Professional Documents

Culture Documents

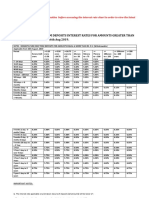

Recurring Deposit Rates w e f August 21 2023

Recurring Deposit Rates w e f August 21 2023

Uploaded by

giraelesCopyright:

Available Formats

You might also like

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Maths ProjectDocument11 pagesMaths ProjectSafin RokaNo ratings yet

- Interest Rates For Recurring Deposits 2023 GDFCDocument1 pageInterest Rates For Recurring Deposits 2023 GDFCRakshith Rahul BNo ratings yet

- Fixed Deposit Plus Rates W e F May 2023Document1 pageFixed Deposit Plus Rates W e F May 2023saurav katarukaNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRavi KumarNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- Fixed Deposit Plus Rates W e F August 21 2023Document1 pageFixed Deposit Plus Rates W e F August 21 2023BhupinderNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Slabs Profit Rate: Deposit and Prematurity RatesDocument1 pageSlabs Profit Rate: Deposit and Prematurity RatesJay KhanNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- Interest Rates On Deposits 01 03 2023Document4 pagesInterest Rates On Deposits 01 03 2023Shashank ChandraNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRajender Singh DeepakNo ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Interest Rates On Domestic Fixed Deposits and Recurring DepositsDocument1 pageInterest Rates On Domestic Fixed Deposits and Recurring Depositsavnish singhNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailAlok GoyalNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailShanawaz KhanNo ratings yet

- Interest Rates On Domestic Fixed Deposit and Recurring DepositDocument1 pageInterest Rates On Domestic Fixed Deposit and Recurring DepositMuditNo ratings yet

- Card Rates For Domestic, NRE & NRO Deposits Less Than INR 1 CroreDocument4 pagesCard Rates For Domestic, NRE & NRO Deposits Less Than INR 1 Croreraghuveer11No ratings yet

- Interest Rates On Deposits 02 11 2023Document4 pagesInterest Rates On Deposits 02 11 2023ashishNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Fixed Deposit Rates Wef August 21 2023 WebsiteDocument1 pageFixed Deposit Rates Wef August 21 2023 WebsiteSudhanshuNo ratings yet

- Interest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresSumanyuSoodNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- Fixed Deposit Rates W e F February 27 2023 WebsiteDocument1 pageFixed Deposit Rates W e F February 27 2023 WebsiteAman singhNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsAkhilesh VijayaKumarNo ratings yet

- Revision of Interest Rate On Fixed Deposit Wef February 28 2019Document1 pageRevision of Interest Rate On Fixed Deposit Wef February 28 2019sg06No ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- Long Term Interest RatesDocument1 pageLong Term Interest Rateshansikamedagedara179No ratings yet

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanNo ratings yet

- Domestic / Non-Resident Rupee Retail Term Deposit Interest Rate Chart W.E.F January 8, 2020Document2 pagesDomestic / Non-Resident Rupee Retail Term Deposit Interest Rate Chart W.E.F January 8, 2020Neha ButalaNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularPrashantGuptaNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaNo ratings yet

- BankingDocument4 pagesBankingBhavin GhoniyaNo ratings yet

- Fixed Deposit Plus Rates W e F October 30 2023 WebsiteDocument1 pageFixed Deposit Plus Rates W e F October 30 2023 Websitekushboog019No ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsRaghav sharmaNo ratings yet

- Long Term Interest RatesDocument1 pageLong Term Interest RatesRasika NandanaNo ratings yet

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDocument2 pagesSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarNo ratings yet

- FD Rate Card - Oct 2022Document2 pagesFD Rate Card - Oct 2022Deepak SuyalNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularK NkNo ratings yet

- Domestic Fixed Deposits 13 OctoberDocument3 pagesDomestic Fixed Deposits 13 OctoberjoyfulsenthilNo ratings yet

- Rates of Return On PLSDeposits OtherDepositsDocument2 pagesRates of Return On PLSDeposits OtherDepositsranamkhan553No ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Better Credit Now - How to Have Better Credit for the Rest of Your LifeFrom EverandBetter Credit Now - How to Have Better Credit for the Rest of Your LifeRating: 1 out of 5 stars1/5 (1)

- The Truest and Quickest Code for Debt Management Excellent for People who are Stocked in Multiple DebtsFrom EverandThe Truest and Quickest Code for Debt Management Excellent for People who are Stocked in Multiple DebtsNo ratings yet

Recurring Deposit Rates w e f August 21 2023

Recurring Deposit Rates w e f August 21 2023

Uploaded by

giraelesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recurring Deposit Rates w e f August 21 2023

Recurring Deposit Rates w e f August 21 2023

Uploaded by

giraelesCopyright:

Available Formats

1 Upto 6 months 6.50% 7.

00%

2 9 months 6.50% 7.00%

3 12 months 6.75% 7.25%

4 15 months 7.00% 7.50%

5 18 months 7.25% 7.75%

6 21 months 7.50% 8.00%

7 Above 21 Months to less than 24 Months 7.50% 8.00%

8 24 Months to 36 months 8.00% 8.50%

9 Above 3 Years upto 5 Years 6.75% 7.25%

10 Above 5 years upto 10 years 6.75% 7.25%

Minimum tenor of the recurring deposit offered would be six months and maximum upto

10 years.

Penalty on premature withdrawal is 1% (not applicable for closure within 7 days) i.e. 1%

less than the card rate as on the date of deposit, for the period for which the deposit has

remained with the Bank or 1% less than the contracted rate, whichever is lower.

For Recurring Deposits, in case of premature closure within a month, no interest shall be

paid out to the customer & only the principal amount shall be returned. No premature

withdrawal penalty shall be charged if the closure happens within a month.

Interest rates are subject to change from time to time. Deposits will be booked post receipt

of clear funds with the Bank at applicable interest rate as on the date of receipt of funds.

For Recurring Deposits, the interest on Deposits is compounded at quarterly intervals, at

the applicable rates. The interest will be calculated from the date, the instalment paid.

The Recurring Deposit shall mature on completion of the contracted tenure even if there

are instalments remaining due to be paid.

Above rates are applicable for fresh recurring deposits.

Interest earned will be subject to Tax Deducted at Source as per Income Tax Act and Rules.

Recurring Deposits amount should be in multiple of ₹100 only.

Tenure of RD should be in multiple of 3 months.

Page 1 of 1

You might also like

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Maths ProjectDocument11 pagesMaths ProjectSafin RokaNo ratings yet

- Interest Rates For Recurring Deposits 2023 GDFCDocument1 pageInterest Rates For Recurring Deposits 2023 GDFCRakshith Rahul BNo ratings yet

- Fixed Deposit Plus Rates W e F May 2023Document1 pageFixed Deposit Plus Rates W e F May 2023saurav katarukaNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRavi KumarNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- Fixed Deposit Plus Rates W e F August 21 2023Document1 pageFixed Deposit Plus Rates W e F August 21 2023BhupinderNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Slabs Profit Rate: Deposit and Prematurity RatesDocument1 pageSlabs Profit Rate: Deposit and Prematurity RatesJay KhanNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- Interest Rates On Deposits 01 03 2023Document4 pagesInterest Rates On Deposits 01 03 2023Shashank ChandraNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRajender Singh DeepakNo ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Interest Rates On Domestic Fixed Deposits and Recurring DepositsDocument1 pageInterest Rates On Domestic Fixed Deposits and Recurring Depositsavnish singhNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailAlok GoyalNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailShanawaz KhanNo ratings yet

- Interest Rates On Domestic Fixed Deposit and Recurring DepositDocument1 pageInterest Rates On Domestic Fixed Deposit and Recurring DepositMuditNo ratings yet

- Card Rates For Domestic, NRE & NRO Deposits Less Than INR 1 CroreDocument4 pagesCard Rates For Domestic, NRE & NRO Deposits Less Than INR 1 Croreraghuveer11No ratings yet

- Interest Rates On Deposits 02 11 2023Document4 pagesInterest Rates On Deposits 02 11 2023ashishNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Fixed Deposit Rates Wef August 21 2023 WebsiteDocument1 pageFixed Deposit Rates Wef August 21 2023 WebsiteSudhanshuNo ratings yet

- Interest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresSumanyuSoodNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- Fixed Deposit Rates W e F February 27 2023 WebsiteDocument1 pageFixed Deposit Rates W e F February 27 2023 WebsiteAman singhNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsAkhilesh VijayaKumarNo ratings yet

- Revision of Interest Rate On Fixed Deposit Wef February 28 2019Document1 pageRevision of Interest Rate On Fixed Deposit Wef February 28 2019sg06No ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- Long Term Interest RatesDocument1 pageLong Term Interest Rateshansikamedagedara179No ratings yet

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanNo ratings yet

- Domestic / Non-Resident Rupee Retail Term Deposit Interest Rate Chart W.E.F January 8, 2020Document2 pagesDomestic / Non-Resident Rupee Retail Term Deposit Interest Rate Chart W.E.F January 8, 2020Neha ButalaNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularPrashantGuptaNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaNo ratings yet

- BankingDocument4 pagesBankingBhavin GhoniyaNo ratings yet

- Fixed Deposit Plus Rates W e F October 30 2023 WebsiteDocument1 pageFixed Deposit Plus Rates W e F October 30 2023 Websitekushboog019No ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsRaghav sharmaNo ratings yet

- Long Term Interest RatesDocument1 pageLong Term Interest RatesRasika NandanaNo ratings yet

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDocument2 pagesSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarNo ratings yet

- FD Rate Card - Oct 2022Document2 pagesFD Rate Card - Oct 2022Deepak SuyalNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularK NkNo ratings yet

- Domestic Fixed Deposits 13 OctoberDocument3 pagesDomestic Fixed Deposits 13 OctoberjoyfulsenthilNo ratings yet

- Rates of Return On PLSDeposits OtherDepositsDocument2 pagesRates of Return On PLSDeposits OtherDepositsranamkhan553No ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Better Credit Now - How to Have Better Credit for the Rest of Your LifeFrom EverandBetter Credit Now - How to Have Better Credit for the Rest of Your LifeRating: 1 out of 5 stars1/5 (1)

- The Truest and Quickest Code for Debt Management Excellent for People who are Stocked in Multiple DebtsFrom EverandThe Truest and Quickest Code for Debt Management Excellent for People who are Stocked in Multiple DebtsNo ratings yet