabagazNo ratings yet

- Annex Desalegn2 Onetime Pre ShipmentDocument12 pagesAnnex Desalegn2 Onetime Pre ShipmentnigussieabagazNo ratings yet

- BazetoDocument13 pagesBazetonigussieabagazNo ratings yet

- AfroDocument5 pagesAfronigussieabagazNo ratings yet

- Muhaba ShewmoloDocument11 pagesMuhaba Shewmolosabrinzo zomaNo ratings yet

- Bisrat TadesseDocument9 pagesBisrat TadessenigussieabagazNo ratings yet

- Abel DanielDocument7 pagesAbel Danielfirehiwotmisganaw3No ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- Functional TrainingDocument46 pagesFunctional TrainingRaushan KumarNo ratings yet

- Cpfdac Loan Application Form IDocument6 pagesCpfdac Loan Application Form IMayita Calderon GómezNo ratings yet

- AHMEE00735693Document2 pagesAHMEE00735693mrfaster04757No ratings yet

- Hinglaj Light Renewal 2018Document4 pagesHinglaj Light Renewal 2018jitendra tirthyaniNo ratings yet

- Credit ManagementDocument13 pagesCredit ManagementAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- GCC 2013-14Document7 pagesGCC 2013-14Noble MeshakNo ratings yet

- Training On NBE Directives and Enat Credit OperationDocument61 pagesTraining On NBE Directives and Enat Credit Operationaddisu bezaNo ratings yet

- Escrow Account Request LetterDocument5 pagesEscrow Account Request LetterAnpriya BalodhiNo ratings yet

- Firehiwote Shimelis Follow Up-1Document21 pagesFirehiwote Shimelis Follow Up-1Melak YizengawNo ratings yet

- BEFTNDocument2 pagesBEFTNAyren Jahan BinduNo ratings yet

- Insta Loan Application Form UpdateDocument1 pageInsta Loan Application Form UpdateMd Abed Ur RahmanNo ratings yet

- Annex APPEALDocument4 pagesAnnex APPEALnigussieabagazNo ratings yet

- Cash Credit (H), Loan Procedure Over National Bank Limited, Khulna BranchDocument19 pagesCash Credit (H), Loan Procedure Over National Bank Limited, Khulna BranchShuvro Kumar Paul50% (2)

- Daily Accounts Sheet - 2021 - KAVDocument3 pagesDaily Accounts Sheet - 2021 - KAVvictoriavows8No ratings yet

- Test Your Progress BookDocument14 pagesTest Your Progress BookarunapecNo ratings yet

- Wa0022.Document8 pagesWa0022.viphainhumNo ratings yet

- Original: Your Credit Score and The Price You Pay For CreditDocument26 pagesOriginal: Your Credit Score and The Price You Pay For CreditMaritza CardonaNo ratings yet

- Guideline MudarabalequidityDocument5 pagesGuideline MudarabalequidityIslam BankNo ratings yet

- Client Account Course Workbook: Version: 2021-001 Last Modified: December 23, 2021Document29 pagesClient Account Course Workbook: Version: 2021-001 Last Modified: December 23, 2021Agamveer GillNo ratings yet

- Understanding The Credit Department of A BankDocument6 pagesUnderstanding The Credit Department of A Bankzubair07077371No ratings yet

- Draft CA Formats For SubmissionDocument4 pagesDraft CA Formats For SubmissionAnpriya BalodhiNo ratings yet

- 149389131Document1 page149389131sandeepsharmaocmdual2022No ratings yet

- CAR LOAN-Consolidated Guidelines 45-2021Document77 pagesCAR LOAN-Consolidated Guidelines 45-2021Sanjay GondwalNo ratings yet

- Transaction HeaderDocument3 pagesTransaction HeaderWaleed AljackNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- G K TradingDocument28 pagesG K Tradingdjpatel10No ratings yet

- Digital Customer Copy: I Confirm ThatDocument2 pagesDigital Customer Copy: I Confirm ThatTarun KumarNo ratings yet

- Annexure Ii Standardised Format For BGDocument5 pagesAnnexure Ii Standardised Format For BGNishit Marvania100% (1)

- Model DPR For End Borrower DIDF Scheme 05 Jan2018Document52 pagesModel DPR For End Borrower DIDF Scheme 05 Jan2018muthukrishnanNo ratings yet

- Promotion Practice SetDocument90 pagesPromotion Practice SetPUNEET KR MISHRANo ratings yet

- Wa0007.Document9 pagesWa0007.viphainhumNo ratings yet

- FEDGL05030000410 GPCDocument2 pagesFEDGL05030000410 GPCTarun kumarNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Ermias Lera Lenda Business PlanDocument23 pagesErmias Lera Lenda Business PlannigussieabagazNo ratings yet

- Active Outstanding Import LC - Active Outstanding Import LCDocument3 pagesActive Outstanding Import LC - Active Outstanding Import LCnigussieabagazNo ratings yet

- SPREEDSHEETDocument27 pagesSPREEDSHEETnigussieabagazNo ratings yet

- Double S PLC-Annex - OD-Renw-Apr-2023Document7 pagesDouble S PLC-Annex - OD-Renw-Apr-2023nigussieabagazNo ratings yet

- Tekle Assefa Busienss PlanDocument28 pagesTekle Assefa Busienss PlannigussieabagazNo ratings yet

- Iso 9001 2008 HindiDocument32 pagesIso 9001 2008 HindiNilesh D PatilNo ratings yet

- The Right Way To Fire Someone-HSB H02NMGDocument9 pagesThe Right Way To Fire Someone-HSB H02NMGDileep WarrierNo ratings yet

- OM-Chapter 4Document37 pagesOM-Chapter 4Almaz Getachew0% (1)

- MORE Supermarket, Little World Mall, KhargharDocument24 pagesMORE Supermarket, Little World Mall, KhargharAbhinav PrajapatiNo ratings yet

- Ferreycorp Audited Financial Statements 2020Document84 pagesFerreycorp Audited Financial Statements 2020Eduardo ArcosNo ratings yet

- Presentación de RainTree Febrero de 2023Document3 pagesPresentación de RainTree Febrero de 2023La Silla VacíaNo ratings yet

- Merchant Rates 2019 2020 Oct 2019Document11 pagesMerchant Rates 2019 2020 Oct 2019rh007No ratings yet

- Change in Designated Managing Partners & Partners (For Partnership Firms)Document25 pagesChange in Designated Managing Partners & Partners (For Partnership Firms)Sãmpãth Kûmãř kNo ratings yet

- Turcotte de Bellefeuille Den Hond 2007Document16 pagesTurcotte de Bellefeuille Den Hond 2007fleursinga16No ratings yet

- SRB Working Tarrif 2022 23Document19 pagesSRB Working Tarrif 2022 23Noman ejazNo ratings yet

- Full Download PDF of (Original PDF) Management by Christopher P. Neck All ChapterDocument43 pagesFull Download PDF of (Original PDF) Management by Christopher P. Neck All Chapterprillaaguil100% (6)

- Session 1-4 Introduction To RetailingDocument48 pagesSession 1-4 Introduction To RetailingShakeeb HashmiNo ratings yet

- NIDHI-EIR GuidelineDocument15 pagesNIDHI-EIR GuidelineAdarsh KumarNo ratings yet

- Concrete Construction Article PDF Strategic Planning For ContractorsDocument4 pagesConcrete Construction Article PDF Strategic Planning For ContractorsMohammed NizamNo ratings yet

- Leseprobe PDFDocument14 pagesLeseprobe PDFGovarthanan GopalanNo ratings yet

- Furniture & Homeware - Indonesia - Statista Market ForecastDocument13 pagesFurniture & Homeware - Indonesia - Statista Market ForecastSales InteriorquNo ratings yet

- The Opportunity: Light As A Service® Case Study: Syncreon NiederaulaDocument1 pageThe Opportunity: Light As A Service® Case Study: Syncreon NiederaulaSalah ZyadaNo ratings yet

- Muthu Resume (3) ..Document2 pagesMuthu Resume (3) ..arun kNo ratings yet

- Virtually Present Others and Their Influence On Complainants' Follow-Ups and Firm ResponseDocument15 pagesVirtually Present Others and Their Influence On Complainants' Follow-Ups and Firm ResponseAlessandro ComaiNo ratings yet

- TMOE SyllabusDocument2 pagesTMOE SyllabusDhaivat SridharNo ratings yet

- Organisation DevelopmentDocument55 pagesOrganisation DevelopmentKAYNo ratings yet

- Unibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxDocument17 pagesUnibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxMiguel RamosNo ratings yet

- Breakeven AnalysisDocument38 pagesBreakeven AnalysisJennel AbillaNo ratings yet

- 2017 Myceb Annual ReportDocument23 pages2017 Myceb Annual ReportMohamad Zaki AhmadNo ratings yet

- BobaTrader - Full Options Daytrading GuideDocument33 pagesBobaTrader - Full Options Daytrading Guideprakashrnc100% (1)

- HR C&B Senior Officer (HCB) : Job DescriptionDocument2 pagesHR C&B Senior Officer (HCB) : Job DescriptionnataliasulistyoNo ratings yet

- Adizes 1976 Mismanagement StylesDocument16 pagesAdizes 1976 Mismanagement StylesMavy BouityNo ratings yet