Professional Documents

Culture Documents

The Payment of Wages Act

The Payment of Wages Act

Uploaded by

Vishesh ParasharCopyright:

Available Formats

You might also like

- Franchise For DummiesDocument13 pagesFranchise For Dummiesmary34d100% (2)

- Payment of Gratuity ActDocument21 pagesPayment of Gratuity Actprathu601No ratings yet

- Wage ActDocument1 pageWage ActShumayla KhanNo ratings yet

- Adjudication of Disputes and Claims Under ESI Act, 1948Document4 pagesAdjudication of Disputes and Claims Under ESI Act, 1948AkshayNo ratings yet

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- The Payment of Wages Act, 1936Document14 pagesThe Payment of Wages Act, 1936Prema LathaNo ratings yet

- A Brief Check List of Labour LawsDocument54 pagesA Brief Check List of Labour Lawsjose_sebastian_2100% (1)

- Payement of Wage Act, 1936 Unit-4Document8 pagesPayement of Wage Act, 1936 Unit-4rpsinghsikarwarNo ratings yet

- Abstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesDocument3 pagesAbstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesShabir Tramboo100% (1)

- The Payment of Gratuity Act 1972Document8 pagesThe Payment of Gratuity Act 1972Binny SinghNo ratings yet

- Payment of WagesDocument26 pagesPayment of WagesnawabrpNo ratings yet

- Features of Payment of Wages ActDocument12 pagesFeatures of Payment of Wages ActDevesh Sharma50% (4)

- GRATUTITY ACT An Act To Provide For A Scheme For The Payment of Gratuity ToDocument3 pagesGRATUTITY ACT An Act To Provide For A Scheme For The Payment of Gratuity TovaidehiNo ratings yet

- Payment of Gratuity Act, 1972Document27 pagesPayment of Gratuity Act, 1972leela naga janaki rajitha attiliNo ratings yet

- Law PenaltyDocument36 pagesLaw PenaltyVanshika BhedaNo ratings yet

- Liabilities of AuditorDocument3 pagesLiabilities of AuditorVrinda KNo ratings yet

- Facultyid 112 Supply Under GST 2 1708324818Document79 pagesFacultyid 112 Supply Under GST 2 1708324818r46051843No ratings yet

- The Payment of Gratuity Act, 1972: by Diptiranjan SarangiDocument11 pagesThe Payment of Gratuity Act, 1972: by Diptiranjan SarangiChirag JainNo ratings yet

- Wages and PaymentDocument24 pagesWages and PaymentJahid HasanNo ratings yet

- Payment of Gratuity ActDocument22 pagesPayment of Gratuity Actdivy waliaNo ratings yet

- Brahmastra File To Crack: Ca Final Law Mcqs & Integrated Case ScenariosDocument14 pagesBrahmastra File To Crack: Ca Final Law Mcqs & Integrated Case ScenariosNagendra kumarNo ratings yet

- The Payment of Gratuity Act, 1972Document30 pagesThe Payment of Gratuity Act, 1972Saket DokaniaNo ratings yet

- Abstract of The Payment of Wages ActDocument3 pagesAbstract of The Payment of Wages ActBiswajit Behera100% (1)

- Payment of Gratuity Act 1972Document4 pagesPayment of Gratuity Act 1972PraveenakishorNo ratings yet

- Labour Laws in IndiaDocument6 pagesLabour Laws in Indiaavinashbatra1No ratings yet

- Andhra Pradesh Shops Establishment Act 1988Document11 pagesAndhra Pradesh Shops Establishment Act 1988jlalitha69No ratings yet

- Labrev Hw3 VillanuevaDocument18 pagesLabrev Hw3 VillanuevaSam VillanuevaNo ratings yet

- payment of wages actDocument6 pagespayment of wages actArunaMLNo ratings yet

- The Payment of Gratuity Act, 1972: Prepared & Presented by Debraj Subedi BPT09002 MBA (PT), TUDocument26 pagesThe Payment of Gratuity Act, 1972: Prepared & Presented by Debraj Subedi BPT09002 MBA (PT), TUmugds_hansNo ratings yet

- The Payment of Gratuity Act 1972Document12 pagesThe Payment of Gratuity Act 1972AdityaNo ratings yet

- Payment of Gratuity The Payment of GratuityDocument4 pagesPayment of Gratuity The Payment of Gratuitysubhasishmajumdar100% (1)

- Presented By: Anish GuptaDocument14 pagesPresented By: Anish Guptagupta_ani04No ratings yet

- RCA-Ammendment 2 - 1978Document1 pageRCA-Ammendment 2 - 1978Siddhesh Kamat AzrekarNo ratings yet

- Payment of Wage ActDocument27 pagesPayment of Wage ActPriya SharmaNo ratings yet

- Gratuity Act (Vikram)Document23 pagesGratuity Act (Vikram)AdityaNo ratings yet

- Payment of Wages Act, 1936Document3 pagesPayment of Wages Act, 1936PratikNo ratings yet

- Labor Laws Gratuity Payment 1972 PDFDocument4 pagesLabor Laws Gratuity Payment 1972 PDFSiddharth PandeyNo ratings yet

- Some Important Penalties For CA Inter LawDocument5 pagesSome Important Penalties For CA Inter Lawmattabrhmdoodlemaster2000No ratings yet

- Payment of Gratuity Act 1972Document40 pagesPayment of Gratuity Act 1972Mahesh Kumar100% (1)

- Q1.Define Wages As Per The Payment of Wages Act. Answer-: But Does Not IncludeDocument6 pagesQ1.Define Wages As Per The Payment of Wages Act. Answer-: But Does Not IncludeKhushi DbNo ratings yet

- Labour Laws NewDocument12 pagesLabour Laws Newtushar khomaneNo ratings yet

- Legal ComplianceDocument67 pagesLegal ComplianceAmbati Hari KrishnaNo ratings yet

- The Payment of Bonus Act-ChecklistDocument1 pageThe Payment of Bonus Act-ChecklistRohini G ShettyNo ratings yet

- 04 The Payment of Gratuity ActDocument22 pages04 The Payment of Gratuity ActDharani KumarNo ratings yet

- Unit IV - The Payment of Gratuity Act 1972 - Labour Laws-1Document24 pagesUnit IV - The Payment of Gratuity Act 1972 - Labour Laws-1patelia kevalNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiashyamNo ratings yet

- Important Penalties For Cs Executive JUNE 2020 New Syllabus: About The AuthorDocument9 pagesImportant Penalties For Cs Executive JUNE 2020 New Syllabus: About The Authorarti chowdhryNo ratings yet

- Offences-Penalties of GST EditedDocument12 pagesOffences-Penalties of GST EditedKavitha Kavi KaviNo ratings yet

- HR Check ListDocument18 pagesHR Check ListenareshkumarNo ratings yet

- Form V: Abstract of The Payment of Wages Act, 1936Document4 pagesForm V: Abstract of The Payment of Wages Act, 1936jovioNo ratings yet

- Obligations of Employer and Deductions From Wages Under The Payment of Wages ActDocument13 pagesObligations of Employer and Deductions From Wages Under The Payment of Wages ActRiddhima KrishnanNo ratings yet

- Payment of Gratuity Act, 1972Document56 pagesPayment of Gratuity Act, 1972profkalpeshNo ratings yet

- Gratuty ActDocument14 pagesGratuty ActaishwaryaNo ratings yet

- Employees Old Age Benefits Act 1976Document46 pagesEmployees Old Age Benefits Act 1976Ajwad FarooqNo ratings yet

- HR Laws Check ListDocument18 pagesHR Laws Check Listdpak111No ratings yet

- Payment of Gratuity Act 1972Document22 pagesPayment of Gratuity Act 1972savzzzNo ratings yet

- Comments On Substitute Eddie Garcia BillDocument2 pagesComments On Substitute Eddie Garcia BillSai PastranaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Letter of Authorization: B12SDG04Document1 pageLetter of Authorization: B12SDG04Ahamed kabeerNo ratings yet

- Skippers United Pacific, Inc. v. DozaDocument2 pagesSkippers United Pacific, Inc. v. DozaAntonio BartolomeNo ratings yet

- (1969) Gonzales v. COMELECDocument98 pages(1969) Gonzales v. COMELECteresakristelNo ratings yet

- Pam Contract 2018: 23 February 2019Document22 pagesPam Contract 2018: 23 February 2019Anzas AnggaraNo ratings yet

- Commercial Use License AgreementDocument5 pagesCommercial Use License AgreementRocelle ANo ratings yet

- Re Registration LetterDocument3 pagesRe Registration LettergeeNo ratings yet

- Batelec Vs EiabDocument14 pagesBatelec Vs EiabdezNo ratings yet

- Augmentation of Personnel To Gingoog CpsDocument2 pagesAugmentation of Personnel To Gingoog CpsLlednew Lavodnas100% (2)

- Natural-Law-Theory-Of-St-Thomas-Aquinas 11Document3 pagesNatural-Law-Theory-Of-St-Thomas-Aquinas 11Shagun SainiNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyRio Design GroupNo ratings yet

- Motor Insurance Proposal New IndiaDocument2 pagesMotor Insurance Proposal New IndiaabhishekkurilNo ratings yet

- Saba Ali Asghar Sp18-BBA-111 Assignment Intellectual Property Rights Procedures and Processes in PakistanDocument4 pagesSaba Ali Asghar Sp18-BBA-111 Assignment Intellectual Property Rights Procedures and Processes in Pakistannida vardakNo ratings yet

- MaryAMelchor CandidateSurveyDocument4 pagesMaryAMelchor CandidateSurveyInjustice WatchNo ratings yet

- Fundamentals of Canadian Nursing Concepts Process and Practice Canadian 3rd Edition Kozier Solutions Manual 1Document36 pagesFundamentals of Canadian Nursing Concepts Process and Practice Canadian 3rd Edition Kozier Solutions Manual 1toddvaldezamzxfwnrtq100% (36)

- 808 Chapman FATCA Tax International Clients Assets 1017Document19 pages808 Chapman FATCA Tax International Clients Assets 1017FreeInformation4ALLNo ratings yet

- Angeles vs. Santos, 64 Phil. 697 (1937)Document10 pagesAngeles vs. Santos, 64 Phil. 697 (1937)Emily MontallanaNo ratings yet

- 270051629negligence PDFDocument68 pages270051629negligence PDFIjibotaNo ratings yet

- PropertyDocument31 pagesPropertyHarsh MangalNo ratings yet

- Notes On Affirmative DefensesDocument19 pagesNotes On Affirmative DefensesJayselle BacaltosNo ratings yet

- Wolfe Addison FileDocument47 pagesWolfe Addison Filethe kingfish100% (1)

- 2021 MLC Student Syllabus PALE Problem Areas in Legal Ethics ASDocument8 pages2021 MLC Student Syllabus PALE Problem Areas in Legal Ethics ASqwertyuiopkmrrNo ratings yet

- Textbook of Criminal Law Chapter 16: Causation',: Glanville WilliamsDocument3 pagesTextbook of Criminal Law Chapter 16: Causation',: Glanville WilliamsAllisha BowenNo ratings yet

- Peoria County Jail Booking Sheet For Aug. 19, 2016Document9 pagesPeoria County Jail Booking Sheet For Aug. 19, 2016Journal Star police documentsNo ratings yet

- Docsity Ipc Moot Memorial in The Case of Dowry DeathDocument17 pagesDocsity Ipc Moot Memorial in The Case of Dowry DeathHarsh Jangde100% (1)

- Bill of Lading - Short Form - Not NegotiableDocument1 pageBill of Lading - Short Form - Not NegotiableTrevor BurnettNo ratings yet

- Reply To Rape and Abortion Counter-AffidavitDocument3 pagesReply To Rape and Abortion Counter-AffidavitDave SolarisNo ratings yet

- The Kerala Christian Church Properties Bill PDFDocument9 pagesThe Kerala Christian Church Properties Bill PDFsunilmanitNo ratings yet

- 05-Radiowealth Finance Corp. v. ICB G.R. Nos. 77042-43 February 28, 1990Document6 pages05-Radiowealth Finance Corp. v. ICB G.R. Nos. 77042-43 February 28, 1990Jopan SJNo ratings yet

- Annex C RMO 33-2019-Estate Tax AmnestyDocument1 pageAnnex C RMO 33-2019-Estate Tax AmnestyKate Hazzle JandaNo ratings yet

The Payment of Wages Act

The Payment of Wages Act

Uploaded by

Vishesh ParasharCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Payment of Wages Act

The Payment of Wages Act

Uploaded by

Vishesh ParasharCopyright:

Available Formats

THE PAYMENT OF WAGES ACT, 1936

Many States have carried out exhaustive amendments to the Act to widen its scope and application as far as practicable. The State of

Maharasthra has extended the provisions of the Act to all establishments covered by the Bombay Shops and Establishments Act, 1948.

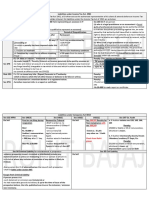

CHECK LIST

Object of the Act

Applicability of Act

Wages to be paid in current coins or

Factory industrial Establishment To regulate the payment of wages of

currency notes

Tramway service or motor transport service certain classes of employed persons

engaged in carrying passengers or good or both Time of payment of wages a. All wages shall be paid in current coins or

by road for hire or reward. currency notes or in both.

Air transport service Dock, Wharf or Jetty, Inland The wages of every person employed is

vessel, mechanically propelled paid. When less than 1000 persons are b. After obtaining the authorization, either by

employed shall be paid before the expiry of Cheque or by crediting the wages in

Mine, quarry or oil-field plantation the 7th day of the following month. When more employees banks Account {Section 6}

Workshop or other establishment etc. than 1000 workers, before the expiry of the

10th day of the following month. {Section 5}

Coverage of Employees Deduction made from wages

Drawing average wage upto Rs.6500 pm as amended with Deductions such as, fine, deduction for

effect from 6th September 2005 amenities and services supplied by the

employer, advances paid, over payment of

wages, loan, granted for house-building or

other purposes, income tax payable, in

pursuance of the order of the Court, Deduction for absence from duties for

Fines as prescribed by

Provident Fund contributions, cooperative unauthorized absence

Not to imposed unless the employer is given an societies, premium for Life Insurance,

contribution to any fund constituted by Absence for whole or any part of the day – If

opportunity to show cause

employer or a trade union, recovery of ten or more persons absent without

to record in the register {Section 8}

losses, Employees State Insurance reasonable cause, deduction of wages upto 8

contribution etc. {Section 7} days {Section 9}

Deduction for damage or loss

Deductions for Service Rendered

For default or negligence of an employee

When accommodation amenity or service has been

resulting into loss. Show cause notice has

accepted by the employee. {Section 11}

to be given to the employee. {Section 10}

PENALTIES

Fine not less than Rs. 1000, which may extend to Rs. 5000. On

On contravention of Section 5 (except Subsection .4), Section 7, Section 8 (except subsequent conviction fine not less than Rs. 5000, may extend to Rs.

Subsection 8), Section 9, Section 10 (except Subsection 2) and Section 11 to Section 10000. On contravention Section 4, 5(4), 6, 8 (8), 10(2) or Section 25 fine

13 not less than Rs. 1000. - may extend to Rs. 5000. On subsequent on

conviction fine not less.

For failing to maintain registers or records; or

Willfully refusing or without lawful excuse neglecting to furnish information

Fine which shall not be less than Rs. 1000 but may extend to Rs.

or return; or 5000 – On record conviction fine not less than Rs. 5000, may

Willfully furnishing or causing to be furnished any information or return extend to Rs. 10000.

which he knows to be false or For second or subsequent conviction, fine not less than Rs. 5000

Refusing to answer or willfully giving a false answer to any question but may extend to Rs. 10000.

necessary for obtaining any information required to be furnished under this

Act.

Willfully obstructing an Inspector in the discharge of his duties under this

Act; or

Refusing or willfully neglecting to afford an Inspector any reasonable facility

Fine not less than Rs.1000 extendable upto Rs.5000 – On subsequent

for making any entry, inspection etc. conviction fine not less than Rs.5000 – may extent to Rs.10,000

Willfully refusing to produce on the demand of an inspector any register or

other document kept in pursuance of this Act; or preventing any person for

appearance etc.

Imprisonment not less than one month extendable upto six

On conviction for any offence and again guilty of Contravention of same

months and fine not less than Rs.2000 extendable upto

provision.

Rs.15000.

Failing or neglecting to pay wages to any employee

Additional fine upto Rs. 100 for each day

You might also like

- Franchise For DummiesDocument13 pagesFranchise For Dummiesmary34d100% (2)

- Payment of Gratuity ActDocument21 pagesPayment of Gratuity Actprathu601No ratings yet

- Wage ActDocument1 pageWage ActShumayla KhanNo ratings yet

- Adjudication of Disputes and Claims Under ESI Act, 1948Document4 pagesAdjudication of Disputes and Claims Under ESI Act, 1948AkshayNo ratings yet

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- The Payment of Wages Act, 1936Document14 pagesThe Payment of Wages Act, 1936Prema LathaNo ratings yet

- A Brief Check List of Labour LawsDocument54 pagesA Brief Check List of Labour Lawsjose_sebastian_2100% (1)

- Payement of Wage Act, 1936 Unit-4Document8 pagesPayement of Wage Act, 1936 Unit-4rpsinghsikarwarNo ratings yet

- Abstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesDocument3 pagesAbstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesShabir Tramboo100% (1)

- The Payment of Gratuity Act 1972Document8 pagesThe Payment of Gratuity Act 1972Binny SinghNo ratings yet

- Payment of WagesDocument26 pagesPayment of WagesnawabrpNo ratings yet

- Features of Payment of Wages ActDocument12 pagesFeatures of Payment of Wages ActDevesh Sharma50% (4)

- GRATUTITY ACT An Act To Provide For A Scheme For The Payment of Gratuity ToDocument3 pagesGRATUTITY ACT An Act To Provide For A Scheme For The Payment of Gratuity TovaidehiNo ratings yet

- Payment of Gratuity Act, 1972Document27 pagesPayment of Gratuity Act, 1972leela naga janaki rajitha attiliNo ratings yet

- Law PenaltyDocument36 pagesLaw PenaltyVanshika BhedaNo ratings yet

- Liabilities of AuditorDocument3 pagesLiabilities of AuditorVrinda KNo ratings yet

- Facultyid 112 Supply Under GST 2 1708324818Document79 pagesFacultyid 112 Supply Under GST 2 1708324818r46051843No ratings yet

- The Payment of Gratuity Act, 1972: by Diptiranjan SarangiDocument11 pagesThe Payment of Gratuity Act, 1972: by Diptiranjan SarangiChirag JainNo ratings yet

- Wages and PaymentDocument24 pagesWages and PaymentJahid HasanNo ratings yet

- Payment of Gratuity ActDocument22 pagesPayment of Gratuity Actdivy waliaNo ratings yet

- Brahmastra File To Crack: Ca Final Law Mcqs & Integrated Case ScenariosDocument14 pagesBrahmastra File To Crack: Ca Final Law Mcqs & Integrated Case ScenariosNagendra kumarNo ratings yet

- The Payment of Gratuity Act, 1972Document30 pagesThe Payment of Gratuity Act, 1972Saket DokaniaNo ratings yet

- Abstract of The Payment of Wages ActDocument3 pagesAbstract of The Payment of Wages ActBiswajit Behera100% (1)

- Payment of Gratuity Act 1972Document4 pagesPayment of Gratuity Act 1972PraveenakishorNo ratings yet

- Labour Laws in IndiaDocument6 pagesLabour Laws in Indiaavinashbatra1No ratings yet

- Andhra Pradesh Shops Establishment Act 1988Document11 pagesAndhra Pradesh Shops Establishment Act 1988jlalitha69No ratings yet

- Labrev Hw3 VillanuevaDocument18 pagesLabrev Hw3 VillanuevaSam VillanuevaNo ratings yet

- payment of wages actDocument6 pagespayment of wages actArunaMLNo ratings yet

- The Payment of Gratuity Act, 1972: Prepared & Presented by Debraj Subedi BPT09002 MBA (PT), TUDocument26 pagesThe Payment of Gratuity Act, 1972: Prepared & Presented by Debraj Subedi BPT09002 MBA (PT), TUmugds_hansNo ratings yet

- The Payment of Gratuity Act 1972Document12 pagesThe Payment of Gratuity Act 1972AdityaNo ratings yet

- Payment of Gratuity The Payment of GratuityDocument4 pagesPayment of Gratuity The Payment of Gratuitysubhasishmajumdar100% (1)

- Presented By: Anish GuptaDocument14 pagesPresented By: Anish Guptagupta_ani04No ratings yet

- RCA-Ammendment 2 - 1978Document1 pageRCA-Ammendment 2 - 1978Siddhesh Kamat AzrekarNo ratings yet

- Payment of Wage ActDocument27 pagesPayment of Wage ActPriya SharmaNo ratings yet

- Gratuity Act (Vikram)Document23 pagesGratuity Act (Vikram)AdityaNo ratings yet

- Payment of Wages Act, 1936Document3 pagesPayment of Wages Act, 1936PratikNo ratings yet

- Labor Laws Gratuity Payment 1972 PDFDocument4 pagesLabor Laws Gratuity Payment 1972 PDFSiddharth PandeyNo ratings yet

- Some Important Penalties For CA Inter LawDocument5 pagesSome Important Penalties For CA Inter Lawmattabrhmdoodlemaster2000No ratings yet

- Payment of Gratuity Act 1972Document40 pagesPayment of Gratuity Act 1972Mahesh Kumar100% (1)

- Q1.Define Wages As Per The Payment of Wages Act. Answer-: But Does Not IncludeDocument6 pagesQ1.Define Wages As Per The Payment of Wages Act. Answer-: But Does Not IncludeKhushi DbNo ratings yet

- Labour Laws NewDocument12 pagesLabour Laws Newtushar khomaneNo ratings yet

- Legal ComplianceDocument67 pagesLegal ComplianceAmbati Hari KrishnaNo ratings yet

- The Payment of Bonus Act-ChecklistDocument1 pageThe Payment of Bonus Act-ChecklistRohini G ShettyNo ratings yet

- 04 The Payment of Gratuity ActDocument22 pages04 The Payment of Gratuity ActDharani KumarNo ratings yet

- Unit IV - The Payment of Gratuity Act 1972 - Labour Laws-1Document24 pagesUnit IV - The Payment of Gratuity Act 1972 - Labour Laws-1patelia kevalNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiashyamNo ratings yet

- Important Penalties For Cs Executive JUNE 2020 New Syllabus: About The AuthorDocument9 pagesImportant Penalties For Cs Executive JUNE 2020 New Syllabus: About The Authorarti chowdhryNo ratings yet

- Offences-Penalties of GST EditedDocument12 pagesOffences-Penalties of GST EditedKavitha Kavi KaviNo ratings yet

- HR Check ListDocument18 pagesHR Check ListenareshkumarNo ratings yet

- Form V: Abstract of The Payment of Wages Act, 1936Document4 pagesForm V: Abstract of The Payment of Wages Act, 1936jovioNo ratings yet

- Obligations of Employer and Deductions From Wages Under The Payment of Wages ActDocument13 pagesObligations of Employer and Deductions From Wages Under The Payment of Wages ActRiddhima KrishnanNo ratings yet

- Payment of Gratuity Act, 1972Document56 pagesPayment of Gratuity Act, 1972profkalpeshNo ratings yet

- Gratuty ActDocument14 pagesGratuty ActaishwaryaNo ratings yet

- Employees Old Age Benefits Act 1976Document46 pagesEmployees Old Age Benefits Act 1976Ajwad FarooqNo ratings yet

- HR Laws Check ListDocument18 pagesHR Laws Check Listdpak111No ratings yet

- Payment of Gratuity Act 1972Document22 pagesPayment of Gratuity Act 1972savzzzNo ratings yet

- Comments On Substitute Eddie Garcia BillDocument2 pagesComments On Substitute Eddie Garcia BillSai PastranaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Letter of Authorization: B12SDG04Document1 pageLetter of Authorization: B12SDG04Ahamed kabeerNo ratings yet

- Skippers United Pacific, Inc. v. DozaDocument2 pagesSkippers United Pacific, Inc. v. DozaAntonio BartolomeNo ratings yet

- (1969) Gonzales v. COMELECDocument98 pages(1969) Gonzales v. COMELECteresakristelNo ratings yet

- Pam Contract 2018: 23 February 2019Document22 pagesPam Contract 2018: 23 February 2019Anzas AnggaraNo ratings yet

- Commercial Use License AgreementDocument5 pagesCommercial Use License AgreementRocelle ANo ratings yet

- Re Registration LetterDocument3 pagesRe Registration LettergeeNo ratings yet

- Batelec Vs EiabDocument14 pagesBatelec Vs EiabdezNo ratings yet

- Augmentation of Personnel To Gingoog CpsDocument2 pagesAugmentation of Personnel To Gingoog CpsLlednew Lavodnas100% (2)

- Natural-Law-Theory-Of-St-Thomas-Aquinas 11Document3 pagesNatural-Law-Theory-Of-St-Thomas-Aquinas 11Shagun SainiNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyRio Design GroupNo ratings yet

- Motor Insurance Proposal New IndiaDocument2 pagesMotor Insurance Proposal New IndiaabhishekkurilNo ratings yet

- Saba Ali Asghar Sp18-BBA-111 Assignment Intellectual Property Rights Procedures and Processes in PakistanDocument4 pagesSaba Ali Asghar Sp18-BBA-111 Assignment Intellectual Property Rights Procedures and Processes in Pakistannida vardakNo ratings yet

- MaryAMelchor CandidateSurveyDocument4 pagesMaryAMelchor CandidateSurveyInjustice WatchNo ratings yet

- Fundamentals of Canadian Nursing Concepts Process and Practice Canadian 3rd Edition Kozier Solutions Manual 1Document36 pagesFundamentals of Canadian Nursing Concepts Process and Practice Canadian 3rd Edition Kozier Solutions Manual 1toddvaldezamzxfwnrtq100% (36)

- 808 Chapman FATCA Tax International Clients Assets 1017Document19 pages808 Chapman FATCA Tax International Clients Assets 1017FreeInformation4ALLNo ratings yet

- Angeles vs. Santos, 64 Phil. 697 (1937)Document10 pagesAngeles vs. Santos, 64 Phil. 697 (1937)Emily MontallanaNo ratings yet

- 270051629negligence PDFDocument68 pages270051629negligence PDFIjibotaNo ratings yet

- PropertyDocument31 pagesPropertyHarsh MangalNo ratings yet

- Notes On Affirmative DefensesDocument19 pagesNotes On Affirmative DefensesJayselle BacaltosNo ratings yet

- Wolfe Addison FileDocument47 pagesWolfe Addison Filethe kingfish100% (1)

- 2021 MLC Student Syllabus PALE Problem Areas in Legal Ethics ASDocument8 pages2021 MLC Student Syllabus PALE Problem Areas in Legal Ethics ASqwertyuiopkmrrNo ratings yet

- Textbook of Criminal Law Chapter 16: Causation',: Glanville WilliamsDocument3 pagesTextbook of Criminal Law Chapter 16: Causation',: Glanville WilliamsAllisha BowenNo ratings yet

- Peoria County Jail Booking Sheet For Aug. 19, 2016Document9 pagesPeoria County Jail Booking Sheet For Aug. 19, 2016Journal Star police documentsNo ratings yet

- Docsity Ipc Moot Memorial in The Case of Dowry DeathDocument17 pagesDocsity Ipc Moot Memorial in The Case of Dowry DeathHarsh Jangde100% (1)

- Bill of Lading - Short Form - Not NegotiableDocument1 pageBill of Lading - Short Form - Not NegotiableTrevor BurnettNo ratings yet

- Reply To Rape and Abortion Counter-AffidavitDocument3 pagesReply To Rape and Abortion Counter-AffidavitDave SolarisNo ratings yet

- The Kerala Christian Church Properties Bill PDFDocument9 pagesThe Kerala Christian Church Properties Bill PDFsunilmanitNo ratings yet

- 05-Radiowealth Finance Corp. v. ICB G.R. Nos. 77042-43 February 28, 1990Document6 pages05-Radiowealth Finance Corp. v. ICB G.R. Nos. 77042-43 February 28, 1990Jopan SJNo ratings yet

- Annex C RMO 33-2019-Estate Tax AmnestyDocument1 pageAnnex C RMO 33-2019-Estate Tax AmnestyKate Hazzle JandaNo ratings yet